Navigating the complex world of financing a master’s degree can feel overwhelming. The decision to pursue postgraduate education often involves significant financial investment, and understanding the various options for student loans is crucial for making informed choices. This guide explores the landscape of master’s program student loans, covering federal and private options, repayment strategies, and alternative funding sources. We’ll delve into the application process, budgeting techniques, and the long-term impact of loan debt on career paths, equipping you with the knowledge to confidently manage your finances throughout your graduate studies and beyond.

From eligibility requirements and interest rates to loan forgiveness programs and the importance of credit history, we aim to provide a clear and comprehensive overview. We will also discuss strategies for minimizing debt and maximizing the return on investment from your master’s degree. This guide serves as a valuable resource for prospective and current master’s students seeking to understand and effectively manage their student loan obligations.

Types of Master’s Program Student Loans

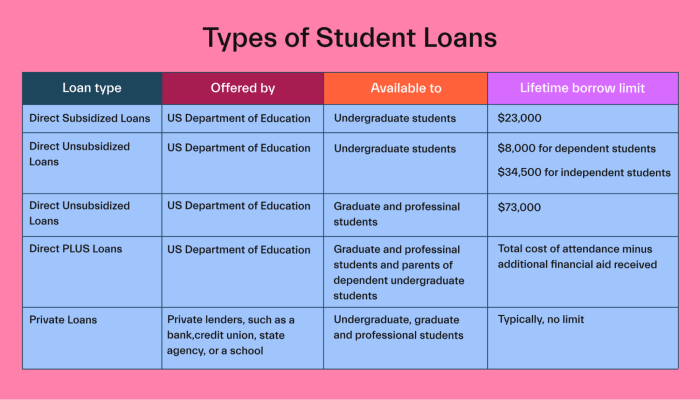

Financing a master’s degree often requires student loans. Understanding the different types available is crucial for making informed borrowing decisions. This section will Artikel the key distinctions between federal and private loans, explore various repayment options, and compare interest rates and fees.

Federal vs. Private Master’s Loans

Federal student loans are offered by the U.S. government and generally come with more borrower protections than private loans. Private loans, on the other hand, are offered by banks and other financial institutions. Key differences include eligibility requirements, interest rates, and repayment options. Federal loans typically have income-driven repayment plans and loan forgiveness programs, while private loans often lack these benefits. The application process for federal loans is generally simpler and more streamlined than for private loans, which may involve a credit check and co-signer requirement.

Master’s Loan Repayment Plans

Several repayment plans are available for master’s program loans, both federal and private. The best option depends on individual financial circumstances. Federal loan repayment plans often include standard repayment, extended repayment, graduated repayment, and income-driven repayment (IDR) plans. IDR plans adjust monthly payments based on income and family size, making them attractive for borrowers with lower post-graduation incomes. Private loan repayment plans vary widely depending on the lender; borrowers should carefully review their loan terms to understand their repayment options.

Interest Rates and Fees

Interest rates and fees significantly impact the total cost of borrowing. Federal student loans typically have lower interest rates than private loans, especially for borrowers with good credit. Private loan interest rates can vary widely depending on the borrower’s credit score, the loan amount, and the lender. Fees associated with loans can include origination fees (charged by the lender at the time of loan disbursement) and late payment fees. Federal loans may have lower or no origination fees compared to private loans. It is crucial to compare interest rates and fees from multiple lenders before choosing a loan.

Loan Term Comparison: Federal vs. Private

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Loan Amount | Varies, but generally capped at the cost of attendance. | Varies widely, depending on creditworthiness and lender. |

| Repayment Period | Standard repayment is 10 years, but other plans offer longer terms. | Varies widely, depending on the loan and lender. |

| Interest Rates | Generally lower than private loans; fixed or variable rates depending on the loan type. | Generally higher than federal loans; fixed or variable rates depending on the loan and lender. |

| Fees | May have origination fees, but often lower than private loans. | May have higher origination fees and late payment fees. |

Eligibility and Application Process

Securing funding for a master’s degree often involves navigating the complexities of student loans. Understanding eligibility requirements and the application process for both federal and private loans is crucial for a successful funding strategy. This section Artikels the key steps and considerations involved in obtaining these loans.

