Is a student loan financial aid? The question itself highlights the crucial role student loans play in higher education funding. While often perceived solely as debt, student loans represent a significant avenue for accessing higher education, alongside grants and scholarships. Understanding the nuances of different loan types, eligibility criteria, and responsible borrowing practices is essential for navigating the complexities of financing a college education.

This exploration delves into the various facets of student loans, from federal and private options to managing debt and exploring loan forgiveness programs. We will examine the increasing reliance on student loans, their impact on post-graduation life, and the broader economic consequences. The goal is to provide a comprehensive understanding of student loans as a vital—yet potentially challenging—component of achieving higher education.

The Role of Student Loans in Higher Education Funding

The rising cost of higher education in recent decades has led to an increased reliance on student loans to finance college degrees. This dependence has created a complex system with significant implications for both students and the broader economy. Understanding the role of student loans in higher education funding is crucial for navigating the challenges and opportunities presented by this financial landscape.

The Impact of Student Loan Debt on Post-Graduation Plans

The substantial debt accumulated by many students significantly impacts their post-graduation plans. High loan repayments can delay major life decisions such as purchasing a home, starting a family, or pursuing further education. The weight of student loan debt can also influence career choices, often pushing graduates towards higher-paying jobs, even if those jobs are not their preferred career paths. This financial pressure can lead to increased stress and anxiety, impacting overall well-being. For example, a recent study showed that graduates with significant student loan debt were more likely to delay marriage and homeownership compared to their debt-free peers. The average debt burden can also affect entrepreneurial endeavors, as the financial risk associated with starting a business may be perceived as too great.

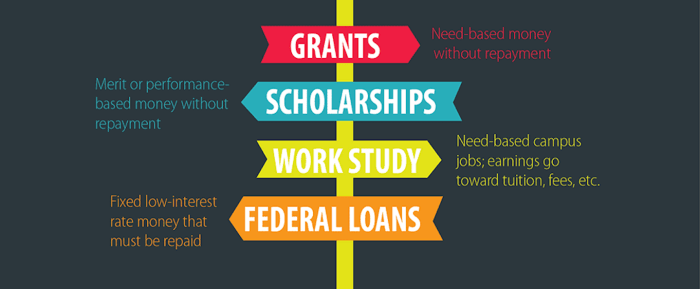

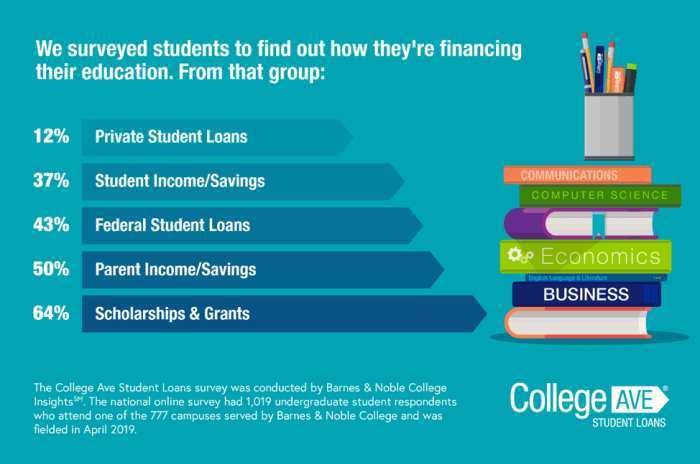

Alternative Funding Sources for Higher Education

Several alternative funding sources can lessen the reliance on student loans. These include scholarships, grants, work-study programs, and savings plans. Scholarships are merit-based awards that do not need to be repaid, often based on academic achievement, athletic ability, or community involvement. Grants, similar to scholarships, are also non-repayable forms of financial aid, often awarded based on financial need. Work-study programs allow students to earn money while attending college, reducing the need for loans. Finally, families can utilize savings plans, such as 529 plans, to accumulate funds for college expenses over time. The effective use of these alternative sources can substantially reduce the amount of student loan debt accumulated.

Applying for Federal Student Loans: A Flowchart Illustration

The process of applying for federal student loans involves several key steps. A simplified flowchart representation would begin with completing the Free Application for Federal Student Aid (FAFSA). This application gathers information about the student’s financial situation and academic background. Following the FAFSA submission, the student receives a Student Aid Report (SAR) summarizing their eligibility for federal aid. Next, the student selects a loan program (e.g., subsidized or unsubsidized) and lender. The lender then verifies the student’s information and approves or denies the loan application. Finally, the loan funds are disbursed to the student’s educational institution. This process, while seemingly straightforward, requires careful attention to deadlines and documentation. The flowchart would visually represent these sequential steps, making the application process clearer and less daunting.

