Navigating the complexities of higher education often involves understanding the financial landscape, and a crucial element of this is comprehending student loan limits. These limits, set by both federal and private lenders, significantly impact a student’s borrowing capacity and ultimately, their long-term financial well-being. This guide delves into the intricacies of these limits, exploring the factors that influence eligibility and offering insights into responsible borrowing strategies.

From understanding the differences between federal subsidized and unsubsidized loans to comparing offers from various private lenders, we aim to equip you with the knowledge necessary to make informed decisions about financing your education. We’ll examine how cost of attendance, dependency status, and even credit history can affect your borrowing power, ultimately helping you plan for a financially sound future.

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families in planning for higher education costs. These limits are set annually by the federal government and vary based on several factors, including the student’s year in school, dependency status, and loan type. Exceeding these limits requires careful consideration of repayment strategies.

Undergraduate Loan Limits

Federal student loan limits for undergraduate students depend on their dependency status (dependent or independent) and year in school. Dependent students generally have lower limits than independent students. The limits are further divided between subsidized and unsubsidized loans. Subsidized loans are need-based and the government pays the interest while the student is in school, whereas unsubsidized loans accrue interest from the time they are disbursed.

Dependency Status and Loan Limits

A student’s dependency status significantly impacts their eligibility for federal student aid, including loan limits. Independent students generally qualify for higher loan amounts than dependent students. Factors determining dependency status include age, marital status, and financial independence from parents. The exact criteria are defined by the Free Application for Federal Student Aid (FAFSA).

Annual and Aggregate Loan Limits

Annual loan limits represent the maximum amount a student can borrow in a single academic year. Aggregate loan limits represent the total amount a student can borrow over their entire undergraduate career. These limits apply across all federal student loan programs. For example, a dependent undergraduate student might have an annual limit of $5,500 and an aggregate limit of $27,000. An independent undergraduate student, conversely, may have a higher annual and aggregate limit.

Subsidized and Unsubsidized Loan Limits

The division between subsidized and unsubsidized loans also affects the loan limits. While both loan types have separate annual and aggregate limits, the total amount a student can borrow is the sum of both. For example, a student might have $3,500 in subsidized loan limits and $6,500 in unsubsidized loan limits for a total annual limit of $10,000. The interest accrual differences between these loan types are significant to consider when planning for repayment.

Federal Student Loan Program Comparison

The following table compares loan limits across different federal student loan programs. These amounts are subject to change and should be verified with the official sources before making any financial decisions. Remember that these limits are only guidelines, and actual eligibility is determined by the student’s financial need and other factors.

| Loan Program | Dependent Undergraduate Annual Limit | Independent Undergraduate Annual Limit | Graduate Student Annual Limit |

|---|---|---|---|

| Subsidized Direct Loans | $3,500 (freshman), $4,500 (sophomore), $5,500 (junior & senior) | $5,500 (freshman), $6,500 (sophomore), $7,500 (junior & senior) | $20,500 |

| Unsubsidized Direct Loans | $2,000 (freshman), $2,000 (sophomore), $2,000 (junior & senior) | $9,500 (freshman), $10,500 (sophomore), $12,500 (junior & senior) | $20,500 |

| Direct PLUS Loans (Graduate Students and Parents) | N/A | N/A | Cost of attendance minus other financial aid |

Private Student Loan Limits

Private student loans offer an alternative funding source for higher education, supplementing federal loans or covering expenses not met by federal aid. However, unlike federal loans, private loan limits vary significantly depending on the lender and the individual borrower’s creditworthiness and financial situation. Understanding these variations is crucial for prospective borrowers to make informed decisions.

Factors Influencing Private Student Loan Limits

Several key factors determine the loan amount a private lender will offer. Credit history plays a dominant role; borrowers with strong credit scores and a history of responsible financial management generally qualify for higher loan limits. Income and employment stability are also crucial considerations, as lenders assess the borrower’s ability to repay the loan. The lender will also consider the cost of attendance at the chosen institution, comparing it to the borrower’s existing financial resources (savings, grants, and federal loans) to determine the remaining need. Finally, the type of degree program pursued might influence loan limits; professional programs often command higher loan amounts due to their potential for higher future earnings. Co-signers can significantly impact loan limits, as their creditworthiness can offset a borrower’s less-than-perfect credit history.

