Navigating the complexities of higher education financing often leaves students and families grappling with the crucial question of affordability. Understanding the limits placed on federal student loans is paramount to making informed decisions about college funding. This exploration delves into the history, factors influencing, and impact of these limits, offering insights into alternative financing options and potential future reforms.

From the evolution of loan limits over the past two decades to the interplay of economic indicators and political considerations, we’ll examine how these factors shape access to higher education. We’ll also analyze the effects of these limits on various student demographics and explore alternative financing routes, providing a comprehensive understanding of the landscape of student loan funding.

History of Federal Student Loan Limits

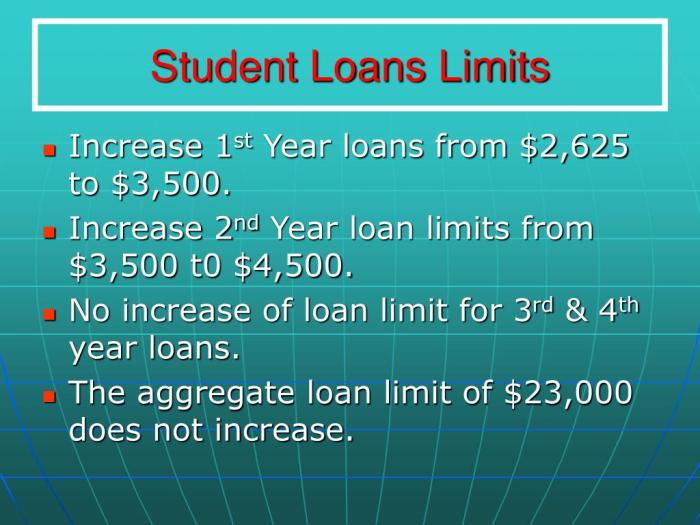

The maximum amounts students can borrow through federal student loan programs have undergone significant changes over the past two decades, reflecting evolving policy priorities and economic conditions. These changes have impacted student debt levels, access to higher education, and the overall financial health of borrowers. Understanding this evolution is crucial to analyzing the current student loan landscape and informing future policy decisions.

Federal student loan limits have been adjusted numerous times since the year 2000, driven by a combination of factors including rising tuition costs, changes in government spending priorities, and concerns about student debt burdens. Key legislation, such as the Higher Education Act reauthorizations, has played a pivotal role in shaping these limits, often accompanied by adjustments to eligibility criteria, such as changes in dependency status or the definition of a dependent student. These changes have had far-reaching effects on students’ ability to finance their education and their subsequent financial trajectories.

