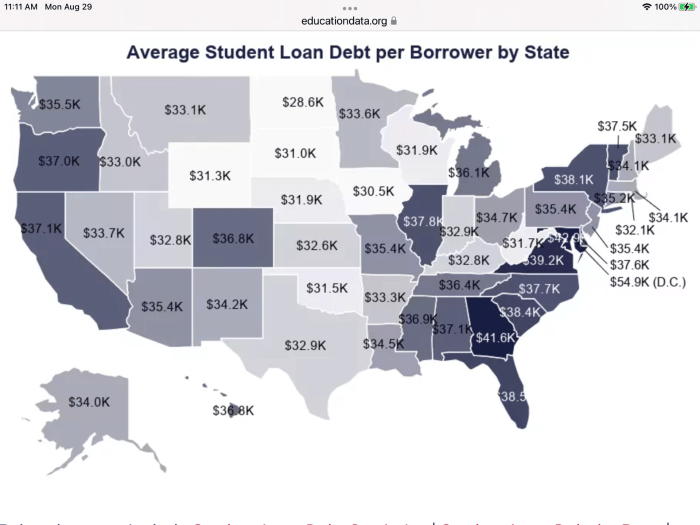

Navigating the complexities of higher education financing can be daunting, particularly when considering student loans. This guide provides a thorough exploration of Maryland student loan programs, offering clarity on eligibility, application processes, repayment options, and available support systems. We aim to empower Maryland students and borrowers with the knowledge needed to make informed decisions and manage their student loan debt effectively.

From understanding the various loan programs offered by the state to developing effective repayment strategies and exploring options for loan forgiveness, this resource serves as a comprehensive roadmap. We’ll delve into the intricacies of interest rates, fees, and the potential consequences of default, ensuring readers are well-equipped to handle their financial obligations responsibly.

Maryland Student Loan Programs

Maryland offers several student loan programs to help residents finance their higher education. These programs vary in eligibility requirements, interest rates, and repayment options, providing flexibility for students with diverse financial needs. Understanding the nuances of each program is crucial for selecting the most suitable option.

Maryland Student Loan Program Overview

Several loan programs exist within the Maryland Higher Education Commission’s (MHEC) umbrella. While specific details are subject to change, the following provides a general overview of the types of aid available. Note that this is not an exhaustive list and direct application through the MHEC or relevant lenders is recommended for the most up-to-date information. It is crucial to remember that federal student loans are often the first option to explore due to their generally favorable terms and extensive consumer protections. Maryland’s state programs typically supplement federal options.

Eligibility Criteria for Maryland Student Loan Programs

Eligibility criteria for Maryland student loan programs often include Maryland residency, enrollment in an eligible institution (typically accredited colleges and universities within Maryland), and demonstration of financial need (for need-based programs). Specific requirements vary based on the program. Income levels, credit history, and academic standing might also be considered. Applicants should carefully review the specific requirements of each program before applying.

Interest Rates and Repayment Options

Interest rates for Maryland student loan programs are generally variable and subject to market fluctuations. They tend to be competitive with other state and private loan options, but may be higher than federal loan rates. Repayment options typically include standard repayment plans (fixed monthly payments over a set period), extended repayment plans (longer repayment terms resulting in lower monthly payments but higher overall interest), and income-driven repayment plans (monthly payments adjusted based on income). Specific repayment options vary by lender and program. Borrowers should carefully consider their financial circumstances when selecting a repayment plan.

Summary of Key Features of Maryland Student Loan Programs

| Program Name | Eligibility | Interest Rate | Repayment Options |

|---|---|---|---|

| (Example: Maryland Higher Education Loan Program – hypothetical) | Maryland residency, enrollment in eligible institution, demonstrated financial need | Variable, subject to market conditions (example: 5-7%) | Standard, extended, income-driven |

| (Example: Maryland Private Loan Program – hypothetical) | Maryland residency, enrollment in eligible institution, credit check required | Variable, based on creditworthiness (example: 7-10%) | Standard, extended |

| (Example: Maryland Graduate Loan Program – hypothetical) | Maryland residency, enrollment in eligible graduate program, demonstrated financial need | Variable, potentially lower than undergraduate rates | Standard, extended, income-driven |

| (Note: This table provides hypothetical examples. Actual programs and their details are subject to change and should be verified through official MHEC resources.) |

Accessing Maryland Student Loan Funds

Securing funding for your education through Maryland student loans involves a straightforward application process. Understanding the requirements and steps involved will ensure a smoother experience. This section details the application process, required documentation, and the disbursement procedure.

