Navigating the complexities of higher education financing can be daunting, particularly when understanding the nuances of subsidized student loans. This guide delves into the intricacies of maximizing your subsidized student loan, exploring eligibility criteria, repayment plans, and potential long-term financial implications. We’ll examine the maximum loan amounts available to undergraduate and graduate students, comparing them to alternative funding options and providing practical examples to illustrate real-world scenarios.

Understanding the maximum subsidized student loan amount is crucial for effective financial planning during and after your studies. This guide provides a clear roadmap to help you make informed decisions about your educational financing, empowering you to manage your debt effectively and achieve your academic goals.

Eligibility Criteria for Maximum Subsidized Student Loan

Securing the maximum amount of subsidized federal student loans hinges on several factors, primarily your financial need and your enrollment status. The process isn’t uniform across all states or institutions, leading to some variations in eligibility requirements. Understanding these nuances is crucial for maximizing your financial aid.

Income Thresholds and Other Requirements

The primary determinant of your eligibility for the maximum subsidized loan amount is your demonstrated financial need. This is calculated using the Free Application for Federal Student Aid (FAFSA), which considers your family’s income, assets, and the number of family members in college. The higher your demonstrated financial need, the greater the potential loan amount. Beyond income, other factors influencing eligibility include your enrollment status (full-time versus part-time), your academic progress (maintaining satisfactory academic progress), and your citizenship status (you must be a U.S. citizen or eligible non-citizen). There are also limits on the total amount of subsidized loans a student can receive over their educational career.

Variations in Eligibility Across States and Institutions

While the federal government sets the overall guidelines for subsidized loans, individual states and educational institutions may have additional requirements or processes. For example, some states may offer supplemental state grants or scholarships that can impact the overall financial aid package, indirectly influencing the amount of subsidized loans needed. Similarly, private institutions may have their own merit-based or need-based aid programs that affect the calculation of financial need and, consequently, the amount of subsidized loans offered. These variations are not significant enough to drastically alter eligibility but could result in minor differences in the final loan amount.

Eligibility Criteria Summary Table

The following table provides a simplified overview. Note that the actual income brackets, loan amounts, and fees can vary based on the year, the student’s specific circumstances, and the institution. This data is for illustrative purposes and should not be considered definitive. Always consult the official FAFSA website and your institution’s financial aid office for the most up-to-date and accurate information.

| Income Bracket | Loan Amount (Example) | Eligibility Requirements | Applicable Fees (Example) |

|---|---|---|---|

| Less than $30,000 | $5,500 per year | Full-time enrollment, satisfactory academic progress, U.S. citizenship or eligible non-citizen status, completion of FAFSA | Origination fee (approximately 1.057%) |

| $30,000 – $60,000 | $3,500 per year | Full-time enrollment, satisfactory academic progress, U.S. citizenship or eligible non-citizen status, completion of FAFSA | Origination fee (approximately 1.057%) |

| $60,000 – $90,000 | $1,500 per year | Full-time enrollment, satisfactory academic progress, U.S. citizenship or eligible non-citizen status, completion of FAFSA | Origination fee (approximately 1.057%) |

| Above $90,000 | $0 (Subsidized) | May qualify for unsubsidized loans, depending on other factors | Origination fee (if applicable to unsubsidized loans) |

Loan Amount and Repayment Plans

Understanding the maximum loan amount you can receive and the available repayment options is crucial for effective financial planning during and after your education. This section details the loan amounts available for undergraduate and graduate students and explains the various repayment plans to help you choose the one best suited to your circumstances.

The maximum subsidized loan amount a student can receive depends on several factors, including their year in school (freshman, sophomore, junior, senior), their dependency status (dependent or independent), and whether they are pursuing an undergraduate or graduate degree. These amounts are subject to change annually, so it’s essential to check with your lender or the federal government’s student aid website for the most up-to-date information. Generally, undergraduate students can borrow significantly less than graduate students, reflecting the shorter duration of undergraduate programs.

Maximum Subsidized Loan Amounts

Federal subsidized loans offer a significant advantage: interest doesn’t accrue while you’re in school, during grace periods, or during deferment. The maximum loan amounts, however, are capped. For example, a dependent undergraduate student might be eligible for a maximum annual subsidized loan of $3,500 as a freshman, increasing incrementally each year to a total aggregate limit. Independent undergraduate students often qualify for higher amounts. Graduate students typically have higher maximum loan limits, reflecting the increased cost of graduate programs and longer duration of study. Precise figures are best obtained from official government sources.