Comparison of Private Lender Loan Limits and Terms

Interest rates and repayment terms are integral components of the overall loan cost. Lower interest rates translate to lower overall borrowing costs, while favorable repayment terms (longer repayment periods) reduce monthly payments but increase total interest paid over the loan’s lifetime. Borrowers should carefully compare these aspects across different lenders to identify the most cost-effective option. Understanding the implications of different interest rates and repayment periods is vital for making informed decisions. For example, a 1% difference in interest rates over a 10-year loan can significantly impact the total interest paid. Similarly, extending the repayment period by a few years can reduce monthly payments but substantially increase the overall interest paid.

Illustrative Comparison of Three Private Lenders

| Lender | Maximum Loan Amount | Interest Rate (Example) | Repayment Term Options |

|---|---|---|---|

| Lender A | $100,000 (with co-signer); $50,000 (without) | Variable, starting at 6.5% | 5, 10, 15 years |

| Lender B | $75,000 (with co-signer); $30,000 (without) | Fixed, 7.0% | 10, 15 years |

| Lender C | $80,000 (with co-signer); $40,000 (without) | Variable, starting at 7.2% | 7, 10, 12 years |

*Note: These are illustrative examples only. Actual loan amounts, interest rates, and repayment terms vary based on individual borrower profiles and lender policies. Always check the lender’s website for the most up-to-date information.*

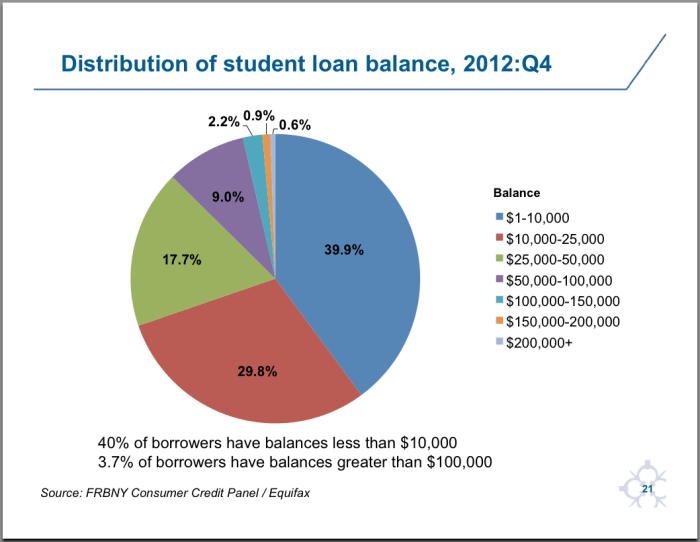

Impact of Loan Limits on Student Debt

Loan limits, whether federal or private, significantly influence the total amount of student loan debt accumulated by borrowers. Understanding these limits and their implications is crucial for responsible financial planning during and after college. The maximum loan amounts available directly affect a student’s borrowing capacity and, consequently, their future financial obligations.

The amount of student loan debt a student takes on directly correlates with the available loan limits. Higher loan limits naturally allow students to borrow more, potentially covering a larger portion of their educational expenses. However, this increased borrowing capacity also increases the risk of accumulating substantial debt. This can have profound long-term financial implications, impacting everything from homeownership to retirement planning.

Long-Term Financial Implications of Maximum Borrowing

Borrowing up to the maximum loan limits can lead to substantial long-term financial consequences. For example, a student who borrows the maximum amount for a four-year undergraduate degree might graduate with $100,000 in debt (this figure varies widely based on the institution and program). Repaying this debt, even with a standard repayment plan, can take many years, significantly impacting the borrower’s ability to save for a down payment on a house, invest in retirement, or even manage unexpected expenses. The interest accrued over the repayment period can also substantially increase the total amount owed, potentially doubling or even tripling the original loan amount. This scenario highlights the importance of careful budgeting and responsible borrowing habits.

