Securing higher education often involves navigating the complexities of student loans. The Iowa Student Loan Liquidity Corporation (ISLSC) plays a vital role in this process, facilitating access to funds and ensuring the stability of the state’s student loan market. Understanding its operations, financial health, and impact on Iowan students is crucial for both borrowers and policymakers alike. This exploration delves into the ISLSC’s history, functions, and future prospects, providing a comprehensive overview of its significance within the Iowa higher education landscape.

From its establishment to its current operations, the ISLSC has consistently adapted to the evolving needs of Iowa’s students and the broader financial environment. This includes not only providing access to capital for student loans but also implementing robust risk management strategies and actively working to prevent loan defaults. The corporation’s financial performance, governance structure, and impact on the state’s economy are all key aspects examined in this analysis.

Iowa Student Loan Liquidity Corporation

The Iowa Student Loan Liquidity Corporation (ISLLC) plays a vital role in supporting access to higher education within the state of Iowa. Established to address specific needs within the student loan market, it operates under a unique legal structure and maintains key relationships with various state and federal entities. Understanding its history, functions, and legal framework is crucial to appreciating its contribution to Iowa’s educational landscape.

History of the Iowa Student Loan Liquidity Corporation

The ISLLC’s precise founding date requires further research from official state records; however, its establishment stemmed from a need to improve the efficiency and stability of the student loan market in Iowa. The corporation likely emerged in response to market fluctuations and a desire to provide a more reliable source of funding for student loans. Its creation aimed to mitigate risks associated with traditional student loan financing, ultimately benefiting both lenders and borrowers. A detailed timeline of its development, including any significant legislative actions or milestones, would require access to official state documents and archives.

Primary Functions and Objectives

The ISLLC’s primary function is to provide liquidity to the Iowa student loan market. This involves purchasing student loans from lenders, thereby freeing up capital for lenders to issue new loans. This process enhances the overall availability of student loan funding within the state. The corporation’s objectives include promoting access to higher education for Iowa residents, stabilizing the student loan market, and supporting the economic well-being of the state by facilitating educational attainment. It aims to achieve these goals by managing risk effectively and ensuring the efficient flow of funds within the student loan system.

Legal Framework Governing Operations

The ISLLC operates under the authority granted by the Iowa Legislature through specific statutes. These statutes define its powers, responsibilities, and operational guidelines. Compliance with these legal provisions is paramount to the corporation’s functioning. The legal framework likely includes provisions regarding its governance structure, financial reporting requirements, and limitations on its activities. Further research into the specific Iowa Code sections governing the ISLLC is necessary to provide a complete understanding of its legal basis.

Relationship with the State of Iowa and Other Relevant Entities

The ISLLC maintains a close relationship with the State of Iowa, likely reporting to a specific state agency or board. This relationship ensures accountability and alignment with state educational policies. It may also interact with other entities involved in higher education financing, such as the Iowa College Aid Commission and potentially federal agencies like the Department of Education. These interactions are vital for coordinating efforts to support student access to higher education and maintaining a stable and effective student loan system. The corporation’s precise interactions and reporting structures should be confirmed through official state documentation.

Financial Operations and Structure

The Iowa Student Loan Liquidity Corporation (ISLLC) maintains a robust financial structure designed to support its mission of providing liquidity to the state’s student loan market. Its operations are underpinned by a diversified funding strategy and rigorous risk management protocols. Understanding these aspects is crucial to appreciating the corporation’s stability and effectiveness.

The corporation’s funding primarily comes from the issuance of short-term debt securities in the municipal bond market. These securities are typically backed by the underlying student loan assets held by ISLLC. Additional funding may be sourced from lines of credit or other short-term borrowing arrangements, providing flexibility in managing cash flow and meeting liquidity demands. The capital structure reflects a commitment to maintaining a strong financial position, enabling the corporation to meet its obligations and support its operational goals.

Funding Sources and Capital Structure

ISLLC’s funding strategy prioritizes low-cost, short-term borrowing to minimize interest expense and maintain financial flexibility. The corporation’s capital structure is designed to leverage its assets efficiently while maintaining a strong credit rating. This approach ensures access to favorable borrowing terms and supports its ability to provide liquidity to participating lenders. The specific mix of funding sources is regularly reviewed and adjusted based on market conditions and the corporation’s overall financial needs. This proactive approach helps mitigate potential risks associated with interest rate fluctuations and changing market dynamics.

