Securing higher education is a pivotal step towards personal and societal advancement, yet financial constraints often impede access for disadvantaged students. This exploration delves into the complexities of student loans specifically designed to support these individuals, examining the various loan types available, the challenges faced in accessing these funds, and the long-term implications of student loan debt. We will also investigate strategies to improve affordability and accessibility, highlighting the crucial roles of government agencies and educational institutions in fostering equitable access to higher education.

The journey to higher education shouldn’t be dictated by financial limitations. This analysis aims to shed light on the current landscape of loans for disadvantaged students, offering insights into both the hurdles and the potential solutions to ensure a more equitable and accessible educational system for all.

Types of Loans for Disadvantaged Students

Securing funding for higher education can be a significant hurdle, particularly for students from disadvantaged backgrounds. Understanding the various loan options available is crucial for navigating this process effectively and making informed decisions about financing your education. This section will Artikel the different types of federal and private student loans, their eligibility requirements, and a comparison of their interest rates and repayment terms.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. These loans are often preferred due to their borrower protections and flexible repayment options. Several types of federal student loans are available to eligible students.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized Stafford Loans are need-based, meaning the government pays the interest while the student is enrolled at least half-time. Unsubsidized Stafford Loans are not need-based; interest accrues while the student is in school. Eligibility is determined by the student’s financial need (for subsidized loans) and their enrollment status (at least half-time). Interest rates are set annually by the government and are generally lower than private loan rates. Repayment typically begins six months after graduation or leaving school.

Federal PLUS Loans

Federal PLUS Loans are available to graduate and professional students, as well as parents of undergraduate students. Eligibility requires a credit check; those with adverse credit history may still qualify under certain circumstances. Interest rates are generally higher than Stafford Loans and accrue interest from the time the loan is disbursed. Repayment plans vary, but generally start within 60 days of the loan’s disbursement.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. These loans often have higher interest rates and less favorable repayment terms than federal loans. Eligibility criteria are typically based on creditworthiness, income, and co-signer availability. Students may need a co-signer (typically a parent or guardian) if they lack a strong credit history. Interest rates and repayment terms vary significantly depending on the lender and the borrower’s credit profile.

Comparison of Loan Types

The following table summarizes the key differences between the loan types discussed:

| Loan Type | Interest Rate | Repayment Period | Eligibility Criteria |

|---|---|---|---|

| Subsidized Stafford Loan | Variable; set annually by the government (generally lower than other options) | Typically begins six months after graduation or leaving school | Demonstrated financial need, enrollment at least half-time |

| Unsubsidized Stafford Loan | Variable; set annually by the government (generally lower than other options) | Typically begins six months after graduation or leaving school | Enrollment at least half-time |

| Federal PLUS Loan | Variable; set annually by the government (generally higher than Stafford Loans) | Typically begins within 60 days of disbursement | Credit check; graduate or professional student or parent of undergraduate student |

| Private Student Loan | Variable; depends on lender and borrower’s creditworthiness (generally higher than federal loans) | Varies depending on the lender and loan terms | Creditworthiness, income, potentially a co-signer |

Access to Financial Aid and Loan Programs

Securing financial aid and loan programs is crucial for disadvantaged students to pursue higher education. However, numerous obstacles prevent equitable access, hindering their ability to achieve their academic goals. Understanding these barriers and exploring effective solutions is vital to fostering a more inclusive and equitable higher education system.

Navigating the complex world of financial aid can be daunting for any student, but the challenges are often amplified for those from disadvantaged backgrounds. These students frequently face systemic barriers that limit their opportunities, creating significant inequities in access to higher education funding.

Challenges Faced by Disadvantaged Students in Accessing Financial Aid

Disadvantaged students often encounter significant hurdles in accessing financial aid. These include limited awareness of available programs, complex application processes, and a lack of adequate support and guidance. Many come from families with limited financial literacy, making it difficult to understand eligibility requirements and navigate the application process effectively. Furthermore, students from underrepresented minority groups may face additional barriers due to systemic biases within the financial aid system. For instance, reliance on parental income in determining financial need can disproportionately disadvantage students from low-income families or those who are estranged from their parents.

