Navigating the world of student loans can feel overwhelming, especially when faced with numerous lenders and loan options. The Massachusetts Educational Financing Authority (MEFA) offers a range of student loan products, presenting a viable alternative to federal loans or private lenders. This exploration delves into the intricacies of MEFA loans, examining their benefits, drawbacks, and overall suitability for prospective borrowers.

Understanding whether a MEFA loan is the right choice requires a comprehensive assessment of individual financial circumstances, credit history, and long-term financial goals. We’ll explore the various MEFA loan programs, compare their interest rates and fees to other lenders, and analyze the application process and repayment options to provide a clear and informative overview.

Understanding MEFA Loans

MEFA, the Massachusetts Educational Financing Authority, offers a range of student loan programs designed to help Massachusetts residents finance their higher education. Understanding the nuances of these programs is crucial for borrowers to make informed decisions about their financing options. This section will detail the various MEFA loan types, eligibility criteria, interest rates, and repayment plans.

MEFA Loan Types

MEFA provides several loan options, each with its own set of features and requirements. The primary loan types generally include subsidized and unsubsidized federal loans (administered through MEFA), as well as private loans offered directly by MEFA. The specific availability and details of these loans can change, so it’s always advisable to check MEFA’s official website for the most up-to-date information. Federal loans often come with more borrower protections than private loans.

Eligibility Requirements for MEFA Loan Programs

Eligibility for MEFA loan programs varies depending on the specific loan type. Generally, applicants must be a Massachusetts resident, be enrolled or accepted into an eligible educational institution, demonstrate financial need (for some programs), and maintain satisfactory academic progress. Specific requirements, such as minimum credit scores or co-signer needs, may apply to private MEFA loans. Federal loans typically have different eligibility criteria than private loans. For example, a federal loan might require filling out a FAFSA (Free Application for Federal Student Aid) form, demonstrating financial need, and meeting certain academic standards. A private MEFA loan may have stricter credit requirements.

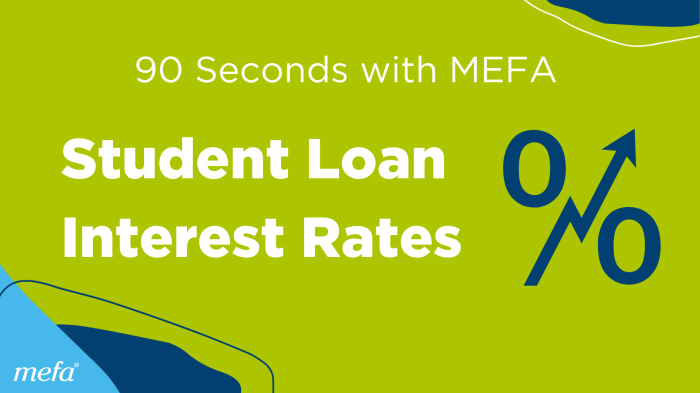

Comparison of MEFA Loan Interest Rates with Other Lenders

MEFA loan interest rates are competitive, but they vary depending on the type of loan, creditworthiness of the borrower, and prevailing market interest rates. Generally, federal student loans tend to have lower interest rates than private loans. Direct comparison with other lenders requires reviewing current interest rate offerings from various institutions. It’s recommended to compare rates from multiple lenders before committing to a loan. For example, one might compare MEFA’s private loan rates with those offered by Sallie Mae or Discover Student Loans. Remember that interest rates are subject to change.

MEFA Loan Repayment Options and Plans

MEFA offers various repayment options and plans to accommodate borrowers’ financial situations. These often include standard repayment plans, graduated repayment plans (where payments increase over time), extended repayment plans (stretching repayment over a longer period), and income-driven repayment plans (linking monthly payments to income). The availability of specific plans depends on the type of loan and the lender. Borrowers should carefully consider their financial circumstances and choose a repayment plan that best suits their needs. Understanding the terms and conditions of each repayment plan is crucial to avoid late payments and potential penalties. For example, an income-driven repayment plan may result in a larger total repayment amount due to the extended repayment period, but it may offer lower monthly payments during periods of lower income.

MEFA Loan Costs and Fees

Understanding the costs associated with a MEFA loan is crucial for responsible borrowing. This section details the fees involved and explores the potential long-term financial implications. It’s important to compare MEFA’s offerings to those of other lenders to make an informed decision.

MEFA loans, like other student loans, come with various fees that can significantly impact the overall cost. These fees can include origination fees, late payment fees, and potentially others depending on the specific loan terms. It is vital to carefully review the loan agreement to understand all associated charges before signing.

