Navigating the complexities of student loan debt can feel overwhelming, especially when considering a figure like $40,000. Is this amount significant? The answer isn’t straightforward, as it hinges on numerous personal factors. This exploration delves into the nuances of this question, considering individual income potential, career paths, and the ever-present cost of living.

We’ll examine the long-term implications of such debt on major life milestones, from homeownership and family planning to retirement savings. By comparing this figure to national averages and exploring various repayment strategies, we aim to provide a comprehensive understanding of whether $40,000 in student loans constitutes a substantial burden or a manageable challenge.

Defining “A Lot” in the Context of Student Loan Debt

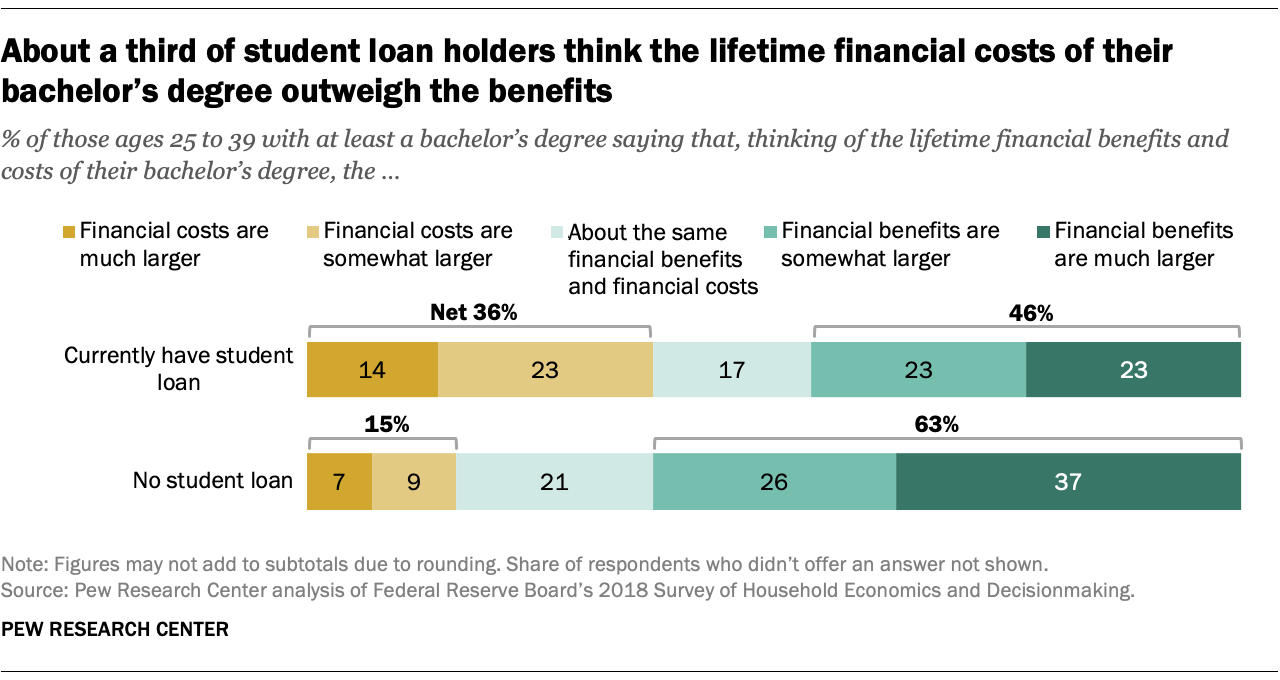

Determining whether $40,000 in student loan debt is a significant amount depends heavily on individual circumstances. It’s not simply a matter of the raw number, but rather how that debt interacts with one’s income, career prospects, and cost of living.

Factors Influencing the Significance of $40,000 in Student Loan Debt

The impact of $40,000 in student loans varies considerably based on several key factors. A high-earning individual in a low-cost-of-living area might find this manageable, while someone with a low income and high living expenses could face significant hardship. Career field plays a crucial role; a doctor earning a substantial salary will likely find repayment easier than someone working in a lower-paying field. Interest rates also significantly affect the total repayment amount and the length of the repayment period.

