Navigating the complex world of student loans can be daunting, especially when understanding the limitations on how much you can borrow. This guide provides a clear overview of federal and private student loan limits, exploring factors influencing eligibility and offering strategies for responsible debt management. We’ll delve into the nuances of different loan programs, the impact of credit history, and how these limits can shape your educational choices.

From undergraduate to graduate studies, the amount you can borrow varies significantly based on your dependency status, chosen program, and the type of loan. Understanding these limits is crucial for financial planning and making informed decisions about your education. This guide aims to demystify the process, providing you with the knowledge to make the best choices for your future.

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families, as these limits directly impact borrowing capacity and future repayment responsibilities. Knowing the specifics can help in financial planning and prevent potential over-borrowing. This section details the current federal student loan limits for undergraduate and graduate students, highlighting key differences based on dependency status and loan program.

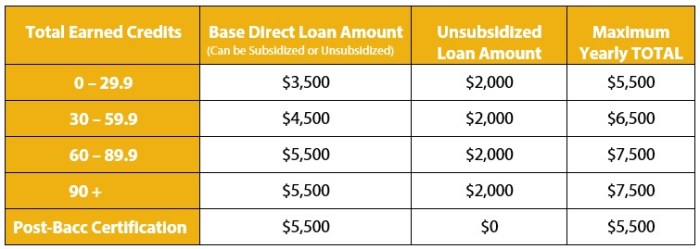

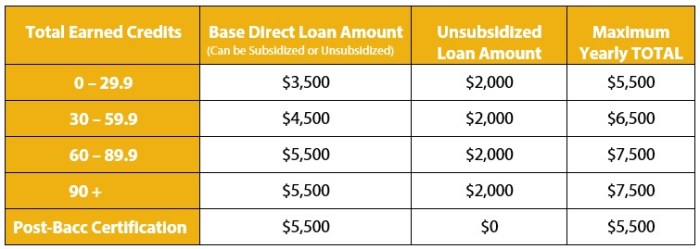

Undergraduate Student Loan Limits

Federal student loan limits for undergraduate students vary depending on their dependency status (dependent or independent) and year in school. Dependent students generally have lower borrowing limits than independent students. The annual limit represents the maximum amount a student can borrow in a single academic year, while the aggregate limit represents the total amount a student can borrow over their entire undergraduate career. These limits are subject to change, so it’s essential to check the official Federal Student Aid website for the most up-to-date information.

Dependent vs. Independent Student Loan Limits

The distinction between dependent and independent students significantly impacts their borrowing eligibility. Dependent students are typically those who are claimed as dependents on their parents’ tax returns. Independent students generally have higher borrowing limits because they are presumed to have greater financial responsibility. For example, a dependent undergraduate student might have a lower annual loan limit than an independent student in the same year of study.

Graduate Student Loan Limits

Graduate student loan limits are generally higher than those for undergraduate students, reflecting the typically higher costs associated with graduate programs. Loan limits often vary depending on the specific graduate program and the student’s enrollment status (full-time or part-time). For instance, a student pursuing a doctoral degree might have higher borrowing limits compared to a student in a master’s program. Moreover, graduate students may be eligible for additional loan programs, such as Grad PLUS loans, which offer higher borrowing amounts.

Federal Loan Program Comparison

Several federal student loan programs exist, each with its own eligibility criteria and loan limits. Direct Subsidized Loans offer interest subsidies while the student is enrolled at least half-time, meaning the government pays the interest during this period. Direct Unsubsidized Loans accrue interest from the time the loan is disbursed, regardless of enrollment status. PLUS Loans are available to parents of dependent undergraduate students and to graduate students, offering higher borrowing amounts but generally at a higher interest rate.

Federal Student Loan Limits Table

The following table summarizes the current federal student loan limits. Please note that these limits are subject to change and should be verified with official sources. This table provides a general overview and may not encompass all scenarios.

| Academic Year | Student Status | Loan Type | Loan Limit |

|---|---|---|---|

| 2023-2024 | Dependent Undergraduate | Direct Subsidized/Unsubsidized | $5,500 (first year), $6,500 (second year), $7,500 (third and fourth years) |

| 2023-2024 | Independent Undergraduate | Direct Subsidized/Unsubsidized | $9,500 (first year), $10,500 (second year), $12,500 (third and fourth years) |

| 2023-2024 | Graduate Student | Direct Unsubsidized/Grad PLUS | Up to the cost of attendance minus other financial aid |

| 2023-2024 | Parent of Dependent Undergraduate | Parent PLUS Loan | Up to the cost of attendance minus other financial aid |

Factors Affecting Student Loan Limits

Student loan limits aren’t universally fixed; several factors interplay to determine the maximum amount a student can borrow. Understanding these factors is crucial for effective financial planning during higher education. This section details the key influences on student loan eligibility and borrowing capacity.

