Navigating the complexities of higher education often involves deciphering the difference between financial aid and student loans. While both contribute to funding your education, they differ significantly in their structure, repayment terms, and long-term financial implications. Understanding these distinctions is crucial for making informed decisions about financing your studies and avoiding potential pitfalls.

This guide will explore the nuances of financial aid, encompassing grants, scholarships, and work-study programs, and contrast them with the various types of student loans, including federal and private options. We’ll examine the application processes, explore effective budgeting strategies, and highlight resources available to manage and repay student loan debt effectively. By the end, you’ll have a clear understanding of how these funding sources work and how to choose the best path for your financial future.

Defining Financial Aid

Financial aid encompasses a wide range of resources designed to help students fund their education. It’s a crucial element in making higher education accessible to a broader population, bridging the gap between tuition costs and students’ financial capabilities. Understanding the different types of aid available and the eligibility criteria is key to successfully navigating the process of paying for college.

Financial aid is not a single entity but rather a collection of funding sources. These sources are designed to assist students in meeting their educational expenses, thereby making higher education more attainable. The availability and amount of aid vary significantly depending on individual circumstances and the specific programs available.

Types of Financial Aid

Several distinct types of financial aid exist, each with its own characteristics and application processes. These aid options can be crucial for students seeking to manage the financial burden of higher education. The most common types include grants, scholarships, and work-study programs.

Grants are essentially gifts of money that do not need to be repaid. They are often awarded based on financial need, and the amount awarded can vary significantly depending on the program and the student’s demonstrated need. Examples include Pell Grants (a federal program for undergraduate students with exceptional financial need) and state-specific grants.

Scholarships are also forms of gift aid, but unlike grants, they are often merit-based, awarded to students who demonstrate academic excellence, athletic prowess, or exceptional talent in a specific area. These scholarships can come from a variety of sources, including universities, private organizations, and corporations. Some scholarships are need-based, while others focus solely on merit.

Work-study programs offer students part-time jobs on campus or at affiliated organizations. Earnings from these jobs can help defray educational expenses, providing a valuable source of income while also offering relevant work experience. Eligibility for work-study is often determined by financial need, and the number of hours students can work is usually limited.

Eligibility Criteria for Financial Aid

Eligibility for various financial aid programs is determined by a range of factors. These factors are crucial in determining an applicant’s financial need and overall suitability for the program. Common criteria include:

* Financial need: Many programs, particularly grants and work-study, consider a student’s demonstrated financial need. This is often assessed using the Free Application for Federal Student Aid (FAFSA) form, which collects information about family income, assets, and household size.

* Academic merit: Scholarships frequently require students to maintain a certain GPA or demonstrate exceptional academic achievement in a specific field.

* Demographic factors: Some programs may prioritize students from specific backgrounds, such as underrepresented minorities or first-generation college students.

* Extracurricular activities and volunteer work: Certain scholarships consider a student’s involvement in extracurricular activities or volunteer work, demonstrating commitment and leadership skills.

Comparison of Grant and Scholarship Programs

| Program Name | Funding Source | Eligibility Requirements | Application Process |

|---|---|---|---|

| Pell Grant | Federal Government | Demonstrated financial need (FAFSA); US citizenship or eligible non-citizen status; enrolled at least half-time in an eligible program | FAFSA application |

| State Grant Programs (vary by state) | State Governments | Vary by state; typically include residency requirements, demonstrated financial need, and enrollment in an eligible program. | State-specific application, often involving the FAFSA |

| National Merit Scholarship | National Merit Scholarship Corporation | High PSAT/NMSQT scores; enrollment in an eligible college or university. | PSAT/NMSQT test; application through the National Merit Scholarship Corporation. |

| University Scholarships | Individual Universities | Vary widely by university; may include academic merit, athletic ability, specific talents, or demonstrated financial need. | University application; separate scholarship applications often required. |

Understanding Student Loans

Student loans are a significant source of funding for higher education, but understanding their intricacies is crucial for responsible borrowing. They differ significantly from financial aid grants, which don’t need to be repaid. Choosing between federal and private loans, and understanding the terms of each, is a critical step in planning for your education and future finances.

