Navigating the complexities of student loan repayment can be daunting. Understanding your repayment options and their long-term financial implications is crucial for responsible financial planning. This exploration of the Student Loan Hero loan calculator aims to demystify the process, providing a clear understanding of its functionality and the valuable insights it offers.

We’ll delve into the core features of the calculator, comparing its capabilities to other available tools. Through illustrative scenarios, we will demonstrate how different repayment choices can significantly impact your overall financial well-being. By examining visual representations of loan repayment, we’ll further illuminate the long-term costs and benefits of various strategies.

Understanding Student Loan Calculator Functionality

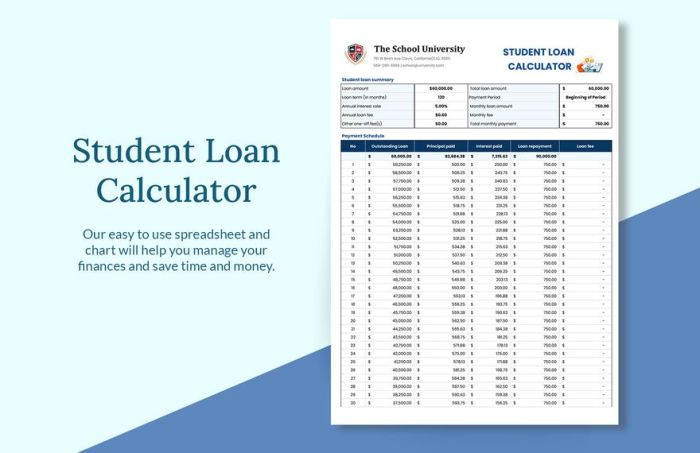

Student loan calculators are invaluable tools for prospective and current borrowers to estimate their monthly payments, total interest paid, and overall loan repayment timelines. Understanding how these calculators work empowers borrowers to make informed financial decisions. This section will detail the core components and functionality of a typical student loan calculator.

A student loan calculator simplifies the complex process of calculating loan repayment by taking various input variables and applying standard amortization formulas. This allows users to quickly explore different repayment scenarios and understand the long-term financial implications of their borrowing decisions.

Core Components of a Student Loan Calculator

A student loan calculator typically comprises input fields for key loan parameters and a results section displaying calculated repayment information. The input fields allow users to customize their scenarios, while the results section provides a clear summary of their potential repayment obligations. Accuracy depends on the calculator’s underlying formulas and the user’s accurate input.

Input Variables

The accuracy of a student loan calculator’s output relies heavily on the accuracy of the input data provided by the user. Common input variables include:

- Loan Amount: The principal amount borrowed for education expenses.

- Interest Rate: The annual percentage rate (APR) charged on the loan. This rate can be fixed or variable, impacting the total cost of the loan.

- Repayment Period (Loan Term): The length of time, typically expressed in years or months, over which the loan will be repaid.

- Repayment Plan Type (Optional): Some calculators allow users to select a specific repayment plan (e.g., standard, graduated, income-driven), which influences the monthly payment amount and overall repayment timeline.

- Additional Payments (Optional): Some calculators allow users to input additional payments made towards the principal, enabling them to see how this impacts the overall repayment time and interest paid.

It’s crucial for users to input accurate information, as even small discrepancies in these variables can significantly affect the calculated results. For instance, a slight increase in the interest rate can lead to a substantial increase in the total interest paid over the life of the loan.

User Interaction Process

The typical user interaction with a student loan calculator follows a straightforward process:

- Inputting Loan Details: The user enters the loan amount, interest rate, and repayment period into the designated fields.

- Selecting Repayment Plan (Optional): If the calculator offers different repayment plan options, the user selects the relevant plan.

- Adding Additional Payments (Optional): The user can optionally input any planned additional payments.

- Calculating Results: The user initiates the calculation process, usually by clicking a “Calculate” or “Show Results” button.

