Lowering student loan interest rates presents a complex economic puzzle with far-reaching consequences. This exploration delves into the potential benefits for borrowers, examining the relief from crushing debt and the potential for increased consumer spending and economic growth. However, we will also analyze the counterarguments, considering the impact on lending institutions and the government’s fiscal position. A balanced perspective is crucial to understanding the true ramifications of such a significant policy shift.

The analysis will cover a range of perspectives, from the individual student struggling with debt repayment to the macroeconomic implications for the national economy. We’ll examine potential government funding mechanisms, the reactions of lending institutions, and the long-term effects on higher education itself, including potential impacts on tuition costs and student enrollment. The goal is to provide a comprehensive overview, allowing readers to form their own informed opinions on this critical issue.

The Economic Impact of Lowering Student Loan Interest Rates

Lowering student loan interest rates has significant implications for the national economy, impacting both individual borrowers and the broader financial landscape. The effects are multifaceted, with both short-term and long-term consequences that ripple through various sectors and income groups. Understanding these effects is crucial for policymakers and individuals alike.

Short-Term and Long-Term Economic Effects

A reduction in student loan interest rates offers immediate relief to borrowers, freeing up disposable income. In the short term, this translates to increased consumer spending as individuals have more money available for non-essential purchases, boosting demand for goods and services. This increased spending can stimulate economic activity and potentially lead to job creation in various sectors. However, the long-term effects are more complex. Lower rates might encourage higher levels of borrowing for education, potentially leading to increased student debt in the long run. This could offset some of the initial positive impacts, particularly if the increased borrowing doesn’t translate into commensurate increases in earning potential. The overall long-term effect hinges on several factors, including the magnitude of the rate reduction, the effectiveness of accompanying financial literacy programs, and the broader economic environment.

Impact on Consumer Spending and Economic Growth

Reduced interest payments directly increase the disposable income of borrowers. This increased purchasing power translates to higher consumer spending, a key driver of economic growth. For example, a family saving $100 per month on interest payments might use that money to purchase household goods, dine out more frequently, or engage in other forms of consumption. This increased demand boosts businesses’ revenues, encouraging investment and employment. However, the extent of this effect depends on several factors, including the size of the rate reduction and the overall economic climate. A robust economy might see a more pronounced impact than a struggling one, where consumers might prioritize debt repayment over increased spending.

Benefits and Drawbacks of Lower Interest Rates

Lowering student loan interest rates offers several benefits, including improved financial well-being for borrowers, increased consumer spending, and potential stimulation of economic growth. However, there are also drawbacks. Reduced rates could incentivize excessive borrowing, potentially leading to a larger overall student debt burden in the future. This could create long-term financial instability for individuals and strain the economy. Furthermore, the government might experience reduced revenue from interest payments, potentially impacting its ability to fund other essential programs. The optimal balance between benefits and drawbacks requires careful consideration and policy design.

Impact on Different Income Brackets

The impact of lower student loan interest rates varies across different income brackets. Lower-income borrowers, who often struggle with high debt burdens, stand to benefit the most from reduced interest payments. The freed-up funds can significantly improve their financial stability and potentially enable them to invest in other aspects of their lives. Higher-income borrowers, while also benefiting from lower payments, might experience a less substantial relative improvement. The overall effect is a potential reduction in income inequality, although this depends on the structure of the rate reduction and the overall distribution of student debt.

Hypothetical Scenario: Impact on Millennial Borrowers

Consider a hypothetical scenario involving a group of millennial borrowers with an average student loan debt of $40,000 and an average interest rate of 6%. A reduction in the interest rate to 4% would result in significant savings over the life of the loan. For example, if the loan is repaid over 10 years, the total interest paid would decrease by approximately $2,000. This extra $2,000, distributed over the repayment period, could represent a significant boost to their disposable income, enabling them to save for a down payment on a house, start a family, or invest in their businesses, thereby stimulating economic growth. This scenario illustrates the potential positive impact of lower interest rates on a specific demographic struggling with student loan debt.

The Impact on Student Borrowers

Lowering student loan interest rates would provide significant relief to millions of borrowers, easing the financial strain of repaying student loan debt and fostering improved financial stability for graduates. This relief would be felt across various loan types, leading to substantial long-term savings.

