Navigating the complexities of higher education financing often leaves students grappling with the question of how much they can realistically borrow. Understanding lifetime maximum student loan limits is crucial for responsible financial planning. This guide delves into the intricacies of these limits, exploring variations across loan programs, influencing factors, and the long-term implications of borrowing the maximum amount. We’ll examine strategies for managing debt, making informed educational choices, and ultimately securing a financially stable future.

From federal and private loan programs to the impact of graduate studies and co-signers, we’ll uncover the key elements that determine individual borrowing capacity. We’ll also explore the potential consequences of exceeding these limits and offer practical advice on minimizing debt while maximizing educational opportunities. The ultimate goal is to empower students to make well-informed decisions that align with their financial realities and long-term aspirations.

Understanding Lifetime Maximum Student Loan Limits

Lifetime maximum student loan limits represent the total amount a borrower can receive in student loans over their entire educational career. Understanding these limits is crucial for responsible financial planning during and after college, as exceeding them can lead to significant debt burdens. These limits vary widely depending on several factors, making it essential to research the specifics of each loan program before borrowing.

Lifetime Maximums by Loan Program

Federal student loans, offered by the U.S. government, typically have lower lifetime borrowing limits than private student loans, which are offered by banks and other financial institutions. Undergraduate students generally have lower limits than graduate students, reflecting the differing costs of education at these levels. Additionally, the specific loan programs (e.g., Stafford Loans, Perkins Loans, PLUS Loans) within the federal loan system each have their own borrowing limits. Private loan limits vary significantly based on the lender, the student’s creditworthiness, and the cost of attendance at their chosen institution. There is no single, universally applicable limit for private loans.

International Variations in Lifetime Loan Limits

Lifetime maximums for student loans differ considerably across countries. Many countries have government-backed loan programs with set limits, while others rely more heavily on private lending, where limits are less standardized. For example, some European countries may have lower maximum loan amounts compared to the United States, reflecting different educational financing models and cultural norms around student debt. Conversely, certain countries might not have formalized lifetime limits at all, leaving the borrowing amount dependent entirely on the lender and the borrower’s creditworthiness. A comprehensive comparison requires detailed research into the specific loan programs of each country.

Lifetime Loan Limits in the USA

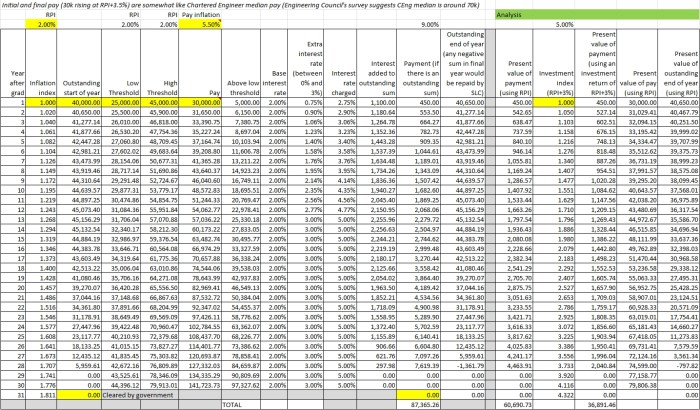

The following table summarizes lifetime loan limits for different federal student loan types in the USA. Note that these limits are subject to change and are simplified representations. Actual limits may vary based on factors such as dependency status and enrollment status. Interest rates are also subject to change and are variable, depending on the loan program and the time of borrowing. Repayment terms depend on the loan type and are not standardized across all programs.

| Loan Type | Maximum Loan Amount (Approximate) | Repayment Terms (Approximate) | Interest Rate (Approximate) |

|---|---|---|---|

| Subsidized Federal Stafford Loan (Undergraduate) | $5,500 (freshman), $6,500 (sophomore), $7,500 (junior/senior) | 10 years | Variable; check current rates |

| Unsubsidized Federal Stafford Loan (Undergraduate) | $5,500 (freshman), $6,500 (sophomore), $7,500 (junior/senior) | 10 years | Variable; check current rates |

| Graduate PLUS Loan | Cost of attendance minus other financial aid | 10 years | Variable; check current rates |

| Parent PLUS Loan | Cost of attendance minus other financial aid | 10 years | Variable; check current rates |

Factors Influencing Lifetime Loan Limits

Several key factors interact to determine a student’s eligibility for federal student loans, ultimately impacting their lifetime borrowing limit. Understanding these factors is crucial for prospective students and their families in planning for higher education financing. These factors are not always independent and can influence each other.