Investment Strategies and Risk Management

ISLLC’s investment strategy focuses on preserving capital and generating sufficient returns to cover operating expenses and maintain a strong financial position. Investments are primarily made in high-quality, short-term securities to minimize interest rate risk and credit risk. The corporation employs a rigorous risk management framework that includes regular portfolio reviews, stress testing, and adherence to established investment guidelines. This framework is designed to identify and mitigate potential risks, ensuring the corporation’s long-term financial stability. Diversification across various asset classes further reduces the overall portfolio risk. For example, ISLLC might invest in a mix of U.S. Treasury securities, agency mortgage-backed securities, and other high-quality short-term instruments.

Financial Performance (Past Five Years)

The following table summarizes ISLLC’s key financial performance indicators over the past five years. Note that these figures are illustrative and should not be considered actual financial data. Access to actual data would require consultation of official ISLLC financial reports.

| Year | Total Assets | Net Income | Return on Assets |

|---|---|---|---|

| 2018 | $XXX Million | $X Million | X% |

| 2019 | $XXX Million | $X Million | X% |

| 2020 | $XXX Million | $X Million | X% |

| 2021 | $XXX Million | $X Million | X% |

| 2022 | $XXX Million | $X Million | X% |

Comparison to Similar Organizations

Comparing ISLLC’s financial performance to similar organizations in other states requires access to comparable data from those organizations. This type of comparative analysis would typically involve reviewing publicly available financial statements and reports from state student loan authorities or liquidity corporations in other jurisdictions. Key metrics for comparison might include return on assets, operating expenses, and credit ratings. Such a comparative analysis would provide valuable insights into ISLLC’s relative efficiency and financial strength within the broader context of the national student loan market.

Student Loan Programs and Services

The Iowa Student Loan Liquidity Corporation (ISLLC) plays a vital role in supporting access to higher education within the state by facilitating and managing various student loan programs. These programs are designed to provide affordable financing options for students pursuing their educational goals, ultimately contributing to Iowa’s economic growth and development. The ISLLC’s involvement ensures a stable and efficient student loan market.

The ISLLC primarily facilitates the management and securitization of student loans originated by participating lenders in Iowa. This indirect involvement means the corporation doesn’t directly lend money to students, but instead works behind the scenes to ensure a smooth and reliable system for loan origination and repayment. This support contributes to a more stable and predictable financial environment for both lenders and borrowers.

Types of Student Loans Facilitated

The ISLLC’s activities encompass a broad range of federal and private student loan programs. While the corporation does not directly originate loans, it supports the flow of funds through the securitization process, making these loans available to students. This includes federal student loans such as Stafford Loans and Perkins Loans, as well as various private student loans offered by participating lenders. The specific types of loans available vary depending on the participating lenders and the student’s eligibility.

Eligibility Criteria for Borrowers

Eligibility for student loans facilitated by the ISLLC is determined by the individual lenders participating in the program. Generally, eligibility criteria include factors such as enrollment status at an eligible institution, U.S. citizenship or eligible non-citizen status, and demonstration of financial need (for need-based programs). Credit history may also be a factor for some private loans. Specific requirements vary depending on the loan program and lender. Prospective borrowers should directly contact the lenders for detailed eligibility information.

Interest Rates and Repayment Terms

Interest rates and repayment terms for student loans facilitated by the ISLLC are determined by the individual lenders and are subject to change. Interest rates for federal loans are set by the government, while private loan interest rates are typically variable and based on market conditions and the borrower’s creditworthiness. Repayment terms typically range from 10 to 20 years, but options may exist for extended repayment plans under certain circumstances. Borrowers should review the terms and conditions of their specific loan agreements for detailed information on interest rates and repayment schedules.

Student Loan Default Prevention and Resolution

The ISLLC’s role in default prevention and resolution is indirect but crucial. By ensuring a stable and efficient market for student loans, the corporation contributes to a healthier lending environment that can reduce the likelihood of defaults. The ISLLC works closely with participating lenders to establish efficient processes for loan servicing and collection, thereby mitigating the risk of defaults. While the corporation does not directly handle default resolution, its activities support a system that aims to prevent defaults and facilitate effective resolution when they do occur. This includes supporting the lenders’ efforts in working with borrowers to establish repayment plans and avoid delinquency.