Federal Master’s Program Loan Eligibility

Eligibility for federal master’s loans, primarily through the Federal Direct Loan program, hinges on several factors. Applicants must be enrolled at least half-time in a graduate program at a participating institution. They must also be a U.S. citizen or eligible non-citizen, and demonstrate financial need (for subsidized loans) or meet the general creditworthiness standards (for unsubsidized loans). Specific requirements, such as maintaining satisfactory academic progress, may also be imposed by the lending institution. Finally, applicants must complete the Free Application for Federal Student Aid (FAFSA) form.

Applying for Federal Master’s Program Loans

The application process for federal master’s loans begins with completing the FAFSA. This form collects information about your financial situation and is used to determine your eligibility for federal aid. Once the FAFSA is processed, your school will provide you with a financial aid award letter detailing your eligibility for federal loans. You will then need to accept your loan offer through your school’s student loan portal. Finally, loan funds are disbursed directly to the school, typically in installments, to cover tuition and other fees.

Private Master’s Program Loan Eligibility and Application Process

Private master’s loans are offered by banks and other financial institutions. Eligibility criteria are typically stricter than for federal loans, often requiring a good credit history and a higher credit score. Lenders may also consider your income, debt-to-income ratio, and the co-signer’s creditworthiness (if applicable). Some lenders may require a co-signer, especially if you lack a strong credit history or have a limited income.

Step-by-Step Guide to the Loan Application Process

A comprehensive approach to applying for master’s program loans involves several key steps:

- Complete the FAFSA (for federal loans): This is the first step for accessing federal student aid. Accurate and timely completion is crucial.

- Explore federal loan options: Determine your eligibility for subsidized and unsubsidized loans, and understand the terms and conditions.

- Research private loan lenders: Compare interest rates, fees, and repayment terms from different private lenders.

- Check your credit report: Review your credit report for accuracy and address any negative marks that could affect your eligibility.

- Gather necessary documentation: This typically includes your FAFSA data, tax returns, proof of enrollment, and potentially bank statements.

- Complete the loan application: Provide accurate and complete information on the lender’s application form.

- Secure a co-signer (if needed): If you don’t meet the lender’s credit requirements, a co-signer with good credit can significantly improve your chances of approval.

- Review and accept loan terms: Carefully review the loan agreement before accepting the loan offer.

- Understand repayment options: Familiarize yourself with repayment plans and potential interest capitalization.

Managing Master’s Program Student Loan Debt

Successfully navigating the financial landscape after completing a master’s program requires a proactive approach to managing student loan debt. Understanding repayment strategies, potential challenges, and available resources is crucial for long-term financial well-being. This section will equip you with the tools and knowledge necessary to effectively manage your student loan repayments.

Effective Budgeting Strategies for Loan Repayment

Creating a realistic budget is the cornerstone of successful loan repayment. This involves meticulously tracking income and expenses to identify areas for potential savings. Prioritize essential expenses like housing, food, and transportation, while carefully evaluating discretionary spending. Allocate a specific amount each month towards loan payments, treating this as a non-negotiable expense. Consider using the debt avalanche or debt snowball methods to prioritize your loan repayments strategically. The debt avalanche method prioritizes paying off the loan with the highest interest rate first, while the debt snowball method focuses on paying off the smallest loan first for a quicker sense of accomplishment. Consistent budgeting and adherence to the plan are key to minimizing interest accrual and accelerating debt repayment.

Potential Challenges in Managing Student Loan Debt

Managing student loan debt presents several challenges. Unexpected expenses, such as medical bills or car repairs, can disrupt carefully planned budgets. Changes in employment status, including job loss or reduced income, can significantly impact repayment capacity. Furthermore, the psychological burden of substantial debt can lead to stress and anxiety, potentially hindering effective financial management. Understanding these potential hurdles allows for proactive planning and mitigation strategies, such as establishing an emergency fund to cover unexpected expenses.

Budgeting Tools and Resources

Numerous budgeting tools and resources are available to assist in managing student loan payments. Spreadsheet software, such as Microsoft Excel or Google Sheets, allows for detailed tracking of income, expenses, and loan repayment progress. Numerous mobile apps, such as Mint or YNAB (You Need A Budget), offer automated tracking and budgeting features, providing real-time insights into spending habits. Additionally, many financial institutions offer online banking tools with budgeting capabilities, simplifying the process of tracking finances and managing loan repayments. These tools can provide valuable insights and facilitate effective financial management.

