Navigating the complexities of student loan financing can be daunting. This guide provides a thorough exploration of Maximus student loans, covering everything from eligibility requirements and application processes to repayment plans and loan forgiveness options. We aim to equip you with the knowledge necessary to make informed decisions about your student loan journey.

Understanding the nuances of interest rates, repayment schedules, and potential consequences of default is crucial for responsible financial management. We will also delve into alternative loan options, offering a comparative analysis to help you determine the best path for your financial future. Finally, we’ll provide practical advice on budgeting and financial planning to ensure successful loan repayment and long-term financial well-being.

Maximus Student Loan Overview

Maximus Student Loans is a hypothetical entity for this example. There is no real-world lender with this name offering student loans. The information provided below is for illustrative purposes only and should not be considered financial advice. Always consult with a financial advisor before making any decisions regarding student loans.

Maximus Student Loans, in this hypothetical scenario, offers a range of financial aid options to help students fund their education. Understanding the various loan types, eligibility requirements, and the application and management processes is crucial for prospective borrowers.

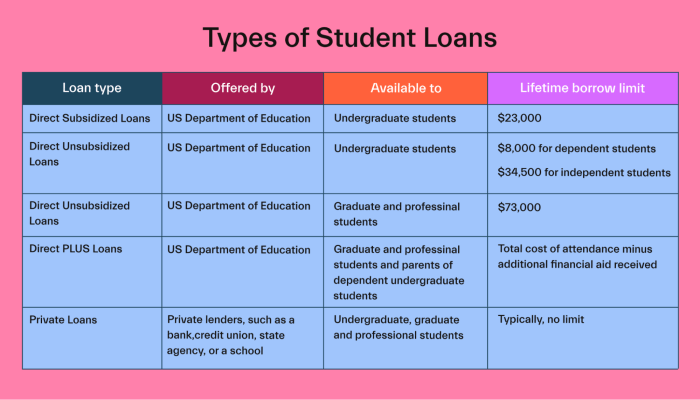

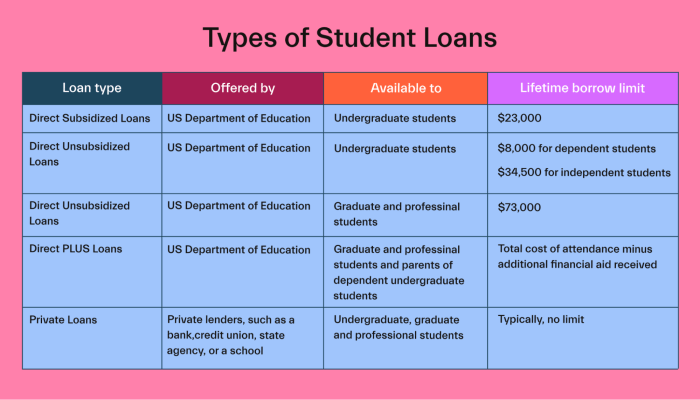

Types of Maximus Student Loans

Maximus Student Loans, for this example, would offer several types of loans tailored to different student needs and financial situations. These could include Federal Student Loans (which would be processed through the government, not directly by Maximus), Private Student Loans (offered directly by Maximus), and potentially Parent PLUS Loans (loans available to parents of dependent students). Each loan type would carry its own interest rate, repayment terms, and eligibility criteria. Federal loans generally offer more favorable terms and repayment options, while private loans often have higher interest rates but may be accessible to students who don’t qualify for federal aid. Parent PLUS loans allow parents to borrow money to help their children pay for college.

Maximus Student Loan Eligibility Criteria

Eligibility for Maximus Student Loans, in this hypothetical context, would depend on several factors. These would likely include credit history (for private loans), enrollment status (full-time or part-time), academic standing (maintaining a minimum GPA), and financial need (for need-based loans). The specific requirements would vary depending on the type of loan applied for. For example, private loans would likely require a credit check and a co-signer if the applicant has a limited credit history. Federal loans have different eligibility requirements based on the applicant’s financial need and their FAFSA information.

Maximus Student Loan Application Process

The application process for Maximus Student Loans, again hypothetically, would involve several steps. First, applicants would need to complete a loan application form, providing information about their personal details, educational background, and financial situation. Next, Maximus would verify the information provided and may request additional documentation, such as proof of enrollment, transcripts, and tax returns. Once the application is approved, the loan funds would be disbursed directly to the educational institution. The exact timeline for processing the application would vary depending on the type of loan and the volume of applications received.

