Navigating the complex world of student loans can feel overwhelming. Understanding the various lenders, loan types, and repayment options is crucial for responsible borrowing. This guide provides a clear and concise overview of student loan companies, empowering students to make informed decisions about their financial future. We’ll explore the differences between government and private loans, discuss key terms and conditions, and offer practical strategies for managing student loan debt effectively.

From identifying reputable lenders to understanding repayment plans and avoiding potential pitfalls, this resource aims to equip students with the knowledge they need to confidently manage their student loan journey. We’ll delve into the specifics of interest rates, fees, and eligibility requirements, providing a comprehensive understanding of the entire process.

Types of Student Loan Companies

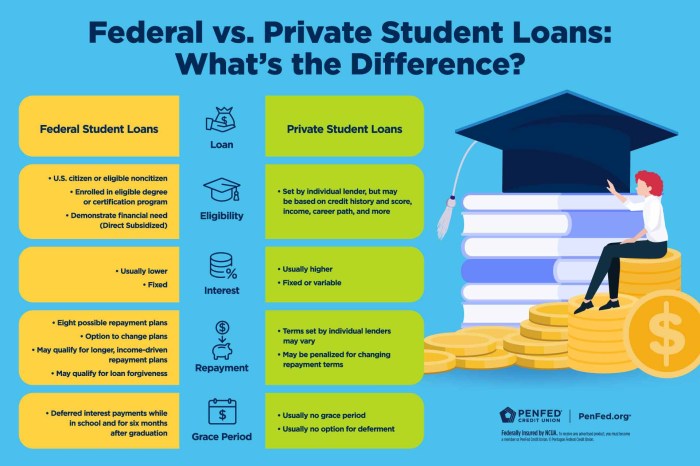

Navigating the world of student loans can be complex, largely due to the diverse range of lenders available. Understanding the different types of student loan companies and their offerings is crucial for making informed borrowing decisions. This section will clarify the distinctions between government and private lenders, highlighting their services, interest rates, and repayment options.

Government Student Loan Companies

Government student loans, primarily offered in the United States through the federal government, are a significant source of funding for higher education. These loans are characterized by their generally lower interest rates and more flexible repayment options compared to private loans. The federal government manages these loans directly or through government-sponsored agencies. Services offered include various loan programs catering to different needs and income levels, as well as income-driven repayment plans that adjust monthly payments based on your income and family size. These plans can significantly reduce monthly burdens and potentially lead to loan forgiveness after a specified period. Additionally, the government offers robust borrower protections and resources, including deferment and forbearance options during times of financial hardship.

Private Student Loan Companies

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike government loans, these loans are subject to credit checks and approval processes, meaning eligibility depends on creditworthiness and co-signer availability. Interest rates on private loans are generally higher than those on federal loans and are often variable, meaning they can fluctuate over the life of the loan. Repayment options are typically less flexible than those offered on federal loans, with fewer income-driven repayment plans available. While private loans can offer a broader range of loan amounts, they often come with less borrower protection and fewer options for hardship relief. Private lenders may also offer services such as loan consolidation to simplify repayment.

Comparison of Interest Rates and Repayment Options

A key difference between government and private student loans lies in their interest rates and repayment options. Government loans typically have significantly lower, fixed interest rates, offering greater predictability and potentially lower overall borrowing costs. They also provide various repayment options, including income-driven repayment plans designed to make monthly payments more manageable. Private loans, conversely, tend to have higher, often variable interest rates, resulting in less predictable monthly payments and potentially higher overall costs. Repayment options are generally less flexible, with fewer income-driven plans available. The choice between government and private loans significantly impacts the long-term financial implications of borrowing for education.

Summary Table of Student Loan Companies

| Company Type | Lender Name Examples | Interest Rate Range (Approximate) | Repayment Options |

|---|---|---|---|

| Government | Federal Direct Loan Program (US), Student Loan Repayment Program (SLRP) | Variable, depending on loan type and interest rate set by the government; generally lower than private loans. | Standard, graduated, extended, income-driven repayment (IBR, PAYE, REPAYE, ICR) |

| Private | Sallie Mae, Discover Student Loans, Citizens Bank, Wells Fargo | Variable, depending on credit score and market conditions; generally higher than government loans. | Standard, graduated, fixed payments; fewer income-driven options. |

Finding and Evaluating Student Loan Companies

Securing student loans is a crucial step for many pursuing higher education. However, navigating the numerous lenders and loan options can be overwhelming. Understanding how to effectively research and compare lenders is essential to finding the best financial fit for your individual circumstances. This section provides a structured approach to help you make informed decisions about your student loan financing.

