Navigating the world of private student loans can feel overwhelming, especially when the goal is securing the lowest possible interest rates. Understanding the factors influencing these rates—from your credit score to the type of loan—is crucial for minimizing your long-term debt burden. This guide provides a clear path to finding the most competitive rates and making informed decisions about your student loan financing.

From comparing fixed versus variable rates and exploring loan refinancing options to understanding eligibility requirements and potential risks, we’ll equip you with the knowledge to make smart financial choices. We’ll also cover crucial aspects often overlooked, ensuring you’re fully prepared before signing any loan agreements. Let’s explore how you can achieve the most favorable terms for your education investment.

Understanding Interest Rates

Securing a private student loan involves understanding the interest rate, a crucial factor determining the total cost of your education. Interest rates represent the cost of borrowing money, essentially the lender’s fee for providing you with funds. The lower the rate, the less you’ll pay in interest over the life of the loan. Several factors influence this rate, impacting the overall affordability of your loan.

Factors Influencing Private Student Loan Interest Rates

Several key factors contribute to the interest rate you’ll receive on a private student loan. Lenders assess these factors to determine your creditworthiness and the associated risk of lending to you. A higher perceived risk translates to a higher interest rate. These factors include your credit score, credit history, the loan amount, the loan term, your income, and the presence of a co-signer. A strong credit history and a high credit score generally result in lower interest rates. Conversely, a shorter loan term may lead to higher monthly payments but lower overall interest paid. A co-signer with excellent credit can significantly improve your chances of securing a lower interest rate.

Credit Score’s Impact on Interest Rates

Your credit score plays a pivotal role in determining your interest rate. Lenders use credit scores to assess your creditworthiness and predict the likelihood of you repaying the loan. A higher credit score, generally above 700, indicates a lower risk to the lender, leading to a more favorable interest rate. Conversely, a lower credit score signifies a higher risk, resulting in a higher interest rate or even loan rejection. For example, a borrower with a credit score of 750 might qualify for an interest rate of 6%, while a borrower with a score of 600 might face an interest rate of 10% or higher, or may not be approved for a loan at all. Improving your credit score before applying for a loan is highly advisable.

Interest Rate Calculation Methods

Private student loan interest rates are typically calculated using one of two main methods: simple interest and compound interest. Simple interest is calculated only on the principal loan amount, while compound interest is calculated on the principal amount plus accumulated interest. Most private student loans use compound interest, meaning interest accrues on both the principal and previously accrued interest. For example, if you have a $10,000 loan with a 5% annual interest rate compounded annually, the first year’s interest would be $500. The second year’s interest would be calculated on $10,500 ($10,000 + $500), resulting in a higher interest payment. The formula for simple interest is: Interest = Principal x Rate x Time. The formula for compound interest is more complex and involves exponential calculations.

Fixed vs. Variable Interest Rates

Private student loans typically offer two types of interest rates: fixed and variable. A fixed interest rate remains constant throughout the loan term, providing predictability in your monthly payments. A variable interest rate fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR. This means your monthly payments could increase or decrease over time depending on market conditions.

Fixed vs. Variable Interest Rate Comparison

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Rate | Stays the same for the loan’s life | Changes periodically based on market indexes |

| Predictability | Highly predictable monthly payments | Unpredictable monthly payments; potential for higher or lower payments |

| Risk | Lower risk of unexpected payment increases | Higher risk of unexpected payment increases |

| Long-term cost | May be higher overall if rates fall | May be lower overall if rates fall, higher if rates rise |

Finding the Lowest Rates

Securing the lowest possible interest rate on your private student loans is crucial for minimizing your overall borrowing costs. By employing strategic approaches and understanding the lending landscape, you can significantly reduce the amount you’ll pay over the life of your loan. This section Artikels effective strategies to achieve this goal.

Finding the best interest rates requires a proactive and informed approach. Several factors influence the rate you’ll receive, including your credit score, credit history, loan amount, and the type of loan you’re seeking. It’s essential to compare offers from multiple lenders to identify the most competitive options.

Lenders Offering Competitive Rates

Several financial institutions and online lenders are known for offering competitive interest rates on private student loans. These include established banks, credit unions, and specialized student loan lenders. It’s important to note that rates change frequently, so checking the current offerings from various sources is always recommended. Examples of lenders that are often cited for competitive rates include Sallie Mae, Discover, and Citizens Bank. However, it’s vital to independently verify current rates on their websites or through other reputable financial comparison tools. Remember that the best lender for you will depend on your individual financial profile and loan needs.

