Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits like the student loan interest deduction can significantly ease the financial burden. In 2023, the IRS offers a deduction for the interest you pay on eligible student loans, potentially reducing your taxable income and your overall tax liability. This guide will walk you through the maximum deduction amount, eligibility requirements, reporting procedures, and comparisons with other relevant tax benefits, empowering you to make informed decisions about maximizing your tax savings.

This detailed explanation will cover the maximum deductible amount for various filing statuses and income levels, clarifying the eligibility criteria and necessary documentation. We’ll also explore how this deduction compares to other student-related tax benefits, providing practical examples and scenarios to illustrate its application. Understanding these nuances is crucial for accurately claiming the deduction and ensuring you receive the full benefit.

Maximum Deductible Amount

The student loan interest deduction allows taxpayers to deduct the actual amount of interest they paid on qualified student loans during the tax year, up to a certain limit. This deduction can significantly reduce your taxable income and, consequently, your tax liability. Understanding the maximum deduction and its limitations is crucial for accurately filing your taxes.

Deduction Limits Based on Filing Status

The maximum amount you can deduct depends on your filing status and your modified adjusted gross income (MAGI). The IRS defines MAGI as your adjusted gross income (AGI) with certain deductions added back in. For 2023, the maximum amount you can deduct is $2,500. However, this limit applies only if you are single, head of household, or qualifying surviving spouse. For those married filing jointly, the maximum deduction is $2,500, even though they may have paid more in student loan interest.

Deduction Calculation Examples

Let’s illustrate how the deduction works with a few examples. Suppose a single taxpayer paid $3,000 in student loan interest during 2023 and has a MAGI below the threshold for phaseout. They can deduct the full $2,500. If their MAGI were above the threshold, the deduction would be reduced or eliminated depending on the MAGI. A married couple filing jointly who paid $4,000 in student loan interest, regardless of their MAGI (assuming it’s below the phaseout threshold), can deduct a maximum of $2,500.

Maximum Deduction Based on MAGI

The student loan interest deduction is subject to phaseout based on your MAGI. This means that the deduction is gradually reduced or eliminated as your MAGI increases. The phaseout ranges vary depending on your filing status. The following table illustrates the maximum deduction for different MAGI levels. Note that these are simplified examples and the actual phaseout may involve more complex calculations. Consult the IRS instructions or a tax professional for precise details.

| Filing Status | MAGI Range (Approximate) | Maximum Deduction | Example |

|---|---|---|---|

| Single | Below $70,000 | $2,500 | Taxpayer with $65,000 MAGI and $3,000 interest paid can deduct $2,500. |

| Married Filing Jointly | Below $140,000 | $2,500 | Couple with $130,000 MAGI and $4,000 interest paid can deduct $2,500. |

| Single | $70,000 – $85,000 | Partially Reduced | Deduction reduced based on MAGI; exact amount requires further calculation. |

| Married Filing Jointly | $140,000 – $170,000 | Partially Reduced | Deduction reduced based on MAGI; exact amount requires further calculation. |

Eligibility Requirements

Claiming the student loan interest deduction requires meeting specific criteria Artikeld by the IRS. Understanding these requirements is crucial to ensure you qualify for this valuable tax break. Failure to meet even one criterion could result in the disallowance of your deduction.

Eligibility hinges on several key factors, including your filing status, the type of student loan, and your residency. Let’s examine each in detail to clarify the conditions under which the deduction is permissible.

Filing Status

Your filing status significantly impacts your eligibility. The deduction is available to single filers, married filing jointly, and qualifying surviving spouses. However, those filing as head of household, married filing separately, or as part of a joint return with a spouse who also itemizes deductions may face limitations or ineligibility. For example, if a married couple files jointly and only one spouse paid student loan interest, only that spouse’s interest is deductible, and it is claimed on the joint return. The limitation applies to the total amount deductible, not per person.

Student Loan Type

The student loan interest deduction applies only to loans taken out for educational purposes. This generally includes loans used to pay for tuition, fees, room and board, and other educational expenses at eligible educational institutions. Loans used for other purposes, such as personal expenses or non-qualified educational programs, do not qualify for the deduction. This includes loans used to refinance existing student loans, unless those loans were originally used for qualified education expenses.