MEFA Loan Fee Comparison

The following table compares MEFA loan fees with those of other common student loan lenders. Note that fees can change, so it’s essential to check directly with the lender for the most up-to-date information. This table provides a general comparison and should not be considered exhaustive.

| Lender Name | Loan Type | Origination Fee | Other Fees (Examples) |

|---|---|---|---|

| MEFA | Direct Loan | Variable, check MEFA website | Late payment fees, returned check fees |

| Sallie Mae | Private Loan | Variable, check Sallie Mae website | Late payment fees, insufficient funds fees |

| Discover | Private Loan | Variable, check Discover website | Late payment fees, processing fees |

| Navient | Federal Loan Servicing | Typically none for federal loans | Late payment fees (if applicable) |

Long-Term Costs of MEFA Loans

The long-term cost of a MEFA loan extends beyond the initial loan amount. Interest accrues over the loan’s lifespan, significantly increasing the total amount repaid. The longer it takes to repay the loan, the more interest will accumulate, leading to a substantially higher total cost. For example, a $10,000 loan with a 7% interest rate over 10 years will cost considerably more than the same loan repaid over 5 years. The specific amount will depend on the interest rate and repayment plan.

Calculating Total Loan Cost

Calculating the total cost of a MEFA loan involves several steps. First, determine the principal loan amount. Then, identify the interest rate and loan term (repayment period). The total cost is the sum of the principal and the total interest accrued over the loan term. Many online loan calculators are available to simplify this process. For instance, a $20,000 loan at 6% interest over 10 years might result in a total repayment exceeding $27,000, due to accumulated interest.

Total Cost = Principal + Total Interest Accrued

Sample MEFA Loan Repayment Schedule

The following is a simplified example of a repayment schedule for a $10,000 MEFA loan at a 5% annual interest rate, amortized over 10 years. Actual repayment schedules will vary based on loan terms and individual circumstances. This is for illustrative purposes only.

| Year | Beginning Balance | Annual Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000 | $1,295 | $500 | $795 | $9,205 |

| 2 | $9,205 | $1,295 | $460 | $835 | $8,370 |

| 3 | $8,370 | $1,295 | $419 | $876 | $7,494 |

| … | … | … | … | … | … |

| 10 | $XXX | $1,295 | $XXX | $XXX | $0 |

Comparing MEFA to Other Student Loan Options

Choosing the right student loan can significantly impact your financial future. This section compares MEFA loans with federal student loans and private loans from other lenders, highlighting key differences to aid your decision-making process. Understanding the nuances of each loan type is crucial for responsible borrowing.

MEFA loans, offered by the Massachusetts Educational Financing Authority, cater specifically to Massachusetts residents. Federal student loans, conversely, are government-backed loans available nationwide, while private loans originate from various banks and financial institutions, often with varying eligibility criteria and interest rates.

MEFA Loans Compared to Federal Student Loans

Federal student loans generally offer more favorable terms than MEFA loans, particularly for borrowers with limited or no credit history. Federal loans often come with lower interest rates, income-driven repayment plans, and protections against default. MEFA loans, while potentially offering competitive rates for borrowers with strong credit, may lack these borrower-friendly features. Furthermore, eligibility for federal student loans is typically broader, encompassing a wider range of educational programs and student demographics. However, MEFA loans might offer more streamlined application processes for Massachusetts residents familiar with the state’s educational system.

MEFA Loans Compared to Private Loans from Other Lenders

The primary advantage of MEFA loans over private loans lies in their potential for lower interest rates, especially for borrowers with excellent credit. However, private loans often offer greater flexibility in terms of loan amounts and repayment options. The availability of various private loan programs from different lenders allows borrowers to compare offers and potentially secure more favorable terms. Conversely, MEFA loans may have stricter eligibility requirements and may not be as widely available as private loan options. The approval process for MEFA loans, while generally straightforward, could also be more stringent than that of some private lenders.

Impact of Credit Score and Credit History on MEFA Loan Approval

A strong credit score and a positive credit history are crucial for securing favorable terms on a MEFA loan. Borrowers with excellent credit can often qualify for lower interest rates and more favorable repayment plans. Conversely, borrowers with poor or limited credit history may face higher interest rates, stricter eligibility requirements, or even loan denial. This contrasts with federal student loans, which often prioritize need-based eligibility over creditworthiness, particularly for subsidized loans. MEFA loan approval, unlike some private loans, may not solely rely on a credit check; other factors like academic performance and co-signer availability might influence the decision.

Key Differences Summarized

- Interest Rates: Federal loans often have lower interest rates than MEFA loans, which in turn can be lower than some private loans, depending on the borrower’s creditworthiness.

- Eligibility: Federal loans have broader eligibility criteria; MEFA loans are restricted to Massachusetts residents; private loans have varying eligibility based on lender requirements.