Finding a suitable student loan provider involves a systematic approach combining online research, comparison tools, and direct communication with lenders. This process allows you to identify loans with terms that align with your financial goals and repayment capabilities.

Steps to Research and Identify Suitable Student Loan Providers

A thorough search for student loan providers should involve several key steps to ensure you’re considering a range of options and comparing them fairly.

- Start with Federal Loan Options: Explore the federal student loan programs offered through the government. These often have more favorable interest rates and repayment plans than private loans.

- Utilize Online Comparison Tools: Many websites provide tools to compare student loan interest rates, fees, and repayment terms from different lenders. These tools can significantly simplify the research process.

- Check Lender Reviews and Ratings: Review independent ratings and customer reviews of potential lenders to assess their reputation and customer service. Sites like the Better Business Bureau can be helpful resources.

- Visit Lender Websites Directly: Once you’ve identified potential lenders, visit their websites to review loan details, eligibility requirements, and application processes. Look for transparency in their terms and conditions.

- Contact Lenders Directly: Don’t hesitate to contact lenders directly with questions. This allows you to clarify any uncertainties and get personalized information about their loan programs.

Key Factors to Consider When Comparing Loan Options

Comparing student loan options requires careful attention to several critical factors that can significantly impact your overall borrowing cost and repayment experience.

- Interest Rates: The interest rate determines the cost of borrowing. Lower interest rates translate to lower overall borrowing costs. Consider both fixed and variable interest rates and their potential implications.

- Fees: Many lenders charge various fees, such as origination fees, late payment fees, and prepayment penalties. These fees can add to the overall cost of the loan. Compare the total cost of the loan, including fees, when making your decision.

- Repayment Terms: The repayment term affects your monthly payments and the total interest paid over the life of the loan. Longer repayment terms result in lower monthly payments but higher total interest. Shorter terms mean higher monthly payments but less interest paid overall.

- Deferment and Forbearance Options: These options allow temporary pauses or reductions in your monthly payments during periods of financial hardship. Understand the availability and terms of these options before committing to a loan.

- Grace Period: This is the period after graduation before you begin making loan repayments. A longer grace period provides more time to find employment and adjust to repayment responsibilities.

Checklist of Questions to Ask Potential Lenders

Before accepting a student loan, it’s crucial to ask lenders specific questions to ensure you fully understand the terms and conditions. This proactive approach helps prevent future misunderstandings and financial difficulties.

- What is the annual percentage rate (APR) of the loan, including all fees?

- What are the repayment terms and options available?

- What are the fees associated with the loan (origination, late payment, prepayment penalties)?

- What are the options for deferment or forbearance if I experience financial hardship?

- What is the length of the grace period before repayment begins?

- What is the lender’s customer service policy and how can I contact them with questions or concerns?

- What is the lender’s complaint resolution process?

- What are the consequences of defaulting on the loan?

- What is the lender’s history and reputation?

- Are there any hidden costs or terms I should be aware of?

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a solid understanding of the terminology and conditions involved. This section clarifies key terms and explains different repayment options to help you make informed decisions about your student loan debt. Understanding these aspects is crucial for responsible loan management and avoiding potential financial difficulties.

Key Student Loan Terms

Several key terms define the structure and implications of your student loan. Understanding these terms is essential for making informed decisions and managing your debt effectively.

- Interest Rate: This is the percentage of your loan’s principal that you’ll pay as interest over time. A higher interest rate means you’ll pay more in total over the life of the loan. For example, a 5% interest rate on a $10,000 loan will result in a significantly lower total repayment than a 10% interest rate on the same loan.

- Principal: This is the original amount of money you borrowed. Your monthly payments go towards both paying down the principal and covering the interest accrued.

- Amortization: This is the process of gradually paying off a loan over time through regular payments. Each payment typically covers a portion of the principal and the accrued interest.

- Deferment: This allows you to temporarily postpone your loan payments, usually due to specific circumstances like returning to school or experiencing unemployment. Interest may or may not accrue during a deferment period, depending on the loan type.

- Forbearance: Similar to deferment, this allows for temporary suspension of payments. However, forbearance is typically granted for reasons of financial hardship, and interest usually accrues during this period.