- Reviewing Results: The calculator displays the results, typically including the estimated monthly payment, total interest paid, and total amount repaid. This allows the user to assess the financial implications of their loan.

The ease of use and clarity of the results presentation are key features of a well-designed student loan calculator. A user-friendly interface ensures that even those with limited financial literacy can easily understand and utilize the tool.

Sample User Interface

The following table illustrates a sample user interface design for a student loan calculator using HTML table tags. This design prioritizes clarity and ease of use, ensuring a seamless user experience.

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Repayment Plan |

|---|---|---|---|

|

Standard Graduated Income-Driven |

|||

|

|

|||

This table provides input fields for the key loan parameters and a button to trigger the calculation. The results section would dynamically update to display the calculated monthly payment, total interest, and total repayment amount.

Repayment Scenarios and Their Implications

Understanding the various repayment scenarios for student loans is crucial for effective financial planning. Different loan amounts, interest rates, and repayment periods significantly impact the total cost and long-term financial health. The following scenarios illustrate the potential consequences of various choices.

Three Student Loan Repayment Scenarios

The table below presents three distinct student loan repayment scenarios, highlighting the differences in loan amount, interest rate, repayment period, and total interest paid. These examples assume a standard repayment plan, without considering income-driven repayment options initially.

| Loan Amount | Interest Rate | Repayment Period (Years) | Total Interest Paid |

|---|---|---|---|

| $20,000 | 7% | 10 | $7,966 (Approximate) |

| $50,000 | 5% | 15 | $22,870 (Approximate) |

| $100,000 | 9% | 20 | $146,600 (Approximate) |

Scenario 1: Moderate Loan, Moderate Interest, Moderate Repayment

This scenario illustrates a relatively manageable loan with a $20,000 principal, a 7% interest rate, and a 10-year repayment period. The total interest paid is approximately $7,966. This scenario represents a common situation for many students and demonstrates that even with moderate loan amounts, interest can accumulate significantly over time. Careful budgeting and prompt repayment are essential to minimize the overall cost.

Scenario 2: Larger Loan, Lower Interest, Longer Repayment

This scenario features a larger loan amount ($50,000) with a lower interest rate (5%) and a longer repayment period (15 years). While the interest rate is lower, the longer repayment period results in a substantial total interest paid, approximately $22,870. This highlights the trade-off between lower monthly payments and higher overall interest costs. Careful consideration of the long-term implications is crucial. For example, this scenario might reflect a student pursuing a higher-earning degree, accepting a longer repayment period to manage monthly expenses.

Scenario 3: High Loan Amount, High Interest, Long Repayment

This scenario represents a high-risk situation with a substantial loan amount ($100,000), a high interest rate (9%), and a long repayment period (20 years). The total interest paid is significantly higher, approximately $146,600. This scenario demonstrates the potential for overwhelming debt if not managed carefully. This could represent a student pursuing a more expensive degree or one who took out additional loans for living expenses. The long-term financial implications are severe, potentially delaying major life milestones like homeownership or retirement.

Impact of Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on income and family size. While monthly payments are lower, the overall repayment period is typically longer, leading to higher total interest paid compared to standard repayment plans. For scenarios 1, 2, and 3, utilizing an income-driven plan would likely reduce monthly payments but increase the total interest paid over the life of the loan. This trade-off should be carefully considered based on individual financial circumstances. For example, in Scenario 3, an income-driven plan might provide immediate relief but significantly increase the long-term debt burden.

Exploring Additional Features and Resources

Student Loan Hero’s loan calculator already provides valuable insights into student loan repayment. However, expanding its functionality with additional features could significantly enhance its user experience and provide a more comprehensive financial planning tool. This section explores potential additions and their implications, focusing on how these features could improve the user’s journey towards financial wellness.

Integrating additional features requires careful consideration of both benefits and limitations. Adding too many features might overwhelm users, while insufficient features might limit the calculator’s usefulness. The goal is to strike a balance, offering powerful tools without sacrificing ease of use. This involves thoughtful design and intuitive user interfaces.

