Navigating the complex world of student loan debt can feel overwhelming. Many graduates find themselves burdened by high interest rates and substantial monthly payments. Refinancing a student loan presents a potential solution, offering the allure of lower interest rates and more manageable monthly payments. However, this decision requires careful consideration, as it involves weighing potential benefits against potential drawbacks. This exploration delves into the key factors to assess before making this significant financial choice.

Understanding the intricacies of refinancing requires examining current interest rates, your credit score, income, and debt-to-income ratio. Different types of student loans—federal and private—present unique refinancing options and eligibility criteria. Ultimately, the decision hinges on a comprehensive analysis of your individual financial circumstances and long-term financial goals. This guide will equip you with the knowledge to make an informed decision.

Current Interest Rates and Loan Terms

Refinancing your student loans can significantly impact your monthly payments and overall repayment costs. Understanding current interest rates and the terms offered by refinancing companies is crucial to making an informed decision. This section will compare current student loan interest rates with those offered through refinancing, detail typical refinancing terms, and illustrate the potential savings through various scenarios.

Currently, federal student loan interest rates vary depending on the loan type (e.g., subsidized, unsubsidized, graduate PLUS loans) and the loan disbursement date. These rates are set by the government and are generally lower than those offered by private lenders. However, private lenders offering student loan refinancing often provide lower interest rates than what borrowers currently pay on their federal loans, especially for those with strong credit scores and high incomes. This difference in rates is the primary driver for many borrowers considering refinancing.

Typical Refinancing Terms and Conditions

A typical student loan refinancing offer includes several key terms and conditions that borrowers should carefully review. These include the interest rate (fixed or variable), the loan term (the length of the repayment period), and any associated fees. Some lenders may also require a minimum credit score or a specific debt-to-income ratio. Prepayment penalties, which charge borrowers for paying off the loan early, are becoming less common but should still be checked. Finally, the lender’s customer service reputation and complaint history are critical factors to consider.

Refinancing Scenarios and Cost Comparisons

Let’s consider a few scenarios to illustrate the potential impact of refinancing. Assume a borrower has $50,000 in student loan debt.

Scenario 1: The borrower currently has a federal loan with a 6% interest rate and a 10-year repayment term. Their monthly payment is approximately $566. They refinance with a private lender at 4% interest over a 15-year term. Their new monthly payment will be roughly $370, but the total interest paid will increase.

Scenario 2: The same borrower refines with a 3% interest rate over a 10-year term. Their monthly payment will be approximately $470, a significant reduction from the original payment. The total interest paid will be less than in Scenario 1, but more than the original loan.

Scenario 3: The borrower decides against refinancing, maintaining the original 6% interest rate and 10-year term. Their monthly payment remains $566, but the total interest paid will be less than both refinancing options.

Comparison of Refinancing Options

The following table summarizes the total cost of repayment under different refinancing options, highlighting the trade-off between lower monthly payments and total interest paid. Note that these are simplified examples and actual figures will vary depending on the lender and individual circumstances.

| Interest Rate | Loan Term (Years) | Approximate Monthly Payment | Total Cost of Repayment |

|---|---|---|---|

| 6% (Original Loan) | 10 | $566 | $67,920 |

| 4% (Refinancing Scenario 1) | 15 | $370 | $66,600 |

| 3% (Refinancing Scenario 2) | 10 | $470 | $56,400 |

Credit Score Impact

Your credit score plays a pivotal role in determining your eligibility for student loan refinancing and the terms you’ll receive. Lenders use your credit score to assess your creditworthiness – essentially, your likelihood of repaying the loan. A higher credit score generally translates to better loan offers, while a lower score can significantly limit your options or result in higher interest rates.

A strong credit score demonstrates responsible financial behavior to lenders, making you a less risky borrower. This allows them to offer you more favorable terms, such as lower interest rates and potentially more flexible repayment options. Conversely, a weak credit score signals higher risk, leading lenders to either reject your application or offer loans with less appealing terms to compensate for the increased risk.

