Navigating the world of student loans can feel overwhelming, but understanding the Master Promissory Note (MPN) is a crucial first step towards financial responsibility. This document, essentially a contract between you and the federal government, Artikels the terms and conditions of your student loan(s). It details everything from repayment plans and interest accrual to the serious consequences of default. This guide will demystify the MPN, empowering you to make informed decisions about your educational financing.

From signing your first MPN to understanding the nuances of repayment options and the potential pitfalls of default, we’ll cover the essential aspects of this critical document. We aim to provide clarity and equip you with the knowledge needed to manage your student loans effectively and responsibly.

Understanding the Master Promissory Note

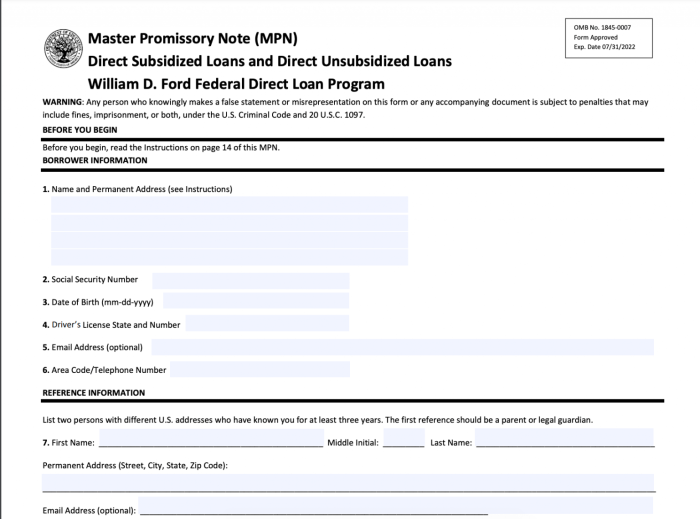

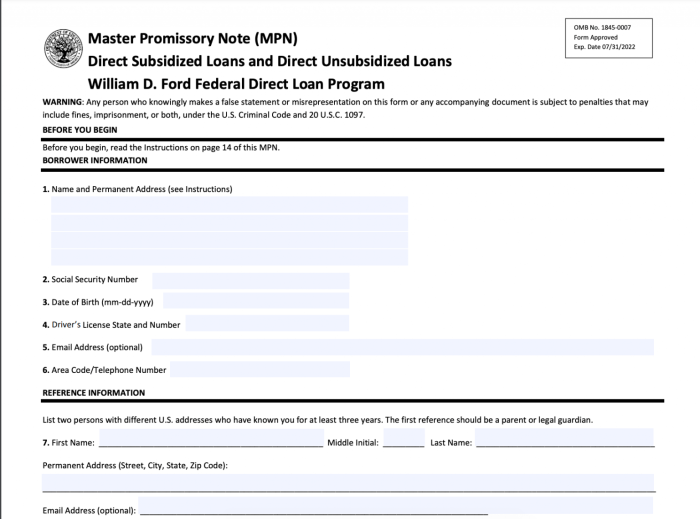

A Master Promissory Note (MPN) is a legally binding agreement you sign to receive federal student loans. It Artikels your responsibilities as a borrower and the terms under which you agree to repay the loan. Understanding its contents is crucial for responsible loan management and avoiding future financial difficulties.

Purpose of a Master Promissory Note

The MPN serves as a single document that covers all federal student loans you borrow from a specific lender during a specific period. This simplifies the borrowing process by eliminating the need to sign separate promissory notes for each loan disbursement. It streamlines repayment, ensuring a clear understanding of your total debt and repayment obligations. The MPN centralizes all the essential terms and conditions, providing a comprehensive record of your borrowing agreement.

Key Components of a Master Promissory Note

Several key components are typically included in an MPN. These include your personal information (name, address, social security number), the loan amounts, the interest rates, the repayment terms, the loan disbursement dates, and the lender’s contact information. Crucially, it also details your repayment options, including standard, graduated, extended, and income-driven repayment plans. Finally, the MPN will specify the consequences of defaulting on your loan, including potential damage to your credit score and wage garnishment.

