The crushing weight of student loan debt impacts millions, hindering financial stability and economic growth. This pervasive issue affects individuals across various demographics, impacting consumer spending and overall economic prosperity. Understanding the complexities of this problem—from government policies to individual financial strategies—is crucial to finding effective solutions.

This exploration delves into the multifaceted nature of student loan debt, examining its economic repercussions, government interventions, the role of higher education institutions, and practical strategies for debt management. We will analyze successful and unsuccessful approaches, ultimately aiming to shed light on pathways towards a more sustainable and equitable future for borrowers.

The Economic Impact of Student Loan Debt

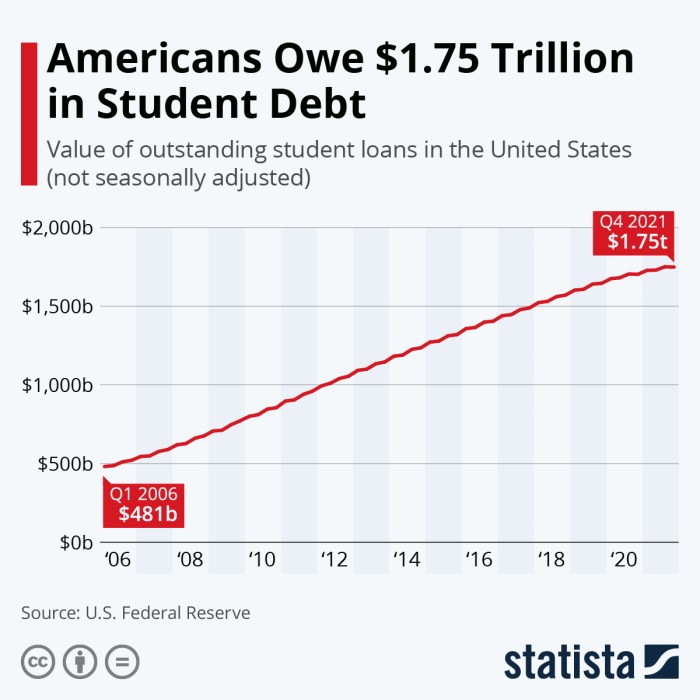

The burgeoning weight of student loan debt in the United States casts a long shadow over the national economy, impacting individual borrowers, businesses, and the overall financial health of the nation. This debt isn’t simply a personal burden; it creates a ripple effect with far-reaching consequences.

The Ripple Effect on the National Economy

High student loan debt significantly dampens economic growth. When young adults – a crucial demographic for driving economic activity – are saddled with substantial debt repayments, their ability to participate fully in the economy is compromised. This impacts various sectors. For example, delayed homeownership reduces construction and related industries’ growth. Lower consumer spending on non-essential goods and services due to loan repayments weakens overall demand. Furthermore, the burden of debt can discourage entrepreneurship, as individuals may be less likely to risk starting businesses when facing significant financial obligations. This reduced entrepreneurial activity limits job creation and innovation, further hindering economic growth. The government also faces challenges, as increased loan defaults can strain public resources and necessitate government intervention, potentially impacting other crucial programs.

Impact on Individual Borrowers’ Financial Health

The individual consequences of high student loan debt are profound and long-lasting. Borrowers often face significant financial constraints, limiting their ability to save for retirement, purchase a home, or invest in their future. The stress associated with managing large debt burdens can also negatively impact mental and physical health. Delayed major life milestones, such as marriage and starting a family, are frequently observed among individuals burdened by student loan debt. The financial burden can also limit career choices, as graduates may prioritize higher-paying jobs over pursuing passions or fields requiring further education, potentially leading to long-term career dissatisfaction. In some cases, the weight of debt can lead to defaults, resulting in damage to credit scores and further financial hardship.