Credit History’s Influence on Loan Eligibility and Amounts

A strong credit history is generally not required for federal student loans, which are primarily based on financial need and cost of attendance. However, private student loans often consider creditworthiness. Lenders assess credit reports to gauge the applicant’s reliability in repaying debt. A poor credit history might lead to higher interest rates, smaller loan amounts, or even loan denial. Conversely, a good credit score can improve loan terms and increase borrowing potential for private loans. Co-signers with good credit can also help students secure loans even with limited or poor credit history.

Cost of Attendance and Loan Limits

The cost of attendance (COA) plays a significant role in determining loan limits. COA includes tuition, fees, room and board, books, and other education-related expenses. Federal student loan programs typically set limits based on a student’s year in school (undergraduate or graduate) and the school’s COA. For example, a student attending a more expensive private university will generally have higher loan limits than a student at a less expensive public institution, reflecting the higher overall cost of their education. The loan amount is usually capped at or below the calculated COA, preventing students from borrowing more than their education costs.

Enrollment Status and Program of Study

A student’s enrollment status (full-time or part-time) directly influences the amount they can borrow. Full-time students generally qualify for higher loan limits than part-time students, reflecting the greater expense associated with full-time study. Similarly, the program of study can indirectly affect loan limits. Graduate programs often have higher tuition and fees than undergraduate programs, potentially resulting in higher loan limits to cover these increased costs. Professional programs, such as medical or law school, might also have higher associated costs and correspondingly higher loan limits.

Impact of Different Financial Aid Sources on Overall Borrowing Limits

Federal student aid, including grants, scholarships, and loans, is often considered before private loans. Grants and scholarships, being non-repayable, reduce the need for loans. Federal loan programs have aggregate limits, meaning there’s a maximum amount a student can borrow across all federal loan programs throughout their education. These limits are designed to prevent excessive debt accumulation. Private loans, on the other hand, are often used to supplement federal aid if the total financial aid package doesn’t cover the entire cost of attendance. The availability of grants and scholarships, therefore, can significantly influence the amount a student needs to borrow through loans.

Flowchart Illustrating Student Loan Eligibility and Limits Determination

The process of determining student loan eligibility and limits can be visualized as a flowchart. The flowchart would begin with the application for financial aid, which would include information about the student’s financial situation, enrollment status, and chosen program. This information would then be used to determine the student’s eligibility for federal grants and scholarships. Next, the cost of attendance for the student’s institution and program would be calculated. This cost, along with the amount of grant and scholarship aid received, would determine the student’s need for loans. Finally, the flowchart would show the calculation of the student’s maximum loan amount based on federal and institutional loan limits and the student’s demonstrated financial need. The final box would show the loan offer, specifying the loan amount, interest rate, and repayment terms. The flowchart would clearly illustrate the interconnectedness of these factors in determining a student’s final loan amount.

Private Student Loan Limits

Private student loans offer a supplemental funding source for higher education, but they differ significantly from federal loans in terms of eligibility, limits, and repayment terms. Understanding these differences is crucial for prospective borrowers to make informed financial decisions.

Differences Between Private and Federal Student Loan Limits

Unlike federal student loans, which have set annual and aggregate limits based on factors like dependency status and year in school, private student loans don’t have a universal limit. The maximum loan amount a student can borrow privately depends entirely on the lender’s assessment of their creditworthiness and the chosen repayment plan. Federal loans offer a safety net with government-backed protections and income-driven repayment options, while private loans are subject to market fluctuations and lender-specific policies. This lack of a standardized limit makes private loan borrowing less predictable and potentially riskier for borrowers.