Hard Credit Inquiry Impact

Applying for student loan refinancing involves a hard credit inquiry. This inquiry appears on your credit report and temporarily lowers your credit score, typically by a few points. While the impact is usually temporary (most scores recover within a year), multiple hard inquiries within a short period can negatively affect your credit score more significantly. The severity of the drop depends on your existing credit history and the scoring model used. For example, a person with an excellent credit score might see a drop of 5-10 points, while someone with a fair score might experience a larger decrease. It’s crucial to weigh the potential benefits of refinancing against the short-term impact on your credit score.

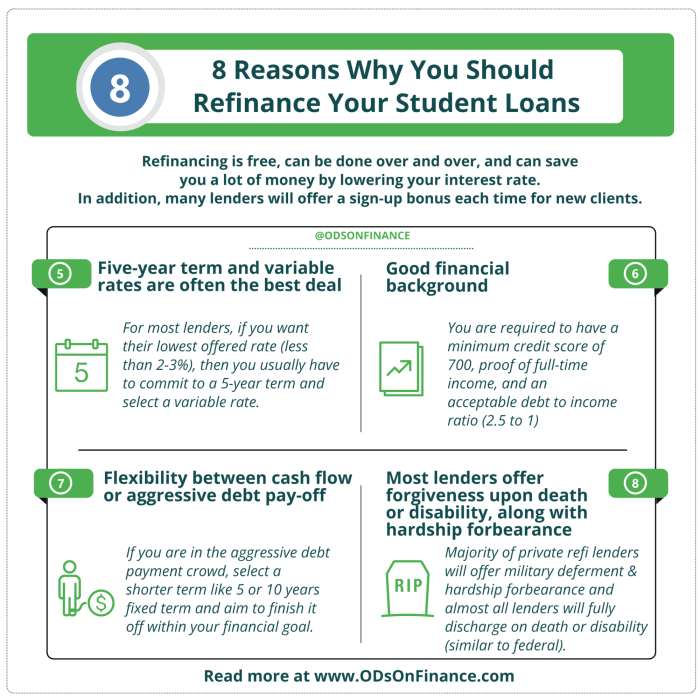

Minimum Credit Score Requirements

Minimum credit score requirements vary among lenders. Some lenders may advertise minimum scores as low as 660, while others may require scores of 700 or higher. These requirements reflect each lender’s risk tolerance and their specific underwriting guidelines. It’s important to research several lenders to compare their requirements and find one that aligns with your credit profile. It’s also advisable to check a lender’s website for the most up-to-date information, as these requirements can change.

Credit Score and Loan Terms

The impact of your credit score on your loan terms is substantial. For instance, a borrower with a credit score of 750 might qualify for a 3.5% interest rate on a refinanced student loan, while a borrower with a score of 680 might only receive a rate of 5.5%. This difference in interest rates can significantly impact the total cost of the loan over its lifespan. Moreover, a lower credit score might restrict your access to certain loan terms, such as longer repayment periods or lower monthly payments. In extreme cases, a very low credit score could result in loan application rejection. For example, someone with a credit score below 600 might find it very difficult to refinance their student loans, even if they have a stable income. Conversely, someone with an excellent credit score (above 800) might be offered preferential terms, including a lower interest rate and potentially a lower origination fee.

Income and Debt-to-Income Ratio

Your income and debt-to-income (DTI) ratio are crucial factors lenders consider when evaluating your student loan refinancing application. A higher income generally increases your approval chances, while a lower DTI ratio demonstrates your ability to manage debt effectively. Lenders assess your ability to repay the refinanced loan based on these financial metrics.

Your debt-to-income ratio is calculated by dividing your total monthly debt payments (including the proposed new student loan payment) by your gross monthly income. A lower DTI ratio indicates a greater capacity to handle additional debt. Lenders use this ratio to gauge the risk associated with lending you more money.

