Navigating the complexities of student loan repayment can feel overwhelming, especially when considering the potential for tax deductions. Understanding the maximum tax deduction for student loan interest is crucial for maximizing your financial well-being. This guide delves into the intricacies of this deduction, providing clarity on eligibility, limitations based on Adjusted Gross Income (AGI), and the necessary steps for claiming this valuable tax benefit. We’ll explore how filing status and meticulous record-keeping play significant roles in maximizing your deduction.

This exploration will cover various scenarios, illustrating how different income levels and filing statuses affect the deductible amount. We’ll also address frequently asked questions and provide insights into potential future changes to the deduction rules, ensuring you’re well-equipped to navigate the process confidently and claim the maximum allowable deduction.

Understanding the Student Loan Interest Deduction

The Student Loan Interest Deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. Understanding the eligibility requirements and the process for claiming this deduction is crucial for maximizing your tax benefits.

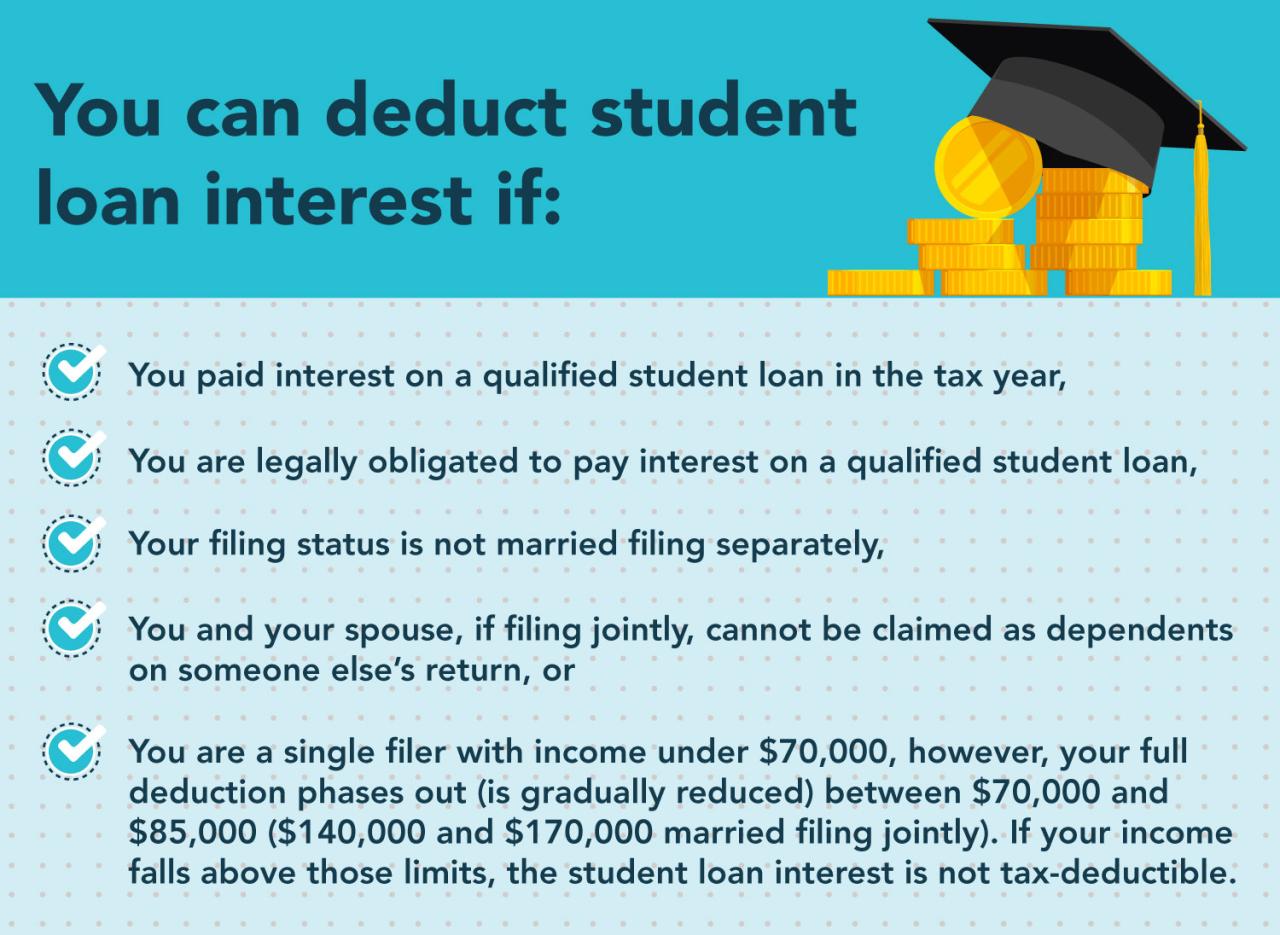

Eligibility Criteria for the Student Loan Interest Deduction

To be eligible for the student loan interest deduction, several criteria must be met. First, the student loans must be used to pay for qualified education expenses, such as tuition, fees, and room and board. Second, the taxpayer must be legally obligated to repay the loan. Third, the taxpayer’s modified adjusted gross income (MAGI) must be below a certain threshold (this threshold varies annually and is adjusted for inflation). Finally, the student loan interest must have been paid on a loan taken out to pay for the education of the taxpayer, their spouse, or a dependent. It’s important to note that the student loan interest deduction is a nonrefundable credit, meaning it can reduce your tax liability to zero, but you won’t receive any of it back as a refund.

Maximum Deductible Student Loan Interest

The maximum amount of student loan interest that can be deducted is $2,500 per year. This limit applies regardless of how much interest you actually paid. Even if you paid more than $2,500 in student loan interest, you can only deduct up to this maximum amount. This maximum amount is not adjusted annually.

Claiming the Student Loan Interest Deduction

Claiming the student loan interest deduction is relatively straightforward. You will need Form 1098-E, “Student Loan Interest Statement,” which your lender should provide. This form reports the total amount of interest you paid during the year. You’ll then use this information to complete Schedule 1 (Additional Income and Adjustments to Income) of your Form 1040, U.S. Individual Income Tax Return. Specifically, you will enter the amount of student loan interest paid on line 21 of Schedule 1. The IRS instructions for Form 1040 provide detailed guidance on how to correctly fill out Schedule 1. Remember to keep accurate records of your student loan payments and Form 1098-E in case of an audit.