Residency

You must be a U.S. citizen or resident alien to claim the student loan interest deduction. This requirement ensures that only individuals who are legally obligated to pay U.S. taxes can benefit from this tax relief. Non-resident aliens generally do not qualify.

Key Eligibility Criteria

The following points summarize the key requirements for claiming the student loan interest deduction:

- You must have paid interest on a qualified student loan during the tax year.

- The loan must have been used to pay for qualified education expenses.

- You must be a U.S. citizen or resident alien.

- Your modified adjusted gross income (MAGI) must be below a certain threshold (this threshold varies annually).

- You must file as single, married filing jointly, or qualifying surviving spouse (certain limitations apply to married filing jointly).

- You cannot be claimed as a dependent on someone else’s tax return.

Documentation and Reporting

Claiming the student loan interest deduction requires careful record-keeping and accurate reporting on your tax return. Failing to provide sufficient documentation or making errors in reporting can lead to delays in processing your return or even penalties. Understanding the necessary documentation and the proper reporting procedures is crucial for a successful claim.

Necessary Documentation

To successfully claim the student loan interest deduction, you will need to gather several key documents. These documents serve as proof of your eligible student loan interest payments and your income. Without proper documentation, the IRS may reject your claim.

Specifically, you’ll need:

- Form 1098-E, Student Loan Interest Statement: This form is issued by your lender and reports the total amount of student loan interest you paid during the tax year. It’s the most important piece of documentation.

- Your tax return from the previous year: This is needed for comparison purposes, especially if you are claiming the deduction for the first time.

- Records of student loan payments: While not always required, keeping detailed records of all your student loan payments, including dates and amounts, is highly recommended. These records can be useful if there’s a discrepancy between the information on your Form 1098-E and your actual payments.

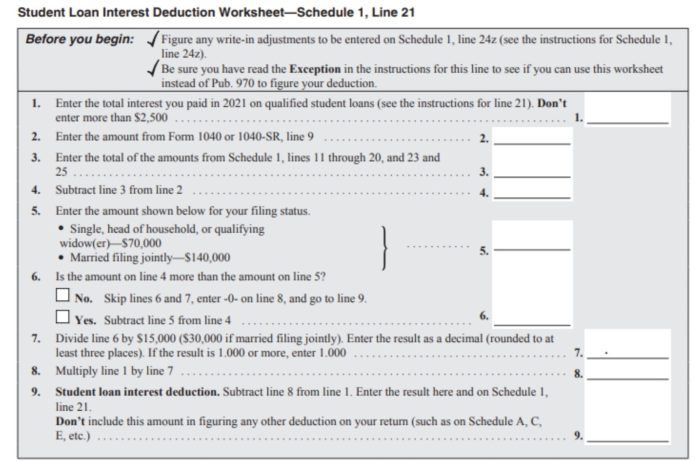

Reporting the Deduction on Tax Forms

The student loan interest deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Specifically, you will enter the amount of eligible student loan interest you paid on Line 21 of Schedule 1. This amount should match the amount reported on your Form 1098-E. Remember to keep a copy of your completed tax return and all supporting documentation for your records.

Consequences of Inaccurate Reporting

Inaccurate reporting of the student loan interest deduction can have several negative consequences. These can range from simple delays in processing your tax return to more serious penalties. For instance, if the IRS determines that you have overstated the amount of your deduction, you may be assessed additional taxes and penalties. Conversely, understating the deduction means you miss out on potential tax savings. The IRS may also conduct an audit if inconsistencies are found in your documentation or reported amounts.

Step-by-Step Guide for Claiming the Deduction

- Gather your documents: Collect your Form 1098-E, tax return from the previous year, and records of student loan payments.

- Review your eligibility: Ensure you meet all eligibility requirements, including adjusted gross income (AGI) limits.

- Complete Form 1040, Schedule 1: Accurately report the eligible student loan interest on Line 21 of Schedule 1. Ensure the amount matches the information on your Form 1098-E.

- File your tax return: Submit your completed tax return, including Schedule 1 and Form 1098-E, to the IRS by the tax deadline.

- Retain records: Keep copies of your completed tax return and all supporting documentation for at least three years in case of an audit.

