Navigating the complex world of student loans can be daunting, especially understanding the maximum amounts you can borrow each year. This crucial information significantly impacts a student’s financial future, influencing not only their immediate educational expenses but also their long-term debt burden. Understanding federal and private loan limits, eligibility criteria, and the potential consequences of borrowing the maximum amount are essential steps in responsible financial planning for higher education.

This guide provides a comprehensive overview of the maximum annual student loan amounts available, covering both federal and private loan programs. We’ll delve into the factors influencing eligibility, explore the long-term implications of borrowing large sums, and offer insights into minimizing debt accumulation. Understanding these factors will empower students to make informed decisions about financing their education.

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families to plan for higher education costs effectively. These limits, set annually by the federal government, determine the maximum amount of federal student loan funds a student can borrow. Exceeding these limits typically requires exploring alternative financing options, such as private loans, which often come with higher interest rates.

Undergraduate Student Loan Limits

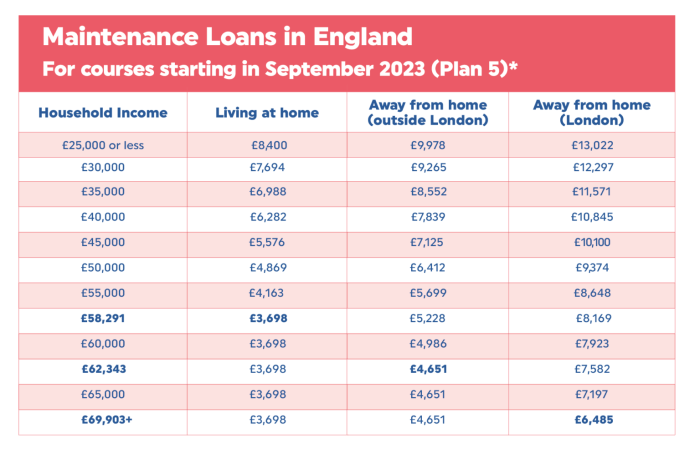

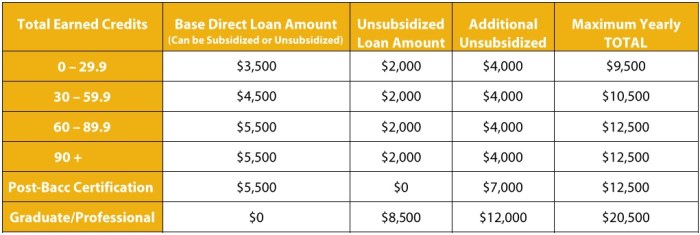

Federal Direct Loan Program limits for undergraduate students vary based on their dependency status (dependent or independent) and year in school. Dependent students generally have lower borrowing limits than independent students. This distinction reflects the expectation that dependent students may have greater access to parental financial support. The limits are also cumulative, meaning the total amount a student can borrow over their undergraduate career is capped.

Graduate Student Loan Limits

Graduate students generally have higher loan limits than undergraduates. This reflects the typically higher cost of graduate programs and the expectation that graduate students may have more significant earning potential after graduation. However, similar to undergraduate loans, there are limits to prevent excessive borrowing. Graduate students also have access to different loan types, which may have varying limits.

Loan Type Limits

Federal student loans are categorized into several types, each with its own borrowing limits. Subsidized loans, for example, do not accrue interest while the student is enrolled at least half-time, while unsubsidized loans accrue interest from the time the loan is disbursed. PLUS loans are available to parents of dependent students and to graduate students, offering additional borrowing capacity but often at a higher interest rate.

Federal Student Loan Limit Summary

| Student Type | Loan Type | Annual Limit | Aggregate Limit |

|---|---|---|---|

| Dependent Undergraduate | Subsidized/Unsubsidized | $5,500 (Freshman), $6,500 (Sophomore), $7,500 (Junior/Senior) | $31,000 |

| Independent Undergraduate | Subsidized/Unsubsidized | $9,500 (Freshman), $10,500 (Sophomore), $12,500 (Junior/Senior) | $57,500 |

| Graduate Student | Subsidized/Unsubsidized | $20,500 | $138,500 (including undergraduate loans) |

| Parent PLUS | PLUS Loan | Cost of attendance minus other financial aid | Cost of attendance minus other financial aid |

| Graduate PLUS | PLUS Loan | Cost of attendance minus other financial aid | Cost of attendance minus other financial aid |

Factors Influencing Loan Eligibility

Securing the maximum amount in federal student loans depends on several key factors. Understanding these factors is crucial for students planning their higher education financing. This section will detail the elements that influence a student’s eligibility for federal student aid, focusing on the maximum loan amounts.

