Understanding how student loan interest is calculated is crucial for effective financial planning. The seemingly simple question of whether interest accrues monthly or yearly significantly impacts the total amount you’ll repay. This exploration delves into the intricacies of student loan interest, examining different interest rate types, repayment plans, and the factors influencing the overall cost of borrowing.

We’ll unpack the differences between simple and compound interest, illustrating how these calculations affect your loan balance over time. We will also compare fixed versus variable interest rates, showing how these choices can lead to vastly different outcomes depending on market fluctuations. Finally, we’ll examine how various repayment plans interact with interest accrual, helping you make informed decisions about managing your student loan debt.

Understanding Interest Accrual

Understanding how student loan interest accrues is crucial for effectively managing your debt. This section will explain the calculation of interest, the difference between simple and compound interest, and provide illustrative examples.

Student loan interest is calculated based on your loan’s principal balance, the interest rate, and the loan’s repayment terms. The interest rate is usually expressed as an annual percentage rate (APR). The interest is calculated on the outstanding principal balance, meaning that the amount of interest you pay will decrease as you pay down your loan. Daily, monthly, or yearly interest calculations are possible, depending on the loan servicer’s practices. However, the annual interest rate is the standard for comparison.

Simple Versus Compound Interest

Simple interest is calculated only on the principal amount of the loan. Compound interest, on the other hand, is calculated on the principal amount plus any accumulated interest. Most student loans use compound interest, meaning that interest accrues on both the original principal and the previously accrued interest. This leads to a faster growth of the total debt over time.

Examples of Interest Accrual

Let’s consider two scenarios to illustrate the difference. Suppose you have a $5,000 student loan with a 6% annual interest rate.

Scenario 1 (Simple Interest): If simple interest were applied over one year, the interest would be $5,000 * 0.06 = $300. Your total amount owed after one year would be $5,300.

Scenario 2 (Compound Interest): With compound interest, the calculation is different. If interest is compounded annually, the first year’s interest is still $300. However, in the second year, the interest is calculated on $5,300, resulting in a higher interest amount. This process continues each year, leading to a significantly larger total amount owed compared to simple interest over several years.

Interest Calculation Table: $10,000 Loan at 5% Interest

The following table illustrates the difference between monthly and yearly interest accrual on a $10,000 loan with a 5% annual interest rate. Note that these calculations assume a fixed interest rate and do not account for any principal payments.

| Year | Monthly Accrual (approx.) | Yearly Accrual | Total Owed (Yearly) |

|---|---|---|---|

| 1 | $41.67 | $500 | $10,500 |

| 2 | $43.75 | $525 | $11,025 |

| 3 | $45.92 | $551.25 | $11,576.25 |

| 4 | $48.20 | $578.81 | $12,155.06 |

Note: Monthly accrual is an approximation. The precise calculation depends on the daily interest rate and the number of days in each month.

Interest Rate Types and Their Impact

Understanding the difference between fixed and variable interest rates is crucial for managing your student loan debt effectively. The type of interest rate you choose significantly impacts your monthly payments and the total amount you pay over the life of the loan.

Fixed and variable interest rates represent two distinct approaches to calculating the interest charged on your loan. A fixed rate remains constant throughout the loan’s term, providing predictability in your monthly payments. Conversely, a variable rate fluctuates based on an underlying index, such as the prime rate or LIBOR, introducing an element of uncertainty into your repayment schedule.

Fixed versus Variable Interest Rates

Fixed interest rates offer stability and predictability. Your monthly payment will remain consistent for the duration of the loan, making budgeting easier. However, fixed rates are typically higher than initial variable rates. Variable rates, on the other hand, offer the potential for lower initial payments if the index rate remains low. However, this comes with the risk of significantly higher payments if the index rate rises. The fluctuation introduces uncertainty in budgeting and can lead to unexpected financial strain.

Impact of Interest Rate Changes on Monthly Payments

Changes in interest rates directly affect your monthly payments. With a fixed-rate loan, your monthly payment remains constant regardless of market fluctuations. With a variable-rate loan, your monthly payment will adjust as the index rate changes. An increase in the index rate will lead to higher monthly payments, while a decrease will result in lower payments. The magnitude of the change in your monthly payment depends on the loan’s terms and the size of the interest rate fluctuation. For example, a 1% increase in a variable rate on a $20,000 loan could lead to a noticeable increase in your monthly payment, potentially hundreds of dollars depending on the loan term.

