Navigating the complexities of student loan repayment can feel overwhelming. Understanding the true cost of your education and planning for repayment is crucial for long-term financial health. A student loan calculator emerges as an invaluable tool, offering clarity and control in a process often shrouded in confusing jargon and complex calculations. This guide explores the functionality, benefits, and intricacies of these essential financial planning aids.

From simple interest calculations to sophisticated amortization schedules, student loan calculators empower borrowers to make informed decisions. By inputting key details such as loan amount, interest rate, and repayment period, users gain insights into their monthly payments, total interest paid, and overall repayment timeline. This allows for effective budgeting and proactive financial planning, reducing stress and fostering a sense of control over one’s financial future.

Understanding “Loan Student Calculator” User Needs

A student loan calculator serves a critical function for individuals navigating the complexities of higher education financing. Understanding the needs and expectations of its users is paramount to designing a tool that is both effective and user-friendly. This requires careful consideration of the target audience, their typical interaction with the tool, and the information they seek.

The primary purpose of a student loan calculator is to provide users with a clear and concise estimate of their potential loan repayment obligations. This empowers them to make informed decisions regarding their educational financing, and helps them to budget effectively for the future.

Primary User Demographics

The primary users of a student loan calculator are prospective and current students, along with their parents or guardians. This demographic encompasses a wide range of ages, financial backgrounds, and levels of financial literacy. Prospective students are often using the calculator to explore financing options and understand the potential cost of their education. Current students may use it to manage their existing loans or explore refinancing options. Parents and guardians often utilize the tool to assist their children in understanding the financial implications of higher education.

Typical User Journey

A typical user journey begins with the user entering key information, such as the desired loan amount, interest rate, loan term, and repayment plan. The calculator then processes this data and provides an estimated monthly payment, total interest paid, and the total amount repaid over the life of the loan. Users may then experiment with different input values to see how changes affect the repayment schedule. For example, a user might adjust the loan term to see how it impacts their monthly payment. The entire process should be intuitive and easy to navigate. A clear display of results, and the ability to easily modify inputs, are crucial elements of a positive user experience.

Information Users Expect to Find

Users expect to find several key pieces of information from a student loan calculator. This includes:

- Estimated monthly payment

- Total interest paid over the life of the loan

- Total amount repaid

- Amortization schedule (showing the breakdown of principal and interest payments over time)

- Comparison of different repayment plans (e.g., standard, graduated, income-driven)

- Information on loan forgiveness programs (if applicable)

Providing this information in a clear and concise manner, perhaps using visual aids like charts and graphs, enhances user understanding and engagement.

Desired Functionalities

Beyond the basic calculations, users may desire additional functionalities. These might include:

- Ability to save and compare different loan scenarios

- Integration with other financial planning tools

- Options to adjust for different interest rates or loan terms

- Incorporation of potential future income to assess affordability

- Ability to factor in additional fees or charges associated with the loan

A well-designed calculator will incorporate these features to provide a comprehensive and user-friendly experience. For instance, the ability to save and compare scenarios allows users to explore different options and make informed decisions based on their individual circumstances. Integration with other financial planning tools would streamline the overall financial planning process.

Features of a Student Loan Calculator

A student loan calculator is a valuable tool for prospective and current students to understand the financial implications of borrowing for education. By inputting key details, users can gain a clear picture of their potential monthly payments, total interest paid, and overall loan repayment burden. Different calculators offer varying levels of complexity and features, catering to diverse user needs and financial literacy levels.

Types of Student Loan Calculators

Simple student loan calculators provide a basic overview of loan repayment. They typically require inputs such as loan amount, interest rate, and loan term, and output a monthly payment amount. Advanced calculators, however, offer more comprehensive features, including the ability to factor in multiple loans with varying terms and interest rates, different repayment plans (e.g., standard, graduated, income-driven), and potential tax benefits. The choice between a simple and advanced calculator depends on the user’s individual needs and understanding of loan repayment mechanics. A user with a single, straightforward loan might find a simple calculator sufficient, while a user with multiple loans or complex repayment plans would benefit from the capabilities of an advanced calculator.