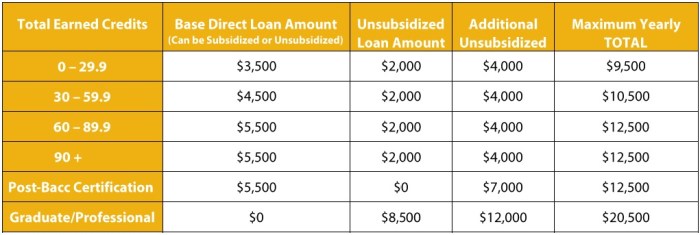

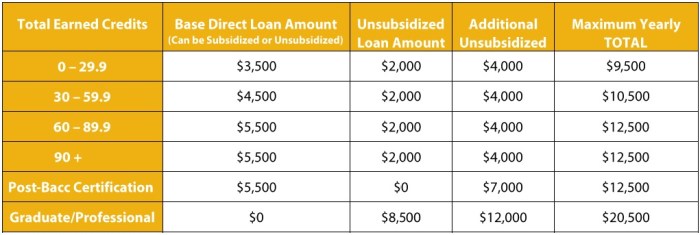

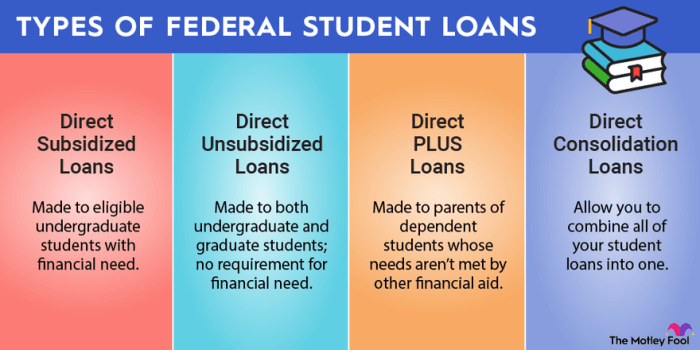

Undergraduate and Graduate Loan Limits Comparison

The federal government offers several loan programs, each with its own set of borrowing limits. Undergraduate students are typically eligible for subsidized and unsubsidized Stafford Loans, as well as PLUS Loans for parents. Graduate students have access to similar programs, but with higher borrowing limits reflecting the generally higher costs of graduate education. For example, the maximum annual loan amount for undergraduate Stafford loans has historically been lower than that for graduate Stafford loans. PLUS loans, available to both graduate and undergraduate students (through their parents), also have different borrowing limits depending on the student’s level of study and the school’s cost of attendance. The specific limits vary from year to year and are subject to change based on Congressional appropriations and recalculations of cost of attendance indexes.

Timeline of Significant Changes in Maximum Loan Amounts

A detailed timeline illustrating the evolution of federal student loan limits would highlight key legislative actions and their impact. While precise figures for every year are beyond the scope of this brief overview, it’s important to note that generally, loan limits have increased over time, often in response to rising tuition costs. However, this increase has not always kept pace with inflation or the growth in tuition, leading to concerns about the escalating burden of student debt. A thorough analysis would need to consult the Federal Student Aid website for precise yearly figures and associated legislation. The impact on student borrowing can be observed in the steady rise of student loan debt levels over the past two decades, which has become a significant national concern.

Factors Influencing Federal Student Loan Limits

Setting federal student loan limits is a complex process influenced by a variety of economic, political, and social factors. These limits directly impact student access to higher education and the overall financial health of the student loan system. Understanding these influencing factors is crucial to evaluating the effectiveness and fairness of the current system.

Economic Indicators Influencing Loan Limits

Several key economic indicators play a significant role in determining federal student loan limits. Inflation, for example, directly impacts the cost of education and the purchasing power of loan funds. High inflation necessitates higher loan limits to maintain the same level of affordability. Similarly, interest rates influence both the cost of borrowing for the government and the repayment burden for students. Rising interest rates might lead to a cautious approach to setting loan limits, potentially limiting the amount available to students. Economic growth also plays a role; strong economic growth might allow for more generous loan limits, while economic downturns could lead to stricter limits to control government spending and potential defaults. Finally, the overall unemployment rate is a factor; high unemployment rates might lead to concerns about student loan repayment, potentially influencing a more conservative approach to loan limits.

Political Considerations in Determining Loan Limits

Political considerations significantly shape the debate and decision-making process surrounding federal student loan limits. The political climate, including the prevailing ideologies of the governing party and the priorities of policymakers, heavily influences these limits. For example, a government prioritizing fiscal responsibility might favor lower loan limits to control government spending, while a government focused on expanding access to higher education might advocate for higher limits. Lobbying efforts by higher education institutions and student advocacy groups also exert considerable pressure on policymakers. Furthermore, the political discourse surrounding student debt and the affordability of higher education significantly influences public opinion and, consequently, the decisions made regarding loan limits. These political dynamics often lead to compromises and negotiations that shape the final loan limit figures.

Influence of Higher Education Costs on Loan Limits

The escalating cost of higher education is a major driver of the demand for and the setting of federal student loan limits. As tuition fees, room and board, and other educational expenses increase, students require larger loans to cover these costs. This rising demand for loans puts pressure on policymakers to adjust loan limits upwards to maintain access to higher education. However, the increase in loan limits needs to be carefully balanced against concerns about the sustainability of the student loan program and the potential for increased student debt. The relationship between rising tuition costs and loan limits is not always directly proportional; political and economic factors often mediate this relationship. A significant disparity between tuition increases and loan limit adjustments can create affordability challenges for students, leading to increased reliance on private loans or reduced access to higher education altogether.