Types of Federal Student Loans Covered by an MPN

An MPN typically covers several types of federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for Graduate Students, and Direct PLUS Loans for Parents. Direct Subsidized Loans offer interest subsidies while you’re enrolled at least half-time, while Direct Unsubsidized Loans accrue interest from the time they are disbursed. Direct PLUS Loans are available to graduate students and parents of undergraduate students to help cover educational expenses. The specific loan types included in your MPN will depend on your individual circumstances and the loans you receive.

Examples of Clauses in MPNs and Their Implications

Several common clauses within MPNs have significant implications for borrowers. For example, a clause detailing the interest capitalization process explains how unpaid interest is added to the principal loan balance, increasing the total amount owed. Another common clause Artikels the consequences of default, which can include negative impacts on credit scores, wage garnishment, and potential legal action. A clause specifying the repayment terms, including the length of the repayment period and the monthly payment amount, is also crucial for borrowers to understand their long-term financial commitments. Finally, clauses related to forbearance and deferment explain the processes for temporarily suspending or reducing loan payments under specific circumstances.

Comparison of MPN Terms and Conditions Across Federal Loan Programs

| Loan Program | Interest Rate | Repayment Options | Deferment/Forbearance Options |

|---|---|---|---|

| Direct Subsidized Loan | Variable, set annually by the government | Standard, Graduated, Extended, Income-Driven | Available during periods of enrollment and unemployment |

| Direct Unsubsidized Loan | Variable, set annually by the government | Standard, Graduated, Extended, Income-Driven | Available during periods of unemployment and economic hardship |

| Direct PLUS Loan (Graduate) | Variable, set annually by the government, typically higher than subsidized/unsubsidized loans | Standard, Extended | Limited options compared to subsidized/unsubsidized loans |

| Direct PLUS Loan (Parent) | Variable, set annually by the government, typically higher than subsidized/unsubsidized loans | Standard, Extended | Limited options compared to subsidized/unsubsidized loans |

Signing and Accepting the MPN

The Master Promissory Note (MPN) is a legally binding agreement between you and your lender. Signing it signifies your understanding and acceptance of the terms and conditions for your student loan. This process is crucial, as it sets the stage for your repayment responsibilities and Artikels your rights as a borrower. Understanding the implications of signing is vital before proceeding.

The process of signing and accepting an MPN typically involves accessing the lender’s online portal, reviewing the terms and conditions carefully, and then electronically signing the document. Some lenders may still offer paper-based MPNs, but the electronic method is far more common. After signing, you will receive confirmation of your acceptance and a copy of the signed MPN for your records. This confirmation should be kept in a safe place for future reference.

Legal Implications of Signing an MPN

Signing an MPN constitutes a legally binding contract. This means you are legally obligated to repay the loan according to the terms Artikeld in the agreement. Failure to do so can have serious consequences, including damage to your credit score, wage garnishment, and potential legal action. The terms will specify the interest rate, repayment schedule, and any applicable fees. It is imperative to understand these terms before signing.

Rights and Responsibilities of Borrowers After Signing an MPN

Upon signing the MPN, borrowers acquire certain rights and simultaneously assume specific responsibilities. Borrowers have the right to receive clear and accurate information about their loan terms, repayment options, and available assistance programs. Responsibilities include making timely payments according to the agreed-upon schedule, notifying the lender of any changes in contact information, and understanding the consequences of default.

Potential Consequences of Failing to Sign or Understand the MPN

Failure to sign the MPN will prevent you from receiving your student loan funds. This can have significant consequences, potentially delaying or preventing your enrollment in educational programs. Furthermore, a lack of understanding of the MPN’s terms can lead to unforeseen financial difficulties. For example, not understanding the repayment schedule could result in missed payments and subsequent penalties. Understanding the implications of signing is paramount to responsible financial management.

Step-by-Step Guide for Signing an MPN

- Access the Lender’s Portal: Log in to the online portal provided by your student loan lender using your credentials.

- Review the MPN Carefully: Read through the entire document thoroughly, paying close attention to the interest rate, repayment terms, and any fees.