Input Fields for a Student Loan Calculator

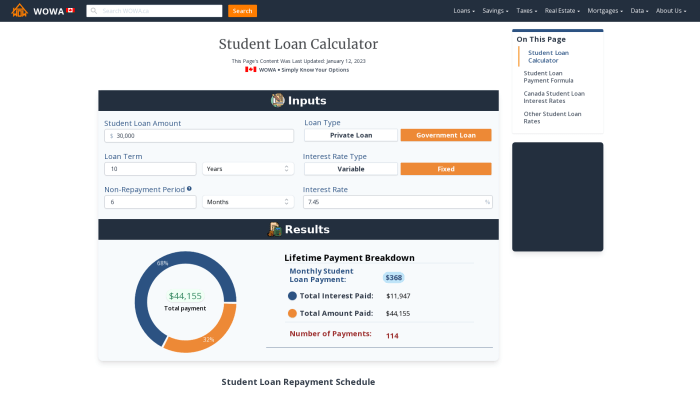

A comprehensive student loan calculator should include several key input fields to accurately model a student’s loan situation. Essential fields include: Loan Amount (the principal borrowed), Annual Interest Rate (the percentage charged on the outstanding balance), Loan Term (the length of the repayment period, usually in years or months), and additional optional fields like Fees (originations fees or other loan-related charges), Repayment Plan (standard, graduated, income-driven), and Additional Payments (any extra payments the borrower plans to make). The inclusion of optional fields enhances the calculator’s accuracy and applicability to a wider range of scenarios. For instance, incorporating fees allows for a more realistic calculation of the total cost of the loan.

User Interface Design

The following HTML table provides a basic example of a responsive 4-column UI for a student loan calculator:

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Monthly Payment |

|---|---|---|---|

This simple table provides a clear and organized layout for input and output fields. The “readonly” attribute for the monthly payment field prevents accidental modification. A more sophisticated UI could include interactive elements like sliders for interest rates and loan terms, providing a more intuitive user experience. The responsive design ensures the calculator adapts to different screen sizes, making it accessible on various devices.

Output Presentation of Calculation Results

Clear and concise presentation of calculation results is crucial for user understanding. The output should clearly display the monthly payment amount, the total amount paid over the loan term (including interest), and the total interest paid. Presenting this information in a visually appealing and easy-to-understand format, such as a summarized table or a clearly labeled breakdown, improves the user experience and reduces the likelihood of misinterpretations. For example, instead of simply displaying a numerical value for total interest paid, the calculator could also display this figure as a percentage of the total loan amount. This contextualization helps users better grasp the overall cost of borrowing.

Calculation Methods and Algorithms

This section details the mathematical underpinnings of our student loan calculator, outlining the formulas used to determine loan payments and the handling of various repayment options and interest rate types. Understanding these calculations ensures transparency and allows users to accurately project their loan repayment schedules.

The core of any student loan calculation revolves around the concept of amortization, a process of gradually paying off a loan over time through regular payments. These payments cover both the principal (the original loan amount) and the interest accrued on the outstanding balance. The specific calculation depends on the repayment plan selected.

Standard Repayment Calculations

Standard repayment plans involve fixed monthly payments over a set loan term (typically 10 years). The formula used to calculate the monthly payment (M) is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* P = Principal loan amount

* i = Monthly interest rate (Annual interest rate / 12)

* n = Total number of payments (Loan term in years * 12)

For example, a $20,000 loan with a 5% annual interest rate over 10 years would result in a monthly payment calculated as follows: P = $20,000, i = 0.05/12 = 0.004167, n = 10 * 12 = 120. Plugging these values into the formula yields a monthly payment of approximately $212.47.

