Navigating the complexities of higher education often involves understanding the financial landscape. Federal student loans play a crucial role for many students, but knowing your borrowing limits is paramount to responsible financial planning. This guide unravels the intricacies of federal student loan limits, providing clarity on eligibility, annual and aggregate caps, and the impact of various factors on your borrowing potential.

From understanding the different loan types – Direct Subsidized, Unsubsidized, and PLUS loans – to grasping the nuances of dependency status and enrollment levels, we aim to equip you with the knowledge needed to make informed decisions about financing your education. We’ll explore how cost of attendance influences loan eligibility and examine historical trends in loan limit adjustments. Ultimately, this resource empowers you to confidently manage your student loan journey.

Federal Student Loan Programs and Limits

Federal student loans are a crucial source of funding for higher education in the United States. Understanding the different types of loans available and their associated limits is essential for prospective and current students to make informed borrowing decisions and manage their debt effectively. This section will Artikel the key federal student loan programs and their respective borrowing limits.

Types of Federal Student Loans and Their Limits

The federal government offers several types of student loans, each with its own eligibility requirements and borrowing limits. The primary types are Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. These loans differ primarily in who is eligible to receive them and whether interest accrues while the student is in school.

Federal Student Loan Limit Comparison

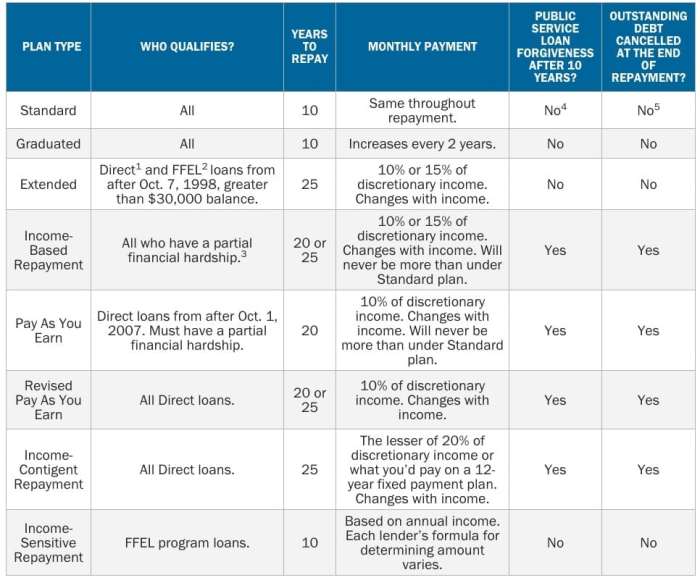

The following table summarizes the annual and aggregate loan limits for undergraduate and graduate students. It’s important to note that these limits can change, so always consult the official Federal Student Aid website for the most up-to-date information. Dependency status also impacts eligibility and loan amounts.

| Loan Type | Undergraduate Limit | Graduate Limit | Dependent/Independent Status |

|---|---|---|---|

| Direct Subsidized Loan | Varies based on year in school and dependency status; check the official website for the most current limits. | Not available to graduate students. | Dependent students have lower limits than independent students. |

| Direct Unsubsidized Loan | Varies based on year in school and dependency status; check the official website for the most current limits. | Varies based on year in school; check the official website for the most current limits. | Dependent students have lower limits than independent students. |

| Direct PLUS Loan (Parent/Graduate) | Not available to undergraduates. | Up to the cost of attendance, minus other financial aid received. | Credit check required; borrower must not have adverse credit history. |

Factors Influencing Loan Eligibility

Several factors determine a student’s eligibility for federal student loans. These include dependency status, which affects the amount a student can borrow, and credit history, which is a critical factor for PLUS loans.

For Direct Subsidized and Unsubsized Loans, dependency status is determined by factors such as the student’s age, marital status, and financial dependence on their parents. Independent students generally have higher borrowing limits. For Direct PLUS Loans, a credit check is conducted to assess the borrower’s creditworthiness. Applicants with adverse credit history may be denied a loan or may be required to obtain an endorser. The cost of attendance at the institution also plays a role in determining the maximum loan amount a student can receive. Students should carefully review their financial aid award letters and understand their borrowing limits before accepting any loans.