The Importance of Shopping Around and Comparing Offers

Shopping around and comparing loan offers from multiple lenders is paramount to securing the lowest interest rate. Avoid accepting the first offer you receive. Different lenders use different criteria to assess risk and determine interest rates, leading to significant variations in the terms they offer. By diligently comparing offers, you can identify the lender offering the most favorable terms. This involves carefully reviewing interest rates, fees, repayment terms, and other conditions associated with each loan. Utilizing online comparison tools can simplify this process, but always verify information directly with the lender.

The Role of Loan Refinancing in Lowering Rates

Loan refinancing can be a powerful tool for lowering your interest rate on existing private student loans. If your credit score has improved since you initially took out your loans, or if interest rates have fallen in the market, refinancing can allow you to secure a lower interest rate and potentially reduce your monthly payments. This involves applying for a new loan with a different lender to pay off your existing loans. The new loan will have a lower interest rate, resulting in savings over the life of the loan. However, it’s crucial to carefully evaluate the terms of the refinancing offer and ensure it truly benefits your financial situation. Refinancing fees and extended repayment periods should be considered before making a decision.

Steps to Find the Best Loan Rates

A systematic approach is key to securing the best rates. The following flowchart illustrates the process:

[Flowchart Description: The flowchart would begin with a “Start” box. It would then branch to a box titled “Check Credit Score and Report,” followed by a box indicating “Improve Credit if Necessary.” Next, it would branch to a box labeled “Research and Compare Lenders,” leading to a box titled “Gather Loan Offers.” After this, a box labeled “Compare Interest Rates, Fees, and Repayment Terms” would follow, leading to a box saying “Choose the Best Offer.” Finally, it would branch to an “End” box. The flowchart would visually represent the decision points and steps involved in the loan application process, creating a clear and logical path for the user.]

Loan Terms and Conditions

Understanding the terms and conditions of your private student loan is crucial for responsible borrowing and avoiding unexpected financial burdens. This section details key aspects you should carefully consider before signing a loan agreement.

Loan Term Length and Total Interest Paid

The length of your loan term significantly impacts the total interest you pay. A longer loan term (e.g., 15 years) results in lower monthly payments but higher overall interest costs because you’re paying interest for a longer period. Conversely, a shorter loan term (e.g., 5 years) means higher monthly payments but lower total interest paid. For example, a $20,000 loan at 7% interest over 10 years would cost approximately $28,000 total, while the same loan over 15 years might cost around $33,000. The difference is substantial, illustrating the importance of carefully weighing monthly affordability against long-term interest costs.

Fees Associated with Private Student Loans

Private student loans often involve various fees that can add to the overall cost. These fees can include origination fees (charged when the loan is disbursed), late payment fees (for missed or late payments), and prepayment penalties (for paying off the loan early). Some lenders may also charge fees for returned payments or for specific services. It’s essential to thoroughly review the loan agreement to understand all applicable fees and their amounts. For instance, an origination fee of 1% on a $10,000 loan adds $100 to the total borrowing cost. These fees can accumulate, so understanding them upfront is crucial for accurate budgeting.

Repayment Options

Private student loan lenders typically offer several repayment options. Common options include standard repayment (fixed monthly payments over a set term), graduated repayment (payments increase over time), and extended repayment (longer repayment periods). Some lenders might also offer income-driven repayment plans, where monthly payments are tied to your income. The choice of repayment plan should align with your anticipated income and financial capabilities. Choosing a plan with higher initial payments might save you money on interest in the long run. A borrower might choose a graduated repayment plan if they anticipate higher income in later years, allowing for manageable payments initially.

Loan Deferment and Forbearance Programs

Loan deferment and forbearance are temporary options that allow borrowers to postpone or reduce their loan payments during periods of financial hardship. Deferment typically pauses both principal and interest payments, while forbearance reduces or suspends payments but usually still accrues interest. Eligibility criteria and the terms of deferment and forbearance vary by lender and loan program. For example, a borrower experiencing unemployment might qualify for a deferment, providing temporary relief until their financial situation improves. However, it is important to note that interest will usually continue to accrue during forbearance periods, increasing the total loan amount over time.

Key Terms to Understand Before Signing

Before signing a private student loan agreement, carefully review and understand these key terms:

- Interest Rate: The annual percentage rate (APR) charged on the loan.

- Loan Term: The length of time you have to repay the loan.

- Principal: The original amount of the loan.

