Navigating the complex world of student loan refinancing can feel overwhelming, but securing the lowest possible rate is key to achieving long-term financial stability. Understanding the factors influencing these rates—from your credit score to your income and debt-to-income ratio—is crucial in your search for the best refinancing options. This guide will empower you to make informed decisions and achieve significant savings.

We’ll explore the intricacies of refinancing, comparing various lenders, and guiding you through the application process. We’ll also delve into alternative debt management strategies, ensuring you have a comprehensive understanding of your choices. Ultimately, our aim is to equip you with the knowledge and tools to confidently navigate this important financial decision.

Understanding Student Loan Refinancing

Student loan refinancing is a process where you replace your existing federal or private student loans with a new loan from a private lender. This new loan typically offers a lower interest rate, potentially saving you money over the life of the loan. Understanding the process and its implications is crucial before making a decision.

Student loan refinancing involves applying to a private lender, providing documentation such as your credit score, income, and existing loan details. The lender will then assess your application and offer a new loan with a specific interest rate and repayment terms. Once you accept the offer, your old loans are paid off, and you begin making payments on the new loan.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing can offer several advantages, including lower monthly payments, a lower overall interest rate, and the simplification of managing multiple loans into a single payment. However, it also presents potential drawbacks. A key disadvantage is the loss of federal student loan protections, such as income-driven repayment plans and loan forgiveness programs. Furthermore, refinancing may result in a longer repayment term, leading to paying more interest overall despite a lower monthly payment. Careful consideration of both benefits and drawbacks is essential.

Types of Student Loans That Can Be Refinanced

Various types of student loans are eligible for refinancing, including federal student loans (such as Direct Subsidized and Unsubsidized Loans, PLUS Loans) and private student loans. However, it’s important to note that refinancing federal loans converts them into private loans, eliminating the benefits associated with federal loan programs. The eligibility criteria for refinancing will vary depending on the lender. For example, some lenders may require a minimum credit score or a certain level of income.

Refinancing Compared to Other Debt Management Strategies

Refinancing should be considered alongside other debt management strategies such as debt consolidation (combining multiple debts into one), balance transfers (moving debt from one credit card to another with a lower interest rate), and debt management plans (working with a credit counseling agency to create a repayment plan). Each strategy has its own advantages and disadvantages, and the best approach depends on individual circumstances. Refinancing may be a suitable option for borrowers with good credit who want to lower their interest rate and simplify their payments, while other strategies may be more appropriate for those with lower credit scores or higher debt levels.

Comparison of Refinancing Lenders

Choosing the right lender is critical. Different lenders offer varying interest rates, fees, and repayment terms. Consider comparing offers from multiple lenders before making a decision.

| Lender | Interest Rate Range | Fees | Repayment Terms |

|---|---|---|---|

| Lender A | 4.00% – 7.00% | $0 – $200 | 5 – 15 years |

| Lender B | 4.50% – 8.00% | $0 | 5 – 20 years |

| Lender C | 3.75% – 6.75% | $100 – $300 | 10 – 15 years |

| Lender D | 4.25% – 7.50% | $0 – $150 | 5 – 10 years |

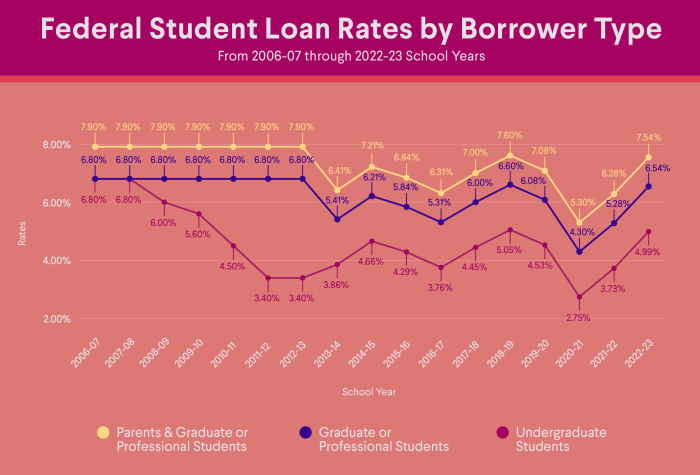

Factors Affecting Refinancing Rates

Securing the lowest student loan refinance rate depends on a variety of factors, all working in concert to determine your eligibility and the interest rate offered. Understanding these factors empowers you to improve your chances of obtaining the most favorable terms. This section will detail the key elements influencing your refinance rate, allowing you to strategically position yourself for success.