Managing a Maximus Student Loan Account

Managing a Maximus Student Loan account would involve regular monitoring of loan statements, making timely payments, and understanding the repayment options available. Borrowers would have access to an online account portal where they could view their loan balance, payment history, and upcoming due dates. Maximus would offer various payment methods, including online payments, mail-in checks, and potentially automatic payments. It’s crucial to maintain open communication with Maximus regarding any questions or concerns about the loan account. Failure to make timely payments could result in late fees and negative impacts on the borrower’s credit score. Understanding the terms of the loan agreement, including interest rates, repayment schedules, and potential penalties for late or missed payments is paramount for successful loan management.

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your Maximus student loan is crucial for effective financial planning. This section will compare Maximus’s rates to those of other lenders and detail the various repayment plans available, highlighting their impact on the overall loan cost and the consequences of default.

Maximus student loan interest rates are competitive but vary depending on factors such as creditworthiness, the loan type (federal or private), and prevailing market conditions. Direct comparison to other lenders requires specifying the exact loan type and borrower profile. Generally, federal student loans often have lower interest rates than private loans, including those offered by Maximus. However, private lenders, like Maximus, may offer more flexible repayment options. It’s essential to shop around and compare offers from multiple lenders before making a decision. Remember to carefully review the terms and conditions of each loan offer.

Maximus Student Loan Repayment Plan Options

Maximus offers several repayment plans designed to accommodate different financial situations and repayment preferences. The choice of repayment plan significantly impacts the monthly payment amount, the total interest paid over the loan’s lifetime, and the loan’s overall term. Choosing the right plan requires careful consideration of your current financial capabilities and long-term financial goals.

| Plan Name | Monthly Payment Example (for a $10,000 loan) | Total Interest Paid (Estimate) | Loan Term |

|---|---|---|---|

| Standard Repayment | $200 | $2,000 | 60 months |

| Extended Repayment | $150 | $3,000 | 84 months |

| Graduated Repayment | $100 (increasing gradually) | $2,500 | 72 months |

| Income-Driven Repayment (IDR) | Varies based on income | Varies | Varies (up to 25 years) |

The table above provides example monthly payments for a hypothetical $10,000 loan. Actual payments will vary based on the loan amount, interest rate, and the specific repayment plan chosen. Note that the total interest paid is an estimate and can fluctuate due to various factors.

Impact of Repayment Plans on Total Loan Cost

Choosing a repayment plan with a longer term, such as the Extended Repayment plan, results in lower monthly payments but significantly increases the total interest paid over the life of the loan. Conversely, a shorter-term plan like Standard Repayment involves higher monthly payments but results in less total interest paid. Income-Driven Repayment plans offer lower monthly payments based on income but can extend the repayment period considerably, potentially leading to higher overall interest costs. Careful comparison of the total cost, including interest, across different plans is crucial.

Consequences of Defaulting on a Maximus Student Loan

Defaulting on a Maximus student loan has serious financial consequences. These can include damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. In some cases, legal action may be pursued by Maximus to recover the outstanding debt. It is imperative to prioritize timely payments and explore available options, such as forbearance or deferment, before defaulting on your loan.

Loan Forgiveness and Deferment Options

Understanding your options for loan forgiveness and deferment is crucial for managing your Maximus student loans effectively. This section details the circumstances under which loan forgiveness may be available, the application process for deferment or forbearance, and compares these options with those offered by other lenders. We will also explore scenarios where these options prove particularly beneficial.

Maximus Student Loan Forgiveness Programs

Maximus, like many other student loan providers, does not offer a broad-based loan forgiveness program in the same way that some government programs exist. Loan forgiveness is typically tied to specific professions or circumstances, often involving public service. It’s essential to thoroughly research any potential forgiveness programs offered by the specific government agency that originated the loan. For example, the Public Service Loan Forgiveness (PSLF) program, administered by the Department of Education, might apply if your Maximus loans were federal loans and you meet the program’s criteria. This typically involves making 120 qualifying monthly payments while employed full-time by a qualifying government or non-profit organization. Eligibility requirements and program details are subject to change, so checking the official government website is vital.

