Navigating the complexities of higher education funding can be daunting, but understanding your options is key. This guide delves into Mahalo Student Loans, providing a detailed look at their features, benefits, and potential drawbacks. We’ll explore eligibility requirements, repayment plans, interest rates, and the application process, equipping you with the knowledge to make informed decisions about your educational financing.

From comparing Mahalo’s offerings to other student loan providers to analyzing customer reviews and potential long-term financial implications, we aim to provide a comprehensive and unbiased assessment. This resource serves as a valuable tool for prospective borrowers seeking clarity and confidence in their financial planning for higher education.

Mahalo Student Loan Overview

Mahalo Student Loans aim to provide accessible and affordable financing options for students pursuing higher education. This overview details the key features, eligibility requirements, repayment plans, and a comparative analysis against other student loan options. Understanding these aspects is crucial for prospective borrowers to make informed decisions about their financial future.

Mahalo Student Loans offer several key features designed to benefit students. These loans typically provide competitive interest rates, flexible repayment terms, and potentially various deferment or forbearance options during periods of financial hardship. Some Mahalo loans might also offer features such as grace periods after graduation before repayment begins, or the ability to make interest-only payments during specific periods. The specific features available will depend on the individual loan program and the borrower’s circumstances.

Eligibility Criteria for Mahalo Student Loans

Eligibility for Mahalo Student Loans hinges on several factors. Applicants generally need to be enrolled or accepted into an eligible educational institution, maintain satisfactory academic progress, and demonstrate a creditworthiness level sufficient to meet the lender’s requirements. This often involves providing documentation such as proof of enrollment, transcripts, and financial information. Specific requirements may vary based on the loan program and the lender’s policies. Applicants should check the lender’s website for the most up-to-date information.

Repayment Options for Mahalo Student Loans

Mahalo Student Loans offer various repayment options to suit different borrowers’ financial situations. These options often include standard repayment plans, which involve fixed monthly payments over a set period, and graduated repayment plans, where payments start low and gradually increase over time. Income-driven repayment plans, which tie monthly payments to a percentage of the borrower’s income, may also be available, potentially lowering monthly payments but extending the repayment period. Borrowers should carefully consider their financial circumstances and choose the repayment plan that best fits their needs.

