Navigating the world of student loans can feel overwhelming, especially when understanding the differences between federal and private options. This exploration delves into the specifics of Stafford Loans, clarifying their place within the federal student aid system. We’ll examine eligibility requirements, application processes, repayment plans, and how Stafford Loans compare to other federal loan programs. Understanding these nuances is crucial for making informed decisions about financing your education.

The Stafford Loan program, a cornerstone of federal student financial assistance, offers a pathway to higher education for millions. This guide aims to demystify the process, providing a clear understanding of the benefits, responsibilities, and potential challenges associated with Stafford Loans. We will cover everything from the initial application to long-term repayment strategies, empowering you to make the best choices for your financial future.

Stafford Loan as a Federal Student Loan

Stafford Loans are a cornerstone of the federal student aid system in the United States, providing millions of students with access to higher education. Understanding their federal nature is crucial for borrowers, as it significantly impacts their repayment options, interest rates, and overall borrowing experience. This section delves into the specifics of Stafford Loans as a federal program.

The federal government plays a vital role in Stafford Loans, acting as both the guarantor and, in some cases, the direct lender. This means the government ensures repayment even if the borrower defaults, mitigating risk for lenders and making it possible to offer lower interest rates to students. Furthermore, the government sets the terms and conditions of the loans, including interest rates, repayment plans, and eligibility requirements. This centralized control ensures consistency and fairness across the system.

Benefits of Federal Stafford Loans

The advantages of choosing a Stafford Loan over a private loan are numerous. Federal student loans, including Stafford Loans, offer several key benefits unavailable with private loans. These benefits provide a strong financial safety net for students and graduates navigating the complexities of higher education financing.

Government Agencies Involved in Stafford Loans

The primary government agency responsible for the Stafford Loan program is the U.S. Department of Education. Within the Department of Education, the Federal Student Aid (FSA) office oversees the administration and disbursement of Stafford Loans. While the Department of Education sets the overarching policies, the actual loan servicing (managing payments, handling deferments, etc.) is often outsourced to private loan servicers under contract with the government. These servicers act on behalf of the government to manage the day-to-day aspects of the loan.

Situations Where Stafford Loans are Preferred

Stafford Loans are often the preferred choice in various scenarios. For instance, if a student has limited credit history, securing a private loan might be difficult or come with significantly higher interest rates. Stafford Loans offer more accessible funding options for students with less-than-perfect credit. Furthermore, federal loans typically offer more flexible repayment options, including income-driven repayment plans that adjust monthly payments based on the borrower’s income and family size. These plans can be particularly beneficial for graduates entering lower-paying professions or experiencing unexpected financial hardships. Finally, federal student loans often include protections against default, such as deferment and forbearance options, which are less common or less favorable in private loans. In situations of financial difficulty, these protections can be crucial in avoiding a negative impact on credit scores and preventing default.

Stafford Loan Application and Disbursement Process

Securing a Stafford Loan involves several key steps, from completing the application to receiving the funds. Understanding this process is crucial for students seeking financial aid for their education. This section details the application and disbursement process for Stafford Loans, providing a step-by-step guide for navigating the FAFSA and receiving your loan funds.

Applying for a Stafford Loan

The Stafford Loan application process begins with completing the Free Application for Federal Student Aid (FAFSA). This application gathers necessary information to determine your eligibility for federal student aid, including Stafford Loans. After submitting the FAFSA, your information is processed, and your school will receive your Student Aid Report (SAR). Your school will then use this information to determine your financial aid package, which may include a Stafford Loan. You will need to accept the loan offer through your school’s financial aid portal. Finally, you may need to complete a Master Promissory Note (MPN) and, if required, entrance counseling.

Receiving Stafford Loan Funds

Once your loan is approved and you’ve completed any required steps, the disbursement process begins. The funds are typically sent directly to your school to cover tuition, fees, and other educational expenses. Disbursement usually occurs in installments, often per semester or academic year. The exact timing depends on your school’s policies and your enrollment status. You will receive notifications from both your school and the loan servicer regarding the disbursement schedule and the amount received. Any remaining funds, after covering tuition and fees, may be disbursed to you directly, but this is dependent on your school’s policies.