Comparison of Student Loan Interest Deduction with Other Education Tax Benefits

The student loan interest deduction is just one of several education-related tax benefits available. Here’s a comparison:

| Tax Benefit | Description | Eligibility Requirements | Maximum Benefit |

|---|---|---|---|

| Student Loan Interest Deduction | Deduction for student loan interest paid | Modified AGI below a certain threshold; loan for qualified education expenses; legally obligated to repay | $2,500 |

| American Opportunity Tax Credit (AOTC) | Credit for qualified education expenses | Student pursuing a degree or other credential; must meet specific enrollment requirements; other income restrictions apply | $2,500 (maximum) |

| Lifetime Learning Credit (LLC) | Credit for qualified education expenses | Student pursuing a degree or other credential; no limit on the number of years the credit can be claimed | $2,000 (maximum) |

AGI and its Impact on the Deduction

The student loan interest deduction, while beneficial, isn’t unlimited. Your Adjusted Gross Income (AGI) plays a crucial role in determining how much, if any, you can deduct. A higher AGI generally means a smaller deduction, or even no deduction at all, due to phase-out rules. Understanding how AGI impacts your deduction is vital for maximizing your tax savings.

The student loan interest deduction is subject to AGI-based limitations. This means that the maximum deduction amount you can claim is reduced, or phased out completely, as your AGI increases. The specific phase-out ranges are adjusted annually for inflation, so it’s essential to consult the most current IRS guidelines. These guidelines determine the thresholds at which the deduction begins to decrease and ultimately disappears.

AGI Phase-Out Ranges and Deduction Limits

The IRS sets specific AGI thresholds that determine the amount of the student loan interest deduction. If your AGI falls within a certain range, your deduction will be reduced. If your AGI exceeds the upper limit, you won’t be able to claim the deduction at all. For example, let’s assume (for illustrative purposes, and these figures are not necessarily reflective of current tax years) that the maximum deduction is $2,500 and the phase-out range for a single filer is between $70,000 and $85,000.

Examples of AGI’s Impact on Deduction

Let’s illustrate with some examples:

| AGI | Deduction Status | Deductible Amount (Illustrative Example) |

|---|---|---|

| $60,000 | Full Deduction Allowed | $2,500 |

| $75,000 | Partial Deduction Allowed (Phase-out) | $1,250 (Illustrative Example – This would be calculated based on the specific phase-out formula used by the IRS for that tax year) |

| $90,000 | No Deduction Allowed | $0 |

These figures are for illustrative purposes only and should not be considered tax advice. Actual phase-out ranges and calculations will vary depending on filing status (single, married filing jointly, etc.) and the applicable tax year.

