Navigating the world of student loans can be daunting, but understanding your options is key to securing a financially sound future. LendingTree, a prominent online marketplace, offers a platform connecting students with various lenders, potentially simplifying the loan application process. This guide delves into the features, benefits, and potential drawbacks of using LendingTree to secure student loans, equipping you with the knowledge to make informed decisions.

We’ll explore LendingTree’s offerings, including the types of loans available, the application process, associated fees and interest rates, and crucial eligibility requirements. Furthermore, we’ll compare LendingTree to competitors, examining repayment options, customer support experiences, and the overall risks and rewards involved. Ultimately, our goal is to provide a clear and comprehensive overview, empowering you to confidently approach the process of obtaining a student loan.

LendingTree Student Loan Platform Overview

LendingTree serves as a student loan marketplace, connecting borrowers with various lenders offering a range of student loan options. It’s a valuable tool for comparing different loan terms and finding the best fit for individual financial circumstances. This platform streamlines the loan search process, saving borrowers significant time and effort.

LendingTree Student Loan Marketplace Features

LendingTree’s marketplace offers several key features designed to simplify the student loan search. These include a user-friendly interface allowing for easy comparison of loan offers based on interest rates, repayment terms, and fees. The platform also provides educational resources to help borrowers understand the various loan types and make informed decisions. Furthermore, LendingTree utilizes advanced algorithms to match borrowers with lenders most likely to approve their applications based on their creditworthiness and financial profile. This personalized approach helps maximize the chances of securing a favorable loan.

Loan Types Offered Through LendingTree

LendingTree facilitates access to a variety of student loan types, catering to diverse borrower needs. These typically include federal student loans (such as Direct Subsidized and Unsubsidized Loans, and Grad PLUS Loans), and private student loans. Private student loans offered through LendingTree’s network of lenders often provide additional flexibility in terms of repayment options and may be suitable for borrowers who have exhausted their federal loan options or require additional funding. The specific loan types available may vary depending on the lender and the borrower’s eligibility.

Applying for a Student Loan via LendingTree

The application process through LendingTree is generally straightforward. Borrowers begin by completing a simple online application, providing information about their educational background, financial situation, and desired loan amount. LendingTree then uses this information to match the borrower with lenders who are likely to offer competitive terms. Once matched, borrowers can review loan offers from multiple lenders and compare them side-by-side. After selecting a loan offer, borrowers will be redirected to the lender’s website to complete the formal loan application process. This may involve submitting additional documentation, such as tax returns or proof of enrollment.

Comparison of LendingTree with Other Major Student Loan Platforms

The following table compares LendingTree with three other major student loan platforms. Note that rates, fees, and customer reviews can fluctuate and are based on general observations and publicly available information at the time of writing. Individual experiences may vary.

| Feature | LendingTree | Sallie Mae | Discover | Earnest |

|---|---|---|---|---|

| Loan Types Offered | Federal and Private | Federal and Private | Private | Private |

| Interest Rates | Variable, depending on lender and borrower profile | Variable, depending on loan type and borrower profile | Variable, depending on borrower profile | Variable, depending on borrower profile |

| Fees | Vary by lender; may include origination fees | May include origination fees | May include origination fees | May include origination fees |

| Customer Reviews | Mixed; generally positive for ease of comparison, but individual lender experiences vary | Mixed; some praise customer service, others cite difficulties | Generally positive for ease of application and clear terms | Generally positive for customer service and flexible repayment options |

LendingTree Student Loan Rates and Fees

Understanding the cost of student loans is crucial for responsible borrowing. LendingTree acts as a marketplace, connecting borrowers with various lenders offering student loan options. Therefore, interest rates and fees aren’t standardized and will vary based on several factors, including your creditworthiness, the type of loan, and the lender you ultimately choose.

LendingTree doesn’t directly lend money; it facilitates the connection between borrowers and lenders. This means the rates and fees you encounter will be those offered by the individual lenders participating in the LendingTree network. It’s essential to compare offers carefully before making a decision.

Student Loan Interest Rates on LendingTree

Interest rates for student loans on LendingTree are highly variable. They depend heavily on your credit history, credit score, the type of loan (federal or private), and the loan’s repayment terms. Generally, borrowers with strong credit scores and excellent financial history will qualify for lower interest rates. Federal student loans typically offer lower interest rates than private loans, but their eligibility criteria are more stringent. For example, a borrower with a 750 credit score might secure a private student loan with an interest rate around 6%, while a borrower with a 650 credit score might face a rate closer to 10%. These figures are illustrative and should not be considered guarantees. Always check the rates offered by individual lenders on the LendingTree platform.