Completing the Free Application for Federal Student Aid (FAFSA)

Completing the FAFSA is the first and most important step in obtaining federal student aid. This process involves creating an FSA ID, gathering necessary financial information (tax returns, W-2s, etc.), and accurately entering this information into the online FAFSA form. The FAFSA asks for information about your family’s income, assets, and household size. It is crucial to answer all questions truthfully and completely. After submission, you’ll receive a Student Aid Report (SAR) summarizing your information and eligibility. Review this report carefully for any errors or inconsistencies. Corrections can be made if needed. The entire process typically takes 30-60 minutes, depending on the complexity of your financial situation.

Stafford Loan Application and Disbursement Flowchart

Imagine a flowchart with the following steps represented visually with boxes and arrows.

Box 1: Complete FAFSA. This box would be the starting point.

Arrow 1: Points from Box 1 to Box 2.

Box 2: Receive Student Aid Report (SAR).

Arrow 2: Points from Box 2 to Box 3.

Box 3: School processes FAFSA data and determines aid eligibility.

Arrow 3: Points from Box 3 to Box 4.

Box 4: Accept Stafford Loan offer.

Arrow 4: Points from Box 4 to Box 5.

Box 5: Complete Master Promissory Note (MPN) and Entrance Counseling (if required).

Arrow 5: Points from Box 5 to Box 6.

Box 6: Loan Disbursement to School.

Arrow 6: Points from Box 6 to Box 7.

Box 7: School applies funds to tuition and fees; remaining funds (if any) disbursed to student. This box represents the end of the process.

Repayment Options and Default Prevention for Stafford Loans

Successfully navigating Stafford Loan repayment requires understanding the available options and proactively employing strategies to avoid default. This section Artikels various repayment plans and provides practical advice for responsible loan management.

Several repayment plans are available for Stafford Loans, each designed to cater to different financial situations and income levels. The choice of plan significantly impacts monthly payments and the overall repayment period. Careful consideration of individual circumstances is crucial in selecting the most suitable option.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most Stafford Loan borrowers. It involves fixed monthly payments over a 10-year period. While straightforward, this plan may result in higher monthly payments compared to income-driven plans.

Graduated Repayment Plan

Under the Graduated Repayment Plan, payments begin low and gradually increase over a 10-year period. This option can be beneficial for borrowers anticipating increased income in the future. However, the initial low payments may not fully cover accruing interest, potentially leading to a larger overall repayment amount.

Extended Repayment Plan

The Extended Repayment Plan offers longer repayment terms, extending the repayment period to up to 25 years. This reduces monthly payments, making them more manageable for borrowers with limited income. However, it increases the total interest paid over the loan’s lifetime.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link monthly payments to the borrower’s discretionary income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans offer lower monthly payments, potentially leading to loan forgiveness after a specific period of time (typically 20-25 years), depending on the plan and loan type. Eligibility requirements vary for each plan.

Strategies for Avoiding Stafford Loan Default

Defaulting on a Stafford Loan has severe consequences, including damage to credit score, wage garnishment, and tax refund offset. Proactive measures are crucial to prevent default. A well-defined repayment strategy, coupled with consistent communication with the loan servicer, is essential.

- Create a Realistic Budget: Track income and expenses to determine affordability of monthly payments.

- Choose the Right Repayment Plan: Select a plan that aligns with current financial capabilities and long-term income projections.

- Automatic Payments: Set up automatic payments to ensure timely and consistent repayments.

- Communicate with Your Loan Servicer: Contact your loan servicer immediately if facing financial hardship. Explore options like deferment or forbearance.

- Consolidate Loans: Consider consolidating multiple loans into a single loan with a potentially lower interest rate or simplified repayment schedule.

Resources for Borrowers Facing Repayment Difficulties

Numerous resources are available to assist borrowers facing repayment challenges. These resources provide guidance, support, and potential solutions to prevent default.

- National Student Loan Data System (NSLDS): Provides access to loan information and repayment options.

- Federal Student Aid Website: Offers comprehensive information on repayment plans, default prevention, and available resources.

- Student Loan Servicers: Direct contact with loan servicers allows for personalized assistance and exploration of available options such as deferment, forbearance, or income-driven repayment plans.

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost credit counseling services, helping borrowers create a budget and manage their debt effectively.

Stafford Loan vs. Other Federal Student Loan Programs

Choosing the right federal student loan can significantly impact your financial future. Understanding the differences between various programs is crucial for making an informed decision. This section compares Stafford Loans with other federal loan options, highlighting key distinctions in eligibility, interest rates, and repayment terms to help you determine the most suitable program for your needs.

