Navigating the complexities of student loan repayment can feel overwhelming, especially when considering the potential tax benefits available. Understanding the maximum student loan tax deduction is crucial for borrowers seeking to minimize their tax burden and optimize their financial well-being. This guide provides a clear and concise overview of the deduction, exploring its eligibility requirements, impact across different income levels, and strategic approaches to maximizing its benefits.

The student loan interest deduction offers a valuable opportunity to reduce your annual tax liability. However, its intricacies, including adjusted gross income (AGI) limitations and specific filing requirements, can make it challenging to fully utilize. This comprehensive guide aims to demystify this process, empowering you to make informed decisions about your student loan repayment strategy and maximize your potential tax savings.

Understanding the Maximum Student Loan Tax Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your tax burden, providing valuable financial relief for those managing student loan debt. Understanding the rules and limitations is crucial to maximizing this benefit.

Current Rules and Regulations Governing the Maximum Student Loan Interest Deduction

The student loan interest deduction is a federal tax deduction. The maximum deduction amount is $2,500 per year, regardless of how much interest you actually paid. This deduction is an above-the-line deduction, meaning it’s subtracted from your gross income before calculating your adjusted gross income (AGI). It’s important to note that this deduction is not refundable; you can only reduce your tax liability to zero. Any excess deduction cannot be refunded to you. The deduction is claimed on Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Specific rules and regulations are subject to change, so always consult the most current IRS guidelines.