Repayment Plan Options

Several repayment plans are available for federal student loans, each with its own terms and conditions. Choosing the right plan depends on your financial situation and post-graduation plans. Careful consideration of interest accrual during deferment and forbearance is essential.

Comparison of Repayment Plans

The following table compares common repayment plans. Note that these are simplified examples and specific terms can vary. Always consult official government resources or your loan servicer for the most accurate and current information.

| Repayment Plan | Monthly Payment | Loan Term (Years) | Interest Accrual During Deferment | Interest Accrual During Forbearance |

|---|---|---|---|---|

| Standard Repayment Plan | Variable, based on loan amount and interest rate | 10 years | Yes | Yes |

| Graduated Repayment Plan | Starts low, gradually increases | 10 years | Yes | Yes |

| Extended Repayment Plan | Lower monthly payments | Up to 25 years | Yes | Yes |

| Income-Driven Repayment Plan (IDR) | Payment based on income and family size | 20-25 years | No (for some IDR plans) | No (for some IDR plans) |

Important Note: Interest rates and repayment terms are subject to change. It’s crucial to review your loan documents and regularly check with your loan servicer for updates.

Impact of Maximum Subsidized Loan on Student Debt

Borrowing the maximum amount in subsidized student loans can significantly impact your financial future. While it allows access to higher education, it also introduces substantial long-term debt that requires careful planning and management. Understanding the potential implications is crucial for making informed decisions about your education and financial well-being. This section will explore realistic repayment scenarios to illustrate the potential consequences.

The total amount of debt accumulated through maximum subsidized loans can vary greatly depending on factors such as the length of your program, the cost of attendance, and any additional financial aid received. The longer the program, and the higher the cost, the more you will likely borrow. This large loan balance can significantly impact your post-graduation financial life, affecting your ability to save, invest, and achieve major financial goals like buying a home or starting a family. Careful budgeting and financial planning are essential to navigate these challenges successfully.

Repayment Scenarios for Different Income Levels

The following examples illustrate potential repayment scenarios for graduates with varying income levels after borrowing the maximum amount in subsidized federal student loans. These are simplified examples and do not account for potential changes in interest rates or income fluctuations. Actual repayment experiences will vary.

These scenarios assume a total loan amount of $57,500 (the maximum subsidized loan amount for a dependent undergraduate student over four years as of 2023, which can vary depending on the school and the year). We’ll explore repayment under the Standard Repayment Plan, which is a 10-year plan. It’s crucial to note that other repayment plans exist, which may alter these examples.

- Scenario 1: Annual Income of $40,000. With an annual income of $40,000, the monthly payment on a $57,500 loan (at a 5% interest rate, a common rate for federal student loans, although this varies) would be approximately $600. Total interest paid over 10 years could be around $14,000, leading to a total repayment of approximately $71,500.

- Scenario 2: Annual Income of $60,000. A $60,000 annual income allows for a higher monthly payment, potentially reducing the total interest paid. The monthly payment would still be significant, approximately $600, but the higher income may allow for faster repayment. Total interest paid could be around $11,000, with total repayment near $68,500.

- Scenario 3: Annual Income of $80,000. With an annual income of $80,000, a borrower could potentially afford a higher monthly payment, leading to faster debt repayment and a reduction in total interest paid. While the exact figures would depend on the specific interest rate, a faster repayment schedule could significantly reduce the overall cost of the loan. This could lead to a total repayment closer to $65,000.

Alternatives to Maximum Subsidized Loans

Securing funding for higher education often involves exploring options beyond the maximum subsidized loan. While federal subsidized loans offer significant advantages, understanding alternative funding sources is crucial for a comprehensive financial strategy. This section will examine several alternatives, comparing their benefits and drawbacks against the maximum subsidized loan.

Several alternative funding avenues exist to lessen reliance on maximum subsidized loans or even eliminate them entirely. These alternatives include scholarships, grants, and private loans, each possessing unique characteristics impacting their suitability for individual circumstances.