The application process for Maryland student loans generally begins online through the Maryland Higher Education Commission (MHEC) or the specific lender’s website, if applicable. The application itself will require personal information, academic details, and financial information. Applicants will need to select the loan program that best suits their needs and complete all required fields accurately. Providing accurate and complete information upfront helps expedite the processing time.

Required Documentation for Loan Applications

To complete the application, you will need to gather several important documents. These documents verify your identity, enrollment, and financial need, allowing the lender to assess your eligibility and determine the loan amount you qualify for.

- Government-issued photo identification (driver’s license, passport, etc.)

- Social Security number

- Proof of enrollment (acceptance letter, enrollment verification from the institution)

- Federal tax returns (or tax transcripts) for you and your parents (if applicable, depending on the loan type)

- Bank statements (to verify account information for disbursement)

Disbursement of Loan Funds

Once your application is approved, the funds are disbursed according to the institution’s schedule. This usually coincides with the start of the academic term. The funds are generally electronically deposited into your designated bank account. It’s crucial to provide accurate banking information to avoid delays.

Step-by-Step Guide: Application to Disbursement

This guide Artikels the process from initial application to receiving your loan funds. Following these steps carefully will streamline the process.

- Complete the Application: Fill out the online application form accurately and completely, ensuring all information is up-to-date.

- Gather Required Documents: Collect all necessary documentation as listed above.

- Submit the Application: Submit your completed application and supporting documents electronically.

- Review and Approval: The lender will review your application. This may involve additional verification steps.

- Loan Approval Notification: You will receive notification of your loan approval, including the loan amount and disbursement details.

- Provide Banking Information: Provide your accurate banking information for electronic disbursement.

- Funds Disbursement: The funds will be electronically deposited into your account according to the institution’s disbursement schedule.

Repayment Options and Strategies for Maryland Student Loans

Understanding your repayment options is crucial for successfully managing your Maryland student loan debt. Choosing the right plan depends on your individual financial situation and long-term goals. Several repayment plans are available, each with its own set of advantages and disadvantages. Careful consideration of these factors will help you navigate the repayment process effectively.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. This plan offers predictability and allows for faster debt payoff. However, the monthly payments can be higher compared to income-driven plans, potentially straining your budget, especially in the early stages of your career. A benefit is the faster payoff, leading to less overall interest paid.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, typically up to 25 years. The longer repayment term results in lower monthly payments, making it more manageable for borrowers with limited income. However, the extended repayment period means you’ll pay significantly more in interest over the life of the loan. This option is best suited for borrowers who prioritize affordability over speed of repayment.

Graduated Repayment Plan

With a graduated repayment plan, your monthly payments start low and gradually increase over time. This can be helpful for borrowers who anticipate increased income in the future. While the initial payments are easier to manage, the later payments can become substantial, requiring careful budgeting as your payments increase. It offers a balance between affordability early on and faster payoff compared to the extended plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments, making them more manageable for borrowers with lower incomes. However, because payments are lower, the repayment period is typically longer, resulting in potentially higher overall interest paid. These plans also offer potential for loan forgiveness after a specified number of qualifying payments.

Comparison of Repayment Plans

| Repayment Plan | Pros | Cons | Best Suited For |

|---|---|---|---|

| Standard Repayment | Predictable payments, faster payoff, lower total interest | Higher monthly payments | Borrowers with stable income and ability to manage higher payments |

| Extended Repayment | Lower monthly payments | Longer repayment period, higher total interest | Borrowers prioritizing affordability over speed of repayment |

| Graduated Repayment | Lower initial payments, gradually increasing | Higher payments later in repayment period | Borrowers anticipating income growth |

| Income-Driven Repayment | Lower monthly payments based on income, potential for loan forgiveness | Longer repayment period, higher total interest | Borrowers with lower income or fluctuating income |

Managing and Avoiding Default on Maryland Student Loans

Successfully managing your Maryland student loans is crucial to avoiding the serious consequences of default. Careful planning and proactive steps can significantly reduce the risk of falling behind on your payments and protect your financial future. This section Artikels strategies for effective repayment, resources available during financial hardship, and the repercussions of default.