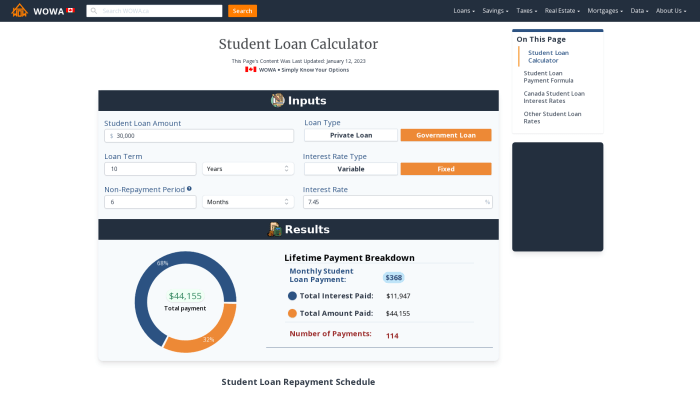

Graduated Repayment Calculations

Graduated repayment plans feature monthly payments that increase over time. The initial payments are lower than in a standard plan, gradually rising to a higher amount over a specified period. Our calculator models this by adjusting the monthly payment amount based on a pre-defined schedule or a user-specified growth rate. The underlying amortization principle remains the same; the increase in monthly payment simply accelerates the loan payoff. The calculation for each payment period will adjust the ‘M’ variable in the standard repayment formula above based on the graduated schedule.

Income-Driven Repayment Calculations

Income-driven repayment plans base monthly payments on a borrower’s income and family size. These plans typically involve a complex formula that considers factors such as discretionary income (income minus a certain percentage of the poverty guideline for the borrower’s family size) and the loan balance. Our calculator uses a simplified model that approximates the payment based on a percentage of the borrower’s discretionary income, with adjustments for loan balance and payment term. The precise calculation varies significantly depending on the specific income-driven repayment plan (e.g., ICR, PAYE, REPAYE), and the calculator will reflect the relevant parameters for the chosen plan. It’s crucial to note that this is a simplified approximation; actual payments under income-driven plans are determined by the federal government and may differ slightly.

Incorporating Fees and Charges

Various fees, such as origination fees or late payment penalties, can significantly impact the total loan cost. Our calculator allows users to input these fees, which are then added to the principal loan amount, thus increasing the overall payment amount and the total interest paid. The increased principal is then used in the standard repayment formula above. For example, a $1,000 origination fee on a $20,000 loan would increase the principal to $21,000, leading to a higher monthly payment.

Fixed vs. Variable Interest Rates

Our calculator handles both fixed and variable interest rates. For fixed-rate loans, the interest rate remains constant throughout the loan term, simplifying the calculation as described above. For variable-rate loans, the interest rate can fluctuate over time, based on a specified index (e.g., LIBOR). Our calculator allows users to input a variable rate, and the calculations are adjusted periodically to reflect the current rate. The monthly payment may vary accordingly, with the calculator illustrating the potential payment changes based on projected interest rate fluctuations.

Visualizations and Data Presentation

Effective data visualization is crucial for a student loan calculator to present complex financial information clearly and understandably. Users need to quickly grasp the implications of their loan choices, and well-designed visuals are key to achieving this. This section details sample visualizations that enhance user comprehension.

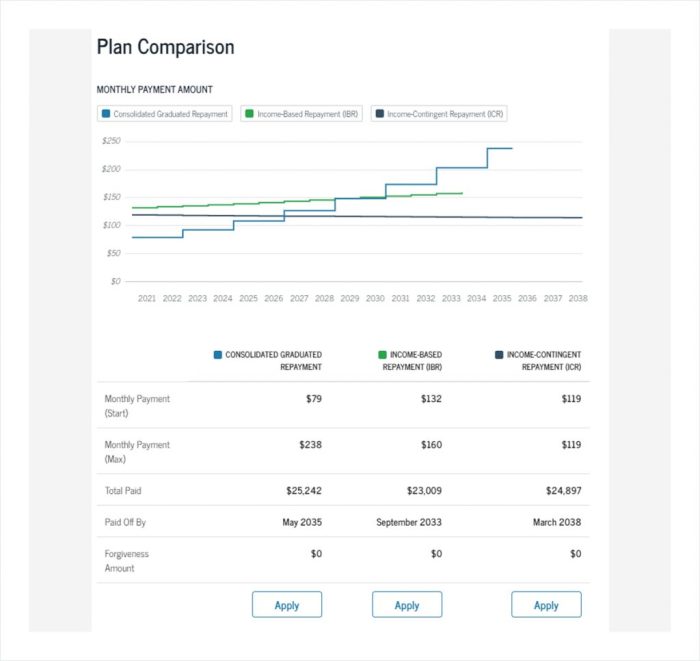

Amortization Schedule Visualization

An amortization schedule visually represents the breakdown of each loan payment over the life of the loan. This table would show, for each payment period (typically monthly), the payment amount, the portion allocated to principal, the portion allocated to interest, and the remaining loan balance. A sample visualization would display this information in a clear tabular format. For example, a $10,000 loan at 5% interest over 10 years would show a decreasing interest portion and an increasing principal portion across the 120 monthly payments. The table would clearly label each column and provide a total repayment amount at the bottom.

