Navigating the complexities of higher education often involves understanding the financial landscape. A crucial element of this is determining the maximum amount of student loans you can borrow each year. This impacts not only your immediate ability to fund your education but also significantly shapes your long-term financial well-being. Understanding the limits, both federal and private, is essential for responsible borrowing and future financial stability.

This guide delves into the specifics of federal and private student loan limits, exploring the factors that influence eligibility and the potential consequences of exceeding borrowing limits. We’ll examine how factors like your student status (dependent or independent), degree program, and cost of attendance influence the maximum loan amount available to you. We’ll also highlight the critical differences between federal and private loans, emphasizing the importance of careful planning and responsible borrowing strategies.

Federal Student Loan Limits

Understanding federal student loan limits is crucial for prospective students and their families in planning for higher education costs. These limits, set by the federal government, determine the maximum amount a student can borrow each year and over the course of their education. Exceeding these limits generally requires private loans, which often come with higher interest rates.

Annual and Aggregate Loan Limits Under the Federal Direct Loan Program

The Federal Direct Loan Program offers subsidized and unsubsidized loans to eligible undergraduate and graduate students. Loan limits vary depending on the student’s dependency status (dependent or independent) and year in school. Dependent students generally have lower borrowing limits than independent students, reflecting the expectation of greater parental financial support. The annual limit represents the maximum a student can borrow in a single academic year, while the aggregate limit represents the total amount they can borrow over their entire educational career.

Loan Limits by Degree Program

Maximum loan amounts differ based on the type of degree program pursued. Undergraduate students generally have lower borrowing limits than graduate students, reflecting the shorter duration of undergraduate programs and the assumption of higher earning potential after graduation. Professional degree programs, such as law or medicine, may have even higher limits due to the significant costs associated with these fields. These higher limits are intended to address the increased cost of these specific programs.

Factors Influencing Eligibility for Maximum Loan Amounts

Several factors determine a student’s eligibility for the maximum loan amount. These include the student’s dependency status, enrollment status (full-time or part-time), year in school (freshman, sophomore, junior, senior, graduate), and cost of attendance at their chosen institution. A student’s credit history is not a factor in determining eligibility for federal student loans, unlike private loans. Furthermore, demonstrating financial need, although not a requirement for unsubsidized loans, may affect the amount of subsidized loans a student can receive. Students must also meet the general eligibility requirements of the Federal Direct Loan Program.

Maximum Federal Student Loan Amounts

The following table summarizes the maximum annual and aggregate loan limits for different student statuses and degree levels. These amounts are subject to change, so it’s essential to consult the official Federal Student Aid website for the most up-to-date information. Note that these are the maximum amounts; students may receive less depending on their financial need and cost of attendance.

| Student Status | Degree Level | Annual Limit | Aggregate Limit |

|---|---|---|---|

| Dependent Undergraduate | Undergraduate | $5,500 – $7,500 (depending on year in school) | $27,000 |

| Independent Undergraduate | Undergraduate | $9,500 – $12,500 (depending on year in school) | $57,500 |

| Dependent Graduate/Professional | Graduate/Professional | $20,500 | $138,500 |

| Independent Graduate/Professional | Graduate/Professional | $20,500 | $138,500 |

Private Student Loan Limits

Private student loans offer an alternative funding source for higher education, but unlike federal loans, they come with varying limits and eligibility criteria determined by private lenders. Understanding these limitations is crucial for prospective borrowers to make informed decisions about financing their education. The maximum amount you can borrow will depend significantly on several factors, making each application unique.

Factors Influencing Private Student Loan Limits

Private lenders assess several factors to determine a student’s borrowing limit. Credit history plays a significant role; a strong credit history generally leads to higher loan amounts and more favorable terms. Conversely, students with no credit history will likely need a co-signer – a creditworthy individual who agrees to repay the loan if the student defaults. The co-signer’s creditworthiness significantly impacts the loan amount and interest rate offered. The prestige and cost of the school attended also factor into the lender’s decision. Lenders may view students attending more expensive institutions or those with higher graduation rates more favorably. Finally, the student’s demonstrated ability to repay the loan, considering their current income and future earning potential, is also evaluated.