Governance and Transparency

The Iowa Student Loan Liquidity Corporation (ISLLC) operates under a robust governance structure designed to ensure accountability, transparency, and ethical conduct in all its operations. This framework promotes public trust and confidence in the corporation’s management of student loan assets and its commitment to serving Iowa’s students.

The corporation’s effectiveness relies heavily on the composition and actions of its board and management. A clear chain of command and defined responsibilities are crucial for efficient decision-making and the prevention of conflicts of interest.

Board of Directors Structure and Composition

The ISLLC Board of Directors consists of a specified number of members appointed based on established criteria, often reflecting diverse backgrounds and expertise relevant to finance, education, and public service. These appointments typically follow a process that includes review by relevant state bodies and confirmation hearings, ensuring a level of public scrutiny and accountability. The board’s responsibilities include oversight of the corporation’s strategic direction, financial performance, and compliance with all applicable laws and regulations. Regular board meetings, with minutes publicly available (subject to applicable privacy laws), provide a formal mechanism for decision-making and accountability.

Accountability Mechanisms and Reporting Procedures

The ISLLC employs a comprehensive system of internal controls and audits to ensure the accuracy and reliability of its financial reporting. These mechanisms include regular internal audits conducted by the corporation’s internal audit function, as well as independent external audits performed by a reputable accounting firm. Financial statements are prepared in accordance with generally accepted accounting principles (GAAP) and are submitted to the appropriate regulatory bodies. The corporation also maintains detailed records of all its transactions and activities, readily accessible for review by authorized personnel. Annual reports, summarizing the corporation’s performance and activities, are publicly available on the ISLLC website.

Public Disclosures and Transparency Initiatives

The ISLLC is committed to transparency and proactively discloses relevant information to the public. This includes publishing annual reports detailing financial performance, operational activities, and key metrics. The corporation’s website serves as a central repository for publicly accessible information, including board meeting minutes, financial statements, and other relevant documents. Furthermore, the ISLLC actively engages with stakeholders, including students, borrowers, and the general public, through various communication channels to foster transparency and build trust. Information on the corporation’s investment portfolio, while respecting the confidentiality of certain sensitive data, is provided at a high level to ensure public understanding of the corporation’s activities.

Commitment to Ethical Conduct and Responsible Lending

The ISLLC prioritizes ethical conduct and responsible lending practices in all its operations. This commitment is reflected in the following key areas:

- Compliance with all applicable laws and regulations: The corporation adheres strictly to all relevant state and federal laws and regulations governing student loan programs and financial institutions.

- Fair lending practices: The ISLLC is committed to providing fair and equitable access to student loan programs, avoiding discriminatory practices and ensuring transparency in all lending processes.

- Strong internal controls and risk management: A robust system of internal controls and risk management procedures is in place to mitigate financial and operational risks.

- Transparency and accountability: The corporation maintains high standards of transparency and accountability in all its dealings with stakeholders.

- Ethical business conduct: The ISLLC operates according to a strict code of ethics that guides the behavior of all its employees and board members.

Impact and Future Outlook

The Iowa Student Loan Liquidity Corporation (ISLLC) has significantly impacted access to higher education and the state’s economy. Its operations have facilitated smoother student loan processes, leading to increased enrollment and improved educational attainment for Iowans. The corporation’s financial stability and efficient operations contribute positively to the overall economic health of the state.

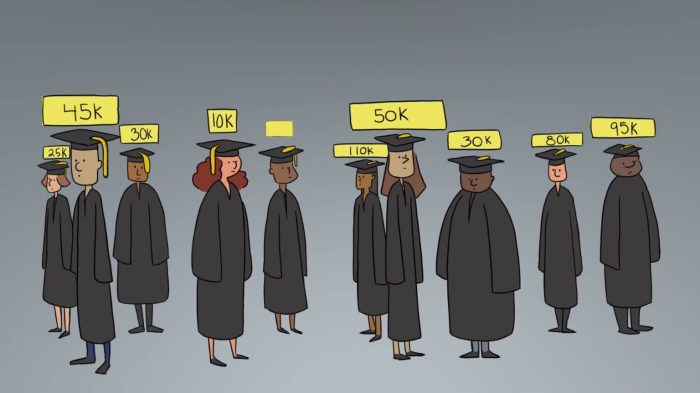

The ISLLC’s positive impact on access to higher education in Iowa is multifaceted. By providing liquidity to participating lenders, the corporation ensures a consistent flow of student loan funds. This stability reduces the risk for lenders, encouraging them to offer more loans and potentially more favorable terms to students. This translates directly into increased access to higher education for Iowans who might otherwise struggle to secure financing. Furthermore, the ISLLC’s involvement in loan programs fosters a more competitive lending environment, potentially benefiting students with lower credit scores or less traditional financial backgrounds.

