Navigating the complexities of higher education often requires financial assistance beyond tuition. Securing a loan for student living expenses can significantly ease the burden, but understanding the various options and potential implications is crucial. This guide explores different loan types, application processes, debt management strategies, and alternative financing solutions to help students make informed decisions about their financial future.

From government-backed loans offering lower interest rates to private options with varying terms, the landscape of student living expense loans can be overwhelming. We’ll dissect the intricacies of each, highlighting key differences in eligibility requirements, repayment plans, and associated risks. We’ll also examine effective budgeting techniques and explore alternative funding sources to minimize reliance on loans.

Types of Student Living Expense Loans

Securing funding for student living expenses can significantly impact a student’s ability to focus on their studies. Understanding the different loan options available, their eligibility criteria, and associated costs is crucial for making an informed decision. This section Artikels various loan types, categorized by lender, to help you navigate this process.

Student Loan Types by Lender and Characteristics

Choosing the right student loan depends heavily on your individual financial situation and creditworthiness. The following table summarizes key features of different loan types. Remember that specific terms and conditions can vary between lenders, so always check directly with the institution for the most up-to-date information.

| Loan Type | Lender Type | Interest Rate Information | Repayment Options |

|---|---|---|---|

| Federal Subsidized Loan | Government (e.g., US Department of Education) | Fixed interest rate; typically lower than private loans. The interest rate is set annually. | Deferred payment during studies; standard repayment plans (10-20 years) available after graduation; income-driven repayment options may be available. |

| Federal Unsubsidized Loan | Government (e.g., US Department of Education) | Fixed interest rate; slightly higher than subsidized loans. Interest accrues during studies. | Deferred payment during studies; standard repayment plans (10-20 years) available after graduation; income-driven repayment options may be available. |

| Private Student Loan | Banks, Credit Unions, and other private lenders | Variable or fixed interest rates; generally higher than federal loans. Rates vary depending on creditworthiness. | Various repayment options; some may offer deferment or forbearance during financial hardship. |

| Credit Union Student Loan | Credit Unions | Potentially lower interest rates than some private banks, often with member benefits. Rates and terms depend on the specific credit union. | Repayment plans vary by credit union, but generally offer flexible options. |

Eligibility Criteria for Student Living Expense Loans

Eligibility requirements for student loans vary depending on the lender and loan type. Common factors include credit history, income verification, and residency status.

Federal student loans generally have less stringent credit score requirements than private loans. For federal loans, demonstrating financial need might be a factor in determining eligibility and loan amount. Income verification is typically required for both federal and private loans to assess repayment ability. Residency status is a crucial factor for federal loans, as they are generally only available to US citizens or eligible non-citizens. Private lenders may have less restrictive residency requirements but might still require verification of identity and legal residency.

Interest Rates and Fees: A Comparison

Interest rates and fees significantly impact the total cost of a student loan. Federal student loans usually offer lower interest rates than private loans. However, private loans might offer more flexible repayment options. Fees can include origination fees (charged by the lender), late payment fees, and prepayment penalties (in some cases). It’s essential to compare the annual percentage rate (APR) across different loan options to understand the true cost of borrowing. For example, a loan with a lower interest rate but higher fees might end up being more expensive than a loan with a slightly higher interest rate but lower fees. Careful calculation of total repayment costs, considering both interest and fees, is crucial before selecting a loan.

Application Process and Requirements

Securing a student living expense loan involves a straightforward process, but careful preparation is key to a smooth application. Understanding the requirements and gathering necessary documentation beforehand will significantly expedite the approval process. This section details the typical steps and documents needed for a successful application.

The application process for a student living expense loan generally involves several key steps. Each lender may have slight variations, but the core elements remain consistent. Thorough preparation and accurate documentation are crucial for a timely and successful outcome.

Application Steps

The application process typically unfolds in a sequential manner. Following these steps carefully will help ensure a complete and accurate application.

- Pre-qualification: Many lenders offer pre-qualification tools to estimate your eligibility and potential loan amount before submitting a formal application. This helps you understand your borrowing power and plan accordingly.

- Complete the Application Form: This usually involves providing personal details, educational information, and financial information. Accuracy is crucial at this stage.