Remember: It’s crucial to accurately report your student loan interest deduction to avoid potential penalties and ensure you receive the full benefit you are entitled to. If you are unsure about any aspect of the process, consult a tax professional.

Comparison with Other Tax Benefits

The student loan interest deduction isn’t the only tax break available to students and recent graduates. Several other options might offer greater savings depending on individual circumstances. Understanding the nuances of each can be crucial in maximizing tax benefits. This section compares the student loan interest deduction with other relevant tax credits, highlighting their respective advantages and disadvantages to aid in strategic tax planning.

Student Loan Interest Deduction versus American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC)

The American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) are tax credits, not deductions, meaning they directly reduce your tax liability dollar-for-dollar, unlike the student loan interest deduction, which reduces your taxable income. The AOTC is generally more valuable for undergraduate students, while the LLC can benefit both undergraduate and graduate students. However, eligibility criteria and maximum credit amounts differ significantly.

| Feature | Student Loan Interest Deduction | American Opportunity Tax Credit (AOTC) | Lifetime Learning Credit (LLC) |

|---|---|---|---|

| Type of Benefit | Deduction (reduces taxable income) | Tax Credit (reduces tax liability) | Tax Credit (reduces tax liability) |

| Maximum Benefit | Up to $2,500 of interest paid (2023) | $2,500 per eligible student (up to $10,000 in expenses) | $2,000 per eligible student (no expense limit) |

| Eligibility Requirements | Must have paid student loan interest, meet adjusted gross income (AGI) limits. | Must be pursuing a degree or other credential at an eligible educational institution, meet course requirements, be enrolled at least half-time, not have completed the first four years of higher education, and meet AGI limits. | Must be taking courses toward a degree or other credential at an eligible educational institution, meet course requirements, and meet AGI limits. No limit on years of eligibility. |

| Advantages | Relatively simple to claim if eligible. | Reduces tax liability more effectively than a deduction (dollar-for-dollar). | Can be claimed for multiple years; beneficial for graduate students or those pursuing professional certifications. |

| Disadvantages | Limited by the amount of interest paid and AGI limits; less impactful than a credit. | Limited to the first four years of higher education; requires maintaining a certain enrollment status. | Lower maximum credit amount than the AOTC. |

Choosing the Most Beneficial Tax Strategy

The best tax strategy depends heavily on individual circumstances, including the amount of student loan interest paid, educational expenses incurred, and overall income. For example, a student with significant educational expenses and a relatively low income might benefit more from the AOTC or LLC than the student loan interest deduction. Conversely, a graduate student with substantial student loan debt but limited educational expenses might find the student loan interest deduction more advantageous. Taxpayers should carefully review their specific situation and consider consulting a tax professional to determine the optimal strategy for maximizing their tax benefits.

Impact of Tax Law Changes

The student loan interest deduction, while seemingly stable, is susceptible to changes in federal tax law. These changes can significantly alter the amount of the deduction, eligibility criteria, or even eliminate the deduction altogether. Understanding the potential impact of these legislative shifts is crucial for taxpayers planning to utilize this benefit.

Proposed tax law changes often center around broader tax reform initiatives, aiming to simplify the tax code or address budget deficits. These broader efforts can inadvertently or directly affect specific deductions like the student loan interest deduction. For example, a general reduction in itemized deductions could indirectly diminish the value of the student loan interest deduction, as taxpayers might find it less beneficial to itemize if the overall savings are reduced. Conversely, targeted changes specifically affecting student loan programs could directly alter the deduction’s availability or calculation.

Changes in Deduction Limits

A hypothetical example would be a legislative change reducing the maximum amount of student loan interest deductible annually. Currently, the maximum deduction is $2,500. If Congress were to lower this to $1,500, taxpayers with student loan interest exceeding $1,500 would see a significant reduction in their tax savings. A taxpayer previously deducting $2,000 in interest would now only deduct $1,500, losing the tax benefit of the remaining $500. This change could disproportionately affect higher-income taxpayers with larger loan balances and higher interest payments.

Modification of Eligibility Requirements

Another potential change could involve modifying eligibility requirements. For example, the current adjusted gross income (AGI) limitation could be lowered. This means fewer taxpayers would qualify for the deduction. If the current AGI phaseout threshold is lowered from its current level, a taxpayer previously eligible might find themselves no longer qualifying, losing the opportunity for this tax break entirely. This could particularly affect middle-income taxpayers who previously benefitted but are now pushed above the new threshold.

