Navigating the complexities of higher education financing can feel overwhelming, particularly when considering the maximum amount of student loans available. This guide provides a clear and concise overview of federal and private student loan limits, helping students and their families make informed decisions about funding their education. We’ll explore the factors influencing borrowing capacity, the potential long-term financial implications of maximum borrowing, and viable alternative funding sources.

From understanding dependency status and credit history’s impact on loan eligibility to exploring the risks associated with private loans and the importance of responsible borrowing strategies, we aim to equip you with the knowledge needed to confidently manage your student loan journey. This comprehensive resource delves into the intricacies of maximizing financial aid while minimizing future debt burdens.

Federal Student Loan Limits

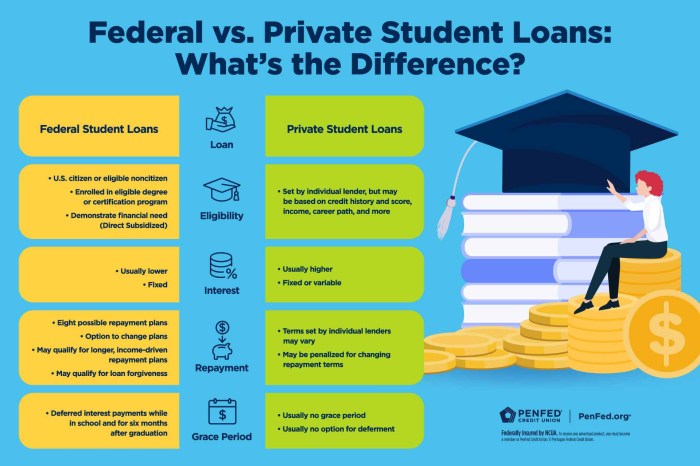

Understanding federal student loan limits is crucial for prospective students and their families in planning for higher education financing. These limits are set annually by the federal government and vary based on several factors, ensuring responsible borrowing while providing access to needed funds.

Undergraduate and Graduate Federal Student Loan Limits

The maximum amount a student can borrow under federal student loan programs depends on their year in school (freshman, sophomore, junior, senior), their dependency status (dependent or independent), and whether they are pursuing an undergraduate or graduate degree. These limits are subject to change, so always consult the official Federal Student Aid website for the most up-to-date information. The following table presents a simplified example for illustrative purposes; actual limits may vary.

| Loan Program | Undergraduate Dependent (Annual Limit) | Undergraduate Independent (Annual Limit) | Graduate (Annual Limit) |

|---|---|---|---|

| Direct Subsidized Loans | $3,500 (Freshman), $4,500 (Sophomore), $5,500 (Junior/Senior) | $5,500 (Freshman/Sophomore/Junior/Senior) | $20,500 |

| Direct Unsubsidized Loans | $2,000 (Freshman), $2,000 (Sophomore), $2,000 (Junior/Senior) | $9,500 (Freshman/Sophomore/Junior/Senior) | $20,500 |

| Total Annual Limit (Subsidized & Unsubsidized) | $5,500 (Freshman), $6,500 (Sophomore), $7,500 (Junior/Senior) | $15,000 (Freshman/Sophomore/Junior/Senior) | $20,500 |

Dependency Status and Loan Limits

A student’s dependency status significantly impacts their loan eligibility. Dependent students, typically those claimed as dependents on their parents’ tax returns, generally have lower loan limits than independent students. Independent students, often those who are married, have children, are veterans, or are orphans, are considered more financially responsible and therefore eligible for higher loan amounts. This reflects the assumption that independent students have greater financial resources and responsibilities.

Factors Influencing Maximum Loan Amounts

Several factors beyond dependency status determine the maximum loan amount a student can receive. These include:

* Year in school: Loan limits generally increase with each year of study, reflecting the increasing cost of education.

* Cost of attendance: The total cost of attendance at the student’s chosen institution (tuition, fees, room, board, etc.) influences the maximum loan amount, as loans are intended to cover these expenses. Students are generally not allowed to borrow more than their cost of attendance.

* Other financial aid: The student’s receipt of grants, scholarships, or other forms of financial aid reduces the amount of federal student loan funding they can receive. Federal loan programs work to ensure the total financial aid package doesn’t exceed the cost of attendance.