Systemic Barriers Preventing Equal Access to Loan Programs

Several systemic factors contribute to unequal access to loan programs for disadvantaged students. One significant barrier is the complexity of the application process itself. The forms are often lengthy and require detailed financial information that many low-income families may not readily possess. Another critical barrier is the lack of sufficient financial aid counseling and support. Many high schools serving disadvantaged communities lack adequate resources to provide comprehensive guidance on financial aid options, leaving students to navigate the process alone. Additionally, some loan programs may have eligibility requirements that unintentionally discriminate against certain groups, such as requiring a co-signer who may not be available to students from low-income families.

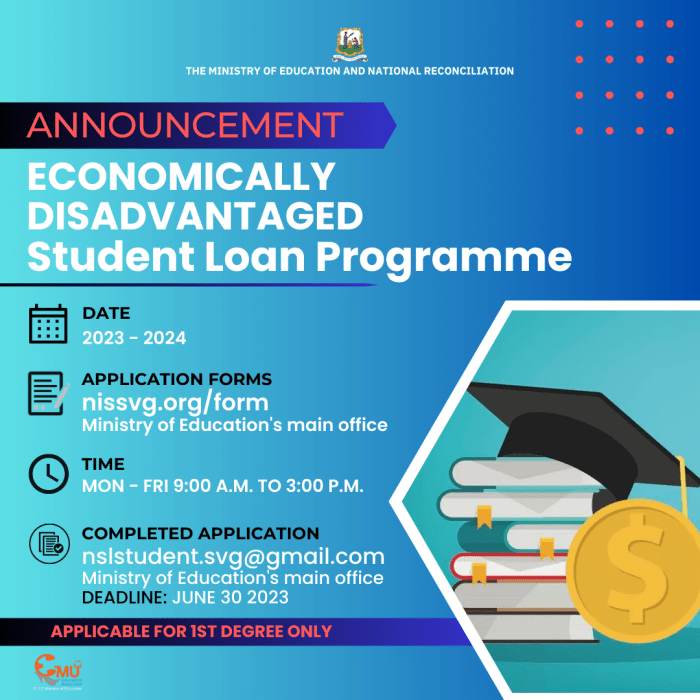

Successful Initiatives to Improve Access for Disadvantaged Groups

Several initiatives have proven successful in improving access to financial aid and loan programs for disadvantaged students. For example, the expansion of grant programs, which do not need to be repaid, has significantly increased access to higher education for low-income students. Furthermore, simplification of the Free Application for Federal Student Aid (FAFSA) form and increased online accessibility have made the application process less daunting. Mentorship programs pairing students with financial aid experts can provide invaluable support and guidance, empowering students to navigate the system effectively. Targeted outreach programs in underserved communities can also raise awareness about available financial aid opportunities.

Role of Guidance Counselors and Financial Aid Offices in Supporting Students

Guidance counselors and financial aid offices play a critical role in supporting disadvantaged students’ access to financial aid. Guidance counselors can provide essential information about financial aid opportunities, assist students with completing applications, and offer personalized support to navigate the complex process. Financial aid offices at colleges and universities should actively reach out to prospective students from disadvantaged backgrounds, provide clear and accessible information about financial aid programs, and offer individualized assistance throughout the application and disbursement process. Proactive outreach and personalized support are essential to ensuring that all students have the opportunity to pursue higher education regardless of their socioeconomic background.

Impact of Loan Debt on Disadvantaged Students

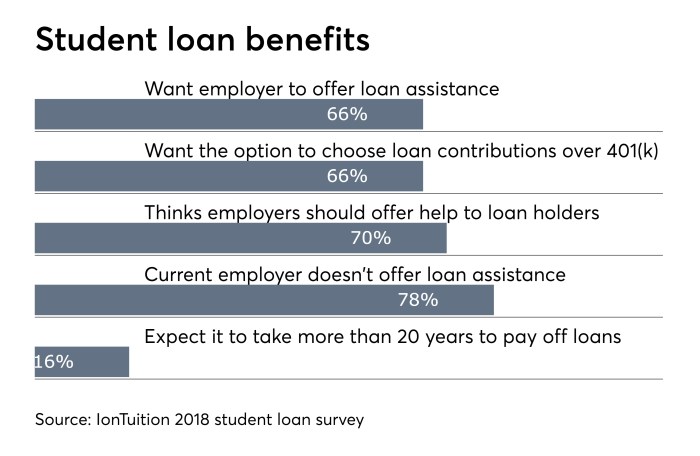

The burden of student loan debt disproportionately affects disadvantaged students, hindering their ability to achieve financial stability and limiting their future opportunities. This section will explore the significant financial consequences associated with high levels of student loan debt for this population, examining its impact on their long-term economic prospects.