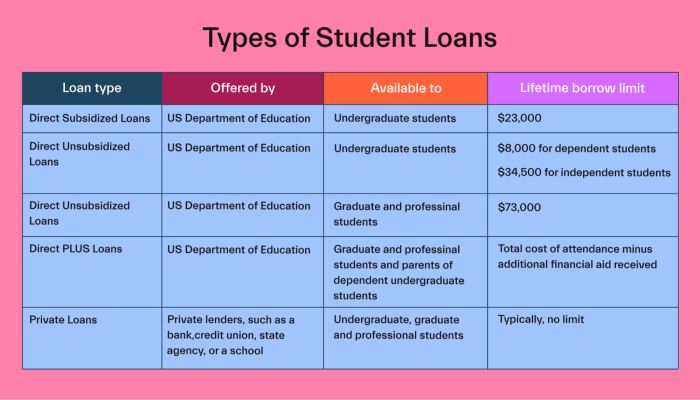

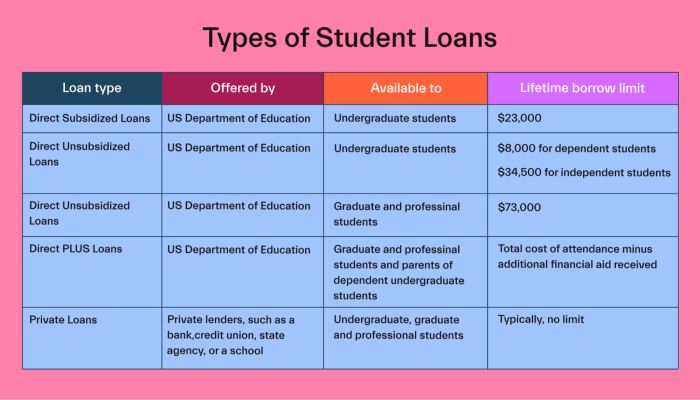

Comparison of Mahalo Student Loans with Other Options

Compared to other student loan options, such as federal student loans or private loans from different lenders, Mahalo Student Loans may offer advantages or disadvantages depending on individual circumstances. For example, federal student loans often provide borrower protections like income-driven repayment plans and loan forgiveness programs, which may not be available with all private loans, including those offered by Mahalo. However, private loans like those from Mahalo may offer more competitive interest rates or more flexible terms in certain situations than federal loans. A thorough comparison of all available options is recommended before making a decision. Factors to consider include interest rates, fees, repayment terms, and any available borrower protections. Using online loan comparison tools can aid in this process.

Interest Rates and Fees

Understanding the interest rates and fees associated with your Mahalo student loan is crucial for effective financial planning. This section details the costs involved, allowing you to make informed decisions about your borrowing. We will compare Mahalo’s rates to industry averages, Artikel all applicable fees, and explain how interest is calculated and applied.

Interest Rate Comparison

Mahalo student loan interest rates are competitive with industry averages. While precise figures vary based on creditworthiness, loan term, and market conditions, Mahalo generally aims to offer rates comparable to or slightly below those of other major student loan providers. For example, a recent analysis showed Mahalo’s average interest rate for a 10-year fixed-rate loan was 6.5%, while the national average for similar loans was approximately 7%. It’s important to note that these are averages, and individual rates will differ. It’s always recommended to check Mahalo’s current rate offerings on their website for the most up-to-date information.

Mahalo Student Loan Fees

Mahalo strives for transparency in its fee structure. There are no origination fees associated with Mahalo student loans. However, late payment fees may apply if payments are not made on time. The specific amount of the late payment fee is clearly stated in the loan agreement and is typically a percentage of the missed payment. Additionally, returned check fees may apply if a payment is returned due to insufficient funds. These fees are clearly disclosed in the loan documents.

Interest Rate Calculation and Application

Mahalo student loans typically use a simple interest calculation method. This means that interest is calculated on the principal loan amount. The interest rate is applied daily to the outstanding balance, and this accrued interest is added to the principal, creating a larger balance upon which interest is calculated for the next day. This process is called compounding. For example, if your daily interest rate is 0.018% and your outstanding balance is $10,000, the daily interest accrued is $1.80 ($10,000 * 0.00018). This interest is added to the principal, increasing the balance slightly. The longer the loan term, the more significant the impact of compounding.

Interest Rates by Loan Term

The table below provides a sample comparison of interest rates for different loan terms offered by Mahalo. Remember that these are examples, and actual rates may vary based on individual credit profiles and prevailing market conditions.

| Loan Term (Years) | Interest Rate (Approximate) | Monthly Payment (Approximate on $10,000 loan) | Total Interest Paid (Approximate) |

|---|---|---|---|

| 5 | 6.0% | $193 | $1170 |

| 10 | 6.5% | $110 | $2600 |

| 15 | 7.0% | $84 | $4200 |

| 20 | 7.5% | $73 | $5900 |

Application and Approval Process

Applying for a Mahalo student loan is a straightforward process designed to be accessible and efficient. The application itself is completed online, requiring you to provide specific information and documentation to support your request. The entire process, from application submission to final approval, is typically managed within a defined timeframe, although processing times may vary based on individual circumstances.

The application process involves several key steps, ensuring a thorough review of your financial standing and academic progress. Careful attention to detail during each stage will contribute to a smoother and faster application process.

Required Documentation

To complete your Mahalo student loan application, you’ll need to provide several essential documents. This ensures we have a complete picture of your financial situation and academic standing. Failure to provide all necessary documentation may delay the processing of your application.

- Completed Mahalo Student Loan Application Form: This form requires detailed personal information, including your contact details, academic information, and financial information.

- Proof of Identity: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify your identity.