Repayment Scenarios Based on Income and Interest Rates

The following table illustrates how different income levels and interest rates impact monthly payments and repayment timelines for a $40,000 student loan. These are simplified examples and do not account for potential changes in interest rates or additional fees. Actual repayment amounts may vary depending on the loan type and repayment plan chosen.

| Income | Interest Rate | Monthly Payment (Estimate) | Repayment Time (Estimate) |

|---|---|---|---|

| $40,000 | 7% | $780 | 7 years |

| $60,000 | 5% | $750 | 6 years |

| $80,000 | 4% | $700 | 5 years |

| $30,000 | 9% | $850 | 8 years |

Perspectives on Manageable Student Loan Debt

Financial experts generally advise keeping total student loan debt below a certain percentage of your expected starting salary. Common recommendations range from 50% to 75%, depending on the individual’s risk tolerance and financial goals. However, personal experiences often vary widely. Some individuals successfully manage significantly higher debt loads through diligent budgeting and high-income careers, while others struggle with much lower amounts due to unexpected life events or lower earning potential. For example, a recent graduate with a $40,000 loan and a starting salary of $50,000 might find it manageable with careful planning, whereas someone with the same loan but a $30,000 salary may face significant financial strain. The “manageable” level is highly subjective and context-dependent.

Impact of $40,000 in Student Loans on Future Financial Planning

Carrying $40,000 in student loan debt can significantly impact major financial decisions, potentially delaying or altering long-term goals. The monthly payments represent a substantial outflow of cash, reducing the funds available for other crucial life expenses and investments. This debt can create considerable stress and uncertainty about the future, especially in the early years after graduation. Understanding the potential effects and available strategies for managing this debt is crucial for navigating this challenging financial landscape.

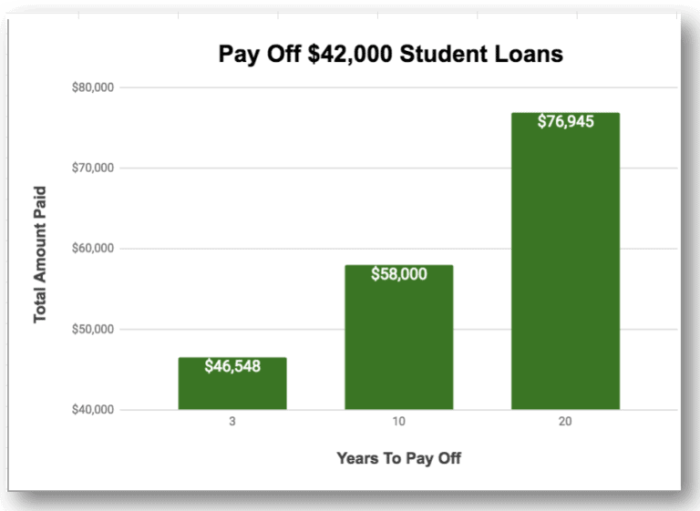

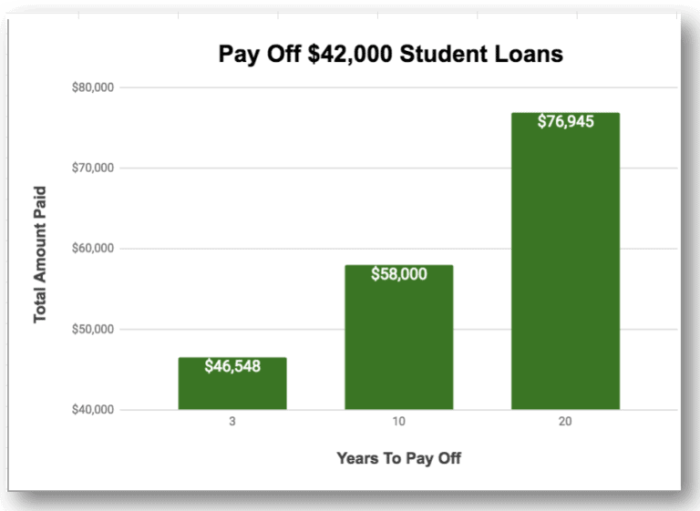

$40,000 in student loan debt can exert considerable pressure on various aspects of long-term financial planning. The weight of these monthly payments can delay significant milestones like homeownership, significantly impact the timing and scale of family planning, and potentially reduce the amount saved for retirement. For instance, a person with a $40,000 loan at a 7% interest rate and a 10-year repayment plan would face a monthly payment of approximately $460. This substantial amount, paid out monthly for a decade, could represent a considerable portion of one’s monthly income, directly impacting savings for a down payment on a house, the ability to save for childcare expenses, or contributions towards retirement savings. The impact varies based on individual income, lifestyle, and financial priorities. However, the potential for delayed progress towards these major life goals is a realistic consideration.

