Navigating the complexities of funding a master’s degree can feel daunting, but understanding your options is key to a successful academic journey. This guide delves into the world of master’s degree student loans, exploring the various types available, the application process, and effective strategies for managing debt. We’ll cover both federal and private loan options, highlighting their differences and helping you make informed decisions.

From understanding eligibility requirements and interest rates to developing a realistic repayment plan and considering alternative funding sources, we aim to equip you with the knowledge to confidently finance your postgraduate education. We’ll also discuss the long-term financial implications of student loan debt and provide practical advice for building a secure financial future.

Types of Master’s Degree Student Loans

Securing funding for a master’s degree often involves navigating the complexities of student loans. Understanding the different loan types available, their eligibility criteria, and associated costs is crucial for making informed financial decisions. This section Artikels the key features of federal and private loans for master’s degree students.

Federal Student Loans for Master’s Degree Students

Federal student loans offer several advantages, including fixed interest rates, flexible repayment plans, and potential for loan forgiveness programs. Eligibility is primarily based on financial need and enrollment status in a degree program at a participating institution. However, the amount you can borrow is capped, and borrowing limits are typically higher for graduate students than undergraduates.

Types of Federal Graduate Student Loans

There are two main types of federal loans available to graduate students: Direct Unsubsidized Loans and Direct PLUS Loans.

Direct Unsubsidized Loans are available to all graduate students regardless of financial need. Interest accrues from the time the loan is disbursed, even while the student is enrolled. The amount a student can borrow is determined by the cost of attendance minus any other financial aid received.

Direct PLUS Loans are credit-based loans available to graduate students and parents of dependent undergraduate students. Credit checks are performed, and applicants with adverse credit history may be denied or required to obtain an endorser. Interest accrues from disbursement. These loans are often used to cover the difference between the cost of attendance and other financial aid received.

Private Student Loans for Master’s Degree Students

Private student loans are offered by banks, credit unions, and other financial institutions. These loans often have variable interest rates, which can fluctuate over the life of the loan, potentially leading to higher overall costs. Eligibility requirements vary among lenders but typically include a credit check, co-signer requirement (if credit history is limited), and enrollment in an eligible program. Repayment terms are also set by the lender. While private loans may offer larger loan amounts than federal loans, they lack the consumer protections afforded by federal loan programs.

Comparison of Federal and Private Master’s Degree Student Loans

The following table summarizes the key differences between federal and private student loans for master’s degree students. Note that interest rates and fees are subject to change and can vary between lenders.

| Loan Type | Interest Rate | Repayment Options | Eligibility Requirements |

|---|---|---|---|

| Federal Direct Unsubsidized Loan | Fixed; determined annually by the government | Standard, graduated, extended, income-driven repayment plans | Enrollment in an eligible graduate program |

| Federal Direct PLUS Loan | Fixed; determined annually by the government | Standard, graduated, extended, income-driven repayment plans | Credit check; may require an endorser |

| Private Student Loan | Variable or fixed; set by the lender | Vary by lender; may include shorter repayment terms | Credit check; often requires a co-signer; enrollment in an eligible program |

The Loan Application Process

Securing funding for your master’s degree often involves navigating the complexities of the student loan application process. This process differs depending on whether you’re applying for federal or private loans, each with its own set of requirements and procedures. Understanding these differences is crucial for a smooth and successful application.

Federal Master’s Degree Student Loan Application

Applying for federal student loans, such as Grad PLUS loans, typically begins with completing the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about your financial situation and educational goals to determine your eligibility for federal aid. This information is then used by your chosen institution to determine your financial need and award you federal aid. After completing the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information and eligibility. Your school will then inform you of your loan eligibility and offer you a loan amount based on your financial need and the cost of attendance. You will then need to accept the offered loan amount and complete the Master Promissory Note (MPN).

Private Master’s Degree Student Loan Application

Private lenders, unlike the federal government, have their own specific requirements and application processes. These processes usually involve completing an online application through the lender’s website. The application will request detailed personal and financial information, including your credit history, income, and employment information. Because private loans are not need-based, your creditworthiness plays a significant role in determining your eligibility and the interest rate offered.

Required Documentation and Information

The necessary documentation for both federal and private loans varies. Federal loan applications require information from your FAFSA, including your Social Security number, tax information, and details about your assets. Private loan applications often require more extensive documentation, such as proof of income, tax returns, bank statements, and sometimes even a co-signer’s financial information. Providing accurate and complete documentation is critical for a timely application process.