Annual and Aggregate Loan Limits

Understanding annual and aggregate loan limits for federal student loans is crucial for prospective borrowers to plan their education financing effectively. These limits prevent students from accumulating unsustainable debt and ensure responsible borrowing practices. Knowing your borrowing limits allows for informed decisions about educational choices and financial planning throughout your college career.

Federal student loan programs have established annual and aggregate loan limits, which are the maximum amounts a student can borrow each year and over their entire educational career, respectively. These limits vary based on the student’s year in school (dependent/independent status) and the type of loan program. Exceeding these limits generally isn’t possible unless there are exceptional circumstances.

Annual Loan Limits for Federal Student Loan Programs

The annual loan limits for federal student loans depend on factors such as the student’s dependency status (dependent or independent) and their year in school (freshman, sophomore, junior, senior). These limits are subject to change, so always consult the official Federal Student Aid website for the most up-to-date information. The following is a general overview and should not be considered definitive.

For example, a dependent undergraduate student might have a maximum annual loan limit of $5,500 for their first year, increasing to $6,500 for their second year, and then $7,500 for their third and fourth years. An independent undergraduate student might have higher limits. Graduate students typically have higher annual loan limits than undergraduates. Unsubsidized loans usually have higher limits than subsidized loans. Specific amounts are subject to change.

Aggregate Loan Limits for Federal Student Loan Programs

The aggregate loan limit represents the total amount a student can borrow across their entire undergraduate and graduate education. This limit is cumulative, encompassing all federal student loans received throughout their educational career. Once this limit is reached, the student is no longer eligible to receive additional federal student loans. The calculation takes into account all loans received, regardless of the program.

Calculating Maximum Borrowable Amount

Calculating the maximum amount a student can borrow involves adding up the annual loan limits for each year of their education, considering their dependency status and program type. This sum cannot exceed the aggregate loan limit. For instance, a dependent undergraduate student might have an aggregate loan limit of $31,000. If their annual limits are $5,500, $6,500, $7,500, and $7,500 for each year, their total borrowing would be $27,000, well within their aggregate limit. However, if their annual loan limits were higher, they would reach their aggregate limit before completing their four years of study. The exact calculation requires precise knowledge of the annual loan limits for each year and the student’s status.

The maximum borrowable amount = Sum of annual loan limits (considering dependency status and year) ≤ Aggregate loan limit.

Impact of Enrollment Status on Loan Limits

Your enrollment status significantly impacts your eligibility for federal student loans and the amount you can borrow. Federal student loan programs generally base loan limits on your enrollment level, defined by the number of credit hours you take each academic year. Full-time students typically have access to the highest loan amounts, while part-time students have lower limits. Understanding these differences is crucial for responsible financial planning during your education.

The amount you can borrow is directly tied to your enrollment status, categorized as full-time, half-time, or less than half-time. This classification is determined by your institution’s definition of full-time enrollment, which varies depending on the school and program. Generally, full-time enrollment involves a minimum number of credit hours per academic year or semester, often between 12 and 18 credit hours. Falling below this threshold results in a designation of half-time or less than half-time enrollment, affecting your loan eligibility.

Loan Limits Based on Credit Hour Enrollment

The following illustrates how loan limits generally vary based on enrollment status. These are examples and may not reflect the exact limits for every program or institution. It’s crucial to consult the specific guidelines of your chosen institution and loan program for accurate figures.

- Full-time Student (e.g., 12+ credit hours): Eligible for the maximum annual and aggregate loan limits established by the federal government for their specific loan program (e.g., Subsidized and Unsubsidized Stafford Loans, PLUS Loans). This allows for the greatest borrowing capacity to cover educational expenses.

- Half-time Student (e.g., 6-11 credit hours): Eligible for a reduced loan amount compared to full-time students. The exact reduction is determined by the loan program and institution, often prorated based on the percentage of full-time enrollment. This means they can borrow a smaller percentage of the maximum loan limits.