Scholarships

Scholarships are merit-based or need-based awards that do not require repayment. They can significantly reduce the overall cost of education and minimize the need for borrowing. Many scholarships are offered by colleges and universities, private organizations, and corporations. Eligibility criteria vary widely, encompassing academic achievement, extracurricular involvement, demonstrated financial need, and specific demographic factors. Successful scholarship applications require diligent research and compelling presentations of qualifications. The competitive nature of some scholarships should be considered, along with the time commitment involved in the application process.

Grants

Grants, similar to scholarships, are forms of financial aid that do not need to be repaid. However, unlike scholarships, grants are primarily need-based. Federal Pell Grants are a prime example, providing funding to undergraduate students demonstrating exceptional financial need. State and local governments, as well as private organizations, also offer various grant programs. Eligibility criteria are typically determined by factors such as income, family size, and cost of attendance. The application process often involves completing the Free Application for Federal Student Aid (FAFSA). Securing grants requires proactive research and careful attention to deadlines.

Private Loans

Private loans are offered by banks, credit unions, and other financial institutions. Unlike federal subsidized loans, private loans often have higher interest rates and less favorable repayment terms. Creditworthiness plays a significant role in eligibility and interest rate determination. Borrowers should carefully compare interest rates, fees, and repayment options before committing to a private loan. The absence of federal protections may also expose borrowers to higher risks. Co-signers may be required if the applicant’s credit history is insufficient.

Comparison of Funding Options

A direct comparison highlights the differences between these funding sources and maximum subsidized loans.

| Loan Type | Interest Rates | Repayment Terms | Eligibility Criteria |

|---|---|---|---|

| Federal Subsidized Loan (Maximum) | Variable, set by the government; generally lower than private loans. | Deferred repayment until after graduation; various repayment plans available. | US citizenship or eligible non-citizen status; enrollment in an eligible program; demonstrated financial need (for subsidized portion). |

| Scholarships | N/A (no repayment) | N/A (no repayment) | Varies widely; merit-based, need-based, or specific criteria set by the awarding institution. |

| Grants | N/A (no repayment) | N/A (no repayment) | Demonstrated financial need; specific criteria set by the awarding institution. |

| Private Loans | Variable; generally higher than federal loans; determined by creditworthiness. | Varies widely depending on the lender; often shorter repayment periods than federal loans. | Creditworthiness; income; co-signer may be required. |

The Role of Financial Aid Offices

Financial aid offices serve as crucial intermediaries between students and the complex world of student funding. They provide essential guidance and support, helping students navigate the often-confusing process of applying for and receiving financial aid, including maximizing their subsidized loan eligibility. Their expertise is invaluable in ensuring students receive the funding they need to pursue their education.

Financial aid offices offer a range of resources and services designed to assist students in securing the maximum amount of subsidized student loans they qualify for. These services extend beyond simply processing applications; they actively work to help students understand their options and complete the necessary paperwork accurately and efficiently. The ultimate goal is to ensure students have access to the financial resources necessary to complete their education without undue financial hardship.

Resources and Services Offered by Financial Aid Offices

Financial aid offices typically offer a comprehensive suite of services. These include individual consultations with financial aid counselors, providing information on various loan programs, assisting with the completion of the Free Application for Federal Student Aid (FAFSA), and explaining the terms and conditions of loans. They also often host workshops and seminars on financial literacy and responsible borrowing, equipping students with the knowledge to make informed decisions about their financial future. Many offices maintain online portals with FAQs, downloadable forms, and updated information on financial aid policies. Furthermore, they provide personalized feedback on submitted applications, helping students rectify any errors or omissions that might affect their eligibility for maximum loan amounts.

Steps to Maximize Loan Amount Through Effective Communication

Effective communication with the financial aid office is paramount in maximizing loan eligibility. Students should proactively seek consultations to discuss their financial situation and explore all available funding options. Maintaining open communication, asking clarifying questions, and promptly responding to requests for additional information are essential. By demonstrating a clear understanding of the application process and a commitment to providing accurate information, students significantly increase their chances of securing the maximum subsidized loan amount. For example, promptly submitting all required documentation, following up on application status, and actively engaging with the office’s resources demonstrate initiative and commitment. Students who actively participate in the process are more likely to receive the necessary support and guidance to achieve their financial aid goals.

Illustrative Scenarios

Understanding the impact of borrowing the maximum subsidized student loan amount requires considering individual circumstances. The following scenarios illustrate how different career paths and unexpected events can significantly alter the long-term financial implications of maximum loan utilization. These are simplified examples and actual outcomes may vary.