Credit History’s Role in PLUS Loan Eligibility

Parent PLUS Loans (PLUS) and Graduate PLUS Loans require a credit check. A negative credit history, including bankruptcies, foreclosures, or significant late payments, can lead to loan denial. Lenders assess creditworthiness to determine the risk associated with lending. Students with adverse credit history may need an endorser to obtain a PLUS loan, or they may be ineligible altogether. The specific criteria for credit approval vary depending on the lender and the program. For example, a certain credit score may be required, or a history of responsible credit management demonstrated over a specific period.

Enrollment Status and Loan Eligibility

A student’s enrollment status directly impacts their eligibility for federal student loans. Full-time students typically qualify for higher loan amounts compared to part-time students. The Department of Education defines full-time enrollment based on credit hours, which vary by institution. Part-time students’ loan eligibility is calculated proportionally to their enrollment status. A student enrolled half-time would generally be eligible for half the maximum loan amount of a full-time student, for example. This ensures that loan amounts are aligned with the student’s academic progress and course load.

Cost of Attendance and Maximum Loan Amount

The cost of attendance (COA) at a student’s chosen institution plays a significant role in determining their maximum loan eligibility. COA encompasses tuition, fees, room and board, books, supplies, and other necessary expenses. Federal student loan programs, such as the Direct Subsidized and Unsubsidized Loans, have annual and aggregate loan limits. However, students cannot borrow more than their calculated COA. This prevents students from borrowing excessively and incurring unsustainable debt. The COA is determined by the institution and may vary based on factors such as the student’s residency status and program of study. The financial aid office at the student’s school calculates this figure.

Flowchart for Determining Maximum Loan Eligibility

The following flowchart illustrates the decision-making process for determining a student’s maximum federal student loan eligibility:

[Imagine a flowchart here. The flowchart would start with a box labeled “Student Applies for Federal Student Loans.” This would lead to two branches: one for “Dependent Student” and one for “Independent Student.” Each branch would then lead to a series of boxes representing checks for factors like enrollment status (full-time/part-time), credit history (if applicable for PLUS loans), and cost of attendance. Each check would lead to a “Yes” or “No” branch, ultimately leading to a final box indicating the maximum loan amount approved, or a denial if any of the criteria are not met. The flowchart would visually represent the conditional logic involved in the process.]

Private Student Loan Limits

Private student loans offer an alternative funding source for higher education, but unlike federal loans, their limits and terms vary significantly among lenders. Understanding these variations is crucial for students and families seeking to manage their borrowing effectively. This section will explore the key aspects of private student loan limits, including maximum loan amounts, influencing factors, and the resulting differences in interest rates and repayment terms.

Factors Influencing Private Student Loan Limits

Several factors influence the maximum loan amount a private lender will offer. These factors are assessed to determine the borrower’s creditworthiness and ability to repay the loan. Lenders typically use a combination of these factors to make lending decisions. A strong credit history and a co-signer often lead to higher loan limits.

- Credit Score: A higher credit score demonstrates a history of responsible borrowing and repayment, leading to greater loan eligibility and potentially more favorable terms.

- Co-signer Availability: Having a co-signer with good credit significantly improves the chances of loan approval and can result in higher loan limits. The co-signer assumes responsibility for repayment if the primary borrower defaults.

- Income and Debt: Lenders assess the borrower’s income and existing debt to determine their debt-to-income ratio (DTI). A lower DTI indicates a greater capacity to repay the loan, potentially leading to higher loan limits.

- Year in School: Loan limits may vary based on the borrower’s year in school (freshman, sophomore, etc.). Lenders may offer lower limits to undergraduate students compared to graduate students, reflecting the perceived higher risk associated with less established credit histories.

