Navigating the complexities of student loan repayment can feel overwhelming, especially when considering the potential tax implications. Many borrowers wonder if they can deduct the interest they pay on their student loans, potentially reducing their overall tax burden. This guide explores the student loan interest deduction, outlining eligibility requirements, calculation methods, and potential pitfalls to help you understand if and how you can benefit.

Understanding this deduction requires careful consideration of your income, filing status, and the specific details of your student loan payments. We’ll break down the process step-by-step, offering clear explanations and practical examples to make navigating this aspect of tax preparation more manageable. We’ll also examine alternative strategies for managing student loan debt, ensuring a comprehensive overview of your options.

Eligibility for Student Loan Interest Deduction

Claiming the student loan interest deduction can provide significant tax savings for eligible taxpayers. Understanding the requirements is crucial to ensure you can accurately claim this deduction and receive the appropriate reduction in your taxable income. This section details the eligibility criteria and provides a step-by-step guide to help you determine if you qualify.

Requirements for Claiming the Student Loan Interest Deduction

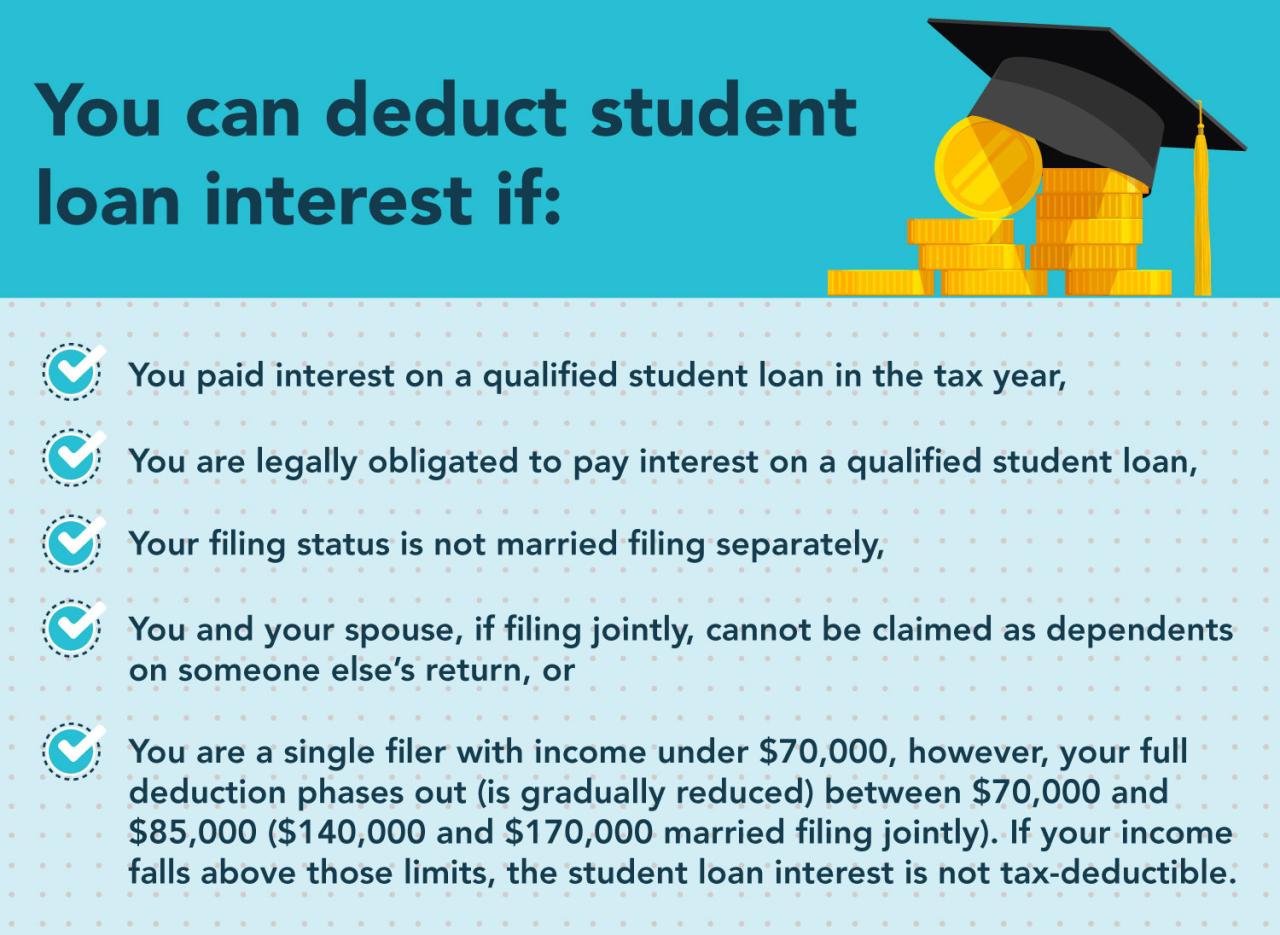

To claim the student loan interest deduction, you must meet several key requirements. First, the interest must be paid on a qualified student loan. This typically means a loan taken out to pay for higher education expenses for yourself, your spouse, or a dependent. The loan must be used to pay for tuition, fees, room and board, or other educational expenses. Secondly, you must be legally obligated to pay the loan. Finally, you must itemize deductions on your tax return rather than using the standard deduction. The deduction is for the actual amount of interest you paid during the tax year, up to a maximum annual limit (which can change, so always check the current IRS guidelines).

Income Limitations Affecting Eligibility

The student loan interest deduction is subject to income limitations. Your eligibility depends on your filing status and your modified adjusted gross income (MAGI). MAGI is your adjusted gross income (AGI) with certain deductions added back in. Exceeding the MAGI threshold for your filing status will disqualify you from claiming the deduction. These limits are adjusted annually for inflation, so it’s vital to consult the most up-to-date IRS publications for the precise figures for the tax year in question.

Determining Eligibility: A Step-by-Step Guide

1. Determine your filing status: Are you single, married filing jointly, married filing separately, head of household, or qualifying widow(er)? Your filing status significantly impacts the MAGI threshold.

2. Calculate your MAGI: Start with your AGI and add back any deductions that were subtracted to arrive at your AGI. Consult IRS Publication 970 for a comprehensive list of adjustments.

3. Find the applicable MAGI limit: Refer to the IRS guidelines for the current tax year to find the maximum MAGI for your filing status that allows you to claim the deduction.