Credit Score’s Impact on Refinancing Rates

Your credit score is arguably the most significant factor affecting your refinance rate. Lenders use your credit score as a primary indicator of your creditworthiness and repayment ability. A higher credit score (generally above 700) significantly increases your chances of qualifying for the lowest interest rates, often resulting in substantial savings over the life of your loan. Conversely, a lower credit score may lead to higher interest rates or even rejection of your application. For example, a borrower with a credit score of 750 might qualify for a rate of 5%, while a borrower with a 650 score might only qualify for a rate of 7%, representing a considerable difference in overall loan cost.

Income and Debt-to-Income Ratio’s Influence

Your income and debt-to-income (DTI) ratio are crucial elements lenders consider. A higher income demonstrates a greater capacity to repay the loan, making you a less risky borrower. Your DTI ratio, calculated by dividing your monthly debt payments by your gross monthly income, indicates how much of your income is already committed to debt. A lower DTI ratio (generally below 43%) typically improves your chances of securing a favorable refinance rate. A borrower with a high income and low DTI ratio will generally be seen as a lower risk than someone with a lower income and high DTI ratio, leading to better loan terms.

The Role of Co-signers in Improving Refinancing Options

Adding a co-signer with a strong credit history can significantly enhance your refinancing prospects, particularly if your credit score is less than ideal. A co-signer essentially guarantees the loan, reducing the lender’s risk. This can lead to lower interest rates and a higher likelihood of approval. For instance, a borrower with a poor credit history might be denied refinancing on their own, but with a co-signer who has excellent credit, they could secure a much more favorable rate. The co-signer, however, assumes responsibility for the loan if the primary borrower defaults.

Prioritized List of Factors Influencing Refinancing Rates

The following list prioritizes the factors discussed above based on their general influence on refinancing rates:

- Credit Score: A high credit score is the single most impactful factor.

- Debt-to-Income Ratio: A low DTI ratio demonstrates responsible debt management.

- Income: Higher income indicates greater repayment capacity.

- Co-signer (if applicable): A co-signer with strong credit can mitigate risk.

Finding the Lowest Rates

Securing the lowest student loan refinance rate requires a proactive and informed approach. By carefully comparing offers from multiple lenders and understanding the factors influencing rates, borrowers can significantly reduce their overall repayment costs. This process involves more than just looking at the headline interest rate; a thorough examination of all fees and terms is crucial.

The following steps Artikel a strategic plan for identifying and securing the best possible refinance rate for your student loans.

A Step-by-Step Guide to Finding the Lowest Rates

- Check Your Credit Score: Your credit score is a major factor influencing your eligibility for refinancing and the interest rate you’ll receive. Before applying to any lender, obtain your credit report and score from one of the three major credit bureaus (Equifax, Experian, and TransUnion). Addressing any negative marks on your report can significantly improve your chances of securing a lower rate.

- Determine Your Loan Amount and Type: Accurately assess the total amount of your student loan debt and the type of loans you hold (federal, private, undergraduate, graduate). This information is essential for lenders to accurately assess your application.

- Compare Multiple Lenders: Don’t rely on just one lender. Shop around and compare offers from at least three to five different reputable lenders. This allows you to identify the most competitive rates and terms. Consider using online comparison tools to streamline this process.

- Analyze Interest Rates and Terms: Focus on the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees. Don’t just focus on the interest rate; consider loan terms, repayment options, and any associated fees.