Federal vs. Private Student Loans

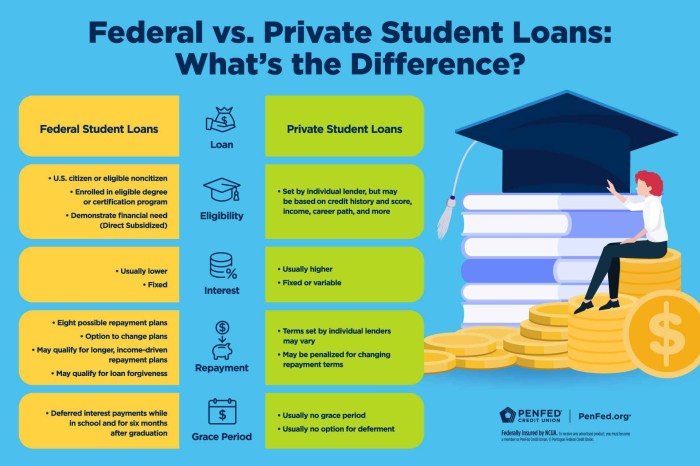

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. Private loans, on the other hand, are provided by banks, credit unions, or other private lenders. The terms and conditions of each vary considerably, impacting both the cost of borrowing and the repayment process. Federal loans typically have lower interest rates and more flexible repayment options, while private loans often come with higher interest rates and stricter terms, especially for borrowers with less-than-perfect credit.

Interest Rates and Repayment Terms

Interest rates for federal student loans are set by the government and are generally lower than those for private loans. The interest rate for a federal loan will vary depending on the loan type (subsidized, unsubsidized, etc.) and the year the loan was disbursed. Repayment terms also vary. Federal loans often offer a standard repayment plan, but also income-driven repayment plans which adjust monthly payments based on income. Private loans, however, have variable interest rates that can fluctuate throughout the repayment period, making it harder to predict total costs. Repayment terms are typically shorter for private loans than for federal loans, leading to higher monthly payments.

Subsidized vs. Unsubsidized Federal Loans

The key difference between subsidized and unsubsidized federal loans lies in whether the government pays the interest while you’re in school. With subsidized loans, the government pays the interest while you’re enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you are in school. This means that the total amount you owe on an unsubsidized loan will be higher than on a subsidized loan of the same amount, because of accumulated interest.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. It can lead to damaged credit scores, making it difficult to obtain loans for cars, houses, or even credit cards in the future. Wage garnishment, where a portion of your paycheck is seized to repay the debt, is also a possibility. The government can also seize tax refunds and even garnish Social Security benefits in extreme cases. Furthermore, defaulting can negatively impact your ability to obtain future federal student aid or government benefits. For example, a person who defaulted on a loan of $20,000 might face a significant reduction in credit score, making it harder to secure a mortgage, and potentially leading to thousands of dollars in additional fees and interest over time due to the collection process.

Key Differences

Financial aid and student loans, while both assisting students with educational expenses, differ significantly in their structure, implications, and long-term effects. Understanding these differences is crucial for making informed decisions about financing your education. The core distinction lies in whether the money needs to be repaid.

Financial aid and student loans have vastly different repayment structures. While student loans require repayment with interest, financial aid, in many cases, does not. This fundamental difference significantly impacts a student’s post-graduation financial burden.

Repayment Requirements

Student loans necessitate a structured repayment plan, typically beginning after a grace period following graduation or the cessation of at least half-time enrollment. Repayment plans vary, but generally involve monthly installments over several years. Failure to meet these obligations can result in negative consequences, including damage to credit scores and potential legal action. In contrast, most forms of financial aid, such as grants and scholarships, do not require repayment. These funds are essentially “free money” awarded based on merit, need, or other criteria.

Impact on Credit History

Student loans are reported to credit bureaus. Responsible repayment builds positive credit history, while consistent late or missed payments can severely damage credit scores, impacting future borrowing opportunities (like mortgages or car loans). Financial aid, on the other hand, generally does not affect credit history, as it doesn’t involve borrowing. Therefore, responsible management of financial aid does not directly influence credit scores.

Advantages and Disadvantages

Understanding the advantages and disadvantages of each funding option is essential for making an informed choice.

Financial Aid (Grants and Scholarships):

- Advantages: Does not need to be repaid; can significantly reduce overall educational costs; may be available based on merit or need.

- Disadvantages: Often highly competitive; amounts awarded may not fully cover educational expenses; eligibility criteria can be restrictive.

Student Loans:

- Advantages: Can cover a larger portion of educational expenses than financial aid alone; allows access to education even with limited savings; builds credit history with responsible repayment.

- Disadvantages: Requires repayment with interest; can lead to significant debt burden; missed payments negatively impact credit scores; may require co-signers.

Hypothetical Scenario: Long-Term Financial Implications

Imagine two students, Alex and Ben, both attending the same university. Alex secures $20,000 in grants and scholarships (financial aid) and takes out $10,000 in student loans. Ben, however, relies solely on $30,000 in student loans. After graduation, Alex has a manageable $10,000 loan to repay, potentially impacting their financial flexibility for a few years. Ben, on the other hand, faces a much larger debt burden, potentially delaying major life milestones like homeownership or starting a family due to the substantial monthly loan payments and accumulated interest over time. This scenario highlights how choosing one funding method over another can significantly shape a graduate’s financial trajectory for years to come. This difference is often amplified by the compounding effect of interest on student loan debt.

