Navigating the complex landscape of student loan debt requires a thorough understanding of interest rates. These rates significantly impact the overall cost of your education and ultimately, your financial future. This guide delves into the intricacies of student loan interest rates, exploring current rates, historical trends, and strategies for effective management. We’ll examine how government policies, economic conditions, and individual loan types influence these rates, empowering you to make informed decisions about your borrowing and repayment.

From understanding the differences between federal and private loans to exploring options like refinancing and income-driven repayment plans, we aim to provide a clear and comprehensive overview. By examining real-world scenarios and hypothetical examples, we’ll illustrate the tangible effects of interest rates on your long-term financial well-being. Ultimately, this guide is designed to equip you with the knowledge necessary to navigate the complexities of student loan debt successfully.

Current Student Loan Interest Rates

Understanding student loan interest rates is crucial for responsible financial planning. These rates, which determine the cost of borrowing, vary significantly depending on the type of loan and the lender. This section will detail current rates and the factors influencing their differences.

Federal student loans and private student loans have distinct interest rate structures. Federal loan rates are generally lower and are set annually by the government, while private loan rates are determined by the lender based on various factors, often resulting in higher rates.

Federal and Private Student Loan Interest Rates

The following table presents a comparison of current interest rates. Note that these rates are subject to change and should be verified with official sources before making any financial decisions. The rates shown below are examples and may not reflect the exact current rates.

| Loan Type | Federal Loan Rate (Example) | Private Loan Rate (Example Range) | Notes |

|---|---|---|---|

| Subsidized Federal Stafford Loan (Undergraduate) | 4.99% | 6.00% – 12.00% | Interest does not accrue while the borrower is in school at least half-time. |

| Unsubsidized Federal Stafford Loan (Undergraduate) | 4.99% | 6.50% – 13.00% | Interest accrues while the borrower is in school. |

| Graduate PLUS Loan | 7.54% | 7.00% – 14.00% | Loan for graduate students; higher interest rate reflects higher risk. |

| Parent PLUS Loan | 7.54% | 8.00% – 15.00% | Loan for parents of undergraduate students. |

Factors Influencing Interest Rate Variation

Several factors contribute to the differences in interest rates across various student loan types. Understanding these factors helps borrowers make informed decisions.

For federal loans, the government sets rates based on market conditions and the 10-year Treasury note. Higher risk loans, such as PLUS loans, generally carry higher rates. For private loans, creditworthiness, loan amount, and the borrower’s income play a significant role in determining the interest rate. A borrower with a higher credit score and stable income is likely to receive a lower interest rate. The length of the loan repayment term also affects the interest rate; longer repayment terms usually mean higher total interest paid.

Federal Student Loan Interest Rate Determination

Interest rates for federal student loans are established annually by Congress. The rates are often tied to market indices, such as the 10-year Treasury note. This means that the interest rate fluctuates based on prevailing economic conditions. The government aims to balance affordability for students with the need to manage the cost of the federal student loan program. Each loan type has a designated rate, reflecting the perceived risk associated with that type of loan. For instance, graduate PLUS loans generally have higher interest rates than undergraduate Stafford loans due to the increased loan amount and potentially higher risk of default.

Historical Trends in Student Loan Interest Rates

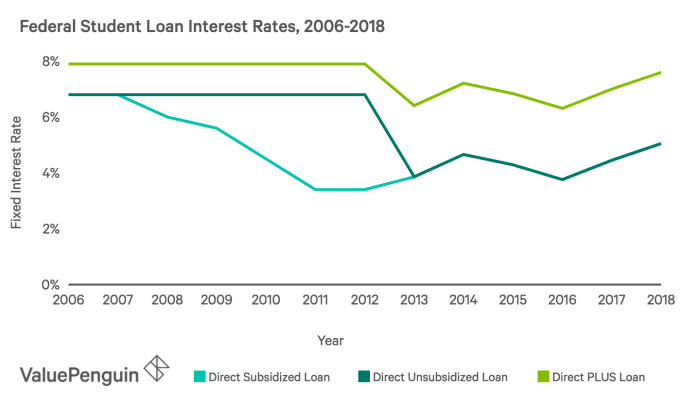

Understanding the historical trends in student loan interest rates provides valuable context for current borrowing conditions. Fluctuations in these rates reflect broader economic shifts, government policies, and the overall health of the lending market. Analyzing these trends allows borrowers and prospective borrowers to better anticipate future costs and make informed financial decisions.