Comparison of Maximum Loan Amounts Across Federal Loan Programs

Different federal loan programs have varying maximum loan amounts. The following table provides a simplified comparison, illustrating the differences; actual amounts may differ based on the factors previously mentioned.

| Loan Program | Undergraduate Maximum (Aggregate) | Graduate Maximum (Aggregate) | Notes |

|---|---|---|---|

| Direct Subsidized Loans | $23,000 | $138,500 | Interest is subsidized while the student is enrolled at least half-time. |

| Direct Unsubsidized Loans | $57,500 | $138,500 | Interest accrues from the time the loan is disbursed. |

| Direct PLUS Loans (Parent/Graduate) | N/A | Cost of attendance minus other financial aid | Available to parents of dependent undergraduate students and to graduate students. |

Private Student Loan Limits

Private student loans offer an alternative funding source for higher education when federal loan limits are insufficient. Understanding the nuances of private loans, including their limits and associated risks, is crucial for prospective borrowers. Unlike federal loans, private loan limits and eligibility criteria vary significantly among lenders.

Maximum Loan Amounts Offered by Private Lenders

Private lenders don’t typically advertise a single, universal maximum loan amount. Instead, the maximum loan amount a student can receive depends heavily on factors like creditworthiness, co-signer availability, and the student’s chosen institution and program. The following is a generalized comparison, and actual amounts will differ based on individual lender policies and applicant profiles.

- Lender A: May offer loan amounts up to the full cost of attendance, minus other financial aid received, potentially reaching tens of thousands of dollars. However, securing the maximum amount usually requires a strong credit history or a co-signer with excellent credit.

- Lender B: Might set a lower maximum loan amount, perhaps capped at $50,000, regardless of cost of attendance. This lender may prioritize applicants with established credit or a demonstrable repayment plan.

- Lender C: Could offer a variable maximum loan amount based on a combination of factors including credit score, debt-to-income ratio, and the student’s academic standing. This might result in loan amounts ranging widely, from a few thousand dollars to potentially higher amounts with favorable applicant profiles.

Factors Affecting Private Loan Eligibility and Maximum Amounts

Several factors influence a private lender’s decision regarding loan eligibility and the maximum loan amount offered. These factors are designed to assess the borrower’s risk of default.

- Credit History and Score: A strong credit history and high credit score are generally essential for securing a favorable loan amount and interest rate. Lenders view a good credit score as an indicator of responsible financial behavior.

- Income and Debt-to-Income Ratio: Lenders assess the borrower’s income and debt-to-income ratio to determine their ability to repay the loan. A higher income and lower debt-to-income ratio generally improve loan eligibility.

- Co-Signer Availability: Having a co-signer with a strong credit history can significantly increase the chances of loan approval and a higher loan amount, as the co-signer shares responsibility for repayment.

- School and Program: The reputation and accreditation of the student’s school and program can influence lender decisions. Programs with high graduation rates and strong job placement records are often viewed more favorably.

- Academic Performance: In some cases, lenders may consider the applicant’s academic performance, as a history of good grades might indicate a higher likelihood of successful completion and future earning potential.

Scenarios Requiring Private Student Loans

There are several situations where a student might exhaust their federal loan limits and need to explore private loans.

- High Cost of Attendance: Students attending expensive private universities or pursuing programs with high tuition costs may quickly reach their federal loan limits. Private loans can help bridge the gap.

- Limited Federal Aid Eligibility: Students who don’t qualify for the maximum amount of federal aid due to factors like credit history or income may need private loans to cover remaining educational expenses.

- Unexpected Expenses: Unforeseen costs, such as medical bills or unexpected living expenses, can create a funding shortfall even after federal loans are maxed out. Private loans can provide temporary relief.

Risks Associated with Private Student Loans

Private student loans often come with higher interest rates and less favorable repayment terms compared to federal loans.

- Higher Interest Rates: Private loans typically carry higher interest rates than federal loans, leading to significantly higher total repayment costs over the life of the loan.

- Less Flexible Repayment Options: Private lenders may offer fewer repayment options compared to federal loans, making it more challenging to manage repayment if financial circumstances change.

- Potential for Debt Collection: Defaulting on a private student loan can have severe consequences, including damage to credit score and aggressive debt collection practices.

Factors Affecting Borrowing Capacity

Securing student loans, whether federal or private, depends on various factors beyond just your academic standing. Understanding these influences is crucial for maximizing your borrowing potential and navigating the loan application process effectively. This section will detail key elements impacting your ability to borrow for higher education.

Credit History’s Influence on Borrowing

A strong credit history is paramount, especially when applying for private student loans. Lenders assess your creditworthiness using your credit score and report, considering factors like payment history, debt levels, and length of credit history. A higher credit score typically translates to better loan terms, including lower interest rates and potentially higher borrowing limits. Conversely, a poor credit history, marked by late payments or defaults, might result in loan denial or significantly reduced borrowing capacity. In some cases, lenders may offer loans only with a significantly higher interest rate to compensate for the perceived risk. For example, a student with a FICO score above 700 might qualify for a loan with a 5% interest rate and a higher borrowing limit, while a student with a score below 600 might face a 10% interest rate or even loan rejection.