Interest Rates and Repayment Terms of Private Loans

Private student loan interest rates are typically higher than federal loan interest rates. These rates are variable, meaning they can fluctuate over the life of the loan, unlike some fixed-rate federal loans. The interest rate offered will depend on the borrower’s creditworthiness, the loan amount, and the prevailing market interest rates. Repayment terms also vary widely among private lenders, ranging from a few years to as long as 20 years. However, longer repayment terms generally mean higher overall interest paid. Unlike federal loans, which often offer income-driven repayment plans, private loan repayment plans are typically less flexible.

Key Differences Between Private and Federal Student Loan Programs

The following bullet points highlight the key differences between private and federal student loans regarding maximum loan amounts and eligibility requirements:

- Maximum Loan Amounts: Federal student loans have set annual and aggregate limits, varying based on the student’s year in school and dependency status. Private loan limits are determined by the lender based on individual creditworthiness and other factors, potentially leading to higher borrowing amounts but also higher risk.

- Eligibility Requirements: Federal student loans have broader eligibility requirements, primarily based on enrollment status and financial need. Private loans require a credit check and often necessitate a co-signer for students with limited or no credit history.

- Interest Rates: Federal student loans typically have lower, fixed interest rates compared to the variable rates often found with private loans.

- Repayment Options: Federal loans provide various repayment plans, including income-driven repayment, which can adjust monthly payments based on income. Private loans generally offer fewer repayment options and less flexibility.

- Loan Forgiveness Programs: Federal student loans may qualify for loan forgiveness programs under certain circumstances (e.g., public service). Private loans do not typically offer such programs.

Factors Affecting Borrowing Limits

Understanding the maximum amount you can borrow in student loans depends on several interconnected factors. These factors work together to determine your eligibility and the overall loan amount offered, influencing your financial planning throughout your education. This section will detail the key elements that shape your borrowing limits.

Several key factors influence the maximum amount a student can borrow for their education. These include the cost of attendance at their chosen institution, their family’s income, and their enrollment status. The interaction of these factors creates a complex system that determines individual borrowing limits.

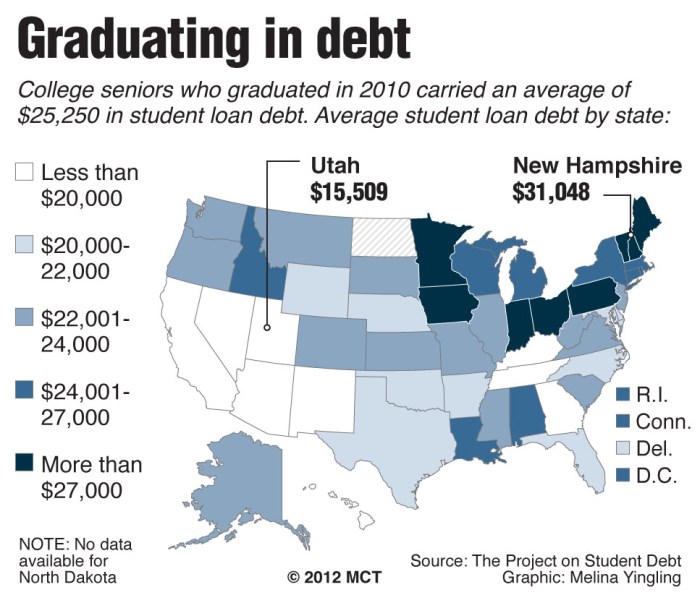

Cost of Attendance and Loan Amounts

The cost of attendance (COA) at a college or university significantly impacts the maximum loan amount a student can receive. COA includes tuition, fees, room and board, books, and other necessary expenses. Generally, students attending more expensive institutions can borrow more, as their overall educational costs are higher. For instance, a student at a private university with a high COA will likely have a higher borrowing limit than a student attending a less expensive public institution in the same state. The government and private lenders base loan limits, at least partially, on the school’s certified COA, ensuring the loan amount is sufficient to cover the student’s educational needs.