Reduced Interest Rate’s Impact on Debt Burden

Reduced interest rates directly translate to lower monthly payments. For example, a borrower with a $50,000 loan at a 7% interest rate might see their monthly payment reduced by $100-$200 with a 4% interest rate, depending on the loan term. This seemingly small difference accumulates significantly over the repayment period, resulting in thousands of dollars saved. This extra money can be used for other crucial expenses such as housing, transportation, or starting a family, easing the immediate financial pressure and allowing for more financial flexibility.

Improved Financial Stability for Graduates

Lower monthly payments free up a significant portion of a graduate’s income. This increased disposable income allows graduates to prioritize other important financial goals, such as paying down other debts, saving for a down payment on a house, or investing in their future. The reduced financial stress associated with lower loan payments can also contribute to improved mental health and overall well-being, enabling graduates to focus on their careers and personal lives more effectively. For instance, a recent graduate might be able to afford a car or save for a down payment on a house sooner, significantly impacting their long-term financial trajectory.

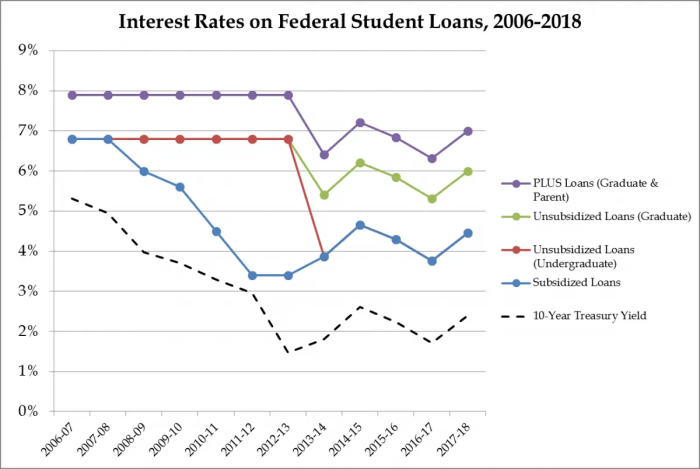

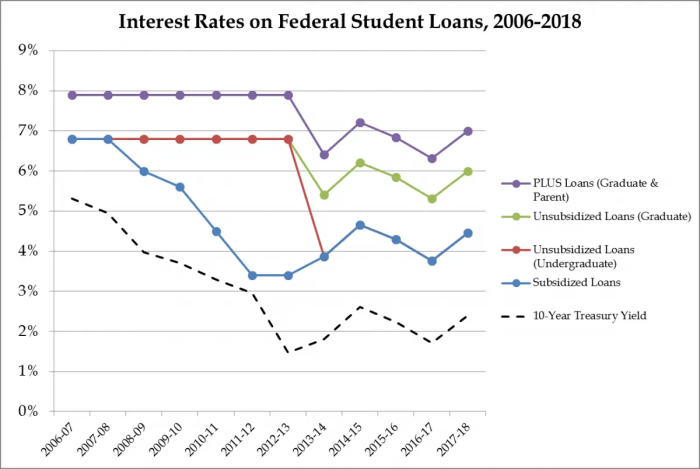

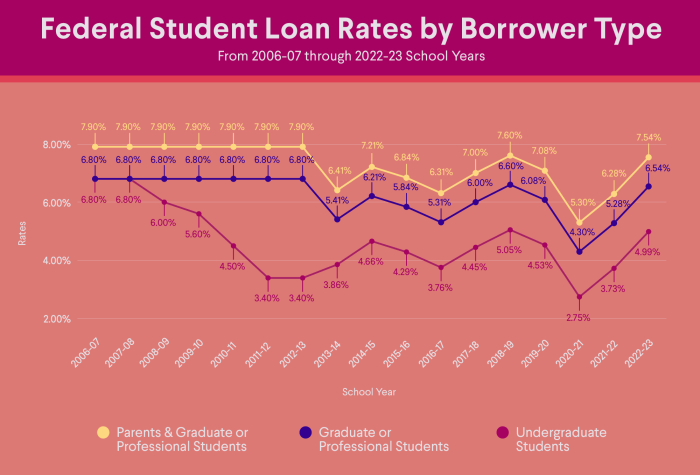

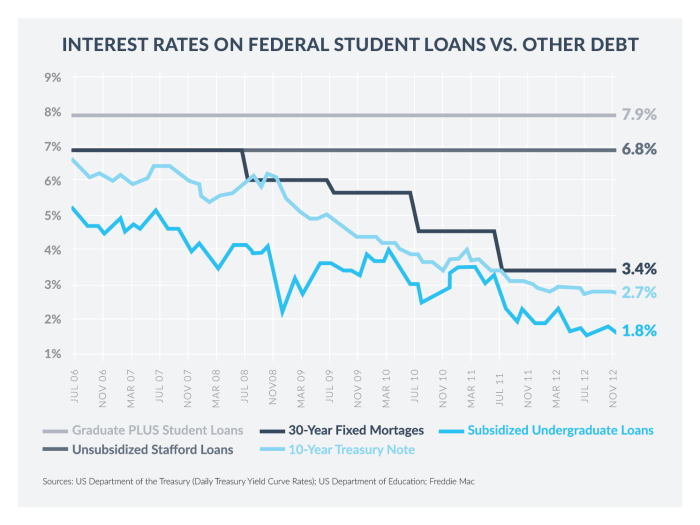

Impact on Different Types of Student Loans

The reduction in interest rates would apply to various types of federal and private student loans. Federal student loans, including subsidized and unsubsidized Stafford Loans, PLUS loans, and Grad PLUS loans, would all benefit. Similarly, private student loans, offered by banks and credit unions, would also see reduced interest rates, though the extent of the reduction may vary depending on the lender and the borrower’s creditworthiness. The impact on each type of loan would be proportional to the current interest rate; loans with higher interest rates would see a more substantial decrease in monthly payments.

Comparison of Monthly Payments Under Current and Lower Rates

The following table compares monthly payments for a $30,000 loan under different interest rates and repayment plans. These figures are illustrative and may vary based on specific loan terms and lender policies.

| Loan Amount | Interest Rate (%) | 10-Year Repayment Plan (Monthly Payment) | 15-Year Repayment Plan (Monthly Payment) |

|---|---|---|---|

| $30,000 | 7% | $345 | $250 |

| $30,000 | 4% | $305 | $220 |

Long-Term Savings for Borrowers