Sample Budget Allocating Funds for Loan Repayments

Let’s consider a sample budget for a recent master’s graduate earning $60,000 annually (approximately $5,000 monthly). This is a simplified example, and individual circumstances will vary significantly.

| Category | Amount ($) |

|---|---|

| Housing | 1500 |

| Food | 500 |

| Transportation | 300 |

| Utilities | 200 |

| Student Loan Payments | 1000 |

| Other Expenses (Entertainment, Savings, etc.) | 500 |

| Total Expenses | 4000 |

| Net Income (after taxes and other deductions, estimated) | 5000 |

Note: This budget demonstrates a significant portion of income allocated to loan repayment. Adjustments should be made based on individual income, expenses, and loan amounts. It is crucial to maintain a balance between debt repayment and maintaining a reasonable standard of living.

The Impact of Master’s Program Loans on Career Choices

Pursuing a master’s degree often involves significant financial investment, and understanding the long-term implications of student loans on career choices is crucial. The decision to borrow for graduate education necessitates a careful evaluation of potential salary increases against loan repayment costs and their impact on future financial flexibility.

A master’s degree frequently leads to higher earning potential compared to a bachelor’s degree. However, the magnitude of this increase varies significantly depending on the field of study, the specific program, and the individual’s career trajectory. The cost of the master’s program, including tuition, fees, and living expenses, directly impacts the overall financial return. Failing to account for this cost can lead to unexpected financial strain and limit career options.

Potential Salary Increase versus Loan Costs

The relationship between salary increase and loan repayment is paramount. For instance, an individual pursuing an MBA might anticipate a substantial salary increase post-graduation, potentially offsetting the loan burden within a reasonable timeframe. Conversely, a student in a humanities field might experience a smaller salary increase, making loan repayment a more significant long-term challenge. A thorough analysis comparing projected salary increases with estimated loan repayment amounts is essential before committing to a master’s program. This comparison should consider factors such as interest rates, loan repayment plans, and projected career growth within the chosen field. For example, a projected annual salary increase of $20,000 might easily cover the monthly repayment of a $50,000 loan, but a $5,000 increase might prove challenging.

Long-Term Financial Implications of Master’s Program Loans

Master’s program loans can significantly impact long-term financial planning. High levels of student loan debt can delay major life decisions such as homeownership, starting a family, or investing in retirement. The interest accrued over the repayment period can substantially increase the total cost of the degree. Careful budgeting and financial planning are crucial to manage loan repayment effectively while maintaining a reasonable standard of living. For example, a $100,000 loan with a 7% interest rate could easily accumulate tens of thousands of dollars in interest over 10 years, depending on the repayment plan. This necessitates a realistic assessment of long-term financial implications before taking out substantial loans.

Influence of Loan Debt on Career Path Decisions

The presence of substantial student loan debt can influence career path decisions. Individuals burdened with high loan repayments might prioritize higher-paying jobs over those offering greater personal fulfillment or work-life balance. The need to quickly repay loans may lead individuals to accept jobs that might not align perfectly with their long-term career goals. For example, someone with a significant loan burden might accept a high-paying corporate job instead of pursuing a less lucrative but more fulfilling career in the non-profit sector.

Return on Investment (ROI) Calculation for a Master’s Degree

Calculating the ROI of a master’s degree, accounting for loan repayment, involves comparing the increase in lifetime earnings due to the advanced degree with the total cost of the degree, including tuition, fees, living expenses, and interest on loans. A simplified formula for ROI calculation is:

ROI = [(Total Lifetime Earnings with Master’s Degree – Total Lifetime Earnings without Master’s Degree) – Total Cost of Master’s Degree] / Total Cost of Master’s Degree * 100%

For example, consider a scenario where a master’s degree results in an additional $50,000 in annual earnings for 30 years (resulting in $1,500,000 in additional lifetime earnings), and the total cost of the degree, including loans and interest, is $100,000. The ROI would be:

ROI = [($1,500,000) – ($100,000)] / ($100,000) * 100% = 1400%

This is a simplified calculation and doesn’t account for factors such as inflation, opportunity costs, and individual career variations. However, it provides a framework for assessing the financial return of a master’s degree investment.

Alternative Funding Options for Master’s Programs

Securing funding for a master’s degree can be challenging, but relying solely on loans isn’t the only path. Numerous alternative funding sources exist, offering opportunities to reduce or even eliminate the need for substantial borrowing. Exploring these options thoroughly can significantly impact your financial well-being during and after your graduate studies.

Exploring these options can significantly reduce your reliance on loans and improve your post-graduation financial situation. This section details various alternative funding sources and their application processes.