Flowchart: AGI and Student Loan Interest Deduction

The following flowchart visually represents the decision-making process concerning the student loan interest deduction based on AGI:

[Imagine a flowchart here. The flowchart would start with a box: “Determine AGI”. This would branch to two boxes: “AGI below lower phase-out threshold?” (Yes/No). If “Yes”, it would go to a box: “Full Deduction Allowed”. If “No”, it would go to a box: “AGI above upper phase-out threshold?” (Yes/No). If “Yes”, it would go to a box: “No Deduction Allowed”. If “No”, it would go to a box: “Partial Deduction Allowed – Calculate based on IRS Formula”. All boxes would have connecting arrows showing the flow.]

Note: Always consult the most current IRS publications and seek professional tax advice for personalized guidance on claiming the student loan interest deduction. The examples provided are for illustrative purposes and do not constitute tax advice.

Married Filing Jointly vs. Other Filing Statuses

The student loan interest deduction, while beneficial, has limitations that vary depending on your filing status. Understanding these differences is crucial for maximizing your tax benefits. Married couples filing jointly often have different deduction limits and eligibility criteria compared to those filing as single, head of household, or married filing separately.

The maximum amount you can deduct is limited to the actual amount of interest you paid during the year, up to a specified limit. This limit, however, changes based on your modified adjusted gross income (MAGI) and filing status. Importantly, even if you paid more in student loan interest than the limit, you can only deduct up to the allowed maximum.

Deduction Limits by Filing Status

The student loan interest deduction limit is dependent on your modified adjusted gross income (MAGI). The IRS provides specific MAGI thresholds that determine the deduction limit. These thresholds are different for each filing status. Exceeding a certain MAGI threshold can reduce or eliminate your ability to claim the deduction.

- Married Filing Jointly: For married couples filing jointly, the deduction is generally phased out once the MAGI reaches a certain level. For example, in a given year, the limit might be $2,500, but this begins to phase out once the MAGI exceeds a threshold like $170,000. Above a higher threshold (e.g., $180,000), the deduction may be completely eliminated. The exact thresholds change annually, so it’s essential to consult the current IRS guidelines.

- Single, Head of Household, Married Filing Separately: Individuals filing under these statuses also have MAGI thresholds that affect their deduction limits. However, these thresholds are typically lower than those for married couples filing jointly. For instance, the phase-out might begin at a MAGI of $85,000 for single filers and the deduction could be eliminated at $95,000, representing half the MAGI thresholds for married couples filing jointly. Again, these figures are examples and are subject to yearly adjustments.

Eligibility Requirements Based on Filing Status

While the primary eligibility requirement – having paid student loan interest – remains consistent across all filing statuses, the impact of filing status is significant due to the varying MAGI thresholds. Meeting the general requirements for claiming the deduction (such as being the student who incurred the debt or being the spouse who made payments) applies regardless of filing status, but the actual deduction amount is directly influenced by the filing status and the taxpayer’s MAGI. It’s important to note that the student loan interest deduction is a deduction, not a credit. This means it reduces your taxable income rather than directly reducing your tax liability.

Documentation and Record Keeping

Proper documentation is crucial for successfully claiming the student loan interest deduction. Failing to maintain accurate records can result in delays or rejection of your claim, potentially costing you valuable tax savings. Careful record-keeping simplifies the tax preparation process and provides peace of mind.

Maintaining accurate records of your student loan payments and interest paid is essential for claiming the student loan interest deduction. The IRS requires substantiation for all deductions, and this deduction is no different. Incomplete or inaccurate records can lead to delays in processing your return or even a denial of your deduction. Organized records will save you time and frustration during tax season.

Necessary Documents for the Student Loan Interest Deduction

To successfully claim the student loan interest deduction, you’ll need to gather several key documents. These documents serve as proof of your payments and the interest paid. Without them, the IRS may not allow the deduction.

- Form 1098-E, Student Loan Interest Statement: This form is issued by your lender and reports the total amount of student loan interest you paid during the tax year. This is your primary source of documentation.

- Student Loan Payment Records: Maintain records of all payments made throughout the year, including the date, amount, and payment method (e.g., check, electronic transfer). Bank statements or online account statements can be used to support this.