4. Compare your MAGI to the limit: If your MAGI is less than or equal to the limit, you are generally eligible to claim the deduction. If your MAGI exceeds the limit, you cannot claim the deduction.

Eligibility Criteria Based on Filing Status and MAGI

The following table summarizes the general eligibility criteria. Remember that these limits are subject to annual adjustments, so always verify the current year’s limits with the IRS.

| Filing Status | MAGI Limit (Example – Illustrative, Check IRS for Current Year) | Eligibility | Example |

|---|---|---|---|

| Single | $70,000 | Eligible if MAGI ≤ $70,000 | A single filer with a MAGI of $65,000 is eligible. |

| Married Filing Jointly | $140,000 | Eligible if MAGI ≤ $140,000 | A married couple filing jointly with a MAGI of $130,000 is eligible. |

| Head of Household | $90,000 | Eligible if MAGI ≤ $90,000 | A head of household filer with a MAGI of $88,000 is eligible. |

Maximum Deductible Amount

The student loan interest deduction allows taxpayers to deduct the actual amount of interest they paid on qualified student loans during the tax year, up to a certain limit. This limit isn’t a fixed amount for everyone; it depends on your Modified Adjusted Gross Income (MAGI). Understanding this maximum and how it’s calculated is crucial for maximizing your tax benefits.

The maximum amount of student loan interest you can deduct annually is $2,500. This means that even if you paid more than $2,500 in student loan interest during the year, you can only deduct up to this limit. The deduction is calculated based on the actual amount of interest you paid during the tax year, but it’s capped at this $2,500 threshold. This cap is not indexed for inflation, meaning it remains consistently at $2,500 regardless of economic changes.

Calculation of the Student Loan Interest Deduction

The deduction is calculated by subtracting your actual student loan interest payments from your taxable income. However, the deduction is phased out for higher-income taxpayers. This means that the amount you can deduct decreases as your MAGI increases. The phase-out range is dependent on your filing status. For example, for single filers in 2023, the deduction begins to phase out if your MAGI is above $70,000 and is completely eliminated if your MAGI is $85,000 or more. The phase-out ranges are different for married couples filing jointly and other filing statuses. It’s essential to consult the most current IRS guidelines for accurate phase-out ranges based on your filing status and tax year.

Situations Where the Actual Deduction Might Be Less Than the Maximum

Several factors can cause your actual student loan interest deduction to be less than the maximum $2,500. The most common reason is exceeding the MAGI thresholds for the phase-out. As your MAGI rises above the specified limits for your filing status, the deduction is reduced proportionally until it reaches zero. Another factor is simply paying less than $2,500 in student loan interest during the tax year. In this case, your deduction will be limited to the actual amount you paid. Finally, if you’re claiming other deductions or credits that reduce your taxable income, it might indirectly affect the value of the student loan interest deduction, although not directly reducing the amount itself.

