Navigating the complexities of higher education financing can feel overwhelming, particularly when understanding the limits on annual student loan borrowing. This guide delves into the maximum amounts students can borrow each year for both federal and private loans, exploring the factors influencing eligibility and the potential long-term implications of borrowing these funds. We’ll examine the differences between undergraduate and graduate loan limits, the impact of various institutional costs, and strategies for responsible borrowing to help you make informed decisions about financing your education.

Understanding your borrowing limits is crucial for effective financial planning. This guide aims to provide clarity on the intricacies of federal and private loan programs, enabling you to create a realistic budget and avoid unnecessary debt. We will cover key factors affecting loan amounts, including your dependency status, school type, and cost of attendance. By exploring real-world scenarios and providing practical advice, we hope to empower you to navigate the student loan landscape with confidence.

Federal Student Loan Limits

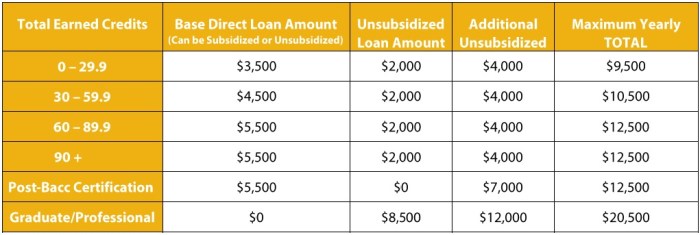

Understanding federal student loan limits is crucial for prospective students and their families in planning for higher education costs. These limits, set annually by the federal government, vary based on several factors, including the student’s dependency status and the type of program they are pursuing. Exceeding these limits requires exploring alternative funding options.

The maximum amount a student can borrow in federal student loans depends on several factors, primarily their year in school (freshman, sophomore, junior, senior), their dependency status (dependent or independent), and whether they are enrolled in an undergraduate or graduate program. Professional school programs often have different loan limits than undergraduate programs.

Federal Student Loan Limits by Student Status and Program

The following table summarizes the maximum federal student loan amounts for the 2023-2024 academic year. Note that these amounts can change annually, so it’s essential to check the official Federal Student Aid website for the most up-to-date information. These figures represent the aggregate loan amount from all federal loan programs (Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans).

| Student Status | Undergraduate (Annual Limit) | Graduate/Professional (Annual Limit) | Aggregate Loan Limit |

|---|---|---|---|

| Dependent Undergraduate | $5,500 (Freshman), $6,500 (Sophomore), $7,500 (Junior/Senior) | $20,500 | $31,000 |

| Independent Undergraduate | $9,500 (Freshman), $10,500 (Sophomore), $12,500 (Junior/Senior) | $20,500 | $138,500 (Undergraduate); $170,500 (Graduate) |

| Dependent Graduate/Professional | N/A | $20,500 | $170,500 |

| Independent Graduate/Professional | N/A | $20,500 | $170,500 |

Loan Limits for Professional Schools

Students enrolled in professional schools, such as law, medicine, dentistry, or veterinary medicine, generally have higher loan limits than undergraduate students. This is because the cost of attendance for these programs is typically significantly higher. The increased loan limits reflect the greater financial burden associated with these specialized fields. The specific amounts vary depending on the program and the student’s status (dependent or independent), but generally fall under the graduate loan limits shown above. However, professional schools may have additional funding options or scholarship opportunities to supplement federal loans.

Factors Influencing Eligibility for Maximum Loan Amounts

Several factors determine a student’s eligibility for the maximum federal student loan amount. These include their dependency status, enrollment status (full-time or part-time), cost of attendance at their chosen institution, and their credit history (for PLUS loans). A student’s demonstrated financial need, as determined by the Free Application for Federal Student Aid (FAFSA), also plays a significant role. Students who demonstrate greater financial need may be eligible for additional aid, even beyond the maximum loan limits, in the form of grants or scholarships. Furthermore, maintaining satisfactory academic progress is a requirement for continued loan eligibility.

Private Student Loan Limits

Private student loans offer an alternative funding source for higher education, supplementing federal loans. However, unlike federal loans, private loan limits vary significantly based on individual lender policies and the borrower’s creditworthiness. Understanding these limitations and the associated risks is crucial for responsible financial planning.

Private lenders don’t have a set maximum loan amount like the federal government. Instead, they assess each applicant individually, considering factors such as credit history, income, debt, and the cost of attendance. This means the maximum loan amount a student can receive will vary widely.