- Default: This occurs when you fail to make your loan payments according to the agreed-upon terms. Default can have serious consequences, including damage to your credit score, wage garnishment, and potential legal action.

Student Loan Repayment Plans

Several repayment plans cater to different financial situations and allow borrowers to choose an option that best suits their needs. The choice of repayment plan significantly impacts the total amount paid and the duration of repayment.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to other plans.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be helpful in the early years after graduation but may lead to higher payments later on.

- Income-Driven Repayment Plans (IDR): These plans base your monthly payment on your income and family size. They typically offer lower monthly payments but may extend the repayment period significantly, potentially resulting in higher total interest paid over the life of the loan. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Calculating Monthly Payments

The exact formula for calculating monthly payments varies slightly depending on the repayment plan and whether interest is compounded monthly or annually. However, a common approximation uses the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Total Number of Payments (Loan Term in Years * 12)

For example, let’s say you have a $20,000 loan with a 6% annual interest rate and a 10-year repayment term.

i = 0.06 / 12 = 0.005

n = 10 * 12 = 120

M = 20000 [ 0.005 (1 + 0.005)^120 ] / [ (1 + 0.005)^120 – 1] ≈ $222.04

This calculation provides an approximate monthly payment. Actual payments may vary slightly depending on the specific loan terms and the repayment plan chosen. It is always recommended to use a loan calculator provided by your lender for precise figures.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and consistent effort. Understanding repayment strategies, budgeting effectively, and recognizing the potential consequences of default are crucial for long-term financial well-being. This section provides practical tips and strategies to help manage and reduce your student loan debt.

Practical Tips for Managing and Reducing Student Loan Debt

Effective student loan management involves a multi-pronged approach. Prioritizing payments, exploring repayment options, and maintaining open communication with your lenders are key components. Consider consolidating multiple loans into a single payment, which can simplify the process and potentially lower your interest rate. Additionally, explore income-driven repayment plans if your current financial situation makes payments difficult. These plans adjust your monthly payment based on your income and family size. Finally, remember that consistent, on-time payments build a positive credit history, which can be beneficial in the future.

Strategies for Budgeting and Prioritizing Loan Payments

Creating a realistic budget is fundamental to successful loan repayment. This involves tracking your income and expenses to identify areas where you can cut back and allocate more funds towards your loans. Prioritize your loan payments alongside essential expenses like housing, food, and transportation. Consider using budgeting apps or spreadsheets to monitor your progress and stay organized. Automating your loan payments can help ensure consistent on-time payments, avoiding late fees and negative impacts on your credit score. Regularly reviewing your budget allows for adjustments as your income or expenses change.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe financial repercussions. It can result in damaged credit scores, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is automatically deducted to repay the debt, is a possibility. The government can also seize tax refunds and other assets to recover the outstanding loan amount. Furthermore, defaulting can negatively impact your ability to secure employment in certain fields, particularly those requiring security clearances or professional licenses. In some cases, default may lead to legal action.

Sample Budget Allocating Funds for Student Loan Payments

A well-structured budget is essential for managing student loan debt effectively. The following example illustrates how to allocate funds, keeping in mind that individual circumstances vary greatly. This is a sample and needs adjustment based on your unique financial situation.

- Income: $3,000 per month (after taxes)

- Essential Expenses:

- Rent/Mortgage: $1,000

- Utilities: $200

- Groceries: $300

- Transportation: $200

- Healthcare: $100

- Debt Payments:

- Student Loans: $500

- Credit Card Payments (if any): $100

- Savings and Other Expenses:

- Emergency Fund: $100

- Entertainment/Personal Spending: $500

Note: This is a simplified example. Adjust categories and amounts to reflect your individual income and expenses. Consider using budgeting tools for a more comprehensive approach.

Resources for Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources are available to provide guidance and support throughout the borrowing and repayment process. These resources offer a range of services, from financial counseling and debt management tools to educational materials and advocacy. Utilizing these resources can significantly improve your understanding of your loan terms, assist in developing a repayment strategy, and help you avoid potential pitfalls.

Understanding the available resources is crucial for effective student loan management. By leveraging the expertise and tools offered by these organizations, borrowers can make informed decisions, optimize their repayment plans, and ultimately achieve financial stability.