The weight of student loan debt can significantly impact the financial well-being of disadvantaged students, creating a cascade of challenges that extend far beyond their college years. Understanding the scope of this problem is crucial for developing effective strategies to mitigate its negative effects and promote equitable access to higher education.

Average Loan Debt for Disadvantaged Students

While precise figures vary depending on the definition of “disadvantaged” and the data source used, studies consistently show that students from low-income backgrounds and minority groups tend to borrow more and graduate with higher levels of student loan debt than their more affluent peers. For example, a report by The Institute for College Access & Success (TICAS) might indicate that the average debt for disadvantaged students is considerably higher – perhaps exceeding $30,000 – compared to the national average. This disparity arises from several factors, including limited access to savings and family resources, higher reliance on loans to cover educational expenses, and potential lower earning potential post-graduation. This higher debt burden can have significant implications for their financial futures.

Long-Term Financial Consequences of High Student Loan Debt

High student loan debt can have profound and long-lasting financial consequences for disadvantaged students. The substantial monthly payments can severely restrict their ability to save for retirement, purchase a home, or start a family. This can lead to a cycle of debt, delaying major life milestones and creating financial insecurity. For instance, a student graduating with $40,000 in debt might face significant challenges in saving for a down payment on a house or accumulating assets for retirement. Furthermore, the stress associated with managing high debt can negatively impact mental health and overall well-being.

Correlation Between Loan Debt and Future Economic Opportunities

The correlation between student loan debt and future economic opportunities is undeniable, particularly for disadvantaged students. High levels of debt can limit career choices, forcing graduates to prioritize higher-paying jobs over those that align with their passions or career goals. The pressure to repay loans quickly may also lead them to accept lower-paying jobs or forgo opportunities for further education or professional development. Moreover, high debt can affect credit scores, making it difficult to secure loans for business ventures, mortgages, or other financial opportunities. This can perpetuate a cycle of financial disadvantage, hindering upward mobility.

Key Impacts of Loan Debt on Disadvantaged Students

- Reduced Financial Stability: High loan payments limit savings and hinder major life purchases like homes and investments.

- Limited Career Choices: The need to repay debt quickly may restrict career options to higher-paying jobs, even if less fulfilling.

- Delayed Life Milestones: Purchasing a home, starting a family, or saving for retirement are significantly delayed.

- Negative Impact on Mental Health: The stress of managing high debt can contribute to anxiety and depression.

- Reduced Access to Future Opportunities: High debt can negatively impact credit scores, limiting access to loans and investments.

Strategies to Improve Loan Affordability and Accessibility

Improving loan affordability and accessibility for disadvantaged students requires a multifaceted approach focusing on increased funding, streamlined application processes, and enhanced financial literacy. These strategies aim to reduce the burden of student debt and improve opportunities for educational attainment. Addressing these issues requires collaboration between educational institutions, government agencies, and non-profit organizations.

Increasing Grant Funding for Disadvantaged Students

A comprehensive program to increase grant funding should prioritize students from low-income backgrounds, first-generation college students, and those facing significant financial hardship. This could involve increasing the overall budget allocated to grant programs, creating new grant opportunities specifically targeting these groups, and simplifying the grant application process to encourage wider participation. For example, a program could allocate a specific percentage of federal student aid funding directly to grants for students meeting pre-defined criteria of financial need, as determined by the FAFSA (Free Application for Federal Student Aid). This targeted approach would ensure that the funds reach the students who need them most. Furthermore, matching grants from private foundations and corporations could supplement government funding, maximizing the impact.

Simplifying the Loan Application Process

The complexities of the student loan application process often deter disadvantaged students. Simplification involves creating user-friendly online portals with clear instructions, multilingual support, and readily available assistance. Streamlining the required documentation, reducing the number of forms, and providing pre-filled information where possible would significantly reduce the administrative burden. For instance, automatic data transfer from the FAFSA to loan applications could eliminate the need for redundant information entry. Additionally, establishing dedicated support centers staffed with bilingual personnel familiar with the challenges faced by disadvantaged students could significantly improve the application process.