Example Calculation

Let’s say John and Mary are married filing jointly. They paid $3,000 in student loan interest during the tax year. Their MAGI is $75,000. The phase-out range for married couples filing jointly begins at $140,000 and ends at $160,000. Since their MAGI is below the phase-out range, their deduction is not affected. Therefore, they can deduct the full $2,500 (the maximum allowable). If their MAGI were above $140,000 but below $160,000, the deduction would be reduced proportionally. If their MAGI were above $160,000, they would not be able to claim the deduction. Note that these phase-out ranges are for illustrative purposes and may change annually. Always refer to the current IRS guidelines for the most accurate information.

Required Documentation and Forms

Claiming the student loan interest deduction requires careful documentation to ensure your return is processed accurately and efficiently. Gathering the necessary information beforehand will streamline the process and prevent delays. This section Artikels the essential forms and supporting documents, along with the information needed for each.

To successfully claim the student loan interest deduction, you’ll need to complete Form 1098-E, “Student Loan Interest Statement,” and potentially other supporting documentation depending on your individual circumstances. Accurate and complete documentation is crucial for a successful claim.

Form 1098-E: Student Loan Interest Statement

Form 1098-E is the primary document you need to claim the student loan interest deduction. This form is provided by your lender and reports the total amount of interest you paid during the tax year on qualified student loans. It’s important to note that not all lenders issue this form; if you don’t receive a 1098-E, you may still be able to claim the deduction if you can prove the interest payments through other documentation such as bank statements.

- Information Reported on Form 1098-E: The form will show your name, lender’s name and contact information, the payer’s TIN (Taxpayer Identification Number), and the total amount of student loan interest you paid during the tax year. This amount will be reported on Box 1. Additional information, like the student’s name, may also be included.

- Accuracy Check: Carefully review the information on your Form 1098-E to ensure it accurately reflects your student loan interest payments. If there are any discrepancies, contact your lender immediately to resolve them.

Supporting Documentation

While Form 1098-E is the cornerstone of your deduction claim, you may need additional supporting documents to substantiate your claim, especially if you didn’t receive a 1098-E or if the information on the form is incomplete or inaccurate.

- Bank Statements or Loan Payment Records: These documents provide proof of your student loan interest payments. They should clearly show the date, amount, and payee (the lender) for each payment. These are particularly important if you are missing a 1098-E.

- Loan Documents: In certain situations, such as if you are claiming interest on multiple loans, or if there are questions about the nature of the loans, having access to your loan documents can help support your claim. This might include promissory notes or loan agreements.

Transferring Information to Your Tax Return

The information from Form 1098-E is transferred to your tax return, Form 1040. Specifically, the amount from Box 1 of Form 1098-E (the total student loan interest paid) is reported on Schedule 1 (Additional Income and Adjustments to Income), line 21.

Remember to keep copies of all your supporting documentation in case of an audit. The IRS may request this information to verify your claim.

Impact on Tax Liability

The student loan interest deduction directly reduces your taxable income, thus lowering your overall tax liability. This means you’ll owe less in federal income taxes. The amount of the reduction depends on the amount of interest you paid during the year and your adjusted gross income (AGI). It’s crucial to understand how this deduction interacts with your other income and deductions to accurately assess its impact.

The student loan interest deduction affects your tax liability by reducing your taxable income. This reduction translates to a lower tax bill. The extent of this reduction varies depending on individual circumstances, specifically the amount of student loan interest paid and the taxpayer’s AGI. For example, a taxpayer with a higher AGI might see a smaller reduction in their tax liability compared to a taxpayer with a lower AGI, even if both paid the same amount of student loan interest. This is because the deduction is phased out for higher income earners.

Tax Liability Comparison: Hypothetical Scenarios

Let’s consider two hypothetical taxpayers, both single filers, who paid $1,000 in student loan interest during the tax year.

Taxpayer A has an AGI of $50,000 and is eligible for the full student loan interest deduction. Assuming a 22% marginal tax rate, the deduction saves them $220 ($1,000 x 0.22). Their tax liability is reduced by this amount.

Taxpayer B has an AGI of $80,000. Due to the phase-out rules, they may only be able to deduct a portion of their student loan interest, perhaps $500. At the same 22% marginal tax rate, their tax savings would be $110 ($500 x 0.22).

This illustrates how the deduction’s impact varies based on income. Higher AGI taxpayers might see a reduced benefit or no benefit at all.