Scenarios Favoring Fixed or Variable Rates

A fixed-rate loan is generally preferable for borrowers who prioritize predictability and stability in their monthly payments. This is particularly beneficial for those with limited financial flexibility or who prefer a consistent budget. A variable rate might be more attractive to borrowers who anticipate a short repayment period and believe that interest rates are likely to remain low or even decrease during that time. For example, a borrower expecting a high-income job soon after graduation might choose a variable rate, hoping to pay off the loan quickly before significant rate increases occur.

Comparison of Total Interest Paid

The following table compares the total interest paid over 10 years for a $20,000 loan with a fixed rate of 6% versus a variable rate that starts at 5% and fluctuates by 1% annually (for illustrative purposes only; actual fluctuations would be more complex). Note that this is a simplified example and does not account for compounding interest daily or other factors that affect the actual interest paid.

| Year | Fixed Rate (6%) – Annual Interest Paid | Variable Rate (Fluctuating) – Annual Interest Paid | Variable Rate (Fluctuating) – Annual Interest Rate |

|---|---|---|---|

| 1 | $1200 | $1000 | 5% |

| 2 | $1200 | $1200 | 6% |

| 3 | $1200 | $1000 | 5% |

| 4 | $1200 | $1200 | 6% |

| 5 | $1200 | $1000 | 5% |

| 6 | $1200 | $1200 | 6% |

| 7 | $1200 | $1000 | 5% |

| 8 | $1200 | $1200 | 6% |

| 9 | $1200 | $1000 | 5% |

| 10 | $1200 | $1200 | 6% |

| Total | $12000 | $11000 |

Payment Schedules and Interest Capitalization

Understanding your repayment plan is crucial for managing student loan debt effectively. Different repayment schedules significantly impact how much interest accrues and, ultimately, the total cost of your loan. Choosing the right plan depends on your individual financial circumstances and long-term goals. This section will explore various repayment options and the implications of interest capitalization.

Interest capitalization occurs when unpaid interest is added to your principal loan balance. This increases the amount of your loan, leading to higher interest payments over time. The impact of capitalization can be substantial, particularly if you’re facing periods of deferment or forbearance where payments are temporarily suspended or reduced. Understanding how different repayment plans influence interest accrual and capitalization is key to minimizing your overall loan burden.

Standard Repayment Plans

Standard repayment plans typically involve fixed monthly payments over a 10-year period. This approach offers predictable budgeting but can result in higher monthly payments compared to other options. While the shorter repayment period minimizes the total interest paid, it requires a higher monthly payment commitment. For example, a $30,000 loan at 5% interest would have a monthly payment of approximately $330 under a standard 10-year plan, resulting in roughly $10,000 in interest paid over the life of the loan. A longer repayment term would lower monthly payments but increase total interest.

Graduated Repayment Plans

Graduated repayment plans feature lower initial monthly payments that gradually increase over time. This option can be helpful for recent graduates who anticipate higher earning potential in the future. However, the longer repayment period and the increasing payments may lead to higher overall interest costs. For instance, a $30,000 loan with the same 5% interest rate might start with a lower monthly payment of around $200 but increase over time, potentially resulting in a total interest paid exceeding that of a standard plan if the loan is not paid off early.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base monthly payments on your income and family size. These plans typically offer lower monthly payments than standard or graduated plans, making them attractive to borrowers with lower incomes or significant financial obligations. However, IDR plans often extend the repayment period to 20 or 25 years, potentially leading to significantly higher total interest payments over the loan’s lifetime. The extended repayment period allows for more interest to accrue. Consider a $30,000 loan at 5% interest; an IDR plan could result in a lower monthly payment initially, but with a longer repayment period, the total interest paid could easily exceed $15,000.

Comparison of Repayment Plan Types

Understanding the pros and cons of each plan type is vital for making an informed decision. The following table summarizes the key differences concerning interest:

| Repayment Plan | Pros (Interest Related) | Cons (Interest Related) |

|---|---|---|

| Standard | Lower total interest paid due to shorter repayment period | Higher monthly payments |

| Graduated | Lower initial payments | Higher total interest paid due to longer repayment period and increasing payments |

| Income-Driven | Lower monthly payments, affordability | Much higher total interest paid due to very long repayment period |

Scenarios Leading to Increased Total Loan Cost Due to Interest Capitalization

Interest capitalization can significantly increase the total loan cost in several scenarios. For example, deferment periods (when payments are temporarily suspended) or forbearance (when payments are reduced) allow interest to accrue and capitalize, adding to the principal balance. This effectively increases the loan amount, leading to higher overall interest charges. Similarly, frequent periods of deferment or forbearance can lead to a snowball effect, dramatically increasing the final loan cost. Another example would be borrowers who repeatedly miss payments; late payment fees and the accrual of unpaid interest can also lead to capitalization, increasing the loan amount and overall cost.