Consequences of Exceeding Recommended Borrowing Amounts

Exceeding recommended borrowing amounts can lead to several negative consequences. It increases the likelihood of defaulting on loans, which can severely damage a borrower’s credit score, making it difficult to obtain loans for mortgages, cars, or even credit cards in the future. Furthermore, exceeding borrowing limits might necessitate a longer repayment period, leading to higher overall interest payments and a delayed start to saving for long-term financial goals. The emotional stress associated with managing overwhelming debt can also significantly impact a borrower’s overall well-being. Consider the example of a graduate student who borrows significantly more than recommended for their program. They might face difficulties securing employment after graduation due to the weight of their debt, potentially delaying their career progression and financial stability.

Strategies for Responsible Borrowing and Debt Management

Responsible borrowing and effective debt management are essential for mitigating the negative impacts of student loan debt. Strategies include: thoroughly researching the cost of education and exploring various funding options, including scholarships and grants; carefully budgeting and tracking expenses; prioritizing needs over wants to minimize reliance on loans; understanding different repayment plans and their implications; and seeking professional financial advice to develop a personalized debt repayment strategy. Creating a realistic budget that accounts for loan repayments after graduation is crucial. This might involve making lifestyle adjustments, such as delaying major purchases or opting for more affordable housing, to ensure timely loan repayments and avoid default.

Resources for Understanding Loan Limits

Navigating the complexities of student loan limits can feel overwhelming, but access to reliable information is key to making informed decisions. Understanding the different sources of information available, both governmental and private, is crucial for students and their families to effectively plan for higher education financing. This section Artikels key resources and the type of information they provide.

Understanding federal and private student loan limits requires consulting several sources. This information is critical for responsible borrowing and avoiding future financial hardship.

Federal Government Resources for Student Financial Aid

The federal government is the primary source of information regarding federal student aid. The Department of Education’s website, studentaid.gov, is a comprehensive resource. Here, students can find detailed information on eligibility requirements, loan programs (such as Direct Subsidized and Unsubsidized Loans, PLUS Loans), and the current loan limits for each program. The site also provides loan repayment calculators and information on various repayment plans. Furthermore, the Federal Student Aid website offers interactive tools and resources to help students estimate their financial need and understand their repayment options. Information on loan forgiveness programs and other aid options is also readily available. Finally, the website includes contact information for federal student aid representatives who can answer specific questions.

Reputable Websites and Organizations Providing Information on Student Loan Limits

Several reputable organizations offer valuable information supplementing the federal government’s resources. These include:

- The National Association of Student Financial Aid Administrators (NASFAA): NASFAA provides resources and information for financial aid professionals, but much of their information is also useful for students and families. They offer insights into trends in student aid and can provide context for understanding the complexities of federal and private loan programs.

- The Institute for College Access & Success (TICAS): TICAS conducts research and analysis on college affordability and student debt. Their publications and reports offer valuable data and perspectives on student loan debt trends and the impact of loan limits on student borrowing.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources on various financial matters, including student loans. Their website offers guidance on understanding loan terms, comparing loan offers, and avoiding predatory lending practices.

- Nonprofit Credit Counseling Agencies: Many nonprofit credit counseling agencies offer free or low-cost financial counseling services, including guidance on student loan management. These agencies can help students create a repayment plan, explore options for consolidating loans, and address any challenges they face in managing their student loan debt.

Resources for Understanding and Managing Student Loans

Beyond information on loan limits, students need resources to understand and manage their loans effectively throughout their education and beyond. These resources include:

- Financial literacy workshops and seminars: Many colleges and universities offer workshops and seminars on financial literacy, including topics such as budgeting, debt management, and student loan repayment. These workshops provide practical guidance and tools for students to manage their finances effectively.

- Individual financial advisors: While not always free, a financial advisor can provide personalized guidance on managing student loans and creating a long-term financial plan. This is particularly helpful for students with complex financial situations or those who require assistance in developing a comprehensive financial strategy.