Potential Tax Savings from the Deduction

Claiming the student loan interest deduction can lead to significant tax savings, especially for those with lower to moderate incomes. The exact amount saved will depend on individual circumstances, including the amount of interest paid, the taxpayer’s tax bracket, and their AGI. However, even a modest reduction in tax liability can provide substantial relief, particularly for those struggling to manage student loan debt. Many taxpayers find that the deduction significantly offsets the burden of their monthly loan payments.

- Reduced Taxable Income: The deduction directly lowers your taxable income, resulting in lower taxes owed.

- Direct Tax Savings: The tax savings are directly proportional to your tax bracket and the amount of interest deducted.

- Financial Relief: The deduction provides financial relief, easing the financial strain of student loan repayment.

- Increased Disposable Income: By reducing your tax burden, you may have more disposable income available for other expenses.

Common Mistakes and Pitfalls

Claiming the student loan interest deduction accurately requires careful attention to detail. Many taxpayers unintentionally make errors, leading to missed deductions or even IRS penalties. Understanding common mistakes and implementing preventative measures is crucial for maximizing your tax benefits.

Many errors stem from a lack of thorough record-keeping or misunderstandings about eligibility requirements. For instance, some taxpayers incorrectly assume that all student loan interest payments are deductible, regardless of the loan type or the recipient of the payment. Others fail to maintain sufficient documentation to support their deduction. These errors can lead to delays in processing refunds or, in more serious cases, adjustments to your tax liability and potential penalties.

Incorrect Reporting of Interest Paid

It’s vital to accurately report the total amount of student loan interest you paid during the tax year. This figure should match the information reported on your Form 1098-E, Student Loan Interest Statement. Discrepancies between your return and the 1098-E can trigger an IRS inquiry, delaying your refund or resulting in a tax adjustment. For example, if you claim a higher amount than reported on your 1098-E without sufficient supporting documentation, the IRS may disallow the deduction. To avoid this, meticulously compare your records with the 1098-E and correct any differences before filing.

Failing to Meet Eligibility Requirements

The student loan interest deduction is subject to several limitations. For example, your modified adjusted gross income (MAGI) must be below a certain threshold, and the loans must be for qualified education expenses. Failing to meet these requirements can invalidate your deduction. For instance, a taxpayer whose MAGI exceeds the limit, even slightly, cannot claim the deduction. Similarly, interest paid on loans not used for qualified education expenses, such as personal loans, is not deductible. Before claiming the deduction, carefully review the eligibility criteria to ensure you qualify.

Inaccurate Record-Keeping

Maintaining detailed and accurate records of your student loan interest payments is paramount. This includes keeping copies of your loan statements, payment receipts, and Form 1098-E. Poor record-keeping makes it difficult to substantiate your deduction if the IRS questions it. A taxpayer who can only provide vague estimates of their interest payments will likely face challenges during an audit. Therefore, adopt a robust system for tracking all your student loan payments throughout the year. This could involve a dedicated spreadsheet, a filing system for physical documents, or utilizing a financial management app.

Claiming the Deduction Without the Necessary Forms

While not always required, having the correct forms on hand is crucial for supporting your claim. Form 1098-E, as mentioned earlier, is helpful, but even without it, maintaining accurate records is essential. If the IRS requests additional information, you need documentation to prove your expenses. For instance, if you paid interest directly to the lender, you need bank statements or payment confirmations to verify the payments. If the IRS requests supporting documentation and you cannot provide it, your claim may be denied.

Overlooking the Modified Adjusted Gross Income (MAGI) Limit

The student loan interest deduction is phased out for taxpayers with higher modified adjusted gross incomes (MAGI). Failing to consider this limit can lead to an incorrect deduction amount or a disallowed deduction altogether. The phase-out range varies annually, so it’s important to check the current IRS guidelines. For example, a married couple filing jointly might find their deduction reduced or eliminated if their MAGI surpasses the specified threshold. Taxpayers should calculate their MAGI carefully and use the appropriate phase-out rules to determine their allowable deduction.

Alternative Ways to Manage Student Loan Debt

Managing student loan debt can feel overwhelming, but several strategies can make repayment more manageable and potentially reduce your overall cost. Exploring these options carefully can significantly impact your financial future. Understanding the advantages and disadvantages of each approach, along with their tax implications, is crucial for making informed decisions.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, typically at a lower interest rate. This can lead to significant savings over the life of the loan. However, refinancing may mean losing federal loan benefits such as income-driven repayment plans or loan forgiveness programs. It’s essential to weigh the potential interest rate savings against the potential loss of these benefits. The impact on your student loan interest deduction will depend on whether the new loan is a federal or private loan; the interest paid on private loans is generally not deductible.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans, offered by the federal government, can lower your monthly payments, making them more affordable, especially during periods of lower income. However, IDR plans typically extend the repayment period, leading to potentially higher total interest paid over the life of the loan. The interest paid on federal student loans may still be deductible, subject to the income limitations and other criteria discussed earlier.

