Navigating the complexities of student loan debt can feel overwhelming, but understanding the potential benefits and drawbacks of consolidation is crucial for long-term financial well-being. Student loan consolidation offers the possibility of simplifying repayment by combining multiple loans into a single, manageable payment. However, the interest rate implications are significant and require careful consideration. This exploration delves into the intricacies of interest rates associated with student loan consolidation, examining how they are calculated, the factors influencing them, and the potential long-term financial consequences.

This guide provides a comprehensive overview of the student loan consolidation process, including eligibility criteria, various consolidation options, and alternative debt management strategies. We will analyze real-world scenarios to illustrate the impact of interest rate fluctuations on repayment schedules and total loan costs. Ultimately, the goal is to empower you with the knowledge needed to make informed decisions about your student loan debt.

Understanding Student Loan Consolidation

Student loan consolidation simplifies your repayment process by combining multiple federal or private student loans into a single loan. This can streamline your finances, potentially leading to a more manageable monthly payment. However, it’s crucial to understand the nuances before making a decision, as consolidation isn’t always the best option for everyone.

Mechanics of Student Loan Consolidation

The process involves applying to a lender (either a government agency or a private lender, depending on the loan type) to combine your existing loans. The lender pays off your original loans, and you receive a new loan with a single monthly payment. The interest rate on your new consolidated loan will depend on several factors, including your creditworthiness and the types of loans being consolidated. Your new interest rate may be a weighted average of your original loan interest rates, or it may be a new rate based on your current credit profile. Importantly, consolidation does not reduce your overall loan balance; it only changes the structure of your repayment.

Types of Student Loan Consolidation Programs

There are primarily two types of student loan consolidation: federal and private. Federal consolidation, offered through the U.S. Department of Education, combines eligible federal student loans (such as Direct Subsidized and Unsubsidized Loans, Stafford Loans, and Federal PLUS Loans) into a Direct Consolidation Loan. Private lenders offer consolidation options for both federal and private student loans, but they are subject to different terms and conditions. Choosing between federal and private consolidation depends on your specific financial situation and the types of loans you have.

Benefits and Drawbacks of Consolidation Options

Federal consolidation offers several advantages, including simplified repayment with a single monthly payment and access to income-driven repayment plans. However, it might not always result in a lower interest rate, and it may extend your repayment period, leading to higher total interest paid over the life of the loan. Private consolidation, while offering the convenience of a single payment, may come with higher interest rates and less flexible repayment options compared to federal consolidation. Carefully weigh the pros and cons before making a decision.

Step-by-Step Guide to Applying for Student Loan Consolidation

1. Gather your information: Collect your loan details, including loan numbers, balances, and interest rates.

2. Check your eligibility: Determine if you meet the eligibility requirements for federal or private consolidation.

3. Choose a lender: Research and compare lenders based on interest rates, fees, and repayment options.

4. Complete the application: Fill out the application accurately and completely.

5. Submit your application: Submit the completed application along with any required documentation.

6. Review your loan terms: Once approved, carefully review the terms of your consolidated loan before accepting it.

Comparison of Interest Rates Offered by Different Lenders

Note: Interest rates are variable and depend on several factors, including credit score and market conditions. This table provides a hypothetical example for illustrative purposes only and should not be considered financial advice.

| Lender | Fixed Interest Rate | Variable Interest Rate | Fees |

|---|---|---|---|

| Federal Direct Consolidation Loan | 7.00% (Example) | N/A | $0 |

| Private Lender A | 8.50% (Example) | 7.00% – 9.00% (Example) | $100 – $300 (Example) |

| Private Lender B | 9.00% (Example) | 7.50% – 9.50% (Example) | $50 – $200 (Example) |

Interest Rate Implications of Consolidation

Student loan consolidation can significantly impact your overall borrowing costs, primarily through changes in your interest rate. Understanding how this works is crucial for making informed financial decisions. The new interest rate on your consolidated loan isn’t simply an average of your existing rates; it’s a weighted average, influenced by several factors. This section will explore these factors and their effects on your repayment plan.

Factors Influencing Consolidated Loan Interest Rates

Several key factors determine the interest rate you’ll receive on a consolidated student loan. These include your credit history, the types of loans being consolidated, the current market interest rates, and the lender’s policies. A strong credit history generally leads to a lower interest rate, while consolidating various loan types with different interest rates can complicate the calculation. Prevailing market conditions also play a role, with higher market rates potentially resulting in a higher consolidated rate.