The long-term savings from lower interest rates can be substantial. For a $50,000 loan, a reduction from 7% to 4% interest could result in thousands of dollars saved over the life of the loan. A borrower with a 10-year repayment plan could save upwards of $5,000, while a borrower with a 15-year plan might save even more. These savings can significantly impact a borrower’s long-term financial well-being, allowing for earlier debt payoff, increased investment opportunities, and greater financial security. For example, this could mean the difference between retiring comfortably or struggling financially in later years.

Governmental Policies and Funding Mechanisms

Lowering student loan interest rates requires careful consideration of governmental policies and funding mechanisms. The government faces a complex interplay of budgetary constraints, political pressures, and the need to balance the benefits for students with the overall fiscal health of the nation. Several approaches exist, each with its own set of advantages and disadvantages.

Funding Lower Interest Rates: Potential Methods and Their Effectiveness

Methods for Funding Reduced Interest Rates

The government could fund lower interest rates through several avenues. One approach is direct budgetary allocation, where funds are explicitly appropriated from general government revenue to subsidize the difference between the market interest rate and the lower rate offered to students. Another method involves issuing government bonds specifically to finance the student loan interest rate reduction. This shifts the burden of financing to future taxpayers through debt servicing. A third approach could involve leveraging existing government programs or agencies, such as reallocating funds from other areas of the budget or utilizing the resources of government-sponsored enterprises. The effectiveness of each method depends on various factors, including the overall fiscal situation, the political climate, and the specific design of the program. Direct budgetary allocation offers greater control but may compete with other pressing budgetary needs. Bond issuance shifts the cost to future generations but adds to the national debt. Leveraging existing programs might be more politically palatable but could compromise other initiatives.

Comparison of Funding Mechanisms: Effectiveness and Trade-offs

A direct comparison requires considering both the short-term and long-term implications. Direct budgetary allocation provides immediate relief but necessitates immediate tax increases or cuts to other programs. Issuing bonds offers a more manageable short-term fiscal impact, but increases the national debt and long-term interest payments. Leveraging existing programs might appear cost-neutral in the short-term, but could lead to unintended consequences in other areas. The most effective mechanism will depend on the government’s priorities and its ability to manage competing demands on the national budget. For example, a government prioritizing immediate student relief might opt for direct budgetary allocation, even if it means temporarily increasing taxes. A government focused on long-term fiscal stability might prefer bond issuance, despite the long-term debt implications.