Relationship Between Tuition Costs and Loan Limits Over Time

The following table illustrates a simplified example of the relationship between average tuition costs and loan limits over time. Note that this is a hypothetical example for illustrative purposes and does not represent actual historical data. Accurate data would require consultation of official government sources and would vary significantly based on institution type and program.

| Year | Average Tuition (USD) | Undergraduate Loan Limit (USD) | Graduate Loan Limit (USD) |

|---|---|---|---|

| 2010 | 7,000 | 5,500 | 10,000 |

| 2015 | 9,000 | 7,000 | 13,000 |

| 2020 | 12,000 | 9,000 | 16,000 |

| 2025 (Projected) | 15,000 | 11,000 | 19,000 |

Impact of Loan Limits on Student Borrowing

Federal student loan limits significantly influence student borrowing patterns and the overall affordability of higher education. The interplay between these limits and the rising costs of tuition and living expenses has created a complex landscape for students navigating the financial aspects of college. Understanding this impact requires examining both aggregate debt levels and the specific challenges faced by different student populations.

The relationship between loan limits and student debt is undeniable. Data from the Federal Reserve and the Department of Education consistently show a correlation between increasing loan limits and growing student loan debt. For example, the steady increase in maximum loan amounts over the past few decades has coincided with a dramatic rise in total student loan debt, reaching trillions of dollars in the United States. While this correlation doesn’t necessarily imply causation, it highlights the significant role loan limits play in shaping borrowing behavior. Higher limits naturally allow students to borrow more, potentially exacerbating debt accumulation if not managed carefully.

Student Affordability and Higher Education Access

Loan limits directly impact a student’s ability to afford higher education. When loan limits are insufficient to cover the total cost of attendance (tuition, fees, room, board, and other expenses), students are forced to make difficult choices. They may need to attend less expensive institutions, potentially compromising their academic aspirations. Alternatively, they may rely more heavily on other forms of financing, such as private loans which often carry higher interest rates and less favorable repayment terms. This situation disproportionately affects students from lower-income families who may have limited access to alternative funding sources. The gap between loan limits and the actual cost of education creates a significant barrier to access, particularly for those pursuing more expensive programs or attending private institutions.

Impact on Different Demographic Groups

The impact of loan limits varies considerably across different demographic groups. Students from lower-income families are particularly vulnerable, as they often have fewer financial resources to supplement their federal loans. This can restrict their college choices and potentially limit their career options after graduation. Similarly, students pursuing graduate or professional degrees, which generally have higher costs, face greater challenges due to the relatively lower loan limits available for graduate study compared to undergraduate education. For instance, a student aiming for a medical degree might find the loan limits insufficient to cover the extensive tuition and living expenses associated with such a program. This can lead to increased reliance on private loans or potentially deferring educational pursuits altogether. Differences in access to financial literacy resources and family support networks also exacerbate these disparities. Effective financial planning and guidance are crucial, but access to such resources often correlates with socioeconomic status, creating further inequities.

Alternatives to Federal Student Loans and Their Limits

Securing funding for higher education involves more than just federal student loans. A diverse range of alternative financing options exists, each with its own set of advantages and disadvantages. Understanding these alternatives is crucial for students to make informed decisions about how to finance their education and manage their debt responsibly. Careful consideration of interest rates, repayment terms, and eligibility criteria is essential before committing to any loan.

Private loans, scholarships, and grants represent significant alternatives to federal student loans. While federal loans offer benefits like income-driven repayment plans and potential loan forgiveness programs, private options often come with higher interest rates and less flexible repayment terms. Scholarships and grants, on the other hand, are generally need-based or merit-based and do not require repayment, making them highly desirable forms of funding.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. They often require a creditworthy co-signer, especially for students with limited or no credit history. Interest rates tend to be higher than federal loan rates and are variable, meaning they can fluctuate over the life of the loan. Repayment terms are typically fixed, but the length of the repayment period can impact the total interest paid. Eligibility criteria vary widely among lenders, often considering credit score, income, and debt-to-income ratio.

Scholarships and Grants

Scholarships and grants provide need-based or merit-based financial aid that does not need to be repaid. Scholarships are often awarded based on academic achievement, athletic ability, or other talents and skills. Grants are typically awarded based on financial need, as determined by the Free Application for Federal Student Aid (FAFSA). These funding sources can significantly reduce the reliance on loans, thereby minimizing overall debt. The eligibility requirements for scholarships and grants vary depending on the awarding institution or organization. Finding and securing these awards often requires diligent research and application.