Weighted Average Interest Rate Calculation

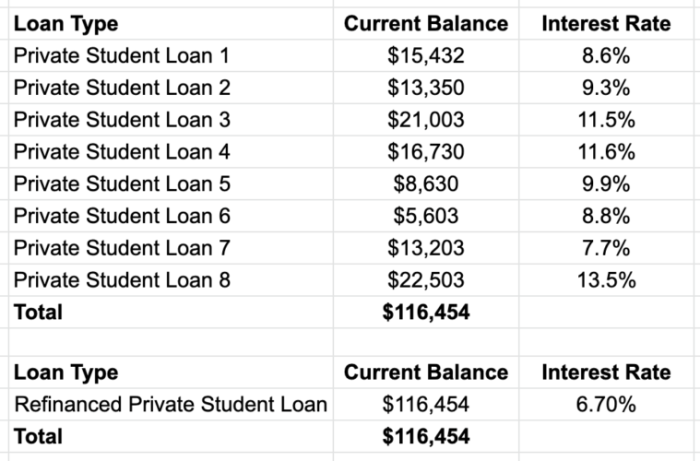

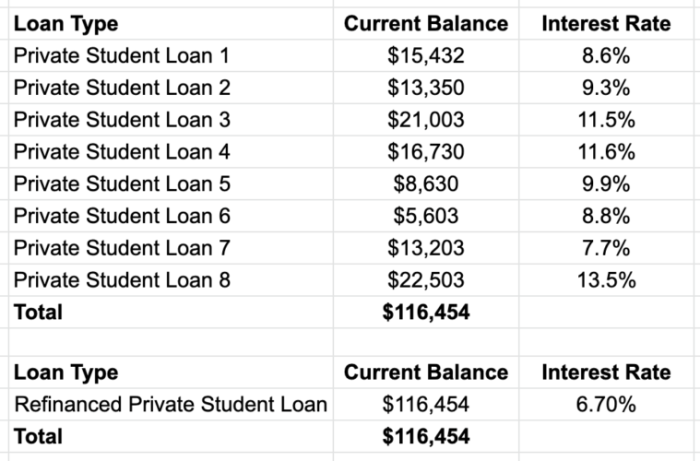

The interest rate on a consolidated loan is calculated as a weighted average of the interest rates of the individual loans being consolidated. This means that loans with larger balances will have a greater influence on the final rate. The calculation involves multiplying each loan’s balance by its interest rate, summing these products, and then dividing by the total consolidated loan balance.

The formula for a weighted average interest rate is: Weighted Average Interest Rate = (Sum of (Individual Loan Balance * Individual Loan Interest Rate)) / Total Consolidated Loan Balance

For example, consider consolidating two loans: one with a $10,000 balance at 5% interest and another with a $20,000 balance at 7% interest. The weighted average would be: (($10,000 * 0.05) + ($20,000 * 0.07)) / ($10,000 + $20,000) = 6.33%. This demonstrates how larger loans disproportionately impact the final rate.

Scenarios Leading to Higher or Lower Interest Rates

Consolidation can result in either a higher or lower interest rate than your current average. If your highest-interest loans represent a significant portion of your overall debt, consolidation might lead to a lower rate, assuming the new rate is below the weighted average of your existing rates. Conversely, if you have a mix of low and high-interest loans, and the new rate is above the weighted average of your existing rates, consolidation may result in a higher interest rate. This often happens when borrowers with excellent credit consolidate loans and then their credit score drops.

Real-World Examples of Interest Rate Impact

Imagine a borrower with two loans: $15,000 at 6% and $10,000 at 4%. Their weighted average is 5.33%. If they consolidate and receive a 5% rate, their monthly payments will be lower, and they’ll save money over the life of the loan. However, if they receive a 6% rate, their total repayment cost will increase. A different borrower with two loans, $20,000 at 8% and $5,000 at 2%, has a weighted average of 7%. If their consolidated rate is 6%, they will save significantly.

Hypothetical Repayment Schedule

Let’s assume a $30,000 loan with a 10-year repayment term. The following table illustrates the impact of different interest rates on total loan cost:

| Interest Rate | Monthly Payment (approx.) | Total Repayment (approx.) |

|---|---|---|

| 5% | $311 | $37,320 |

| 6% | $330 | $39,600 |

| 7% | $350 | $42,000 |

Note: These figures are approximate and do not include any fees. Actual payments may vary based on the lender and loan terms. The difference in total repayment, even with seemingly small interest rate changes, can be substantial over the life of the loan.

Eligibility and Qualification Criteria

Student loan consolidation, while offering the potential for simplified repayment, isn’t accessible to everyone. Understanding the eligibility requirements for both federal and private programs is crucial before pursuing consolidation. These requirements vary depending on the type of loans you hold and your overall financial standing.