School Type and Program

The type of institution attended significantly influences loan limits. Federal student loan programs often have different maximum loan amounts for students attending public, private non-profit, and for-profit institutions. Additionally, the specific program of study can affect loan eligibility. For instance, graduate programs often have higher loan limits than undergraduate programs, reflecting the typically higher costs associated with advanced degrees. A student pursuing a doctorate in engineering may be eligible for significantly higher loan amounts than a student pursuing an associate’s degree in culinary arts.

Enrollment Status

A student’s enrollment status—full-time versus part-time—also impacts loan eligibility. Full-time students generally qualify for higher loan amounts than part-time students because they are considered to be pursuing their degree more intensely and therefore have higher associated costs. The definition of full-time enrollment varies by institution, but generally involves a minimum number of credit hours per term. Part-time students should anticipate lower loan limits and may need to supplement their funding with other resources.

Graduate Studies and Loan Limits

Graduate students typically have access to higher loan limits compared to undergraduates. This is because graduate programs often involve higher tuition fees, longer program durations, and potentially higher living expenses. For example, a student pursuing a Master’s degree in Business Administration (MBA) might be eligible for substantially more in federal loans than an undergraduate student pursuing a Bachelor’s degree in the same field. The increased loan limits reflect the increased financial commitment required for advanced studies.

Role of Co-signers

While co-signers do not directly increase the *federal* loan limits set by the government, they can significantly improve a student’s chances of loan approval and potentially access private loans with higher limits. A co-signer with a strong credit history can offset the risk associated with a student borrower who may lack a substantial credit history. In essence, a co-signer’s good credit serves as a guarantee for the lender, potentially making the student a more attractive borrower and opening up access to higher loan amounts, particularly in the private loan market. However, it is crucial to remember that a co-signer assumes responsibility for the loan if the student defaults.

Flowchart: Determining Maximum Student Loan Eligibility

The process of determining maximum student loan eligibility can be visualized as a flowchart. The flowchart would begin with the student’s application. The application would be checked against the student’s enrollment status (full-time or part-time), the type of school (public, private non-profit, for-profit), and the program of study. This information would then be used to determine the initial loan limit based on federal guidelines. Next, the flowchart would incorporate the student’s credit history and, if applicable, the co-signer’s credit history. A strong credit history would potentially lead to approval for the full determined loan limit, while a weak credit history might lead to a reduced loan amount or a requirement for a co-signer. Finally, the flowchart would conclude with the approved loan amount. The flowchart would represent a simplified visual representation of a complex process that takes into account many variables.

Managing Debt Within Lifetime Limits

Successfully navigating the complexities of student loan debt requires proactive planning and a firm understanding of your borrowing limits. Minimizing debt while maximizing educational opportunities involves a strategic approach that combines careful budgeting, financial planning, and a realistic assessment of future earning potential. Failing to manage debt effectively can lead to significant long-term financial consequences.

Strategies for Minimizing Student Loan Debt

Effective debt management begins with a thorough understanding of your financial situation. This includes accurately assessing the cost of your education, including tuition, fees, room and board, and other expenses. Explore all available financial aid options, including grants, scholarships, and work-study programs, to reduce your reliance on loans. Prioritize grants and scholarships as these are forms of financial aid that don’t need to be repaid. Consider attending a less expensive college or university, or opting for a shorter educational program, if possible. Careful consideration of these factors can significantly reduce your overall borrowing needs.

Budgeting Techniques and Financial Planning Tools

Creating a realistic budget is crucial for managing student loan debt. Track your income and expenses meticulously to identify areas where you can cut back. Utilize budgeting apps or spreadsheets to monitor your spending habits and ensure you stay within your financial means. Financial planning tools, such as online calculators that project loan repayment amounts and interest accrual, can help you visualize the long-term implications of your borrowing decisions. For example, a student could use a loan repayment calculator to determine how much their monthly payments would be based on different loan amounts and interest rates. This allows for informed decision-making regarding borrowing.