Effective Student Loan Repayment Management Strategies

Developing a robust repayment plan is paramount. This involves understanding your loan terms, including interest rates, repayment schedules, and any applicable fees. Creating a realistic budget that prioritizes loan payments alongside essential living expenses is essential. Consider exploring different repayment options offered by your loan servicer, such as income-driven repayment plans which adjust your monthly payments based on your income and family size. Regularly monitoring your loan account online and staying in contact with your loan servicer allows you to identify potential issues early and proactively address them. Automating payments can prevent missed payments and ensure consistent progress towards loan repayment.

Resources for Borrowers Experiencing Financial Difficulties

Facing unexpected financial difficulties does not necessitate defaulting on your student loans. Several resources are available to assist borrowers during challenging times. The Maryland Higher Education Commission (MHEC) website provides information on available repayment assistance programs and counseling services. National organizations, such as the National Foundation for Credit Counseling (NFCC), offer free or low-cost credit counseling to help you create a manageable budget and explore debt management options. Contacting your loan servicer directly to discuss your situation and explore potential deferment or forbearance options is a crucial step. These options temporarily suspend or reduce your payments, providing much-needed breathing room during periods of financial strain. Remember, proactive communication is key to avoiding default.

Consequences of Defaulting on a Maryland Student Loan

Defaulting on a Maryland student loan has severe consequences that extend far beyond missed payments. Your credit score will suffer significantly, making it challenging to secure loans, rent an apartment, or even obtain certain jobs. Wage garnishment, where a portion of your paycheck is automatically deducted to repay the loan, is a possibility. The government may also seize your tax refunds to apply towards your outstanding debt. Furthermore, your ability to obtain federal student aid in the future will be severely compromised or completely eliminated. The long-term financial and personal implications of default are substantial, making proactive management of your loans vital.

Practical Tips for Avoiding Loan Default

Understanding the importance of consistent payments is paramount to avoiding default. Here are some practical steps to take:

- Budget Carefully: Create a detailed budget that includes all income and expenses, prioritizing loan payments.

- Automate Payments: Set up automatic payments to avoid missed payments due to oversight.

- Explore Repayment Options: Research and consider income-driven repayment plans or other options offered by your loan servicer.

- Communicate with Your Servicer: Contact your loan servicer immediately if you anticipate difficulty making payments.

- Seek Financial Counseling: Utilize free or low-cost credit counseling services to manage your finances effectively.

Governmental and Institutional Support for Maryland Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, both the federal government and the state of Maryland, along with Maryland’s higher education institutions, offer various programs and resources designed to assist borrowers in managing their debt. Understanding these support systems is crucial for Maryland students and graduates seeking financial stability.

Several federal and state programs provide direct assistance to student loan borrowers in Maryland. These programs offer a range of support, from income-driven repayment plans to loan forgiveness programs, depending on the borrower’s specific circumstances and the type of loan they hold. Furthermore, Maryland’s colleges and universities often play a vital role in providing guidance and resources to their students and alumni regarding loan management and repayment strategies.

Federal Student Loan Repayment Assistance Programs

The federal government offers several programs designed to make student loan repayment more manageable. These include income-driven repayment plans (IDR), which adjust monthly payments based on income and family size. Other programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, offer partial or complete loan forgiveness after meeting specific criteria, such as working in public service or teaching in a low-income school. Borrowers should carefully review the eligibility requirements for each program to determine if they qualify. For example, PSLF requires 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer.

Maryland State-Specific Student Loan Assistance Programs

While Maryland doesn’t have its own comprehensive loan forgiveness program, the state actively participates in and promotes federal programs. The Maryland Higher Education Commission (MHEC) serves as a key resource, providing information and guidance on federal loan repayment options and other financial aid opportunities. They often host workshops and online resources to educate borrowers about available assistance programs. The MHEC website is a valuable tool for finding details on these programs and determining eligibility.

Support from Maryland Colleges and Universities

Maryland’s colleges and universities recognize the challenges students face in managing student loan debt. Many institutions provide on-campus financial aid offices that offer counseling and guidance on loan repayment strategies. These offices often provide workshops, individual consultations, and access to online resources to help students create a personalized repayment plan. Some universities may even partner with external organizations to offer additional support services, such as credit counseling or debt management workshops. These services can be particularly helpful for graduates transitioning into the workforce and facing the realities of student loan repayment.

