Navigating the complexities of higher education financing often leaves students and families questioning the accessibility and limitations of federal student loans. Understanding the annual and aggregate loan limits is crucial for responsible financial planning. This guide delves into the intricacies of federal student loan limits, exploring the various factors that influence eligibility and the potential impact on overall student debt.

From understanding the differences between subsidized and unsubsidized loans to analyzing the influence of dependency status and credit history, we’ll provide a clear picture of how these limits are determined. We’ll also examine the historical context of these limits, comparing past and present figures, and speculate on potential future trends influenced by economic factors and government policies. Finally, we’ll compare federal loan limits to those offered by private lenders, highlighting the key differences and implications for borrowers.

Loan Limit Changes and Future Trends

Federal student loan limits have fluctuated significantly over the years, reflecting evolving government policies, economic conditions, and the ever-increasing cost of higher education. Understanding these changes and anticipating future trends is crucial for both prospective and current students, as well as policymakers. This section will examine recent adjustments, historical context, and potential future directions for these limits.

Recent years have seen a period of relative stability in federal student loan limits, following a period of significant increases in the preceding decades. However, the impact of inflation and the ongoing debate surrounding the affordability of higher education continue to influence the discussion surrounding potential future adjustments. The limits themselves are often viewed as a key lever in influencing college enrollment and overall student debt levels.

Recent Changes and Historical Context of Federal Student Loan Limits

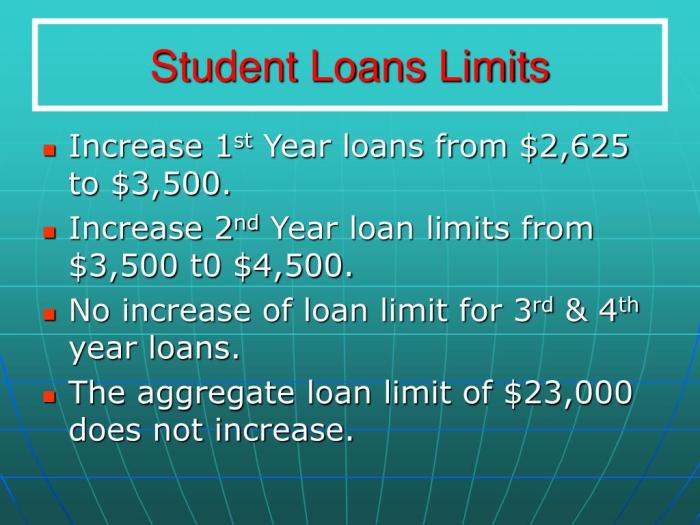

The maximum amount a student can borrow through federal student loan programs has varied considerably throughout the years. Historically, increases were often tied to inflation and the rising cost of tuition. However, recent years have seen a more cautious approach, with some periods of stagnation or even slight decreases in real terms (after accounting for inflation). For example, while nominal limits may have increased, the purchasing power of those limits may have actually decreased due to inflation. Understanding this distinction is crucial for assessing the true impact of these changes on student borrowing. This requires analyzing the data not just in nominal terms, but also adjusting for inflation to reveal the real impact on borrowing capacity.

Comparison of Federal Student Loan Limits Over Time

| Academic Year | Dependent Undergraduate Limit | Independent Undergraduate Limit | Graduate Student Limit |

|---|---|---|---|

| 2010-2011 | $5,500 | $10,500 | $20,500 |

| 2015-2016 | $5,750 | $12,500 | $20,500 |

| 2020-2021 | $5,500 | $12,500 | $20,500 |

| 2023-2024 | $5,500 | $12,500 | $20,500 |

Note: These figures represent the maximum annual loan limits and do not include other factors like PLUS loans. Actual amounts borrowed may vary depending on individual financial need and other eligibility criteria. Furthermore, these figures are presented in nominal dollars and haven’t been adjusted for inflation.

Potential Future Trends in Federal Student Loan Limits

Future changes to federal student loan limits will likely be influenced by several key factors. Inflation will undoubtedly play a significant role, as will the ongoing political debate surrounding the rising cost of higher education and the overall level of student debt. Government policy decisions, such as potential changes to income-driven repayment plans or loan forgiveness programs, could also indirectly influence the need for and desirability of adjusting loan limits. For instance, a more generous loan forgiveness program might reduce the perceived need for higher borrowing limits. Conversely, increased tuition costs, unmitigated by other policy interventions, may necessitate increases in loan limits to maintain student access to higher education. Predicting the precise trajectory is difficult, but analyzing past trends and current policy discussions provides a framework for understanding potential future scenarios. For example, if inflation continues at a significant rate, a case could be made for increasing loan limits to maintain the purchasing power of the loans.