Elimination of the Deduction

In a more drastic scenario, the student loan interest deduction could be entirely eliminated as part of broader tax reform. This would remove the tax benefit for all eligible taxpayers. A taxpayer who previously relied on this deduction to reduce their tax liability would face a higher tax burden. This scenario is unlikely without significant changes to broader tax policy and student loan programs, but it’s important to consider the possibility. Such a change would impact millions of borrowers.

Illustrative Scenarios

Let’s examine several hypothetical scenarios to understand how the student loan interest deduction works in practice. These examples illustrate the deduction’s application for different income levels and loan amounts. Remember that tax laws are subject to change, so always consult the latest IRS guidelines.

Scenario 1: Single Filer with Moderate Income and Loan Payments

This scenario involves a single filer, Sarah, who paid $1,500 in student loan interest during the tax year. Her modified adjusted gross income (MAGI) is $60,000. Since her MAGI is below the phaseout threshold (which varies annually, consult IRS Publication 970 for the most up-to-date information), she can deduct the full $1,500. This will reduce her taxable income by $1,500, resulting in a tax savings dependent on her applicable tax bracket.

Visual Representation: Imagine a simple table. One column shows “Student Loan Interest Paid: $1,500,” another column shows “MAGI: $60,000 (Below Phaseout),” and a final column shows “Deduction: $1,500”.

Scenario 2: Married Filing Jointly with High Income and Significant Loan Payments

John and Mary are married and filed jointly. They paid $3,000 in student loan interest during the tax year. Their combined MAGI is $180,000. This exceeds the phaseout range for married couples filing jointly (check IRS Publication 970 for the current thresholds). The deduction will be partially or completely eliminated depending on how much their income exceeds the limit. Let’s assume their income puts them just above the limit, resulting in a reduced deduction of $1,000.

Visual Representation: A table with “Student Loan Interest Paid: $3,000,” “MAGI: $180,000 (Above Phaseout),” and “Deduction: $1,000 (Partially Phased Out).”

Scenario 3: Head of Household with Low Income and Minimal Loan Payments

David is a head of household and paid $500 in student loan interest. His MAGI is $35,000. Because his MAGI is well below the phaseout limits, he can deduct the full $500. The tax savings will be smaller than in Scenario 1 due to the lower amount of interest paid.

Visual Representation: A table: “Student Loan Interest Paid: $500,” “MAGI: $35,000 (Well Below Phaseout),” “Deduction: $500”.

Scenario 4: No Deduction Due to Income

Lisa paid $2,000 in student loan interest. However, her MAGI is $200,000, significantly above the phaseout threshold for her filing status (check IRS Publication 970 for current limits). In this case, she is not eligible for any student loan interest deduction.

Visual Representation: A table: “Student Loan Interest Paid: $2,000,” “MAGI: $200,000 (Far Above Phaseout),” “Deduction: $0”.

Conclusive Thoughts

Successfully navigating the student loan interest deduction requires careful attention to detail and a thorough understanding of the eligibility requirements and reporting procedures. By carefully reviewing your financial situation and utilizing the information provided in this guide, you can confidently claim this valuable tax benefit and minimize your tax liability. Remember to consult a tax professional if you have specific questions or complex circumstances. Proper planning and informed decision-making are key to maximizing your tax savings and achieving long-term financial stability.

FAQ Summary

What forms do I need to claim the student loan interest deduction?

You’ll primarily use Form 1040 and Schedule 1 (Additional Income and Adjustments to Income) to claim the deduction. You may also need supporting documentation like your Form 1098-E (Student Loan Interest Statement).

Can I deduct interest paid on loans for graduate school?

Yes, as long as the other eligibility requirements are met, the interest paid on graduate school loans is eligible for the deduction.

What happens if I accidentally overstate my deduction?

The IRS may issue a notice requiring you to amend your return. Inaccurate reporting can result in penalties and interest charges.

Is the student loan interest deduction subject to any phaseout limits?

Yes, the deduction is subject to modified adjusted gross income (MAGI) limitations. The maximum deduction amount decreases as your MAGI increases.