Factors Affecting Interest Rates

Several key factors influence the interest rate you’ll pay on your student loans. Understanding these factors can help you secure the most favorable terms possible and plan effectively for repayment. These factors vary depending on whether your loan is federal or private.

Interest rates are determined by a complex interplay of economic conditions, your individual financial profile, and the type of loan you obtain. Federal loan interest rates are generally set by the government, while private loan rates are determined by the lender based on a credit assessment. Your creditworthiness, the loan’s terms, and prevailing market conditions all play a significant role.

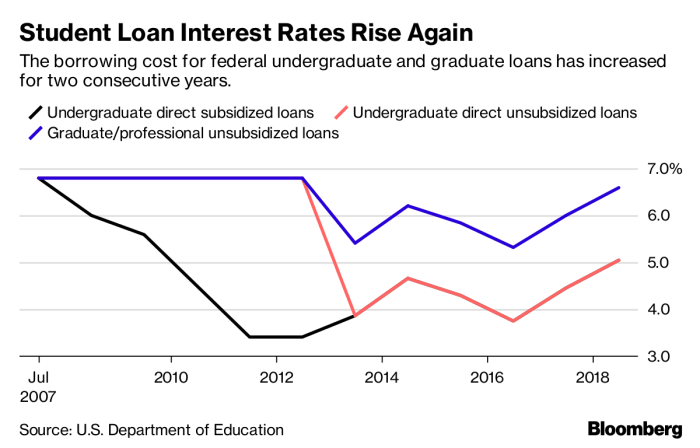

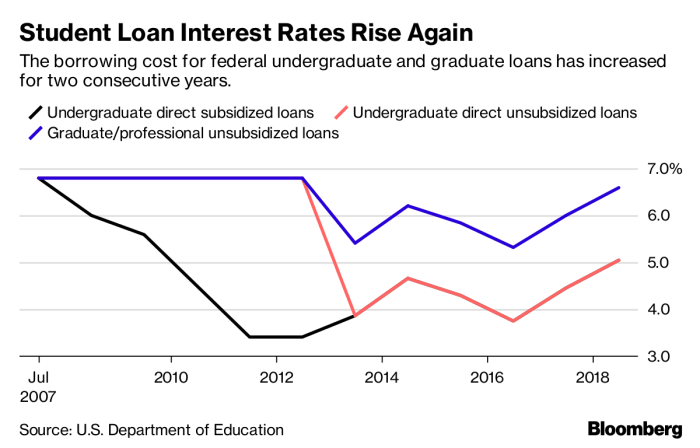

Federal Student Loan Interest Rates

The federal government sets interest rates for federal student loans annually. These rates are typically tied to the 10-year Treasury note and adjusted each July 1st for the upcoming academic year. The specific rate a borrower receives depends on the loan type (e.g., subsidized or unsubsidized Stafford loans, PLUS loans) and the borrower’s loan disbursement date. For example, a subsidized Stafford loan might have a lower interest rate than an unsubsidized Stafford loan, reflecting the government’s subsidy on the former. The interest rate remains fixed for the life of the loan.

Private Student Loan Interest Rates

Private student loans, offered by banks and other financial institutions, have variable or fixed interest rates. Unlike federal loans, these rates are not set by the government. Instead, lenders assess the borrower’s creditworthiness to determine the appropriate interest rate. A borrower with a strong credit history and high credit score will typically qualify for a lower interest rate compared to a borrower with a poor credit history and low credit score. The lender also considers factors like the loan amount, repayment term, and the presence of a co-signer.

Credit Score’s Impact on Interest Rates

A borrower’s credit score significantly impacts their interest rate, particularly for private student loans. A higher credit score indicates lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score suggests higher risk, leading to a higher interest rate.