Student Loan Debt and Consumer Spending

High student loan debt directly affects consumer spending. With a significant portion of their income allocated to loan repayments, borrowers have less disposable income to spend on goods and services. This reduced consumer spending weakens aggregate demand, impacting businesses and hindering economic growth. For instance, a young graduate might postpone purchasing a car or delaying a vacation due to their student loan payments, thus reducing demand in those sectors. This reduced spending creates a downward pressure on the economy, creating a cycle where reduced economic activity further hinders individual financial improvement.

Demographic Differences in the Impact of Student Loan Debt

The impact of student loan debt is not uniformly distributed across demographics. Minority groups and low-income individuals often disproportionately bear the burden of student loan debt. This disparity is often linked to factors such as limited access to financial aid, higher interest rates, and lower earning potential after graduation. For example, Black and Hispanic borrowers are more likely to default on their loans compared to white borrowers, largely due to systemic inequalities and disparities in access to quality education and employment opportunities. This unequal impact exacerbates existing socioeconomic inequalities, creating a cycle of debt and disadvantage.

Distribution of Student Loan Debt Across Income Brackets

| Income Bracket | Average Debt | Percentage of Borrowers | Default Rate |

|---|---|---|---|

| Under $30,000 | $25,000 (estimated) | 25% (estimated) | 15% (estimated) |

| $30,000 – $50,000 | $35,000 (estimated) | 35% (estimated) | 10% (estimated) |

| $50,000 – $75,000 | $45,000 (estimated) | 25% (estimated) | 5% (estimated) |

| Over $75,000 | $60,000 (estimated) | 15% (estimated) | 2% (estimated) |

Government Policies and Student Loan Forgiveness Programs

Government policies regarding student loan debt vary significantly across nations, reflecting differing priorities and economic contexts. While many aim to make higher education more accessible, the effectiveness of these policies in reducing overall debt burdens and promoting equitable access is a subject of ongoing debate. This section will examine existing policies, successful international examples, a hypothetical program, and different approaches to forgiveness, weighing their fiscal and equity implications.

Effectiveness of Existing US Government Policies

Existing US government policies, such as income-driven repayment plans and loan consolidation programs, aim to make student loan repayment more manageable. However, the effectiveness of these policies is debated. Income-driven repayment plans can extend repayment periods significantly, potentially reducing monthly payments but increasing overall interest paid. Consolidation programs can simplify repayment but may not necessarily lower the total amount owed. Furthermore, these programs haven’t prevented the rapid growth of student loan debt in recent decades, indicating a need for more comprehensive strategies. Studies show that many borrowers still struggle to manage their debt even with these programs in place, highlighting the need for more impactful solutions.

Successful Student Loan Forgiveness Programs in Other Countries

Several countries have implemented successful student loan forgiveness programs with varying approaches. Australia, for example, offers income-contingent repayment plans where borrowers only repay a percentage of their income above a certain threshold. If their income remains low, their debt may be eventually forgiven. This model demonstrates a focus on ensuring repayment is manageable while still promoting access to higher education. Similarly, some Scandinavian countries have generous grant programs and forgiving policies that reduce the burden of student loans, contributing to a more equitable system. These examples highlight the potential of different approaches to debt forgiveness, although the specific context and economic conditions of each country must be considered.

Hypothetical Student Loan Forgiveness Program: The “Targeted Debt Relief Initiative”

The “Targeted Debt Relief Initiative” would focus on forgiving loans for borrowers who meet specific criteria, prioritizing those from low-income backgrounds or those pursuing careers in high-need fields like education or healthcare. This program would allocate funds based on a tiered system, providing greater forgiveness to those facing the greatest financial hardship. A potential benefit is increased economic mobility for targeted groups, leading to higher earning potential and a boost to sectors experiencing workforce shortages. However, a significant drawback is the substantial fiscal cost, requiring careful consideration of funding mechanisms and potential trade-offs with other government programs. The program would need robust oversight to prevent fraud and ensure funds are distributed effectively.

