Navigating the complexities of higher education often involves securing student financing. Understanding the nuances of different loan providers is crucial for making informed decisions. This guide delves into the specifics of Macu student loans, providing a clear and concise overview of eligibility requirements, interest rates, repayment options, and the application process. We aim to equip prospective borrowers with the knowledge necessary to confidently navigate this significant financial undertaking.

From comparing Macu’s offerings to those of other lenders, both public and private, to exploring available forgiveness and deferment programs, this resource serves as a one-stop shop for all things Macu student loans. We’ll unpack the intricacies of loan terms, fees, and repayment schedules, empowering you to make the best choice for your financial future.

Macu Student Loan Eligibility Requirements

Securing a Macu student loan hinges on meeting specific eligibility criteria. Understanding these requirements is crucial for prospective borrowers to determine their chances of loan approval and to plan accordingly. Factors such as credit history, income, and enrollment status all play a significant role in the application process.

Macu offers various student loan products, each with its own set of eligibility requirements. These requirements can vary depending on the type of loan (e.g., undergraduate, graduate, parent), the borrower’s financial situation, and the specific program offered by Macu. It’s important to review the detailed eligibility criteria for each loan type before applying.

Macu Student Loan Types and Eligibility

Macu’s student loan offerings typically include options for undergraduate and graduate students, as well as parent loans. Eligibility for each varies. Undergraduate loans often require enrollment at least half-time in an eligible degree program, while graduate loans may have similar requirements but may also consider the student’s field of study and professional experience. Parent loans typically require a demonstrated ability to repay the loan and a close relationship with the student. Specific credit score minimums and income requirements will be detailed in the application process and vary by loan product.

Credit History Considerations for Macu Student Loans

While Macu may consider applicants with less-than-perfect credit histories, a strong credit score generally improves the chances of loan approval and can lead to more favorable interest rates. Applicants with poor credit may be required to provide a co-signer or may face higher interest rates to mitigate the lender’s risk. Building and maintaining a positive credit history is highly recommended before applying for any student loan. This involves paying bills on time, keeping credit utilization low, and avoiding excessive applications for new credit.

Comparison with Other Major Student Loan Providers

Macu’s eligibility requirements are comparable to those of other major student loan providers, although specific criteria can differ. Many lenders consider factors such as credit score, income, enrollment status, and debt-to-income ratio. Some lenders may place greater emphasis on credit history than others. It’s beneficial to compare eligibility requirements across multiple lenders to identify the most suitable option based on individual circumstances. Factors like interest rates, repayment terms, and available loan amounts should also be considered in this comparison.

Macu Student Loan Eligibility Criteria Summary

| Loan Type | Credit History | Income Requirements | Enrollment Status |

|---|---|---|---|

| Undergraduate | Generally considered, may require co-signer for lower scores | May be considered, depending on loan amount | At least half-time enrollment in eligible program |

| Graduate | Generally considered, may require co-signer for lower scores | May be considered, depending on loan amount and program | At least half-time enrollment in eligible program |

| Parent | Generally requires good credit history | Demonstrated ability to repay the loan | Student’s enrollment status in eligible program |

Macu Student Loan Interest Rates and Fees

Understanding the interest rates and fees associated with your Macu student loan is crucial for effective financial planning. This section will provide a clear breakdown of these costs, allowing you to make informed decisions about your borrowing. We will also offer a comparison with competitor offerings to help you assess the overall value proposition.

Macu’s student loan interest rates and fees are subject to change, and it’s essential to confirm the current rates directly with Macu before making any borrowing decisions. The information presented here is for illustrative purposes and should not be considered a definitive guide. Always refer to the official Macu website or contact their customer service for the most up-to-date details.

Interest Rates for Macu Student Loan Products

Macu typically offers a range of student loan products, each with its own interest rate structure. These rates are often influenced by factors such as the borrower’s creditworthiness, the loan term, and the type of loan (e.g., undergraduate, graduate, parent). While specific rates aren’t publicly listed in a standardized format across all loan types, you can expect rates to be competitive within the current market landscape. For example, a typical undergraduate loan might range from a low fixed rate to a slightly higher variable rate, depending on the prevailing market conditions. Graduate loans might have slightly higher rates reflecting the higher loan amounts often involved. It is vital to obtain a personalized rate quote from Macu based on your individual circumstances.

Associated Fees

Macu may charge various fees associated with their student loans. These could include origination fees, which are typically a percentage of the loan amount and are paid upfront. Late payment penalties are also common; these are usually a percentage of the missed payment amount. There may also be fees for specific services, such as loan consolidation or deferment. It’s important to carefully review the loan agreement to fully understand all applicable fees.