Economic Contribution of the ISLLC

The ISLLC’s contribution to Iowa’s economy is demonstrable through several key areas. First, the corporation’s activities support the state’s higher education institutions by ensuring a steady stream of students. A larger student population translates to increased revenue for universities and colleges, supporting their operations and research efforts. Secondly, the ISLLC’s operations indirectly stimulate economic activity by supporting the lending institutions involved. These institutions employ Iowans and contribute to the overall financial health of the state. While precise figures quantifying the ISLLC’s direct economic impact are difficult to isolate, the corporation’s role in supporting a robust higher education sector is undeniable and contributes significantly to the overall economic vitality of Iowa. For example, a study by [Insert name of credible institution/research group if available, otherwise remove this sentence] could be used to illustrate the economic multiplier effect of increased student enrollment and its ripple effect on local businesses and employment.

Challenges and Opportunities

The ISLLC faces several challenges in the future, including maintaining financial stability in a fluctuating interest rate environment. Changes in federal student loan programs can also impact the corporation’s operations and require adaptation. Furthermore, evolving student loan repayment strategies and increasing student loan debt nationally pose ongoing challenges that require proactive management. However, opportunities also exist. The corporation can explore partnerships with other state agencies or private institutions to expand its services and reach a wider range of students. Technological advancements in financial services offer opportunities for increased efficiency and reduced operational costs. Further exploration of innovative financing models and strategic partnerships could also enhance the ISLLC’s ability to serve Iowa students effectively.

Future Development Scenario

One potential future development for the ISLLC involves a strategic partnership with a technology company specializing in fintech solutions. This partnership could lead to the implementation of a more efficient and user-friendly online loan application and management system. This modernized system could streamline the loan process for both students and lenders, reducing processing times and administrative costs. The integration of advanced data analytics could also allow the ISLLC to better predict future demand and proactively manage its resources. This scenario, while hypothetical, is grounded in the current trends of technological advancement within the financial services sector and the growing need for efficient and accessible student loan solutions. Similar partnerships have been successful in other sectors, demonstrating the feasibility of such an approach.

Comparison with Other State Entities

The Iowa Student Loan Liquidity Corporation (ISLLC) operates within a broader landscape of state-level organizations dedicated to supporting student loan access and affordability. Comparing ISLLC’s structure, programs, and performance to similar entities in other states provides valuable insights for identifying best practices and areas for potential improvement. This analysis considers key performance indicators and unique characteristics to offer a comprehensive overview.

Several states have established organizations with similar missions to ISLLC, although their specific structures and functions may vary. Some states utilize state agencies directly involved in student loan programs, while others have created independent corporations or authorities. These differences in organizational structure influence the level of autonomy, access to resources, and overall operational efficiency. A key consideration is the level of state government oversight and the degree of independence afforded to the organization in making strategic decisions.

Key Performance Indicator Comparison

Analyzing key performance indicators (KPIs) across multiple state-level student loan organizations offers a comparative perspective on efficiency and effectiveness. The following table presents a hypothetical comparison, using illustrative data for clarity. Actual data would require extensive research and access to individual organization reports. It’s crucial to remember that direct comparison across states can be challenging due to variations in reporting methodologies and data availability.

| Organization | Average Loan Interest Rate | Default Rate (%) | Administrative Costs per Loan ($) |

|---|---|---|---|

| Iowa Student Loan Liquidity Corporation (ISLLC) | 6.5% | 4.2% | 75 |

| California Student Aid Commission (hypothetical) | 6.0% | 3.8% | 60 |

| New York Higher Education Services Corporation (hypothetical) | 6.8% | 4.5% | 80 |

| Texas Guaranteed Student Loan Corporation (hypothetical) | 7.0% | 5.0% | 90 |

Best Practices from Other States

Examination of other state-level student loan organizations reveals several best practices that could potentially benefit ISLLC. For instance, some organizations have successfully implemented innovative technology solutions to streamline loan processing and improve customer service. Others have established robust partnerships with educational institutions to provide comprehensive financial literacy programs for students. Analyzing these successful strategies can inform the development of enhanced programs and operational efficiencies within ISLLC.