The Impact of Co-signers on Borrowing Capacity

For students lacking a substantial credit history or facing credit challenges, a co-signer can be a game-changer. A co-signer, typically a parent or other financially responsible individual, agrees to repay the loan if the student defaults. Their creditworthiness is added to the student’s application, significantly improving the chances of approval and often leading to more favorable loan terms, including higher borrowing limits and lower interest rates. The co-signer essentially acts as a guarantor, mitigating the risk for the lender. This is particularly beneficial for students with limited or no credit history, allowing them to access funds they might otherwise be unable to obtain.

Income Verification Methods Used by Lenders

Lenders employ various methods to verify a student’s or co-signer’s income, ensuring the ability to repay the loan. This verification process is essential for responsible lending practices.

| Verification Method | Description | Pros | Cons |

|---|---|---|---|

| Tax Returns (W-2s, 1099s) | Review of tax documents to confirm reported income. | Provides a clear picture of income over a year. | May not reflect current income accurately. |

| Pay Stubs | Verification of current employment and income through recent pay stubs. | Shows current income and employment status. | Limited historical income data. |

| Bank Statements | Examination of bank statements to assess cash flow and income deposits. | Provides a broader financial picture, including savings. | Can be time-consuming to review thoroughly. |

| Employer Verification | Direct contact with the employer to confirm employment and income. | Confirms employment and income directly with the source. | Requires additional time and effort from the lender. |

Cost of Attendance and Expected Family Contribution’s Influence

A student’s cost of attendance (COA), encompassing tuition, fees, room, board, and other expenses, plays a significant role in determining maximum loan eligibility. This is especially true for federal student loans. The COA is compared to the student’s expected family contribution (EFC), a measure of the family’s financial ability to contribute to the student’s education. The difference between the COA and the EFC represents the student’s financial need, which directly influences the maximum amount of federal student loans they can receive. For example, a student with a high COA and a low EFC will typically be eligible for a larger loan amount compared to a student with a low COA and a high EFC. Private lenders may also consider these factors, although their lending criteria may differ from federal loan programs.

Repayment Implications of Maximum Borrowing

Borrowing the maximum amount of student loans can significantly impact your long-term financial well-being. While accessing the necessary funds for education is crucial, understanding the potential consequences of maximum borrowing is essential for responsible financial planning. Failing to adequately consider repayment strategies can lead to prolonged debt, hindering major life goals such as homeownership, starting a family, or retirement planning.

The sheer size of the debt accumulated from maximum borrowing necessitates a comprehensive understanding of repayment options and their implications. The longer the repayment period, the more interest will accrue, ultimately increasing the total cost of your education. Conversely, shorter repayment periods lead to higher monthly payments, potentially straining your budget. Careful consideration of these factors is vital for making informed decisions.

Repayment Plan Options and Their Impact

Several federal repayment plans exist, each with varying monthly payment amounts and total repayment costs. For instance, the Standard Repayment Plan typically spreads payments over 10 years, while the Extended Repayment Plan can extend the repayment period to up to 25 years. An Income-Driven Repayment (IDR) plan bases monthly payments on your income and family size, offering lower monthly payments but potentially extending the repayment period significantly. The total interest paid will vary considerably across these plans. For example, a $100,000 loan repaid over 10 years at a 5% interest rate will cost significantly more than the same loan repaid over 25 years, though the monthly payments will be substantially higher in the shorter repayment period. Choosing the right plan depends on your individual financial situation and priorities.

Consequences of Student Loan Default

Defaulting on student loans carries severe consequences. It can severely damage your credit score, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. The government may garnish your wages, seize your tax refunds, and even pursue legal action. Default can also lead to additional fees and penalties, further increasing your debt burden. For instance, a default could result in the loss of future federal student aid eligibility, impacting any subsequent educational endeavors. The impact on creditworthiness can extend for years, making it crucial to prioritize responsible repayment strategies.

Strategies for Responsible Borrowing and Debt Management

Responsible borrowing starts with careful budgeting and realistic financial planning. Before taking out student loans, create a detailed budget to assess your ability to repay the loans after graduation. Consider exploring scholarships, grants, and work-study opportunities to minimize your reliance on loans. During your studies, prioritize academic success to increase your earning potential post-graduation, thereby improving your repayment capacity. Actively monitor your loan balances and repayment progress, and consider refinancing options if interest rates decline, potentially reducing your overall repayment costs. Regular communication with your loan servicer is essential to understand your options and avoid default. Seeking professional financial advice can be invaluable in navigating the complexities of student loan repayment.