- Less than Half-time Student (e.g., fewer than 6 credit hours): May have very limited or no eligibility for federal student loans. Many programs require a minimum enrollment level to qualify for any loan assistance. This significantly restricts borrowing capacity and may necessitate alternative funding sources.

Implications of Part-Time Enrollment on Borrowing Capacity

Part-time enrollment significantly impacts overall borrowing capacity. Students enrolled part-time have lower loan limits, potentially requiring them to rely more on savings, family contributions, or private loans to cover educational expenses. This could lead to a higher reliance on alternative funding sources, which may carry higher interest rates or stricter repayment terms. For instance, a student aiming for a four-year degree but attending part-time may find their total borrowing capacity significantly less than a full-time student completing the same degree in four years, potentially extending their repayment period and increasing overall interest costs. Careful budgeting and financial planning are crucial for part-time students to manage their educational expenses effectively.

Cost of Attendance and Loan Limits

Federal student loan limits are directly tied to a student’s cost of attendance (COA) at their chosen institution. Understanding this relationship is crucial for students planning to finance their education through federal loans, as it determines the maximum amount they can borrow. The COA isn’t simply tuition; it encompasses a broader range of educational expenses.

The cost of attendance represents the total estimated cost of attending a particular college or university for one academic year. Schools determine this figure by calculating various expenses, including tuition and fees, room and board, books and supplies, transportation, and other personal expenses. The specific components and their weighting can vary slightly between institutions, but the overall goal is to provide a comprehensive estimate of a student’s financial needs. These calculations often involve surveys of current student spending, market research on local costs, and institutional policies regarding fees and charges.

Cost of Attendance Calculation Methods

Institutions use a variety of methods to calculate the cost of attendance, often combining institutional data with national averages and local market research. For example, tuition and fees are readily available from the institution’s published fee schedule. Room and board costs are often determined by surveying the costs of on-campus housing and meal plans, potentially offering various tiers to reflect different living arrangements. Books and supplies are usually estimated based on surveys of students’ reported spending or faculty input on required materials. Transportation costs are often estimated based on regional averages, accounting for commuting distances and local transportation costs. Finally, the “other expenses” category is a catch-all that usually includes personal expenses like clothing, entertainment, and miscellaneous items, often calculated as a percentage of other COA components or based on national student expenditure surveys.

Scenario Comparing Loan Amounts at Institutions with Varying Costs of Attendance

Let’s consider three hypothetical students attending different institutions with varying COAs.

Student A attends a public in-state university with a COA of $20,000. Assuming they are a dependent undergraduate, their maximum annual federal loan limit (combining subsidized and unsubsidized loans) might be around $5,500-$6,000. Over four years, they could borrow a significant portion of their educational expenses.

Student B attends a private university with a COA of $50,000. With a higher COA, this student’s maximum annual loan limit, again assuming they are a dependent undergraduate, might reach the maximum amount allowable, which is typically higher than Student A’s. The total amount they could borrow over four years would significantly exceed the amount available to Student A, reflecting the higher cost of attendance.

Student C attends a community college with a COA of $10,000. Their maximum annual loan limit would be lower than both Student A and Student B, reflecting the lower overall cost of attendance. They might only be able to borrow a smaller portion of their educational expenses.

It’s important to note that these are hypothetical examples, and actual loan limits can vary based on factors like dependency status, year in school, and loan program participation. The COA significantly influences the amount of federal student loan funds available to a student, highlighting the importance of understanding both the institution’s cost structure and the applicable loan limits.

Changes to Federal Student Loan Limits Over Time

Federal student loan limits have fluctuated over the past decade, reflecting changes in the cost of higher education and government policy. Understanding these changes is crucial for prospective and current students to accurately plan their financing. This section provides a historical overview of these limits, highlighting key trends and explanations for significant shifts.