- Seek Clarification if Needed: If you have any questions or uncertainties about the terms, contact your lender’s customer service department for clarification.

- Electronically Sign the MPN: Once you understand and agree to the terms, electronically sign the MPN using the provided method.

- Keep a Copy: Download and save a copy of the signed MPN for your records. This is crucial for future reference.

Repayment of Student Loans under the MPN

Understanding your repayment options is crucial for managing your student loan debt effectively. This section Artikels the various repayment plans available, payment methods, and the potential impact of different plans on your overall repayment costs. Careful consideration of these factors will help you choose a plan that aligns with your financial situation and long-term goals.

Available Repayment Plans

Several repayment plans are typically offered under a Master Promissory Note (MPN), each designed to cater to different financial circumstances. The specific plans available may vary depending on the lender and the type of loan. Common plans include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. Standard Repayment involves fixed monthly payments over a 10-year period. Extended Repayment offers longer repayment terms, reducing monthly payments but increasing total interest paid. Graduated Repayment starts with lower monthly payments that gradually increase over time. IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base monthly payments on your income and family size, potentially leading to lower monthly payments but longer repayment periods.

Methods for Making Loan Payments

Borrowers typically have several convenient options for making their loan payments. These often include online payments through the lender’s website, automated clearing house (ACH) transfers from a bank account, mail-in checks or money orders, and phone payments (though fees may apply). Many lenders encourage automatic payments, often offering a small interest rate reduction as an incentive. It’s essential to choose a method that suits your preferences and ensures timely payments to avoid late fees and negative impacts on your credit score.

Comparison of Repayment Plan Advantages and Disadvantages

The optimal repayment plan depends heavily on individual financial circumstances and priorities. For example, the Standard Repayment plan offers the shortest repayment period, minimizing total interest paid but requiring higher monthly payments. Extended Repayment reduces monthly payments but extends the repayment period, resulting in significantly higher total interest paid. Graduated Repayment offers a manageable initial payment, gradually increasing, but can lead to higher payments later in the repayment period. IDR plans offer the lowest monthly payments based on income, but repayment can extend significantly beyond the standard 10 years, potentially increasing the total interest paid over the life of the loan.

Examples Illustrating the Impact of Different Repayment Plans on Total Interest Paid

Consider two borrowers, both with a $30,000 loan at a 5% interest rate. Borrower A chooses the Standard Repayment plan (10 years), while Borrower B opts for the Extended Repayment plan (25 years). Borrower A will pay approximately $38,000 in total (principal + interest), while Borrower B will pay significantly more, around $55,000, due to the extended repayment period and accumulating interest. The difference highlights the trade-off between lower monthly payments and increased total interest costs. A similar comparison could be made between Standard Repayment and an IDR plan, demonstrating the potential for longer repayment periods and higher total interest paid despite lower monthly payments.

Sample Repayment Schedule

The following table illustrates a simplified repayment schedule, comparing different monthly payment amounts and their impact on the total repayment time and interest paid for a $10,000 loan at a 6% interest rate. Note that this is a simplified example and actual repayment schedules may vary.

| Monthly Payment | Repayment Period (Years) | Total Interest Paid | Total Repaid |

|---|---|---|---|

| $100 | 13 | $1800 | $11800 |

| $150 | 8 | $1000 | $11000 |

| $200 | 6 | $600 | $10600 |

| $250 | 5 | $350 | $10350 |

Defaulting on Student Loans

Defaulting on your student loans is a serious matter with significant consequences. It occurs when you fail to make your loan payments according to the terms Artikeld in your Master Promissory Note (MPN). Understanding what constitutes default and the potential repercussions is crucial for responsible loan management.

Definition of Student Loan Default

Student loan default is officially defined as failing to make a payment for a specified period, typically 270 days (nine months) or more, after your grace period ends. The exact timeframe may vary slightly depending on your loan servicer and the type of loan. This period of non-payment triggers a series of actions by your loan servicer, ultimately leading to significant negative impacts on your credit and financial standing.