Family Income and Loan Eligibility

A student’s family income plays a crucial role in determining their eligibility for federal student loans and the amount they can borrow. Federal loan programs often use a student’s family income (as reported on the FAFSA) to calculate their Expected Family Contribution (EFC). A lower EFC generally translates to higher eligibility for need-based federal loans. Students from families with higher incomes may still be eligible for loans, but their maximum borrowing limits may be lower compared to students from lower-income families. This is because the principle behind need-based aid is to assist students who require financial support to pursue higher education.

Financial Aid Package and Loan Amounts

A student’s overall financial aid package, which includes grants and scholarships, directly affects their need for loans and consequently, the maximum amount they can borrow. Grants and scholarships are forms of financial aid that do not need to be repaid. Because they reduce the overall cost of attendance, a student’s need for loans decreases. For example, a student who receives a substantial scholarship might only need to borrow a small amount to cover the remaining expenses, even if their COA is high. Therefore, the availability and amount of non-loan aid significantly influence the maximum loan amount a student will ultimately receive.

Factors Affecting Borrowing Limits: Summary Table

| Factor | Explanation |

|---|---|

| Cost of Attendance (COA) | The total cost of attending a college or university, including tuition, fees, room and board, books, and other expenses. Higher COA generally allows for higher borrowing limits. |

| Family Income | Used to calculate the Expected Family Contribution (EFC), which determines eligibility for need-based federal student loans. Lower EFC typically leads to higher loan eligibility. |

| Financial Aid Package (Grants & Scholarships) | Reduces the overall cost of attendance, thus decreasing the amount of loans needed. A larger financial aid package leads to lower loan amounts. |

| Enrollment Status | Full-time students generally have higher borrowing limits than part-time students, reflecting the increased costs associated with full-time enrollment. |