Historical Federal Student Loan Limits (2014-2024)

The following table presents a summary of federal student loan limits for undergraduate and graduate students over the past ten years. Note that these figures represent the maximum loan amounts available and actual borrowing may vary based on individual financial need and cost of attendance. Data is approximated and may vary slightly depending on the source. It is recommended to consult official government websites for the most precise figures for any given year.

| Year | Loan Type | Undergraduate Limit | Graduate Limit |

|---|---|---|---|

| 2014 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2015 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2016 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2017 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2018 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2019 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2020 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2021 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2022 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2023 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 |

| 2024 | Direct Subsidized/Unsubsidized Loans | $5,500 (Freshman), $6,500 (Sophmore), $7,500 (Junior/Senior) | $20,500 (Estimate) |

Trends in Loan Limit Changes

Over the past ten years, there has been a notable lack of significant increases in federal student loan limits. While the cost of college tuition has continued to rise, the maximum loan amounts available to students have remained relatively stagnant. This disparity has contributed to increased reliance on other forms of financing, such as private loans, and growing student loan debt.

Explanations for Significant Changes (or Lack Thereof)

The absence of substantial increases in federal student loan limits can be attributed to several factors. Budgetary constraints and concerns about the growing national student loan debt burden have likely played a significant role in the government’s decision-making process. Furthermore, ongoing debates regarding the affordability and accessibility of higher education have influenced policy decisions related to student financial aid. The impact of the COVID-19 pandemic and subsequent economic shifts may also have contributed to the lack of substantial changes. For example, the pause on student loan payments during the pandemic demonstrated the significant financial burden faced by many borrowers.

Resources for Determining Loan Eligibility and Limits

Accurately determining your eligibility and the limits on federal student loans is crucial for effective financial planning during your education. Understanding the resources available and how to navigate them is key to avoiding potential pitfalls and ensuring you receive the correct information. Misinformation can lead to borrowing more than necessary or missing out on available funds.

Finding accurate and up-to-date information on federal student loan limits requires utilizing official government websites. These sources provide the most reliable data, ensuring you make informed decisions about your financing. Relying on unofficial websites or anecdotal information can be risky, leading to incorrect assumptions about your eligibility and loan amounts.

Official Government Websites for Federal Student Aid Information

The primary source for information on federal student aid, including loan limits, is the Federal Student Aid website, studentaid.gov. This website provides comprehensive information on all aspects of federal student financial aid programs. Navigation is generally intuitive, with clear menus and search functions. The site is regularly updated to reflect changes in legislation and program guidelines. Another valuable resource is the National Student Loan Data System (NSLDS), which allows you to access your federal student loan history and information.

Step-by-Step Navigation of studentaid.gov for Loan Limit Information

To find your federal student loan limits on studentaid.gov, follow these steps:

1. Visit the website: Go to studentaid.gov.

2. Navigate to the “Loan Limits” section: This section may be found under a tab labeled “Loans,” “Borrowing,” or a similar heading. The website’s search function can also be utilized to quickly locate this information.

3. Select your loan type: Determine whether you are interested in information about Direct Subsidized Loans, Direct Unsubsidized Loans, or Graduate PLUS Loans. Each loan type has its own set of limit specifications.

4. Specify your enrollment status: Your enrollment status (undergraduate, graduate, professional) will significantly impact your loan limits. The website will guide you to select the appropriate status.

5. Review the loan limit tables: The website will provide tables outlining the annual and aggregate loan limits for your chosen loan type and enrollment status. These tables clearly display the maximum amount you can borrow each year and over the course of your education.

6. Consult the FAQ section: If any questions remain, the website’s frequently asked questions (FAQ) section may provide additional clarity.

Importance of Using Official Sources to Avoid Misinformation

Using official sources like studentaid.gov is paramount to avoid misinformation. Unofficial websites or forums may contain outdated, inaccurate, or misleading information. This can lead to incorrect borrowing decisions with significant financial consequences. Always prioritize information directly from the Department of Education or other official government sources to ensure accuracy and avoid potential problems.

Visual Representation of Loan Limits

Understanding federal student loan limits can be challenging due to the varying factors involved. Visual aids significantly improve comprehension by presenting complex data in a readily digestible format. Below are descriptions of charts that effectively illustrate key aspects of federal student loan limits.