Creditworthiness and Loan Eligibility for Private Loans

Lenders assess a borrower’s creditworthiness using several factors. Credit history, including credit score and payment history, plays a significant role. A strong credit history demonstrates responsible financial behavior and increases the likelihood of loan approval at favorable terms. Income and debt-to-income ratio are also key considerations. Lenders want assurance that the borrower has sufficient income to comfortably repay the loan without undue financial strain. Collateral, such as assets that can be seized if the loan defaults, may be required by some lenders, particularly for larger loan amounts. Finally, the borrower’s educational background and future earning potential are assessed as an indicator of their ability to repay the debt. For instance, a student pursuing a high-demand profession might be considered a lower-risk borrower than one entering a field with limited job prospects.

Factors Influencing Interest Rates and Repayment Terms

Several factors determine the interest rates and repayment terms of private student loans. The borrower’s credit score is a major influence; higher scores generally translate to lower interest rates. The loan amount also impacts the interest rate; larger loans may come with higher rates due to increased risk for the lender. The repayment term (loan duration) influences both the monthly payment and the total interest paid; longer repayment periods result in lower monthly payments but higher overall interest costs. The lender’s prevailing interest rates and market conditions also play a role, with rates fluctuating based on economic factors. Finally, the type of loan (e.g., variable vs. fixed interest rate) significantly affects repayment costs. Variable-rate loans offer potentially lower initial rates but are subject to fluctuations based on market changes, while fixed-rate loans provide predictable monthly payments.

Co-Signer Requirements and Their Impact on Loan Amounts

Many private lenders require a co-signer, typically a parent or other financially responsible individual, for students with limited or no credit history. A co-signer shares responsibility for loan repayment, mitigating the lender’s risk. The presence of a co-signer often increases the likelihood of loan approval and can result in a larger loan amount or more favorable interest rates. However, it also means that the co-signer’s creditworthiness is also taken into account, and they bear the financial responsibility if the primary borrower defaults. This shared responsibility underscores the importance of careful consideration before involving a co-signer in a private student loan agreement.

Comparison of Private Student Loan Scenarios

The following table illustrates hypothetical private student loan scenarios to demonstrate the impact of various factors on interest rates and repayment terms. These are examples and actual rates and terms will vary depending on the lender and borrower’s specific circumstances.

| Scenario | Loan Amount | Interest Rate (Fixed) | Monthly Payment (10-year repayment) |

|---|---|---|---|

| Scenario A: Strong Credit, Co-signer | $20,000 | 6% | $210 |

| Scenario B: Fair Credit, No Co-signer | $15,000 | 9% | $170 |

| Scenario C: Limited Credit History, Co-signer | $10,000 | 7% | $110 |

| Scenario D: Excellent Credit, No Co-signer | $25,000 | 5% | $260 |

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and a thorough understanding of available resources. Minimizing debt accumulation and effectively managing repayment are crucial for long-term financial well-being. This section will explore strategies to achieve these goals.

Strategies for Minimizing Student Loan Debt Accumulation

Careful financial planning before, during, and after college significantly impacts the total amount of student loan debt accrued. Exploring scholarships and grants, maximizing federal aid eligibility, and considering less expensive educational options like community colleges or vocational training can all reduce reliance on loans. Furthermore, diligent budgeting and frugal living habits throughout college can minimize the need to borrow additional funds. For example, a student prioritizing part-time employment during their studies might significantly reduce their borrowing needs compared to a student relying solely on loans.

Understanding Loan Repayment Plans

Choosing the right repayment plan is critical for effective debt management. Different plans offer varying monthly payments and overall repayment periods, each with its own advantages and disadvantages. Understanding the terms and conditions of each plan is essential to making an informed decision. Failure to understand these nuances can lead to unexpected financial strain and potential default.

Benefits and Drawbacks of Various Repayment Options

Several repayment plans exist, each catering to different financial situations. The Standard Repayment Plan offers fixed monthly payments over 10 years. While predictable, the monthly payments can be high. The Extended Repayment Plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest costs. Income-Driven Repayment (IDR) plans, such as ICR, PAYE, and REPAYE, tie monthly payments to a percentage of discretionary income, offering flexibility but potentially leading to longer repayment periods and higher total interest paid. For instance, a recent graduate with a low income might find an IDR plan more manageable than a standard plan, despite the longer repayment timeframe.

Creating a Realistic Budget to Manage Student Loan Payments

Budgeting is paramount for successful loan repayment. A step-by-step guide follows:

- Track Expenses: Record all income and expenses for a month to identify spending patterns.

- Prioritize Essential Expenses: Categorize expenses into necessities (housing, food, transportation) and non-essentials (entertainment, dining out).

