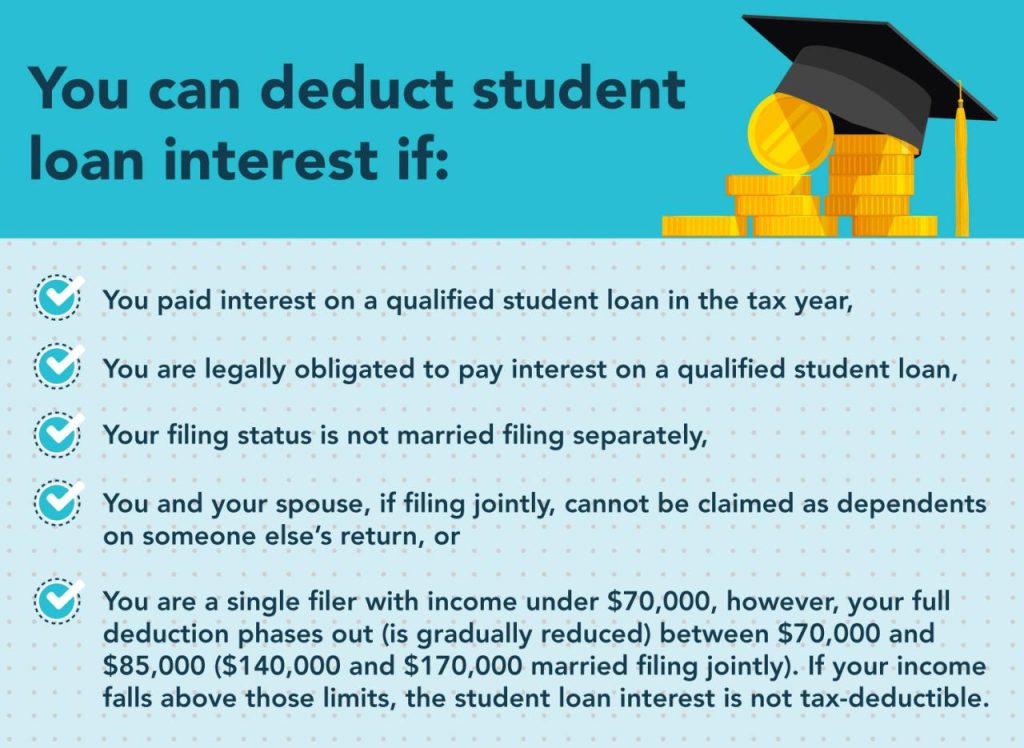

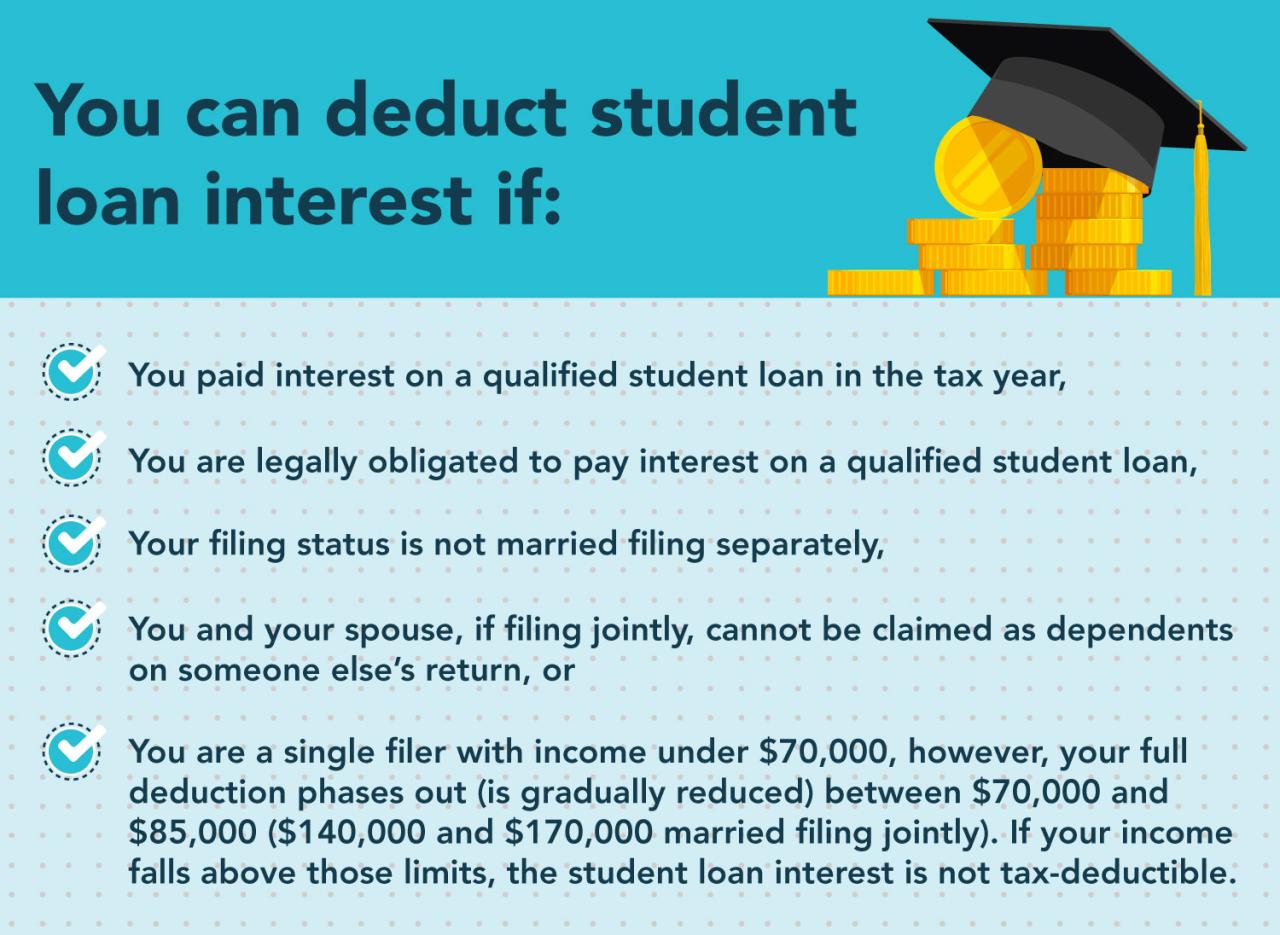

Navigating the complexities of student loan repayment is a significant challenge for many. Understanding the potential tax benefits, such as the student loan interest deduction, can significantly ease the financial burden. This deduction allows eligible taxpayers to reduce their taxable income by the amount of interest they paid on qualified student loans during the tax year. However, eligibility hinges on several factors, including adjusted gross income (AGI) and the type of loan. This guide will delve into the intricacies of this deduction, providing clarity on eligibility requirements, calculation methods, and the necessary documentation.

Successfully claiming the student loan interest deduction requires a thorough understanding of the IRS guidelines. This involves not only meeting the eligibility criteria but also accurately calculating the deductible amount and properly documenting your claim on your tax return. Failure to comply with these requirements can result in penalties or a rejection of your claim. This guide aims to provide a comprehensive overview of the process, empowering taxpayers to confidently navigate the complexities of this valuable tax benefit.

Documentation and Tax Form Requirements

Claiming the student loan interest deduction requires careful record-keeping and accurate completion of your tax forms. Failing to provide the necessary documentation can result in the denial of your deduction, potentially leading to a higher tax liability. Understanding the required documentation and the proper completion of Form 1040 and Schedule 1 is crucial for a successful claim.

Necessary Documentation for the Student Loan Interest Deduction