Comparison with Competitor Offerings

Comparing Macu’s student loan offerings with those of other lenders is crucial for finding the best deal. Competitors often offer similar loan products with varying interest rates and fees. Some lenders might have lower interest rates but higher fees, while others may offer a different balance. Consider factors like the overall cost of borrowing (including interest and fees), repayment options, and customer service when comparing different lenders. Websites that aggregate student loan information can be helpful tools for this comparison.

Macu Student Loan Interest Rates and Fees Comparison Table

The following table provides a sample comparison of potential interest rates and fees. Remember that these are illustrative examples only and may not reflect the actual rates and fees offered by Macu or its competitors at any given time.

| Loan Type | Macu Estimated Interest Rate (Annual Percentage Rate) | Macu Estimated Fees (Origination) | Competitor Estimated Interest Rate (Annual Percentage Rate) |

|---|---|---|---|

| Undergraduate | 4.5% – 7.0% | 1% of loan amount | 4.0% – 6.5% |

| Graduate | 5.0% – 7.5% | 1.25% of loan amount | 4.5% – 7.0% |

| Parent PLUS | 6.0% – 8.5% | 1.5% of loan amount | 5.5% – 8.0% |

Macu Student Loan Repayment Options

Choosing the right repayment plan for your Macu student loan is crucial for managing your debt effectively and minimizing long-term costs. Several repayment options are available, each with its own advantages and disadvantages. Understanding these differences will help you select the plan that best aligns with your financial situation and goals.

The optimal repayment plan depends on several factors, including your income, your loan amount, your financial goals, and your risk tolerance. It’s essential to carefully consider your individual circumstances before making a decision. While some plans offer lower monthly payments, they may lead to higher overall interest payments and a longer repayment period. Conversely, plans with higher monthly payments may lead to faster debt payoff and lower total interest costs.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment plan spread over a 10-year period. This plan offers predictability and simplicity, making it a popular choice for many borrowers.

- Fixed Monthly Payment: A consistent monthly payment amount throughout the loan term.

- Loan Term: Typically 10 years.

- Benefits: Predictable budgeting, relatively short repayment period.

- Drawbacks: Higher monthly payments compared to some other plans.

Extended Repayment Plan

An extended repayment plan offers lower monthly payments by stretching the repayment period over a longer timeframe. This can be beneficial for borrowers with limited income or those prioritizing lower monthly expenses.

- Lower Monthly Payments: Reduced monthly payments compared to the standard plan.

- Longer Loan Term: Typically 25 years, potentially leading to higher total interest paid.

- Benefits: More manageable monthly payments.

- Drawbacks: Significantly longer repayment period, substantially higher total interest paid over the life of the loan.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be helpful for borrowers who anticipate higher income in the future.

- Increasing Monthly Payments: Payments start low and increase incrementally.

- Loan Term: Typically 10 years.

- Benefits: Lower initial payments, manageable for those anticipating income growth.

- Drawbacks: Payments become increasingly higher over time, potentially causing financial strain later in the repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans tie your monthly payment to your income and family size. These plans are designed to make repayment more manageable for borrowers with lower incomes. Specific plans and their eligibility requirements vary. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

- Payment Based on Income: Monthly payments are calculated as a percentage of your discretionary income.

- Loan Forgiveness Potential: Some plans offer loan forgiveness after a set number of payments (typically 20 or 25 years).

- Benefits: Affordable monthly payments, potential for loan forgiveness.

- Drawbacks: Potentially longer repayment periods, may result in higher total interest paid if the loan is not forgiven.

Macu Student Loan Application Process

Applying for a Macu student loan involves several straightforward steps. The process is designed to be efficient and user-friendly, guiding you through the necessary documentation and information required for your application. Careful preparation will ensure a smooth and timely application.

The application process requires specific documentation to verify your identity, financial situation, and academic standing. Providing accurate and complete information is crucial for a successful application. Incomplete applications may result in delays or rejection.

Required Documentation

To complete your Macu student loan application, you will need to gather several essential documents. These documents help verify your identity, financial situation, and academic eligibility. Failure to provide all necessary documentation may delay the processing of your application.

- Government-issued photo identification: This could include a driver’s license, passport, or state-issued ID card. Ensure the ID is current and clearly shows your name and photograph.

- Social Security number: You will need to provide your Social Security number to verify your identity and track your loan information.

- Proof of enrollment: This typically involves an acceptance letter or enrollment verification from your chosen educational institution. The document should clearly state your enrollment status and program of study.

- Financial aid award letter (if applicable): If you’ve received financial aid, this letter will Artikel the amounts and types of aid you’ve been awarded. This helps Macu assess your overall financial need.