A visual representation of student loan interest rate changes over the past two decades would reveal a dynamic landscape. A line graph, for example, could depict the average annual interest rate for federal student loans (both subsidized and unsubsidized) against a timeline spanning from 2004 to 2024. The horizontal axis (x-axis) would represent the year, clearly labeled from 2004 to 2024 in one-year increments. The vertical axis (y-axis) would represent the interest rate, clearly labeled in percentage points, perhaps ranging from 0% to 10%, depending on the data. The graph would include two distinct lines: one representing the average interest rate for subsidized federal loans and another for unsubsidized federal loans. A clear legend would distinguish between the two lines. The visual elements, such as line thickness, color, and data point markers, would be chosen for optimal clarity and readability. Periods of significant increase or decrease in interest rates would be easily identifiable as steep upward or downward slopes on the lines.

Significant Events Impacting Student Loan Interest Rates

Several significant events and policy changes have substantially influenced student loan interest rates. The 2008 financial crisis, for example, led to increased volatility and uncertainty in the lending market, impacting interest rates across the board, including student loans. Subsequent government interventions, such as the various stimulus packages and changes to federal loan programs, also played a role. The implementation of income-driven repayment plans, while not directly affecting interest rates, influenced the overall risk profile for lenders, potentially impacting rates indirectly. Furthermore, changes in the overall economic climate, such as inflation rates and monetary policy decisions by the Federal Reserve, have had a significant impact on the cost of borrowing.

Comparison of Federal and Private Student Loan Interest Rates

Federal and private student loan interest rates have followed distinct trends. Federal student loan rates are typically lower than private loan rates, reflecting the lower risk associated with government-backed loans. However, both types of loans have experienced fluctuations in response to broader economic conditions. Private loan rates are often more closely tied to market interest rates and the creditworthiness of the borrower, leading to greater variability. During periods of economic uncertainty, private loan rates may increase more dramatically than federal loan rates, reflecting the increased risk perception by private lenders. Conversely, during periods of low interest rates, the gap between federal and private rates may narrow. This difference underscores the importance of exploring all available options and understanding the nuances of each type of loan before committing to borrowing.

Impact of Interest Rates on Student Loan Borrowers

Student loan interest rates significantly influence the overall cost of higher education. Understanding how these rates affect repayment is crucial for borrowers to make informed financial decisions and plan effectively for the future. Even small differences in interest rates can translate into substantial variations in the total amount repaid over the loan’s lifespan.

The impact of interest rates on student loan borrowers is multifaceted, affecting not only the total amount repaid but also the length of the repayment period and the overall financial burden. This section will explore how varying interest rates influence the total cost of a loan, the implications of accruing interest during periods of deferment or forbearance, and illustrate the differences through a hypothetical repayment schedule.

Interest Rate Variations and Total Loan Cost

Different interest rates applied to student loans lead to vastly different total repayment amounts. Higher interest rates accelerate the growth of loan principal, resulting in a significantly higher total cost. Conversely, lower interest rates mean less interest accrues, reducing the overall debt burden.

- Scenario 1: A $20,000 loan at 5% interest over 10 years would result in a total repayment of approximately $25,600. This includes both the principal and accumulated interest.

- Scenario 2: The same $20,000 loan at 7% interest over 10 years would increase the total repayment to approximately $28,000. The additional 2% interest rate results in a nearly $2,400 increase in the total cost.

- Scenario 3: A larger loan amount, say $40,000 at 5% interest over 10 years, would lead to a total repayment of approximately $51,200. This highlights the compounding effect of both loan size and interest rate.

- Scenario 4: The same $40,000 loan at 7% interest over 10 years would see the total repayment rise to approximately $56,000. The difference in total cost between a 5% and a 7% interest rate is amplified with a larger principal amount.

Interest Accrual During Deferment or Forbearance

Periods of deferment or forbearance, while offering temporary relief from repayment, often lead to increased overall loan costs. During these periods, interest continues to accrue on the loan principal, increasing the total amount owed. This means that the borrower will owe more than the original principal amount once the deferment or forbearance period ends. The longer the deferment or forbearance, the more significant the impact on the total cost. For example, a borrower who defers payments for two years on a $10,000 loan at 6% interest could accrue several hundred dollars in additional interest, increasing their total debt.