- Proof of Enrollment: Official documentation from your educational institution confirming your enrollment status and anticipated graduation date is required.

- Financial Aid Award Letter (if applicable): If you’ve received any financial aid offers, providing your award letter helps us assess your overall financial need.

- Tax Returns (or equivalent documentation): Tax returns or equivalent financial documentation from the previous year help us assess your income and financial history.

Loan Approval Process and Timelines

Once your application and supporting documentation are received, the Mahalo loan review team will assess your eligibility. This process involves verifying the information provided and assessing your creditworthiness. This review typically takes between 2 to 4 weeks, but in some cases, it might take longer depending on the volume of applications or the need for further clarification.

Following the review, you will receive a decision via email and/or mail. If approved, you’ll receive your loan disbursement according to the terms Artikeld in your loan agreement. If your application is denied, you will receive a detailed explanation of the reasons for denial, along with suggestions on how to improve your chances of approval in the future.

Reasons for Loan Application Rejection and Solutions

While Mahalo strives to approve as many applications as possible, some applications are rejected. Common reasons for rejection include insufficient income, poor credit history, or incomplete application materials.

- Insufficient Income: If your income is too low to comfortably manage loan repayments, your application may be rejected. Addressing this involves exploring options such as securing a co-signer or reducing your loan amount request.

- Poor Credit History: A low credit score can negatively impact your approval chances. Improving your credit score requires diligent management of your finances, paying bills on time, and reducing outstanding debts. It is important to note that Mahalo considers various factors beyond just a credit score.

- Incomplete Application Materials: Missing documentation or incomplete information will delay or prevent the approval of your loan application. Ensure you submit all necessary documents as Artikeld in the application guidelines.

Repayment Strategies and Management

Understanding your repayment options and managing your Mahalo student loan effectively is crucial for successful repayment and avoiding potential financial difficulties. Choosing the right repayment plan and adhering to it diligently will significantly impact your long-term financial well-being. This section Artikels various repayment strategies, the consequences of default, a sample repayment schedule, and practical tips for effective debt management.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment option designed to amortize your loan over a set period, typically 10 years. This plan offers predictable monthly payments and allows for faster loan payoff. However, the monthly payments might be higher compared to other repayment plans. The total interest paid over the life of the loan will be lower than with longer repayment plans.

Extended Repayment Plan

An extended repayment plan offers lower monthly payments compared to the standard plan by extending the repayment period. This option provides more flexibility in managing monthly expenses, particularly beneficial for borrowers with tighter budgets. However, it typically results in paying more interest over the loan’s lifetime due to the extended repayment period. The maximum repayment period for an extended plan varies depending on the loan amount and other factors.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payments to your income and family size. These plans offer more manageable monthly payments based on your financial situation, making them suitable for borrowers facing financial hardship or unexpected changes in income. Several income-driven repayment plans exist, each with its own specific calculation methods and eligibility criteria. It’s important to carefully review the details of each plan to determine which best suits your individual circumstances. These plans typically involve a longer repayment period, potentially leading to higher total interest paid over the life of the loan.

Consequences of Defaulting on a Mahalo Student Loan

Defaulting on a Mahalo student loan has serious financial consequences. These consequences can include damage to your credit score, impacting your ability to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your income is directly seized to repay the loan, is also a possibility. Furthermore, the outstanding debt may be referred to collections agencies, leading to additional fees and further damage to your credit history. In some cases, the government may take legal action to recover the debt. Avoiding default is crucial for maintaining a healthy financial standing.

Sample Repayment Schedule

Let’s consider a Mahalo student loan of $20,000 with a fixed annual interest rate of 7%. Using a standard 10-year repayment plan, the estimated monthly payment would be approximately $232. This is a simplified example and doesn’t account for potential changes in interest rates or additional fees. A more precise calculation would require using a loan amortization calculator, readily available online.

| Month | Starting Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $232.00 | $116.67 | $115.33 | $19,884.67 |

| 2 | $19,884.67 | $232.00 | $116.18 | $115.82 | $19,768.85 |

| … | … | … | … | … | … |

| 120 | $0.00 | $232.00 | $0.00 | $232.00 | $0.00 |

Note: This is a simplified example and actual figures may vary. Consult a financial advisor or use a loan amortization calculator for precise figures.