- Tax returns (or tax transcripts): You may need to provide copies of your most recent tax returns or tax transcripts to verify your income and financial situation. This helps Macu assess your repayment ability.

- Bank statements (may be required): Depending on the loan amount and your financial circumstances, Macu may request bank statements to verify your account information and financial stability.

Step-by-Step Application Guide

The application process is designed to be intuitive, but following these steps will ensure a smooth and efficient application. Remember to double-check all information for accuracy before submitting.

- Complete the online application form: Begin by accessing the Macu student loan application portal online. Carefully fill out all required fields, ensuring accuracy in your personal information, academic details, and financial information.

- Gather and upload required documents: Once you’ve completed the online form, gather all the necessary documentation listed previously. Upload these documents securely through the online portal. Ensure the documents are clear, legible, and in the correct format.

- Review and submit your application: Before submitting, thoroughly review all information entered to ensure accuracy. Once you are confident in the completeness and accuracy of your application, submit it through the online portal.

- Receive confirmation and follow up: You will receive a confirmation email or notification once your application has been received. Macu will review your application and contact you with updates on the status of your loan. If you haven’t heard back within a reasonable timeframe, follow up with Macu directly.

Macu Student Loan Customer Service and Support

Securing a student loan is a significant financial decision, and having access to reliable and responsive customer service is crucial throughout the borrowing process. Macu, understanding this, provides various support channels designed to assist borrowers with any questions or concerns they may encounter. This section details the available resources and aims to provide insights into the typical customer service experience.

Macu’s commitment to providing excellent customer support is reflected in the multiple avenues available to borrowers seeking assistance. These channels allow for flexible communication, catering to individual preferences and the urgency of the matter. The overall experience, based on available reviews and feedback, generally points to a helpful and responsive team, although individual experiences can vary.

Available Customer Support Channels

Macu offers a variety of ways for borrowers to connect with their customer service team. These options ensure accessibility and convenience for all borrowers, regardless of their preferred communication method. The goal is to provide timely and effective assistance for all inquiries.

- Phone Support: A dedicated phone number provides direct access to a customer service representative. This is often the quickest way to resolve urgent issues or receive immediate clarification.

- Email Support: Borrowers can send detailed inquiries via email, allowing for a written record of the communication and potentially a more thorough response. This is beneficial for complex questions or situations requiring documentation.

- Online Portal: A secure online portal provides access to account information, payment options, and frequently asked questions (FAQs). Many routine inquiries can be handled efficiently through the portal, eliminating the need for direct contact.

- Mail Support: For formal requests or documentation submissions, a mailing address is provided. While slower than other methods, this remains a viable option for certain situations.

Customer Service Responsiveness and Helpfulness

The responsiveness of Macu’s customer service varies depending on the method of contact and the time of year. Generally, phone support offers the quickest response, while email may take a bit longer, particularly during peak periods. The online portal is designed for self-service, offering immediate access to information. However, for complex issues requiring personalized assistance, contacting a representative directly via phone or email is usually recommended. Many online reviews suggest that while wait times can sometimes be longer, the representatives are generally knowledgeable and helpful in resolving issues.

Resources for Borrowers Needing Assistance

Macu provides various resources beyond direct customer support to help borrowers manage their loans effectively. These resources are designed to empower borrowers with the information and tools they need to navigate the loan process successfully.

- Frequently Asked Questions (FAQs): A comprehensive FAQ section on their website addresses common questions and concerns. This self-service resource is a great starting point for many inquiries.

- Educational Materials: Macu may offer online resources, guides, or webinars to help borrowers understand loan terms, repayment options, and financial management strategies.

- Financial Calculators: Online calculators can help borrowers estimate their monthly payments, understand the impact of different repayment plans, and plan for their financial future.

Macu Student Loan Contact Information and Support Resources

For quick reference, here’s a summarized list of Macu’s contact information and support resources. Remember to always verify this information on the official Macu website for the most up-to-date details.

- Phone Number: [Insert Macu’s Phone Number Here]

- Email Address: [Insert Macu’s Email Address Here]

- Mailing Address: [Insert Macu’s Mailing Address Here]

- Website: [Insert Macu’s Website Address Here]

Macu Student Loan Forgiveness and Deferment Programs

MACU offers several programs designed to assist borrowers facing financial hardship or pursuing careers in public service. These programs can provide temporary relief through deferment or, in some cases, the potential for loan forgiveness. Understanding the eligibility criteria and application processes is crucial for maximizing these benefits.