Alternative Funding Sources

Securing funding for higher education can be a significant challenge. While student loans are a common option, exploring alternative funding sources can significantly reduce reliance on debt and its associated long-term financial implications. These alternatives offer various advantages and disadvantages, making careful consideration crucial before committing to any financial aid strategy.

Exploring alternative funding sources for higher education involves examining various options that can supplement or even replace student loans. These alternatives often come with fewer strings attached compared to loans, potentially leading to a more manageable financial future after graduation.

Scholarships

Scholarships are essentially free money awarded based on merit, academic achievement, athletic ability, or demonstrated financial need. They typically don’t need to be repaid.

- Merit-based scholarships: Awarded for academic excellence, talent in specific areas (arts, athletics, etc.), or leadership qualities. These often require high GPA’s, standardized test scores, or participation in extracurricular activities.

- Need-based scholarships: Awarded based on demonstrated financial need, assessed through the FAFSA (Free Application for Federal Student Aid). These consider factors like family income, assets, and number of dependents.

- Specific scholarships: Offered by organizations, companies, or institutions based on specific criteria, such as major, ethnicity, or career goals. Examples include scholarships sponsored by professional organizations or local businesses.

Grants

Similar to scholarships, grants provide financial aid that doesn’t need repayment. However, grants are typically awarded based on financial need, determined through the FAFSA or other applications.

- Federal Pell Grants: A need-based grant offered by the federal government to undergraduate students who demonstrate exceptional financial need. The amount awarded varies depending on the student’s financial situation and the cost of attendance.

- State grants: Many states offer their own grant programs for students attending in-state colleges and universities. Eligibility requirements vary by state.

- Institutional grants: Colleges and universities often provide their own grants to students based on academic merit or financial need. These are often awarded in addition to federal and state aid.

Work-Study Programs

Work-study programs offer part-time jobs on or off campus, allowing students to earn money while attending school. These programs are often need-based and coordinated through the college or university’s financial aid office.

- On-campus jobs: May include positions in libraries, student centers, administrative offices, or research labs.

- Off-campus jobs: May involve positions related to the student’s field of study or general part-time employment.

- Earnings limitations: The amount a student can earn through work-study is usually capped, and the program is intended to supplement, not replace, other forms of financial aid.

Comparison of Funding Sources

The following table summarizes the advantages and disadvantages of using alternative funding sources compared to loans:

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Scholarships | Free money, no repayment required; can be substantial | Competitive; requires effort to find and apply for; not guaranteed |

| Grants | Free money, no repayment required; based on need | Limited availability; stringent eligibility requirements; amount may not cover full cost |

| Work-Study | Earn money while studying; valuable work experience | Limited earnings potential; requires time commitment; may impact academic performance if workload is excessive |

| Loans | Covers full cost of education; flexible repayment options | Accumulates interest; long-term financial burden; potential for default |

Decision-Making Flowchart

A flowchart illustrating the decision-making process for choosing between loans and alternative funding options would begin with assessing the student’s financial need and academic merit. This would then lead to exploring available scholarships and grants. If these sources do not fully cover educational costs, the flowchart would branch to explore work-study options. Finally, if funding gaps remain, student loans would be considered as a last resort. The flowchart would visually represent these steps, with decision points and outcomes clearly indicated. The ultimate goal is to minimize loan dependence while maximizing available resources.

Final Conclusion

Securing higher education funding requires careful planning and a thorough understanding of available resources. While borrowing the maximum amount of student loans might seem appealing, it’s crucial to weigh the long-term financial implications. By carefully considering federal and private loan limits, exploring alternative funding options, and employing responsible borrowing strategies, students can navigate the complexities of student loan debt and achieve their educational goals without undue financial strain. Remember, informed decision-making is key to a successful and sustainable financial future.

FAQ Explained

What happens if I borrow the maximum amount and still need more money for college?

If you exhaust your federal loan limits and still face a funding gap, you might explore private loans or additional alternative funding sources like scholarships and grants. However, carefully consider the higher interest rates and potential risks associated with private loans.

Can I refinance my student loans to lower my monthly payments?

Yes, refinancing your student loans can potentially lower your monthly payments and interest rate, but it’s essential to compare offers from different lenders and understand the terms and conditions before refinancing. Note that refinancing federal loans into private loans can result in the loss of certain federal protections.

What are the consequences of defaulting on my student loans?

Defaulting on student loans has severe consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. It can significantly impact your ability to obtain future loans or credit. Contact your loan servicer immediately if you’re struggling to make payments to explore options for repayment assistance.

How does my credit score affect my ability to get a private student loan?

A good credit score significantly improves your chances of securing a private student loan with favorable terms. Lenders use credit scores to assess your creditworthiness and determine your eligibility for a loan and the interest rate you’ll receive. A poor credit score may limit your borrowing options or result in higher interest rates.