Political and Budgetary Challenges

Implementing a policy to lower student loan interest rates faces significant political and budgetary hurdles. Competing priorities within the budget often limit the availability of funds for such initiatives. Furthermore, there may be political opposition from groups who disagree with the policy’s rationale or its potential impact on the national debt. Securing bipartisan support for such a policy is crucial for its successful implementation. The potential impact on the national budget and deficit needs to be carefully analyzed and presented transparently to the public. For instance, a significant reduction in interest rates could lead to a substantial increase in the cost of the student loan program, potentially impacting other government spending areas.

Examples of Similar Policies in Other Countries

Several countries have implemented policies to reduce the cost of higher education, including adjustments to student loan interest rates. For example, some European nations have government-backed loan programs with subsidized interest rates or even interest-free periods. These programs often involve intricate mechanisms to target support to specific demographics or income levels. However, the specific approaches vary widely, reflecting different political and economic contexts. A thorough review of international best practices could inform the design and implementation of a similar policy. Studying the success and challenges faced by other countries can provide valuable insights and help avoid potential pitfalls.

Impact on the National Budget and Deficit

Lowering student loan interest rates directly increases government spending. The magnitude of this increase depends on the extent of the rate reduction, the number of borrowers affected, and the duration of the policy. This added spending could contribute to an increase in the national deficit or require adjustments elsewhere in the budget. Accurate forecasting of the fiscal impact is crucial for responsible policymaking. For instance, a detailed cost-benefit analysis should consider the potential economic benefits of a more educated workforce against the increased government spending. This analysis should also factor in potential long-term savings from reduced loan defaults and improved economic outcomes for borrowers.

The Role of Lending Institutions

Lowering student loan interest rates significantly impacts lending institutions, altering their profitability and necessitating adjustments to their lending strategies. The magnitude of this impact depends on factors such as the lender’s portfolio composition, risk appetite, and overall business model.

The primary effect of lower interest rates is a reduction in the net interest margin – the difference between the interest a lender earns on loans and the interest it pays on deposits or borrowed funds. This directly translates to lower profitability. To compensate, lenders must explore various strategies to maintain their financial health.

Profitability Adjustments by Lending Institutions

Reduced interest rates force lending institutions to re-evaluate their operational efficiency and explore new revenue streams. They may increase fees associated with loan origination, servicing, or late payments. Alternatively, they might focus on increasing loan volume to offset the lower interest earned per loan. This could involve expanding their marketing efforts or relaxing lending criteria, potentially increasing their risk exposure. For example, a bank might increase its marketing campaign targeting graduate students, a segment often associated with higher loan amounts.

Strategies Employed by Different Lenders

Different types of lenders, such as banks, credit unions, and private lenders, will likely adopt varied strategies. Banks, with their larger capital bases and diversified portfolios, may be better equipped to absorb the impact of lower rates. They might focus on strategic acquisitions or expanding into higher-margin lending areas. Credit unions, often driven by a social mission, might prioritize maintaining loan accessibility and affordability, even with reduced profitability. Private lenders, driven by profit maximization, may become more selective in their lending, focusing on borrowers with strong credit scores and higher repayment prospects, potentially excluding some students. This could lead to a widening gap in loan accessibility between different types of lenders.

Examples of Adapted Lending Practices

A major bank might introduce a new student loan product with a bundled financial planning service, charging a fee for this additional service to offset lower interest margins. A smaller credit union might increase its outreach to community colleges to offer more tailored financial literacy programs and build relationships with potential borrowers. A private lender might shift its focus to refinancing existing student loans, leveraging the potential for higher interest rates on refinanced debt. These examples illustrate the diverse responses expected from different lenders facing lower interest rates.

Challenges Faced by Lenders

The transition to a lower interest rate environment presents several challenges for lending institutions:

- Reduced profitability and net interest margins.

- Increased competition for borrowers.

- Pressure to maintain loan volume to compensate for lower interest income.

- Potential increase in loan defaults due to relaxed lending criteria or economic downturns.

- Need for innovation and diversification of revenue streams.

- Balancing profitability with maintaining accessibility and affordability of student loans.

Long-Term Implications for Higher Education

Lowering student loan interest rates can have profound and multifaceted long-term consequences for the higher education landscape. While offering immediate relief to borrowers, the ripple effects extend to tuition costs, student enrollment patterns, and the overall accessibility of higher education. Understanding these implications is crucial for policymakers and institutions alike.