The Application Process

Navigating the world of financial aid and student loans can feel overwhelming, but understanding the application process is the first step towards securing funding for your education. Both financial aid and student loans require separate applications, each with its own set of requirements and timelines. Careful planning and organization are key to a successful application.

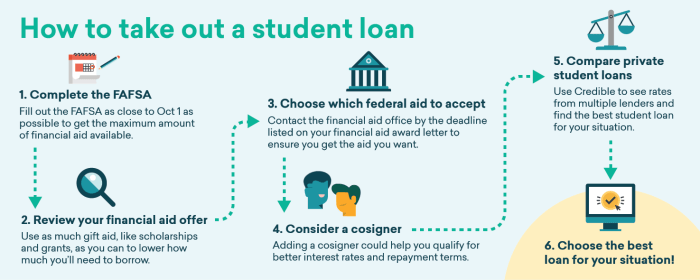

Applying for financial aid and student loans involves distinct processes, although they often overlap. The primary application for federal financial aid is the Free Application for Federal Student Aid (FAFSA), which is crucial for determining eligibility for grants, scholarships, and federal student loans. Private loan applications, on the other hand, are handled directly through individual lenders and typically require a more credit-focused approach.

Applying for Federal Financial Aid (FAFSA)

Completing the FAFSA is the cornerstone of the federal financial aid application process. This application gathers information about your family’s financial situation to determine your eligibility for federal grants and loans. The process is primarily online, and accuracy is paramount, as errors can lead to delays or ineligibility.

- Gather Necessary Information: Before starting, collect your Social Security number (SSN), federal tax returns (IRS Form 1040), W-2s, and other relevant financial documents for both you and your parents (if you are a dependent student). You will also need your driver’s license or state ID, and your FSA ID. Having this information readily available will streamline the process.

- Create an FSA ID: This is your personal identifier for accessing and managing your FAFSA data. Both you and your parent (if applicable) will need a separate FSA ID.

- Complete the Online FAFSA Form: The FAFSA form itself is comprehensive, requesting details about your income, assets, family size, and educational plans. Answer all questions accurately and completely.

- Review and Submit: Once completed, thoroughly review your application for accuracy before submitting it. Errors can delay the processing of your application.

- Track Your Application Status: After submission, you can monitor the status of your FAFSA application online through the official FAFSA website.

Applying for Private Student Loans

Private student loans are offered by banks and other financial institutions. The application process varies depending on the lender, but generally involves a credit check and a review of your financial history.

- Research Lenders: Compare interest rates, fees, and repayment options from different private lenders. Consider factors like your credit score and co-signer availability when making your choice.

- Complete the Loan Application: Each lender has its own application form, which typically requests personal information, academic details, and financial history. You may need to provide proof of enrollment and possibly a co-signer.

- Provide Documentation: Lenders will usually require documentation such as your tax returns, bank statements, and proof of enrollment. The specific documents requested will vary depending on the lender.

- Review Loan Terms: Carefully review the loan terms, including the interest rate, fees, and repayment schedule, before accepting the loan.

Required Documentation

The documentation needed for financial aid and private student loans differs significantly. For federal financial aid (FAFSA), you’ll need tax information (IRS Form 1040, W-2s), Social Security numbers, and driver’s licenses. Private student loan applications may additionally require bank statements, credit reports, and proof of enrollment.

Flowchart Illustrating the Application Process

A flowchart would visually represent the steps involved. The FAFSA process would branch into awarding aid (grants, loans) based on eligibility, while the private loan application would proceed based on creditworthiness and lender approval. The flowchart would clearly show the different paths and decisions involved in both processes. Unfortunately, I cannot create visual representations within this text-based format.

Managing Financial Aid and Loans

Successfully navigating the financial landscape of higher education requires careful planning and proactive management of both financial aid and student loans. Understanding your award package, creating a realistic budget, and developing a sound repayment strategy are crucial steps to minimizing debt and maximizing your educational investment. This section will Artikel effective strategies for managing your finances throughout your studies and beyond.

Effective Budgeting Strategies for Students

Creating a comprehensive budget is paramount for students receiving financial aid and loans. This involves tracking income (including financial aid disbursements and any part-time earnings) and meticulously recording expenses. Categorizing expenses (tuition, housing, food, transportation, books, entertainment, etc.) allows for identification of areas where savings can be made. Budgeting apps and spreadsheets can be invaluable tools in this process. For example, a student might allocate a specific amount for groceries each week, limiting dining out to a certain number of times per month, and utilizing free or low-cost entertainment options. Regularly reviewing and adjusting the budget based on actual spending habits ensures its effectiveness.

Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each designed to cater to different financial situations and repayment preferences. Standard repayment involves fixed monthly payments over a 10-year period. Income-driven repayment plans (IDR) adjust monthly payments based on income and family size, potentially extending the repayment period. Graduated repayment starts with lower payments that gradually increase over time. Extended repayment plans stretch the repayment period to up to 25 years. Choosing the right plan depends on individual circumstances and financial goals. For instance, a recent graduate with a low income might opt for an IDR plan to manage monthly payments, while someone with a stable, higher income might prefer a standard repayment plan to pay off the loan quicker.

Tips for Avoiding Excessive Student Loan Debt

Minimizing student loan debt requires proactive measures throughout the educational journey. Exploring scholarship opportunities, grants, and work-study programs can significantly reduce reliance on loans. Choosing an affordable college or university, considering community college for the first two years, and opting for less expensive housing options can also lower overall costs. Careful consideration of the projected return on investment (ROI) for a particular degree program is crucial. A student might consider the potential salary range of a chosen career path against the cost of education and associated debt. For example, a student pursuing a high-demand career with a strong salary outlook might be more willing to take on a larger loan burden than someone entering a lower-paying field.

Resources for Students Struggling with Loan Repayment

Numerous resources are available for students facing difficulties in managing student loan repayments. Federal student loan servicers offer options such as forbearance (temporary suspension of payments) and deferment (postponement of payments). Loan rehabilitation programs can help restore a borrower’s credit rating after default. National and local non-profit organizations provide financial counseling and guidance to students struggling with debt. These organizations can help borrowers understand their repayment options, create a budget, and explore debt management strategies. Furthermore, some employers offer student loan repayment assistance programs as part of their employee benefits package. These resources provide crucial support and guidance for navigating the complexities of student loan repayment.

Illustrative Examples

Understanding the nuances of financial aid and student loans is best achieved through practical examples. These scenarios illustrate how different funding sources can impact a student’s educational journey and overall financial picture.

Scenario: Reliance on Grants and Scholarships

Imagine Sarah, a bright and motivated student accepted into a prestigious state university. Through diligent research and applications, she secures a full scholarship covering her tuition and a substantial grant covering her room and board. This means Sarah graduates debt-free, allowing her to enter the workforce without the burden of student loan repayments. This financial freedom enables her to pursue her career goals without immediate financial constraints, potentially allowing her to save for a down payment on a house or invest in further education. Her focus remains solely on her studies and extracurricular activities, leading to a more well-rounded college experience.

Scenario: Heavy Reliance on Student Loans

Contrastingly, consider David, who also attends the same university but lacks the same access to grants and scholarships. To afford his education, he takes out the maximum amount of federal student loans, along with several private loans. While he graduates with a degree, he also carries a significant debt burden. This debt necessitates careful budgeting and may limit his immediate career choices, potentially delaying major life decisions like buying a house or starting a family. The repayment process, often spanning several years, represents a considerable financial commitment, impacting his ability to save and invest.

Visual Representation of Education Costs

A bar graph would effectively illustrate the total cost of education with and without financial aid and loans. The first bar would represent the total cost of tuition, fees, room, and board—let’s say $100,000 for a four-year degree. The second bar would show the same total cost, but this time, a portion is visually subtracted, representing the value of grants and scholarships received – for example, $20,000. The remaining portion would then be segmented to show the amount covered by student loans (perhaps $60,000) and the amount paid out-of-pocket ($20,000). A third bar would depict the final cost after loan repayment, incorporating the accumulated interest. Assuming a 6% interest rate over 10 years, the interest accrued could easily add another $20,000 to the total cost, making the final repayment amount $80,000. The visual contrast between the initial cost, the cost after financial aid, and the final cost after loan repayment and interest clearly demonstrates the significant impact of financial aid and the compounding effect of loan interest. The difference between the first bar and the third bar powerfully illustrates the long-term financial consequences of relying heavily on student loans.

Concluding Remarks

Ultimately, the decision of how to finance your education is a personal one, dependent on individual circumstances and financial goals. While financial aid, in the form of grants and scholarships, offers a debt-free path, student loans often become necessary to bridge the funding gap. Careful planning, informed decision-making, and a proactive approach to managing repayment are essential to ensure a positive outcome. By understanding the differences between financial aid and student loans, and utilizing the resources available, you can navigate the complexities of higher education funding and build a solid financial foundation for your future.

Commonly Asked Questions

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I get financial aid if I have a poor credit score?

Your credit score primarily affects your eligibility for private student loans, not federal aid. However, a co-signer might be necessary for private loans.

What happens if I don’t repay my student loans?

Defaulting on student loans can result in wage garnishment, tax refund offset, and damage to your credit score.

Are there any limits on how much financial aid I can receive?

Yes, there are limits on federal financial aid based on factors such as cost of attendance and dependency status.

Where can I find more information about financial aid and student loan options?

The Federal Student Aid website (studentaid.gov) is an excellent resource for information on federal student aid programs. Your college’s financial aid office can also provide guidance.