Several federal student loan programs exist, each with specific eligibility requirements and terms. While Stafford Loans are a common choice, other options like Perkins Loans and PLUS Loans offer different benefits and drawbacks. Careful consideration of your financial situation and educational goals is essential for selecting the optimal loan type.

Key Differences in Federal Student Loan Programs

The following table summarizes the key features of Stafford, Perkins, and PLUS Loans, providing a clear comparison to aid in your decision-making process.

| Feature | Stafford Loan | Perkins Loan | PLUS Loan |

|---|---|---|---|

| Eligibility | Undergraduate and graduate students; demonstrated financial need may affect loan amount. | Undergraduate and graduate students; exceptional financial need required. Limited funding available. | Parents of dependent undergraduate students; graduate and professional students; credit check required. |

| Interest Rate | Fixed rate, set annually by the government. Generally lower than PLUS Loans. | Fixed, historically very low rate. Program is largely phased out. | Variable rate, generally higher than Stafford Loans. |

| Repayment | Several repayment plans available, including income-driven repayment options. | Grace period and flexible repayment options. | Repayment begins within 60 days of the final loan disbursement. |

| Loan Limits | Annual and aggregate limits exist, varying based on year in school and dependency status. | Annual and aggregate limits exist, and are generally lower than Stafford Loans. | Loan amount is determined based on the cost of attendance minus other financial aid. |

| Loan Fees | Origination fees are typically deducted from the loan disbursement. | No origination fees. | Origination fees are typically deducted from the loan disbursement. |

Choosing the Most Suitable Federal Student Loan Program

The best federal student loan program depends on individual circumstances. For example, a student with limited financial need might find a Stafford Loan sufficient, while a student with significant need might benefit from a Perkins Loan (where available). Parents of dependent students may consider a PLUS Loan to help cover educational expenses. Students should carefully review their financial aid award letter and compare the interest rates and repayment terms of different loan options before making a decision. It’s often advisable to borrow only the amount needed to cover educational costs, minimizing long-term debt.

Understanding Stafford Loan Interest Rates and Fees

Stafford Loans, while offering crucial financial assistance for higher education, come with associated interest rates and fees that significantly impact the overall cost. Understanding these components is vital for responsible borrowing and effective financial planning throughout your educational journey and beyond. This section details how these rates and fees are determined and their impact on your total loan repayment.