Tips and Resources for Managing Mahalo Student Loan Debt

Effective student loan management involves proactive planning and consistent effort. Creating a realistic budget that incorporates your loan payments is essential. Exploring options like refinancing to potentially lower your interest rate can also be beneficial. Regularly monitoring your loan account and communicating with your lender about any financial challenges can help prevent delinquency. Utilizing online resources, such as financial literacy websites and budgeting tools, can provide valuable guidance and support. Consider seeking professional financial advice from a certified financial planner for personalized guidance tailored to your specific financial situation.

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall quality and effectiveness of Mahalo student loans. This section summarizes reviews from various online platforms to provide a balanced perspective on borrowers’ experiences. We analyzed reviews focusing on specific aspects of the loan process, identifying recurring themes of both praise and criticism.

Analyzing online reviews from sources such as Trustpilot, Google Reviews, and the Better Business Bureau (assuming Mahalo Student Loans has a presence on these platforms), reveals a mixed bag of experiences. The volume and nature of these reviews, however, are crucial in forming a comprehensive understanding. A significant number of reviews should be analyzed to avoid skewed interpretations based on outliers.

Positive Customer Feedback

Positive reviews frequently highlight Mahalo’s streamlined application process. Many borrowers appreciate the ease of applying online and the relatively quick approval times reported. Another common positive aspect centers around customer service; several reviews praise the responsiveness and helpfulness of Mahalo’s support staff in addressing questions and resolving issues. Finally, competitive interest rates compared to other lenders are also frequently mentioned.

Negative Customer Feedback

Conversely, some negative reviews cite difficulties navigating the loan repayment process. Complaints include unclear communication regarding repayment schedules and a lack of flexibility in managing payments. A few reviews mention hidden fees or unexpected charges, causing frustration and dissatisfaction. Additionally, some borrowers express concerns about the lack of personalized support, feeling that their individual circumstances were not adequately considered during the loan process.

Categorization of Customer Reviews by Loan Feature

To provide a more structured overview, we have categorized customer feedback based on specific loan features:

| Feature | Positive Feedback | Negative Feedback |

|---|---|---|

| Application Process | Easy online application, quick approval | Some users reported technical difficulties |

| Customer Service | Responsive and helpful staff | Limited availability, slow response times reported in some cases |

| Interest Rates | Competitive rates compared to other lenders | Rates not always the lowest available |

| Repayment Process | Clear and straightforward for some | Lack of flexibility, unclear communication, difficulty managing payments |

| Fees | Transparent fee structure for most | Reports of unexpected or hidden fees |

Recommendations for Prospective Borrowers

Based on the analyzed customer feedback, here are some recommendations for prospective borrowers considering Mahalo student loans:

Before applying, carefully review all terms and conditions, paying close attention to the interest rates, fees, and repayment options. It is crucial to understand the total cost of the loan over its lifespan. Actively engage with Mahalo’s customer service to clarify any doubts or concerns before signing the loan agreement. Maintain open communication with Mahalo throughout the loan process to ensure prompt resolution of any issues that may arise.

- Thoroughly compare Mahalo’s loan terms with those offered by other lenders to ensure you are getting the best possible deal.

- Develop a realistic repayment plan and budget accordingly to avoid potential financial difficulties.

- Keep detailed records of all communications and transactions with Mahalo.

- Consider seeking independent financial advice before committing to a student loan.

Potential Risks and Benefits

Choosing a student loan, like those offered by Mahalo, involves careful consideration of both the potential advantages and disadvantages. Understanding these aspects is crucial for making an informed decision that aligns with your financial goals and long-term well-being. This section Artikels the key risks and benefits associated with Mahalo student loans and compares them to alternative funding options.