High-Demand Career Scenario

This scenario depicts a student pursuing a high-demand career, such as software engineering, with a strong projected income potential. Let’s assume Sarah graduates with a computer science degree and takes on the maximum subsidized loan amount of $57,500 (this is an example amount and may vary depending on the student’s circumstances and the year). Before borrowing, Sarah had minimal debt and relied on part-time work to cover living expenses. After graduation, she secures a job paying $80,000 annually. Her high income allows for relatively quick loan repayment, minimizing interest accumulation. While her initial debt burden is substantial, her earning potential ensures manageable monthly payments and a relatively short repayment period. Her post-graduation expenses include rent, utilities, transportation, and loan repayment. Despite the large initial debt, Sarah’s high income allows her to comfortably manage her finances and quickly pay down her student loans.

Lower-Paying Career Scenario

In contrast, consider David, who graduates with a degree in the humanities and secures a position as a teacher, earning $45,000 annually. He also borrowed the maximum subsidized loan amount of $57,500. Before borrowing, David’s financial situation was similar to Sarah’s, relying on part-time income. However, his lower post-graduation income significantly impacts his ability to repay his loans. His monthly payments represent a larger portion of his disposable income, leaving less for savings, investments, and other financial goals. David’s post-graduation expenses, while similar to Sarah’s in type, consume a much larger percentage of his income. He may struggle to meet his financial obligations and could experience longer-term financial strain.

Unexpected Life Events Scenario

This scenario highlights the vulnerability of relying solely on maximum loan amounts when unexpected life events occur. Imagine Emily, who borrowed the maximum subsidized loan amount and was pursuing a career in nursing. Before borrowing, she had minimal debt. After graduation, she secured a nursing job with a moderate salary, but unexpectedly faced a major medical expense requiring significant out-of-pocket costs. This unexpected event created a substantial financial burden, making loan repayments challenging. The additional financial strain from the medical expense, combined with her existing loan debt, could significantly impact her financial stability and potentially lead to loan default or difficulty meeting other financial obligations. Even with a stable job, unforeseen circumstances can dramatically alter the financial landscape for a student with maximum loan debt.

Government Regulations and Policies Affecting Subsidized Loans

The availability and terms of subsidized federal student loans are heavily influenced by government regulations and policies, which are subject to change. Understanding these regulations is crucial for students and families planning for higher education financing. These policies dictate eligibility criteria, loan amounts, interest rates, and repayment options, significantly impacting the overall cost of a college education.

Government regulations governing subsidized student loans are complex and multifaceted, encompassing various aspects of the loan process. These regulations are primarily set by the U.S. Department of Education and are subject to periodic review and revision based on factors such as economic conditions, budgetary constraints, and evolving educational policies. These changes can significantly alter the landscape of student financial aid, impacting both the accessibility and affordability of higher education.

Eligibility Requirements and Loan Limits

Eligibility for subsidized federal student loans is determined by several factors, including the student’s financial need, enrollment status, and academic progress. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to determine eligibility. Regulations specify the maximum loan amounts students can borrow each year, which vary depending on the student’s year in college (freshman, sophomore, junior, senior), and dependency status. These limits are adjusted annually to account for inflation and other economic factors. For example, a change in the maximum Pell Grant award would indirectly affect the amount of subsidized loan a student may qualify for, since the combined amount of grants and loans is often capped.

Interest Rates and Repayment Plans

Government regulations dictate the interest rates applied to subsidized federal student loans. These rates are typically set annually and are generally lower than unsubsidized loan rates, reflecting the government’s subsidy of the interest during the student’s in-school period. Repayment plans are also regulated, offering various options to borrowers based on their income and financial circumstances. Changes in interest rates, driven by economic policies, directly impact the total cost of borrowing and the monthly payment amounts. For instance, a rise in interest rates would lead to higher overall borrowing costs for students. Similarly, changes to income-driven repayment plans, such as the implementation of the Revised Pay As You Earn (REPAYE) plan, can significantly impact long-term repayment burdens.

Impact of Budgetary Constraints

Government budget decisions significantly influence the availability and terms of subsidized student loans. Periods of fiscal austerity may lead to reductions in funding for student aid programs, resulting in reduced loan amounts, increased interest rates, or stricter eligibility criteria. For example, a decrease in federal funding for higher education could force a reduction in the maximum loan amounts available to students, making college more expensive for those who rely on loans to finance their education. This could also result in a higher percentage of students needing to rely on private loans, which often carry higher interest rates and less favorable repayment terms. Conversely, increased federal funding could lead to more generous loan amounts and more accessible repayment options.