Fees Associated with LendingTree Student Loans

Lenders participating on LendingTree may charge various fees associated with student loans. These fees can include origination fees, late payment fees, and potentially prepayment penalties, though prepayment penalties are less common for student loans. Origination fees are typically a percentage of the loan amount and are charged upfront. Late payment fees are assessed if you miss a payment, and their amount varies depending on the lender. It is crucial to review the loan terms and conditions carefully to understand all associated fees before accepting a loan offer. Remember, these fees directly impact the overall cost of borrowing.

Comparison of LendingTree Rates and Fees with Other Lenders

Directly comparing LendingTree’s rates and fees to those of other lenders requires specifying the type of loan and the borrower’s credit profile. However, generally speaking, LendingTree offers access to a wide range of lenders, allowing borrowers to compare offers and potentially find competitive rates. Other lenders, such as Sallie Mae or Discover Student Loans, also offer student loans, and their rates and fees will vary based on the same factors mentioned previously. The advantage of LendingTree lies in its ability to facilitate comparison shopping, empowering borrowers to make informed decisions.

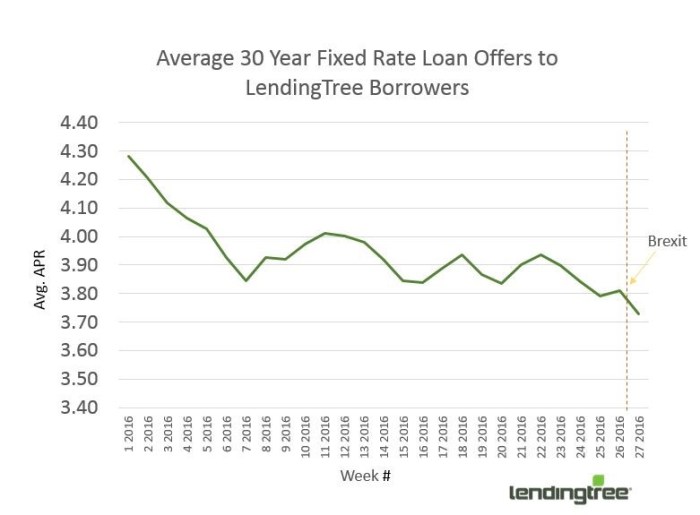

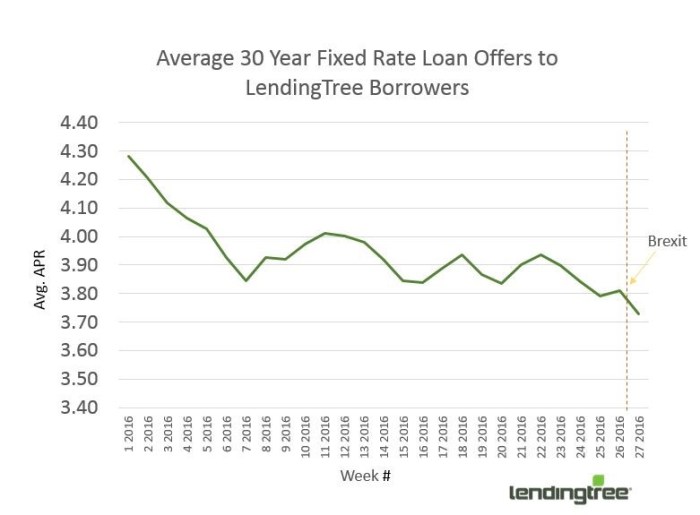

Visual Representation: Credit Score vs. Interest Rate

The visual representation would be a line graph. The x-axis would represent the credit score (ranging from 300 to 850), and the y-axis would represent the interest rate (as a percentage). The graph would show a downward-sloping line, illustrating the inverse relationship between credit score and interest rate. The line would not be perfectly straight, reflecting the fact that the relationship is not perfectly linear. Data points could be included to represent average interest rates at different credit score ranges (e.g., a point showing an average interest rate of 8% for a credit score of 680, and a point showing 5% for a credit score of 780). The graph’s title would be “LendingTree Student Loan Interest Rates by Credit Score,” and a clear legend would explain the axes and data points. The graph would visually demonstrate that higher credit scores generally lead to lower interest rates on student loans obtained through the LendingTree platform.

Repayment Options and Customer Support

LendingTree doesn’t directly provide student loans; instead, it acts as a marketplace connecting borrowers with various lenders. Therefore, repayment options and customer support will vary depending on the specific lender you choose through the platform. Understanding these variations is crucial before committing to a loan.

Understanding your repayment options and the level of customer support available is paramount to a positive borrowing experience. LendingTree’s role is to present options, but the specifics are determined by your chosen lender.

Repayment Plan Options

The repayment plans available will depend entirely on the lender selected through the LendingTree platform. Common options offered by student loan lenders include standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Standard repayment involves fixed monthly payments over a set period (usually 10 years). Graduated repayment starts with lower payments that increase over time. Extended repayment plans stretch the repayment period, lowering monthly payments but increasing total interest paid. Income-driven repayment plans tie your monthly payment to your income, offering lower payments but potentially extending the repayment period significantly. Always review the terms and conditions provided by the individual lender before selecting a plan.