Macu Student Loan Deferment Options

Deferment temporarily postpones your loan payments, offering financial breathing room during challenging times. MACU may offer deferment options based on specific circumstances, such as unemployment or enrollment in graduate school. It’s important to note that interest may still accrue during a deferment period, depending on the specific program. Contact MACU directly to determine your eligibility for a deferment and the specific terms applicable to your loan.

Macu Student Loan Forgiveness Programs

Loan forgiveness programs, while less common than deferment, offer the possibility of having a portion or all of your student loan balance canceled. These programs often target borrowers who pursue careers in specific fields, such as teaching or public service. The requirements and application processes for these programs can be complex and vary widely depending on the specific program and the governing body. It is essential to research the specific programs and their criteria carefully.

Macu Student Loan Forgiveness and Deferment Application Process

The application process typically involves submitting a formal request to MACU, along with supporting documentation to verify eligibility. This documentation may include proof of employment, enrollment, or other relevant information. The specific documents required will depend on the program you’re applying for. MACU will review your application and notify you of their decision. It’s advisable to submit your application well in advance of when you need the deferment or forgiveness to take effect.

Comparison of Macu Student Loan Forgiveness and Deferment Programs

| Program Name | Eligibility Requirements | Application Process | Key Features |

|---|---|---|---|

| Unemployment Deferment | Proof of unemployment, meeting MACU’s definition of unemployment. | Submit application with documentation of unemployment. | Temporary suspension of payments; interest may accrue. |

| Graduate School Deferment | Enrollment in a graduate program at an eligible institution. | Submit application with proof of enrollment. | Temporary suspension of payments; interest may accrue. |

| Public Service Loan Forgiveness (PSLF) (If applicable through MACU) | Employment in a qualifying public service role, making 120 qualifying monthly payments under an income-driven repayment plan. | Submit application with proof of employment and repayment history. | Potential for loan forgiveness after 120 qualifying payments. |

| Income-Driven Repayment Plans (IDR) (If offered through MACU) | Meeting income requirements set by the program. | Submit application with income documentation. | Lower monthly payments based on income; potential for forgiveness after a set period (depending on the specific plan). |

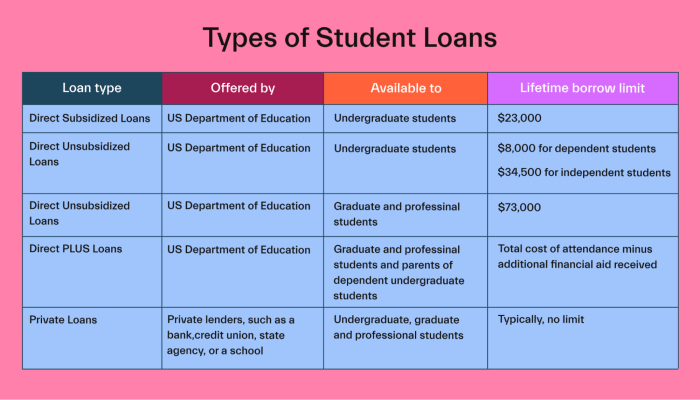

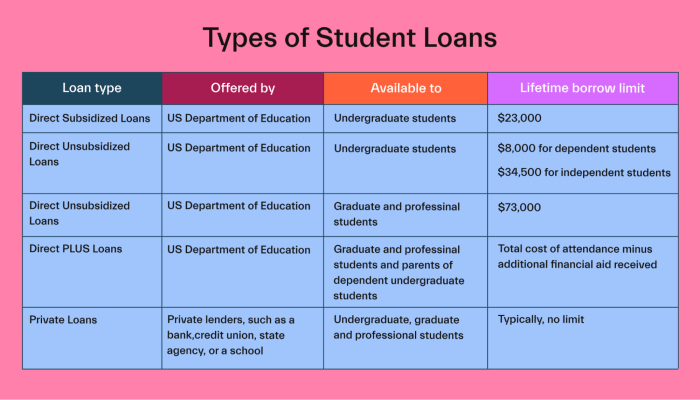

Comparing Macu Student Loans with Other Options

Choosing the right student loan can significantly impact your financial future. Understanding the differences between various loan types is crucial for making an informed decision. This section compares Macu student loans with federal and other private student loans, highlighting key differences in interest rates, repayment options, and eligibility criteria.