Maximum Loan Amounts Offered by Private Lenders

The maximum loan amount a private lender will offer is highly individualized and dependent on the lender’s policies and the borrower’s financial profile. It’s impossible to provide a single “maximum” figure. However, a comparison of typical loan amounts offered by different lenders illustrates the variability.

- Lender A: May offer up to the full cost of attendance minus other financial aid received, subject to credit approval and income verification. This could potentially be significantly higher than federal loan limits in some cases.

- Lender B: Might cap loans at a certain percentage of the cost of attendance, for example, 80%, even if the borrower’s creditworthiness would allow for a larger loan. This is a common approach to manage risk.

- Lender C: May have a lower overall loan limit, perhaps a maximum of $100,000 across all undergraduate and graduate loans. This limit could be independent of the cost of attendance or the borrower’s creditworthiness.

Criteria for Private Student Loan Eligibility and Maximum Loan Amounts

Private lenders use a variety of factors to assess a borrower’s eligibility and determine the maximum loan amount. These factors help them gauge the risk of default.

- Credit Score and History: A strong credit history is often a prerequisite for securing a private student loan, and a higher credit score typically translates to better loan terms and higher loan limits. Borrowers with limited or poor credit history may find it difficult to qualify or may receive smaller loans with higher interest rates.

- Income and Debt: Lenders consider the borrower’s income and existing debt to assess their ability to repay the loan. Higher income and lower debt typically lead to higher loan approvals and larger loan amounts.

- Cost of Attendance: The cost of tuition, fees, room, and board at the student’s chosen institution plays a significant role. Lenders often base their loan offers on a percentage of the total cost, ensuring the loan amount is reasonably related to the educational expenses.

- Co-signer: Many lenders require a co-signer, typically a parent or other responsible adult with good credit, to mitigate the risk of default, especially for students with limited or no credit history. A co-signer can significantly increase the chances of loan approval and may result in a higher loan amount.

Risks and Benefits of Private Student Loans

Supplementing federal loans with private student loans presents both potential benefits and risks. Careful consideration of these aspects is essential before proceeding.

- Benefits: Private loans can help cover educational expenses exceeding federal loan limits, providing access to necessary funding. Some private lenders offer competitive interest rates, potentially lower than some federal loan programs, depending on the borrower’s creditworthiness.

- Risks: Private student loans typically carry higher interest rates than federal loans, potentially leading to a greater overall debt burden. They often lack the same borrower protections as federal loans, such as income-driven repayment plans and loan forgiveness programs. Defaulting on a private student loan can severely damage a borrower’s credit score, making it harder to obtain loans or credit in the future.

Impact of Loan Limits on Student Borrowing

Student loan limits, both federal and private, significantly influence how much students can borrow for higher education. These limits, while designed to prevent excessive debt, can also create challenges for students aiming to pursue expensive programs or manage unexpected costs. Understanding these limitations and their impact is crucial for responsible financial planning during college.

Hypothetical Scenario: Cumulative Student Loan Debt

Let’s consider a hypothetical student pursuing a four-year undergraduate degree. Assume the maximum federal student loan amount available each year is $12,500 (a simplified example, as actual amounts vary by year and dependency status). If this student borrows the maximum amount each year, their total undergraduate debt would be $50,000 ($12,500/year * 4 years). This doesn’t include potential private loans, interest that accrues during studies and after graduation, or additional living expenses. This hypothetical scenario underscores the potential for substantial debt accumulation, even with responsible borrowing practices within established limits.

Strategies to Minimize Borrowing Needs

Students can employ several strategies to minimize their reliance on loans. Thorough financial planning is key. This includes exploring scholarships and grants, which provide need-based or merit-based funding without requiring repayment. Students should also prioritize working part-time during the academic year or full-time during breaks to offset educational expenses. Furthermore, choosing a less expensive college or university, whether through attending a community college for the first two years or selecting a state institution over a private one, can dramatically reduce overall costs. Finally, carefully budgeting and managing living expenses is critical.

Comparison of Average Student Loan Debt by Major

Average student loan debt varies significantly across different majors. For instance, graduates with advanced degrees in fields like medicine or law often accumulate substantially higher debt due to longer program lengths and higher tuition costs. Conversely, students pursuing less expensive majors such as education or social work may graduate with lower debt loads. The availability of maximum loan limits, however, can still influence these figures. Students in high-cost programs might reach the loan limits and still require additional financing, increasing their overall debt, while those in lower-cost programs may not borrow the maximum amount. This highlights the importance of considering both program costs and potential earnings when making educational decisions. A detailed analysis of average debt by major would require extensive data from sources like the National Center for Education Statistics. Such data would reveal the interplay between program costs, loan limits, and resulting debt levels for graduates.