Credit History and Co-signers

A strong credit history is vital for securing private loans, as lenders assess your creditworthiness to determine the risk of lending you money. A good credit score can lead to better interest rates and loan terms. Individuals with limited or poor credit history may need a co-signer – someone with good credit who agrees to be responsible for the loan repayment if you default. While federal loans don’t directly require a co-signer, a poor credit history might impact your eligibility for a Grad PLUS loan.

Step-by-Step Guide to Completing a Loan Application

- Gather Necessary Documents: Collect all required documents, including tax returns, bank statements, and proof of enrollment.

- Complete the Application: Fill out the application accurately and completely. Double-check all information for accuracy before submitting.

- Submit the Application: Submit your application online or via mail, depending on the lender’s requirements.

- Review Loan Offer: Carefully review the loan offer, paying close attention to interest rates, fees, and repayment terms.

- Accept or Decline the Loan: Decide whether to accept the loan offer based on your financial situation and repayment capabilities.

Potential challenges include incomplete applications, inaccurate information, and credit issues. Solutions include carefully reviewing all requirements, ensuring accuracy, and seeking assistance from a financial advisor if necessary. For instance, if you encounter difficulties with your credit history, exploring options such as a co-signer or credit counseling may be helpful.

Managing Master’s Degree Student Loan Debt

Successfully navigating the financial landscape of graduate school requires a proactive approach to managing student loan debt. Failing to plan effectively can lead to significant financial strain long after graduation. This section Artikels strategies for budgeting, understanding repayment options, and avoiding the serious consequences of loan default.

Creating a Realistic Budget

A well-structured budget is crucial for managing loan repayments alongside other essential expenses. Begin by meticulously tracking your income and expenses for a month or two to gain a clear picture of your spending habits. Categorize your expenses (housing, food, transportation, entertainment, etc.) to identify areas where you can potentially reduce spending. Remember to include all loan payments in your budget from the start, treating them as a non-negotiable expense. Using budgeting apps or spreadsheets can significantly simplify this process. Consider creating a contingency fund for unexpected expenses to prevent further debt accumulation.

Master’s Degree Loan Repayment Plans

Several repayment plans are available to help borrowers manage their student loan debt. The standard repayment plan involves fixed monthly payments over a 10-year period. A graduated repayment plan starts with lower monthly payments that gradually increase over time. Income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), calculate monthly payments based on your income and family size. These plans typically extend the repayment period to 20 or 25 years, resulting in lower monthly payments but potentially higher overall interest paid. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Consequences of Loan Default and Avoidance Strategies

Defaulting on your student loans has severe consequences, including damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. To avoid default, prioritize consistent loan payments. If you anticipate difficulty making payments, contact your loan servicer immediately to explore options like deferment or forbearance. These temporary measures can provide relief, but they often accrue interest. Consider consolidating your loans into a single payment to simplify management. Budgeting meticulously and seeking professional financial advice can help you proactively manage your debt and prevent default.

Sample Budget for a Master’s Degree Student

The following sample budget illustrates how to incorporate tuition, living expenses, and loan repayments. Note that this is a general example, and your actual expenses may vary.

| Category | Monthly Amount |

|---|---|

| Tuition (monthly payment) | $1,000 |

| Housing (rent/mortgage) | $800 |

| Food | $400 |

| Transportation | $200 |

| Utilities (electricity, water, internet) | $150 |

| Student Loan Repayment | $300 |

| Books and Supplies | $50 |

| Personal Care | $75 |

| Entertainment & Miscellaneous | $125 |

| Total Monthly Expenses | $3100 |

The Impact of Master’s Degree Student Loans on Career Choices

The significant investment of pursuing a master’s degree, often fueled by student loans, inevitably shapes career decisions. Graduates must carefully consider the potential return on investment (ROI) in terms of future earnings and career satisfaction when weighing their options. The pressure to secure a high-paying job to manage loan repayment can influence career paths, sometimes overshadowing personal aspirations.