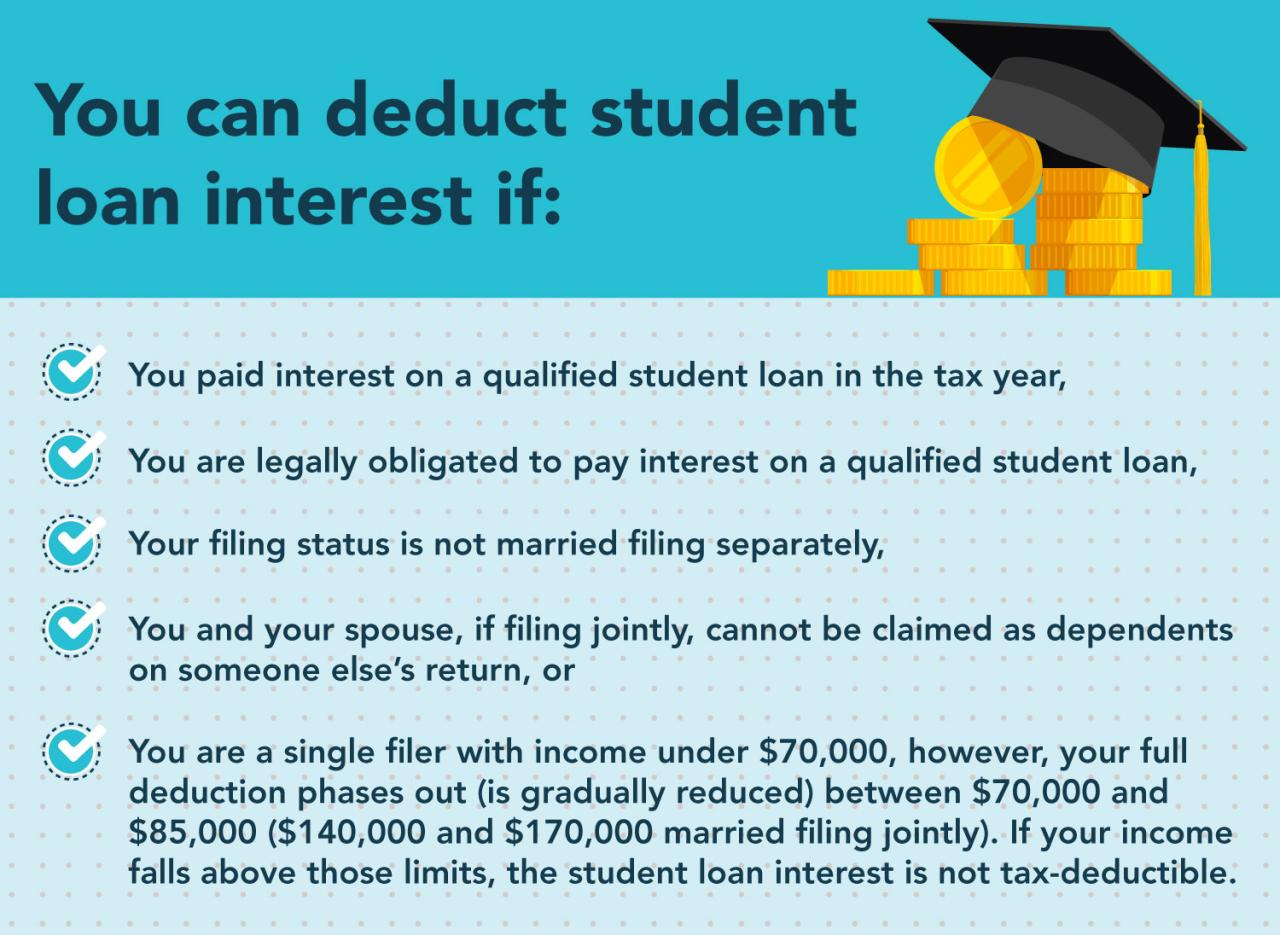

Eligibility Requirements for Claiming the Deduction

To claim the student loan interest deduction, you must meet several criteria. First, the student loans must be taken out for yourself, your spouse, or a dependent. Second, you must be legally obligated to pay the loan. Third, the loan must be used to pay for qualified education expenses, including tuition, fees, room and board, and other necessary expenses. Crucially, your modified adjusted gross income (MAGI) must be below a certain threshold. These limits vary depending on your filing status and are adjusted annually for inflation. For example, in a given year, a single filer might be eligible if their MAGI is below $85,000, while a married filing jointly filer might have a higher limit, such as $170,000. These limits are subject to change; check the IRS website for the most up-to-date information. Finally, you must itemize your deductions if your total itemized deductions exceed your standard deduction.

Step-by-Step Guide on Claiming the Deduction on a Federal Tax Return

Claiming the student loan interest deduction is a straightforward process. First, gather all your student loan interest statements from the year in question. These statements will detail the total amount of interest you paid. Next, determine your modified adjusted gross income (MAGI). This is your adjusted gross income (AGI) with certain deductions added back in. Ensure your MAGI falls below the specified limit for your filing status. If eligible, complete Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Enter the total amount of student loan interest paid on the appropriate line. Finally, review your completed tax return carefully before filing.

Comparison of the Student Loan Interest Deduction to Other Tax Benefits for Education

The student loan interest deduction is just one of several tax benefits available for education. Understanding the differences between these benefits can help you maximize your savings.

| Benefit Name | Eligibility Requirements | Maximum Deduction | Tax Form |

|---|---|---|---|

| Student Loan Interest Deduction | Specific AGI limits, legally obligated to repay student loans for qualified education expenses | $2,500 | Form 1040, Schedule 1 |

| American Opportunity Tax Credit (AOTC) | Student pursuing undergraduate education, certain income limits | Up to $2,500 per student | Form 8863 |

| Lifetime Learning Credit (LLC) | Student pursuing undergraduate or graduate education | Up to $2,000 per tax return | Form 8863 |

| IRA Deduction (for education savings) | Contributions to a traditional IRA | Up to the maximum IRA contribution limit | Form 1040 |

Impact of the Deduction on Different Income Levels

The student loan interest deduction, while beneficial, isn’t universally accessible at its maximum potential. The amount a taxpayer can deduct is significantly influenced by their Adjusted Gross Income (AGI), creating a tiered system of benefits. Understanding this relationship is crucial for accurately assessing the financial impact of the deduction on different income brackets.

The deduction’s effectiveness varies dramatically depending on a taxpayer’s AGI. The maximum deduction amount is phased out for higher-income taxpayers, meaning the benefit decreases as income rises. This phase-out significantly affects the overall tax savings, with high-income earners potentially receiving a much smaller deduction, or none at all, compared to those with lower incomes. This disparity highlights the progressive nature of the deduction, aiming to provide more significant relief to those who need it most.

AGI Limits and Tax Savings

The Internal Revenue Service (IRS) sets specific AGI thresholds that determine the eligibility and amount of the student loan interest deduction. For the 2023 tax year, a single filer could deduct the full amount if their AGI is below $85,000. For married couples filing jointly, the threshold is $170,000. Above these limits, the deduction is gradually reduced until it completely disappears at higher AGI levels. For instance, a single filer with an AGI of $95,000 might see a significantly reduced deduction, while someone earning $150,000 might not be eligible at all. This means a taxpayer with an AGI just below the threshold could save substantially more than a taxpayer with an AGI just above it, even if their student loan interest payments are identical.