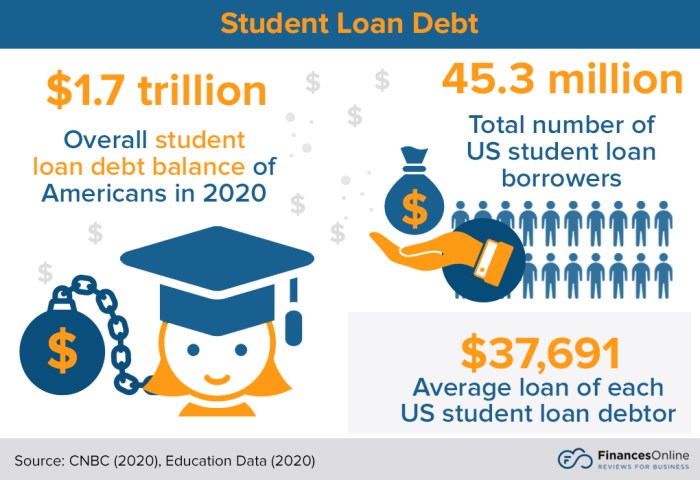

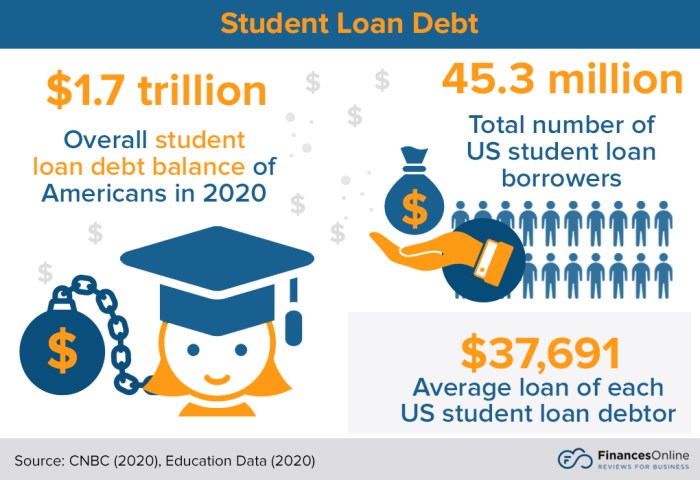

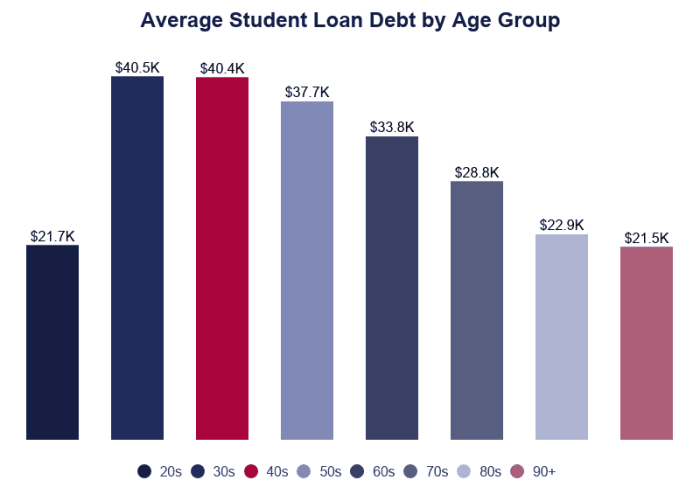

Impact of Loan Limits on Student Debt

The existence of maximum loan limits, while intended to protect students from crippling debt, can ironically contribute to the overall student debt problem. High limits, even with responsible borrowing, can encourage students to borrow more than they truly need, leading to larger loan balances and potentially longer repayment periods. Understanding the interplay between loan limits and debt accumulation is crucial for students navigating the complexities of higher education financing.

High loan limits can significantly impact student debt accumulation and future financial well-being. Students may overestimate their need for funds, believing they can easily repay larger loans. This can lead to a lifestyle inflation during their studies, where expenses increase to match the increased available funds, rather than focusing on cost-effective strategies. The consequence is often higher debt upon graduation, which can delay major life milestones such as homeownership, starting a family, or even retirement savings. The pressure to maintain a certain lifestyle while accumulating substantial debt can create significant financial stress long after graduation.

Responsible Borrowing and Exceeding Loan Limits

Borrowing responsibly requires careful planning and a realistic assessment of future earning potential. Exceeding the maximum loan amount, whether through multiple loan types or private loans with higher interest rates, can dramatically increase the overall cost of education. This can lead to a snowball effect, where interest accrues quickly, making the debt even more challenging to repay. Students who exceed their loan limits often find themselves struggling to meet minimum monthly payments, potentially impacting their credit score and future borrowing opportunities. For example, a student who borrows the maximum amount for four years of undergraduate study and then needs additional funds for graduate school could face a substantial debt burden with limited options for repayment.

Strategies for Effective Student Loan Debt Management

Effective student loan debt management begins long before graduation. Creating a detailed budget that tracks income and expenses is fundamental. Students should explore various repayment plans, such as income-driven repayment (IDR) plans, which adjust monthly payments based on income and family size. Consolidating multiple loans into a single loan can simplify repayment and potentially lower interest rates. Finally, actively engaging with loan servicers to understand repayment options and address any challenges is crucial. For instance, a student could explore refinancing options after graduation to secure a lower interest rate, reducing the overall cost of repayment.

Minimizing Reliance on Loans

Careful planning and proactive measures can significantly reduce the need for student loans.

The following steps can help students minimize their reliance on loans:

- Maximize Financial Aid: Complete the FAFSA (Free Application for Federal Student Aid) diligently to access grants, scholarships, and federal student loans. Explore all available institutional aid.

- Explore Scholarships and Grants: Actively search for external scholarships and grants through organizations, communities, and professional associations.

- Work Part-Time or Full-Time: Earning money during the academic year or summer breaks can significantly reduce the need to borrow.

