Navigating the world of student loans can be daunting, especially for independent students who lack the support network of parents or guardians. Securing funding for higher education requires understanding the various loan types available, eligibility criteria, and repayment options. This guide provides a comprehensive overview of the process, empowering independent students to make informed decisions about their financial future and successfully manage their student loan debt.

From federal and private loan options to alternative financing methods like scholarships and grants, we explore the entire landscape of financial aid for independent students. We’ll delve into the intricacies of interest rates, repayment plans, and the crucial importance of financial literacy in managing student loan debt effectively. This guide aims to equip you with the knowledge and tools needed to confidently pursue your educational goals without being overwhelmed by the financial burden.

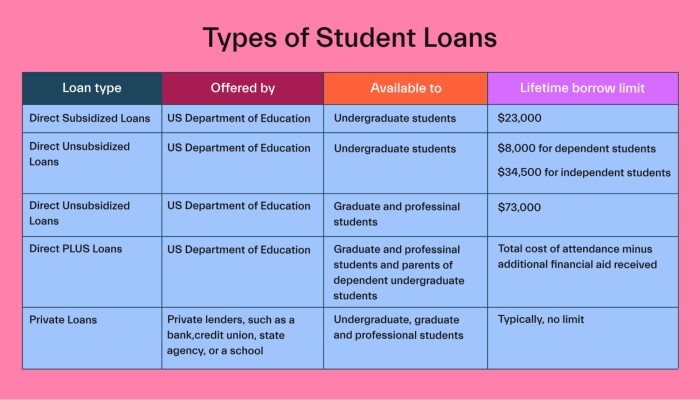

Types of Loans Available

Securing funding for higher education as an independent student can feel daunting, but understanding the different loan options available is the first step towards financial success. This section Artikels the various types of loans, their sources, and key considerations to help you navigate the process.

Independent students, unlike dependent students, are not financially supported by their parents. This means they must rely on their own resources and creditworthiness to secure loans. The types of loans available generally fall into two main categories: federal and private.

Federal Student Loans

Federal student loans are offered by the U.S. Department of Education and generally offer more favorable terms than private loans, including lower interest rates and flexible repayment options. However, eligibility requirements and loan limits apply.

| Loan Type | Lender Type | Eligibility Requirements | Interest Rate Information |

|---|---|---|---|

| Subsidized Direct Loan | Federal Government | Demonstrated financial need, enrollment at least half-time in an eligible program, maintaining satisfactory academic progress. | Interest rate is set annually by the government and is not charged while the student is enrolled at least half-time. |

| Unsubsidized Direct Loan | Federal Government | Enrollment at least half-time in an eligible program, maintaining satisfactory academic progress. | Interest rate is set annually by the government and accrues interest from the time the loan is disbursed. |

| Direct PLUS Loan | Federal Government | Credit check required; may be subject to additional requirements depending on credit history. | Interest rate is set annually by the government and accrues interest from the time the loan is disbursed. |

Subsidized vs. Unsubsidized Federal Student Loans

The key difference between subsidized and unsubsidized federal loans lies in interest accrual. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during certain grace periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, even while the student is in school. This means the borrower will owe more at repayment than the initial loan amount. For independent students, securing subsidized loans often requires demonstrating financial need through the Free Application for Federal Student Aid (FAFSA).

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. These loans typically have higher interest rates and less flexible repayment options compared to federal loans. However, they may be an option for students who have exhausted their federal loan eligibility or need additional funding.

Examples of private loan providers include Sallie Mae, Discover Student Loans, and Citizens Bank. These institutions offer various loan products tailored to different student needs, including those for independent students. The specific interest rates and terms offered will vary based on the applicant’s credit history, credit score, and co-signer availability.

Eligibility Criteria and Requirements

Securing federal student loans as an independent student involves meeting specific criteria and providing necessary documentation. Understanding these requirements is crucial for a smooth application process. This section details the eligibility criteria, the process of establishing independent status, and the required documentation.

Independent Student Status

To be considered an independent student for federal student aid purposes, you must meet at least one of several criteria defined by the Free Application for Federal Student Aid (FAFSA). These criteria generally revolve around age, marital status, dependency status, and veteran status. For example, students who are 24 years or older are automatically considered independent. Similarly, married students, or those who are veterans or have dependents, are also generally classified as independent. The FAFSA form itself will guide you through the specific questions to determine your independent status. Failure to meet these criteria will result in your application being processed under the dependent student category, requiring parental information.

Required Documentation for Loan Applications

Providing accurate and complete documentation is essential for a successful loan application. Incomplete applications may lead to delays or rejection. The following documents are commonly required:

- Completed FAFSA: This form is the foundation of your application and collects crucial information about your financial situation and educational plans.