- Repayment Options: Federal loans offer income-driven repayment plans; MEFA and private loan repayment options vary greatly.

- Credit Score Impact: Credit score significantly impacts MEFA and private loan interest rates and approval; it plays a less dominant role in federal loan eligibility (except for unsubsidized loans).

- Borrower Protections: Federal loans provide stronger borrower protections in case of default compared to MEFA or private loans.

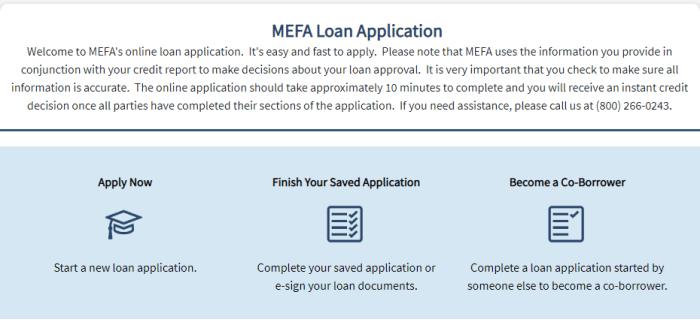

MEFA Loan Application Process

Applying for a MEFA student loan involves several key steps, and understanding these steps will help ensure a smooth and efficient application process. The entire process is designed to be straightforward, but careful preparation is crucial for a successful outcome. This section details the application procedure, required documentation, helpful tips, and typical processing times.

The MEFA loan application process generally follows a standardized procedure. Applicants begin by completing the online application form, providing accurate and complete information. This initial step is vital as any inconsistencies may delay the processing of your application. Following the submission of the application, MEFA will review the information and may request additional documentation to verify the provided details. This verification process is a standard part of the loan application procedure and is designed to ensure the integrity of the loan program.

Required Documentation

Applicants should gather all necessary documentation before starting the application to streamline the process. This will minimize delays and ensure a smoother application experience. Commonly required documents include proof of enrollment at an eligible institution, a completed FAFSA (Free Application for Federal Student Aid), and tax returns or other proof of income for the applicant and their parents (if applicable). Depending on the specific loan program, additional documentation may be requested. For example, some programs might require proof of residency or evidence of exceptional circumstances affecting financial need. It’s advisable to keep copies of all submitted documents for your records.

Tips for a Successful MEFA Loan Application

Careful preparation significantly increases the likelihood of a successful application. Accuracy is paramount; ensure all information provided is correct and consistent across all documents. Complete the application thoroughly and double-check all entries before submission. If you anticipate any difficulty in providing certain information, contact MEFA directly for assistance. Early application is also recommended, as processing times may vary depending on the volume of applications received. Furthermore, maintain open communication with MEFA throughout the application process; promptly respond to any requests for additional information.

Typical Processing Time

The processing time for a MEFA loan application can vary. While MEFA aims to process applications efficiently, factors such as the volume of applications and the completeness of the submitted documentation can influence processing time. While specific timelines are not guaranteed, applicants should generally allow several weeks for the application to be processed and approved. It’s advisable to apply well in advance of the needed funds to account for any potential delays. Regularly checking your application status online can provide updates on the progress of your application. Proactive communication with MEFA can help address any questions or concerns promptly and potentially expedite the process.

Managing MEFA Student Loans

Successfully navigating the repayment of your MEFA student loan requires proactive planning and responsible financial habits. Understanding your repayment options and potential consequences of default is crucial for long-term financial well-being. This section Artikels strategies for effective loan management and resources available to borrowers facing financial hardship.

Responsible Student Loan Management Strategies

Effective management of your MEFA student loan involves several key strategies. Prioritizing timely payments is paramount, preventing late fees and negative impacts on your credit score. Creating a realistic budget that incorporates your loan payments is essential. This budget should account for all expenses, ensuring sufficient funds are allocated for loan repayment. Consider exploring auto-pay options to streamline payments and avoid missed deadlines. Regularly reviewing your loan statements and understanding your interest rate and repayment schedule helps maintain transparency and allows for proactive adjustments if needed. Finally, open communication with MEFA regarding any financial difficulties is crucial, enabling them to offer potential solutions before the situation escalates.

Consequences of Defaulting on a MEFA Student Loan

Defaulting on a MEFA student loan carries significant consequences. Your credit score will suffer severely, making it difficult to obtain future loans, credit cards, or even rent an apartment. MEFA may pursue wage garnishment, seizing a portion of your earnings to repay the debt. Your tax refund could be withheld to cover the outstanding balance. Furthermore, your ability to secure employment in certain professions might be impacted, depending on the licensing or certification requirements. In severe cases, legal action, including lawsuits and potential wage garnishment, could be initiated. The long-term financial repercussions of defaulting are substantial and far-reaching, making responsible repayment a critical priority.