Macu Student Loans Compared to Federal Student Loans

Federal student loans are offered by the U.S. government and often come with significant advantages. These advantages include various repayment plans, income-driven repayment options, and potential loan forgiveness programs. However, federal loans may have a more rigorous application process and may not always offer the most competitive interest rates. Macu student loans, being private loans, typically operate under different terms.

| Feature | Macu Student Loan | Federal Student Loan |

|---|---|---|

| Interest Rates | Variable or fixed rates, generally determined by creditworthiness and market conditions. Rates may be higher than federal loans for borrowers with less-than-stellar credit. | Variable or fixed rates, generally lower than private loans, especially for subsidized loans. Rates are set by the government. |

| Repayment Options | Typically offers standard repayment plans, possibly including options like extended repayment terms. Specific options depend on the loan agreement. | Offers a wider variety of repayment plans, including income-driven repayment, extended repayment, and graduated repayment, providing flexibility for borrowers with varying financial situations. |

| Eligibility | Eligibility is based on creditworthiness, income, and other financial factors. Generally requires a credit check and co-signer may be required for borrowers with limited credit history. | Eligibility is primarily based on enrollment status at an eligible institution and citizenship/residency status. Credit history is generally not a factor. |

Macu Student Loans Compared to Private Student Loans from Other Lenders

The private student loan market is highly competitive, with numerous lenders offering various loan products. Comparing Macu’s offerings to those of other private lenders requires careful consideration of interest rates, fees, repayment terms, and customer service. Factors like your credit score and co-signer availability will influence the loan options available to you from different lenders.

| Feature | Macu Student Loan | Private Student Loans from Other Lenders |

|---|---|---|

| Interest Rates | Rates will vary based on individual creditworthiness and market conditions. | Rates vary widely across lenders and depend on creditworthiness, loan amount, and other factors. Some lenders may offer lower rates than Macu, while others may offer higher rates. |

| Repayment Options | Repayment options are defined by the loan agreement. | Repayment options vary considerably between lenders, some offering more flexible plans than others. |

| Eligibility | Eligibility criteria are specific to Macu’s lending policies. | Eligibility requirements differ based on lender policies and individual borrower profiles. |

Advantages and Disadvantages of Choosing Macu Over Other Lenders

Choosing between Macu and other lenders involves weighing the advantages and disadvantages of each. Macu may offer benefits such as convenient online application processes or personalized customer service, but other lenders may provide more competitive interest rates or more flexible repayment plans. A thorough comparison across multiple lenders is essential to find the best fit for individual circumstances.

Illustrative Example of Macu Student Loan Scenario

Let’s consider a hypothetical scenario to illustrate how a Macu student loan might work in practice. This example uses estimated figures and does not represent a specific Macu loan offer; actual terms and conditions will vary.

Sarah, a diligent student at a local university, needs $20,000 to cover her tuition and living expenses for the upcoming academic year. She applies for and is approved for a Macu student loan with a fixed interest rate of 6% per year. She chooses a standard 10-year repayment plan.

Loan Details and Repayment Schedule

This section details Sarah’s loan terms and the resulting repayment schedule. We will calculate the monthly payments and the total cost of the loan over its lifespan.

Sarah’s loan amount is $20,000 with a 6% annual interest rate. Using a standard loan amortization calculator (widely available online), we can determine her monthly payment. Over a 10-year repayment period (120 months), her estimated monthly payment would be approximately $222. This figure is an approximation and may vary slightly based on the exact calculation method used by Macu.

Total Loan Cost Calculation

This section calculates the total amount Sarah will repay, including principal and interest.

Over the 10-year repayment period, Sarah will make 120 monthly payments of approximately $222 each. This results in a total repayment of approximately $26,640. The difference between the total repayment ($26,640) and the original loan amount ($20,000) represents the total interest paid, which is approximately $6,640. This highlights the importance of understanding the total cost of borrowing and exploring different repayment options to minimize interest charges. Again, these figures are estimates and should not be considered a guaranteed representation of Macu’s loan terms.

Closure

Securing a student loan is a substantial financial commitment, and choosing the right lender is paramount. This guide has provided a detailed exploration of Macu student loans, covering key aspects from eligibility to repayment. By carefully considering the information presented, prospective borrowers can confidently assess whether a Macu student loan aligns with their individual needs and financial circumstances. Remember to thoroughly compare options and seek professional financial advice before making a final decision.

Popular Questions

What credit score is required for a Macu student loan?

Macu’s credit score requirements vary depending on the loan type and applicant’s circumstances. It’s best to check their website or contact them directly for specific requirements.

Can I refinance my Macu student loan?

Macu may offer refinancing options; however, the availability and terms will depend on your current loan and financial situation. Contact Macu directly to inquire about refinancing possibilities.

What happens if I miss a payment on my Macu student loan?

Missing payments will result in late fees and can negatively impact your credit score. Contact Macu immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Macu offer any hardship programs?

Macu may offer hardship programs for borrowers facing financial difficulties. Check their website or contact their customer service for details on available programs and eligibility criteria.