Promoting Financial Literacy Among Disadvantaged Students

Financial literacy education is crucial for disadvantaged students to make informed decisions about borrowing and managing their debt. This can be achieved through mandatory financial literacy courses integrated into high school and college curricula, workshops offered by universities and community organizations, and easily accessible online resources. The curriculum should cover topics such as budgeting, credit scores, loan repayment options, and debt management strategies. For example, interactive online modules could simulate real-life financial scenarios, allowing students to practice making informed decisions. Partnering with local credit unions and financial institutions could provide practical, hands-on experience and mentorship.

Actionable Steps to Improve Affordability

The following steps can significantly improve the affordability and accessibility of student loans for disadvantaged students:

- Increase the maximum Pell Grant award amount to better cover the cost of tuition and living expenses.

- Expand eligibility criteria for federal grants and scholarships to include a wider range of disadvantaged students.

- Implement income-driven repayment plans with lower monthly payments and loan forgiveness options for borrowers who work in public service or other low-paying fields.

- Create a national database of scholarships and grants specifically for disadvantaged students, making it easier to find and apply for funding opportunities.

- Invest in financial literacy programs that teach students how to manage their finances and avoid excessive debt.

- Provide free or low-cost financial counseling services to help students navigate the complexities of student loans.

The Role of Government and Educational Institutions

Government agencies and educational institutions play crucial, interconnected roles in ensuring equitable access to loans for disadvantaged students. Their actions, or lack thereof, significantly impact a student’s ability to pursue higher education and their subsequent financial well-being. Effective collaboration between these entities is vital for creating a truly accessible and supportive system.

Government Responsibilities in Ensuring Equitable Loan Access

Federal and state governments bear the primary responsibility for establishing and maintaining loan programs designed to support disadvantaged students. This includes setting eligibility criteria, determining loan amounts and interest rates, and overseeing the disbursement of funds. Key responsibilities also involve monitoring lending practices to prevent predatory lending and ensuring that programs are effectively reaching their intended target populations. For example, the US Department of Education’s oversight of federal student loan programs, including Pell Grants and subsidized loans, directly impacts millions of students. Similarly, state-level initiatives often supplement federal programs, providing additional grants or loan forgiveness programs tailored to the specific needs of their residents. Effective government oversight also necessitates robust data collection and analysis to identify systemic inequities and inform policy adjustments.

The Role of Colleges and Universities in Supporting Students with Loan Applications

Colleges and universities have a significant role in guiding students through the often-complex process of applying for financial aid, including loans. This involves providing clear and accessible information about various loan options, assisting students with completing applications, and offering financial literacy workshops to help students understand their borrowing responsibilities. Many institutions also maintain dedicated financial aid offices staffed with trained professionals who can answer student questions, resolve application issues, and provide personalized guidance. Furthermore, proactive outreach to students from disadvantaged backgrounds is critical to ensure that they are aware of available resources and feel supported throughout the process. Effective communication and individualized support can significantly improve application success rates and reduce the risk of students making ill-informed borrowing decisions.

Comparative Approaches of Institutions in Addressing Student Loan Debt

Different institutions employ varying approaches to address student loan debt. Some institutions offer robust financial aid packages that minimize the need for students to borrow heavily. Others may prioritize loan counseling and repayment assistance programs, providing support to graduates struggling with debt. Some institutions may partner with external organizations to offer loan forgiveness programs or debt consolidation options. The effectiveness of these approaches varies, depending on factors such as the institution’s resources, its commitment to student support, and the specific needs of its student population. For example, some elite private universities may have substantial endowments allowing them to offer generous financial aid packages, while smaller public institutions may rely more heavily on government loan programs and may have fewer resources for individualized student support. The approaches also vary by the type of institution (public vs. private, for-profit vs. non-profit) and the specific characteristics of their student body.