Exploring Loan Forgiveness or Income-Driven Repayment Plans

Several options exist for borrowers struggling to manage their MEFA student loan repayments. Income-driven repayment plans adjust your monthly payment based on your income and family size, making repayments more manageable during periods of financial hardship. Loan forgiveness programs, while rare and typically requiring specific employment in public service or non-profit sectors, may offer complete or partial loan cancellation after a set period of qualifying payments. It’s crucial to research the eligibility criteria for these programs thoroughly and contact MEFA directly to explore their suitability to your circumstances. Understanding the specific requirements and limitations of these programs is essential before applying. For instance, certain professions may qualify for Public Service Loan Forgiveness (PSLF), while others might be eligible for income-based repayment plans under the Income-Driven Repayment (IDR) program.

Steps to Take When Facing Difficulty Repaying a MEFA Loan

The flowchart above visually represents the process. First, contact MEFA to discuss your financial difficulties. They can then help you explore options like income-driven repayment plans or loan forgiveness programs, or work with you to create a more manageable repayment plan. Failing to communicate with MEFA may lead to more serious consequences. Remember, proactive communication is key to preventing default.

Illustrative Examples of MEFA Loan Scenarios

Understanding the practical implications of MEFA loans requires examining specific scenarios. These examples illustrate the potential costs, benefits, and risks associated with borrowing through MEFA, helping prospective borrowers make informed decisions. The scenarios presented are illustrative and may not reflect every individual’s circumstances. Actual loan terms and costs can vary.

MEFA Loan Scenario: Financing a Four-Year Undergraduate Degree

Let’s consider a student, Sarah, pursuing a four-year undergraduate degree at a private university. She needs $25,000 annually for tuition, fees, and living expenses, totaling $100,000 over four years. Sarah secures a MEFA loan for the full amount at a fixed interest rate of 6.5% over a 10-year repayment period. Her monthly payments would be approximately $1,050. Over the life of the loan, she would pay approximately $126,000, including interest. This represents a total interest cost of $26,000. This scenario assumes consistent payments and does not account for potential fees or penalties.

Impact of Different Repayment Options on Total Loan Cost

Now, let’s compare Sarah’s scenario to a situation where she chooses a shorter repayment period. If Sarah opted for a 5-year repayment plan instead of 10 years, while maintaining the same loan amount and interest rate, her monthly payments would increase significantly, perhaps to around $1,950. However, she would pay substantially less in interest over the life of the loan, potentially reducing the total cost by several thousand dollars due to less accumulated interest. Conversely, a longer repayment period, say 15 years, would lower her monthly payments, but significantly increase the total interest paid, potentially exceeding $40,000. This highlights the trade-off between monthly affordability and long-term cost.

Consequences of Late or Missed Payments

Imagine that due to unforeseen circumstances, Sarah misses several loan payments. MEFA, like most lenders, will likely charge late payment fees. These fees can quickly add up, significantly increasing the overall cost of the loan. Furthermore, missed payments will negatively impact her credit score, making it more difficult to secure loans or other forms of credit in the future. Repeated delinquencies could lead to loan default, resulting in serious financial consequences, including wage garnishment or legal action.

Comparison of MEFA Loan Cost to Another Lender

Let’s compare Sarah’s MEFA loan to a similar loan from a private lender. Assume a private lender offers a loan with a slightly lower interest rate of 6%, but charges higher origination fees. While the lower interest rate might seem advantageous, the additional fees could offset the savings. A thorough comparison of all fees and interest rates is crucial to determine the true cost of each loan option. In this comparison, it’s vital to factor in all associated costs, not just the interest rate, to make an accurate assessment of which loan offers better overall value.

End of Discussion

Ultimately, the question of whether a MEFA loan is “good” depends entirely on the individual borrower’s needs and financial profile. While MEFA offers competitive options and valuable resources for Massachusetts residents, careful comparison with federal and other private loans is crucial. By understanding the associated costs, repayment plans, and potential long-term implications, prospective borrowers can make an informed decision that aligns with their financial future.

FAQ Summary

What is MEFA’s role in student financing?

MEFA is a non-profit organization that provides various financial aid options, including student loans, to Massachusetts residents pursuing higher education.

Does MEFA offer loans to students outside of Massachusetts?

No, MEFA primarily serves Massachusetts residents. Eligibility criteria usually require residency in the state.

What happens if I miss a MEFA loan payment?

Late or missed payments will negatively impact your credit score and may result in late fees and increased interest charges. Consistent late payments could lead to loan default.

Can I refinance my MEFA loan?

Yes, once your MEFA loan is in repayment, you may be eligible to refinance it with another lender, potentially securing a lower interest rate.