Comparison of Approaches to Student Loan Forgiveness

Different approaches to student loan forgiveness, such as blanket forgiveness versus targeted forgiveness, have vastly different fiscal and equity implications. Blanket forgiveness, while potentially simpler to administer, would be incredibly expensive and might not address the underlying issues of rising tuition costs and unequal access to higher education. Targeted forgiveness, as exemplified by the hypothetical program above, offers a more focused approach, potentially maximizing the impact on those most in need while minimizing overall cost. However, it requires a complex eligibility determination process and may face challenges in ensuring fairness and avoiding unintended consequences. The choice between these approaches necessitates a careful balancing of economic considerations and social equity goals.

Potential Criteria for Eligibility in a Student Loan Forgiveness Program

Careful consideration of eligibility criteria is crucial for any student loan forgiveness program to ensure fairness and effectiveness. A potential set of criteria could include:

- Borrower’s income level (below a certain poverty threshold).

- Occupation in a high-need field (e.g., healthcare, education, social work).

- Demonstrated financial hardship (e.g., bankruptcy, long-term unemployment).

- Length of time in repayment (e.g., exceeding a certain number of years).

- Type of degree pursued (e.g., prioritizing those with vocational or undergraduate degrees).

These criteria aim to prioritize borrowers who face significant financial challenges or who are contributing to vital sectors of the economy. However, the specific thresholds and weighting of each criterion would require further analysis and debate.

The Role of Higher Education Institutions

Higher education institutions play a pivotal role in shaping the student loan debt landscape. Their pricing structures, financial aid offerings, and overall approach to affordability directly impact the amount of debt students accumulate and their ability to manage it post-graduation. By proactively addressing these issues, universities can significantly contribute to a more sustainable and equitable higher education system.

Universities can implement several strategies to mitigate the burden of student loan debt on graduates. These strategies fall broadly into the areas of cost control, increased financial aid, and innovative funding models. Effective implementation requires a holistic approach, acknowledging the interconnectedness of these factors.

Strategies for Improving Affordability and Transparency in Higher Education Costs

Transparency in pricing is crucial. Universities should clearly articulate the total cost of attendance, including tuition, fees, room and board, books, and other expenses, in a readily accessible and easily understandable format. This clarity allows prospective students and their families to make informed decisions and avoid unexpected costs that can lead to increased borrowing. Furthermore, institutions should actively explore ways to control and potentially reduce the rate of tuition increases, aligning price hikes with demonstrable improvements in educational quality and resources. This could involve streamlining administrative processes, negotiating better deals with vendors, and prioritizing investments in areas with the highest impact on student learning. For example, a university might analyze its administrative costs to identify areas for efficiency gains, potentially reinvesting savings into financial aid programs.

Increased Financial Aid and Scholarship Opportunities

Expanding financial aid and scholarship programs is paramount. Universities should increase the availability and amount of need-based and merit-based aid, ensuring that these funds reach students from diverse socioeconomic backgrounds. This could involve increasing endowment allocations to financial aid, actively seeking out external funding sources, and implementing more efficient aid disbursement processes. For example, a university might establish a new scholarship fund specifically targeting students from low-income families or those pursuing STEM fields. Additionally, they should actively promote and simplify the application processes for these opportunities, making them easily accessible to all eligible students.

The Impact of Tuition Increases on Student Debt Accumulation Over Time

Consistent and significant tuition increases directly contribute to the rising levels of student loan debt. Each year’s increase compounds the overall cost of education, forcing students to borrow more to cover expenses. This effect is particularly pronounced for students pursuing longer degree programs, such as graduate or professional degrees. For instance, a 5% annual tuition increase over four years translates to a substantial overall cost increase, significantly impacting the amount of debt a student accumulates. Universities must critically evaluate their tuition policies, considering the long-term financial consequences for students and their families.