- Fees: Any charges associated with the loan, such as origination fees, late payment fees, and prepayment penalties.

- Repayment Plan: The schedule for making loan payments.

- Deferment/Forbearance: Options for temporarily suspending or reducing loan payments.

- Default: Failure to make loan payments as agreed.

- APR (Annual Percentage Rate): The annual cost of the loan, including interest and fees.

Eligibility and Qualifications

Securing a private student loan hinges on meeting specific eligibility criteria set by the lender. These requirements are designed to assess the borrower’s creditworthiness and ability to repay the loan. Understanding these requirements is crucial for a successful application process and securing the most favorable interest rates.

Private student loan lenders typically evaluate several key factors to determine eligibility. These factors often include credit history, income, debt-to-income ratio, and the type of degree being pursued. Meeting these requirements increases the chances of approval and can influence the interest rate offered.

Co-signers and Lower Interest Rates

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. Their creditworthiness is considered alongside the borrower’s, often resulting in a lower interest rate or increased likelihood of approval, especially for borrowers with limited or poor credit history. Lenders view the co-signer’s strong credit as a mitigating factor against the risk of default. The co-signer assumes significant financial responsibility, so it’s a crucial decision for both parties involved. Choosing a co-signer with excellent credit is essential to maximize the benefits.

Improving Creditworthiness for Better Rates

Improving creditworthiness is a proactive approach to securing better interest rates on private student loans. Several strategies can significantly enhance your credit score. These include paying all bills on time, maintaining low credit utilization (the amount of credit used compared to the total available), and avoiding new credit applications, which can temporarily lower your score. Regularly checking your credit report for errors and disputing any inaccuracies is also crucial. Building a positive credit history takes time and consistent responsible financial behavior.

Impact of Poor Credit History on Loan Approval

A poor credit history can significantly hinder loan approval or result in significantly higher interest rates. Lenders perceive borrowers with a history of missed payments or defaults as higher risk. This risk translates to less favorable loan terms. In some cases, a poor credit history might lead to loan denial altogether. It’s crucial to address any credit issues before applying for a private student loan. Consider exploring credit counseling or debt management programs to improve your credit profile.

Factors Influencing Loan Approval and Interest Rates

| Factor | Impact on Loan Approval | Impact on Interest Rate | Example |

|---|---|---|---|

| Credit Score | Higher score increases approval chances | Higher score leads to lower rates | A score above 700 typically qualifies for better terms. |

| Debt-to-Income Ratio | Lower ratio increases approval chances | Lower ratio may lead to lower rates | A lower ratio demonstrates responsible borrowing. |

| Income | Higher income increases approval chances | Higher income may lead to lower rates | Stable employment and sufficient income demonstrate repayment ability. |

| Co-signer Creditworthiness | Strong co-signer significantly increases chances | Strong co-signer leads to lower rates | A co-signer with excellent credit mitigates risk for the lender. |

| Loan Amount | Larger amounts may be harder to approve | Larger amounts may lead to higher rates | Borrowing responsibly and only what’s needed is advisable. |

Potential Risks and Considerations

Securing a private student loan can significantly impact your financial future. While they offer access to funds for education, understanding the potential risks and responsibilities involved is crucial before signing any loan agreement. Responsible borrowing practices are paramount to avoid detrimental financial consequences.