- Online student loan calculators and tools: Numerous online tools can help students estimate their monthly payments, explore different repayment options, and understand the long-term cost of their loans. These calculators can provide valuable insights and help students make informed decisions about their borrowing.

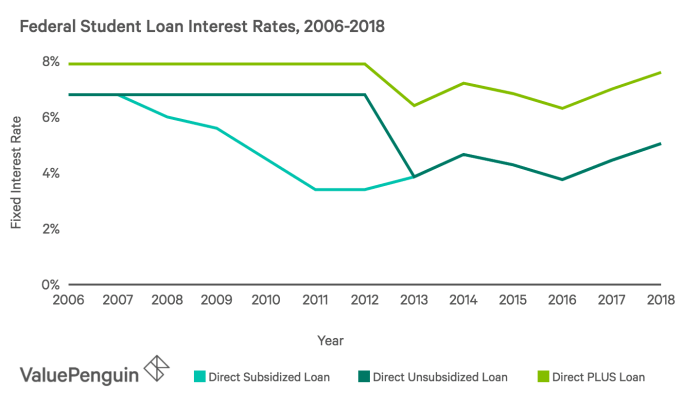

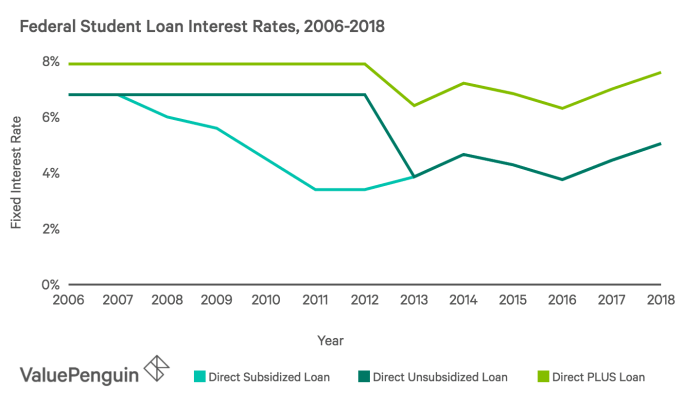

Visual Representation of Loan Limits Over Time

Understanding the historical trends in federal student loan limits provides valuable context for assessing the current student debt crisis. Analyzing these limits over time reveals how borrowing capacity has changed, impacting student borrowing behavior and the overall accumulation of student loan debt. This section will present a visual representation of these trends, highlighting key shifts and patterns.

Analyzing the data requires acknowledging the complexity of the federal student loan system, which includes different loan programs with varying limits. For simplicity, we’ll focus on the aggregate trends for undergraduate federal student loans, recognizing that the actual experience of individual borrowers will vary. Furthermore, the data presented represents the maximum loan limits available; actual borrowing amounts vary based on individual financial need and other factors.

Undergraduate Federal Student Loan Limits: 2013-2023 (Illustrative Data)

To illustrate the historical trends, consider a hypothetical bar graph representing the maximum annual and aggregate loan limits for dependent undergraduate students over the past decade. (Note: Actual data would need to be sourced from the Department of Education or similar reliable source and may differ from this example.)

The horizontal axis would represent the academic year (e.g., 2013-2014, 2014-2015, etc., up to 2022-2023). The vertical axis would represent the loan limit in US dollars. Two bars would be presented for each academic year: one for the maximum annual loan limit and one for the maximum aggregate loan limit (the total amount a student could borrow over their undergraduate career).

For example: Let’s assume the maximum annual loan limit for dependent undergraduates was $5,500 in 2013-2014 and increased to $6,000 in 2014-2015, then $6,500 in 2015-2016, remaining constant for a few years, before rising to $7,000 in 2020-2021, and finally to $7,500 in 2022-2023. Similarly, the maximum aggregate limit could have started at $27,500 in 2013-2014, increased gradually over the years, reaching, for example, $35,000 in 2022-2023. The graph would visually represent these increases.

The graph would show a general upward trend in both annual and aggregate loan limits over the decade. However, the rate of increase would not necessarily be consistent; there might be years with smaller or no increases, reflecting potential changes in government policy or budgetary considerations. Any periods of stagnation or significant jumps in the loan limits would be clearly visible in the graph, offering insights into the factors influencing these changes.