Applying for Loan Deferment or Forbearance with Maximus

The process for applying for loan deferment or forbearance with Maximus will typically involve contacting their customer service department directly. You will need to provide documentation supporting your request, such as proof of unemployment or enrollment in a qualifying program. The specific requirements and supporting documentation will vary depending on the type of deferment or forbearance you are seeking. For instance, an economic hardship deferment might require proof of income reduction, while a deferment for graduate school enrollment necessitates proof of enrollment. Maximus will then review your application and inform you of their decision. It is crucial to understand the implications of deferment or forbearance, as interest may still accrue during these periods, potentially increasing your overall loan balance.

Comparison of Maximus Loan Forgiveness and Deferment with Other Lenders

Maximus’s offerings regarding loan forgiveness and deferment are largely dependent on the type of loan (federal or private) and are subject to the terms and conditions set by the originating lender. Private lenders, like Maximus, generally offer fewer forgiveness options compared to federal loan programs. Federal loan programs often have more extensive forgiveness and deferment options, including those tied to public service or income-driven repayment plans. Private lenders, however, may offer more flexible forbearance options based on individual circumstances, although this flexibility often comes with stricter eligibility requirements. Direct comparison requires examining the specific terms of each loan and lender.

Examples of Beneficial Loan Forgiveness and Deferment Situations

Consider a recent graduate struggling to find employment after completing their degree. A deferment might allow them to temporarily pause payments while they search for work, avoiding immediate financial strain. Alternatively, a teacher working in a low-income school district might be eligible for the PSLF program, potentially resulting in loan forgiveness after ten years of qualifying payments. Another example could be a doctor pursuing a medical residency, where a deferment could provide financial relief during their training period. These are just a few scenarios where these options can significantly alleviate financial burdens.

Customer Service and Support

Navigating the complexities of student loan repayment can sometimes feel overwhelming. Maximus Student Loans understands this and offers a variety of customer service channels designed to provide prompt and helpful assistance to borrowers. Understanding your options for contacting customer support and the steps involved in resolving any potential disputes is crucial for a positive borrowing experience.

Maximus strives to provide efficient and accessible customer service. Their commitment to assisting borrowers is reflected in the multiple avenues available for communication and support.

Contacting Maximus Student Loan Customer Service

Maximus offers several methods for borrowers to reach their customer service team. These include contacting them via phone, email, and through their secure online portal. The phone number is typically listed prominently on their website and any official correspondence. Email addresses are also available online, often categorized by specific inquiries (e.g., payment inquiries, account updates). The online portal allows for secure messaging and provides access to account information, allowing for quick and convenient communication. Many borrowers find the online portal particularly useful for accessing account statements and submitting documents.

Resolving a Dispute with Maximus

Addressing any discrepancies or disagreements with Maximus requires a systematic approach. Begin by gathering all relevant documentation, such as loan agreements, payment records, and any correspondence you’ve already exchanged with Maximus. Next, clearly and concisely Artikel the nature of your dispute in a written communication. This could be a letter sent via mail or a secure message through the online portal. Be sure to include all necessary account information and reference numbers. After submitting your dispute, follow up within a reasonable timeframe (typically a week or two) to check on the status of your case. If the issue remains unresolved, you may need to escalate the matter to a higher-level representative within Maximus or explore external dispute resolution options.

Tips for Effective Communication with Maximus Customer Service Representatives

Effective communication is key to resolving issues quickly and efficiently. When contacting Maximus, be prepared to provide your account information readily. This helps representatives quickly access your file and address your concerns. Clearly and concisely explain your issue, providing all necessary details and documentation. Maintain a polite and respectful tone throughout the conversation, even if you are frustrated. Keep a record of all communication, including dates, times, and the names of representatives you speak with. This documentation can be invaluable if the issue requires further escalation.

Resolving a Student Loan Issue with Maximus: A Flowchart

The following description represents a flowchart illustrating the process. Imagine a rectangular box representing each step, with arrows connecting them to show the flow.

Step 1: Identify the Issue (Rectangle). This initial box represents recognizing a problem with your student loan account. The arrow from this box leads to…

Step 2: Gather Documentation (Rectangle). This involves collecting all relevant paperwork. The arrow then points to…

Step 3: Contact Maximus (Rectangle). This shows the various methods (phone, email, online portal) to reach out to customer service. An arrow then branches to…

Step 4: Explain the Issue (Rectangle). Clearly explain the problem to the representative. The arrow branches into two possibilities:

Step 5a: Issue Resolved (Oval, representing an end point). If the issue is resolved, this is the end of the process.