Hypothetical Repayment Schedule

The following table demonstrates the difference between a high and low-interest loan over a 10-year repayment period. Both loans are for $20,000.

| Year | Low Interest Loan (5%) | High Interest Loan (7%) |

|---|---|---|

| 1 | $2,296.47 | $2,509.74 |

| 2 | $2,260.85 | $2,467.27 |

| 3 | $2,223.48 | $2,422.55 |

| 4 | $2,184.38 | $2,375.50 |

| 5 | $2,143.52 | $2,326.06 |

| 6 | $2,000.00 | $2,274.16 |

| 7 | $1,954.75 | $2,219.74 |

| 8 | $1,907.75 | $2,162.72 |

| 9 | $1,858.97 | $2,103.05 |

| 10 | $1,808.40 | $2,040.68 |

| Total Repayment | $22,964.57 | $25,091.41 |

Strategies for Managing Student Loan Interest Rates

Navigating the complexities of student loan debt often involves understanding and managing interest rates. High interest rates can significantly increase the total cost of your education, making it crucial to explore strategies for minimizing their impact. This section Artikels several approaches borrowers can take to control their loan costs and achieve a more manageable repayment plan.

Several strategies exist to help borrowers mitigate the effects of high student loan interest rates. These range from proactive steps like refinancing to leveraging government programs designed to make repayment more affordable.

Strategies to Minimize the Impact of High Interest Rates

Borrowers have several options to lessen the burden of high interest rates. Choosing the right strategy depends on individual circumstances, including credit score, income, and loan type. Here are some key approaches:

- Refinancing: This involves replacing your existing student loans with a new loan at a lower interest rate. This can significantly reduce your monthly payments and overall interest paid.

- Income-Driven Repayment Plans (IDR): These plans adjust your monthly payments based on your income and family size. While they may extend your repayment period, they can make payments more manageable in the short term.

- Making Extra Payments: Paying more than the minimum monthly payment, even a small extra amount, can save you money on interest in the long run and reduce the total repayment time.

- Consolidation: Combining multiple student loans into a single loan can simplify repayment and potentially lower your interest rate, though this isn’t always guaranteed.

Refinancing Student Loans: Pros and Cons

Refinancing student loans can be a powerful tool for reducing interest costs, but it’s essential to weigh the advantages and disadvantages carefully before making a decision.

Pros: Lower interest rates, potentially lower monthly payments, simplified repayment with a single loan, and the possibility of switching to a shorter repayment term.

Cons: Loss of federal loan benefits (like income-driven repayment plans or deferment options), potential for higher fees, the need for a good credit score to qualify for favorable rates, and the risk of locking into a fixed interest rate that might be higher than future rates if you refinance at the wrong time.

Applying for an Income-Driven Repayment Plan

Income-driven repayment plans offer a path to more affordable monthly payments by tying your payments to your income. The application process generally involves these steps:

- Determine Eligibility: Check if you qualify for an IDR plan based on your loan type and income.

- Choose a Plan: Select the IDR plan that best suits your financial situation. Options include Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE).

- Gather Required Documents: Prepare your tax returns and other documentation to verify your income and family size.

- Submit Your Application: Complete the application through the student loan servicer’s website.

- Monitor Your Payments: Regularly check your account to ensure your payments are accurately calculated based on your income.

The Role of Government Policy on Student Loan Interest Rates

Government policies play a pivotal role in shaping the landscape of student loan interest rates, significantly impacting both borrowers and the overall economy. These policies influence not only the rates themselves but also the accessibility and affordability of higher education. Understanding the government’s involvement is crucial for navigating the complexities of student loan debt.

Government intervention in student loan interest rates primarily occurs through direct lending programs, subsidies, and regulatory frameworks. Many countries have established government-backed student loan programs, where the government either directly lends money to students or guarantees loans made by private lenders. This involvement often translates to lower interest rates than those available in the private market, making higher education more financially accessible. Furthermore, governments may choose to subsidize interest rates, effectively reducing the cost of borrowing for students. Regulations also play a crucial part, setting parameters for lending practices, interest rate caps, and repayment terms.

Government Subsidies and Direct Lending Programs

Government subsidies are a key mechanism for influencing student loan interest rates. These subsidies directly reduce the interest rate that borrowers pay, effectively lowering the overall cost of their education. The extent of these subsidies varies across countries and often depends on factors such as the student’s financial need, the type of institution attended, and the field of study. For example, some countries may offer larger subsidies for students pursuing STEM fields, reflecting a national policy prioritizing these sectors. Direct lending programs, where the government is the primary lender, offer another avenue for controlling interest rates. By acting as the lender, the government can set interest rates directly, offering a level of control not possible in a purely market-driven system. The implementation of these programs can significantly impact student debt levels and the overall affordability of college education.