Consequences of Exceeding Lifetime Loan Limits

Exceeding your lifetime loan limits can have severe repercussions. You may find yourself with a significantly higher debt burden than anticipated, leading to extended repayment periods and substantial interest charges. This can negatively impact your credit score, making it more difficult to obtain loans for future purchases like a car or a house. Furthermore, high levels of student loan debt can restrict your financial flexibility, limiting your ability to save for retirement or other long-term goals. In extreme cases, it can even lead to financial distress and hardship.

Resources and Support Systems for Students with Student Loan Debt

Numerous resources and support systems are available to assist students struggling with student loan debt. Your college or university’s financial aid office can provide guidance on managing loans and exploring repayment options. Government websites, such as the Federal Student Aid website, offer valuable information on loan programs and repayment plans. Nonprofit organizations dedicated to student loan debt relief can provide counseling and support. Additionally, financial advisors can offer personalized guidance on creating a debt management plan tailored to your specific circumstances. Seeking help early is crucial in mitigating the potential negative impacts of student loan debt.

The Impact of Lifetime Loan Limits on Educational Choices

Lifetime maximum student loan limits significantly influence the educational decisions students make, impacting their choices of major, institution, and overall educational path. Understanding these limitations is crucial for prospective students to make informed choices that align with their financial capabilities and long-term goals. Failing to consider these limits can lead to significant financial strain and hinder the achievement of career aspirations.

The financial burden of higher education varies drastically depending on the chosen path. For instance, pursuing a four-year degree at a private university is considerably more expensive than attending a community college followed by a state university. Lifetime loan limits, therefore, act as a constraint, forcing students to carefully evaluate the cost-benefit ratio of different educational options. A student approaching the lifetime limit after only a few years of community college might find themselves unable to afford the remaining years of a bachelor’s degree, potentially necessitating a change of plans.

College Major Selection and Lifetime Loan Limits

The cost of a college education is not uniform across all majors. Some fields, like medicine or engineering, often require longer periods of study, leading to higher overall tuition costs. These costs can quickly push students towards their lifetime loan limits, forcing them to consider less expensive majors even if they are less aligned with their passions. For example, a student passionate about engineering might be forced to choose a less expensive major due to loan limit constraints, potentially impacting their long-term career prospects and earning potential. This highlights the crucial interplay between financial constraints and career aspirations.

Institutional Choices and Financial Constraints

The choice of institution – public versus private, in-state versus out-of-state – significantly affects the overall cost of education. Private universities and out-of-state tuition typically command much higher fees, quickly depleting a student’s borrowing capacity under lifetime loan limits. A student aiming for a prestigious private institution might find themselves severely limited in their ability to pursue postgraduate studies due to earlier borrowing. Conversely, a student choosing a less expensive state school might have more financial flexibility to pursue further education or professional development opportunities later in life.

Long-Term Career Goals and Financial Stability

Lifetime loan limits can have a profound impact on long-term career goals and financial stability. Students burdened with significant debt upon graduation might face limitations in their career choices, potentially accepting lower-paying jobs to manage their debt repayment. This can lead to delayed financial independence and a longer path to achieving financial stability. For instance, a student graduating with substantial loan debt might choose a stable but lower-paying job over a riskier, potentially higher-paying career path, fearing the inability to manage loan repayments alongside the financial uncertainties of a new career.

Alternative Funding Sources for Higher Education

Considering the significant impact of lifetime loan limits, exploring alternative funding sources is essential. Proactive planning and diligent research can significantly alleviate the financial burden of higher education.

The importance of securing alternative funding cannot be overstated. It can significantly reduce reliance on loans and improve a student’s financial outlook post-graduation.

- Scholarships: Merit-based and need-based scholarships can significantly reduce tuition costs. Many organizations, including universities, corporations, and community groups, offer scholarships to deserving students.

- Grants: Grants are similar to scholarships but are often based on financial need. Federal and state governments, as well as private organizations, provide various grant programs.

- Work-Study Programs: Work-study programs allow students to earn money while attending school, reducing their dependence on loans. These programs often involve on-campus jobs or community service positions.

- Federal Student Aid: The Free Application for Federal Student Aid (FAFSA) is the primary gateway to federal student aid, including grants, loans, and work-study opportunities.

- Private Loans: While these should be considered carefully due to potentially higher interest rates, they can supplement other funding sources when necessary. However, it’s crucial to compare rates and terms before committing.