Major Life Decisions and Student Loan Debt

The burden of $40,000 in student loans can significantly affect major life decisions. The high monthly payments reduce disposable income, making it challenging to save for a down payment on a house, impacting the timing of starting a family due to childcare costs, and limiting contributions to retirement accounts. For example, the average down payment on a home in many US markets significantly exceeds the savings that could be accumulated while making substantial student loan payments. Similarly, the cost of childcare can be substantial, and the presence of significant student loan debt could make it harder to plan for having children or limit the number of children a family might consider. Retirement savings are often the first area impacted by financial strain; the inability to contribute aggressively to retirement accounts during the prime earning years can significantly reduce the amount accumulated by retirement age.

Strategies for Managing and Reducing Student Loan Debt

Effectively managing student loan debt requires a proactive approach. Several strategies can help borrowers navigate their repayment and potentially reduce their overall debt burden.

Several approaches can help manage and potentially reduce student loan debt. These strategies should be carefully considered based on individual financial circumstances and risk tolerance.

- Refinancing: Refinancing student loans might lower the interest rate, leading to lower monthly payments and faster repayment. However, it’s crucial to compare rates and terms from multiple lenders before refinancing. It’s also important to note that refinancing might eliminate certain federal protections, such as income-driven repayment plans.

- Income-Driven Repayment Plans (IDR): IDR plans adjust monthly payments based on income and family size. While monthly payments may be lower, the loan repayment period extends, potentially leading to higher overall interest paid. These plans are often available for federal student loans.

- Debt Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower the interest rate. However, this might also extend the repayment period.

Opportunity Cost of Paying Off Student Loans

A crucial consideration is the opportunity cost of aggressively paying down student loans versus investing the same funds. While eliminating debt quickly reduces financial stress and interest payments, investing those funds could yield higher returns over the long term, particularly if the interest rate on the loan is lower than the potential investment returns.

The decision of prioritizing student loan repayment versus investing requires a careful evaluation of several factors. There’s no one-size-fits-all answer.

The optimal strategy often involves a balance between aggressive debt repayment and strategic investing.

For instance, if a borrower has a high-interest loan (e.g., above 7%), aggressively paying it down might be more financially beneficial than investing in lower-return options. Conversely, if the interest rate is low (e.g., below 4%), investing in higher-return assets (like index funds) could potentially generate greater wealth over the long term. Individual circumstances, including risk tolerance and financial goals, significantly influence the best course of action.

Comparison to National Averages and Trends

Understanding whether $40,000 in student loan debt is significant requires comparing it to national averages and identifying trends in student loan debt accumulation. This analysis considers variations across fields of study, demographics, and time, providing a broader context for evaluating the impact of this debt level.

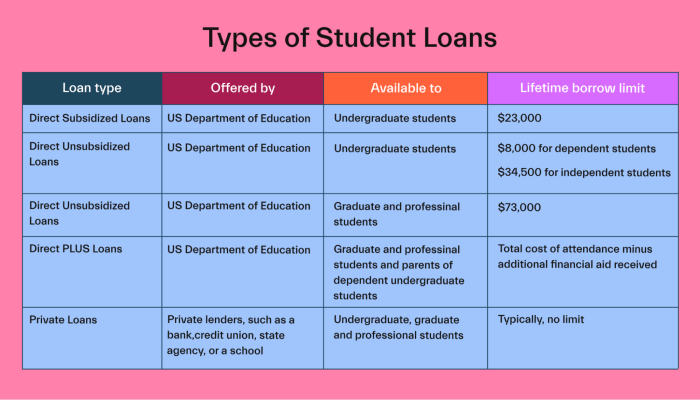

Considering the average student loan debt varies considerably based on several factors, a comprehensive comparison is crucial. These factors include the chosen field of study, the type of institution attended (public vs. private), and even geographic location. Furthermore, understanding trends in student loan debt accumulation helps contextualize the current situation and its potential implications for future borrowers.