Acceptable Debt-to-Income Ratios for Refinancing

While there’s no universally accepted DTI ratio for student loan refinancing, lenders generally prefer applicants with a DTI ratio below 43%. However, some lenders may consider applicants with slightly higher ratios, depending on other factors like credit score, loan amount, and the type of income. A lower DTI ratio significantly improves your chances of approval and often qualifies you for more favorable interest rates. Conversely, a high DTI ratio might lead to rejection or higher interest rates to compensate for the perceived higher risk.

Impact of Income and Debt Ratio on Loan Approval

The following table illustrates how different income levels and DTI ratios affect the likelihood of loan approval and the offered interest rate. These are illustrative examples and actual results may vary based on individual lender policies and other factors.

| Income (Annual) | Debt-to-Income Ratio | Loan Approval Likelihood | Interest Rate (Example) |

|---|---|---|---|

| $60,000 | 30% | High | 6.5% |

| $60,000 | 45% | Moderate | 8.0% |

| $60,000 | 55% | Low | 9.5% or Rejection |

| $100,000 | 40% | High | 6.0% |

Documentation Required to Demonstrate Income and Debt

To verify your income and debt, lenders typically require supporting documentation. This usually includes:

* Pay stubs: Recent pay stubs showing your gross monthly income. The number of pay stubs requested will vary by lender.

* W-2 forms: Your most recent W-2 form(s) to verify your annual income.

* Tax returns: Copies of your federal and state tax returns for the past few years, to provide a comprehensive picture of your income history. This may include schedules detailing income from self-employment, investments, or other sources.

* Bank statements: Bank statements for the past few months to demonstrate consistent income and savings.

* Debt documentation: Statements or schedules listing all your current debts (credit cards, auto loans, mortgages, etc.) to calculate your DTI ratio.

Providing complete and accurate documentation is crucial for a smooth and efficient refinancing process. Incomplete or inaccurate information may delay the approval process or even lead to rejection.

Types of Student Loans and Refinancing Options

Understanding the different types of student loans and their refinancing possibilities is crucial for making informed financial decisions. Refinancing can potentially lower your monthly payments and interest rate, but it’s essential to weigh the pros and cons carefully based on your specific loan type and financial situation. This section will Artikel the key distinctions between federal and private student loans and explore the refinancing options available for each.

Federal Student Loan Types and Refinancing Eligibility

Federal student loans are offered by the U.S. government and come with various benefits, including income-driven repayment plans and potential loan forgiveness programs. However, these benefits are often lost upon refinancing. The primary types include Direct Subsidized Loans (for undergraduate students with financial need), Direct Unsubsidized Loans (for undergraduate and graduate students, regardless of need), Direct PLUS Loans (for graduate students and parents of undergraduate students), and Direct Consolidation Loans (combining multiple federal loans). Refinancing federal loans typically involves consolidating them into a private loan, thereby forfeiting the federal protections mentioned above. Eligibility for refinancing federal loans depends on the lender’s requirements, which usually include a minimum credit score, stable income, and a manageable debt-to-income ratio. The specific criteria vary among lenders.

Private Student Loan Types and Refinancing Eligibility

Private student loans are offered by banks, credit unions, and other private lenders. They generally have higher interest rates and fewer protections compared to federal loans. Eligibility for private student loan refinancing is also determined by lender-specific criteria, primarily focusing on creditworthiness. Lenders assess credit scores, income, debt-to-income ratios, and loan history to determine eligibility. Generally, borrowers with good credit and a strong income are more likely to qualify for favorable refinancing terms. Different private lenders may have varying requirements, such as the minimum loan amount to be refinanced or the types of loans they will accept.

Advantages and Disadvantages of Refinancing Federal vs. Private Loans

Refinancing federal student loans into private loans offers the potential for lower interest rates and simplified monthly payments through consolidation. However, this comes at the cost of losing federal protections like income-driven repayment plans and potential loan forgiveness programs. Refinancing private student loans, on the other hand, can simplify payments and potentially lower the interest rate if a borrower’s credit has improved since the original loan was issued. The disadvantage is that it does not affect the original loan terms and may not provide significant savings if interest rates haven’t dropped substantially.