- Use Online Calculators: Many lenders offer online calculators that allow you to estimate your potential monthly payments and total savings based on different interest rates and loan terms. Experiment with various scenarios to determine the most cost-effective option.

- Read the Fine Print: Carefully review the loan agreement before signing. Understand all terms and conditions, including prepayment penalties, late payment fees, and any other potential charges.

Reputable Student Loan Refinancing Lenders

Several reputable lenders specialize in student loan refinancing. It’s crucial to research and compare offers from multiple lenders to ensure you’re getting the best deal. The following are examples, but this list is not exhaustive and does not constitute an endorsement.

- SoFi: Known for its technology-driven approach and competitive rates.

- Earnest: Offers personalized service and flexible repayment options.

- LendKey: Partners with credit unions to provide refinancing options.

Comparing Interest Rates and Terms

Consider the following example. Suppose three lenders offer the following rates and terms for a $30,000 loan with a 10-year repayment period:

| Lender | Interest Rate | APR | Fees | Monthly Payment (Estimate) |

|---|---|---|---|---|

| Lender A | 6.00% | 6.25% | $100 | $320 |

| Lender B | 5.75% | 6.00% | $0 | $315 |

| Lender C | 6.25% | 6.50% | $200 | $330 |

While Lender B has the lowest interest rate, Lender A has a lower APR due to lower fees. Lender C has the highest APR due to both a higher interest rate and significant fees. This illustrates the importance of considering the APR and all associated fees, not just the interest rate alone.

The Importance of Comparing APRs and Fees

The Annual Percentage Rate (APR) provides a more comprehensive picture of the total cost of borrowing than the interest rate alone. It incorporates interest, fees, and other charges into a single percentage. Comparing APRs across lenders allows for a more accurate comparison of the overall cost of the loan. Fees, such as origination fees, can significantly impact the total cost of borrowing and should not be overlooked.

Using Online Tools and Calculators to Estimate Potential Savings

Many online tools and calculators are available to estimate potential savings from refinancing. These tools typically require you to input your current loan details (balance, interest rate, and remaining term) and the proposed refinance terms. The calculator will then project your monthly payments, total interest paid, and the total amount saved by refinancing. This allows borrowers to make informed decisions based on concrete numbers.

For example, if refinancing reduces your interest rate from 7% to 5%, the savings over the life of the loan could be substantial, potentially amounting to thousands of dollars.

Navigating the Application Process

Refinancing your student loans can seem daunting, but understanding the application process can significantly ease the burden. A smooth application hinges on preparation, accuracy, and proactive communication with your lender. This section will guide you through the necessary steps, highlighting potential pitfalls and offering strategies for a successful refinance.

The application process typically involves several key stages, from gathering required documents to securing your new loan terms. Careful attention to detail at each stage can significantly increase your chances of securing the best possible rate.

Required Documentation for Refinancing

Lenders require specific documentation to verify your income, creditworthiness, and the details of your existing student loans. Commonly requested documents include proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or tax returns), and details of your existing student loans (including loan amounts, interest rates, and servicers). You may also be asked for your Social Security number and employment history. Providing complete and accurate documentation upfront will expedite the process and prevent delays.

Steps in Completing a Student Loan Refinance Application

The application process usually begins with completing an online application form. This form will request personal and financial information. Following the completion of the online form, you will need to upload the required documentation. After the lender reviews your application and documents, they may request additional information or clarification. Once everything is deemed satisfactory, you’ll receive a loan offer outlining the terms and conditions. Finally, you’ll need to electronically sign the loan documents to finalize the refinance. This entire process can take anywhere from a few weeks to a couple of months, depending on the lender and the complexity of your application.

Common Application Pitfalls to Avoid

One common mistake is submitting an incomplete application. Ensure all required documents are submitted accurately and completely. Another pitfall is failing to compare offers from multiple lenders. Different lenders offer different terms and rates, so shopping around is crucial. Finally, neglecting to thoroughly read and understand the loan terms before signing the documents is a significant error. Take your time to review the details carefully before committing to a refinance.