Managing Student Loan Debt

Navigating the complexities of student loan debt requires proactive planning and a thorough understanding of available repayment options. Effective management begins long before graduation, with careful consideration of borrowing amounts and the potential long-term financial implications. A well-defined repayment strategy, implemented promptly after graduation, can significantly reduce the burden and accelerate the path to financial independence.

Responsible borrowing and repayment planning hinge on several key strategies. Firstly, only borrow what is absolutely necessary. Carefully assess the cost of education against potential future earnings. Explore scholarships, grants, and work-study opportunities to minimize loan dependence. Secondly, understand the terms and conditions of each loan, including interest rates, repayment periods, and any associated fees. Finally, create a realistic budget that incorporates loan repayments alongside other essential expenses. This proactive approach sets the stage for successful debt management.

Repayment Plan Options and Their Implications

Several repayment plans are available, each with its own advantages and disadvantages. Standard repayment plans typically involve fixed monthly payments over a 10-year period. This option offers the shortest repayment timeframe but may result in higher monthly payments. Extended repayment plans stretch payments over a longer period, resulting in lower monthly payments but higher overall interest costs. Graduated repayment plans begin with lower monthly payments that gradually increase over time, offering flexibility in the early years but potentially leading to higher payments later on. Finally, income-driven repayment plans adjust monthly payments based on income and family size.

Income-Driven Repayment Plans: Benefits and Drawbacks

Income-driven repayment (IDR) plans offer significant advantages for borrowers facing financial hardship. They provide lower monthly payments, potentially making repayment more manageable during periods of lower income. Furthermore, some IDR plans may offer loan forgiveness after a specified period of repayment, often 20 or 25 years, depending on the plan and the borrower’s income. However, IDR plans also have drawbacks. They generally extend the repayment period, resulting in significantly higher total interest paid over the life of the loan. Moreover, the eligibility criteria for IDR plans can be complex, and the forgiveness provision may not be guaranteed for all borrowers. For example, the Public Service Loan Forgiveness (PSLF) program, while designed to forgive student loans for those working in public service, has faced significant administrative challenges, impacting many borrowers’ eligibility.

Resources for Students Facing Financial Difficulties

Students struggling with student loan debt can access numerous resources to navigate their financial challenges. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping borrowers create personalized debt management plans. Your loan servicer can provide information on available repayment options and hardship programs. Additionally, many colleges and universities offer financial aid offices that provide guidance and support to students facing financial difficulties. Finally, government websites, such as the Federal Student Aid website (studentaid.gov), offer comprehensive information on student loan programs and repayment options.

The Impact of Student Loans on the Economy

Student loan debt has become a significant factor in the American economy, influencing consumer spending, investment patterns, and overall economic growth. The sheer volume of outstanding student loan debt, coupled with its impact on individual borrowers’ financial well-being, creates a ripple effect across various sectors. Understanding this impact is crucial for policymakers and individuals alike.

The widespread accumulation of student loan debt has several demonstrable economic effects. Firstly, it can significantly constrain consumer spending. Individuals burdened with substantial loan repayments may postpone major purchases like homes or cars, impacting the housing and automotive industries. This reduced consumer demand can, in turn, slow overall economic growth. Secondly, the debt can limit entrepreneurial activity. Young adults who would otherwise start businesses may delay or forgo this opportunity due to the financial burden of repaying student loans. This represents a loss of potential innovation and job creation. Finally, the weight of student loan debt can negatively affect long-term savings and investment, further impacting economic growth.

Consequences of Loan Defaults

Loan defaults represent a significant risk to the economy. When borrowers fail to repay their loans, lenders experience financial losses, potentially leading to increased interest rates for future borrowers or even impacting the stability of lending institutions. These losses are often passed on to taxpayers, particularly in government-backed loan programs. Furthermore, high default rates can indicate broader economic issues, such as underemployment or a mismatch between skills and job opportunities. The resulting financial strain on individuals and the economy necessitates proactive strategies to minimize defaults through financial literacy programs and effective repayment options. For example, the rise in defaults during the 2008 recession highlighted the vulnerability of the system to economic downturns.

Government’s Role in Managing Student Loan Programs

The government plays a crucial role in managing student loan programs, acting as both a lender and a regulator. It sets interest rates, establishes repayment plans, and oversees the overall health of the loan market. Government intervention aims to ensure access to higher education while mitigating the risks associated with widespread student loan debt. Effective government management requires a balance between promoting access to education and managing the risks of defaults and economic instability. This involves implementing policies that encourage responsible borrowing, providing adequate support for borrowers facing financial hardship, and actively monitoring the performance of the loan programs. For instance, income-driven repayment plans, which tie monthly payments to a borrower’s income, are designed to alleviate the burden of repayment and reduce the risk of default.