Managing Payments and Account Access

Each lender will have its own online portal or mobile app for managing payments and accessing account information. These portals typically allow you to view your loan balance, make payments, download statements, and update your contact information. The specific features and accessibility of these portals will differ depending on the lender. LendingTree itself does not manage payments directly; it serves as a platform to find lenders, not a loan servicer.

Customer Support Channels

LendingTree’s customer support focuses primarily on assisting users in navigating the platform and connecting with lenders. Their support may not directly address issues with individual loans once they’re approved. The effectiveness of their support varies based on user reviews.

- Phone Support: LendingTree offers phone support, but the effectiveness varies according to user reviews. Some users report long wait times or difficulty reaching a representative who can fully address their concerns. Others report positive experiences with helpful and responsive representatives.

- Email Support: Email support is another option, but response times can be inconsistent. Some users report receiving timely and helpful responses, while others note delays or lack of clarity in the responses received.

- Online Help Center/FAQ: LendingTree maintains an online help center and frequently asked questions (FAQ) section. This resource can be useful for resolving common issues, but complex or unique problems may require direct contact with customer support.

Customer Service Experience Across Reviews

Reviews of LendingTree’s customer service are mixed. While some users praise the platform’s ease of use and the range of lenders offered, others express frustration with the lack of direct support for loan-related issues. Many reviews highlight the importance of carefully reviewing the terms and conditions offered by the individual lender before proceeding with a loan, as LendingTree’s role is primarily facilitative. The responsibility for loan servicing and customer support for the loan itself rests with the selected lender.

Potential Risks and Benefits

LendingTree serves as a marketplace connecting borrowers with various student loan lenders. While this offers convenience and potentially competitive rates, it’s crucial to understand both the advantages and disadvantages before utilizing the platform. Weighing these factors carefully will help you make an informed decision that aligns with your financial goals and risk tolerance.

Choosing a student loan involves significant long-term financial commitments, and understanding the potential risks and rewards is paramount. This section will explore the potential pitfalls and benefits associated with using LendingTree for student loan needs, specifically focusing on refinancing and consolidation.

Risks Associated with Using LendingTree for Student Loans

Using LendingTree to find student loans carries certain risks. The platform itself doesn’t lend money; it acts as an intermediary. Therefore, the actual terms and conditions of the loan will be determined by the lender you choose through the platform. Potential risks include:

- Exposure to higher interest rates than you might find independently if you thoroughly research different lenders. While LendingTree aims to provide competitive rates, it doesn’t guarantee the absolute lowest rate available.

- The potential for misleading or incomplete information from lenders listed on the platform. It’s essential to carefully review all loan documents before signing.

- Data privacy concerns. Sharing your financial information with LendingTree and multiple lenders increases your vulnerability to potential data breaches.

- Hidden fees. Always scrutinize the loan terms and conditions for any hidden fees or charges beyond the advertised interest rate.

Benefits of Using LendingTree for Student Loan Refinancing

Refinancing your student loans through LendingTree can offer several advantages, particularly if you qualify for a lower interest rate. This can significantly reduce your overall loan repayment costs over time.

- Access to a wider range of lenders and loan options than you might find by searching independently. This allows for comparison shopping and finding the most suitable terms.

- Potential for lower interest rates. If your credit score has improved since you initially took out your student loans, refinancing could lead to significant savings.

- Simplified application process. LendingTree’s platform streamlines the application process, allowing you to compare multiple lenders simultaneously.

- Potential for a shorter repayment term. This can reduce the total interest paid, but it will result in higher monthly payments.

Long-Term Financial Implications of Student Loans Obtained Through LendingTree

Student loans obtained through LendingTree, or any platform for that matter, represent a substantial long-term financial commitment. The interest accrued over the life of the loan can significantly increase the total repayment amount. For example, a $50,000 loan at 7% interest over 10 years could result in total repayment exceeding $65,000, due to accumulated interest. Careful budgeting and responsible financial planning are crucial to manage these long-term obligations effectively. Failing to repay the loan as agreed can lead to serious consequences, including damage to your credit score and potential legal action.

Comparison of Advantages and Disadvantages of Using LendingTree for Student Loan Consolidation

Student loan consolidation, facilitated through LendingTree, combines multiple student loans into a single loan. This simplifies repayment but has both advantages and disadvantages.

- Advantages:

- Simplified repayment with a single monthly payment.

- Potential for a lower monthly payment (though the total amount repaid might be higher due to a longer repayment period).

- Potential for a fixed interest rate, eliminating the uncertainty of variable rates across multiple loans.