Scholarships

Scholarships are merit-based awards that don’t require repayment. They are often granted based on academic achievement, extracurricular involvement, leadership qualities, or specific skills. Many organizations, universities, and professional associations offer scholarships specifically for master’s degree students. Some scholarships are need-based, considering the applicant’s financial situation.

- Example: The National Merit Scholarship Corporation offers scholarships to high-achieving students pursuing graduate studies.

- Example: Many universities offer merit-based scholarships to incoming master’s students based on their GPA and GRE scores.

Grants

Grants, like scholarships, are generally need-based and don’t need to be repaid. They are often awarded by government agencies, foundations, and private organizations to support students pursuing specific fields of study or facing financial hardship. The application process usually involves submitting a detailed financial aid application and supporting documentation.

- Example: The federal government offers Pell Grants to undergraduate students, but some graduate programs may also have access to similar need-based grants.

- Example: Private foundations, such as the Gates Millennium Scholars program, offer grants to students from disadvantaged backgrounds pursuing graduate degrees.

Fellowships

Fellowships are typically awarded to students pursuing advanced research or studies in specific fields. They often provide funding for tuition, living expenses, and research materials. Fellowships are highly competitive and often require strong academic records, research proposals, and letters of recommendation.

- Example: The National Science Foundation (NSF) offers fellowships for graduate students pursuing research in various scientific disciplines.

- Example: Many universities offer internal fellowships to their graduate students, often based on research potential and faculty mentorship.

Advantages and Disadvantages of Alternative Funding Options

Understanding the pros and cons of each option is crucial for making informed decisions.

- Scholarships:

- Advantages: Free money, no repayment required, can significantly reduce overall costs.

- Disadvantages: Highly competitive, specific eligibility criteria, may not cover all expenses.

- Grants:

- Advantages: Free money, no repayment required, often available to students with financial need.

- Disadvantages: Highly competitive, specific eligibility criteria, may not cover all expenses.

- Fellowships:

- Advantages: Often covers tuition and living expenses, can provide valuable research experience.

- Disadvantages: Extremely competitive, specific eligibility criteria, may require a commitment to research.

Understanding Loan Forgiveness and Repayment Programs

Navigating the complexities of student loan repayment can be daunting, especially after completing a master’s program. Fortunately, several programs exist to help alleviate the burden of student loan debt, offering forgiveness or modified repayment plans. Understanding these options is crucial for effective financial planning post-graduation.

Loan Forgiveness Programs for Master’s Degree Holders

Specific loan forgiveness programs exist for individuals pursuing master’s degrees in high-demand fields, often tied to public service. These programs typically require a commitment to working in a qualifying role for a specified period. For example, the Public Service Loan Forgiveness (PSLF) program may forgive the remaining balance on federal Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a government organization or a 501(c)(3) non-profit organization. Eligibility criteria can be stringent and vary depending on the specific program. It’s vital to thoroughly research and understand the requirements of any program before committing.

Income-Driven Repayment Plans for Master’s Program Loans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). These plans typically extend the repayment period, resulting in lower monthly payments but potentially higher total interest paid over the life of the loan. The specific terms and conditions vary between plans, so careful comparison is essential. For instance, REPAYE typically forgives any remaining loan balance after 20 or 25 years of payments, depending on the loan type.

Conditions and Eligibility Requirements for Loan Forgiveness or Repayment Assistance

Eligibility for loan forgiveness or repayment assistance programs is often contingent upon several factors, including the type of loan, the lender, the borrower’s income, and the borrower’s employment. For example, PSLF requires borrowers to consolidate their federal student loans into a Direct Consolidation Loan and make 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. Failure to meet these criteria can result in ineligibility for loan forgiveness. Furthermore, some programs have specific deadlines or application windows, highlighting the importance of proactive planning and timely application.

Comparison of Repayment Programs

| Program | Eligibility | Payment Calculation | Forgiveness/Cancellation |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Federal Direct Loans, 120 qualifying payments, full-time employment with qualifying employer | Based on income and family size (IDR plan) | Remaining balance forgiven after 120 qualifying payments |

| REPAYE | Federal Direct Loans | Based on income and family size | Remaining balance forgiven after 20 or 25 years, depending on loan type |

| IBR | Federal Direct Loans and FFEL Program loans (with consolidation) | Based on income and family size | Remaining balance forgiven after 25 years |

| ICR | Federal Direct Loans and FFEL Program loans (with consolidation) | Based on income and family size | Remaining balance forgiven after 25 years |

The Role of Credit History and Credit Scores

Securing funding for a master’s degree often involves applying for student loans. Lenders, like banks and government agencies, assess your creditworthiness to determine your eligibility and the interest rate they’ll offer. A strong credit history significantly influences this process, impacting both your approval chances and the overall cost of your education.