- Copy of Your Student Loan Agreement: This document Artikels the terms of your loan, including the loan amount, interest rate, and repayment schedule. While not always required, it can be helpful in resolving any discrepancies.

- Tax Return from the Previous Year (if applicable): If you are amending a previous return, you will need the previous year’s return to show the changes being made.

Organizing Financial Documents for Tax Preparation

Effective organization is key to a smooth tax preparation process. A well-organized system prevents lost documents and ensures you have everything readily available when you file.

Consider using a dedicated file or folder specifically for tax-related documents. You can organize these documents chronologically (by year) or by type of document (e.g., student loan interest statements, bank statements, etc.). A digital filing system, using cloud storage or a dedicated computer folder, is also an efficient method for storing and accessing your documents. Regardless of the method, maintaining a clear and consistent system is vital. For example, you might create separate folders for each year’s tax documents, and within each year’s folder, you could have subfolders for different categories of documents. This method allows for easy retrieval of specific documents when needed.

Remember to keep all your student loan documents for at least three years after filing your tax return, in case of an audit.

Potential Scenarios and Examples

Understanding the student loan interest deduction requires considering various individual circumstances. The maximum deduction is capped, and your Adjusted Gross Income (AGI) plays a crucial role. Let’s explore some scenarios to illustrate how the deduction works in practice.

Scenario 1: Single Filer with Moderate Income

Sarah is a single filer with an AGI of $70,000 in 2024. She paid $2,500 in student loan interest during the year. Since her AGI is below the phaseout threshold (which varies annually and depends on filing status), she can deduct the full $2,500. This reduces her taxable income by $2,500, resulting in a lower tax liability. If her tax bracket is 22%, the tax savings would be approximately $550 ($2,500 x 0.22). A change in her income that pushes her AGI above the phaseout threshold would gradually reduce her allowable deduction. Similarly, a decrease in her student loan interest payments would directly lower the deductible amount.

Scenario 2: Married Filing Jointly with High Income

John and Mary are married filing jointly with a combined AGI of $200,000 in 2024. They paid a total of $4,000 in student loan interest. For married couples filing jointly, the AGI phaseout thresholds are higher than for single filers. However, their high AGI might still impact their deduction. Assuming their AGI places them within the phaseout range, only a portion of their $4,000 interest payment would be deductible. The exact deductible amount would depend on the specific phaseout rules for their AGI bracket in the relevant tax year. A decrease in their income could potentially increase their deductible amount, moving them to a lower AGI bracket where the full deduction might be allowed. Conversely, an increase in income could further reduce their allowable deduction or eliminate it entirely.

Scenario 3: Single Filer with High AGI and Reduced Loan Payments

David is a single filer with an AGI of $150,000 in 2024. He paid $1,000 in student loan interest. Due to his high AGI, he may find himself in a phaseout range where only a portion of his student loan interest is deductible, or possibly none at all, depending on the specific thresholds for his filing status and the tax year. If his AGI decreased, he might become eligible for a larger deduction. Furthermore, a reduction in his student loan payments would directly impact the deductible amount; lower payments mean a lower deduction. Conversely, if he paid off a significant portion of his loans, the deduction would be correspondingly reduced or eliminated.

Tax Form and Related Information

To claim the student loan interest deduction, you’ll need to use Form 1098-E, Student Loan Interest Statement. This form is provided by your lender and reports the total amount of student loan interest you paid during the tax year. Accurate completion of this form is crucial for successfully claiming your deduction.

The information reported on Form 1098-E is straightforward but requires careful attention. Understanding the different sections will help ensure you accurately reflect your student loan interest payments on your tax return.

Form 1098-E: Key Sections and Fields

Form 1098-E contains several key sections. The most important are those providing your name, address, and the total amount of student loan interest paid. Other sections might include information about the lender and the specific loans for which interest was paid, though this information isn’t directly used for calculating the deduction itself. The crucial information for the deduction is found in the section reporting the total interest paid. It’s essential to verify the accuracy of this amount against your own records.

Example of Form 1098-E Completion

Let’s say John and Mary Smith received Form 1098-E from their lender, showing the following information: Their names and address are correctly listed; Box 1, “Payer’s name, address, and identification number,” accurately reflects their lender’s details; Box 2, “Borrower’s name, address, and identification number,” correctly reflects John and Mary Smith’s details; and finally, Box 1, “Amount of student loan interest paid to you,” shows $2,000. John and Mary would use this $2,000 figure when completing their Form 1040, Schedule 1 (Additional Income and Adjustments to Income), line 21, which is where they will claim the student loan interest deduction. They will then use the information on their Form 1040 to calculate their Adjusted Gross Income (AGI) and determine the maximum allowable deduction.