- Attend a Less Expensive Institution: Consider community colleges for the first two years of study or explore affordable online programs. Compare the overall cost of attendance, including tuition, fees, room, and board, between institutions.

- Live at Home or Find Affordable Housing: Reducing living expenses can free up funds to pay for tuition and fees.

Illustrative Examples of Loan Scenarios

Understanding the different ways student loan amounts can vary based on individual circumstances is crucial for effective financial planning. The following scenarios illustrate how factors like family income and additional financial aid can significantly impact a student’s overall borrowing needs and long-term financial outlook.

Scenario 1: Maximum Loan Amount

This scenario depicts a student who qualifies for and receives the maximum federal student loan amount allowed for their year of study. Let’s assume this student is an independent undergraduate pursuing a four-year degree and is eligible for the maximum federal subsidized and unsubsidized loan amounts. Their total cost of attendance is $25,000 per year, including tuition, fees, room, and board. They receive no grants or scholarships. Their federal loan amount covers a significant portion of their educational expenses, but they may still need to consider other financing options or work to cover the remaining costs. Over four years, this could lead to substantial student loan debt requiring a robust repayment plan post-graduation. The long-term financial implications include potentially delayed large purchases like a house or car, and a longer period of financial constraint while repaying the loans.

Scenario 2: Lower Loan Amount Due to Family Income

In this scenario, a student’s family income is considered when determining their eligibility for federal student aid. Their family’s income falls below a certain threshold, limiting their eligibility for federal loans. Let’s say this student’s total cost of attendance is also $25,000 per year, but due to their family’s income, their federal loan eligibility is reduced. They might only receive $10,000 per year in federal loans. This requires them to explore additional avenues for funding, such as part-time employment, private loans (which may have higher interest rates), or increased reliance on family contributions. The long-term implications could involve a higher reliance on family support, potentially slower repayment of loans due to lower income after graduation, or a need to adjust their career plans to accommodate their debt burden.

Scenario 3: Combination of Grants, Scholarships, and Loans

This scenario highlights the benefits of a diverse financial aid package. This student’s total cost of attendance is again $25,000 per year. However, they receive $5,000 annually in grants and $2,000 annually in scholarships. This reduces the amount they need to borrow. They may only need to take out $18,000 in federal loans annually. The long-term financial implications of this scenario are significantly more positive. With less debt accumulated, they will have more financial flexibility after graduation and can more easily meet major life goals. This also reduces the stress and anxiety associated with substantial student loan debt.

Comparison of Loan Scenarios

| Scenario | Total Cost of Attendance (Annual) | Loan Amount (Annual) | Grant/Scholarship Amount (Annual) | Remaining Balance (Annual) |

|---|---|---|---|---|

| Maximum Loan | $25,000 | $25,000 (Assuming maximum eligibility) | $0 | $0 |

| Lower Loan (Income-Based) | $25,000 | $10,000 | $0 | $15,000 |

| Grants, Scholarships, and Loans | $25,000 | $18,000 | $7,000 | $0 |

Summary

Successfully navigating the student loan process requires a comprehensive understanding of available resources and responsible borrowing practices. By carefully considering your financial needs, exploring all available aid options (including grants and scholarships), and understanding the implications of both federal and private loans, you can create a financial plan that supports your educational goals without overwhelming your future financial stability. Remember, responsible borrowing is key to a successful and sustainable path towards achieving your academic aspirations.

General Inquiries

What happens if I borrow more than the maximum amount?

Exceeding the maximum loan amount can lead to higher debt burdens, impacting your credit score and future financial opportunities. It’s crucial to borrow responsibly and only take out what you genuinely need.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing options exist, both through private lenders and sometimes government programs. However, carefully compare terms and interest rates before refinancing, as it might impact your eligibility for certain repayment plans.

Are there any penalties for not repaying my student loans?

Failure to repay your student loans can result in late fees, damage to your credit score, wage garnishment, and even legal action. Explore repayment options if you’re struggling to make payments.

How do I apply for federal student loans?

You apply for federal student loans through the Free Application for Federal Student Aid (FAFSA).