Closure

Securing the maximum subsidized student loan can significantly impact your financial future. Careful consideration of eligibility requirements, repayment plans, and alternative funding options is essential for responsible borrowing. By understanding the potential long-term implications and utilizing the resources available through financial aid offices, students can make informed decisions that align with their academic and financial goals. Remember to thoroughly research and compare all available options before committing to any loan.

Top FAQs

What happens if I don’t repay my subsidized student loan?

Failure to repay your subsidized student loan can result in negative consequences, including damage to your credit score, wage garnishment, and potential legal action. The government may also pursue collection efforts.

Can I consolidate my subsidized student loans?

Yes, you can consolidate multiple subsidized student loans into a single loan, potentially simplifying repayment. Consolidation may also offer different repayment plan options.

Are there income-driven repayment plans for subsidized loans?

Yes, several income-driven repayment plans are available for federal student loans, including subsidized loans. These plans base your monthly payments on your income and family size.

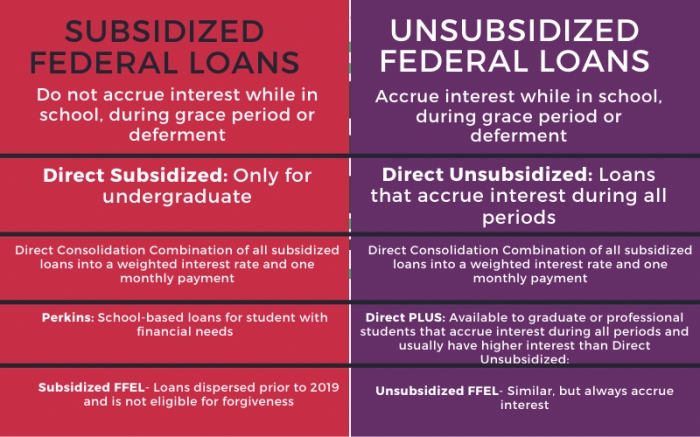

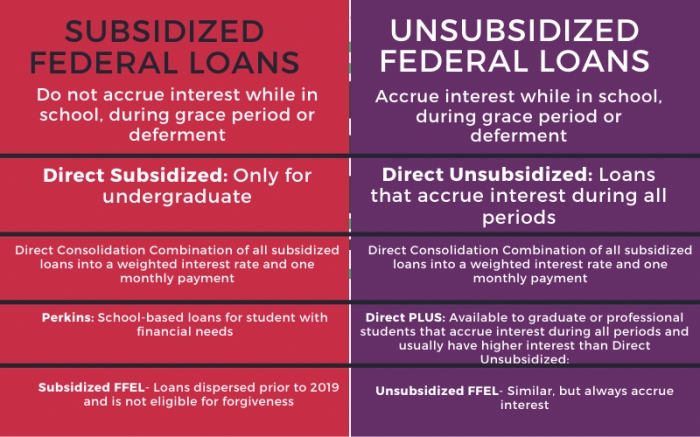

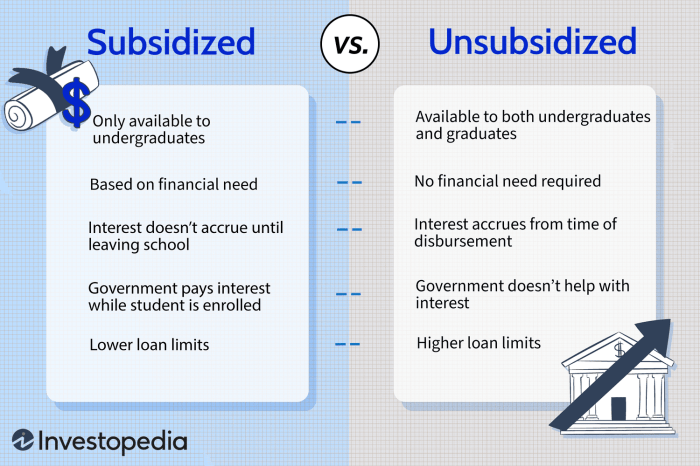

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or in deferment. Unsubsidized loans accrue interest throughout your education.