- Gather Required Documents: Collect all necessary documentation, such as proof of enrollment, income statements, and bank statements. Having these readily available saves time and prevents delays.

- Submit the Application: Submit your completed application form and all supporting documents to the lender. This can be done online, by mail, or in person, depending on the lender’s procedures.

- Loan Review and Approval: The lender will review your application and supporting documentation. This process may take several days or weeks.

- Loan Disbursement: Once approved, the loan funds will be disbursed according to the lender’s terms and conditions, often directly to the student’s account or to cover specific expenses.

Required Documents

Lenders require specific documentation to verify your identity, enrollment, and financial situation. Providing complete and accurate documentation is essential for a successful application.

- Proof of Enrollment: This typically includes an acceptance letter from your educational institution or a current enrollment verification.

- Government-Issued Photo Identification: A valid driver’s license, passport, or other government-issued photo ID is required for verification purposes.

- Income Statements (if applicable): If you or your co-signer have income, lenders will require proof of income to assess your repayment ability. This could be pay stubs, tax returns, or bank statements.

- Bank Statements: Bank statements are used to verify your financial history and assess your ability to manage finances.

- Co-signer Information (if applicable): If a co-signer is required, they will need to provide similar documentation to the applicant.

Sample Loan Application Form

The following is a sample loan application form. Note that actual forms may vary depending on the lender.

| Field | Description |

|---|---|

| Applicant Name | Full legal name of the applicant |

| Date of Birth | Applicant’s date of birth |

| Social Security Number | Applicant’s social security number |

| Address | Applicant’s current mailing address |

| Phone Number | Applicant’s contact phone number |

| Email Address | Applicant’s email address |

| Institution Name | Name of educational institution |

| Program of Study | Applicant’s major or area of study |

| Expected Graduation Date | Anticipated date of graduation |

| Loan Amount Requested | The amount of money the applicant is requesting |

| Purpose of Loan | How the applicant intends to use the loan funds (living expenses) |

| Annual Income | Applicant’s annual gross income |

| Monthly Expenses | Applicant’s approximate monthly expenses |

| Bank Name | Name of applicant’s primary bank |

| Account Number | Applicant’s bank account number |

| Co-signer Information (if applicable) | Similar fields as above for co-signer |

Impact on Future Finances

Taking out a student loan for living expenses can significantly impact your financial future, both positively and negatively. Understanding the potential long-term effects is crucial for making informed borrowing decisions. Careful planning and responsible management are essential to mitigate potential risks and maximize the benefits of higher education.