Key Features of Various Refinancing Programs

Before considering refinancing, it’s important to compare different programs. The following points highlight key features to look for:

- Interest Rate: The annual interest rate significantly impacts the total cost of the loan. Look for the lowest possible rate that aligns with your creditworthiness.

- Loan Term: Shorter loan terms result in higher monthly payments but lower overall interest paid. Longer terms lead to lower monthly payments but higher overall interest.

- Fees: Some lenders charge origination fees or prepayment penalties. Be aware of all associated fees.

- Repayment Options: Consider whether the lender offers various repayment options, such as fixed or variable interest rates, and flexible payment plans.

- Customer Service and Reviews: Research the lender’s reputation and customer service record before committing to a refinancing program. Check online reviews to get a sense of customer experiences.

Potential Benefits and Drawbacks

Refinancing student loans can be a complex decision with significant financial implications. Weighing the potential benefits against the potential drawbacks is crucial before proceeding. Understanding the specifics of your individual financial situation and loan characteristics will help you determine if refinancing is the right choice for you.

Refinancing offers the possibility of substantial savings, but it also carries risks. A thorough assessment of your current financial standing and future projections is necessary to make an informed decision.

Lower Interest Rates and Reduced Monthly Payments

One of the primary motivations for refinancing student loans is to secure a lower interest rate. A lower interest rate translates directly into lower monthly payments and less interest paid over the life of the loan. For example, someone with $50,000 in federal student loans at 7% interest could see a significant reduction in their monthly payments and total interest paid if they refinance to a private loan with a 4% interest rate. This savings can be substantial over the repayment period, freeing up funds for other financial goals. However, it is crucial to remember that the actual savings will depend on the new interest rate offered, the loan term, and the original loan balance.

Loss of Federal Loan Benefits

A significant drawback of refinancing federal student loans is the potential loss of federal protections and benefits. These benefits can include income-driven repayment plans (IDR), which adjust monthly payments based on your income and family size; deferment or forbearance options, which allow temporary pauses in payments during financial hardship; and loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), which can forgive remaining loan balances after a certain period of qualifying public service employment. Refinancing with a private lender typically eliminates access to these crucial benefits. For example, if you are working towards PSLF, refinancing would forfeit your progress towards loan forgiveness.

Scenarios Where Refinancing is Beneficial and Not Beneficial

Refinancing can be highly beneficial for borrowers with excellent credit scores who qualify for significantly lower interest rates. For instance, someone with a high credit score and a stable income might find that refinancing reduces their monthly payments by hundreds of dollars, allowing them to accelerate their debt repayment or free up funds for other financial priorities. Conversely, refinancing is generally not advisable for borrowers with poor credit scores, those expecting a significant change in income, or those who rely on federal loan benefits such as IDR plans or loan forgiveness programs. A borrower with a high debt-to-income ratio might find it difficult to qualify for a lower interest rate and may face higher monthly payments if their credit score is low.

Comparison of Pros and Cons of Refinancing

| Benefit/Drawback | Description | Example | Impact |

|---|---|---|---|

| Lower Interest Rate | Reduced interest rate on your loan. | Refinancing from 7% to 4% on a $50,000 loan. | Significant reduction in monthly payments and total interest paid over the life of the loan. |

| Lower Monthly Payments | Smaller monthly payments making budgeting easier. | Reducing monthly payments from $700 to $500. | Improved cash flow and financial flexibility. |

| Loss of Federal Benefits | Loss of access to income-driven repayment plans, deferment, forbearance, and loan forgiveness programs. | Losing eligibility for Public Service Loan Forgiveness (PSLF). | Increased risk of default and higher total interest paid if financial hardship occurs. |

| Potential for Higher Total Interest Paid | Longer repayment term may lead to higher total interest paid despite lower monthly payments. | Extending the repayment term from 10 years to 15 years. | Increased overall cost of the loan. |

Long-Term Financial Implications

Refinancing your student loans can significantly impact your finances over the long term, affecting both the total amount you pay and the duration of your repayment. Understanding these implications is crucial before making a decision. Careful consideration of your current loan terms, your projected income, and your risk tolerance is essential for making an informed choice.

