Navigating the world of student loans can be daunting, especially when choosing a lender. This guide delves into MEFA student loans, providing a comprehensive review based on borrower experiences, application processes, repayment options, and comparisons with alternative lenders. We aim to equip prospective borrowers with the information needed to make informed decisions about their educational financing.

From understanding the various loan products MEFA offers and their eligibility criteria to exploring the application process and repayment plans, we cover all the essential aspects. We’ll also analyze customer service experiences, highlighting both positive and negative feedback to provide a balanced perspective. Finally, we’ll compare MEFA loans to federal loan programs and other private lenders, helping you determine if MEFA is the right choice for your financial situation.

MEFA Student Loan Application Process

Applying for a MEFA student loan involves several key steps designed to ensure a smooth and efficient process for borrowers. Understanding these steps and preparing necessary documentation beforehand can significantly streamline the application and increase the likelihood of approval. This section provides a detailed guide to navigate the MEFA student loan application.

Steps Involved in the MEFA Student Loan Application

The MEFA student loan application process generally follows a structured sequence. Applicants should be prepared to provide comprehensive personal and financial information. Failure to provide complete and accurate information may delay the process or result in application rejection. The key steps are generally consistent across various MEFA loan programs, although specific requirements may vary.

- Complete the Application Form: This involves providing accurate personal details, educational information, and financial data. Be thorough and double-check all entries for accuracy.

- Gather Required Documentation: MEFA will require supporting documents to verify your information. This typically includes tax returns, bank statements, and possibly proof of enrollment. Having these readily available will expedite the process.

- Submit the Application: Submit your completed application and all supporting documents through the designated MEFA online portal or via mail, depending on the instructions provided. Keep a copy of your application and supporting documents for your records.

- Await Processing and Review: MEFA will review your application and supporting documentation. This process may take several weeks. You can often track the status of your application online.

- Loan Approval or Denial: Once reviewed, MEFA will notify you of their decision. If approved, you will receive details regarding loan terms, disbursement dates, and repayment schedules. If denied, you may be provided with reasons for the denial and may have the opportunity to appeal or reapply.

Completing the MEFA Student Loan Application Form

The MEFA application form typically requests information across several key areas. Accurate and complete information is crucial for a successful application. It is recommended to gather all necessary information before beginning the application process to avoid delays.

- Personal Information: This includes your name, address, social security number, date of birth, and contact information.

- Educational Information: Details about your school, program of study, expected graduation date, and student ID number are required.

- Financial Information: This section requires details about your income, assets, and debts. Accurate reporting is crucial for loan eligibility determination.

- Co-signer Information (if applicable): If required, provide complete information for your co-signer, including their personal and financial details.

- Electronic Signature: The application will likely require an electronic signature to confirm your agreement to the loan terms and conditions.

Tips for a Successful MEFA Student Loan Application

Preparing thoroughly and understanding the requirements can significantly increase your chances of a successful application.

- Start Early: Begin the application process well in advance of the deadlines to allow ample time for gathering documents and addressing any potential issues.

- Read Instructions Carefully: Pay close attention to all instructions and requirements to avoid errors and delays.

- Organize Your Documents: Keep all necessary documents organized and readily accessible to expedite the application process.

- Double-Check for Accuracy: Before submitting your application, thoroughly review all information for accuracy and completeness.

- Contact MEFA with Questions: If you have any questions or encounter any issues, contact MEFA directly for assistance.

Flowchart Illustrating the Application Process

Imagine a flowchart with the following boxes and connecting arrows:

[Start] –> [Complete Application Form] –> [Gather Required Documents] –> [Submit Application] –> [MEFA Review] –> [Approval/Denial Notification] –> [Loan Disbursement (if approved)] –> [End]

Each box represents a step in the process, and the arrows indicate the sequence of events. The “MEFA Review” box could have a branching arrow leading to either “Approval Notification” or “Denial Notification,” depending on the outcome of the review.

Borrower Experiences and Feedback

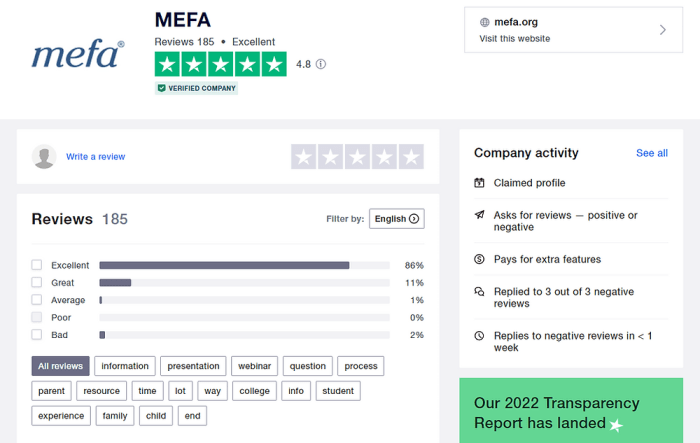

MEFA student loans, while a common choice for Massachusetts residents, garner a range of experiences from borrowers. Analyzing online reviews reveals recurring themes that shed light on both the strengths and weaknesses of the loan process and MEFA’s customer service. Understanding these diverse perspectives is crucial for prospective borrowers to make informed decisions.