Average Student Loan Debt Across Fields of Study and Demographics

The following table presents estimated average student loan debt for graduating students in various fields, along with repayment periods and default rates. These figures are averages and individual experiences can vary significantly. Data limitations prevent the inclusion of granular demographic breakdowns within this table; however, it’s important to acknowledge that significant disparities exist based on race, ethnicity, and socioeconomic background. Further research into specific demographics would be necessary for a complete understanding.

| Field of Study | Average Debt (USD) | Average Repayment Period (Years) | Default Rate (%) |

|---|---|---|---|

| Medicine | 200,000 – 300,000 | 10-20 | Low (due to high earning potential) |

| Law | 150,000 – 200,000 | 10-15 | Low to Moderate |

| Engineering | 75,000 – 125,000 | 8-12 | Low to Moderate |

| Business | 60,000 – 100,000 | 7-10 | Moderate |

| Humanities | 40,000 – 70,000 | 7-10 | Moderate to High |

| Education | 50,000 – 80,000 | 7-10 | Moderate |

Note: These figures are estimates based on available data from various sources and may vary depending on the specific institution and year. Default rates are also subject to change.

Trends in Student Loan Debt Accumulation

Student loan debt has been steadily increasing over the past several decades. Several factors contribute to this trend, including the rising cost of tuition and fees, reduced state funding for public colleges and universities, and an increase in the use of private student loans. The cost of higher education has outpaced inflation for many years, making it increasingly difficult for students and families to afford college without borrowing. Furthermore, the availability of easy-access student loans has encouraged increased borrowing, even for expenses that might be covered through other means.

Student Loan Forgiveness Programs and Their Impact

Several student loan forgiveness programs exist at both the federal and state levels, aiming to alleviate the burden of student loan debt. These programs typically target specific borrowers, such as those working in public service or those who have experienced financial hardship. While these programs can significantly reduce individual debt burdens, their impact on overall debt levels is a subject of ongoing debate. The scale of these programs relative to the overall size of the student loan debt market means that their effect on the total amount of outstanding debt is relatively limited. Furthermore, the eligibility criteria for many programs are stringent, limiting their reach to a smaller subset of borrowers. The long-term effectiveness and overall impact of these programs remain an area of ongoing study and discussion.

Illustrative Scenarios and Case Studies

This section presents two contrasting scenarios to illustrate how $40,000 in student loan debt can impact graduates’ financial lives depending on their post-graduation employment. We will examine the challenges faced, coping mechanisms employed, and the long-term effects of various repayment strategies.

Scenario 1: Financial Struggle with Low-Paying Job

Sarah, a recent graduate with a degree in sociology, owes $40,000 in student loans. She secured a position as a social worker, earning a modest salary of $35,000 annually. Her monthly student loan payment, even with an income-driven repayment plan, consumes a significant portion of her income, leaving little room for savings, investments, or addressing unexpected expenses. Sarah finds herself constantly juggling bills, often resorting to using credit cards for essential needs, accumulating additional debt. She experiences significant stress and anxiety about her financial situation, impacting her mental well-being. Her coping mechanisms include limiting social activities, meticulously tracking her spending, and seeking financial counseling.

Scenario 2: Financial Stability with High-Paying Job

Mark, also a recent graduate with a degree in computer science, also owes $40,000 in student loans. However, he landed a high-paying job as a software engineer, earning $90,000 annually. His student loan payments represent a smaller percentage of his income, allowing him to comfortably meet his financial obligations and still save and invest. He prioritizes paying down his loans aggressively while building an emergency fund and contributing to retirement accounts. Mark experiences less financial stress and enjoys greater financial freedom.

Impact of Different Repayment Strategies

The choice of repayment strategy significantly influences the long-term financial health of both Sarah and Mark.

The following bullet points illustrate how different repayment strategies affect their long-term financial health:

- Standard Repayment: Both Sarah and Mark could opt for the standard repayment plan, which involves fixed monthly payments over a 10-year period. For Sarah, this would leave her with minimal disposable income, potentially delaying major life goals such as homeownership or starting a family. For Mark, this would allow for quicker loan repayment, freeing up significant funds for other financial goals sooner.

- Income-Driven Repayment (IDR): Sarah would likely benefit most from an IDR plan, which adjusts monthly payments based on her income and family size. This would make her payments more manageable in the short term, though it could lead to a longer repayment period and higher overall interest paid. Mark might also consider an IDR plan, although it wouldn’t be as crucial given his higher income. The longer repayment period might not be a significant drawback for him, but he could still benefit from more aggressive repayment strategies.