Student Loan Consolidation

Consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of payments and potentially lowering your monthly payment. However, the interest rate on the consolidated loan might be a weighted average of your existing loan rates, which may not result in a lower rate. The consolidated loan will likely still qualify for the student loan interest deduction if the underlying loans were eligible.

Table Comparing Student Loan Repayment Options and Tax Implications

| Repayment Option | Monthly Payment | Total Interest Paid | Tax Deductibility of Interest |

|---|---|---|---|

| Standard Repayment Plan (Federal) | Fixed, relatively high | Potentially lower | Potentially deductible (subject to income limits) |

| Extended Repayment Plan (Federal) | Lower | Potentially higher | Potentially deductible (subject to income limits) |

| Income-Driven Repayment Plan (Federal) | Variable, income-based | Potentially higher | Potentially deductible (subject to income limits) |

| Refinancing (Private) | Potentially lower | Potentially lower | Generally not deductible |

Changes in Tax Laws Affecting the Student Loan Interest Deduction

The student loan interest deduction, while offering valuable tax relief, has seen its share of modifications over the years. Understanding these changes is crucial for taxpayers to accurately claim the deduction and maximize their tax benefits. These changes often reflect broader shifts in tax policy and economic priorities.

Historical Overview of Changes to the Student Loan Interest Deduction

The student loan interest deduction has not been immune to adjustments throughout its existence. While the basic structure has remained consistent – allowing a deduction for interest paid on qualified student loans – the specifics, such as the maximum deduction amount and income limitations, have fluctuated. For example, the American Taxpayer Relief Act of 2012 (ATRA) made several changes to the deduction, including adjustments to income thresholds. Prior to ATRA, the deduction was more generous in terms of both the maximum deduction and the income limits. These changes have generally aimed to limit the benefit to taxpayers with more modest incomes.

Tax Cuts and Jobs Act of 2017 Impact

The Tax Cuts and Jobs Act of 2017 (TCJA) significantly altered the landscape of many tax deductions, and the student loan interest deduction was not spared. While the deduction itself remained, the TCJA doubled the standard deduction amounts. This change, in effect, reduced the number of taxpayers who would benefit from itemizing their deductions, including the student loan interest deduction. Many taxpayers who previously itemized to claim this deduction found it more advantageous to use the standard deduction, effectively negating the benefit of the student loan interest deduction. For instance, a single taxpayer with a modest student loan interest payment and a relatively high standard deduction might find that itemizing to claim the student loan interest deduction is no longer beneficial.

Potential Future Changes

Predicting future changes to tax laws is inherently speculative. However, based on current political and economic climates, potential changes to the student loan interest deduction could include further adjustments to income limitations or even the complete elimination of the deduction as part of broader tax reform efforts. Such changes could drastically affect the affordability of higher education for many individuals. A hypothetical example: If the income limit for the deduction were significantly lowered, many middle-class families currently utilizing the deduction could lose access to this tax benefit, potentially impacting their ability to manage student loan debt. Alternatively, an expansion of the deduction, while unlikely in the current fiscal environment, could provide increased relief to those struggling with student loan repayment.

Conclusion

Successfully claiming the student loan interest deduction can provide significant tax savings, but careful attention to detail is crucial. Understanding eligibility criteria, accurately calculating the deduction, and maintaining thorough records are essential steps to avoid common mistakes. By exploring the information provided, you can confidently assess your eligibility, optimize your tax strategy, and effectively manage your student loan debt. Remember to consult a tax professional for personalized advice tailored to your specific financial situation.

Answers to Common Questions

Can I deduct interest on private student loans?

Yes, as long as you meet the eligibility requirements for the student loan interest deduction, the type of loan (federal or private) doesn’t matter.

What if I paid off my student loans early?

You can still deduct the interest you paid during the year, even if you paid off the loan before the tax filing deadline.

What happens if my MAGI exceeds the limit?

You will not be eligible for the student loan interest deduction if your Modified Adjusted Gross Income (MAGI) surpasses the specified limit for your filing status.

Where can I find the necessary tax forms?

The IRS website (IRS.gov) provides access to all necessary forms and publications. Form 1040, Schedule 1 (Additional Income and Adjustments to Income), is where you’ll claim the deduction.