Innovative Funding Models to Reduce Reliance on Student Loans

Exploring innovative funding models can help reduce student loan dependency. Income share agreements (ISAs), for example, offer an alternative where students pay a percentage of their future income after graduation, rather than incurring traditional debt. Other models include partnerships with employers who provide tuition assistance or guarantee repayment of student loans for their employees. These alternative models offer the potential to align the costs of higher education with students’ future earning capacity, mitigating the risks associated with high levels of debt. For example, a university could pilot an ISA program for students in high-demand fields, providing a more predictable and manageable repayment structure. Another example could involve partnerships with local businesses that offer internships or guaranteed employment to students in exchange for reduced tuition costs.

Individual Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive and informed approach. Understanding your loan types, repayment options, and personal financial situation is crucial for developing a sustainable plan to minimize your debt burden and improve your long-term financial health. This section Artikels practical strategies to help you navigate this process successfully.

Student Loan Repayment Plans

Different repayment plans offer varying benefits and drawbacks depending on individual circumstances. The standard repayment plan involves fixed monthly payments over 10 years. Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), tie monthly payments to your income and family size, resulting in lower monthly payments but potentially extending the repayment period and increasing total interest paid. Deferment and forbearance offer temporary pauses in payments, but interest usually continues to accrue, increasing the total debt. Choosing the right plan depends on your current income, expected future income, and risk tolerance. For example, someone with a low income immediately after graduation might benefit from an income-driven plan, while someone with a stable, higher income might prefer the standard plan to pay off their debt faster.

Budgeting Techniques and Financial Literacy Resources

Effective budgeting is paramount for managing student loan debt. Creating a realistic budget involves tracking income and expenses to identify areas where spending can be reduced. The 50/30/20 rule, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, is a popular budgeting guideline. Numerous free online resources, such as Mint, YNAB (You Need A Budget), and Personal Capital, offer tools to track spending, create budgets, and set financial goals. Beyond budgeting, improving financial literacy is essential. Many non-profit organizations and government agencies provide free educational resources on topics like budgeting, saving, investing, and credit management. These resources empower individuals to make informed financial decisions and develop long-term financial stability.

Student Loan Consolidation and Refinancing

Consolidation combines multiple federal student loans into a single loan, simplifying repayment. Refinancing involves replacing existing student loans with a new loan from a private lender, often with a lower interest rate. Before considering either option, borrowers should carefully compare interest rates, fees, and repayment terms. A step-by-step guide might include: 1) Researching available options; 2) Comparing interest rates and fees from multiple lenders; 3) Checking credit score and reviewing financial documents; 4) Applying for consolidation or refinancing; 5) Reviewing the loan terms and signing the loan documents. It’s crucial to understand that refinancing federal loans with a private lender means losing access to federal loan benefits, such as income-driven repayment plans and deferment options.

Impact of Responsible Financial Planning

Responsible financial planning significantly impacts long-term student loan repayment. Early and consistent repayment reduces the total interest paid, shortening the repayment period and freeing up financial resources for other goals like saving for a down payment on a house or investing for retirement. A well-structured budget, coupled with consistent contributions to an emergency fund, helps mitigate financial shocks that could disrupt repayment efforts. For instance, a borrower who diligently follows a budget and maintains an emergency fund is better positioned to handle unexpected expenses without resorting to deferment or forbearance, which can lead to increased overall debt. By prioritizing financial responsibility, individuals can effectively manage their student loan debt and build a strong financial foundation for the future.

The Future of Student Loan Debt and Potential Solutions

The current student loan debt crisis presents a significant challenge to the economic well-being of individuals and the stability of the national economy. Understanding the potential long-term consequences and exploring innovative solutions is crucial for mitigating the impact and preventing future escalation. This section examines potential future scenarios, emerging trends, and proposes concrete solutions to address the burgeoning student loan debt problem.

