Navigating the complexities of student loans can feel overwhelming, especially when understanding the maximum amounts you can borrow annually. This guide aims to demystify the process, providing a clear overview of federal and private loan limits for both undergraduate and graduate students. We’ll explore the factors influencing loan eligibility, highlighting the crucial differences between dependent and independent student statuses, and delve into the long-term implications of borrowing the maximum amount. Understanding these nuances is vital for responsible financial planning during and after your education.

From understanding annual and aggregate limits to exploring the impact of your academic progress and cost of attendance, we’ll equip you with the knowledge to make informed decisions about your student loan borrowing. We’ll also cover the key distinctions between federal and private loans, including interest rates and repayment options, helping you weigh the pros and cons of each. Ultimately, our goal is to empower you to approach student loan financing strategically and confidently.

Federal Student Loan Limits

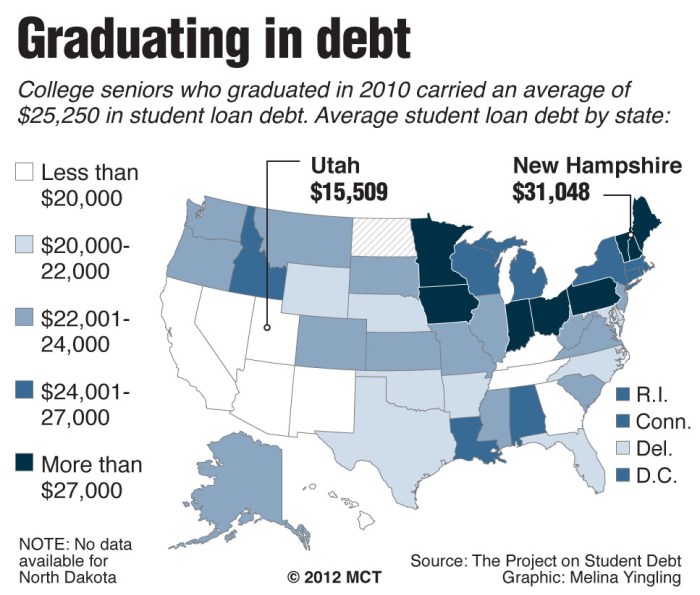

Understanding federal student loan limits is crucial for prospective college students and their families. These limits, set annually by the federal government, determine the maximum amount of federal student loan money a student can borrow for their undergraduate education. The amounts vary depending on several factors, primarily the student’s dependency status and the type of loan.

Annual and Aggregate Loan Limits for Undergraduate Students

Federal student loan limits are categorized by annual and aggregate amounts. The annual limit represents the maximum a student can borrow in a single academic year, while the aggregate limit represents the total amount a student can borrow over their entire undergraduate career. These limits are designed to help students finance their education responsibly while preventing excessive debt accumulation. It’s important to remember that these are maximums; students may borrow less than the maximum amount.

Differences in Loan Limits for Dependent and Independent Students

The federal government distinguishes between dependent and independent students when determining loan eligibility and limits. Dependent students are generally those who are claimed as dependents on their parents’ or guardians’ tax returns. Independent students, on the other hand, are generally those who are not claimed as dependents. Independent students are typically eligible to borrow higher amounts due to the assumption of greater financial responsibility.