Significant Shifts and Patterns in Loan Limits

The hypothetical graph would reveal a general upward trend in student loan limits over the past decade. This trend reflects a combination of factors, including the rising cost of higher education and government efforts to make college more accessible. However, the data would also likely highlight periods of slower growth or even stagnation, possibly correlating with changes in federal policy or economic conditions. Analyzing the data against concurrent trends in tuition inflation would be particularly revealing in understanding the impact of loan limits on student debt. For example, if tuition increases outpace the increase in loan limits, students may face increasing challenges in affording college. Conversely, periods of more significant increases in loan limits might coincide with periods of more robust economic growth or policy changes aimed at expanding access to higher education.

The Role of Cost of Attendance in Determining Borrowing Needs

Understanding the cost of attendance is crucial for determining how much student loan debt you might accumulate. This cost encompasses tuition, fees, and living expenses, all of which significantly influence the amount of financial aid – including loans – you’ll need to cover your education. Failing to accurately assess these costs can lead to under- or over-borrowing, both of which have potential negative consequences.

The cost of attendance directly impacts the amount of student loans needed because it represents the total expense of attending a specific institution for a given academic year. Tuition and fees are typically the largest components, but room and board, books, transportation, and other personal expenses also contribute significantly. The higher the cost of attendance, the greater the potential need for student loans, assuming other funding sources are insufficient. Accurately calculating these costs is essential for creating a realistic budget and developing a sound financial plan for your education.

Alternative Funding Sources and Their Impact on Loan Dependence

Exploring alternative funding sources, such as scholarships and grants, is paramount in minimizing reliance on student loans. These sources provide non-repayable financial aid, reducing the overall debt burden after graduation. Scholarships can be merit-based (awarded for academic achievement or talent) or need-based (awarded based on financial need). Grants, similarly, are often need-based and offered by federal, state, and institutional programs. Proactively searching for and applying to these opportunities can significantly decrease the amount of money you need to borrow. A thorough understanding of available funding options can significantly reduce the overall cost of higher education.

Hypothetical Example of Cost of Attendance and Borrowing Needs

Consider two hypothetical students, both attending the same university. Student A attends a state university with a total cost of attendance (including tuition, fees, and living expenses) of $20,000 per year. Student B attends a private university with a total cost of attendance of $60,000 per year. Assuming both students receive $5,000 in scholarships and grants annually, Student A would need to borrow $15,000 per year ($20,000 – $5,000), while Student B would need to borrow $55,000 per year ($60,000 – $5,000). Over four years, Student A’s total borrowing could be $60,000, whereas Student B’s could be $220,000. This stark difference highlights how the cost of attendance directly influences the amount of borrowing required, even with the same level of scholarship assistance. This example demonstrates the significant financial implications of choosing an institution with a higher cost of attendance.

Last Recap

Successfully navigating the student loan process requires a thorough understanding of the available options and the implications of different borrowing choices. By carefully considering federal and private loan limits, exploring alternative funding sources, and practicing responsible debt management, students can minimize the long-term financial burden of higher education. Remember, informed borrowing is key to a successful and financially stable post-graduate life. Utilize the resources provided and seek professional advice when needed to make the best decisions for your unique circumstances.

FAQ Section

What happens if I borrow more than the recommended amount?

Borrowing beyond recommended limits increases your overall debt and monthly payments, potentially impacting your post-graduation financial stability. It’s crucial to carefully consider your repayment capacity before borrowing the maximum amount.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s important to compare offers from different lenders and understand the terms and conditions before refinancing.

Are there any penalties for not repaying my student loans?

Failure to repay student loans can lead to serious consequences, including damaged credit scores, wage garnishment, and potential legal action. It’s crucial to adhere to the repayment plan you choose.

How can I estimate my total cost of attendance?

Your school’s financial aid office can provide a detailed cost of attendance estimate, including tuition, fees, room and board, and other expenses. Use this estimate to determine your borrowing needs.