To successfully claim the student loan interest deduction, you must have readily available documentation to substantiate your claim. This documentation serves as proof that you paid eligible student loan interest during the tax year. Without this supporting evidence, the IRS may reject your deduction. The key piece of documentation is Form 1098-E, Student Loan Interest Statement. This form is issued by your lender and reports the total amount of student loan interest you paid during the year. If you made payments to multiple lenders, you will need a Form 1098-E from each. In addition to Form 1098-E, retaining canceled checks, bank statements, or online payment confirmations showing the interest paid is advisable. These documents provide further evidence in case of discrepancies or missing 1098-E forms.

Completing Form 1040 and Schedule 1

The student loan interest deduction is claimed on Schedule 1 (Additional Income and Adjustments to Income), which is part of Form 1040, U.S. Individual Income Tax Return. You will report the total amount of student loan interest paid during the year on line 21 of Schedule 1. This amount should match the total reported on your Form 1098-E(s). Remember to accurately transfer the amount from Schedule 1 to the appropriate line on Form 1040, which will affect your adjusted gross income (AGI). The AGI is a crucial figure used to determine your eligibility for various tax benefits and credits. For example, if your total student loan interest was $2,000, you would enter “$2,000” on line 21 of Schedule 1. Incorrectly reporting this amount can lead to penalties.

Consequences of Insufficient Documentation

The IRS carefully reviews tax returns to ensure accuracy and compliance. Submitting your tax return without the necessary documentation to support your student loan interest deduction claim can result in several negative consequences. The IRS may disallow the deduction entirely, increasing your taxable income and resulting in a higher tax liability. In addition to a higher tax bill, you may also face penalties and interest charges for inaccurate reporting. Furthermore, the IRS might initiate an audit, requiring you to provide additional documentation and potentially delaying your tax refund. In extreme cases, deliberate misrepresentation of information can result in more serious legal repercussions.