The Impact of Government Policy Changes on Student Loan Debt

Changes in government policies regarding student loan interest rates can have far-reaching consequences for student loan debt levels. For instance, a reduction in government subsidies can lead to a direct increase in the interest rates borrowers face, potentially resulting in a significant rise in the overall cost of their loans over the life of the repayment plan. Conversely, increases in subsidies can lower borrowing costs, making higher education more accessible and reducing the overall burden of student loan debt. Furthermore, changes in the regulatory environment, such as alterations to repayment plans or the introduction of income-driven repayment options, can also indirectly impact student loan debt levels by affecting the affordability and manageability of repayments. For example, the introduction of income-driven repayment plans in the United States has helped many borrowers manage their debt, preventing default and minimizing the overall impact of student loan debt on their financial well-being.

International Comparisons of Student Loan Interest Rate Policies

Different countries adopt diverse approaches to student loan interest rates. Some countries, like Germany, utilize a primarily market-based system with minimal government intervention, resulting in potentially higher interest rates for borrowers. In contrast, other countries, such as the United Kingdom, have implemented extensive government-backed loan programs with lower, often subsidized, interest rates. These differing approaches reflect the varying national priorities and economic conditions. Furthermore, the level of government involvement often correlates with the country’s overall approach to higher education funding and accessibility. Countries with a strong commitment to affordable higher education tend to exhibit greater government intervention in the student loan market, resulting in lower interest rates and increased access to education.

Student Loan Interest Rates and the Economy

Student loan interest rates are not isolated from the broader economic landscape; they are intricately woven into the fabric of inflation, recessionary periods, and overall economic health. Understanding this relationship is crucial for both borrowers facing repayment and policymakers striving for economic stability. Fluctuations in the economy directly influence the cost of borrowing for students and, consequently, have far-reaching effects on individual financial well-being and national economic growth.

The relationship between overall economic conditions and student loan interest rates is multifaceted. During periods of high inflation, the Federal Reserve typically raises interest rates to curb inflation. This increase in the federal funds rate – the target rate banks charge each other for overnight loans – directly impacts other interest rates, including those on student loans. Conversely, during recessions, the Fed often lowers interest rates to stimulate economic activity. This reduction can lead to lower student loan interest rates, making borrowing more attractive. However, a recession also typically leads to higher unemployment, potentially impacting borrowers’ ability to repay their loans. This creates a complex interplay between economic stimulus and the burden of student debt.

The Impact of High Student Loan Interest Rates on the Overall Economy

High student loan interest rates can significantly impede economic growth. The burden of high interest payments diverts considerable disposable income from borrowers, reducing consumer spending and investment. This decreased consumer demand can slow economic growth and potentially prolong a recession. Furthermore, high interest rates can discourage individuals from pursuing higher education, potentially leading to a less skilled workforce and hindering long-term economic productivity. For example, a significant increase in student loan interest rates could deter prospective students from pursuing advanced degrees in fields like STEM, ultimately impacting technological innovation and economic competitiveness. The accumulated debt can also delay major life decisions like homeownership, further impacting the housing market and overall economic activity.

The Influence of the Federal Funds Rate on Student Loan Interest Rates

The federal funds rate acts as a benchmark for other interest rates in the economy. While student loan interest rates aren’t directly tied to the federal funds rate in a one-to-one relationship, changes in the federal funds rate significantly influence the overall cost of borrowing. When the Fed raises the federal funds rate, lenders tend to increase interest rates across the board, including those on student loans. This is because the increased cost of borrowing for banks translates into higher interest rates charged to consumers. Conversely, a decrease in the federal funds rate usually leads to lower interest rates on student loans, making borrowing cheaper. The magnitude of the impact, however, depends on various factors including the type of loan (federal vs. private), the lender’s risk assessment, and market conditions. For instance, a 0.25% increase in the federal funds rate might translate to a 0.5% or even a 1% increase in certain student loan interest rates depending on these influencing factors.

Final Review

Understanding student loan interest rates is crucial for responsible borrowing and effective debt management. By carefully considering the factors influencing these rates, exploring available repayment options, and proactively managing your debt, you can minimize the long-term financial burden of student loans. This guide has provided a framework for understanding the complexities involved, empowering you to make informed decisions and pave the way for a secure financial future. Remember to regularly review your loan terms and explore all available resources to ensure you are utilizing the most beneficial repayment strategies for your circumstances.

FAQ Section

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest throughout your education.

Can I refinance my federal student loans?

Yes, but refinancing federal loans into private loans means losing federal protections like income-driven repayment plans.

What is an income-driven repayment plan?

These plans base your monthly payment on your income and family size, potentially leading to loan forgiveness after 20-25 years.

How often do student loan interest rates change?

Federal student loan interest rates are typically set annually, while private loan rates can fluctuate more frequently.

What happens if I default on my student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your lender if you’re struggling to make payments.