Navigating the complexities of student loan financing can be daunting. This guide provides a clear and concise overview of KeyCorp’s student loan offerings, covering everything from application processes and repayment options to customer service and potential forgiveness programs. We’ll compare KeyCorp’s options to those of its competitors, helping you make informed decisions about your financial future.

Understanding the intricacies of interest rates, fees, and repayment plans is crucial for responsible borrowing. We aim to demystify the process, empowering you to confidently manage your student loan debt and achieve your financial goals. This guide will equip you with the knowledge to navigate the KeyCorp student loan landscape effectively.

KeyCorp Student Loan Products

KeyCorp offers a range of student loan products designed to help students finance their education. While KeyCorp itself doesn’t directly originate federal student loans, they often partner with lenders to offer private student loans, which can supplement federal aid. Understanding the nuances of these private loans, their eligibility requirements, and how they compare to competitors is crucial for prospective borrowers.

KeyCorp Private Student Loan Offerings

KeyCorp’s private student loan offerings typically include options for undergraduate and graduate students, as well as parent loans. Specific details regarding interest rates, fees, and repayment plans are subject to change and are determined at the time of application based on individual creditworthiness and market conditions. KeyCorp often works with multiple lending partners, so the precise terms may vary depending on the chosen lender. It’s essential to carefully review the loan documents before signing. Generally, these loans offer flexible repayment options, including fixed or variable interest rates, and varying repayment terms.

KeyCorp Student Loan Eligibility Requirements

Eligibility for KeyCorp’s private student loans is determined by the partnering lender. Common requirements typically include being a U.S. citizen or permanent resident, enrolling at least half-time in an eligible educational program, having a co-signer (often required for students with limited or no credit history), and meeting the lender’s minimum credit score and income requirements. Specific requirements can vary significantly depending on the lender and the applicant’s profile. It is advisable to contact KeyCorp or a participating lender directly to ascertain the precise eligibility criteria for your specific situation.

Comparison with Competitors

Comparing KeyCorp’s private student loan offerings to those of major competitors like Sallie Mae and Discover Student Loans reveals some key differences. While all three offer private student loans, the interest rates, fees, and repayment options may vary significantly. For instance, Sallie Mae often provides a wider array of repayment plans, including income-driven repayment options, which may be more appealing to borrowers anticipating fluctuating income after graduation. Discover Student Loans, on the other hand, might offer cash back rewards programs or other incentives. KeyCorp’s offerings may be more competitive in certain aspects, depending on the specific lender and applicant profile, making direct comparison necessary for each individual borrower. It’s recommended to compare loan offers from multiple lenders to secure the most favorable terms.

KeyCorp Student Loan Feature Comparison

| Feature | KeyCorp (Example) | Sallie Mae (Example) | Discover (Example) |

|---|---|---|---|

| Interest Rate (Variable) | 6.5% – 12% | 6% – 11% | 7% – 13% |

| Interest Rate (Fixed) | 7% – 13% | 7.5% – 12.5% | 8% – 14% |

| Origination Fee | 0% – 4% | 0% – 4% | 0% – 3% |

| Repayment Options | Standard, Extended | Standard, Extended, Income-Driven | Standard, Extended |

*Note: These are example rates and fees. Actual rates and fees will vary based on creditworthiness, loan amount, and other factors. Always check with the lender for the most up-to-date information.*

KeyCorp Student Loan Application Process

Applying for a KeyCorp student loan involves several key steps designed to ensure a smooth and efficient process. Understanding these steps beforehand will help you prepare the necessary documentation and expedite the application. This section details the application procedure, required documents, and common reasons for application rejection.

The KeyCorp student loan application process is generally straightforward, but it’s crucial to follow the instructions carefully and submit all required documentation. Failure to do so can lead to delays or rejection of your application. The entire process is designed to assess your creditworthiness and ability to repay the loan.

KeyCorp Student Loan Application Steps

The application process typically involves these steps:

- Pre-qualification: Before formally applying, consider using KeyCorp’s pre-qualification tools (if available) to get an estimate of your potential loan amount and interest rate. This helps you understand your borrowing power and plan accordingly.

- Application Submission: Complete the online application form through KeyCorp’s website. This will require providing personal information, academic details, and financial information.

- Document Upload: Upload all the necessary supporting documents as specified in the application. This typically includes proof of enrollment, transcripts, and financial aid award letters.

- Credit Check: KeyCorp will perform a credit check as part of the application process. A strong credit history improves your chances of approval.

- Review and Processing: KeyCorp will review your application and supporting documents. This process can take several weeks.

- Approval/Rejection Notification: You will receive notification of your application’s approval or rejection, along with reasons for rejection if applicable.

- Loan Disbursement: If approved, the loan funds will be disbursed according to the terms Artikeld in your loan agreement.