Consider these hypothetical scenarios:

| Borrower | Credit Score | Approximate Interest Rate (Private Loan) |

|---|---|---|

| Alice | 750 | 5% |

| Bob | 650 | 8% |

| Charlie | 550 | 12% (or loan denial) |

These are illustrative examples, and actual interest rates will vary based on numerous other factors, including the lender, loan term, and prevailing market conditions. It is important to note that a poor credit score can significantly increase the cost of borrowing or even lead to loan application denial.

Comparison of Federal and Private Student Loan Interest Rates

Generally, federal student loans offer lower interest rates than private student loans, especially for borrowers with less-than-perfect credit. However, federal loans may have stricter eligibility requirements and loan limits. Private loans can offer higher loan amounts, but come with the risk of higher interest rates and less favorable repayment terms. The choice between federal and private loans depends heavily on the borrower’s individual financial situation and credit history.

Illustrative Examples and Scenarios

Understanding the difference between monthly and yearly interest calculations on student loans is crucial for effective financial planning. Failing to grasp this distinction can lead to inaccurate budgeting, delayed loan payoff, and ultimately, increased overall interest payments. The following examples illustrate the importance of this understanding.

Scenario: The Importance of Monthly vs. Yearly Interest in Financial Planning

Imagine two recent graduates, Sarah and David, both with $30,000 in student loan debt at a 6% annual interest rate. Sarah incorrectly assumes interest is calculated yearly, while David understands it’s compounded monthly. Sarah budgets based on a yearly interest calculation of $1800 (6% of $30,000), while David accounts for the monthly compounding, resulting in a slightly higher monthly interest charge. Over the course of a 10-year repayment plan, this seemingly small difference compounds significantly. Sarah might find herself consistently short on her payments, leading to late fees and potentially extended repayment periods, increasing her overall cost. David, on the other hand, accurately anticipates his monthly payments and avoids such pitfalls. This scenario highlights how a fundamental understanding of interest calculation frequency directly impacts financial stability and long-term cost.

Visual Representation of Cumulative Interest

The visual representation would be a line graph. The x-axis would represent time (in years), ranging from 0 to 10. The y-axis would represent the cumulative interest paid (in dollars). The graph would show a steadily increasing line, starting at $0 at year 0. Key data points to be included would be the cumulative interest paid at years 2, 5, and 10. For instance, if the loan was $30,000 with a 6% annual interest rate compounded monthly, the cumulative interest paid at year 2 might be approximately $3,700, at year 5 around $10,000, and at year 10 approximately $18,000 (these are estimates and the actual figures would depend on the specific repayment plan). The graph would clearly illustrate the exponential growth of cumulative interest over time, emphasizing the importance of timely payments and strategic repayment strategies.

Hypothetical Situation: Saving Money Through Understanding Interest Calculation

Consider Alex, who has a $25,000 student loan with a 7% annual interest rate compounded monthly. Initially, Alex makes minimum monthly payments. After two years, Alex realizes the slow progress and decides to make additional payments each month, specifically targeting the principal amount. By understanding that interest is calculated on the remaining principal balance each month, Alex strategically reduces the principal faster. This strategy results in a significant reduction in overall interest paid compared to continuing with only minimum payments. While the total number of payments might remain the same, the total interest paid is considerably lower due to the accelerated reduction of the principal balance. This example showcases how a deep understanding of monthly interest calculation can lead to substantial savings over the loan’s lifetime.

Last Word

Navigating the complexities of student loan interest requires a clear understanding of how interest accrues, the impact of different interest rate types and repayment plans, and the various factors that influence your overall loan cost. By carefully considering these elements, you can develop a comprehensive financial strategy to effectively manage your student loan debt and minimize the long-term financial burden. Remember, informed decisions lead to better outcomes, so take the time to understand the nuances of your student loan terms.

FAQ Overview

What is the difference between simple and compound interest in student loans?

Simple interest is calculated only on the principal loan amount. Compound interest is calculated on the principal plus accumulated interest, resulting in faster debt growth.

Can I pay off my student loan faster than the scheduled repayment plan?

Yes, making extra payments can significantly reduce the total interest paid and shorten the repayment period. Check with your lender to ensure there are no prepayment penalties.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, which has serious financial consequences.

How often are my student loan interest payments calculated?

Most student loans calculate interest daily and accrue monthly. However, the interest is typically capitalized (added to the principal) at the end of the month or year, depending on the loan terms.