Consequences of Student Loan Default

Defaulting on your student loans has severe and far-reaching consequences. These consequences can impact your credit score significantly, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Your wages may be garnished to recover the debt, and your tax refund could be seized. Furthermore, you may lose eligibility for future federal student aid programs, and your default status could negatively affect your ability to obtain employment in certain professions. The accumulation of interest and fees during default significantly increases the total amount owed, making repayment even more challenging.

Options Available to Borrowers Facing Default

Borrowers facing default have several options to explore. One crucial step is to contact your loan servicer immediately. They can explain your options, including rehabilitation, consolidation, and income-driven repayment plans. Rehabilitation involves making a series of on-time payments to restore your loan to good standing. Consolidation combines multiple loans into a single loan with potentially more manageable monthly payments. Income-driven repayment plans adjust your monthly payments based on your income and family size, making them more affordable in the short term.

Resources Available to Borrowers Struggling with Repayment

Numerous resources are available to assist borrowers struggling with student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping borrowers create a budget and develop a repayment plan. The U.S. Department of Education also provides information and resources on managing student loans, including details on repayment plans and available assistance programs. Additionally, many non-profit organizations offer financial literacy programs and support to borrowers facing financial hardship.

Student Loan Default Process Flowchart

The following describes the steps involved in the student loan default process. Imagine a flowchart with boxes and arrows.

Box 1: Missed Payments (9 months or more after grace period ends). Arrow pointing to Box 2.

Box 2: Loan Servicer Contact. (Attempt to contact borrower; letters, phone calls). Arrow pointing to Box 3.

Box 3: Default Status. (Loan officially enters default). Arrow pointing to Box 4.

Box 4: Collection Actions. (Wage garnishment, tax refund offset, negative credit reporting). Arrow pointing to Box 5.

Box 5: Potential Loan Forgiveness/Rehabilitation Options. (Depending on circumstances and actions taken by the borrower).

MPN and Loan Consolidation

Consolidating your federal student loans involves combining multiple loans into a single, new loan with a single monthly payment. This process can simplify repayment, potentially leading to a lower monthly payment, but it’s crucial to understand the implications before proceeding. The Master Promissory Note (MPN) plays a significant role in this process.

The Loan Consolidation Process

The federal government offers a Direct Consolidation Loan program. To consolidate, borrowers apply online through the Federal Student Aid website. They must provide information on their existing federal student loans, including the loan amounts, lenders, and interest rates. After the application is approved, the new consolidated loan is disbursed, and the original loans are paid off. The borrower then makes monthly payments to their new loan servicer.

The MPN’s Role in Loan Consolidation

When you consolidate your federal student loans, a new MPN is created for the consolidated loan. Your original MPNs for the individual loans are essentially retired. The terms and conditions Artikeld in this new MPN govern the repayment of the consolidated loan. This new MPN will reflect the new loan amount, interest rate, and repayment plan. It’s essential to carefully review this new MPN before signing it.

Benefits and Drawbacks of Loan Consolidation

Consolidating loans can offer several advantages. A lower monthly payment is often a primary motivator, making repayment more manageable. It simplifies repayment by reducing the number of payments from multiple loans to a single monthly payment. A fixed interest rate can also be beneficial, especially if you have loans with variable interest rates. However, consolidation may not always be advantageous. Consolidation can potentially lengthen the repayment period, resulting in paying more interest over the life of the loan. Also, the weighted average interest rate of the consolidated loan might be higher than the lowest interest rate of your individual loans, increasing the total interest paid.

Comparison of Consolidated Loan Terms and Original MPN Terms

A consolidated loan under a new MPN will typically have a different interest rate than your original loans – this is a weighted average of the interest rates of your original loans. The repayment term may be longer or shorter depending on your chosen repayment plan. The loan servicer will change, and the repayment schedule will reflect the new terms of the consolidated loan. The original MPNs will no longer be relevant, except for historical purposes in regards to your repayment history. For example, if you had a loan with a 4% interest rate and another with a 6% interest rate, your consolidated loan interest rate might be around 5%, depending on the loan amounts. However, extending the repayment period to 20 years might increase the total interest paid even if the monthly payment is lower.