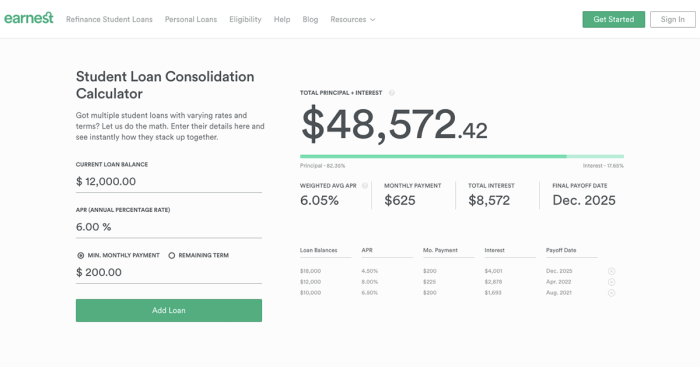

Loan Consolidation Options

Student Loan Hero could incorporate a loan consolidation feature, allowing users to simulate the effects of combining multiple loans into a single payment. This would involve input fields for the interest rates and balances of each individual loan, and the calculator would then project the new monthly payment, total interest paid, and overall repayment timeline under various consolidation scenarios. This feature would be particularly beneficial for users with multiple loans from different lenders, offering a clear comparison of their current repayment situation versus a consolidated one. A limitation is the complexity of accurately reflecting all potential consolidation scenarios, as individual lender policies and program specifics can vary widely. The calculator would need to include clear disclaimers acknowledging this limitation and encouraging users to consult with a financial advisor before making any decisions.

Budgeting Tools and Debt Management Strategies

Incorporating budgeting tools and debt management strategies would significantly enhance the calculator’s value. This could include a simple budgeting tool allowing users to input their income and expenses, showing how their student loan payments fit into their overall financial picture. Further, integrating various debt management strategies, such as the debt snowball or debt avalanche methods, would allow users to explore different approaches to paying down their debt and see their projected timelines under each strategy. This would empower users to make informed decisions about their debt repayment approach. A limitation is the potential for oversimplification. Personal finance is complex, and a simplified budgeting tool might not capture the nuances of individual financial situations. Clear disclaimers emphasizing this limitation would be essential.

Integration with Other Financial Services and Educational Resources

Student Loan Hero could enhance its platform by integrating with other financial services and educational resources. For example, the calculator could link to external resources offering financial literacy education, budgeting workshops, or credit counseling services. Integration with financial institutions could allow users to directly import their loan information, streamlining the input process and improving accuracy. This integration could also allow for the display of personalized recommendations based on the user’s financial situation and loan profile, such as connecting users with relevant repayment assistance programs or refinancing options. A limitation is data privacy and security; robust measures would need to be in place to protect user data and ensure compliance with relevant regulations. Furthermore, successful integration requires careful selection of compatible and reputable partners. For example, integration with a well-established credit counseling agency would enhance user trust and provide valuable resources.

Epilogue

Student Loan Hero’s loan calculator emerges as a powerful tool for navigating the often-overwhelming world of student loan repayment. By providing users with clear, comprehensive data and insightful visualizations, the calculator empowers informed decision-making. Understanding the impact of different repayment plans and interest rates is key to achieving long-term financial stability, and Student Loan Hero provides the necessary resources to make that happen.

FAQ Summary

What types of student loans does the Student Loan Hero calculator handle?

It typically handles federal and private student loans, allowing you to input various loan details for accurate calculations.

Can I adjust repayment plan parameters within the calculator?

Yes, many calculators allow for adjustments to repayment plans, such as standard, extended, or income-driven repayment, to see how they impact your total cost.

Is my data secure when using the Student Loan Hero calculator?

Reputable calculators prioritize data security using encryption and secure protocols. Always check the site’s privacy policy for specifics.

What if I have multiple student loans with different interest rates?

Most calculators can handle multiple loans; you’ll need to input the details of each individual loan for an accurate calculation.