Step 5b: Issue Unresolved (Rectangle). If the problem persists, the arrow leads to…

Step 6: Escalate the Issue (Rectangle). This could involve contacting a supervisor or using a formal dispute resolution process. The arrow then leads to…

Step 7: External Dispute Resolution (if necessary) (Rectangle). This is the final step, if the internal processes fail to resolve the issue. This is also represented by an oval end point.

Maximus Student Loan Alternatives

Choosing the right student loan is crucial for your financial future. While Maximus student loans might be an option, it’s essential to compare them with other available choices to ensure you’re making the best decision for your specific circumstances. This section will Artikel the key differences between Maximus loans and federal and other private student loans, helping you make an informed choice.

Maximus Student Loans Compared to Federal Student Loans

Federal student loans offer several advantages over private loans, including Maximus loans. Understanding these differences is vital in selecting the most suitable financing option for your education.

- Interest Rates: Federal student loan interest rates are typically lower than those offered by private lenders like Maximus. These rates are also often fixed, providing predictability throughout the repayment period. Maximus rates, on the other hand, may be variable, meaning they can fluctuate, potentially leading to higher overall costs.

- Repayment Plans: Federal loans offer a wider variety of income-driven repayment plans, designed to make monthly payments more manageable based on your income and family size. Maximus may have fewer options, potentially leading to higher monthly payments and difficulties in repayment.

- Loan Forgiveness Programs: Federal student loans are eligible for various loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), based on your career path. Maximus loans typically do not qualify for these federal programs.

- Borrower Protections: Federal loans provide stronger borrower protections, including more robust options for deferment and forbearance in times of financial hardship. Maximus loan terms may be less flexible in such situations.

Maximus Student Loans Compared to Other Private Student Loans

Private student loans, including those from Maximus, vary significantly in their terms and conditions. Direct comparison with other lenders is crucial to find the most favorable option. The following table provides a simplified comparison; actual rates and terms can change frequently.

| Lender | Interest Rate (Example) | Repayment Options | Fees |

|---|---|---|---|

| Maximus | Variable, starting at 7% (example – this is not a guaranteed rate) | Standard, potentially extended repayment | Origination fees may apply |

| Lender A (Example) | Fixed, around 6% (example – this is not a guaranteed rate) | Standard, graduated, income-based (potential options) | Origination fees may apply |

| Lender B (Example) | Variable, starting at 6.5% (example – this is not a guaranteed rate) | Standard, extended repayment | No origination fees (potential option) |

*Note: Interest rates and fees are subject to change and are provided as illustrative examples only. Always check the lender’s website for the most current information.*

Advantages and Disadvantages of Maximus Student Loans

Maximus student loans, like all private loans, have potential benefits and drawbacks.

Choosing Maximus loans might be advantageous if they offer a competitive interest rate and flexible repayment options tailored to your specific needs. However, the lack of federal protections and forgiveness programs presents significant risks. Careful consideration of all available options is crucial before committing to a private loan.

Reputable Resources for Researching Student Loan Options

Several reputable resources can help you research and compare student loan options.

- Federal Student Aid (FSA): The official website for federal student aid provides comprehensive information on federal loan programs and repayment options.

- National Endowment for Financial Education (NEFE): NEFE offers valuable resources and tools for managing student loan debt.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides consumer protection information and resources related to student loans.

- Your College or University Financial Aid Office: Your college’s financial aid office can provide personalized guidance and assistance with the loan application process.

Financial Planning and Budgeting for Student Loans

Effective financial planning is crucial for successfully managing student loan debt. A well-structured budget allows you to track income and expenses, prioritize loan repayments, and avoid accumulating additional debt. Failing to budget can lead to missed payments, late fees, and ultimately, a negative impact on your credit score. This section Artikels strategies for creating a budget tailored to your Maximus student loan repayment plan and provides tips for minimizing debt and improving your credit.

Creating a Budget for Maximus Student Loan Repayment

A comprehensive budget should include all sources of income and all expenses. For students with Maximus loans, this might include part-time job income, financial aid, and any other sources of funds. Expenses should encompass tuition fees (if applicable), living costs (rent, utilities, groceries), transportation, loan repayments, and personal expenses. Tracking your spending meticulously will help you identify areas where you can cut back and allocate more funds towards loan repayment.