Examples of Beneficial and Detrimental Consolidation

Consolidation is beneficial for a borrower struggling with multiple payments, especially those with a mix of high and low interest rates, where a weighted average results in a manageable monthly payment. For example, a borrower with five loans totaling $50,000 with varying interest rates and repayment schedules could consolidate into a single loan with a lower monthly payment. However, consolidation is detrimental for a borrower who could afford higher payments on their existing loans and who would pay significantly more interest over a longer repayment period. For instance, a borrower with a few loans at low interest rates might pay more in total interest over time by consolidating and extending their repayment term.

Understanding Interest Accrual

Understanding how interest accrues on your student loans is crucial for effective financial planning. This section details the process, influencing factors, and provides illustrative examples to help you manage your loan repayment effectively.

Interest accrual on student loans governed by a Master Promissory Note (MPN) begins from the date of disbursement, meaning the day the funds are released to your school. The amount of interest that accumulates depends on several key factors.

Factors Influencing Interest Accrual

Several factors determine the amount of interest accruing on your student loan. These include the principal loan amount, the interest rate, the loan repayment plan, and the capitalization of interest. A higher principal balance naturally leads to higher interest charges. The interest rate, often fixed or variable, directly impacts the daily interest calculation. Different repayment plans affect how quickly the principal is reduced, influencing the total interest paid. Interest capitalization, where accrued but unpaid interest is added to the principal, significantly increases the total loan amount over time.

Interest Calculation Examples

The following table demonstrates interest calculations using different interest rates and repayment plans. For simplicity, we’ll assume a $10,000 principal loan amount and daily interest accrual (365 days per year). Note that actual calculations may vary slightly based on the specific lender’s methodology.

| Interest Rate | Repayment Plan (Monthly Payment) | Year 1 Interest Accrued | Year 1 Principal Reduction |

|---|---|---|---|

| 5% | $100 | $475 (approx.) | $245 (approx.) |

| 7% | $100 | $675 (approx.) | $125 (approx.) |

| 5% | $200 | $375 (approx.) | $525 (approx.) |

| 7% | $200 | $575 (approx.) | $325 (approx.) |

Interest Capitalization

Interest capitalization occurs when unpaid interest is added to the principal loan balance. This increases the principal amount, leading to higher interest charges in subsequent periods. For example, if you have $10,000 in outstanding loans with a 5% interest rate, and $500 in accrued interest, after capitalization, your new principal becomes $10,500. Future interest calculations will be based on this increased principal. This compounding effect can significantly increase the total cost of your loan over its lifespan.

Visual Representation of Interest Impact

Imagine a graph with time on the x-axis and total loan cost on the y-axis. A line representing a loan with no interest would be a straight horizontal line, reflecting the initial principal amount. However, a loan with interest would show a steadily rising curve, demonstrating how the total loan cost increases over time due to accumulating interest. The steeper the curve, the higher the interest rate or the longer the repayment period. The impact of interest capitalization would be visible as a sudden jump in the curve, reflecting the addition of accrued interest to the principal. This visualization clearly demonstrates that paying down the principal as quickly as possible minimizes the total interest paid and keeps the total cost lower.

Final Summary

Successfully managing your student loans requires a proactive approach and a thorough understanding of your MPN. By grasping the key components of this agreement—from signing and repayment to the potential consequences of default—you can take control of your financial future. Remember to always seek clarification when needed and utilize available resources to navigate this important stage of your life. Proactive planning and informed decisions are key to a successful journey through student loan repayment.

FAQ Corner

What happens if I lose my MPN?

Contact your loan servicer immediately. They can provide you with a copy of your MPN.

Can I change my repayment plan after signing the MPN?

Yes, you can usually switch to a different repayment plan, but this may affect your monthly payment and total interest paid. Check with your loan servicer for available options.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately to explore options like deferment, forbearance, or income-driven repayment plans. There are resources available to help you avoid default.

How does interest capitalization work?

Interest capitalization occurs when unpaid interest is added to your principal loan balance, increasing the amount you owe. This can significantly impact your total loan cost over time.