Negotiating Better Terms with Lenders

While lenders have set guidelines, there is often room for negotiation. If you have a strong credit score and a stable income, you may be able to negotiate a lower interest rate or a more favorable repayment term. Clearly articulating your financial situation and highlighting your positive credit history can strengthen your negotiating position. Consider highlighting any positive changes in your financial circumstances since your last credit check. For example, if you’ve recently received a promotion or paid down other debts, be sure to mention it.

Pre-Application, Application, and Post-Application Checklist

Before applying: Check your credit report for errors, gather all necessary documents, and compare offers from multiple lenders. During application: Complete the application accurately and thoroughly, promptly respond to any lender requests, and maintain open communication. After application: Carefully review the loan documents before signing, understand your repayment schedule, and track your payments diligently. A well-organized approach will ensure a smoother and more successful refinance.

Long-Term Implications of Refinancing

Refinancing your student loans can offer significant short-term benefits, such as a lower monthly payment. However, understanding the long-term implications is crucial for making an informed decision. The seemingly attractive lower monthly payment might mask potential long-term financial consequences that could outweigh the initial savings. This section explores these long-term effects, helping you weigh the pros and cons before refinancing.

Refinancing fundamentally alters the terms of your loan agreement. This change can have a ripple effect across your financial life, impacting your credit score and future borrowing capacity. It’s essential to carefully consider these broader financial ramifications before proceeding.

Impact on Credit Score and Future Borrowing

Your credit score is a critical factor in obtaining loans and other forms of credit. Refinancing involves a hard credit inquiry, which can temporarily lower your score. Furthermore, the length of your repayment period after refinancing can also influence your credit utilization ratio, another key component of your credit score. A longer repayment term might improve your debt-to-income ratio in the short term, but it ultimately increases the total interest paid over the life of the loan. Conversely, a shorter repayment term might negatively impact your debt-to-income ratio initially, but it significantly reduces the overall interest paid. Therefore, the effect on your credit score and future borrowing capacity depends on the specific terms of your refinancing agreement and your overall financial situation. A well-structured refinancing plan can positively impact your credit score over the long term by demonstrating responsible debt management, but a poorly chosen plan can have the opposite effect.

Comparison of Refinancing Benefits and Risks

While refinancing can lower your monthly payments and potentially reduce your overall interest rate, it’s crucial to acknowledge the potential downsides. For example, you might lose valuable benefits associated with federal student loans, such as income-driven repayment plans or deferment options. Refinancing typically converts federal loans into private loans, eliminating these crucial protections. This loss of flexibility can be particularly problematic if you experience unforeseen financial hardship. The decision to refinance should carefully weigh the potential reduction in monthly payments and interest against the loss of federal loan benefits and the potential impact on your credit score and future borrowing capabilities. The ideal scenario involves a comprehensive assessment of your current financial situation, future financial goals, and risk tolerance.

Scenarios Where Refinancing May or May Not Be Beneficial

Refinancing can be advantageous for borrowers with good credit scores and stable incomes who are confident in their ability to maintain consistent payments. For example, a borrower with a high credit score and a stable job might benefit from refinancing their high-interest student loans to a lower rate, saving thousands of dollars in interest over the life of the loan. However, for borrowers with inconsistent income or poor credit, refinancing might not be the best option. For instance, a borrower facing job insecurity or struggling with debt might find themselves in a worse position if their financial situation deteriorates and they are unable to maintain their new repayment schedule. In such cases, the loss of federal loan protections could have severe consequences. Furthermore, borrowers with low credit scores might not qualify for the most favorable refinancing rates, potentially negating any benefits.