Risks Associated with Private Student Loans

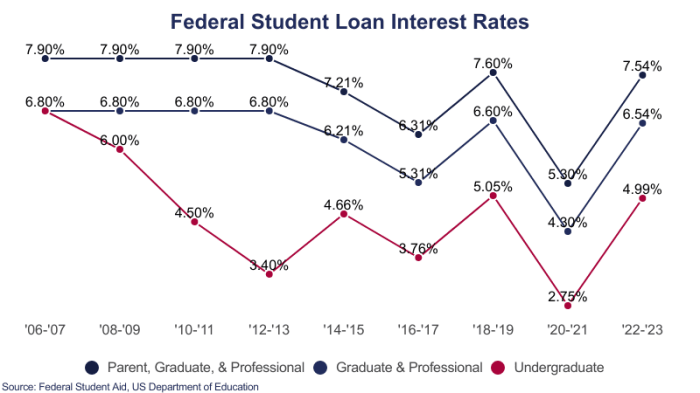

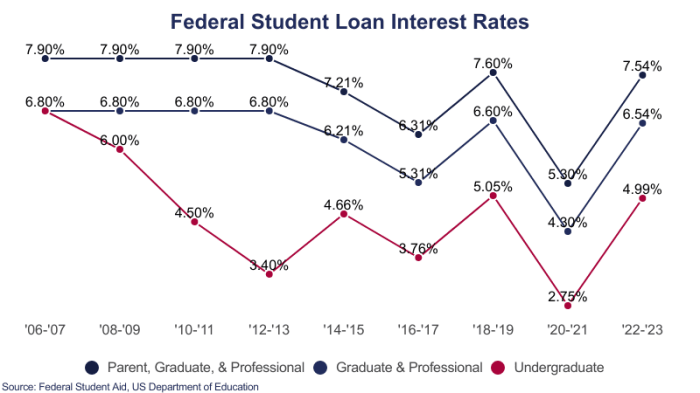

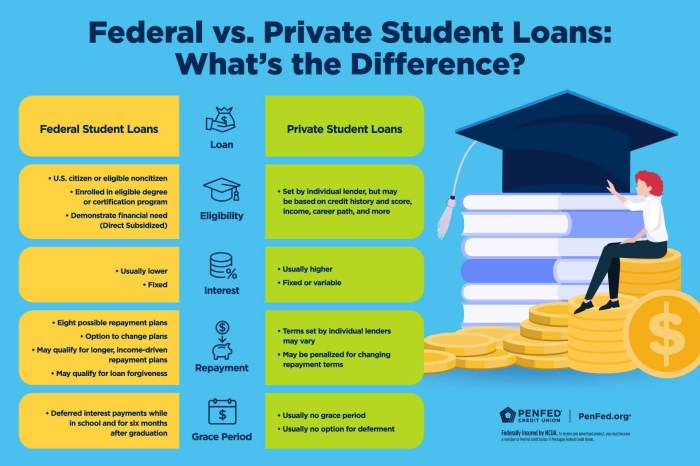

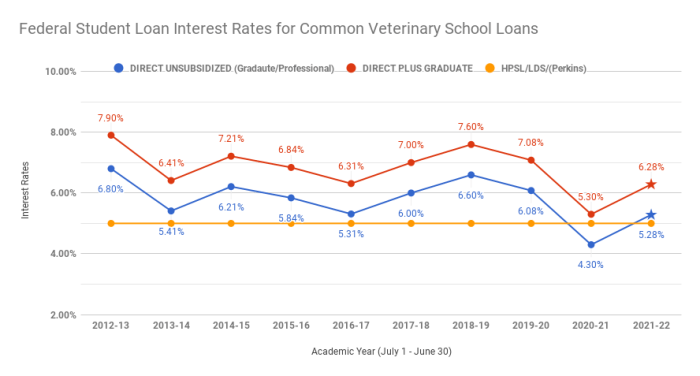

Private student loans, unlike federal loans, aren’t backed by the government. This means there are fewer protections if you encounter financial hardship. Interest rates tend to be higher than federal loan rates, leading to a larger overall repayment amount. Furthermore, the terms and conditions can be less flexible, making it challenging to manage repayments if your circumstances change. The absence of income-driven repayment plans or loan forgiveness programs common with federal loans increases the risk of long-term debt.

Responsible Borrowing Practices

Before taking out a private student loan, carefully evaluate your financial situation. Determine how much you genuinely need to borrow, factoring in your existing savings, potential scholarships, and grants. Compare interest rates and repayment terms from multiple lenders to secure the most favorable loan. Create a realistic budget that incorporates loan repayments alongside other living expenses. Prioritize building good credit to improve your chances of securing better loan terms in the future. Regularly monitor your loan balance and payments to stay informed about your progress.

Scenarios Where Private Loans Might Not Be the Best Option

Private student loans may not be the optimal choice if you qualify for federal student loans, which offer more borrower protections and potentially lower interest rates. If you’re unsure about your ability to manage repayments, opting for a smaller loan amount or exploring alternative funding options like scholarships or part-time work might be more prudent. If your credit score is poor, securing a private loan might be difficult or result in unfavorable terms. Consider the overall cost of borrowing, including interest and fees, to determine if it aligns with your long-term financial goals. For example, a student anticipating a low-paying career path after graduation might find the high cost of private loans unsustainable.