Long-Term Implications of Lifetime Student Loan Debt

Borrowing the maximum amount in student loans can significantly impact your financial future, extending far beyond your graduation date. The weight of this debt can influence major life decisions and shape your long-term financial health, potentially hindering your ability to achieve key financial milestones. Understanding these implications is crucial for responsible borrowing and financial planning.

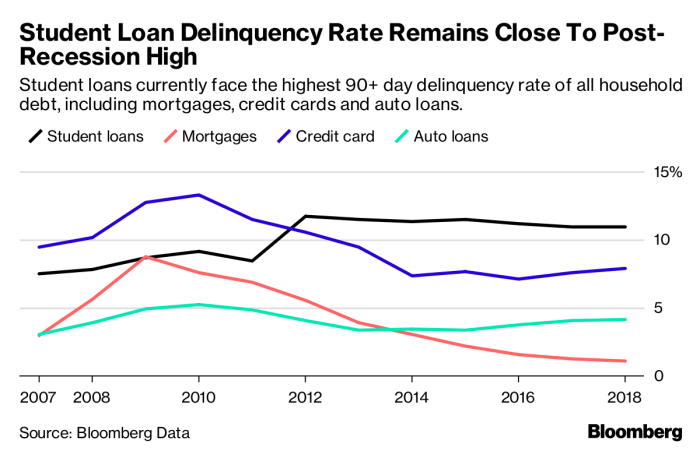

High student loan debt can create a domino effect, impacting various aspects of your life. The monthly payments can consume a substantial portion of your income, leaving less for saving, investing, and other essential expenses. This can lead to delayed or reduced opportunities for homeownership, starting a family, and achieving other significant financial goals. The psychological stress associated with significant debt can also be considerable, affecting overall well-being.

Effects on Major Life Decisions

The burden of substantial student loan debt can significantly delay or even prevent major life milestones. For example, the high monthly payments might make it difficult to save for a down payment on a home, forcing individuals to postpone homeownership or opt for smaller, less desirable properties. Similarly, the financial strain could delay starting a family, as raising children is inherently expensive. Many individuals find themselves forced to prioritize debt repayment over other significant financial goals, such as retirement savings or investments. For instance, a young couple might delay having children for several years to aggressively pay down their loans, impacting their family planning timeline.

Student Loan Repayment Plans and Their Impact

Several repayment plans exist, each with its own implications for long-term financial health. The Standard Repayment Plan, for example, involves fixed monthly payments over 10 years. While straightforward, this plan results in higher monthly payments and may leave little room for other financial goals. Income-Driven Repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE) plan, adjust monthly payments based on income and family size. While offering lower monthly payments, these plans often extend the repayment period to 20 or 25 years, leading to significantly higher overall interest payments. Choosing the right plan requires careful consideration of your current financial situation and long-term goals. For example, a recent graduate with a low income might benefit from an IDR plan to manage monthly payments, but they should be aware of the long-term cost of increased interest.

Refinancing Student Loans: Benefits and Drawbacks

Refinancing student loans involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing often requires a strong credit score and a stable income, making it inaccessible to some borrowers. Furthermore, refinancing federal student loans means losing access to federal protections, such as income-driven repayment plans and loan forgiveness programs. For example, a borrower with a high credit score and stable employment might successfully refinance their loans at a lower interest rate, saving thousands of dollars over the repayment period. Conversely, a borrower with a poor credit history might be denied refinancing, leaving them with their original loan terms.

Final Summary

Successfully navigating the world of student loans requires careful planning and a thorough understanding of the limitations and opportunities available. By understanding lifetime maximum student loan limits, students can make informed decisions about their educational path, minimizing long-term debt burdens. This guide has provided a framework for understanding these limits, exploring the various factors influencing eligibility, and outlining strategies for responsible borrowing and debt management. Remember to utilize available resources and seek professional advice when necessary to ensure a financially secure future.

Frequently Asked Questions

What happens if I exceed my lifetime loan limit?

Exceeding your lifetime loan limit typically means your application for additional loans will be denied. You may need to explore alternative funding options or adjust your educational plans.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers carefully and understand the terms before refinancing.

Are there income-driven repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size, potentially lowering your payments and extending your repayment period.

How does my credit history affect my loan eligibility?

A good credit history generally improves your chances of loan approval and may lead to more favorable interest rates. A poor credit history may limit your borrowing options or result in higher interest rates.