Accessing Support: A Flowchart

The following flowchart illustrates the process of accessing support from various agencies:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Need Student Loan Repayment Assistance?”. This would branch to two boxes: “Federal Programs” and “State/Institutional Programs”. The “Federal Programs” box would branch to boxes representing IDR plans, PSLF, and Teacher Loan Forgiveness, each with arrows leading to boxes detailing the application process for each. The “State/Institutional Programs” box would branch to boxes representing the MHEC website and individual university financial aid offices, again with arrows leading to boxes describing the resources available through each. All paths ultimately lead to a final box: “Reduced Student Loan Burden”.]

Understanding Interest Rates and Fees Associated with Maryland Student Loans

Securing a Maryland student loan involves understanding the associated costs, primarily interest rates and fees. These factors significantly impact the overall loan repayment amount, so careful consideration is crucial before borrowing. This section clarifies how these costs are determined and how they vary across different loan types.

Interest Rate Determination for Maryland Student Loans

The interest rate applied to a Maryland student loan is influenced by several factors. The most significant is the type of loan. Federal student loans, for example, often have fixed interest rates set annually by the government, while private loans from lenders in Maryland will have variable or fixed rates based on the borrower’s creditworthiness and market conditions at the time of loan origination. Credit history, income, and the loan term also play a role in determining the final interest rate for private loans. Additionally, the loan’s repayment plan (e.g., standard, graduated, income-driven) can sometimes indirectly affect the total interest paid, though it doesn’t directly alter the initial interest rate itself. Borrowers should carefully review their loan documents to understand the specific interest rate and its implications.

Fees Associated with Maryland Student Loans

Several fees can be associated with Maryland student loans, varying depending on the lender and loan type. Origination fees, charged by the lender to process the loan application, are common. These fees can be a percentage of the loan amount or a fixed dollar amount. Late payment fees are incurred if a borrower fails to make timely payments. These fees can add significantly to the total cost of the loan over time. Some lenders might also charge prepayment penalties if a borrower pays off the loan early. Finally, returned payment fees are levied if a payment is returned due to insufficient funds. It’s vital to understand all potential fees to accurately budget for loan repayment.

Comparison of Interest Rates Across Different Maryland Student Loans

Interest rates vary significantly across different types of Maryland student loans. Federal student loans generally offer lower interest rates than private loans. Within federal loans, subsidized loans (where interest is not accrued while the student is enrolled at least half-time) typically have lower rates than unsubsidized loans. Private loans, on the other hand, have interest rates that are highly variable and often reflect the borrower’s credit risk. For instance, a borrower with excellent credit might secure a lower interest rate than a borrower with limited or poor credit history.

Visual Representation of Interest Rate Differences

Imagine a bar chart with the horizontal axis representing the different loan types: Federal Subsidized Loans, Federal Unsubsidized Loans, and Private Loans. The vertical axis represents the annual interest rate (as a percentage). Let’s assume, for illustrative purposes, the following rates: Federal Subsidized Loans have an average annual interest rate of 4.5%, Federal Unsubsidized Loans at 6%, and Private Loans ranging from 7% to 12%, depending on creditworthiness. The bar for Federal Subsidized Loans would be the shortest, the bar for Federal Unsubsidized Loans would be taller, and the bar for Private Loans would be the tallest, with its height varying to represent the range of possible rates. This visual representation clearly shows the potential significant difference in interest rates across various loan types. This is a simplified example; actual rates will vary depending on the year and specific loan terms.

Closure

Securing a higher education should be an accessible endeavor, and understanding the nuances of Maryland student loans is crucial for achieving this goal. This guide has provided a framework for navigating the complexities of student loan financing in Maryland, from application to repayment and beyond. By utilizing the information and resources provided, Maryland students can confidently pursue their academic aspirations while managing their financial future responsibly. Remember to explore all available options and seek assistance when needed to ensure a smooth and successful journey through the student loan process.

Answers to Common Questions

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default.

Can I consolidate my Maryland student loans?

Yes, loan consolidation can simplify repayment by combining multiple loans into a single payment. Check with your loan servicer for eligibility.

Are there any scholarships or grants available to help with student loan debt?

Yes, various scholarships and grants are available at both the state and federal levels. Research opportunities through your college and online resources.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.