Bar Chart Comparing Loan Limits Across Loan Types

This bar chart would compare the maximum annual and aggregate loan limits for different federal student loan programs. The horizontal axis (x-axis) would list the loan types, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. The vertical axis (y-axis) would represent the loan limit amounts in US dollars. Separate bars would be used to represent undergraduate and graduate student loan limits for each loan type. For example, a bar for “Direct Unsubsidized Loans – Undergraduate” would show its annual and aggregate limits, while another bar next to it, “Direct Unsubsidized Loans – Graduate,” would show the higher limits for graduate students. The chart would clearly distinguish between annual and aggregate limits, perhaps using different colors or patterns within each bar. Data points would be clearly labeled on each bar, making it easy to compare the loan limits across different programs and student statuses.

Cumulative Borrowing Limits Over a Student’s Educational Career

This visual would depict the total amount a student could borrow over their entire educational career. A line graph would be ideal. The x-axis would represent the academic year (e.g., Year 1, Year 2, Year 3, Year 4, Year 5, etc.), reflecting the potential duration of undergraduate and graduate studies. The y-axis would represent the cumulative loan amount in US dollars. The line graph would show the increasing cumulative loan limit as the student progresses through their education. For instance, the line would start at zero in Year 1 and gradually increase each year, reflecting the annual loan limits added up. Different lines could represent different scenarios, such as the maximum borrowing for an undergraduate student versus a graduate student, or the impact of different enrollment statuses (full-time vs. part-time). Clear labels and a legend would explain the different lines. This graph would illustrate the potential for substantial debt accumulation over time and the importance of careful financial planning.

Conclusive Thoughts

Securing a higher education requires careful financial planning, and understanding federal student loan limits is a critical component of that process. This guide has provided a comprehensive overview of the various factors influencing borrowing capacity, from loan type and enrollment status to cost of attendance and historical trends. By utilizing the resources and information presented here, students can approach their financial aid strategy with greater confidence and make well-informed decisions that align with their long-term financial goals. Remember to always consult official government websites for the most up-to-date information.

Common Queries

What happens if I borrow more than the loan limit?

You cannot borrow beyond the established loan limits. Your application will be rejected for any amount exceeding the maximum allowed.

Can I borrow the maximum amount every year?

While you may be eligible for the maximum annual amount, it’s crucial to borrow only what you need to cover educational expenses. Overborrowing can lead to significant debt after graduation.

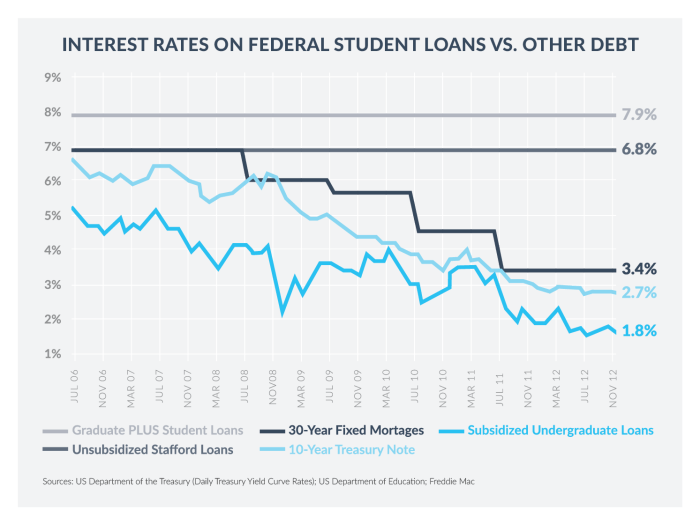

How are interest rates determined for federal student loans?

Interest rates for federal student loans are set annually by the government and vary depending on the loan type and the year the loan was disbursed. They are generally lower than private loan interest rates.

What if my school’s cost of attendance is unusually high?

Even with a higher cost of attendance, your borrowing limits are still capped at the maximum amounts established by the federal government. You may need to explore alternative funding options to cover the additional expenses.