- Disadvantages:

- Potential for a higher overall interest paid compared to keeping existing loans with lower interest rates.

- Loss of potential benefits associated with specific loan programs, such as income-driven repayment plans.

- Risk of extending the repayment period, increasing the total interest paid.

Alternatives to LendingTree for Student Loans

LendingTree is a valuable resource for comparing student loan options, but it’s not the only game in town. Several other platforms and lenders offer similar services, each with its own strengths and weaknesses. Understanding these alternatives allows borrowers to make informed decisions based on their individual financial situations and needs.

Exploring alternative platforms can lead to better loan terms, lower interest rates, or more suitable repayment plans. Direct lenders, government programs, and other online marketplaces all offer distinct advantages and should be considered alongside LendingTree.

Direct Lenders

Direct lenders, such as Sallie Mae, Discover Student Loans, and private banks, offer student loans directly to borrowers without using a third-party marketplace. This can sometimes streamline the application process and provide more personalized service. However, it limits the ability to compare multiple lenders simultaneously.

Comparing direct lenders involves assessing interest rates, fees, repayment options, and customer service. Borrowers should carefully review the terms and conditions of each loan before signing. Some direct lenders may offer specific benefits like discounts for good grades or automatic payments.

Government Loan Programs

Federal student loans, offered through the U.S. Department of Education, are a significant alternative to private loans. These loans typically offer lower interest rates and more flexible repayment options, including income-driven repayment plans. However, the application process may be more complex, and eligibility requirements vary.

Federal student loans are often prioritized due to their borrower protections and flexible repayment plans. Understanding the nuances of federal loan programs, such as subsidized vs. unsubsidized loans, is crucial for making an informed decision. The Federal Student Aid website (studentaid.gov) provides comprehensive information on eligibility and application procedures.

Other Online Marketplaces

Several online marketplaces, similar to LendingTree, facilitate comparisons of student loan offers from multiple lenders. Examples include Credible and ELFI. These platforms often provide a streamlined comparison tool, but it’s crucial to understand their business models and potential biases.

While convenient, it’s essential to independently verify the information provided by these marketplaces and compare offers directly with the lenders. This ensures you’re receiving accurate and up-to-date information before making a commitment.

Factors to Consider When Choosing a Student Loan Lender

Choosing the right student loan lender requires careful consideration of several key factors. These include interest rates, fees, repayment options, customer service, and the lender’s reputation. Borrowers should also assess their eligibility for different loan types and compare the overall cost of borrowing.

A comprehensive comparison should involve analyzing the annual percentage rate (APR), which reflects the total cost of borrowing, including interest and fees. Borrowers should also consider the length of the repayment term and the potential impact on their future financial situation. Checking online reviews and ratings can provide valuable insights into the lender’s customer service and overall reputation.

Flowchart for Selecting a Student Loan Provider

The following describes a flowchart to guide users through the decision-making process. An image generation tool could easily create a visual representation based on this description. The flowchart would begin with a “Start” node, branching into two main paths: “Federal Loans” and “Private Loans”.

The “Federal Loans” path would lead to a decision node asking, “Am I eligible for federal loans?”. A “Yes” branch would lead to a series of nodes detailing the application process and different loan types (Subsidized, Unsubsidized, etc.). A “No” branch would lead to the “Private Loans” path.

The “Private Loans” path would lead to a node presenting options like “LendingTree,” “Direct Lenders,” and “Other Marketplaces”. Each option would branch to a series of nodes detailing the specifics of that option: rate comparison, fee analysis, repayment options, and customer reviews. All paths would eventually converge at an “End” node, representing the selection of a loan provider.

Throughout the flowchart, decision nodes would be represented by diamonds, process nodes by rectangles, and the start and end nodes by ovals. Arrows would indicate the flow of the decision-making process.

Epilogue

Securing a student loan is a significant financial undertaking, requiring careful consideration of various factors. While LendingTree offers a convenient platform to compare lenders and potentially secure favorable loan terms, it’s crucial to thoroughly research all available options and understand the associated risks and benefits. By carefully weighing your options and understanding the details of each loan offer, you can make an informed decision that aligns with your individual financial circumstances and long-term goals. Remember to always read the fine print and seek professional financial advice if needed.

Question Bank

What credit score is needed for a LendingTree student loan?

LendingTree doesn’t set a minimum credit score, but lenders on the platform will have their own requirements. A higher credit score generally leads to better interest rates.

Can I use LendingTree for private student loans only?

No, LendingTree may also connect you with lenders offering federal student loans. The availability of loan types varies depending on the lender.

How long does the LendingTree application process take?

The application time varies depending on lender processing times, but generally, the initial application through LendingTree is quick. Final loan approval may take several days or weeks.

What happens if my loan application is denied?

If your application is denied, LendingTree may offer suggestions for improving your chances, such as exploring co-signers or addressing credit issues.