Effective Tax Savings for High-Income vs. Low-Income Taxpayers

Consider two taxpayers: Sarah, a single filer with an AGI of $70,000 and $2,500 in student loan interest, and David, a single filer with an AGI of $90,000 and the same $2,500 in student loan interest. Sarah, falling well below the AGI limit, can deduct the full $2,500. Assuming a 22% marginal tax bracket, her tax savings would be $550 ($2,500 x 0.22). David, however, is above the threshold, and his deduction will be partially or completely phased out, resulting in significantly less tax savings, potentially none at all. This illustrates the considerable difference in effective tax relief based solely on AGI.

Financial Implications for Different Student Loan Borrowers

The student loan interest deduction’s financial impact varies widely depending on individual circumstances. Borrowers with substantial student loan debt and lower AGIs will likely experience the most significant benefit, potentially reducing their overall tax liability considerably. Conversely, high-income borrowers with smaller student loan balances may receive minimal or no benefit. Furthermore, the deduction’s value can change year to year based on the taxpayer’s income and the IRS’s AGI thresholds, making consistent long-term financial planning challenging.

AGI and Maximum Deduction Amount

| Adjusted Gross Income (AGI) | Maximum Deduction (Single Filers) | Maximum Deduction (Married Filing Jointly) |

|---|---|---|

| Below $85,000 | $2,500 | $5,000 |

| $85,000 – $95,000 | Partially Phased Out | Partially Phased Out |

| Above $95,000 | $0 | Above $170,000: $0 |

| Above $170,000 | N/A | Partially Phased Out |

Note: This chart illustrates a simplified representation and does not account for potential changes in AGI thresholds or tax laws. Actual phase-out calculations are more complex and should be verified with the IRS guidelines. The actual amount deductible will depend on the taxpayer’s individual circumstances and AGI.

Changes and Trends in the Student Loan Interest Deduction

The student loan interest deduction, while intended to ease the financial burden of higher education, has seen significant changes over time. These changes reflect evolving economic conditions, shifting political priorities, and ongoing debates about the fairness and effectiveness of the deduction itself. Understanding these historical shifts and potential future alterations is crucial for anyone planning to utilize this tax benefit.

The maximum deduction amount and eligibility requirements haven’t remained static. Instead, they’ve been subject to adjustments based on various factors, influencing the overall accessibility and value of the deduction for taxpayers. These alterations have a direct impact on the number of people who qualify and the amount of tax relief they receive.

Historical Changes to the Deduction

The student loan interest deduction was first introduced in 1986 as part of the Tax Reform Act. Initially, the maximum deduction was significantly lower than it is today, and the eligibility criteria were also more restrictive. Over the years, Congress has modified both the maximum allowable deduction and the income thresholds for eligibility. For example, the maximum deduction amount has been adjusted periodically, sometimes increasing and sometimes decreasing, depending on the prevailing economic climate and legislative priorities. Similarly, the income limits for claiming the deduction have fluctuated, making it accessible to a broader or narrower range of taxpayers at different points in time. These changes highlight the dynamic nature of the tax code and the ongoing process of legislative refinement.

Proposed Legislative Changes and Future Discussions

There’s ongoing debate about the future of the student loan interest deduction. Some proposals suggest increasing the maximum deduction amount to provide greater relief to borrowers. Others advocate for modifying the eligibility criteria, perhaps expanding access to more individuals or adjusting income limits. Conversely, some lawmakers have proposed eliminating or significantly reducing the deduction as a means of budget savings or to encourage other avenues of student financial aid. These discussions highlight the tension between providing tax relief for student loan borrowers and broader budgetary concerns. For instance, the debate around simplifying the tax code sometimes includes the student loan interest deduction as a potential target for reform or elimination, reflecting a broader discussion about the complexity and efficiency of the current tax system.