Best Practices Implemented by Educational Institutions to Support Students

| Institution Type | Best Practice 1 | Best Practice 2 | Best Practice 3 |

|---|---|---|---|

| Public University (Example: University of California System) | Comprehensive online resources and workshops on financial literacy and loan management. | Dedicated financial aid counselors who provide personalized support and guidance. | Partnerships with local organizations to offer debt counseling and repayment assistance programs. |

| Private University (Example: Stanford University) | Need-blind admissions and generous financial aid packages that meet 100% of demonstrated financial need. | Early intervention programs to educate students about responsible borrowing before they even apply for loans. | Robust loan repayment planning tools and resources available online and through individual advising sessions. |

| Community College (Example: City Colleges of Chicago) | Strong emphasis on career services and job placement assistance to ensure students can secure employment upon graduation and repay their loans. | Partnerships with local businesses and organizations to provide scholarships and other forms of financial support. | Accessible and multilingual financial aid information and application assistance. |

| For-Profit Institution (Example: *Note: Examples of best practices from for-profit institutions are less readily available due to scrutiny and varying levels of support offered.*) | *Transparent and easily accessible information regarding loan terms and repayment options.* | *Clearly defined processes for addressing student concerns and complaints regarding financial aid.* | *Potential partnerships with non-profit organizations for financial literacy training and debt management resources.* |

Illustrative Examples of Successful Programs

Numerous programs have demonstrated success in improving loan access and repayment for disadvantaged students. These initiatives highlight the effectiveness of targeted interventions and comprehensive support systems. Examining these examples provides valuable insights into best practices and potential strategies for future development.

The Kalamazoo Promise: A Model for Enhanced Access to Higher Education

The Kalamazoo Promise, a scholarship program in Kalamazoo, Michigan, serves as a compelling example of a successful initiative improving college access for disadvantaged students. Launched in 2005, the program guarantees tuition and fees at public Michigan universities and community colleges for eligible students who graduate from Kalamazoo Public Schools. Its structure involves a multifaceted approach: local businesses and philanthropists fund the program, the Kalamazoo Public Schools oversee eligibility determination, and participating universities manage the disbursement of funds. The impact has been significant, resulting in increased college enrollment and graduation rates among Kalamazoo Public Schools graduates, demonstrating a clear link between financial aid and educational attainment for previously underserved populations. The program’s success stems from its community-based approach, long-term commitment, and comprehensive support beyond financial aid. Data shows a dramatic increase in college enrollment and graduation rates among participating students, surpassing national averages for similar demographics.

The American Student Assistance’s Loan Repayment Assistance Program

The American Student Assistance (ASA) offers a loan repayment assistance program exemplifying effective strategies for managing and repaying student loans. ASA’s program, while not a singular initiative but rather a collection of support services, focuses on providing personalized guidance and resources to borrowers. These services include financial literacy workshops, individualized repayment plan development, and connections to relevant government programs. The program’s success lies in its holistic approach, addressing not only the financial burden but also the emotional and psychological stress associated with student loan debt. By offering personalized counseling and practical tools, ASA empowers borrowers to make informed decisions and develop sustainable repayment strategies, ultimately reducing the risk of default and improving long-term financial well-being. The program’s effectiveness is measured by increased borrower knowledge of repayment options, decreased default rates, and improved credit scores among participating students. Their data shows a demonstrably positive impact on borrower financial health and reduced anxiety surrounding loan repayment.

Ending Remarks

Ultimately, ensuring equitable access to higher education for disadvantaged students requires a multifaceted approach. While various loan programs exist, systemic barriers and the long-term impact of student loan debt remain significant concerns. By fostering financial literacy, streamlining application processes, increasing grant funding, and promoting collaboration between government agencies and educational institutions, we can pave the way for a more just and accessible higher education system. The success stories highlighted demonstrate that meaningful progress is possible, inspiring continued efforts towards creating a future where financial limitations do not hinder the pursuit of knowledge and opportunity.

FAQ Explained

What are the potential consequences of defaulting on a student loan?

Defaulting on student loans can lead to severe consequences, including damaged credit scores, wage garnishment, and difficulty obtaining future loans or credit. It can significantly impact your financial future.

Are there any loan forgiveness programs for disadvantaged students?

Yes, several loan forgiveness programs exist, often targeting specific professions or employment sectors. Eligibility criteria vary, so it’s crucial to research available options and their requirements.

How can I find a financial advisor who specializes in student loan debt?

Many financial planning organizations and credit counseling agencies offer services specifically tailored to managing student loan debt. You can also search online directories for certified financial planners with expertise in this area.

What resources are available to help me budget and manage my student loan payments?

Numerous online budgeting tools and resources are available, along with financial literacy programs offered by colleges, universities, and non-profit organizations. These tools can assist in creating a realistic repayment plan.