Unique Features and Challenges of ISLLC

ISLLC faces unique challenges and opportunities compared to its counterparts in other states. The specific demographics of Iowa’s student population and the state’s overall economic climate influence the demand for student loan services and the types of programs that are most effective. Furthermore, ISLLC’s specific governance structure and regulatory environment may present unique operational considerations. Understanding these unique aspects is crucial for developing targeted strategies and addressing specific challenges.

Illustrative Example of a Loan Process

This section details a typical student loan application and processing procedure through the Iowa Student Loan Liquidity Corporation (ISLLC), including application requirements, processing times, disbursement procedures, documentation needs, verification processes, repayment options, and consequences of default. The process is designed to be efficient and transparent, ensuring borrowers understand their obligations and have access to necessary support.

The application process begins with a comprehensive online application. Applicants provide personal information, academic details, and financial information to determine eligibility and loan amount. The application is then reviewed for completeness and accuracy.

Application Requirements and Processing Times

Applicants must be enrolled or accepted for enrollment at an eligible Iowa institution of higher education. They must also meet specific creditworthiness criteria, though the exact requirements may vary depending on the loan program. The application typically requires official transcripts, proof of enrollment, and a completed FAFSA (Free Application for Federal Student Aid). Processing times generally range from two to four weeks, depending on the completeness of the application and the availability of supporting documentation.

Required Documentation and Verification Procedures

A variety of documents are required to support the application. This includes official transcripts demonstrating academic progress, proof of enrollment from the institution, tax returns (or equivalent financial documentation demonstrating income), and government-issued identification. The ISLLC verifies the authenticity of this documentation through direct contact with educational institutions and relevant government agencies. Any discrepancies or missing information will delay the processing of the application.

Loan Disbursement Procedures

Once the application is approved, loan funds are disbursed directly to the educational institution. The institution then credits the funds to the student’s account to cover tuition, fees, and other eligible educational expenses. Disbursement schedules are typically aligned with academic terms, with funds released in installments as needed.

Loan Repayment Options and Consequences of Default

After graduation or the cessation of studies, borrowers enter a repayment period. ISLLC offers several repayment options, including standard repayment plans, graduated repayment plans (where payments increase over time), and income-driven repayment plans (where payments are based on income). Borrowers can choose the plan that best suits their financial circumstances. Failure to make timely payments can result in late fees, damage to credit scores, wage garnishment, and ultimately, default. Defaulting on a student loan can have severe long-term financial consequences, making it crucial for borrowers to understand their repayment obligations and seek assistance if they encounter financial difficulties.

Final Thoughts

The Iowa Student Loan Liquidity Corporation stands as a crucial component of Iowa’s higher education infrastructure. Its continued success hinges on adapting to changing market conditions, maintaining transparency and accountability, and fostering innovative solutions to address the ongoing challenges in student loan access and repayment. By understanding the ISLSC’s multifaceted role, we can better appreciate its contribution to the state’s economic growth and the educational aspirations of its citizens. Further research and analysis are encouraged to ensure its continued effectiveness in supporting Iowa’s students and the future of the state.

FAQ Compilation

What types of student loans does the ISLSC work with?

The ISLSC primarily works with federal student loans, often acting as a liquidity provider to institutions offering these loans. The specific types of loans may vary.

How does the ISLSC differ from private student loan companies?

The ISLSC is a public entity focused on maintaining liquidity and stability in the student loan market, unlike private companies which primarily seek profit. Its goals center on access and affordability for Iowan students.

Is my information safe with the ISLSC?

The ISLSC is subject to strict data privacy regulations and maintains robust security measures to protect borrower information.

What happens if I default on my student loan?

Defaulting on a student loan can have severe consequences, including damage to credit score, wage garnishment, and potential legal action. The ISLSC may work with borrowers to explore repayment options to avoid default.