Completing the KeyCorp Student Loan Application Form

The KeyCorp student loan application form will request specific information. Accuracy is crucial; ensure all information is correct and up-to-date. Carefully review each section before submitting.

The form will likely include sections for personal details (name, address, contact information), educational details (school name, program, expected graduation date), financial information (income, assets, existing debts), and co-signer information (if applicable). You will also be asked to authorize a credit check.

Required Documentation for KeyCorp Student Loan Application

To ensure a smooth and timely application process, gather the following documents before you begin:

- Proof of enrollment (acceptance letter or current enrollment verification from your educational institution).

- Official or unofficial transcripts showing your academic record.

- Financial aid award letter (if applicable).

- Government-issued photo identification (e.g., driver’s license or passport).

- Social Security number.

- Tax returns (or other documentation showing income and assets).

- Information about existing debts (e.g., credit card balances, other loans).

Reasons for KeyCorp Student Loan Application Rejection

Several factors can lead to the rejection of a student loan application. Understanding these reasons can help you improve your chances of approval in future applications.

- Poor Credit History: A low credit score or history of missed payments can significantly impact your eligibility.

- Insufficient Income: KeyCorp may assess your ability to repay the loan based on your current income and expenses. Insufficient income may lead to rejection.

- Incomplete Application: Failing to provide all required documentation or completing the application form inaccurately can result in rejection.

- Lack of Co-signer (if required): If a co-signer is required and not provided, the application may be rejected.

- Unacceptable Debt-to-Income Ratio: A high debt-to-income ratio may indicate a higher risk of default, leading to application rejection.

- Issues with Enrollment Verification: KeyCorp may reject applications if they cannot verify your enrollment status at the educational institution.

KeyCorp Student Loan Repayment Options

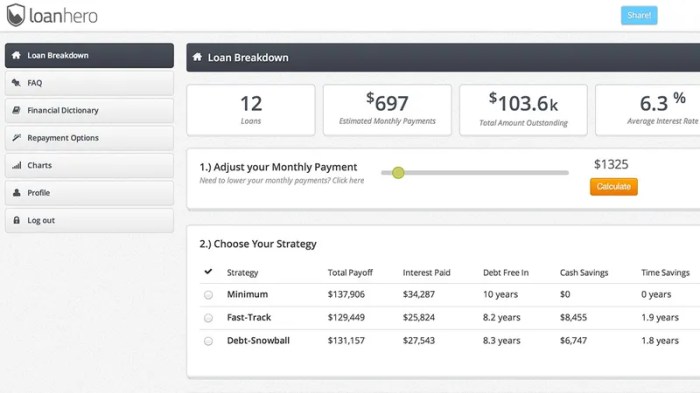

Understanding your repayment options is crucial for effectively managing your KeyCorp student loans. Choosing the right plan can significantly impact your monthly payments, total interest paid, and overall repayment timeline. KeyCorp likely offers several repayment plans to cater to diverse financial situations and borrower needs. Let’s explore the common options and their implications.

Standard Repayment Plan

The standard repayment plan is typically the default option. It involves fixed monthly payments spread over a set period (usually 10 years). This plan offers predictable payments, making budgeting easier. However, the fixed monthly payments might be higher than other options, leading to a faster repayment but potentially straining your budget in the short term. The advantage is a shorter repayment period, minimizing the total interest paid. The disadvantage is the higher monthly payment which could be a challenge for some borrowers.

Extended Repayment Plan

An extended repayment plan stretches the loan repayment period over a longer time frame, usually 25 years. This results in lower monthly payments, making it more manageable for borrowers with limited income. However, the extended repayment period means you’ll pay significantly more interest over the life of the loan. This option is advantageous for borrowers needing immediate financial relief but comes with the cost of increased total interest paid.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers anticipating increased income in the future. The initial lower payments ease the financial burden initially, but the increasing payments may become challenging later on. The benefit is a manageable start, while the drawback is the unpredictable rise in payments over time.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. These plans, if offered by KeyCorp, typically offer lower monthly payments than standard plans, making them attractive for borrowers with lower incomes or high debt burdens. However, IDRs usually extend the repayment period, leading to higher total interest paid over the loan’s life. The advantage is affordability, while the disadvantage is a longer repayment period and increased total interest.

| Repayment Plan | Monthly Payment | Interest Accrual | Loan Term |

|---|---|---|---|

| Standard | Fixed, potentially higher | Standard rate | Typically 10 years |

| Extended | Lower, fixed | Standard rate, higher total interest | Typically 25 years |

| Graduated | Low initially, gradually increases | Standard rate | Typically 10 years |

| Income-Driven | Variable, based on income | Standard rate, potential for forgiveness after 20-25 years (depending on plan and eligibility) | Variable, potentially longer |

Strategies for Managing Student Loan Debt

Creating a comprehensive budget to track income and expenses is fundamental. Prioritizing loan repayment and exploring options like refinancing or consolidation with KeyCorp (if available) can help lower interest rates and streamline payments. Careful financial planning and consistent repayment are key to successfully managing your student loan debt. For example, setting up automatic payments can help avoid late fees and maintain a positive payment history.