- Tax Returns (Yours and Your Spouse’s, if applicable): These documents verify your income and tax filing status, essential for determining your financial need and loan eligibility.

- Official College Transcripts: Transcripts confirm your enrollment status and academic progress at your chosen institution.

- Proof of Identity: This usually includes a government-issued photo ID, such as a driver’s license or passport.

- Social Security Number (SSN): Your SSN is required for verification and tracking purposes.

Federal Student Loan Application Process Flowchart

The following flowchart illustrates a simplified version of the federal student loan application process for independent students:

[Begin] –> [Complete FAFSA] –> [Determine Eligibility (Independent Status)] –> [Gather Required Documentation] –> [Submit Application to Loan Provider] –> [Application Review and Processing] –> [Loan Approval/Denial] –> [Loan Disbursement (if approved)] –> [End]

Each stage in this process involves specific steps and potential delays. For example, the “Application Review and Processing” stage may take several weeks depending on the volume of applications and the completeness of the submitted documents. The “Loan Disbursement” stage involves the transfer of funds to your educational institution. Discrepancies or missing information can significantly impact the processing time at each step.

Interest Rates and Repayment Plans

Understanding interest rates and repayment options is crucial for independent students navigating the complexities of student loans. Choosing the right loan and repayment plan can significantly impact your long-term financial health. This section will provide a clearer picture of the financial landscape you’ll encounter.

Interest rates and repayment plans vary considerably depending on the lender, the type of loan, and your creditworthiness. Federal student loans generally offer lower interest rates than private loans, but private loans may be necessary to cover the full cost of education if federal aid is insufficient. Careful comparison shopping is essential before committing to any loan.

Interest Rate Comparison for Independent Students

The following table offers a sample comparison of interest rates and repayment terms. Note that these rates are illustrative and can change based on market conditions and individual borrower profiles. Always check with the lender for the most up-to-date information.

| Lender | Loan Type | Interest Rate (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Federal Government (Direct Loan) | Unsubsidized Loan | 5.0% – 7.5% (variable depending on loan period) | Standard 10-year repayment, but options available for shorter or longer terms. |

| Private Lender A | Undergraduate Loan | 7.0% – 12.0% (variable, based on credit score) | 5-15 year options; potential for variable interest rate. |

| Private Lender B | Graduate Loan | 8.5% – 14.0% (variable, based on credit score and co-signer availability) | 10-20 year options; interest rate may change based on market conditions. |

Repayment Plan Options

After graduation, several repayment plans are available to help manage student loan debt. The choice depends on your income and financial situation. Choosing a plan with lower monthly payments might seem attractive, but it can significantly increase the total interest paid over the life of the loan.

Examples of repayment plans include:

- Standard Repayment Plan: Fixed monthly payments over 10 years. This plan results in the lowest total interest paid but may have higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This offers lower initial payments but higher payments later and results in more total interest paid than standard repayment.

- Extended Repayment Plan: Spreads payments over a longer period (up to 25 years). This lowers monthly payments but significantly increases the total interest paid over the loan’s life.

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on your income and family size. These plans often result in loan forgiveness after 20-25 years, but the total amount repaid can be substantially higher than with other plans.

Implications of Different Repayment Plans

Choosing a repayment plan involves a trade-off between monthly payment affordability and total interest paid. For instance, an extended repayment plan might seem appealing due to lower monthly payments, but the significantly longer repayment period leads to substantially higher overall interest costs. Conversely, a standard repayment plan with higher monthly payments results in paying off the loan quicker and reducing the total interest paid. Careful consideration of your financial circumstances and long-term goals is crucial in making this decision. It is recommended to use a student loan repayment calculator to model different scenarios and understand the total cost implications of each plan.

Managing Student Loan Debt

Successfully navigating student loan debt is crucial for independent students aiming for financial stability. Understanding budgeting, repayment strategies, and the consequences of default are key to a positive financial future. This section provides a practical guide to effectively manage your student loans.

Effective management of student loan debt requires a proactive and organized approach. Creating a realistic budget, exploring repayment options, and consistently monitoring your progress are essential steps. Failing to manage your debt can lead to significant financial hardship, impacting your credit score and future borrowing opportunities.

Budgeting and Managing Student Loan Debt: A Step-by-Step Guide

- Create a Detailed Budget: Track all income and expenses. Use budgeting apps or spreadsheets to monitor your spending and identify areas for potential savings. Categorize expenses (housing, food, transportation, loan payments, etc.) to gain a clear picture of your financial situation.

- Prioritize Loan Payments: Determine which loans to prioritize based on interest rates and repayment terms. Prioritize high-interest loans to minimize overall interest paid. Consider using extra funds to make additional principal payments on high-interest loans to shorten the repayment period.