Impact of Interest Rates on Total Repayment Cost Visualization

This visualization would compare total repayment costs under different interest rate scenarios. A bar chart would be ideal, with each bar representing a different interest rate (e.g., 4%, 5%, 6%, 7%). The height of each bar would correspond to the total amount repaid over the loan term. This allows for immediate comparison of the significant impact that even small changes in interest rates can have on the overall cost of borrowing. For instance, a $20,000 loan over 5 years might show a substantial difference in total repayment cost between a 4% and a 7% interest rate, visually highlighting the importance of securing a favorable interest rate.

Presentation of Key Calculation Results

The calculator should present key results concisely and prominently. This includes the total loan amount, monthly payment, total interest paid, and total repayment amount. These should be clearly labeled and easy to locate.

Total Loan Amount: $15,000

Monthly Payment: $280.00

Total Interest Paid: $4,000

Total Repayment Amount: $19,000

These key figures should be presented in a prominent location, perhaps at the top of the results section, ensuring users immediately see the most important information. Additional details, such as the amortization schedule, can be presented below. The use of clear formatting and concise language ensures that the user experience remains intuitive and efficient.

Accessibility and User Experience

Creating a student loan calculator that is both functional and accessible to all users is crucial. A well-designed calculator ensures ease of use, regardless of the user’s technical skills or disabilities. This section details strategies to improve accessibility and create a positive user experience.

Accessibility Challenges for Users with Disabilities

Several accessibility challenges must be considered when designing a student loan calculator. These challenges affect users with various disabilities, including visual, auditory, motor, and cognitive impairments. For example, users with visual impairments might rely on screen readers, requiring the calculator to have well-structured HTML and appropriate alternative text for images and interactive elements. Users with motor impairments might struggle with small buttons or complex navigation, necessitating larger interactive elements and keyboard navigation. Users with cognitive impairments may benefit from clear, concise language and simplified calculations.

Strategies to Improve User Experience

Improving the user experience focuses on making the calculator intuitive and easy to use. This involves several key strategies. Clear and concise labeling of all input fields and output results is paramount. The calculator’s layout should be logical and easy to follow, with a clear visual hierarchy. Providing immediate feedback to user input helps to maintain engagement and reduces frustration. For instance, as the user inputs data, the calculator could dynamically update the results in real-time. Furthermore, incorporating features like progress indicators and clear error messages enhances the user experience. The calculator should also be responsive and adapt to different screen sizes, ensuring usability across various devices.

Best Practices for Design

Designing a functional and visually appealing calculator involves adhering to established best practices. High contrast between text and background colors ensures readability for users with low vision. Sufficient spacing between elements prevents visual clutter and improves usability. The use of consistent fonts and styles maintains visual coherence. A simple and uncluttered design minimizes cognitive load and enhances the overall user experience. Consider using colorblind-friendly palettes to ensure accessibility for users with color vision deficiencies. For example, relying on color alone to convey information is problematic; using text labels in addition to color coding is crucial. Regular user testing with diverse participants can identify and address usability issues early in the design process.

Conclusion

Ultimately, a student loan calculator serves as a powerful tool for financial empowerment. By providing transparent and accessible information, it helps students and borrowers understand the implications of their loan choices, fostering responsible financial management. Armed with this knowledge, individuals can navigate the complexities of student loan repayment with greater confidence and achieve their long-term financial goals.

Questions Often Asked

What types of loans can a student loan calculator handle?

Most calculators can handle federal and private student loans, often allowing you to input multiple loans with varying terms and interest rates.

How accurate are student loan calculators?

Accuracy depends on the input data. Using the most up-to-date information on your loan terms and interest rates will yield the most accurate results. Remember, calculators provide estimates, not guaranteed figures.

Can I use a student loan calculator to compare different repayment plans?

Many calculators allow you to explore various repayment options, such as standard, graduated, or income-driven plans, enabling side-by-side comparisons of their financial implications.

What if my interest rate is variable?

Good calculators will allow for variable interest rates. You might need to input an average expected rate or a range of rates to see potential scenarios.