- Aggressive Repayment: Mark could significantly reduce his debt burden by making extra payments whenever possible. This could involve allocating bonuses, tax refunds, or additional income towards his student loans, accelerating repayment and reducing overall interest paid. Sarah might struggle to implement this strategy due to her limited disposable income, but even small extra payments could make a difference over time.

- Refinancing: Both Sarah and Mark could explore refinancing their loans if interest rates drop. This could potentially lower their monthly payments and shorten the repayment period. However, refinancing might not be beneficial if their credit scores are low or if they are considering income-driven repayment plans.

Exploring Resources and Support Systems

Navigating the complexities of student loan debt can be daunting, but numerous resources exist to provide guidance and support. Understanding these options and proactively seeking assistance can significantly improve your financial well-being and alleviate the stress associated with loan repayment. This section will Artikel available resources, the process of seeking help, and strategies for improving financial literacy.

Many organizations and government programs offer assistance to students and graduates struggling with student loan debt. These resources provide valuable support in managing repayments, exploring repayment options, and developing long-term financial strategies.

Available Resources for Student Loan Debt Management

Several organizations and government programs offer support for managing student loan debt. These resources can help you understand your options, navigate the repayment process, and potentially reduce your overall debt burden.

- Federal Student Aid (FSA): The FSA website provides comprehensive information on federal student loan programs, repayment plans, and options for borrowers experiencing financial hardship. They offer tools to estimate monthly payments, explore income-driven repayment plans, and understand loan forgiveness programs.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services. Certified credit counselors can help you create a budget, develop a debt management plan, and negotiate with your lenders.

- Student Loan Borrower Assistance Program: Many states have programs specifically designed to assist residents with their student loan debt. These programs may offer counseling, workshops, and other resources to help borrowers manage their debt effectively. Contact your state’s attorney general’s office or higher education agency for more information.

- Your Loan Servicer: Your loan servicer is responsible for managing your student loans. They can provide information about your loan terms, repayment options, and available assistance programs. It’s crucial to maintain open communication with your servicer.

Seeking Financial Counseling and Debt Management Assistance

The process of seeking financial counseling typically begins with contacting a reputable organization like the NFCC or a similar non-profit. These organizations often offer free initial consultations to assess your financial situation and determine the best course of action. Counseling may involve creating a budget, exploring debt management strategies (such as debt consolidation or negotiation), and developing a long-term financial plan.

Debt management plans often involve consolidating multiple loans into a single, lower-interest payment, making it easier to track and manage your debt. Negotiating with lenders may involve requesting forbearance (temporary suspension of payments) or deferment (postponement of payments) if you’re facing temporary financial hardship. It’s important to carefully review the terms and conditions of any debt management plan before agreeing to it.

Improving Financial Literacy and Informed Borrowing Decisions

Improving financial literacy is crucial for making informed decisions about student loan borrowing and repayment. This involves understanding key financial concepts such as budgeting, saving, investing, and debt management. Several resources are available to enhance your financial literacy, including online courses, workshops, and financial literacy programs offered by community organizations and libraries.

Before taking out student loans, it’s essential to research different loan options, compare interest rates, and understand the repayment terms. Carefully consider your future earning potential and the overall cost of your education to ensure you can realistically manage your loan payments after graduation. Creating a realistic budget and sticking to it throughout your education and repayment period will significantly impact your success in managing your student loan debt.

Closing Summary

Ultimately, determining whether $40,000 in student loan debt is “a lot” requires a personalized assessment. While the absolute number can seem daunting, factors like income, career prospects, and diligent financial planning play crucial roles in shaping the long-term impact. By understanding your individual circumstances and exploring available resources, you can develop a strategy that empowers you to manage your debt effectively and achieve your financial goals.

Essential Questionnaire

What are income-driven repayment plans?

Income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering your payments and extending your repayment period.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers and understand the terms before refinancing.

What is student loan forgiveness?

Student loan forgiveness programs, often targeted at specific professions or through public service, can eliminate a portion or all of your student loan debt under specific conditions. Eligibility requirements vary widely.

Where can I find financial counseling?

Many non-profit organizations and government agencies offer free or low-cost financial counseling services to help you manage your debt.