Impact of Economic Factors on the Deduction’s Real Value

Inflation significantly impacts the real value of the student loan interest deduction. Even if the maximum deduction amount remains unchanged, its purchasing power diminishes as inflation erodes the value of money. For example, a $2,500 deduction might have represented a larger share of a borrower’s overall tax liability in the past, compared to its current relative value. This decrease in real value necessitates considering the inflation-adjusted amount when assessing the actual benefit received by taxpayers. This is especially relevant given the persistent rise in tuition costs and the overall increase in student loan debt, further highlighting the need to consider the actual benefit the deduction provides in relation to the rising costs of higher education.

Timeline of Key Changes and Events

To illustrate the evolution of the student loan interest deduction, a timeline is helpful:

| Year | Event | Description |

|---|---|---|

| 1986 | Student Loan Interest Deduction Introduced | The deduction is initially established as part of the Tax Reform Act. |

| [Insert Year of Significant Change 1] | [Description of Change 1] | [Details of the change, e.g., increase in maximum deduction amount or change in eligibility criteria] |

| [Insert Year of Significant Change 2] | [Description of Change 2] | [Details of the change, e.g., adjustment to income limits or other relevant modifications] |

| [Insert Year of Significant Change 3] | [Description of Change 3] | [Details of the change, e.g., legislative proposals for reform or elimination] |

Comparison with Other Student Loan Repayment Assistance Programs

The student loan interest deduction, while helpful, is just one piece of the puzzle when it comes to managing student loan debt. Several other federal and state programs offer different forms of assistance, each with its own set of eligibility requirements and benefits. Understanding these options allows borrowers to strategically choose the best approach for their individual circumstances. This section will compare and contrast the student loan interest deduction with other prominent programs, highlighting their advantages and disadvantages.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable, especially during periods of lower income. However, IDR plans typically extend the repayment period, leading to potentially higher total interest paid over the life of the loan. Eligibility requires having federal student loans and completing an application process. Different IDR plans exist (like ICR, PAYE, REPAYE, and IBR), each with its own specific income calculations and repayment terms.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance of your federal student loans after you’ve made 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization. This program offers significant long-term debt relief for those in public service careers. However, the eligibility criteria are stringent, and many borrowers struggle to meet all the requirements, including maintaining continuous employment and making consistent payments under an eligible IDR plan. Furthermore, recent changes have tightened eligibility requirements.

Key Features Comparison

Understanding the differences between these programs is crucial for effective debt management. The following table summarizes key features and potential benefits:

| Program | Eligibility | Advantages | Disadvantages |

|---|---|---|---|

| Student Loan Interest Deduction | Tax filers with student loan interest payments, subject to income limits. | Reduces taxable income, resulting in a lower tax bill. | Limited deduction amount, income limitations may exclude many borrowers. |

| Income-Driven Repayment (IDR) Plans | Federal student loan borrowers. | Lower monthly payments, more manageable debt. | Extended repayment period, potentially higher total interest paid. |

| Public Service Loan Forgiveness (PSLF) | Federal student loan borrowers employed full-time by a qualifying employer for 10 years, making consistent payments under an IDR plan. | Potential for complete loan forgiveness. | Stringent eligibility requirements, complex application process, and potential for delays in forgiveness. |

Strategies for Maximizing the Student Loan Interest Deduction

Maximizing your student loan interest deduction requires careful planning and accurate record-keeping. Understanding the rules and employing effective strategies can significantly reduce your tax liability. This section Artikels practical steps to help you claim the maximum allowable deduction.

The student loan interest deduction allows taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. However, the amount deductible is subject to several limitations, including adjusted gross income (AGI) and the total amount of interest paid. Therefore, understanding these limitations and employing strategies to work within them is crucial for maximizing the deduction.

Accurate Tracking of Student Loan Interest Payments

Maintaining meticulous records of your student loan interest payments is paramount. This involves gathering all payment statements, bank statements, or any other documentation that verifies the interest paid on your qualified student loans throughout the year. Organize these documents chronologically for easy access during tax preparation. Consider using a dedicated spreadsheet or a personal finance software program to categorize and track your payments. This organized approach minimizes the risk of errors and ensures a smooth and accurate tax filing process. Keep these records for at least three years after filing your tax return, in case of an audit.

Accurate Reporting of Student Loan Interest on Tax Returns

Accurate reporting of student loan interest on your tax return is critical for claiming the deduction. The information should align perfectly with the documentation you’ve meticulously maintained. Use IRS Form 1098-E, which your lender provides, to report the interest paid. Carefully review this form to ensure accuracy, and double-check that the reported amount matches your records. If there’s a discrepancy, contact your lender immediately to resolve the issue before filing your tax return. Inaccurate reporting can lead to delays in processing or even penalties. Familiarize yourself with the instructions accompanying Form 1098-E to ensure proper completion.