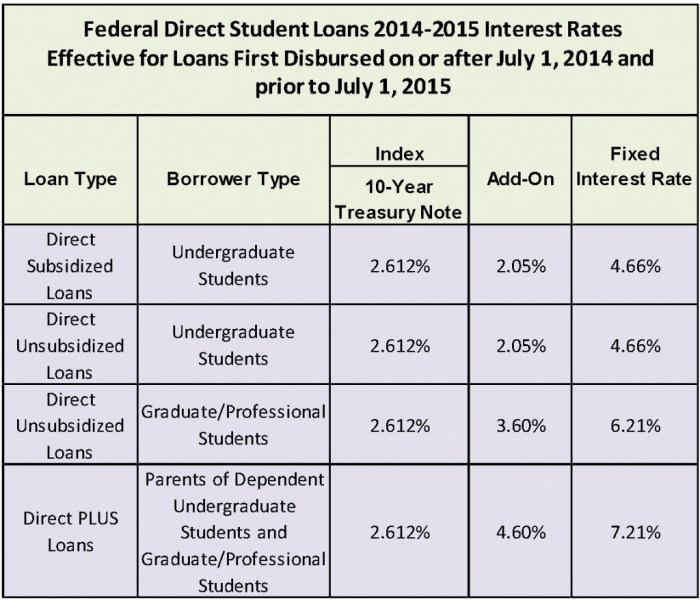

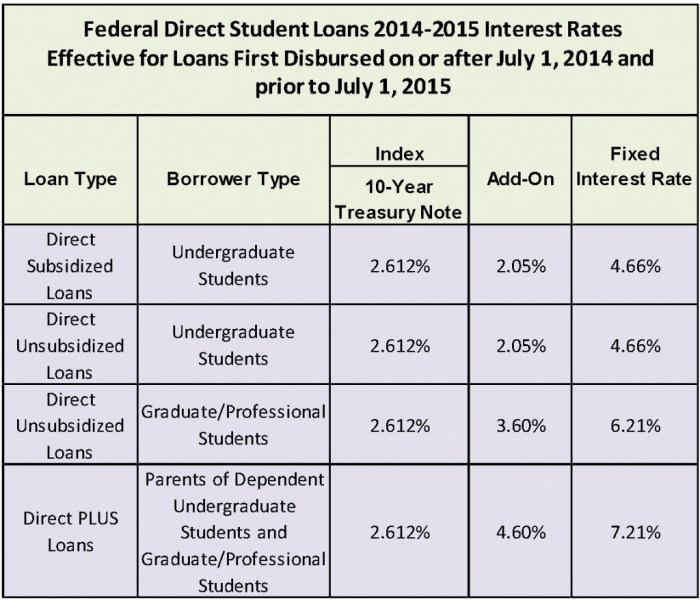

Stafford Loan interest rates are variable and depend on several factors. The most significant is the loan’s disbursement date. The federal government sets interest rates for each loan period, typically annually, for both subsidized and unsubsidized Stafford Loans. These rates are usually tied to the 10-year Treasury Note, meaning they fluctuate based on market conditions. Furthermore, the interest rate applied will differ based on whether the loan is a subsidized or unsubsidized Stafford Loan; subsidized loans often have lower rates as the government pays the interest while the student is enrolled at least half-time. Finally, your credit history, while not a direct factor in determining the initial interest rate for federal Stafford loans, could impact your eligibility for certain repayment plans or loan consolidation options down the line.

Stafford Loan Fees

Several fees are associated with Stafford Loans. Origination fees, charged by the lender, are deducted from the loan disbursement before the funds are released to the borrower. These fees are a percentage of the loan amount and help cover the lender’s administrative costs. There are typically no other significant fees directly associated with Stafford Loans themselves; however, late payment fees might be incurred if payments are missed. Additionally, borrowers should be aware of any fees charged by their institution or loan servicer for processing payments or providing account management services.

Interest Capitalization and its Effect on Total Loan Cost

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This occurs when interest accrues on the loan during periods of deferment or forbearance (periods where repayment is temporarily suspended or reduced). This increases the principal amount, resulting in a larger overall loan balance and higher total interest paid over the life of the loan.

For example, imagine a $10,000 Stafford Loan with a 5% interest rate. If interest accrues for two years during a deferment period, the accrued interest would be added to the principal. This new, larger principal would then accrue interest for the remaining repayment period, leading to a higher total cost compared to a scenario where interest was not capitalized. The longer the deferment period and the higher the interest rate, the more significant the impact of capitalization.

Illustrative Example of Interest Accrual

Let’s visualize interest accrual over time using a simplified example. Imagine a $5,000 loan with a fixed 4% annual interest rate.

Year 1: Interest accrued = $5,000 * 0.04 = $200. Total owed at the end of Year 1: $5,200.

Year 2: Interest accrued = $5,200 * 0.04 = $208. Total owed at the end of Year 2: $5,408.

Year 3: Interest accrued = $5,408 * 0.04 = $216.32. Total owed at the end of Year 3: $5,624.32.

This demonstrates how interest compounds over time, increasing the total amount owed. The longer the repayment period, the more significant the impact of compounding interest. If interest is capitalized, the subsequent year’s interest calculation would use the accumulated principal, further increasing the total cost.

Concluding Remarks

Securing a Stafford Loan can be a significant step towards achieving your educational goals. By understanding the intricacies of the program, from eligibility criteria to repayment options, you can navigate the process confidently. Remember to carefully consider your financial situation, explore all available resources, and plan for responsible repayment to maximize the benefits of federal student aid. Ultimately, informed decision-making ensures a smoother path towards academic success and financial stability.

Question Bank

What is the difference between a subsidized and unsubsidized Stafford Loan?

Subsidized Stafford Loans have government-paid interest while you’re in school, during grace periods, and during deferment. Unsubsidized loans accrue interest throughout your entire loan term.

Can I consolidate my Stafford Loans?

Yes, you can consolidate multiple Stafford Loans into a single Direct Consolidation Loan, potentially simplifying repayment.

What happens if I default on my Stafford Loan?

Defaulting on a Stafford Loan can have serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

How long is the grace period for Stafford Loans?

The grace period for Stafford Loans is typically six months after graduation or leaving school.

Where can I find more information about Stafford Loan repayment plans?

The Federal Student Aid website (studentaid.gov) provides detailed information on various repayment plans and options.