Comparative Table of Financing Options

The following table summarizes the key differences between federal student loans and alternative financing options:

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Federal Student Loan | Generally lower than private loans; varies by loan type | Flexible repayment plans available (e.g., income-driven repayment); loan forgiveness programs may apply | US citizenship or eligible non-citizen status; enrollment in an eligible educational program |

| Private Student Loan | Generally higher than federal loans; often variable | Fixed repayment terms; less flexibility than federal loans | Good credit score (often requires a co-signer); income verification; debt-to-income ratio assessment |

| Scholarships | No repayment required | N/A | Academic achievement, athletic ability, demonstrated talent, specific criteria set by the awarding institution or organization |

| Grants | No repayment required | N/A | Demonstrated financial need (based on FAFSA); specific criteria set by the awarding institution or organization |

Potential Reforms and Future of Federal Student Loan Limits

The current system of federal student loan limits, while aiming to make higher education accessible, faces significant challenges in balancing affordability with responsible borrowing. Reforms are crucial to ensure the system remains sustainable and effectively serves students while mitigating the growing national student loan debt crisis. A multifaceted approach, considering both the immediate needs of borrowers and long-term systemic issues, is necessary to create a more equitable and efficient system.

The implications of altering federal student loan limits are far-reaching. Increasing limits could lead to higher borrowing and potentially exacerbate the debt problem, while decreasing limits might restrict access to higher education for some students. Finding the right balance requires careful consideration of economic factors, demographic trends, and the overall goal of promoting educational attainment without unduly burdening borrowers.

Income-Driven Repayment Reform

Income-driven repayment (IDR) plans are designed to make monthly payments more manageable for borrowers based on their income. However, current IDR plans often have complexities and shortcomings. Reforms could focus on simplifying the application process, streamlining eligibility requirements, and ensuring that borrowers are accurately informed about their repayment options. For example, a simplified, standardized IDR plan with clear and easily accessible information could reduce confusion and help borrowers make informed decisions. Furthermore, adjustments to the forgiveness provisions of IDR plans could offer more substantial debt relief to borrowers who make consistent payments for extended periods. This could incentivize responsible borrowing and reduce the overall burden of student loan debt.

Targeted Loan Limit Adjustments Based on Program and Field of Study

A potential reform involves tailoring loan limits to specific programs and fields of study. This could acknowledge the varying costs associated with different educational paths. For instance, programs with demonstrably higher costs, such as medical school or certain engineering programs, might justify higher loan limits. Conversely, programs with lower costs could have lower limits, encouraging more careful consideration of program selection and overall educational investment. However, this approach necessitates careful consideration to avoid unintended consequences, such as disproportionately affecting students from lower socioeconomic backgrounds who may be more likely to pursue less expensive programs. This strategy needs robust safeguards to prevent limiting access to high-demand fields crucial to the national economy.

Increased Transparency and Financial Literacy Initiatives

Improving transparency around borrowing and repayment options is critical. This involves strengthening financial literacy programs to help students understand the long-term implications of taking on student loan debt. The implementation of user-friendly online tools and resources, including personalized debt calculators and repayment plan simulators, could significantly improve borrowers’ understanding of their options. These tools could also help students make informed decisions about their educational path and borrowing strategy. Furthermore, mandating clear and concise disclosures of loan terms and conditions would empower students to make more informed choices and avoid unforeseen financial burdens. This comprehensive approach addresses the issue at its root, empowering future borrowers to make sound financial decisions.

Expanding Grant and Scholarship Programs

Expanding grant and scholarship programs can reduce reliance on loans. Increasing funding for federal grant programs, such as Pell Grants, could significantly reduce the amount of debt students need to borrow. Simultaneously, promoting and expanding merit-based and need-based scholarships can help students finance their education without incurring debt. For example, a national initiative to increase scholarship funding through private and public partnerships could make a substantial difference in reducing student debt. However, the effectiveness of this approach relies on increased funding and efficient allocation of resources to ensure maximum impact. Increased investment in grant programs and scholarships would directly address the root cause of student loan debt by decreasing the reliance on loans.

The Role of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans significantly alter how borrowers perceive the impact of federal student loan limits. While high loan limits might initially seem daunting, the availability of IDR plans can mitigate the perceived burden by adjusting monthly payments based on income and family size. This makes higher loan amounts more manageable for borrowers who anticipate lower earnings in the early stages of their careers. Understanding these plans is crucial for both borrowers and policymakers alike.

IDR plans offer a crucial safety net for borrowers who might otherwise struggle with repayment under standard repayment plans. These plans fundamentally change the relationship between loan limits and borrower affordability, potentially encouraging borrowers to take on larger loans knowing that their monthly payments will be adjusted to their financial capacity. However, it is important to note that while IDR plans ease short-term repayment pressures, they often extend the repayment period, potentially leading to higher total interest paid over the life of the loan.