Refinancing alters the trajectory of your student loan repayment, potentially leading to substantial savings or unforeseen costs depending on several factors. The primary factors influencing the long-term financial outcome are the new interest rate secured and the length of the new repayment term. A lower interest rate will generally reduce the total interest paid, while a longer repayment term might lower monthly payments but increase the overall cost.

Total Interest Paid and Repayment Length

The most significant long-term implication of refinancing is the change in total interest paid. Lower interest rates directly translate to lower total interest payments over the life of the loan. For example, consider two scenarios: Scenario A, where a $50,000 loan at 7% interest over 10 years results in approximately $18,000 in interest paid. Scenario B, where the same loan is refinanced at 5% interest over 10 years, reduces the total interest paid to approximately $11,000. This represents a savings of $7,000. However, extending the repayment term to 15 years at 5% would reduce monthly payments, but increase total interest paid to roughly $16,500. While the monthly payments are lower, the total cost is now higher than the original 10-year loan at 7%.

Examples of Cumulative Cost Savings (or Losses)

Let’s illustrate with concrete examples. Suppose an individual has a $30,000 student loan with a 6% interest rate and a 10-year repayment plan. Their total interest paid would be approximately $11,000. If they refinance to a 4% interest rate over the same 10-year period, their total interest paid would drop to roughly $7,000, resulting in a savings of $4,000. Conversely, if they refinance to a 4% interest rate but extend the repayment term to 15 years, their total interest paid would increase to about $9,000, negating the benefits of the lower interest rate.

Impact of Different Interest Rates on Total Repayment

The interest rate plays a dominant role in determining the total repayment amount. A small difference in interest rates can significantly impact the total cost over the loan’s lifespan. For instance, a 1% increase in the interest rate on a $40,000 loan over 10 years could lead to thousands of dollars more in interest paid. Conversely, a 1% decrease could result in substantial savings. It’s crucial to shop around for the best rates and compare offers before making a decision.

Comparison of Repayment Schedules

A visual representation, such as a bar graph, could effectively illustrate this. One bar would represent the original repayment schedule, showing the monthly payment, total interest paid, and total repayment amount. A second bar would depict the new repayment schedule after refinancing, highlighting the changes in these parameters. The difference in the lengths of the bars representing total repayment would visually demonstrate the cumulative cost savings or losses resulting from refinancing. For instance, if the original repayment schedule shows a total repayment of $60,000 and the refinanced schedule shows a total repayment of $50,000, the visual would clearly show a $10,000 saving. If the refinanced schedule showed $65,000, the visual would highlight a $5,000 loss.

Wrap-Up

Refinancing student loans can be a powerful tool for managing debt, but it’s crucial to approach it strategically. By carefully evaluating current interest rates, your creditworthiness, income, and the specific terms of any refinancing offer, you can determine whether it aligns with your long-term financial objectives. Remember to weigh the potential benefits—such as lower monthly payments and reduced overall interest paid—against any potential drawbacks, such as the loss of federal loan benefits. A thorough understanding of your financial situation and a well-informed decision are key to achieving financial success.

FAQ Corner

What is the impact of a hard credit inquiry during the refinancing process?

A hard credit inquiry, while necessary for the lender to assess your creditworthiness, can temporarily lower your credit score. However, this impact is usually minimal and temporary.

Can I refinance both federal and private student loans together?

Some lenders allow refinancing of both federal and private loans simultaneously, while others may only refinance one type or the other. Check with individual lenders for their specific policies.

How long does the refinancing process typically take?

The timeframe varies depending on the lender and your individual circumstances, but it generally ranges from a few weeks to a couple of months.

What documents will I need to provide for refinancing?

Typically, you’ll need documentation proving your income, employment history, and student loan details. Specific requirements vary by lender.