Reputable Resources for Student Loan Borrowers

The following table lists several reputable websites and organizations that offer valuable resources and support to student loan borrowers. These organizations provide a variety of services designed to help borrowers manage their debt effectively.

| Resource Name | Website URL | Type of Service | Description of Service |

|---|---|---|---|

| National Foundation for Credit Counseling (NFCC) | nfcc.org | Financial Counseling, Debt Management Plans | Offers certified credit counselors who can provide personalized guidance on managing student loan debt, including budgeting, debt consolidation, and exploring repayment options. They can also help borrowers develop and implement a comprehensive debt management plan. |

| StudentAid.gov (Federal Student Aid) | studentaid.gov | Information, Repayment Plans, Loan Management Tools | The official website for the U.S. Department of Education’s Federal Student Aid program. Provides comprehensive information on federal student loans, including repayment plans (Standard, Graduated, Extended, Income-Driven), loan forgiveness programs, and online tools for managing your loans. |

| The Consumer Financial Protection Bureau (CFPB) | consumerfinance.gov | Consumer Protection, Information, Resources | Provides resources and information to help consumers understand their rights and avoid predatory lending practices. They offer educational materials on student loans and tools to compare loan options. |

| National Consumer Law Center (NCLC) | consumerlaw.org | Legal Assistance, Advocacy | A non-profit organization that advocates for consumer rights and provides legal assistance to low- and moderate-income consumers facing financial difficulties, including student loan debt issues. They offer educational materials and legal resources. |

Illustrative Example: A Student’s Loan Journey

Sarah, a bright and ambitious student, embarked on her higher education journey with a clear goal: a degree in engineering. However, the cost of tuition was a significant hurdle. Her family’s financial resources were limited, making student loans a necessary part of her plan. This narrative follows Sarah’s experience navigating the complexities of student loans, from application to repayment.

Sarah began her research by exploring different types of student loans available. She learned about federal loans, known for their lower interest rates and flexible repayment options, and private loans, often offering higher loan amounts but potentially with less favorable terms. She carefully weighed the pros and cons of each, considering her financial situation and long-term goals.

Federal Loan Application and Approval

Sarah decided to apply for federal student loans first, understanding the government’s support system and the potential benefits. The application process, while initially daunting, proved manageable with online resources and guidance from her university’s financial aid office. She meticulously completed the Free Application for Federal Student Aid (FAFSA), providing accurate information about her family’s income and assets. After a few weeks, she received notification of her loan approval, specifying the amount she was eligible for and the repayment terms. This initial step instilled confidence and provided a solid financial foundation for her education.

Managing Loan Payments During and After College

During her college years, Sarah diligently tracked her loan balances and interest accrual. She took advantage of deferment options during summer breaks, minimizing interest accumulation while she wasn’t actively studying. Upon graduation, Sarah immediately began exploring her repayment options. She chose an income-driven repayment plan, aligning her monthly payments with her starting salary as an engineer. This allowed for manageable payments while she built her career and financial stability. She also actively researched and utilized resources available to borrowers, including workshops and online tools, to stay informed and manage her debt effectively. She understood the importance of responsible borrowing and repayment, viewing her student loans as an investment in her future.

Unexpected Challenges and Problem-Solving

Sarah encountered unexpected challenges along the way. A period of unemployment due to an industry downturn temporarily impacted her ability to make her scheduled payments. However, she proactively contacted her loan servicer to explore options, such as forbearance or a temporary modification to her repayment plan. Open communication and proactive planning prevented her debt from spiraling out of control. Through careful budgeting and disciplined financial management, Sarah successfully navigated this difficult period and resumed her regular payments once she secured a new position.

Wrap-Up

Securing a student loan is a significant financial commitment. By carefully researching lenders, understanding loan terms, and employing effective debt management strategies, students can minimize financial strain and pave the way for a successful future. Remember, proactive planning and informed decision-making are key to navigating the complexities of student loan repayment and achieving long-term financial well-being. This guide serves as a starting point for a journey toward responsible borrowing and financial literacy.

Essential FAQs

What is the difference between a subsidized and unsubsidized federal loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payments, but it may involve losing federal loan benefits. Carefully weigh the pros and cons before refinancing.

What happens if I default on my student loans?

Defaulting on student loans can lead to wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain future loans or credit.

How can I find a reputable student loan counselor?

Look for counselors certified by the National Foundation for Credit Counseling (NFCC) or other reputable organizations. Be wary of counselors who charge upfront fees.