Securing a student loan with the lowest possible interest rate is a crucial step towards managing your higher education financing effectively. Navigating the complexities of loan options, understanding eligibility criteria, and comparing offers from various lenders can feel overwhelming. This guide aims to simplify the process, empowering you to make informed decisions and minimize your long-term debt burden. We’ll explore federal and private loan options, delve into the factors impacting interest rates, and provide actionable strategies for securing the most favorable terms.

From understanding the influence of credit scores and exploring the benefits of co-signers to mastering the art of comparing loan offers, we’ll cover all the essential aspects. We’ll also equip you with the knowledge to identify and avoid potentially predatory lending practices, ensuring a smooth and transparent borrowing experience. Ultimately, our goal is to equip you with the tools and insights necessary to confidently navigate the student loan landscape and achieve your educational aspirations without unnecessary financial strain.

Eligibility for Lowest Interest Rates

Securing the lowest interest rate on your student loans significantly impacts the overall cost of your education. Several factors determine your eligibility for these favorable rates, and understanding these factors is crucial for responsible financial planning. This section will Artikel the key criteria lenders consider when assessing your application.

The interest rate you qualify for is largely determined by a combination of your creditworthiness, the type of loan, and sometimes, your affiliation with specific programs. Lenders assess risk; a borrower perceived as lower risk will typically receive a lower interest rate. This risk assessment considers various aspects of your financial profile.

Credit Score and Credit History

A strong credit score and a positive credit history are essential for obtaining the lowest interest rates on student loans. Lenders use your credit score as an indicator of your ability to repay debt responsibly. A higher credit score demonstrates a lower risk to the lender, making them more likely to offer you a lower interest rate. Conversely, a low credit score or a history of missed payments can significantly increase the interest rate you’ll be offered, or even prevent you from qualifying for a loan altogether. For example, a borrower with a FICO score above 750 might qualify for a rate several percentage points lower than a borrower with a score below 600. Building a positive credit history before applying for student loans is therefore a proactive step towards securing favorable terms.

The Role of Co-signers

If you lack a strong credit history or a high credit score, a co-signer can significantly improve your chances of securing a lower interest rate. A co-signer is an individual with good credit who agrees to be responsible for your loan payments if you default. Their strong credit history essentially mitigates the risk for the lender, allowing them to offer a lower interest rate than they would to a borrower with a weaker credit profile. However, it’s crucial to remember that choosing a co-signer is a significant commitment for both parties involved. The co-signer is legally obligated to repay the loan if you are unable to do so.

Government and Institutional Programs

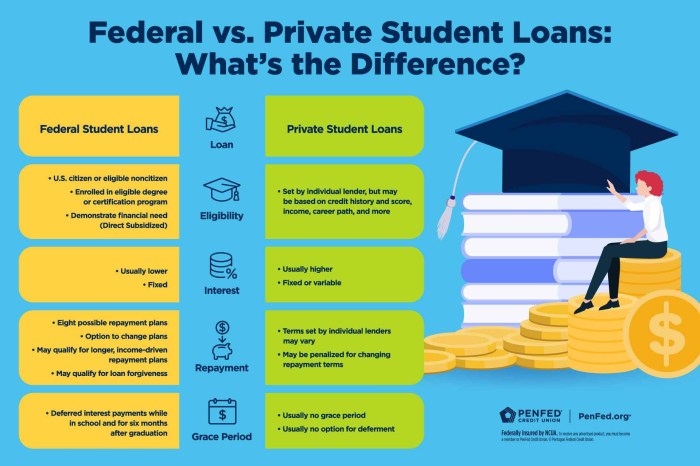

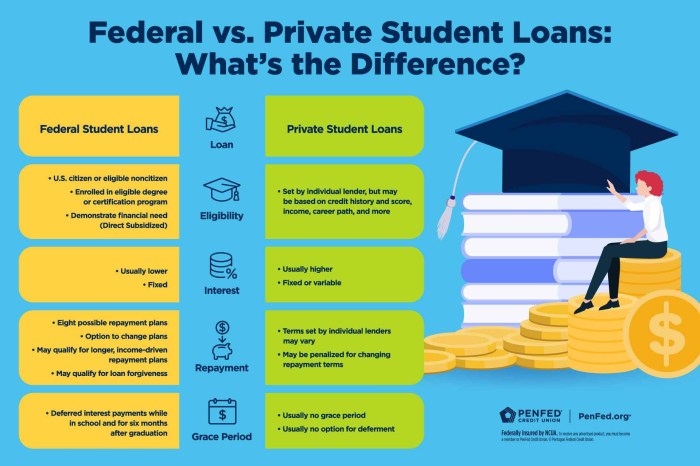

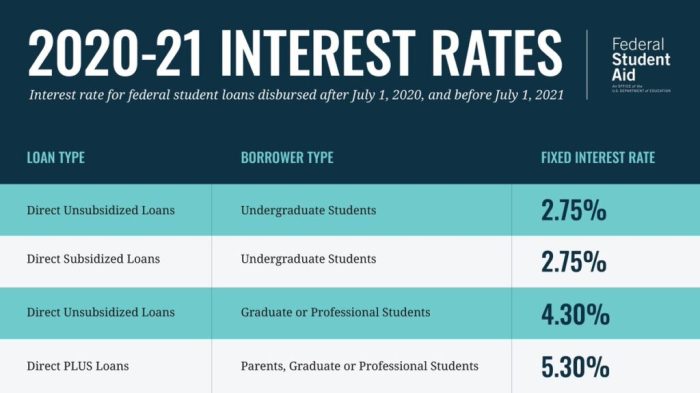

Several government and institutional programs offer reduced interest rates to specific student populations. These programs often target students pursuing specific fields of study or those from disadvantaged backgrounds. For example, federal student loans often have lower interest rates than private loans. Additionally, some universities or colleges might offer their own loan programs with subsidized interest rates for enrolled students. These programs aim to make higher education more accessible and affordable. Eligibility requirements vary depending on the specific program, but often include factors like academic performance, financial need, and field of study. Researching these programs can be beneficial for securing lower interest rates.

End of Discussion

Successfully securing a student loan with the lowest interest rate requires careful planning, research, and a thorough understanding of the available options. By understanding the factors that influence interest rates, diligently comparing offers, and proactively managing your repayment strategy, you can significantly reduce your overall borrowing costs. Remember to always prioritize responsible borrowing practices and seek guidance from reputable financial resources when making crucial decisions about your educational funding. Your future financial well-being depends on making informed choices today.

Key Questions Answered

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

How can I improve my chances of getting a lower interest rate?

Maintain a good credit score, have a strong credit history, and consider applying with a co-signer who has excellent credit.

What are some warning signs of predatory lenders?

High fees, hidden charges, aggressive sales tactics, and a lack of transparency are all red flags. Always thoroughly research any lender before signing any loan documents.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default, which has serious financial consequences.

Are there any resources available to help me manage my student loan debt?

Yes, many non-profit organizations and government agencies offer free counseling and resources to help borrowers manage their student loans. Your school’s financial aid office may also provide assistance.