Types of Income-Driven Repayment Plans

Several income-driven repayment plans are available to federal student loan borrowers. The specific details and eligibility requirements can vary, and borrowers should consult the Federal Student Aid website for the most up-to-date information. The choice of plan depends on individual circumstances and financial projections.

Income-Driven Repayment Plan Mechanics and Eligibility

Income-driven repayment plans calculate monthly payments based on a borrower’s discretionary income, which is typically calculated as adjusted gross income (AGI) minus 150% of the poverty guideline for the borrower’s family size and state of residence. The payment amount is capped at a percentage of the borrower’s discretionary income, and the repayment period is extended beyond the standard 10 years. This means lower monthly payments but a longer repayment term, potentially increasing the total interest paid.

Different plans use slightly different formulas and have varying eligibility requirements. For instance, some plans may require borrowers to have specific types of federal loans or to meet certain income thresholds. Generally, borrowers must demonstrate financial need and maintain consistent income documentation throughout the repayment period. Failure to do so can result in the plan being terminated, potentially leading to a significant increase in monthly payments. After a specific number of years of consistent payments (typically 20-25 years, depending on the plan), any remaining loan balance may be forgiven. However, this forgiven amount is typically considered taxable income. This tax implication is a crucial factor to consider when evaluating the long-term financial implications of choosing an IDR plan. Borrowers should carefully weigh the advantages of lower monthly payments against the potential for higher overall interest costs and eventual tax liability.

Visual Representation of Loan Limit Data

A clear visual representation of federal student loan limit changes over time is crucial for understanding trends and their potential impact on student borrowing. Such a visualization can highlight periods of significant increases or decreases, revealing patterns that might otherwise be obscured in tabular data. A well-designed graph allows for a quick and intuitive grasp of the historical context of loan limits.

The most effective visual would be a line graph, charting the maximum annual loan limits for both dependent and independent undergraduate students, as well as graduate students, over several decades. The horizontal axis (x-axis) would represent the academic year, starting from the earliest available data. The vertical axis (y-axis) would represent the loan limit amount, expressed in US dollars. Each type of student loan (dependent undergraduate, independent undergraduate, graduate) would be represented by a different colored line. Data points for each academic year would be clearly marked on the lines, and the lines themselves would be labeled clearly to avoid ambiguity.

Line Graph Details

The graph would clearly show the overall trend of loan limits over time. For example, periods of rapid increase might coincide with periods of rising tuition costs or changes in federal education policy. Conversely, periods of stagnation or even decrease in loan limits could reflect budget constraints or shifts in government priorities. The graph should be large enough to allow for easy readability, with clearly labeled axes and a legend explaining the different colored lines. Furthermore, the use of a consistent scale on the y-axis ensures accurate comparison between different loan limit categories and across different years. Adding vertical gridlines at five-year intervals would further enhance readability and aid in quick visual interpretation of long-term trends. Any significant policy changes impacting loan limits should be noted on the graph, perhaps using annotations or highlighted sections to draw attention to periods of particularly dramatic shifts.

Final Summary

The system of federal student loan limits is a dynamic interplay of economic realities, political decisions, and the ever-increasing costs of higher education. While these limits play a crucial role in managing student debt, understanding their impact and exploring alternative financing options are essential for navigating the complexities of college funding. Continued discussion and potential reforms are necessary to ensure equitable access to higher education for all.

Commonly Asked Questions

What happens if I exceed my federal student loan limit?

You may need to explore alternative financing options like private loans, scholarships, or grants to cover the remaining costs. Private loans often come with higher interest rates and less favorable repayment terms.

Can I borrow more than the limit under special circumstances?

While exceeding the federal loan limits is generally not possible, certain exceptional circumstances may be considered on a case-by-case basis. Contact your financial aid office to inquire about potential exceptions.

How are federal student loan limits adjusted over time?

Adjustments are typically influenced by factors such as inflation, changes in higher education costs, and government policy. The process often involves legislative action and consideration of economic indicators.

Are there any resources to help me understand my eligibility for federal student loans?

The Federal Student Aid website (studentaid.gov) provides comprehensive information on eligibility requirements, loan limits, and repayment plans. Your college’s financial aid office can also offer personalized guidance.