Federal Student Loan Consolidation Eligibility

To consolidate federal student loans, you must have at least one eligible federal student loan. These typically include Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. However, certain loans, like defaulted loans, may require rehabilitation before consolidation is possible. There are no specific credit score or income requirements for federal consolidation, making it a more accessible option for borrowers with less-than-perfect credit histories. The primary focus is on the type and status of your existing federal student loans. For example, a borrower with a history of late payments on their federal loans might still be eligible for consolidation, although their interest rate might reflect that history.

Private Student Loan Consolidation Eligibility

Private student loan consolidation, in contrast, is significantly more stringent. Private lenders, unlike the federal government, assess applicants based on their creditworthiness. This typically involves a credit check, examining your credit score, debt-to-income ratio, and overall financial history. A higher credit score and a lower debt-to-income ratio generally improve your chances of approval and potentially secure a lower interest rate. For example, a borrower with an excellent credit score (750 or above) and a low debt-to-income ratio is far more likely to qualify for favorable terms than someone with a poor credit score and high debt. Income requirements are not always explicitly stated, but a demonstrable ability to repay the consolidated loan is crucial.

Examples of Ineligibility for Consolidation

Several situations can lead to ineligibility for consolidation. For federal consolidation, having defaulted federal loans without rehabilitation is a common reason for denial. For private consolidation, a very low credit score (below 600, for example), a high debt-to-income ratio, or a history of bankruptcy could all result in rejection. Furthermore, some lenders may refuse consolidation if the applicant has outstanding debts or judgments against them. For instance, a borrower with multiple outstanding collections might find it difficult to secure private loan consolidation.

Required Documents for Student Loan Consolidation

Before applying for student loan consolidation, gathering the necessary documentation is essential to streamline the process. This typically includes:

- Your Social Security number

- Your federal student loan details (loan numbers, balances, and servicers)

- Your credit report (for private consolidation)

- Proof of income (pay stubs, tax returns, or bank statements)

- Information about your existing debts (for private consolidation)

The specific documents required might vary slightly depending on the lender or government agency processing your application. It’s always advisable to check the lender’s website or contact them directly for a comprehensive list.

Application Process for Different Consolidation Types

The application process differs slightly between federal and private consolidation. Federal consolidation is typically completed online through the Federal Student Aid website (StudentAid.gov). The process involves completing an application, providing the necessary documentation, and selecting a repayment plan. Private consolidation involves applying directly through a private lender. This typically includes completing a loan application, undergoing a credit check, and providing supporting financial documentation. The lender will then review the application and inform the applicant of their decision. The entire process, for both federal and private options, can take several weeks to complete.

Long-Term Financial Impact

Consolidating your student loans can significantly alter your long-term financial picture, offering both advantages and potential drawbacks. Understanding these implications is crucial for making an informed decision that aligns with your individual financial goals and risk tolerance. The long-term effects extend beyond the immediate reduction in monthly payments, impacting your credit score, overall debt burden, and future financial flexibility.

Consolidation’s long-term impact hinges on several factors, including the interest rate of the consolidated loan, the repayment plan chosen, and your ability to maintain consistent, on-time payments. A lower interest rate can lead to substantial savings over the life of the loan, while a poorly chosen repayment plan could extend the repayment period and ultimately increase the total interest paid. Furthermore, responsible management of your consolidated debt is key to maximizing its benefits and avoiding potential pitfalls.

Managing Consolidated Student Loan Debt

Effective management of consolidated student loans requires a proactive approach. This involves creating a detailed budget that incorporates the monthly loan payment, prioritizing timely payments to avoid late fees and negative impacts on your credit score, and exploring options for additional payments whenever possible to accelerate debt repayment. Regularly reviewing your loan terms and remaining balance can help you stay informed and adjust your repayment strategy as needed. For example, consider setting up automatic payments to ensure consistent on-time payments, a practice that not only avoids late fees but also demonstrates financial responsibility to lenders. Furthermore, actively tracking your progress using budgeting apps or spreadsheets can help you stay motivated and on track to achieving your debt-free goals.

Impact of Consolidation on Credit Score

The impact of student loan consolidation on your credit score is multifaceted. While the consolidation process itself doesn’t directly improve your credit score, responsible management of the consolidated loan can positively influence it over time. Consistent on-time payments on your consolidated loan demonstrate responsible credit behavior, which can lead to a gradual increase in your credit score. Conversely, late payments or defaulting on your consolidated loan can severely damage your credit score, making it harder to secure loans or credit cards in the future. For instance, consistently paying your consolidated loan on time for a year or more will generally show a positive trend in your credit report. Conversely, a single missed payment can negatively impact your score, highlighting the importance of diligent payment management.