Impact of Loan Limits on Student Debt

Federal student loan limits play a significant role in shaping the overall student debt landscape in the United States. While designed to help make higher education accessible, these limits, coupled with rising tuition costs, can inadvertently contribute to increasing levels of student debt and influence borrowing behavior. Understanding the relationship between loan limits and student debt is crucial for developing effective strategies to manage and mitigate the burden of student loans.

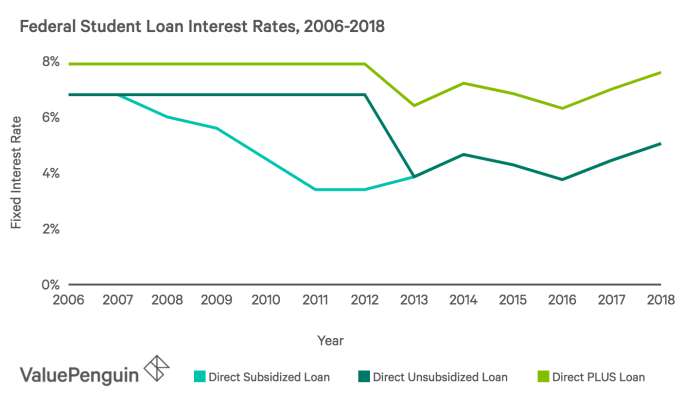

The availability of federal student loans, while offering a relatively low-interest rate compared to private loans, sets a baseline for how much students can borrow. However, when these limits are insufficient to cover the full cost of tuition, fees, and living expenses, students are often forced to seek alternative financing options. This frequently leads to reliance on private loans, which typically carry significantly higher interest rates and less favorable repayment terms. The accumulation of both federal and private loans dramatically increases the overall debt burden, potentially extending repayment periods for many years and impacting long-term financial stability.

Consequences of Exceeding Federal Loan Limits

Exceeding federal student loan limits often necessitates borrowing from private lenders. This can result in a substantially higher overall debt load due to the increased interest rates and fees associated with private loans. For example, a student might borrow $20,000 in federal loans at a fixed 5% interest rate, but then need an additional $10,000 from a private lender at a variable rate of 8%, significantly increasing their total interest payments over the life of the loans. The increased debt burden can delay major life milestones like homeownership, starting a family, or retirement planning. Furthermore, borrowers may struggle to manage their payments, potentially leading to delinquency and default, which has serious long-term financial and credit implications.

Growth in Student Loan Debt: A Visual Representation

Imagine a graph charting the growth of student loan debt over the past decade. The x-axis represents the years from 2013 to 2023, and the y-axis represents the total outstanding student loan debt in trillions of dollars. The line representing the total debt would show a consistent upward trend, starting at approximately $1 trillion in 2013 and climbing steadily to over $1.7 trillion by 2023 (these are approximate figures and would need to be verified with official data sources like the Federal Reserve or the Department of Education). This growth isn’t solely attributable to increased enrollment; the graph would also demonstrate periods of steeper increases correlating with periods when federal loan limits were either unchanged or only marginally increased, while tuition costs continued to rise. This visual representation would powerfully illustrate how loan limits, when not adjusted to keep pace with rising educational costs, contribute to the accelerating growth of student loan debt. For instance, a significant jump in the slope of the line might coincide with a year where tuition inflation outpaced any increases in federal loan limits. The visual would clearly show that loan limits act as a constraint, pushing students towards more expensive private loan options when the federal limits are insufficient.

Final Wrap-Up

Securing a higher education requires careful consideration of financial resources. By understanding the intricacies of federal student loan limits, prospective students can make informed decisions about their borrowing. This guide has illuminated the factors affecting eligibility, the historical context of loan limits, and the potential long-term implications of borrowing. Remember to thoroughly research all available options and consider the long-term impact on your financial well-being before taking on student loan debt.

Questions and Answers

What happens if I exceed my federal student loan limit?

Exceeding your federal loan limit necessitates exploring private loan options, which typically come with higher interest rates and less favorable repayment terms. This can significantly increase your overall debt burden.

Can I appeal a denied loan application?

Yes, you can usually appeal a denied loan application by providing additional documentation or addressing the reasons for denial. Contact your lender or the federal student aid office for guidance.

How does my credit score affect my loan eligibility?

While federal student loans don’t typically require a credit check for undergraduate students, a poor credit history can impact your ability to secure private loans or obtain favorable terms if you need to borrow beyond the federal limits.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans begin accruing interest immediately.