Credit history, a record of your past borrowing and repayment behavior, provides lenders with a crucial insight into your financial responsibility. It encompasses factors like credit accounts (credit cards, loans), payment history (on-time payments versus late or missed payments), credit utilization (the amount of credit you use relative to your available credit), and the length of your credit history. This information is summarized in a credit score, a three-digit number typically ranging from 300 to 850 (depending on the scoring model used). Higher scores indicate a lower risk to lenders, leading to more favorable loan terms.

Impact of Credit History on Loan Approval and Interest Rates

A positive credit history, reflected in a high credit score, significantly improves your chances of loan approval and often results in lower interest rates. Lenders view individuals with a history of responsible borrowing as less risky, thus offering them more attractive loan terms. Conversely, a poor credit history, characterized by late payments, defaults, or high credit utilization, can lead to loan rejection or significantly higher interest rates to compensate for the increased perceived risk. For example, an applicant with a credit score of 750 might qualify for a loan with a 5% interest rate, while an applicant with a score of 600 might only qualify for a loan with an 8% or even higher interest rate, or face loan application denial altogether. The difference in interest rates can significantly impact the total cost of the loan over its lifetime.

Improving Credit Scores Before Applying for Loans

Improving your credit score before applying for student loans can be beneficial. This involves several key strategies. First, consistently pay all bills on time. Late payments negatively impact your credit score, and even one missed payment can have a detrimental effect. Second, keep your credit utilization low. Aim to use less than 30% of your available credit on each card. Third, maintain a mix of credit accounts. Having a variety of credit accounts, such as credit cards and installment loans, can demonstrate responsible credit management. Fourth, check your credit report regularly for errors and dispute any inaccuracies. Finally, consider paying down existing debt to lower your credit utilization ratio. Consistent and responsible credit behavior over time will gradually improve your credit score.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. It damages your credit score significantly, making it extremely difficult to obtain future loans (including mortgages and auto loans). It can lead to wage garnishment, where a portion of your earnings is automatically deducted to repay the debt. Furthermore, it can affect your ability to rent an apartment or secure certain jobs, as many employers conduct credit checks. The government can also take legal action to recover the debt, potentially leading to legal fees and further financial difficulties. In short, defaulting on student loans can have long-lasting and far-reaching negative impacts on your financial well-being.

Benefits of a Good Credit Score for Loan Applications

A good credit score (generally considered to be 700 or above) provides several advantages when applying for student loans. It significantly increases the likelihood of loan approval, as lenders view applicants with high scores as lower risk. It allows access to a wider range of loan options, potentially with more favorable terms, including lower interest rates and more flexible repayment plans. This translates to substantial savings over the life of the loan. For instance, a lower interest rate on a $50,000 loan could save thousands of dollars in interest payments over a ten-year repayment period. Furthermore, a good credit score can also improve your negotiating power, enabling you to potentially secure better loan terms by comparing offers from multiple lenders. In essence, a good credit score acts as a powerful tool in securing affordable and accessible funding for your master’s degree.

Ultimate Conclusion

Securing funding for a master’s degree requires careful planning and a thorough understanding of the available options. By weighing the advantages and disadvantages of federal and private loans, exploring alternative funding sources, and developing effective budgeting strategies, you can significantly reduce the financial burden of graduate education. Remember that proactive planning and informed decision-making are key to successfully managing your student loan debt and achieving your career goals. This guide provides a solid foundation for navigating this crucial aspect of your postgraduate journey.

Question & Answer Hub

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my master’s student loans?

Yes, refinancing can potentially lower your interest rate, but it might involve losing federal loan benefits.

What happens if I default on my student loans?

Defaulting can severely damage your credit score, leading to wage garnishment and difficulty obtaining future loans.

How can I find scholarships for my master’s program?

Utilize online scholarship databases, your university’s financial aid office, and professional organizations related to your field.

What is a co-signer, and why might I need one for a private loan?

A co-signer is someone who agrees to repay your loan if you can’t. Lenders often require co-signers for applicants with limited or poor credit history.