Form 1040: Incorporating the Deduction

After receiving Form 1098-E, the information needs to be transferred to your personal income tax return, Form 1040. Specifically, the amount of student loan interest paid, as shown on Form 1098-E, will be entered on Schedule 1 (Additional Income and Adjustments to Income), line 21. This is the line designated for “Student loan interest.” This amount will then be used to calculate the adjusted gross income (AGI). Remember that the deduction is limited based on your modified adjusted gross income (MAGI). The instructions for Form 1040 provide detailed guidance on calculating the MAGI and applying the student loan interest deduction.

Changes and Updates to the Student Loan Interest Deduction

The student loan interest deduction, while seemingly straightforward, has seen some modifications over the years. Understanding these changes, both past and potentially future, is crucial for taxpayers to accurately claim the deduction and maximize their tax benefits. These alterations often reflect broader economic and legislative priorities.

While the basic structure of the deduction—allowing taxpayers to deduct the actual amount of student loan interest paid, up to a certain limit—has remained relatively consistent, the specifics regarding adjusted gross income (AGI) limitations and other qualifying criteria have been subject to change. These changes can significantly impact the amount a taxpayer can deduct, and in some cases, even their eligibility.

Recent Changes to the Student Loan Interest Deduction

The student loan interest deduction has not undergone major overhauls in recent years. However, the AGI thresholds that determine eligibility and the maximum deduction amount have remained static, potentially leading to a decreased real value of the deduction due to inflation. For example, while the maximum deduction remains capped at $2,500, its purchasing power has diminished over time compared to when the limit was initially set. This means that while the rules haven’t changed, the practical effect of the deduction has been subtly altered by inflation. Taxpayers should be aware of this erosion of the deduction’s value and factor it into their financial planning.

Proposed Future Changes to the Student Loan Interest Deduction

Predicting future changes to tax laws is inherently speculative. However, political discourse and economic conditions frequently lead to proposals for altering tax deductions. Discussions around simplifying the tax code or addressing income inequality could potentially impact the student loan interest deduction. For instance, proposals for expanding or contracting tax credits aimed at higher education could indirectly affect the deduction’s significance. Some proposals might focus on eliminating the deduction altogether to simplify the tax code or to offset other tax cuts. Others might adjust the AGI thresholds to make the deduction more accessible to lower-income borrowers. The impact of such changes would vary depending on the specifics of the proposal and the taxpayer’s individual circumstances. It is crucial to stay informed about proposed legislative changes that might affect the deduction.

Impact of Potential Changes on Taxpayers

The impact of any changes to the student loan interest deduction would depend heavily on the nature of the changes. A reduction in the maximum deduction amount or an increase in the AGI phaseout thresholds would directly lower the tax benefits for many taxpayers. Conversely, an increase in the maximum deduction or a decrease in the AGI phaseout thresholds would increase the tax benefits. For example, a hypothetical increase in the AGI phaseout threshold from $85,000 (for single filers in a recent year) could make the deduction accessible to a larger segment of taxpayers. Elimination of the deduction would completely remove this tax benefit for all eligible taxpayers. Staying informed about proposed legislation and its potential impact on your personal tax situation is essential for effective financial planning.

Outcome Summary

Successfully claiming the maximum student loan interest deduction requires careful attention to detail and a thorough understanding of the relevant rules and regulations. By meticulously documenting your loan payments, understanding the impact of your AGI, and choosing the appropriate filing status, you can significantly reduce your tax burden. Remember to consult with a tax professional if you have complex financial situations or require personalized guidance. Proactive planning and informed decision-making empower you to optimize your tax return and effectively manage your student loan debt.

Answers to Common Questions

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest you paid, even if you paid off your loans early in the tax year. You can only deduct the interest paid during the tax year.

Are there income limits for claiming the student loan interest deduction?

Yes, the deduction is phased out for higher AGIs. The exact phase-out range changes annually, so it’s essential to check the current IRS guidelines.

What if I’m a graduate student and have multiple student loans?

You can deduct the interest paid on all eligible student loans, regardless of the type of loan or educational program.

Can I deduct interest paid on PLUS loans?

Yes, interest paid on PLUS loans is deductible, provided you meet all other eligibility requirements.