The Flow of Money in the Student Loan System

Imagine a circular flow diagram. At the center is the student. Arrows point outwards, one towards educational institutions (colleges and universities), representing tuition payments funded partially or wholly by student loans. Another arrow points towards the government or private lenders, signifying the loan disbursement. Arrows then point inwards towards the student, representing the receipt of funds for education. Finally, arrows point from the student back to the government or private lenders, representing loan repayments over time, completing the cycle. This simplified model illustrates the movement of funds within the student loan system, highlighting the roles of students, educational institutions, and lenders. The size and direction of the arrows can vary based on factors like loan amounts, interest rates, and repayment schedules, reflecting the dynamic nature of the system.

Student Loan Forgiveness Programs

Student loan forgiveness programs offer a lifeline to borrowers struggling under the weight of student loan debt. These programs, while beneficial for many, are often complex and come with specific eligibility criteria and limitations. Understanding these nuances is crucial for borrowers hoping to benefit from them.

Eligibility Requirements for Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies significantly depending on the specific program. For instance, the Public Service Loan Forgiveness (PSLF) program requires borrowers to work full-time for a qualifying government or non-profit organization and make 120 qualifying monthly payments under an income-driven repayment plan. Other programs, like the Teacher Loan Forgiveness program, target specific professions and have their own unique requirements, such as teaching in a low-income school for a certain number of years. Some programs may also have income restrictions or limitations based on the type of loan held (e.g., federal vs. private). It’s vital to thoroughly research the specific requirements of each program before applying.

The Application Process for Loan Forgiveness

Applying for student loan forgiveness typically involves completing a detailed application form and providing extensive documentation. This might include proof of employment, tax returns, payment history, and loan details. The process can be time-consuming and require meticulous record-keeping. Many programs have specific deadlines and submission requirements, so careful attention to detail is paramount. Moreover, the processing time for applications can vary significantly depending on the program and the volume of applications received. Borrowers should expect potential delays and be prepared to follow up on their application status.

Limitations and Challenges of Student Loan Forgiveness Programs

Student loan forgiveness programs are not without their limitations and challenges. One major limitation is the stringent eligibility requirements, which can exclude many borrowers who are still struggling with debt. The application process itself can be complex and burdensome, often deterring borrowers from applying. Furthermore, some programs have limited funding, leading to long wait times and potential rejection even for eligible applicants. There are also concerns about the long-term sustainability of these programs given their potential financial impact on the government. Finally, the forgiveness of loans may not always address the underlying issues that contribute to student loan debt, such as rising tuition costs and inadequate financial aid.

Long-Term Impact of Student Loan Forgiveness on the Economy and Individuals

The long-term economic and individual impacts of widespread student loan forgiveness are complex and subject to ongoing debate. Proponents argue that forgiveness could stimulate economic growth by freeing up borrowers to spend and invest more, potentially boosting consumer demand and entrepreneurship. It could also alleviate financial stress for millions of individuals, improving their overall well-being and potentially increasing their participation in the workforce. However, critics raise concerns about the potential cost to taxpayers and the impact on future borrowing and lending. Some argue that forgiveness might disincentivize responsible borrowing and could lead to increased tuition costs in the future. The actual impact will likely depend on the scale and design of any forgiveness program, as well as broader economic conditions. For example, the potential benefits of forgiveness might be muted during an economic downturn, while the fiscal costs might be more acutely felt during periods of budget constraints. The experience of previous smaller-scale forgiveness programs offers some insight, but the effects of a large-scale initiative remain largely uncertain.

Concluding Remarks

Securing a college education often necessitates careful consideration of financial resources. Student loans, while a significant commitment, offer a pathway to higher learning for many. By understanding the different types of loans available, developing responsible borrowing habits, and exploring available resources for repayment, students can effectively manage their debt and build a brighter future. The information presented here serves as a starting point for navigating this complex landscape and making informed decisions about financing your education.

FAQ

What is the difference between a subsidized and unsubsidized federal student loan?

With subsidized loans, the government pays the interest while you’re in school (at least half-time) and during grace periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I consolidate my student loans?

Yes, consolidating multiple student loans into a single loan can simplify repayment. However, it might affect your interest rate and repayment terms. Explore options carefully.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your loan servicer if you’re struggling to repay.

Where can I find additional resources for managing student loan debt?

The National Foundation for Credit Counseling (NFCC) and the U.S. Department of Education website offer valuable resources and tools for managing student loan debt.