KeyCorp Student Loan Customer Service

Navigating the complexities of student loan repayment can be challenging, and having reliable customer service is crucial. KeyCorp aims to provide comprehensive support to its student loan borrowers through various channels and resources. Understanding the available options and the experiences of other borrowers can help you effectively manage your loan.

KeyCorp offers several methods for contacting student loan customer service. Borrowers can typically reach out via phone, mail, and increasingly, through secure online messaging systems within their KeyCorp account portal. The specific contact information and availability of these channels may vary depending on the type of loan and the borrower’s specific situation. It’s always best to check the KeyCorp website for the most up-to-date contact details.

Contact Methods and Response Times

KeyCorp’s customer service response times are reported to vary. While many borrowers report positive experiences with prompt and helpful responses, particularly through phone calls, others have noted longer wait times, especially during peak periods or when dealing with complex issues. The efficiency of communication often depends on the method chosen and the complexity of the inquiry. For straightforward questions, online messaging may suffice; however, more complex issues might require a phone call to ensure a quicker resolution. Anecdotal evidence suggests that email communication may result in the longest response times.

Available Resources for Borrowers

KeyCorp strives to empower borrowers with self-service tools. Their online account portal typically provides access to account statements, payment history, repayment schedule information, and loan details. Many borrowers find this online portal a convenient way to manage their accounts and access important information 24/7. Furthermore, KeyCorp’s website often includes FAQs, educational resources on loan management strategies, and helpful guides for understanding various repayment options. These resources can help borrowers proactively address potential challenges and avoid unnecessary contact with customer service.

Frequently Asked Questions

Understanding common concerns can streamline the borrowing process. The following are frequently asked questions and their corresponding answers:

- Q: How do I make a payment on my KeyCorp student loan?

A: You can typically make payments online through your KeyCorp account portal, by mail, or via phone. Specific instructions are usually provided on your account statement or within the online portal. - Q: What happens if I miss a payment?

A: Missing a payment can result in late fees and negatively impact your credit score. KeyCorp typically provides grace periods, but it’s crucial to contact them immediately if you anticipate difficulty making a payment to explore potential solutions. - Q: What repayment options are available?

A: KeyCorp likely offers various repayment plans, such as standard, graduated, extended, and possibly income-driven repayment plans. Review your loan documents or contact customer service to understand your available options. - Q: How can I contact KeyCorp student loan customer service?

A: Contact information, including phone numbers and mailing addresses, is usually available on your loan documents and the KeyCorp website. Check the official website for the most up-to-date details. - Q: Can I consolidate my KeyCorp student loans?

A: The possibility of consolidating your loans depends on your specific loan terms and KeyCorp’s current offerings. Contacting customer service directly is the best way to determine if loan consolidation is an option for you.

KeyCorp Student Loan Forgiveness Programs

KeyCorp itself does not offer student loan forgiveness programs. KeyCorp is a bank, and as such, they primarily focus on providing financing options for student loans, not managing federal forgiveness programs. Therefore, information regarding forgiveness options will relate to federal programs, and KeyCorp’s role would be limited to servicing the loan if it’s held through them.

It’s crucial to understand that student loan forgiveness is primarily determined by federal programs, not by individual lenders. KeyCorp may service loans that are eligible for these programs, but they do not administer the programs themselves.

Eligibility Requirements for Federal Student Loan Forgiveness Programs

Eligibility for federal student loan forgiveness programs varies significantly depending on the specific program. Common programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans that can lead to loan forgiveness after a certain period. Each program has its own set of requirements concerning the type of loan, employment, income, and repayment plan. For example, PSLF requires 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness has specific requirements related to teaching in low-income schools. IDR plans, while not direct forgiveness, can significantly reduce monthly payments and potentially lead to forgiveness after 20 or 25 years, depending on the plan. Detailed eligibility criteria for each program are available on the Federal Student Aid website (studentaid.gov).

The Application Process for Federal Student Loan Forgiveness Programs

The application process for federal student loan forgiveness programs is typically handled through the Federal Student Aid website. It often involves completing an application form, providing documentation to verify employment and income, and ensuring your loans are consolidated into a Direct Loan program if necessary. The process can be lengthy and require meticulous record-keeping to demonstrate consistent payments and employment. For example, applying for PSLF often requires submitting employment certifications from your employer for each qualifying payment period. Each program has its own specific application process, so careful review of the program guidelines is essential.