- Explore Repayment Options: Understand the different repayment plans offered (standard, graduated, extended, income-driven). Choose a plan that aligns with your current financial capacity and long-term goals. Contact your loan servicer to discuss options and eligibility.

- Automate Payments: Set up automatic payments to avoid late fees and ensure consistent repayment. This eliminates the risk of missed payments due to oversight and helps build a positive payment history.

- Regularly Monitor Progress: Review your budget and loan statements monthly. Track your progress towards loan repayment and adjust your budget as needed. Early detection of potential issues allows for timely intervention and prevents further complications.

Practical Tips and Strategies for Minimizing Student Loan Debt

Several strategies can help minimize the burden of student loan debt. These strategies focus on proactive planning, efficient repayment, and responsible financial behavior.

- Graduate Quickly: Completing your degree in a timely manner reduces the overall cost of education and the total amount borrowed.

- Explore Scholarships and Grants: Maximize the use of financial aid that doesn’t require repayment to reduce loan dependency.

- Work Part-Time While Studying: Earning income during your studies helps reduce the need for borrowing and allows for early loan repayment.

- Live Frugally: Minimize non-essential expenses to maximize funds available for loan repayment.

- Refine Budgeting Regularly: Adjust your budget as your income or expenses change to maintain financial stability and ensure consistent loan payments.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences that can significantly impact your financial future. Understanding these consequences is crucial for responsible loan management.

- Damaged Credit Score: A default will significantly lower your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the debt, reducing your disposable income.

- Tax Refund Offset: Your tax refund may be seized to pay off the defaulted loan.

- Difficulty Obtaining Future Loans: A default makes it extremely difficult to secure future loans for education, housing, or other purposes.

- Collection Agency Involvement: Your debt may be transferred to a collection agency, which can aggressively pursue repayment through various means.

Resources and Support for Independent Students

Navigating the complexities of student loans as an independent student can feel overwhelming. However, numerous resources and support systems are available to guide you through the process, from finding suitable loan options to managing your debt effectively. Understanding where to find this assistance is crucial for your financial success.

Securing financial aid and managing student loan debt requires proactive engagement with available resources. Independent students often face unique challenges, making access to reliable information and support even more critical. This section details key resources and provides a sample communication template for interacting with lenders.

Reliable Resources and Organizations

Several organizations offer valuable support and guidance to independent students seeking loans. These resources provide information on loan options, application processes, financial literacy, and debt management strategies. Accessing these resources can significantly improve your understanding and management of your student loan journey.

- The National Association of Student Financial Aid Administrators (NASFAA): NASFAA offers a wealth of information on federal and private student loans, including eligibility requirements and application processes. Their website provides articles, FAQs, and resources to help students understand their options.

- The U.S. Department of Education: The federal government’s website is a primary source for information on federal student loans, including the Federal Direct Loan Program. This site provides details on loan types, interest rates, repayment plans, and loan forgiveness programs.

- Your College or University’s Financial Aid Office: Your institution’s financial aid office is an invaluable resource. They can provide personalized guidance on loan options, help you complete the Free Application for Federal Student Aid (FAFSA), and answer specific questions about your financial situation.

- Nonprofit Credit Counseling Agencies: Organizations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost credit counseling services. They can help you create a budget, manage debt, and explore options for consolidating or refinancing your student loans.

- Student Loan Repayment Companies: Several companies specialize in helping students manage their student loan debt. These companies may offer services such as loan consolidation, repayment planning, and debt management strategies. It is important to research these companies carefully to ensure they are reputable and transparent.

Sample Email Template for Contacting Lenders

Effective communication with potential lenders is essential for obtaining the best loan terms. A well-structured email clearly outlining your needs and qualifications increases your chances of a positive response. This sample email provides a framework for your communication.

Subject: Inquiry Regarding Student Loan Options – [Your Name]

Dear [Lender Contact Person or “Loan Officer”],

My name is [Your Name], and I am an independent student seeking a student loan to finance my education at [University Name]. I am pursuing a [Degree] in [Major] and anticipate needing approximately [Loan Amount] in funding.

I am interested in learning more about your student loan programs, specifically [Mention specific loan types if applicable, e.g., undergraduate loans, private loans]. Could you please provide information on your interest rates, repayment options, and application requirements?

I have attached my [Resume/Transcript – optional]. I am available for a call at your earliest convenience to discuss my financial needs further. Thank you for your time and consideration.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Importance of Financial Literacy for Independent Students Managing Loans

Financial literacy is paramount for independent students managing student loans. A strong understanding of budgeting, debt management, and financial planning enables informed decision-making and helps prevent future financial difficulties. This includes understanding interest rates, repayment schedules, and the long-term implications of loan choices.