- School and Program: The type of school (e.g., public vs. private) and the chosen program of study might influence the loan amount offered. Some programs may be deemed more valuable in the job market, potentially influencing a lender’s risk assessment.

Examples of Private Student Loan Limits and Terms

It’s impossible to provide exact figures for maximum loan amounts, as these change frequently based on market conditions and lender-specific policies. However, we can illustrate the potential range and the relationship between loan limits and interest rates. It’s crucial to check directly with individual lenders for their current offerings.

- Lender A: Might offer a maximum annual loan amount of $50,000 for graduate students with excellent credit and a co-signer, but only $25,000 for undergraduates with limited credit history. Interest rates could range from 6% to 12% depending on creditworthiness.

- Lender B: May have a lower maximum loan amount, perhaps $40,000, even for graduate students with strong credit, but might offer more competitive interest rates for borrowers with excellent credit scores.

- Lender C: Could offer a higher maximum loan amount but with stricter eligibility requirements and potentially higher interest rates for borrowers with less-than-perfect credit.

Interest Rates and Repayment Terms

Interest rates on private student loans are generally variable and higher than those on federal loans. The interest rate offered will depend heavily on the borrower’s creditworthiness and the loan amount. Longer repayment terms may reduce monthly payments but result in paying significantly more interest over the life of the loan. Shorter repayment terms result in higher monthly payments but lower overall interest paid. For example, a loan with a 10-year repayment term will accrue less interest than a 20-year term, all other factors being equal.

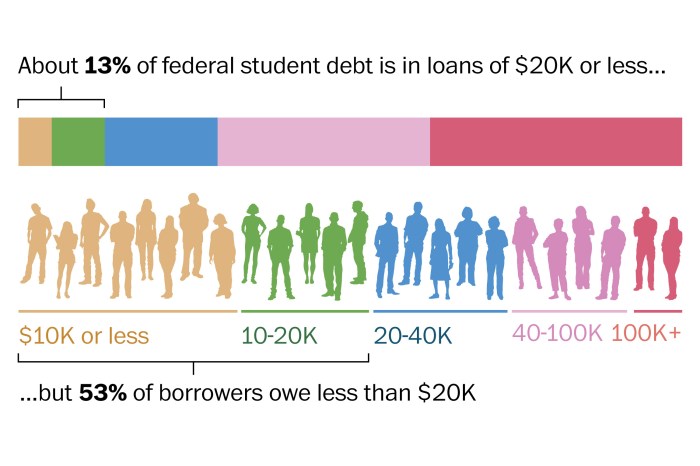

Impact of Maximum Loan Amounts on Student Debt

Borrowing the maximum amount of student loans each year can significantly impact a student’s financial future, potentially leading to substantial long-term debt and limiting financial flexibility after graduation. Understanding the potential consequences and employing responsible borrowing strategies is crucial for navigating the complexities of student financing.

The potential long-term consequences of borrowing the maximum loan amount each year are considerable. High debt burdens can delay major life milestones such as homeownership, starting a family, or investing in retirement. Furthermore, high monthly loan payments can strain a graduate’s budget, limiting their ability to save, pursue further education, or simply enjoy a comfortable standard of living. The interest accrued over the loan repayment period can also dramatically increase the total cost of education, making the overall financial burden even more significant. For example, a student who borrows the maximum amount for a four-year degree program might face decades of loan repayments, significantly impacting their financial freedom and future opportunities.

Strategies to Minimize Reliance on Maximum Loan Amounts

Students can employ several strategies to reduce their dependence on maximum loan amounts. Careful budgeting and financial planning before and during college are essential. Exploring scholarship opportunities, grants, and work-study programs can significantly reduce the need for loans. Choosing a less expensive college or university, considering community college for the first two years, or opting for a shorter degree program can also help lower overall education costs. Furthermore, students should prioritize maximizing their financial aid and exploring loan consolidation options to manage their debt effectively after graduation.

Considering the Total Cost of Education

Accurately assessing the total cost of education, including tuition, fees, room and board, books, and other expenses, is vital before borrowing any student loans. Students should create a comprehensive budget that accounts for all education-related costs and explore various funding options to determine their actual borrowing needs. By carefully analyzing their financial resources and available funding, students can avoid unnecessary borrowing and minimize their long-term debt burden. For instance, comparing the total cost of a four-year private university versus a less expensive public institution or community college can reveal substantial differences in the amount of borrowing required.