Calculating Potential Savings from Student Loan Forgiveness Programs

Calculating potential savings depends entirely on the specific loan forgiveness program and the individual’s loan details. For instance, consider a borrower with $50,000 in federal student loans. If they qualify for PSLF after 120 qualifying payments, their potential savings would be the entire $50,000 principal balance. Under an IDR plan, the calculation is more complex, as it depends on the income-driven payment amount, the loan’s interest rate, and the repayment period. A simplified calculation would involve subtracting the total payments made under the IDR plan from the original loan balance, assuming the remaining balance is forgiven after the program’s duration. For accurate calculations, borrowers should utilize online loan calculators specifically designed for IDR plans or consult with a financial advisor who can model the potential savings based on individual circumstances. For example, a loan calculator might show a total payment of $30,000 under an IDR plan, resulting in $20,000 in potential savings if the remaining balance is forgiven. However, it is important to note that this is a simplified illustration and does not account for interest accrual or other factors that may affect the final amount.

KeyCorp Student Loan Consolidation

Consolidating your student loans through KeyCorp can simplify your repayment process by combining multiple loans into a single, manageable payment. This can be beneficial for borrowers with various loan types and interest rates, offering potential advantages in terms of monthly payment amounts and overall interest paid. However, it’s crucial to carefully weigh the potential benefits against any drawbacks before making a decision.

KeyCorp’s student loan consolidation options, if available, might offer a streamlined approach to managing your debt. However, it’s essential to confirm the availability of this service directly with KeyCorp, as their offerings can change. It’s also vital to compare KeyCorp’s consolidation options with those from other lenders to ensure you’re getting the best possible terms.

Benefits and Drawbacks of KeyCorp Student Loan Consolidation

Consolidating student loans can offer several advantages, but it’s important to be aware of potential downsides. A simplified repayment process with a single monthly payment is a significant benefit. This can improve budgeting and reduce the risk of missed payments. However, depending on the terms of the consolidation, the overall interest paid might increase, and the length of the repayment period may extend, potentially leading to higher total interest costs over the life of the loan. Careful comparison of the total interest paid before and after consolidation is essential.

KeyCorp Student Loan Consolidation Process

A step-by-step guide to the KeyCorp student loan consolidation process, assuming it’s offered, would generally involve these stages: First, confirm the availability of the consolidation option through KeyCorp’s official channels. Next, gather all necessary documentation related to your existing student loans, including loan numbers, balances, and interest rates. Then, complete KeyCorp’s loan consolidation application, providing all required information accurately. Following application submission, KeyCorp will review your application and notify you of their decision. Finally, once approved, you will receive your new consolidated loan terms and begin making payments under the new agreement. Remember that this is a general Artikel, and the specific steps may vary.

Comparison of Before-and-After Consolidation Effects

Let’s illustrate a hypothetical scenario to visualize the potential impact of consolidation.

Before Consolidation:

Imagine you have three student loans:

* Loan 1: $10,000 at 5% interest, $200 monthly payment

* Loan 2: $15,000 at 7% interest, $300 monthly payment

* Loan 3: $5,000 at 6% interest, $100 monthly payment

Total monthly payment: $600

Total debt: $30,000

After Consolidation (Hypothetical):

After consolidating with KeyCorp (assuming a fixed interest rate of 6.5%), your new loan might look like this:

* Consolidated Loan: $30,000 at 6.5% interest, $550 monthly payment (this is a simplified example; the actual payment would depend on the loan term).

In this hypothetical example, the monthly payment decreased by $50, providing a simpler payment structure. However, the total interest paid over the life of the loan *might* increase, even with a lower monthly payment, depending on the length of the new loan term. A longer repayment period will generally result in more total interest paid. It’s crucial to obtain a detailed amortization schedule from KeyCorp to compare the total interest paid under both scenarios (before and after consolidation).

Final Thoughts

Securing a student loan is a significant financial commitment. By understanding KeyCorp’s offerings, comparing them to alternatives, and developing a robust repayment strategy, you can minimize debt burden and pave the way for a financially secure future. Remember to utilize KeyCorp’s resources and customer service channels to address any questions or concerns throughout the loan process. Careful planning and informed decision-making are key to successful student loan management.

Clarifying Questions

What credit score is needed for a KeyCorp student loan?

KeyCorp’s specific credit score requirements vary depending on the loan type and applicant’s circumstances. Generally, a higher credit score improves approval chances and may lead to more favorable interest rates.

Can I refinance my existing student loans with KeyCorp?

KeyCorp may offer student loan refinancing options. Check their website or contact their customer service for current availability and eligibility criteria.

What happens if I miss a student loan payment with KeyCorp?

Missing payments will negatively impact your credit score and may incur late fees. Contact KeyCorp immediately to discuss options to avoid further penalties.

Does KeyCorp offer deferment or forbearance options?

KeyCorp may offer deferment or forbearance under certain circumstances, such as unemployment or financial hardship. Contact KeyCorp to explore these possibilities.