Without adequate financial literacy, students may struggle to understand loan terms, leading to poor financial choices. This could result in higher interest payments, difficulty in repayment, and potential damage to their credit score. Proactive learning about personal finance is crucial for long-term financial well-being.

Alternatives to Traditional Loans

Securing funding for higher education as an independent student can be challenging, but thankfully, traditional loans aren’t the only option. Exploring alternative financing methods can significantly reduce your reliance on debt and potentially lead to more manageable repayment plans in the future. This section will Artikel several alternatives and compare them to traditional student loans.

Many independent students successfully fund their education without solely relying on loans. By strategically combining different funding sources, you can create a financial plan that best suits your individual needs and circumstances. This often involves a combination of merit-based and need-based aid, along with personal savings and part-time employment.

Types of Alternative Financing Options

Independent students have access to a range of alternative financing options, primarily scholarships, grants, and work-study programs. Scholarships are typically awarded based on merit, talent, or specific achievements. Grants are awarded based on financial need, and work-study programs provide part-time employment opportunities on campus or in the community. These options can significantly reduce the overall cost of education and minimize the need for substantial borrowing.

Comparison of Traditional Loans and Alternative Financing Options

The following table compares and contrasts the advantages and disadvantages of traditional loans versus alternative financing options, offering a clearer picture to help you make informed decisions.

| Option | Advantages | Disadvantages | Application Process |

|---|---|---|---|

| Traditional Student Loans (Federal & Private) | Large sums available; flexible repayment options (depending on the loan type); potentially lower interest rates for federal loans. | Accumulates debt; interest accrues over time; can negatively impact credit score if not managed properly; requires a credit check (for private loans). | Application through federal student aid website (FAFSA) for federal loans or directly through private lenders for private loans. Involves credit checks and documentation of income and expenses. |

| Scholarships | Free money; doesn’t need to be repaid; can significantly reduce overall educational costs. | Competitive application process; limited availability; requires significant time and effort to research and apply. | Varies depending on the scholarship provider; usually involves completing an application, providing transcripts, and writing essays or providing recommendations. |

| Grants | Free money; doesn’t need to be repaid; based on financial need; can be substantial depending on eligibility. | Limited availability; stringent eligibility requirements; competitive application process. | Application through FAFSA or directly through grant-providing organizations. Requires documentation of financial need. |

| Work-Study Programs | Earns money to cover educational expenses; provides valuable work experience; flexible scheduling options (often). | Limited earning potential; may impact study time; availability depends on the institution and program. | Application through FAFSA; placement determined by the institution’s work-study office. |

Examples of Scholarship and Grant Opportunities for Independent Students

Several organizations offer scholarships and grants specifically designed to support independent students. Researching these opportunities diligently is crucial. Note that eligibility criteria and application processes vary significantly.

Examples include (but are not limited to):

- Sallie Mae Scholarships: Sallie Mae offers various scholarships based on academic achievement, community involvement, and financial need. These are highly competitive and require a strong application.

- Fastweb: This online scholarship search engine allows students to search for scholarships based on various criteria, including independent student status. It aggregates scholarships from numerous sources.

- The Jack Kent Cooke Foundation Undergraduate Transfer Scholarship: This prestigious scholarship supports high-achieving community college students transferring to four-year institutions. It is specifically designed for students with financial need.

- State-Specific Grants: Many states offer grants to students who meet specific residency and financial need requirements. These grants often have less competition than national scholarships.

Concluding Remarks

Securing funding for higher education as an independent student requires careful planning and a thorough understanding of available resources. By understanding the different loan types, eligibility requirements, and repayment options, independent students can navigate the complexities of student loans and make informed decisions that align with their financial goals. Remember to utilize the available resources, prioritize financial literacy, and explore alternative financing options to minimize debt and pave the way for a successful academic and financial future.

Essential FAQs

What is considered independent student status for federal loans?

Generally, you’re considered an independent student if you’re at least 24 years old, married, have dependents, are a veteran, or are an orphan/ward of the court. Specific criteria are Artikeld on the Federal Student Aid website.

Can I refinance my student loans after graduation?

Yes, refinancing can lower your interest rate and monthly payments, but it often involves private lenders and may not be suitable for all borrowers. Carefully compare offers before refinancing.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, lead to wage garnishment, and impact your ability to obtain future loans or credit. Contact your lender immediately if you’re struggling to make payments.

Are there any loan forgiveness programs for independent students?

Several loan forgiveness programs exist, often tied to specific professions (e.g., public service). Eligibility requirements vary significantly, so research the programs available to see if you qualify.