Impact on College Tuition Costs

Reduced borrowing costs might indirectly influence college tuition. The argument suggests that if students have easier access to funds due to lower interest rates, colleges might feel less pressure to keep tuition increases in check. This is based on the premise that increased demand, fueled by more accessible financing, could embolden institutions to raise prices. However, this effect is not guaranteed; other factors like government regulations and market competition will play significant roles. For example, if a significant number of students choose more affordable community colleges or online programs due to improved affordability, the demand for high-priced private universities might decrease, limiting their ability to significantly raise tuition.

Effects on Student Enrollment and Choices of Higher Education

Lower interest rates could lead to increased student enrollment across the board, particularly in programs with higher tuition costs. Students might feel more comfortable pursuing more expensive degrees or longer programs, knowing their monthly loan repayments will be lower. This could shift the balance of enrollment towards postgraduate studies or professional degrees, potentially impacting the overall distribution of skilled labor in the long term. Conversely, students from lower-income families might find higher education more accessible, leading to greater social mobility. However, a lack of sufficient financial literacy could lead some students to over-borrow despite lower interest rates, creating future financial challenges.

Influence on the Accessibility of Higher Education

Lower interest rates can improve the accessibility of higher education for many students. This increased accessibility is particularly beneficial for students from disadvantaged backgrounds who might otherwise be deterred by high borrowing costs. However, the actual impact on accessibility depends on various factors, including the availability of financial aid, the overall cost of education, and the ability of students to navigate the financial aid process. The positive effect of lower interest rates might be limited if the underlying cost of tuition continues to rise at a faster rate than the decrease in interest costs. Therefore, the accessibility gains might be marginal unless accompanied by other affordability initiatives.

Hypothetical Scenario Illustrating Long-Term Effects

Imagine a scenario where student loan interest rates are significantly reduced for ten years. Initially, enrollment in higher education institutions increases across the board, particularly in graduate programs and expensive private colleges. Tuition costs might rise modestly due to increased demand, but not dramatically, as the improved affordability also attracts students who previously could not afford higher education. However, after ten years, if interest rates return to previous levels, there could be a sudden shock to the system as borrowers face higher repayment amounts. This could lead to a decrease in enrollment, as prospective students become more cautious about taking on debt. The long-term outcome might be a slightly increased overall level of higher education attainment, but with a potential for increased financial strain on a subset of borrowers.

Interconnectedness of Factors

Imagine a diagram with four circles representing: Student Loan Interest Rates, College Tuition Costs, Student Enrollment, and Accessibility of Higher Education. Arrows connect each circle to the others, indicating the complex interrelationships. For example, a decrease in Student Loan Interest Rates (circle 1) leads to an increase in Student Enrollment (circle 3), which could potentially increase College Tuition Costs (circle 2). However, increased Enrollment might also increase the Accessibility of Higher Education (circle 4) for some, while simultaneously potentially impacting its affordability for others, creating a feedback loop. The size of each circle could represent the relative magnitude of each factor’s impact over time, showing how these elements interact dynamically. The diagram visually depicts how changes in one area cascade throughout the entire higher education system, resulting in both positive and negative long-term consequences.

Summary

Ultimately, the decision to lower student loan interest rates involves a careful weighing of economic benefits and potential drawbacks. While reduced rates offer significant relief to borrowers and could stimulate economic growth, the financial implications for the government and lending institutions must be carefully considered. A comprehensive approach, incorporating diverse perspectives and thorough analysis, is essential for crafting effective and sustainable policies in this critical area.

Essential FAQs

How would lower interest rates affect my monthly payments?

Lower interest rates would directly reduce the amount you pay each month, making your repayment burden more manageable. The exact amount saved depends on your loan amount, interest rate, and repayment plan.

What types of student loans are typically eligible for interest rate reductions?

Federal student loans are generally the focus of interest rate adjustments, although private lenders might also adjust their rates in response to government policy changes.

Will lowering interest rates increase the national debt?

Potentially, yes. Government subsidies to lower interest rates would likely increase government spending and could contribute to the national debt. The extent of the impact depends on the scale of the interest rate reduction and the chosen funding mechanism.

Are there any downsides to lowering student loan interest rates for lenders?

Yes, lower interest rates reduce the profitability of lending institutions. They might respond by tightening lending criteria, increasing fees, or altering their lending strategies to compensate for reduced margins.