Comparison of Private and Federal Student Loans

| Feature | Private Student Loans | Federal Student Loans |

|---|---|---|

| Government Backing | No | Yes |

| Interest Rates | Generally higher | Generally lower |

| Repayment Options | Less flexible | More flexible, including income-driven repayment plans |

| Loan Forgiveness Programs | Generally unavailable | Potentially available |

| Default Consequences | Severe, including damage to credit score and potential legal action | Serious, but with potential for rehabilitation programs |

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe consequences. Your credit score will suffer significantly, making it harder to secure loans, credit cards, or even rent an apartment in the future. Collection agencies may pursue legal action to recover the debt, potentially leading to wage garnishment or bank levy. The debt can remain on your credit report for seven years, impacting your financial opportunities for an extended period. In some cases, the lender may initiate legal proceedings, which can result in a court judgment and further financial penalties. For example, a default could impact the ability to purchase a home or obtain a car loan for many years.

Illustrative Examples

Understanding how interest rates impact loan costs requires looking at specific scenarios. The following examples illustrate the factors that influence interest rates and the potential savings achievable through refinancing and strategic repayment planning.

A Borrower Obtaining a Low Interest Rate

Sarah, a recent graduate with a strong academic record and a high credit score of 780, secured a private student loan with a remarkably low interest rate of 4.5%. Several factors contributed to this favorable rate. Her excellent credit history demonstrated her responsible financial behavior to the lender. Additionally, she co-signed the loan with her parent, who had an even higher credit score and a stable income, further reducing the perceived risk for the lender. Finally, she opted for a shorter repayment term (10 years), reducing the lender’s risk and leading to a lower interest rate.

A Borrower Obtaining a High Interest Rate

In contrast, Mark, a student with a limited credit history and a lower credit score of 620, received a private student loan with a significantly higher interest rate of 10%. His lack of credit history made it difficult for the lender to assess his creditworthiness. The lender perceived a higher risk of default, resulting in a higher interest rate to compensate for that risk. Furthermore, he chose a longer repayment term (20 years), increasing the lender’s exposure and contributing to the elevated interest rate. The absence of a co-signer also played a role in the higher rate.

Loan Refinancing Leading to Significant Savings

John initially took out a private student loan of $30,000 at a 9% interest rate with a 15-year repayment term. His monthly payments were approximately $300. After several years of responsible repayment, his credit score improved significantly to 750. He decided to refinance his loan. He secured a new loan with a 6% interest rate and a 10-year repayment term. His new monthly payment increased slightly to $330, but the reduced interest rate resulted in significant savings over the life of the loan. His original loan would have cost him approximately $51,000 in total interest payments. With refinancing, his total interest payments will be approximately $10,000 less. This demonstrates the potential for substantial savings through refinancing when creditworthiness improves.

Impact of Different Repayment Plans on Total Loan Cost

The choice of repayment plan significantly affects the total cost of a student loan. Consider a $25,000 loan at a 7% interest rate:

- Standard Repayment (10 years): Monthly payment: ~$280; Total interest paid: ~$10,000; Total cost: ~$35,000

- Extended Repayment (20 years): Monthly payment: ~$200; Total interest paid: ~$19,000; Total cost: ~$44,000

- Income-Driven Repayment (IBR): Monthly payments vary based on income; Total interest paid: Potentially significantly higher due to longer repayment period; Total cost: Highly variable, potentially much higher than standard repayment.

This illustrates that while a longer repayment term lowers monthly payments, it substantially increases the total interest paid over the life of the loan. Income-driven repayment plans offer flexibility but often result in the highest overall cost due to the extended repayment periods.

Ultimate Conclusion

Securing the lowest private student loan rates requires careful planning and proactive research. By understanding the factors that influence interest rates, comparing offers from multiple lenders, and employing strategies like refinancing, you can significantly reduce the overall cost of your education. Remember to always borrow responsibly and prioritize understanding the terms and conditions before committing to a loan. Armed with this knowledge, you can confidently navigate the student loan landscape and achieve your educational goals with greater financial ease.

Expert Answers

What is the average interest rate for private student loans?

Average interest rates for private student loans vary significantly depending on factors like credit score, loan term, and lender. There’s no single “average” rate; it’s crucial to shop around and compare offers.

Can I get a private student loan without a co-signer?

Yes, but it’s more challenging. Lenders typically require a strong credit history and high credit score to approve loans without a co-signer. A co-signer improves your chances of approval and may also secure you a lower interest rate.

What happens if I default on a private student loan?

Defaulting on a private student loan can severely damage your credit score, making it difficult to obtain future loans or credit. It can also lead to wage garnishment, lawsuits, and collection agency involvement.

How often can I refinance my student loans?

There’s no set limit on how often you can refinance, but lenders typically require a certain amount of time to pass between refinancing attempts. Check with your lender for their specific requirements.