Subsidized and Unsubsidized Loan Limits

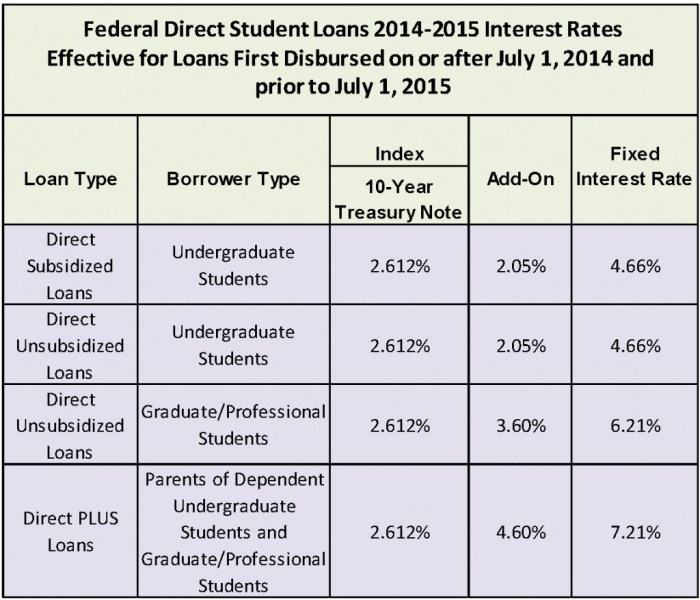

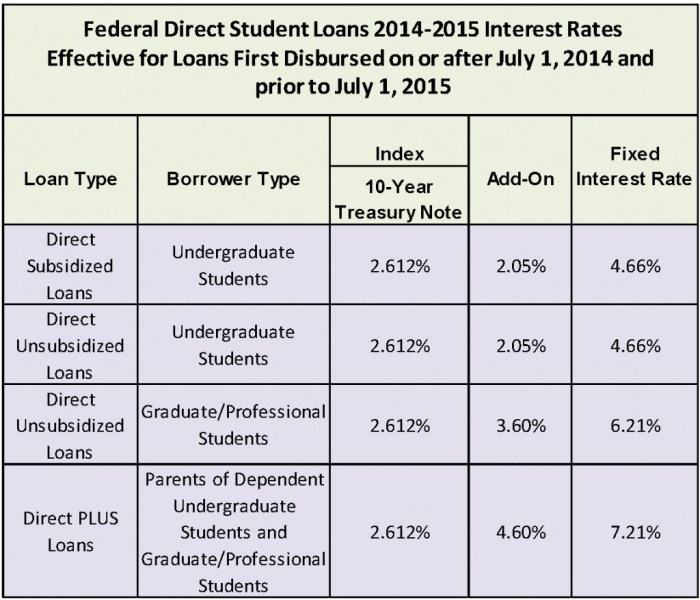

Federal student loans are offered in two main categories: subsidized and unsubsidized. Subsidized loans have the benefit of the government paying the interest while the student is enrolled at least half-time. Unsubsidized loans accrue interest from the moment the loan is disbursed, regardless of the student’s enrollment status. Both subsidized and unsubsidized loans have annual and aggregate limits, and these limits are the same for both types of loans. The distinction lies in the interest accrual, not the maximum loan amount.

Maximum Loan Amounts by Year of Undergraduate Study

The following table summarizes the maximum loan amounts for dependent and independent undergraduate students for each year of study. These figures are subject to change, so it’s always recommended to consult the official Federal Student Aid website for the most up-to-date information. Remember that these are maximum amounts, and students may borrow less.

| Year | Dependent Student Limit | Independent Student Limit | Total Cumulative Limit |

|---|---|---|---|

| Freshman | $5,500 | $9,500 | $5,500 |

| Sophomore | $5,500 | $10,500 | $11,000 |

| Junior | $5,500 | $10,500 | $16,500 |

| Senior | $5,500 | $10,500 | $22,000 |

Graduate Student Loan Limits

Securing funding for graduate education often involves navigating the complexities of student loans. Understanding the available loan limits and eligibility criteria is crucial for responsible financial planning. This section details the maximum loan amounts available to graduate students, differentiating between federal and private options and highlighting key factors influencing eligibility.

Annual and Aggregate Loan Limits for Graduate Students

Federal graduate student loan limits are higher than those for undergraduate students, reflecting the typically greater cost of graduate programs. The annual limit for federal Direct Unsubsidized Loans and Direct PLUS Loans combined varies depending on enrollment status and whether the student is dependent or independent. There’s also an aggregate limit, representing the total amount a student can borrow over their entire graduate career. These limits are subject to change, so consulting the official Federal Student Aid website for the most up-to-date information is essential. For example, a graduate student might be eligible for a significantly higher annual loan amount compared to an undergraduate student pursuing a bachelor’s degree. This reflects the increased cost of tuition, fees, and living expenses often associated with graduate studies.

Loan Limits Across Different Graduate Programs

While the general guidelines for federal loan limits apply across various graduate programs (Master’s, PhD, etc.), the actual amount a student can borrow may vary depending on their program’s cost of attendance. A PhD program, for instance, which typically spans several years, may necessitate a larger total loan amount compared to a shorter Master’s program. The institution’s cost of attendance is a key factor determining the total loan need and, consequently, the amount a student might borrow. This is because the loan amount is often calculated based on the difference between the cost of attendance and other financial aid received.

Factors Influencing Graduate Student Loan Eligibility

Several factors influence a graduate student’s eligibility for federal and private loans. These include credit history (particularly for PLUS loans), enrollment status (full-time versus part-time), and satisfactory academic progress. Maintaining a minimum GPA and completing coursework within a reasonable timeframe are essential for continued eligibility. Furthermore, students must demonstrate a need for the loan amount requested. This often involves completing a FAFSA (Free Application for Federal Student Aid) form, which takes into account other sources of funding, such as scholarships and grants. Private lenders may have additional eligibility requirements, often focusing on creditworthiness and debt-to-income ratios.

Federal and Private Graduate Loan Limits

- Federal Direct Unsubsidized Loans: Annual limits vary depending on the student’s year in graduate school and their dependency status. Aggregate limits also exist. These loans accrue interest while the student is in school.

- Federal Direct PLUS Loans: These loans are available to graduate students (and parents of undergraduate students) and have annual and aggregate limits. Credit checks are required, and borrowers are responsible for all interest charges.

- Private Graduate Loans: Private lenders set their own loan limits, interest rates, and eligibility criteria. These limits are highly variable and depend heavily on the borrower’s credit history, income, and the specific lender’s policies. These loans may offer higher loan amounts but often come with higher interest rates.