Checklist of Required Documents

The following checklist Artikels the necessary documents and their purpose in supporting your student loan interest deduction:

- Form 1098-E, Student Loan Interest Statement: This official form from your lender details the amount of student loan interest you paid during the tax year. It’s the primary supporting document for your deduction.

- Canceled checks or bank statements: These provide supporting evidence of your student loan interest payments, especially helpful if you are missing a Form 1098-E or if there are discrepancies.

- Online payment confirmations: Similar to canceled checks and bank statements, online payment confirmations serve as backup documentation, providing a detailed record of your payments.

- Copy of your tax return: Retaining a copy of your completed tax return, including Schedule 1 and Form 1040, is crucial for record-keeping purposes. It facilitates easy reference in case of any future inquiries from the IRS.

Impact of Tax Law Changes on Deductibility

The student loan interest deduction, while seemingly straightforward, has been subject to various alterations throughout its history. Understanding these changes is crucial for taxpayers, as modifications can significantly impact the amount of the deduction, or even eliminate it entirely. This section explores past and potential future adjustments to the tax law affecting the deductibility of student loan interest and their consequences for individuals.

The student loan interest deduction’s availability and limitations are directly tied to broader tax legislation. Changes to tax brackets, standard deductions, and overall tax policy can indirectly influence the deduction’s effectiveness. For example, an increase in the standard deduction might reduce the number of taxpayers who itemize and, consequently, claim the student loan interest deduction. Conversely, changes in the AGI (Adjusted Gross Income) thresholds for claiming the deduction directly affect eligibility.

Past Adjustments to the Student Loan Interest Deduction

The student loan interest deduction has not always been in its current form. Several modifications have occurred over the years, altering its maximum deduction amount, eligibility requirements, and phase-out ranges. For instance, the maximum deduction amount has fluctuated, starting lower and increasing over time before potentially being adjusted again in the future. Similarly, the income thresholds determining eligibility have also shifted, making the deduction accessible to a wider or narrower range of taxpayers depending on the prevailing economic and political climate. One notable example is the Tax Cuts and Jobs Act of 2017, which temporarily increased the standard deduction, potentially reducing the number of taxpayers who itemized and thus claimed the deduction. This illustrates how seemingly unrelated tax changes can indirectly impact the student loan interest deduction.

Potential Future Changes and Their Impact

Predicting future tax law changes is inherently speculative, but considering past trends and current economic conditions, several scenarios are plausible.

The following bullet points illustrate the effects of different hypothetical tax law scenarios:

- Scenario 1: Increased AGI Thresholds: Raising the AGI thresholds for claiming the deduction would make it accessible to higher-income taxpayers. This would benefit individuals earning more, potentially increasing the overall number of taxpayers claiming the deduction but reducing the government’s expenditure on this tax break.

- Scenario 2: Reduction or Elimination of the Deduction: In times of budget constraints, the government might consider reducing or eliminating the student loan interest deduction entirely. This would significantly impact taxpayers currently utilizing it, increasing their overall tax liability. This action would likely be met with significant opposition from student advocacy groups and potentially lead to legislative debate.

- Scenario 3: Modification of Maximum Deductible Amount: A decrease in the maximum deductible amount would limit the potential tax savings for taxpayers, regardless of their income. This could be implemented to control government spending on tax breaks or as part of broader tax reform. Conversely, an increase in the maximum amount would provide greater tax relief to those eligible.

These are just hypothetical scenarios. The actual impact of future tax law changes will depend on numerous factors, including the prevailing economic climate, political priorities, and public opinion. It is advisable to remain informed about potential changes and their implications for your personal tax situation.

Conclusive Thoughts

Successfully claiming the student loan interest deduction can provide significant tax relief to eligible borrowers. By carefully reviewing the eligibility requirements, accurately calculating the deductible amount, and meticulously maintaining necessary documentation, taxpayers can maximize their tax savings. Understanding the interplay between AGI limits, loan types, and other relevant factors is crucial for optimizing this benefit. Remember to consult with a tax professional if you have any questions or uncertainties regarding your specific circumstances.

Key Questions Answered

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest paid, even if you paid off your loans early in the tax year.

Can I deduct interest paid on PLUS loans?

Yes, PLUS loans generally qualify for the deduction, provided you meet other eligibility requirements.

What if my AGI is slightly above the limit? Are there any exceptions?

No, there are no exceptions for exceeding the AGI limits. You won’t be eligible for the deduction if your AGI surpasses the threshold.

Where can I find Form 1040 and Schedule 1?

You can download these forms from the IRS website (irs.gov).

What happens if I make a mistake on my tax return regarding this deduction?

You may need to file an amended return to correct any errors. Depending on the nature of the mistake, penalties may apply.