Comparison of Long-Term Costs

The long-term costs of different consolidation strategies vary significantly depending on the interest rate offered, the length of the repayment term, and any associated fees. For example, a direct consolidation loan from the federal government may offer a fixed, weighted average interest rate based on your existing loans, potentially leading to lower interest payments compared to a private consolidation loan which may carry a higher interest rate. A longer repayment term may lower your monthly payments, but it will ultimately result in paying more interest over the life of the loan. Conversely, a shorter repayment term will result in higher monthly payments but significantly less interest paid in the long run. Careful comparison of these factors is essential to choosing a strategy that aligns with your financial capabilities and long-term goals.

Potential Financial Risks Associated with Consolidation

Before consolidating your student loans, it’s crucial to understand the potential financial risks involved.

- Higher Interest Rate: A private consolidation loan might offer a higher interest rate than some of your existing federal loans, leading to higher overall interest payments.

- Loss of Federal Loan Benefits: Consolidating federal loans into a private loan may cause you to lose access to income-driven repayment plans, deferment, or forbearance options.

- Extended Repayment Period: While a longer repayment term reduces monthly payments, it increases the total interest paid over the life of the loan.

- Impact on Credit Score (Negative): Missed payments or default on your consolidated loan can severely damage your credit score.

- Hidden Fees: Some consolidation companies may charge high upfront or ongoing fees.

Alternatives to Consolidation

Student loan consolidation isn’t the only path to managing your student loan debt. Several alternative strategies offer different advantages and disadvantages, depending on your individual financial situation and goals. Understanding these alternatives is crucial for making informed decisions about your repayment strategy.

Loan Refinancing

Loan refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing typically means losing federal student loan benefits, such as income-driven repayment plans and potential loan forgiveness programs. A thorough comparison of your current interest rates and the offered refinancing rates is essential before proceeding. For example, if you currently have federal loans with a 6% interest rate and a private lender offers a 4% refinancing rate, the savings could be substantial over the loan term. Conversely, if the refinancing rate is higher or similar, the benefits would be minimal, and the loss of federal benefits might outweigh any potential savings.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans are available for federal student loans and can make your monthly payments more manageable, especially during periods of lower income. However, IDR plans typically extend the repayment period, leading to higher total interest paid over the life of the loan. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has its own specific income and family size calculations and repayment terms. For instance, a PAYE plan might calculate your monthly payment based on 10% of your discretionary income, while an IBR plan may use a different percentage. The application process usually involves submitting your tax information and income documentation to your loan servicer.

Applying for Income-Driven Repayment Plans

The process of applying for an IDR plan generally involves completing an application online through the Federal Student Aid website (StudentAid.gov). You will need to provide information about your income, family size, and loan details. Once approved, your monthly payment will be recalculated based on your chosen plan’s formula. Regular updates of income information are often required annually to maintain eligibility. Failure to update your information could lead to inaccurate payment calculations and potential issues down the line.

Comparison of Consolidation and Other Debt Management Strategies

| Strategy | Interest Rate | Monthly Payment | Loan Forgiveness Programs | Repayment Period |

|---|---|---|---|---|

| Consolidation | Potentially lower, depending on weighted average | Potentially lower, depending on repayment term | Retains eligibility (if using federal loans) | Can be extended or shortened |

| Refinancing | Potentially lower, but private loan | Potentially lower | Loses eligibility for federal programs | Typically fixed |

| IDR Plans | Remains the same | Adjusted based on income | Maintains eligibility for federal programs | Extended repayment period |

Conclusive Thoughts

Successfully managing student loan debt requires a proactive and informed approach. While student loan consolidation can simplify repayment, understanding the nuances of interest rate calculations and potential long-term financial impacts is paramount. By carefully weighing the benefits and drawbacks of consolidation against alternative strategies, such as refinancing or income-driven repayment plans, you can develop a personalized debt management plan that aligns with your financial goals. Remember to thoroughly research your options and, if necessary, seek professional financial advice to ensure you make the best decision for your unique circumstances.

FAQ Overview

What is a weighted average interest rate?

A weighted average interest rate for a consolidated loan reflects the average interest rate of your individual loans, weighted by their outstanding balances. Larger loans have a greater influence on the final rate.

Can I consolidate private and federal student loans together?

Generally, you cannot consolidate federal and private student loans into a single federal loan. However, some private lenders may offer consolidation options for both types of loans.

Will consolidating my loans affect my credit score?

The impact on your credit score is typically minimal, but it can depend on the specific circumstances. Applying for a new loan might result in a temporary slight dip, but responsible repayment of the consolidated loan should improve or maintain your score.

What happens if I miss payments on my consolidated loan?

Missing payments on a consolidated loan will negatively impact your credit score and could lead to late fees, collection actions, and potentially default.