Long-Term Cost Comparison of Refinancing Options

Imagine a bar graph. The horizontal axis represents different refinancing options, each labeled with its interest rate and loan term (e.g., “Option A: 6%, 10 years,” “Option B: 7%, 15 years,” “Option C: 8%, 20 years”). The vertical axis represents the total interest paid over the life of the loan. Each option is represented by a bar, the height corresponding to the total interest paid. Option A would have the shortest bar, indicating the lowest total interest, while Option C would have the tallest bar, representing the highest total interest paid. This visual representation clearly illustrates how choosing a longer repayment term (even with a slightly lower interest rate) can significantly increase the total interest paid over time, potentially negating any initial savings from a lower monthly payment. This comparison underscores the importance of carefully considering the long-term financial implications before choosing a refinancing option.

Alternative Options to Refinancing

Refinancing isn’t the only path to managing student loan debt. Several alternative strategies can help borrowers achieve their financial goals, each with its own set of advantages and disadvantages. Choosing the right approach depends on individual circumstances, such as income, credit score, and the type of loans held. Carefully weighing these options against refinancing is crucial for making an informed decision.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. These plans offer lower monthly payments than standard repayment plans, potentially making them more manageable during periods of financial hardship. However, they often extend the repayment period, leading to higher overall interest paid over the life of the loan. The potential for loan forgiveness after a specified period is a significant benefit, but it’s crucial to understand the specific requirements and potential tax implications of this forgiveness.

- Pros: Lower monthly payments, potential for loan forgiveness, flexibility for fluctuating income.

- Cons: Longer repayment period, higher total interest paid, potential tax implications on forgiven amounts.

Debt Consolidation

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. While this can simplify repayment and potentially lower monthly payments, it’s important to note that it doesn’t necessarily reduce the total amount of interest paid. Furthermore, consolidating federal student loans into a private loan means losing access to federal protections and repayment programs, such as IDR plans and potential forgiveness options.

- Pros: Simplified repayment, potentially lower monthly payments (depending on the new interest rate).

- Cons: May not reduce total interest paid, loss of federal loan benefits if consolidating federal loans into a private loan.

Comparing Refinancing and Debt Consolidation

Refinancing and debt consolidation are often confused, but they differ significantly. Refinancing typically involves replacing existing loans with new loans from the same or a different lender, often aiming for a lower interest rate. Debt consolidation focuses on combining multiple loans into a single payment, regardless of the interest rate change. Refinancing might be preferable for borrowers with good credit seeking a lower interest rate on their existing loans, while debt consolidation might be better suited for those wanting simplified repayment, even if the interest rate doesn’t improve significantly.

Situations Where Alternatives Are Preferable

For borrowers with low credit scores or high debt-to-income ratios, refinancing might not be feasible. In such cases, IDR plans offer a more accessible path to manageable monthly payments. Similarly, if a borrower values the federal loan benefits and protections, debt consolidation into a private loan should be avoided, making IDR plans or sticking with the original federal loan repayment a more suitable option. For example, a recent graduate with a low income and high student loan debt might find an IDR plan more manageable than refinancing, even if a lower interest rate is available. Conversely, a borrower with a high credit score and stable income might benefit significantly from refinancing.

Concluding Remarks

Securing the lowest student loan refinance rate requires diligent research, careful planning, and a strategic approach. By understanding the factors that influence rates, comparing lenders meticulously, and navigating the application process effectively, you can significantly reduce your monthly payments and accelerate your path to financial freedom. Remember to weigh the long-term implications and consider alternative options before making a final decision. Your informed choice will pave the way for a brighter financial future.

FAQs

What is the impact of a late payment on my refinance application?

Late payments negatively impact your credit score, potentially resulting in higher interest rates or even rejection of your application. Lenders carefully review your credit history.

Can I refinance federal student loans?

Yes, but refinancing federal loans means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully consider the trade-offs.

How long does the refinance process typically take?

The process usually takes several weeks, from application submission to loan disbursement. Processing times vary between lenders.

What happens if my income changes after I refinance?

Most lenders don’t offer adjustments based on income changes after refinancing. Your monthly payment remains fixed unless you refinance again.