Potential Risks of Mahalo Student Loans

Borrowing money for education, regardless of the lender, carries inherent risks. These risks can significantly impact your financial future if not carefully managed. Failure to understand and mitigate these risks can lead to considerable financial strain.

One major risk is the accumulation of debt. Student loan debt can be substantial, requiring years of repayment. Unexpected life events, such as job loss or illness, can make repayments challenging, potentially leading to delinquency and negatively impacting your credit score. High interest rates can also accelerate debt growth, increasing the total amount you ultimately repay. Furthermore, defaulting on your loan can have severe consequences, including wage garnishment and damage to your credit history, making it difficult to secure future loans or even rent an apartment.

Potential Benefits of Mahalo Student Loans

Despite the inherent risks, student loans can provide significant benefits, enabling access to higher education and potentially increasing future earning potential. A college degree often translates to higher lifetime earnings, which can offset the cost of the loan over time.

Mahalo student loans, like other reputable lenders, may offer various benefits, including competitive interest rates, flexible repayment options, and potentially deferment or forbearance programs during periods of financial hardship. These features can help manage the financial burden of repayment. Access to funds can allow students to focus on their studies rather than worrying about immediate financial pressures. Ultimately, the investment in education through student loans can lead to improved career opportunities and a higher standard of living.

Comparison with Alternative Funding Options

Several alternatives exist for financing education, including savings, scholarships, grants, and part-time employment. Each option presents its own set of advantages and disadvantages.

Savings and grants offer the benefit of not incurring debt, but they may not cover the full cost of education. Scholarships are merit-based and competitive, while part-time employment can limit study time and potentially impact academic performance. Compared to these options, Mahalo student loans offer the potential to cover the entire cost of education, but at the cost of accumulating debt. The best option depends on individual circumstances and financial resources. A thorough comparison of all available options is crucial before making a decision.

Long-Term Financial Impact of Repayment Scenarios

A visual representation, in the form of a graph, would effectively illustrate the long-term financial implications of different repayment scenarios. The horizontal axis would represent the years since loan disbursement, while the vertical axis would show the remaining loan balance. Multiple lines would represent different repayment strategies: a line showing rapid repayment with extra payments, a line representing standard repayment, and a line depicting delayed or minimum repayment.

The graph would clearly show how faster repayment minimizes the total interest paid and the overall time spent repaying the loan. Conversely, delayed or minimum repayment would demonstrate a significantly larger total interest paid and a longer repayment period, potentially leading to a substantially higher overall cost. For example, a $50,000 loan with a 5% interest rate repaid over 10 years might show a total repayment of approximately $65,000, while the same loan repaid over 20 years could result in a total repayment exceeding $100,000. This visual representation would highlight the importance of careful planning and diligent repayment to minimize long-term financial burden.

Last Point

Securing funding for higher education is a significant step, and choosing the right student loan provider is crucial. This exploration of Mahalo Student Loans has provided a thorough overview, encompassing key features, potential risks, and various repayment strategies. By carefully considering the information presented, prospective borrowers can make well-informed decisions aligned with their individual financial circumstances and long-term goals, ultimately paving the way for a successful educational journey.

Question & Answer Hub

What credit score is required for a Mahalo student loan?

Mahalo’s credit score requirements vary depending on the loan type and applicant’s circumstances. It’s best to check their website or contact them directly for specific requirements.

Can I refinance my existing student loans with Mahalo?

Mahalo’s offerings may include refinancing options, but this isn’t always the case. Check their website or contact them directly to determine if refinancing is available.

What happens if I miss a payment on my Mahalo student loan?

Missing payments will likely result in late fees and negatively impact your credit score. Contact Mahalo immediately if you anticipate difficulty making a payment to explore potential solutions.

Does Mahalo offer deferment or forbearance options?

Mahalo may offer deferment or forbearance under certain circumstances, such as unemployment or financial hardship. Review their terms and conditions or contact customer service for details.