Private Student Loan Options

Private student loans offer an alternative funding source for higher education expenses beyond federal loans. These loans are offered by private lenders, such as banks and credit unions, and often have varying terms and conditions compared to their federal counterparts. Understanding the nuances of private student loans is crucial for making informed borrowing decisions.

Private student loans are not subject to the same regulations and protections as federal loans. This means that interest rates, fees, and repayment terms can vary significantly depending on the lender and the borrower’s creditworthiness. It’s essential to compare offers from multiple lenders before making a commitment.

Private Student Loan Interest Rates and Repayment Terms

Interest rates on private student loans are typically variable, meaning they can fluctuate over the life of the loan, or fixed, remaining constant throughout the loan term. The interest rate offered will depend on several factors, including the borrower’s credit score, credit history, the loan amount, and the repayment term. Longer repayment terms generally result in lower monthly payments but lead to higher overall interest paid. For example, a 10-year repayment plan will have lower monthly payments than a 5-year plan, but the total interest paid will be substantially higher. Some private lenders may offer options such as interest-only payments during school or a grace period before repayment begins. However, these options should be carefully considered as they can ultimately increase the total cost of the loan.

Risks and Benefits of Private Student Loans

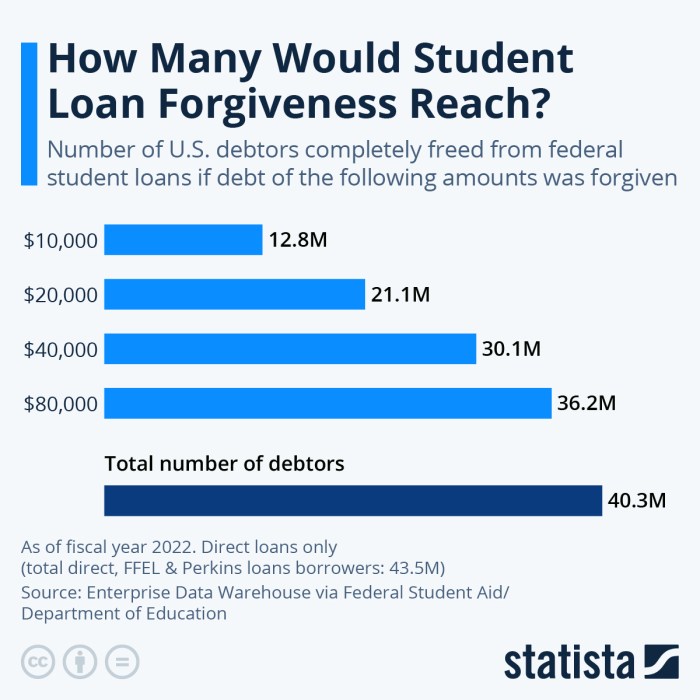

Borrowing from private lenders presents both advantages and disadvantages. A significant benefit is the potential for higher loan amounts than what’s available through federal programs. However, this comes with increased risk. Private loans often carry higher interest rates than federal loans, potentially leading to significantly higher total repayment costs. Furthermore, private lenders may not offer the same borrower protections as federal loans, such as income-driven repayment plans or loan forgiveness programs. In the event of default, the consequences can be severe, including damage to credit scores and potential legal action. On the other hand, a strong credit history and a co-signer with good credit can help secure more favorable terms.

Key Differences Between Federal and Private Student Loans

Understanding the differences between federal and private student loans is vital for responsible borrowing. The following points highlight key distinctions:

The table below summarizes the key differences:

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower and fixed or variable depending on the loan type | Generally higher and can be fixed or variable |

| Loan Limits | Set by the government and vary by year and student status; subject to change | Set by the lender; may be higher than federal limits, but subject to borrower’s creditworthiness |

| Repayment Options | Multiple repayment plans available, including income-driven repayment | Fewer repayment options; typically fixed repayment schedules |

| Borrower Protections | Strong borrower protections, including deferment and forbearance options | Fewer borrower protections; default can severely impact credit |

| Eligibility | Based on financial need and enrollment status | Based on creditworthiness and income; co-signer often required |

Final Summary

Securing the funding necessary for higher education is a significant step, and understanding your student loan options is crucial for successful financial planning. By carefully considering federal versus private loans, annual and aggregate limits, and the long-term implications of your borrowing decisions, you can create a roadmap for responsible debt management. Remember, utilizing available resources and seeking guidance when needed can greatly enhance your ability to navigate this process effectively. Making informed choices now will pave the way for a brighter financial future.

Popular Questions

What happens if I don’t meet satisfactory academic progress requirements?

Failure to meet satisfactory academic progress can result in a reduction or termination of your student loan eligibility.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing your student loans with a private lender may offer a lower interest rate, but it’s crucial to compare offers carefully and understand the terms and conditions.

Are there any income-driven repayment plans available for federal student loans?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Where can I find a comprehensive list of loan forgiveness programs?

The Federal Student Aid website (studentaid.gov) provides detailed information on federal loan forgiveness programs and eligibility criteria.