Factors Affecting Annual Loan Amounts

Beyond the student’s enrollment status (undergraduate, graduate, etc.), several crucial factors influence the maximum amount of federal student loans a student can receive annually. These factors interact to determine a student’s financial need and, consequently, their borrowing eligibility.

Understanding these factors is essential for students and their families to plan effectively for college financing. Accurate assessment allows for responsible borrowing and minimizes the risk of accumulating excessive debt.

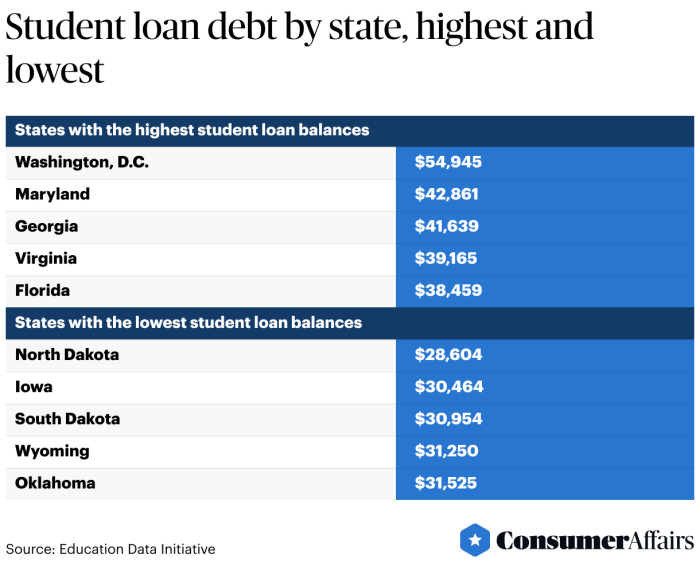

Cost of Attendance and Loan Amounts

The cost of attendance (COA) at a college or university significantly impacts the amount of student loans a student might need. COA includes tuition and fees, room and board, books and supplies, and other living expenses. Private institutions generally have substantially higher COAs than public institutions, particularly public in-state institutions. This difference directly affects the amount of financial aid, including loans, a student may be eligible to receive. A student attending a private university with a COA of $70,000 annually will likely need to borrow significantly more than a student attending a public in-state university with a COA of $25,000 annually, even if both students have similar family incomes.

Dependency Status and Family Income

A student’s dependency status (dependent or independent) and their family’s income play a crucial role in determining their eligibility for federal financial aid, including loans. Dependent students typically have their parents’ financial information considered in the aid calculation. The higher the family income, the lower the demonstrated financial need, and therefore the lower the amount of federal student loans the student may be eligible for. Conversely, independent students, such as those who are married, have children, or are orphans, have their financial need assessed based solely on their own income and assets.

For instance, a dependent student from a high-income family might only qualify for a smaller federal loan amount, even if their chosen institution’s COA is high. In contrast, an independent student with low income and a high COA might be eligible for a significantly larger loan amount.

Changes in Financial Aid Eligibility and Loan Amounts

A change in a student’s financial circumstances during their college career can affect their eligibility for financial aid and, consequently, their maximum loan amount. For example, a student whose family experiences a job loss or a significant decrease in income may qualify for a higher amount of federal student aid, including loans, in subsequent academic years. Conversely, if a student’s family income increases, their eligibility for financial aid might decrease, reducing their maximum loan amount.

Consider a scenario where a student receives a $5,000 federal loan in their freshman year. During their sophomore year, their family experiences a financial hardship, resulting in a significant reduction in their income. This change in circumstances could make the student eligible for a larger loan amount, potentially up to the maximum allowed for their year and enrollment status, allowing them to cover the increased financial need.