Comparative Illustration of Debt Accumulation

A comparative illustration could be created using a bar graph. The horizontal axis would represent different years of study (Year 1, Year 2, Year 3, Year 4), while the vertical axis would represent the cumulative loan debt. Two bars would be shown for each year: one representing the cumulative debt for a student borrowing the maximum loan amount each year, and the other representing the cumulative debt for a student who borrows less, perhaps only the amount needed to cover tuition and fees. The graph would clearly illustrate the exponential growth of debt for the student borrowing the maximum amount versus the significantly lower debt accumulated by the student who borrows less. Data points for each bar would be clearly labelled, showing the precise loan amount accumulated in each year and the cumulative total. This visual representation would effectively demonstrate the long-term impact of borrowing decisions on overall student debt. For example, the graph might show a student borrowing the maximum accumulating $100,000 in debt after four years, compared to a student borrowing less accumulating only $50,000. This stark difference would highlight the importance of responsible borrowing strategies.

State-Specific Loan Programs

Many states offer student loan programs that supplement federal aid, providing additional funding options for students pursuing higher education. These programs often have varying eligibility requirements and loan amounts, making it crucial for students to research their state’s offerings. Understanding these state-level programs can significantly impact a student’s ability to finance their education.

State-Specific Loan Program Eligibility and Amounts

Eligibility criteria for state-specific loan programs vary widely. Factors such as residency requirements (often requiring in-state residency for a specified period), academic performance (minimum GPA requirements), and enrollment in specific programs or institutions are common. Maximum loan amounts also differ considerably, ranging from a few thousand dollars to significantly larger sums, depending on the program and the student’s needs. The application processes are usually distinct from federal loan applications, requiring separate submissions and documentation.

State Loan Program Application Processes

The application process for state-level student loan programs generally involves completing a state-specific application form, providing documentation of residency, academic transcripts, and financial need (often demonstrated through the FAFSA). Some programs may also require essays or letters of recommendation. Processing times can vary, so it’s essential to apply well in advance of the academic year. Many state programs maintain online portals for applications and status updates, simplifying the process.

Examples of State Student Loan Programs

The following table provides examples of state student loan programs. Note that program details, including eligibility and loan amounts, are subject to change and should be verified directly with the respective state agency.

| State | Program Name | Maximum Loan Amount | Eligibility Criteria |

|---|---|---|---|

| California | California Dream Act Application | Varies; dependent on financial need and demonstrated academic merit | California resident, undocumented or AB 540 student, enrolled at least half-time at an eligible institution, completed FAFSA or CA Dream Act Application |

| New York | HESC (Higher Education Services Corporation) Loans | Varies depending on the specific loan program and the student’s need. Some programs have no maximum loan amount. | New York residency, enrollment in an eligible institution, demonstrated financial need. Specific requirements vary by program. |

| Texas | Texas Guaranteed Student Loan Program (TGSLP) | Varies depending on the specific program and financial need. Maximum amounts are not publicly stated in a single place, but are set individually per application. | Texas residency, enrollment at an eligible Texas institution, completion of FAFSA. Specific program requirements vary. |

Ending Remarks

Successfully navigating the complexities of student loan financing requires a thorough understanding of the maximum amounts available and the factors that influence eligibility. By carefully considering both federal and private loan options, understanding the long-term financial implications, and exploring strategies to minimize debt, students can make informed choices that align with their financial goals. Responsible borrowing practices are key to ensuring a positive and sustainable financial future after graduation.

FAQ Summary

What happens if I borrow the maximum amount and can’t repay?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit.

Can I borrow the maximum amount for multiple years?

Yes, but be aware that your total debt will accumulate significantly. Consider your post-graduation earning potential to ensure manageable repayment.

Are there any penalties for borrowing less than the maximum amount?

No, there are no penalties for borrowing less than the maximum allowed. Borrowing only what you need is a responsible financial practice.

How do interest rates affect the total amount I repay?

Interest rates significantly impact the total cost of your loans. Higher interest rates mean you’ll pay more over the life of the loan.