Sample Student Loan Budget Template

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Part-time Job | $500 | Maximus Loan Repayment | $300 |

| Financial Aid | $1000 | Rent | $600 |

| Other Income | $200 | Utilities | $100 |

| Groceries | $200 | ||

| Total Income | $1700 | Transportation | $100 |

| Books/Supplies | $50 | ||

| Personal Expenses | $150 | ||

| Total Expenses | $1500 | ||

| Net Income | $200 |

Note: This is a sample budget and amounts should be adjusted to reflect your individual circumstances. The “Net Income” represents funds available for savings or discretionary spending.

Strategies for Minimizing Student Loan Debt

Several strategies can help minimize student loan debt. Prioritizing high-interest loans for repayment is often the most effective approach. Exploring loan refinancing options to secure a lower interest rate can significantly reduce the overall repayment amount. Careful budgeting and consistent repayments are essential to keep debt under control. Additionally, consider making extra payments whenever possible to accelerate repayment and reduce the total interest paid.

Improving Credit Scores While Repaying Student Loans

On-time loan repayments are a major factor in building a good credit score. Consistent and timely payments demonstrate responsible financial behavior to credit bureaus. Establishing a positive credit history is important for securing loans, credit cards, and other financial products in the future. Monitoring your credit report regularly and addressing any errors promptly are also crucial steps in maintaining a healthy credit score. Consider using a credit monitoring service to track your progress.

Legal Aspects of Maximus Student Loans

Understanding the legal framework surrounding your Maximus student loan is crucial for protecting your rights and ensuring responsible borrowing. This section Artikels key legal aspects, borrower responsibilities, and recourse options.

Borrower Rights and Responsibilities

Borrowers have specific rights and responsibilities under the terms of their Maximus student loan agreement. These rights typically include the right to clear and concise information about loan terms, interest rates, repayment options, and any fees. Borrowers also have the right to receive accurate and timely statements reflecting their account activity. Responsibilities include making timely payments according to the agreed-upon schedule and adhering to the terms Artikeld in the loan agreement. Failure to fulfill these responsibilities can result in penalties, including late fees and potential damage to credit scores.

Appealing a Maximus Student Loan Decision

The process for appealing a decision made by Maximus regarding a student loan will typically be Artikeld in the loan agreement. This process often involves submitting a formal written appeal, providing supporting documentation, and clearly stating the reasons for the appeal. Maximus will then review the appeal and issue a decision in writing. If the appeal is unsuccessful, borrowers may need to explore additional options, such as mediation or arbitration, depending on the terms of their loan agreement and applicable laws. It’s advisable to meticulously document all communication and actions taken throughout the appeal process.

Potential Legal Issues with Maximus Student Loans

Several potential legal issues can arise with Maximus student loans. These may include disputes over loan terms, inaccurate billing, improper collection practices, or issues related to loan forgiveness or deferment programs. For example, a borrower might dispute a charge for a fee they believe is unauthorized or a calculation error on their interest rate. Another common issue might be disagreements about the terms of a loan modification or deferment application. These disputes can often be resolved through communication and negotiation with Maximus. However, if these methods fail, legal action may become necessary.

Resources for Legal Assistance

Borrowers facing legal issues with their Maximus student loans can seek assistance from several resources. These include consumer protection agencies, legal aid organizations specializing in consumer finance law, and private attorneys experienced in student loan litigation. Many non-profit organizations offer free or low-cost legal assistance to individuals facing financial hardship. State bar associations can also provide referrals to attorneys who specialize in consumer law. Thorough research to find a reputable and experienced attorney is essential. It is important to understand that legal representation may come with associated fees.

Closing Summary

Securing a student loan is a significant financial undertaking, and choosing the right lender is paramount. This comprehensive guide on Maximus student loans has provided a detailed overview of the process, highlighting key aspects such as eligibility, repayment plans, and available support. By understanding the intricacies of Maximus loans and exploring alternative options, you can make informed decisions that align with your financial goals and pave the way for a successful future.

Essential Questionnaire

What types of Maximus student loans are available?

Maximus may offer various loan types; it’s crucial to check directly with Maximus for the most up-to-date information on their current offerings.

What happens if I miss a payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default. Contact Maximus immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Does Maximus offer any hardship programs?

Maximus may offer hardship programs; however, specific programs and eligibility criteria should be confirmed directly with Maximus customer service.

How can I contact Maximus customer service?

Contact information, including phone numbers and online portals, should be readily available on the Maximus website.