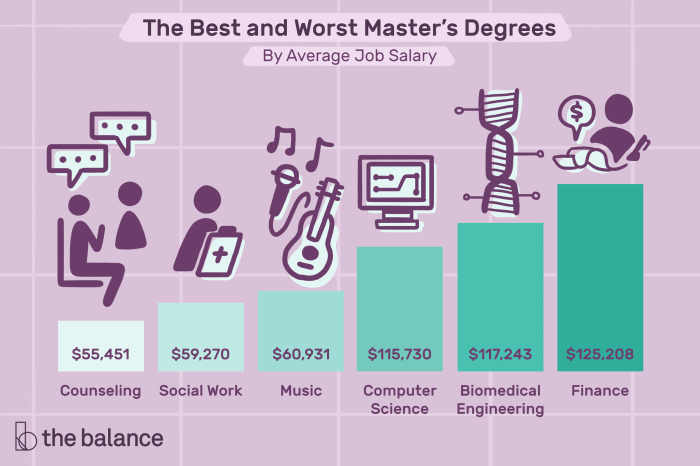

Career Paths with Higher Earning Potential

Master’s degrees in specific fields tend to lead to higher salaries, offering better prospects for repaying student loan debt. Fields such as engineering (especially software engineering), medicine, law, finance (particularly investment banking or financial analysis), and data science often boast significantly higher average salaries compared to other fields. These lucrative career paths, however, usually demand extensive training, long hours, and intense competition.

Trade-offs Between High-Paying and Fulfilling Careers

Choosing a career is rarely a simple equation of salary versus fulfillment. A high-paying job in finance might offer financial security and rapid loan repayment, but it could also involve significant stress and long hours, potentially impacting work-life balance and overall well-being. Conversely, a more fulfilling but lower-paying career in the non-profit sector, for example, might align more closely with personal values, but it may require more time to repay student loans. This trade-off requires careful self-reflection and a realistic assessment of priorities.

Salary Expectations Across Master’s Degree Fields

Salary expectations vary significantly depending on the field of study, experience, location, and employer. The following table offers a general comparison; these figures are estimates and can fluctuate widely.

| Field of Study | Average Starting Salary (USD) | Median Salary (USD) after 5 years | Potential for Growth |

|---|---|---|---|

| Software Engineering | 80,000 – 120,000 | 120,000 – 180,000 | High |

| Medicine (Physician) | 200,000+ | 250,000+ | Very High |

| Law | 60,000 – 100,000 | 100,000 – 150,000 | Moderate to High |

| Business Administration (MBA) | 70,000 – 100,000 | 100,000 – 150,000 | Moderate to High |

Resources for Employment

Finding employment after completing a master’s degree requires proactive effort and utilization of available resources. Networking is crucial; attending industry events, connecting with alumni, and leveraging professional platforms like LinkedIn can significantly increase job prospects. University career services departments often offer resume reviews, interview preparation, and job postings tailored to graduates’ fields of study. Online job boards, such as Indeed, Glassdoor, and Monster, provide a broader reach. Furthermore, professional organizations within specific fields frequently offer job boards and networking opportunities.

Alternative Funding Options for Master’s Degree Students

Securing funding for a master’s degree can be challenging, but relying solely on loans isn’t necessary. A diverse funding strategy, incorporating scholarships, grants, and personal resources, can significantly reduce the overall financial burden and improve long-term financial health. This section explores various alternative funding avenues available to master’s degree students.

Scholarship and Grant Opportunities

Numerous scholarships and grants are specifically designed to support master’s degree students. These awards can be merit-based, need-based, or field-specific, offering significant financial assistance without the need for repayment. The application process varies depending on the awarding organization, but generally involves submitting an application, transcripts, letters of recommendation, and a personal statement highlighting academic achievements, career goals, and financial need.

The Scholarship and Grant Application Process

Applying for scholarships and grants requires diligent research and meticulous application preparation. Students should begin their search early, ideally well before the application deadlines. This involves identifying potential funding sources, carefully reviewing eligibility criteria, and crafting compelling application materials that showcase their qualifications and potential. Many applications require essays, letters of recommendation, and official transcripts. Maintaining organized records of deadlines and application statuses is crucial for a successful application process.

Benefits and Drawbacks of Alternative Funding Sources

Utilizing family contributions or personal savings offers several advantages, primarily reducing reliance on loans and potentially lowering long-term debt. However, relying solely on these sources may limit educational choices or create financial strain on families. Careful consideration of the potential benefits and drawbacks is necessary before deciding on this funding approach. For example, relying heavily on family contributions might create undue financial pressure on family members, while using personal savings could deplete funds needed for other important life goals. A balanced approach, combining several funding options, often proves most effective.

Examples of Reputable Organizations Offering Scholarships and Grants

Several reputable organizations offer scholarships and grants for master’s degree students. These organizations often have specific criteria, such as academic merit, field of study, or demonstrated financial need. Successful applicants often demonstrate strong academic records, compelling personal statements, and letters of recommendation that highlight their potential.

- The National Science Foundation (NSF): Offers graduate research fellowships and other grants for students pursuing advanced degrees in science and engineering.

- The American Association of University Women (AAUW): Provides fellowships and grants for women pursuing graduate education in various fields.