- Allocate Funds for Loan Payments: Integrate your student loan payment amount into your budget as a non-negotiable expense.

- Identify Areas for Reduction: Analyze non-essential expenses to find areas where spending can be reduced.

- Set Financial Goals: Establish short-term and long-term financial goals to stay motivated and track progress.

- Regularly Review and Adjust: Periodically review your budget and make adjustments as needed to adapt to changing circumstances.

For example, someone might initially allocate a larger portion of their budget to loan repayment and gradually increase this amount as their income grows.

Resources for Managing Student Loan Debt

Numerous resources exist to support students in managing their debt.

- Federal Student Aid Website: Provides comprehensive information on repayment plans, loan forgiveness programs, and other resources.

- National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including student loan debt management advice.

- Student Loan Servicing Companies: Your loan servicer can provide personalized guidance on repayment options and manage your account.

- Financial Aid Offices at Colleges and Universities: Often provide workshops and counseling on financial planning and debt management.

Impact of Loan Limits on Student Choice

Student loan limits significantly influence a student’s educational journey, shaping their choices regarding institutions, majors, and career paths. The availability and amount of loan funding directly impact accessibility and affordability, creating both opportunities and limitations for prospective students. Understanding these impacts is crucial for both students and policymakers alike.

Influence on College or University Choice

Loan limits often restrict students to institutions with lower tuition costs. Students who cannot secure sufficient loans to cover the expenses of a more expensive private university, for example, may be forced to attend a less costly community college or in-state public university. This can limit their access to specific programs or learning environments they might prefer. The geographic location of the institution also becomes a factor; students may need to choose a college closer to home to reduce living expenses if their loan amount is insufficient to cover out-of-state tuition and accommodation.

Impact on Low-Income Students

Limited loan access disproportionately affects students from low-income backgrounds. These students often rely more heavily on loans to finance their education, and lower loan limits exacerbate existing financial barriers. They may face even greater challenges in affording higher education, potentially limiting their opportunities for upward mobility. The lack of sufficient loan funding can force them to forgo higher education altogether or significantly restrict their choices regarding the type of institution they can attend. This can perpetuate cycles of poverty and inequality.

Influence on Major and Career Path

Loan limits can also affect a student’s choice of major and subsequent career path. Students pursuing high-cost fields like medicine or engineering, which often require longer periods of study, may be deterred by the prospect of accumulating substantial debt exceeding loan limits. Conversely, students might choose less expensive majors even if they are less passionate about them, simply to manage their debt burden more effectively. This can lead to career dissatisfaction and reduced earning potential in the long run.

Examples of Navigating Limited Loan Access

Many students successfully navigate the challenges of limited loan access through careful planning and resourcefulness. Some might choose to attend community college for their first two years before transferring to a four-year university to reduce overall costs. Others might take on part-time jobs during their studies or seek scholarships and grants to supplement their loans. Some students might opt for shorter degree programs or online learning options to minimize expenses. These strategies highlight the adaptability and resilience of students facing financial constraints.

Hypothetical Scenario Illustrating Loan Limit Effects

Consider two students, Sarah and John, both aiming for a bachelor’s degree. Sarah, from a high-income family, has access to substantial family support and generous loan limits. She can afford to attend a prestigious private university with high tuition fees and pursue a demanding engineering major. John, from a low-income family, faces significantly lower loan limits and limited family support. He may be forced to attend a less expensive community college, potentially delaying his entry into a four-year university and limiting his major choices to more affordable options, potentially impacting his long-term career prospects. This scenario highlights the unequal opportunities created by varying loan limits.

Epilogue

Successfully managing student loan debt requires careful planning and a comprehensive understanding of the available resources. By familiarizing yourself with federal and private loan limits, understanding the factors influencing eligibility, and exploring various repayment options, you can navigate the complexities of higher education financing with greater confidence. Remember to prioritize responsible borrowing and explore all available financial aid options to minimize future debt burden.

Questions Often Asked

What happens if I borrow the maximum amount and still need more money for college?

Explore additional funding options like scholarships, grants, part-time jobs, or work-study programs. You might also consider attending a less expensive institution.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing is possible, but it often involves switching from federal to private loans, potentially losing federal protections like income-driven repayment plans. Carefully weigh the pros and cons before refinancing.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How do I apply for student loans?

You typically apply for federal student loans through the Free Application for Federal Student Aid (FAFSA). Private loan applications are processed through individual lenders.