Tax Planning Strategies to Enhance the Student Loan Interest Deduction

Strategic tax planning can amplify the benefits of the student loan interest deduction. One key strategy involves making larger student loan payments earlier in the year, potentially maximizing the deduction within the AGI limits. For example, if you anticipate being close to the AGI threshold, making larger payments in the early months could help you stay within the limits and benefit from the full deduction. Additionally, consider bundling your student loan payments with other deductible expenses to potentially reduce your overall tax burden. Consult with a qualified tax professional to explore additional tax planning strategies tailored to your specific financial situation and income level. They can provide personalized advice on optimizing your deductions and minimizing your tax liability.

Illustrative Examples of Tax Scenarios

Understanding the student loan interest deduction requires examining its application in various real-world scenarios. The deduction’s impact varies significantly based on factors like income, filing status, and the amount of interest paid. The following examples illustrate how these factors influence the deduction’s effectiveness.

Single Filer with Moderate Income

Let’s consider Sarah, a single filer who paid $1,500 in student loan interest during the tax year. Her adjusted gross income (AGI) is $60,000. Since her AGI is below the phaseout threshold (which varies annually but is generally above $80,000 for single filers), she can deduct the full $1,500. This will directly reduce her taxable income by $1,500, resulting in a lower tax liability. The exact tax savings will depend on her applicable tax bracket. Assuming a 22% marginal tax rate, her tax savings would be approximately $330 ($1,500 x 0.22).

Married Filing Jointly with High Income

Now, let’s look at David and Emily, a married couple filing jointly. They paid a combined $2,000 in student loan interest. Their AGI is $150,000. Because their AGI exceeds the phaseout threshold for married couples filing jointly (this threshold also varies annually, typically above $160,000), they may not be able to deduct the full amount. The deduction is gradually phased out as AGI increases beyond the threshold. Depending on the exact phaseout rules for the year, they might be able to deduct a portion of the $2,000, or none at all. This highlights the importance of understanding the phaseout rules for your specific income level and filing status.

Head of Household with Low Income

Consider Michael, a head of household filer who paid $800 in student loan interest. His AGI is $40,000. Because his AGI is well below the phaseout threshold for head of household filers, he can deduct the full $800. This will reduce his taxable income, leading to a lower tax bill. The amount of tax savings will be determined by his marginal tax rate. For example, if his marginal tax rate is 12%, his tax savings would be approximately $96 ($800 x 0.12).

Impact of Filing Status

These examples demonstrate how filing status significantly impacts the student loan interest deduction. Single filers, married filing jointly, and head of household filers have different AGI phaseout thresholds. A taxpayer’s filing status determines the applicable AGI threshold, which in turn dictates the extent to which they can claim the deduction. It is crucial to file using the correct status to ensure accurate calculation of the deduction.

Impact of Income Level

The examples also showcase the influence of income level on the deduction. Taxpayers with higher AGIs are more likely to encounter the phaseout limitations, reducing or eliminating their ability to claim the full deduction. Conversely, taxpayers with lower AGIs are more likely to claim the full deduction, maximizing its tax-saving potential. It’s vital to understand your income bracket and the relevant phaseout rules to accurately determine your potential deduction.

Summary

Successfully navigating the student loan interest deduction requires a thorough understanding of its rules and regulations, along with careful planning and accurate record-keeping. By leveraging the strategies and insights presented in this guide, borrowers can confidently claim this valuable tax benefit, reducing their overall tax burden and accelerating their path towards financial freedom. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

Detailed FAQs

Can I deduct student loan interest if I’m not itemizing?

No, the student loan interest deduction is an itemized deduction. You must itemize deductions on Schedule A (Form 1040) to claim it.

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest paid during the tax year, regardless of when the loan was paid off.

My AGI is slightly above the limit. Are there any exceptions?

No, the AGI limits are generally strict. There are no exceptions based on minor exceedances. If your AGI is above the limit, you cannot claim the deduction.

What form do I use to claim the student loan interest deduction?

You claim the deduction on Form 1040, Schedule 1 (Additional Income and Adjustments to Income).