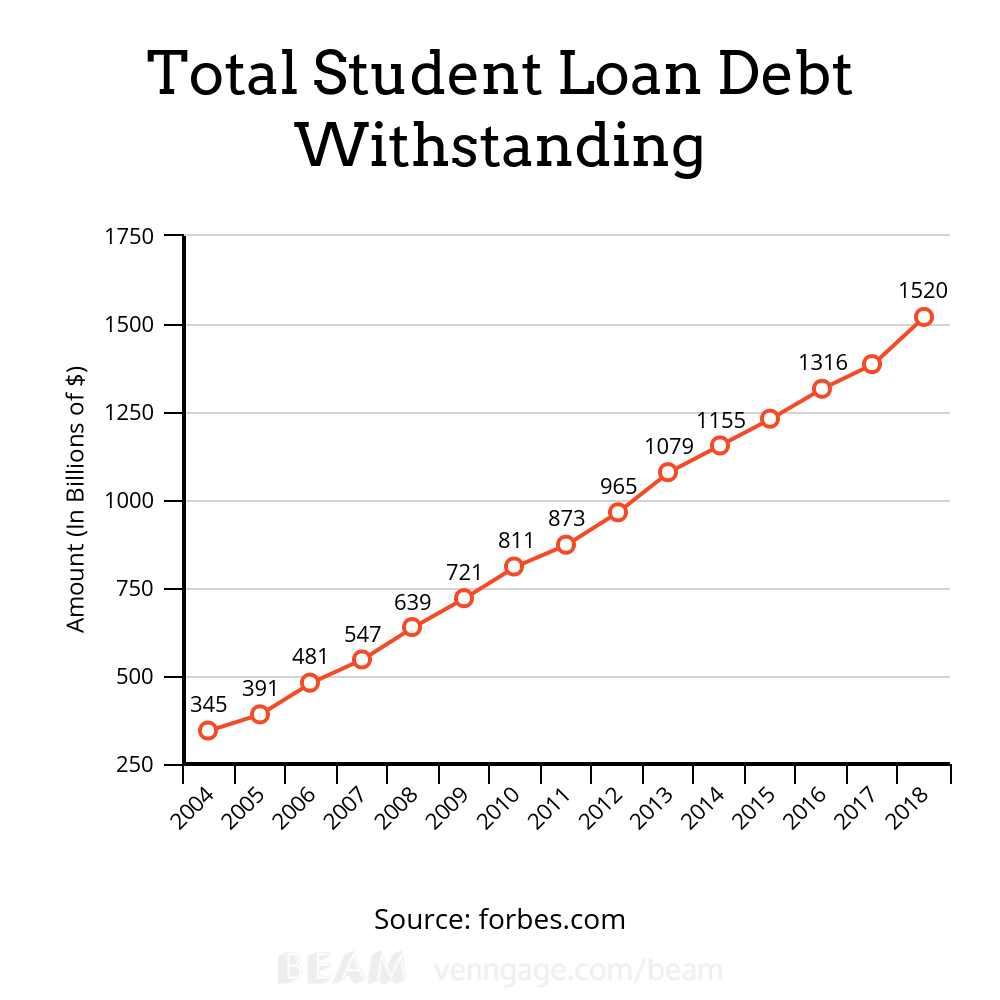

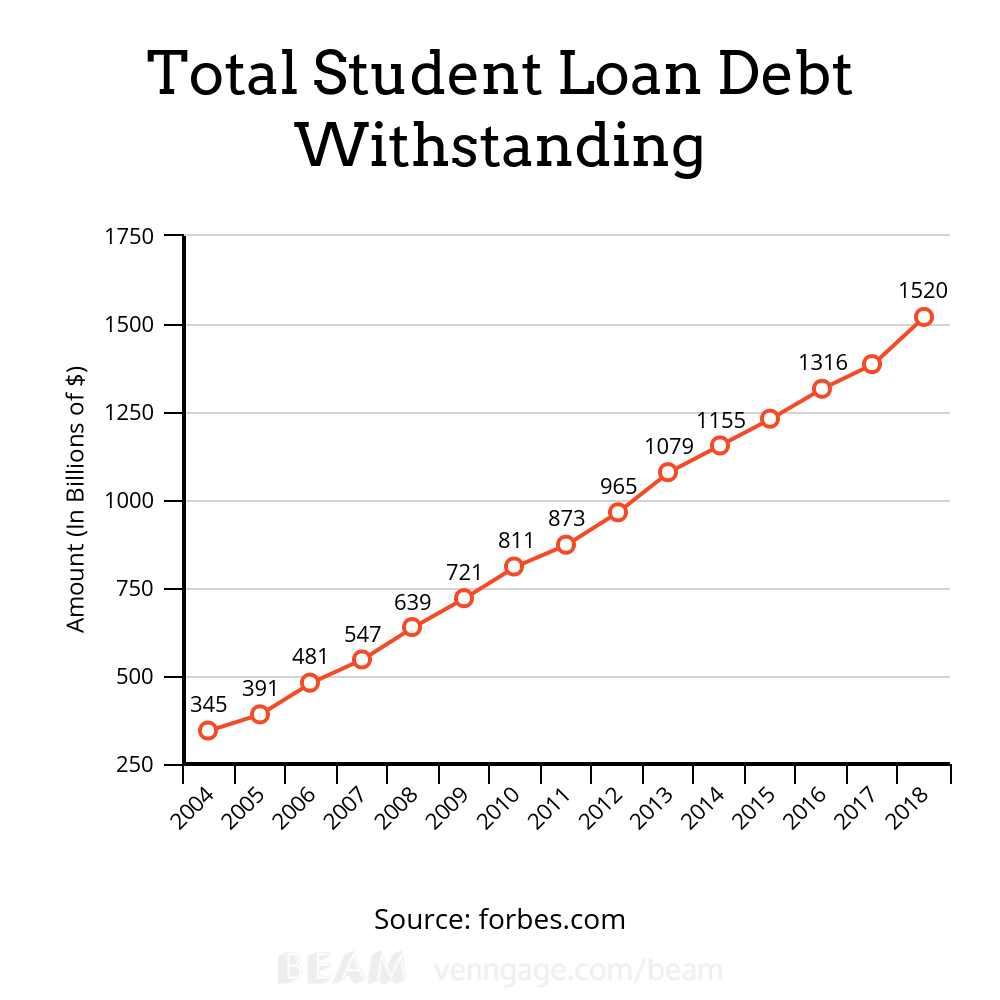

Visual Representation of Loan Limits Over Time

Understanding the trends in maximum student loan limits over the past decade provides valuable insight into the evolving landscape of higher education financing. A clear visual representation, such as a line graph, can effectively illustrate these changes.

The graph would display the maximum annual federal student loan limits on the vertical axis, measured in US dollars, and the years from 2014 to 2024 on the horizontal axis. Each data point on the graph would represent the maximum loan amount permissible for a given academic year. For instance, a data point for 2014 might show a limit of $5,500 for dependent undergraduates, while a point for 2024 would reflect the current limit. The line connecting these points would visually represent the trend in loan limits over time, highlighting any significant increases or decreases. Additional lines could be included to represent different borrower categories (dependent undergraduate, independent undergraduate, graduate student).

Causes of Fluctuations in Loan Limits

Significant increases or decreases in student loan limits over time are influenced by a complex interplay of factors. Economic conditions play a crucial role; periods of economic growth might see increases in loan limits to reflect rising tuition costs and the increased need for student financial aid. Conversely, during economic downturns, there might be pressure to limit loan amounts to control government spending and reduce the national debt. Changes in government priorities regarding higher education affordability also significantly influence loan limits. Increased political focus on making college more accessible could lead to increases in loan limits, while a shift in focus to other policy areas might result in stagnation or even decreases.

Impact of Government Policies