- The Gates Cambridge Scholarship: Offers full-cost scholarships for outstanding students from outside the UK to pursue graduate studies at the University of Cambridge.

- ProFellow: A comprehensive database that lists thousands of fellowships and grants for graduate students across various disciplines.

Long-Term Financial Planning with Master’s Degree Loan Debt

Successfully navigating the financial landscape after graduate school requires a proactive and well-structured approach to managing student loan debt while simultaneously building a secure financial future. Integrating loan repayment into a comprehensive long-term financial plan is crucial for achieving long-term financial well-being and avoiding undue stress. This involves a blend of strategic budgeting, disciplined saving, and informed investment choices.

A robust long-term financial plan acknowledges the reality of student loan repayments while still allowing for wealth accumulation and retirement planning. This requires a realistic assessment of income, expenses, and loan repayment obligations, followed by the implementation of effective strategies to balance these competing priorities. Financial literacy plays a pivotal role in this process, equipping individuals with the knowledge and skills to make informed decisions about their money.

Incorporating Loan Repayment into a Long-Term Financial Plan

Successfully integrating loan repayment into a long-term financial plan requires a multi-pronged approach. First, create a detailed budget that accurately reflects your income and expenses, including your monthly loan payment. Second, prioritize high-interest debt, such as credit card debt, before focusing solely on student loan repayment, if applicable. Third, explore various repayment options, such as income-driven repayment plans, to ensure affordability. Finally, regularly review and adjust your budget as your income and expenses change. Consistent monitoring and adaptation are key to maintaining financial stability.

Strategies for Building Wealth and Saving for Retirement While Managing Student Loan Debt

Building wealth and saving for retirement while managing student loan debt demands careful planning and prioritization. Prioritize high-yield savings accounts and investment options such as index funds or ETFs, even with modest contributions. Consider automating your savings and investments to ensure consistent contributions. Diversification of investments can help mitigate risk. Utilizing employer-sponsored retirement plans like 401(k)s, and maximizing contributions to take advantage of employer matching, can significantly boost retirement savings. Remember, even small, consistent contributions can accumulate substantial value over time due to compounding.

The Importance of Financial Literacy and Responsible Money Management

Financial literacy empowers individuals to make informed financial decisions, crucial for long-term success. Understanding budgeting, debt management, investing, and retirement planning are essential components. Developing responsible money management habits, such as tracking expenses, creating a budget, and avoiding impulsive spending, is critical for long-term financial stability. Seeking professional financial advice from a qualified advisor can provide personalized guidance and support in navigating complex financial matters. Continuous learning and adaptation to changing financial circumstances are key to maintaining financial well-being.

Hypothetical Example of a Long-Term Financial Plan

Let’s consider Sarah, a recent master’s graduate with $50,000 in student loan debt at a 6% interest rate. She earns $60,000 annually and aims to pay off her loans within 10 years while also saving for retirement and building wealth.

- Budgeting: Sarah allocates 15% of her income for loan repayment ($9,000 annually), 10% for retirement savings ($6,000 annually), and 5% for investments ($3,000 annually). The remaining amount covers her living expenses.

- Debt Repayment: Sarah aggressively pays down her loans, aiming for extra payments whenever possible to reduce the principal and interest paid over time.

- Retirement Savings: She maximizes contributions to her employer’s 401(k) plan, taking advantage of any employer matching.

- Investment Strategy: Sarah invests in a diversified portfolio of low-cost index funds, aiming for long-term growth.

- Financial Literacy: Sarah regularly attends financial literacy workshops and reads books on personal finance to improve her knowledge and skills.

This hypothetical example illustrates how a comprehensive financial plan can successfully integrate loan repayment with other financial goals. Sarah’s commitment to budgeting, debt management, and investing, coupled with her dedication to continuous financial learning, sets her on a path toward achieving long-term financial security.

Concluding Remarks

Securing funding for your master’s degree is a significant step, and understanding the nuances of student loans is crucial for long-term financial well-being. By carefully considering the various loan types, application processes, and repayment strategies Artikeld in this guide, you can approach your postgraduate education with greater confidence. Remember that proactive planning and responsible financial management are essential for navigating the complexities of student loan debt and achieving your academic and career goals.

Helpful Answers

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I refinance my master’s degree student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it might involve switching from a federal to a private loan, impacting potential benefits like income-driven repayment plans.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset.

How long does it take to repay master’s degree student loans?

Repayment timelines vary depending on the loan type and repayment plan chosen. Standard repayment plans typically last 10 years, while income-driven plans can extend for longer periods.