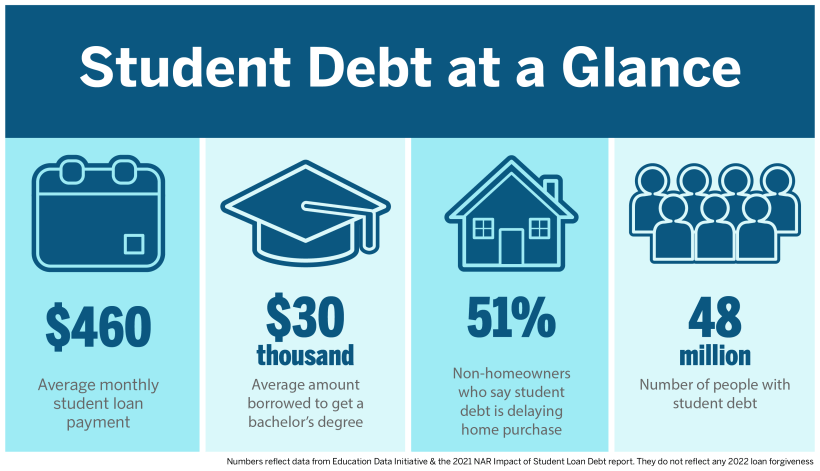

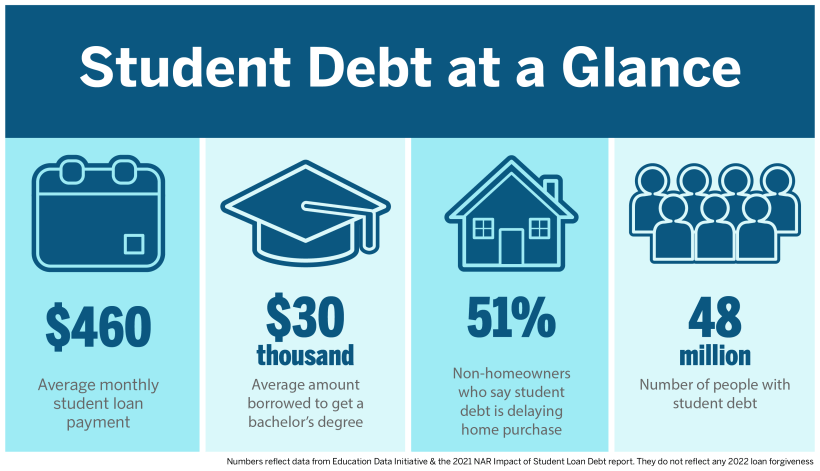

The primary concern is the accumulation of debt. Student loan repayments, often stretching over several years, can substantially reduce disposable income, affecting your ability to save, invest, and achieve other financial goals. The total cost of the loan, including interest, will be significantly higher than the initial loan amount. This increased cost directly correlates with the loan amount and the interest rate applied.

Projected Debt Accumulation and Repayment Schedules

The following table illustrates the potential impact of different loan amounts and interest rates on total debt and repayment schedules. These are simplified examples and do not account for potential changes in interest rates or repayment plans. Actual repayment amounts may vary depending on the lender and the chosen repayment plan.

| Loan Amount | Interest Rate | Repayment Period (Years) | Total Repaid | Monthly Payment (approx.) |

|---|---|---|---|---|

| $10,000 | 5% | 10 | $12,578 | $105 |

| $20,000 | 7% | 10 | $28,733 | $240 |

| $30,000 | 9% | 15 | $56,780 | $310 |

Note: These figures are estimations and may vary depending on the specific loan terms and repayment plan.

Impact on Credit Scores and Future Borrowing

Student loan debt significantly impacts your credit score. Missed or late payments can negatively affect your credit rating, making it more difficult to secure loans or credit cards in the future, such as a mortgage or auto loan. A lower credit score can also result in higher interest rates on future borrowing, increasing the overall cost of financing.

Moreover, a substantial amount of student loan debt can reduce your debt-to-income ratio, potentially limiting your ability to borrow money for other purposes. Lenders assess this ratio to determine your ability to repay loans. A high debt-to-income ratio can make it harder to qualify for mortgages, auto loans, or even credit cards.

Assessing Repayment Ability After Graduation

Before taking out student loans, it’s crucial to realistically assess your ability to manage repayments after graduation. This involves a thorough evaluation of your expected income, expenses, and other financial obligations.

- Estimate Post-Graduation Income: Research average salaries for your chosen field and consider factors like location and experience level.

- Project Monthly Expenses: Create a detailed budget encompassing rent, utilities, transportation, food, and other essential living costs.

- Calculate Disposable Income: Subtract your projected monthly expenses from your estimated post-graduation income. This represents the amount available for loan repayments and other financial goals.

- Compare Income to Loan Payments: Compare your disposable income to the estimated monthly loan payments. Ensure that the loan payments are manageable without compromising your ability to meet other essential expenses and save for the future.

- Explore Repayment Options: Familiarize yourself with various repayment plans offered by lenders, such as income-driven repayment plans, to determine the most suitable option for your financial circumstances.

Closing Notes

Successfully managing student loan debt requires careful planning and proactive strategies. By understanding the diverse loan options available, diligently comparing interest rates and fees, and exploring alternative funding sources, students can mitigate financial risks and build a solid foundation for their post-graduation financial well-being. Remember, responsible borrowing and effective debt management are key to achieving long-term financial success.

Detailed FAQs

What happens if I can’t make my loan payments?

Contact your lender immediately. They may offer forbearance (temporary suspension of payments) or deferment (postponement of payments). Failing to communicate can severely damage your credit.

Can I refinance my student loan for living expenses?

Yes, refinancing is possible once you’ve established a good credit history. This could potentially lower your interest rate, but be sure to compare offers carefully.

What’s the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. Subsidized loans generally have stricter eligibility requirements.

How do student loans impact my credit score?

On-time payments build credit, while missed payments negatively impact your score. Consistent repayment demonstrates financial responsibility, benefiting your creditworthiness.