Government policies have a direct and substantial impact on annual student loan limits. Legislative actions, such as the passage of new higher education acts or amendments to existing legislation, directly determine the annual loan limits. For example, changes in the Higher Education Act, a cornerstone of federal student aid, directly affect loan amounts. Budgetary decisions also play a significant role. Allocations for student aid programs within the federal budget directly influence the available funds and, consequently, the maximum loan amounts that can be offered. Furthermore, administrative actions by government agencies, such as the Department of Education, can influence loan limits through policy adjustments and interpretations of existing legislation. These policies can affect not only the amount of money students can borrow but also the terms and conditions of their loans, such as interest rates and repayment plans.

Final Thoughts

Successfully financing your education requires a thorough understanding of the available loan options and their limitations. By carefully considering your eligibility, exploring both federal and private loan possibilities, and implementing responsible borrowing strategies, you can effectively manage your educational expenses and build a solid foundation for your future. Remember that careful planning and informed decision-making are essential to avoid overwhelming debt and ensure a smooth transition into your professional life after graduation. This guide serves as a starting point for your research; always consult official sources and seek professional financial advice when necessary.

Popular Questions

What happens if I borrow the maximum amount and still need more money for college?

Consider exploring scholarships, grants, part-time employment, and work-study programs to bridge the funding gap. You might also need to reassess your college choices and consider more affordable options.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing is an option once you’ve graduated. However, carefully compare rates and terms from different lenders before refinancing, as it may affect your eligibility for certain federal loan forgiveness programs.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or while you’re in deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.

How does my credit score affect my eligibility for private student loans?

A good credit score generally improves your chances of approval and secures more favorable interest rates on private student loans. Those with poor credit may need a co-signer.