Long-Term Consequences of the Student Loan Debt Crisis

The persistent growth of student loan debt carries substantial long-term consequences. Delayed homeownership, reduced savings for retirement, and hindered entrepreneurial activity are all potential outcomes. For example, a significant portion of young adults are delaying major life milestones like marriage and starting a family due to the burden of loan repayments. This can have cascading effects on population growth and overall economic productivity. Furthermore, the inability to save adequately for retirement can lead to a greater reliance on social security and other government assistance programs in later life, placing further strain on public resources. The weight of debt can also discourage individuals from pursuing entrepreneurial ventures, limiting innovation and economic growth.

Emerging Trends and Challenges

Several trends exacerbate the student loan debt crisis. The rising cost of higher education continues to outpace inflation, making college increasingly unaffordable for many. Simultaneously, the increasing prevalence of alternative lending options, while offering accessibility, can often come with predatory interest rates and opaque terms, further complicating the debt landscape. Additionally, the increasing number of students pursuing postgraduate degrees contributes to the overall debt burden, as these programs often involve higher tuition fees and longer repayment periods. The lack of sufficient financial literacy among students also plays a significant role, leading to poor borrowing decisions and difficulties in managing debt effectively.

Innovative Solutions to Prevent Future Increases in Student Loan Debt

Several innovative solutions could help prevent future increases in student loan debt. One approach is to promote greater transparency and affordability in higher education. This could involve implementing stricter regulations on for-profit colleges and universities, encouraging greater price competition among institutions, and expanding access to affordable, high-quality community colleges and vocational training programs. Another solution is to incentivize income-driven repayment plans, making loan repayments more manageable for borrowers based on their income levels. This could involve offering more flexible repayment options, such as extended repayment periods or graduated payment plans, which would ease the financial burden on borrowers. Finally, expanding access to financial literacy programs for students could empower them to make informed borrowing decisions and manage their debt effectively.

Comparison of Proposed Solutions

The effectiveness of various proposed solutions varies. Income-driven repayment plans are generally considered effective in providing short-term relief, but they may not fully address the underlying problem of rising tuition costs. Regulations on for-profit colleges could reduce predatory lending practices, but their impact on overall tuition costs might be limited. Expanding access to affordable higher education options is arguably the most effective long-term solution, but it requires significant investment and coordination among government, educational institutions, and other stakeholders. The feasibility of each solution also varies depending on political will, budgetary constraints, and the overall economic climate.

Potential Legislative Changes to Alleviate Student Loan Debt Burden

Several legislative changes could help alleviate the student loan debt burden.

- Increased funding for need-based financial aid programs.

- Expansion of income-driven repayment plans with more favorable terms.

- Implementation of tuition caps or freezes at public colleges and universities.

- Strengthened regulations on for-profit colleges and predatory lending practices.

- Investment in affordable higher education options, such as community colleges and vocational training programs.

- Creation of a national student loan forgiveness program targeted at specific demographics or fields of study.

Summary

Addressing the student loan debt crisis requires a multi-pronged approach involving government action, institutional reform, and individual responsibility. While no single solution magically erases debt, a combination of targeted policies, increased financial aid, responsible borrowing practices, and innovative repayment options offers a path towards alleviating the burden and fostering a healthier financial landscape for future generations. The journey towards lower student loan debt requires collective effort and a commitment to long-term solutions.

FAQ Corner

What is loan consolidation?

Loan consolidation combines multiple student loans into a single loan, often with a simplified repayment plan. This can simplify management but may not always lower the overall interest paid.

Can I discharge my student loans through bankruptcy?

Discharging student loans through bankruptcy is exceptionally difficult and requires demonstrating undue hardship. This is a high bar to meet and is rarely successful.

What are income-driven repayment plans?

Income-driven repayment plans base monthly payments on your income and family size, potentially lowering monthly payments but extending the repayment period.

What resources are available for financial literacy?

Many non-profit organizations and government agencies offer free financial literacy resources, including budgeting tools, debt management advice, and credit counseling services. Check online for local and national resources.