Online reviews consistently highlight several key aspects of the MEFA student loan experience. These reviews offer valuable insights into the borrower journey, allowing prospective borrowers to anticipate potential challenges and understand what to expect throughout the process.

Common Themes in MEFA Student Loan Reviews

Analysis of online reviews reveals several recurring themes. Positive feedback frequently centers on the straightforward application process, competitive interest rates, and the availability of various loan options tailored to different needs. Conversely, negative reviews often cite issues with customer service responsiveness, difficulties navigating the online portal, and occasional delays in loan disbursement. These contrasting experiences underscore the importance of thorough research and careful consideration before choosing a MEFA student loan.

Undergraduate vs. Graduate Borrower Experiences

While both undergraduate and graduate borrowers report similar positive experiences regarding interest rates and loan options, differences emerge in the complexity of their borrowing needs. Undergraduate borrowers often express satisfaction with the streamlined application process designed for their simpler financial situations. Graduate students, however, with potentially higher loan amounts and more complex financial circumstances, sometimes report more challenges in navigating the system and communicating with MEFA’s customer service representatives. The increased complexity of their financial situations can lead to more frequent interactions with MEFA, potentially increasing the likelihood of encountering service-related issues.

MEFA Customer Service Performance

Instances where MEFA’s customer service excelled often involve prompt responses to straightforward inquiries and efficient processing of standard loan applications. Conversely, negative experiences frequently describe lengthy wait times, difficulties reaching a representative, and unhelpful or unclear responses to complex issues. The variability in customer service experiences suggests that the effectiveness of MEFA’s support may depend on the specific issue and the individual representative contacted.

Visual Representation of Review Distribution

Imagine a bar graph with several bars representing different aspects of the MEFA student loan process: application process, interest rates, loan disbursement, customer service, and online portal usability. Each bar is divided into two sections, one representing the percentage of positive reviews and the other representing the percentage of negative reviews for that specific aspect. For example, the “interest rates” bar might show 85% positive and 15% negative, indicating generally favorable borrower sentiment regarding interest rates. In contrast, the “customer service” bar might show a more even distribution, perhaps 55% positive and 45% negative, reflecting a wider range of experiences. The visual clearly illustrates the areas where MEFA receives consistently high praise and the areas where improvement is needed, offering a clear snapshot of borrower sentiment across the entire loan process.

Financial Implications and Considerations

Taking out student loans, even through a reputable organization like MEFA, represents a significant financial commitment with long-term consequences. Understanding these implications is crucial for responsible borrowing and successful repayment. Careful planning and awareness of potential risks are essential to avoid future financial hardship.

Borrowing through MEFA, like any student loan program, involves taking on debt that will need to be repaid with interest. The longer it takes to repay the loan, the more interest will accrue, ultimately increasing the total amount owed. This can significantly impact your future financial goals, such as buying a home, investing, or starting a family. The interest rate, loan term, and repayment plan all influence the overall cost of the loan. For example, a loan with a higher interest rate and a longer repayment period will result in substantially higher total payments compared to a loan with a lower interest rate and a shorter repayment period.

Long-Term Financial Impact of MEFA Loans

The long-term financial impact of MEFA loans depends on several factors, including the loan amount, interest rate, repayment plan, and the borrower’s post-graduation income. A large loan balance with a high interest rate will require substantial monthly payments, potentially limiting financial flexibility for years to come. Conversely, a smaller loan balance with a low interest rate and a manageable repayment plan can allow for faster debt repayment and improved financial well-being. For instance, a graduate with a high-paying job may be able to repay their MEFA loan quickly, minimizing the long-term financial burden. However, a graduate with a lower-paying job may struggle to make timely payments, potentially leading to delinquency or default.

Strategies for Responsible Borrowing and Repayment

Responsible borrowing involves careful planning and budgeting. Before taking out loans, it’s crucial to estimate the total cost of borrowing, including interest, and compare it to potential post-graduation earnings. Explore different repayment options, such as income-driven repayment plans, to determine the most manageable plan based on your expected income. Creating a detailed budget that prioritizes loan repayment is essential. For example, tracking expenses and identifying areas for potential savings can free up funds for loan payments. Additionally, exploring options for refinancing loans with lower interest rates can significantly reduce the overall cost of borrowing.

Consequences of Loan Default

Defaulting on a MEFA student loan has serious consequences. It can damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and legal action are all potential consequences of loan default. Furthermore, default can negatively impact your ability to secure future employment, as some employers conduct credit checks. The financial and personal repercussions of loan default can be substantial and long-lasting.

Resources and Tools for Effective Debt Management

MEFA itself provides resources and tools to assist borrowers in managing their student loan debt. Their website typically offers information on repayment options, budgeting tools, and financial counseling services. Additionally, numerous free online resources, such as government websites and non-profit organizations, provide guidance on student loan repayment strategies and financial literacy. These resources can offer valuable support and assistance in navigating the complexities of student loan repayment. For example, websites like the National Foundation for Credit Counseling offer free financial counseling services to help borrowers create a personalized debt management plan.

Closure

Ultimately, the decision of whether to choose MEFA student loans rests on individual circumstances and financial priorities. This guide has aimed to provide a thorough analysis of MEFA’s offerings, drawing upon both official information and real-world borrower experiences. By carefully considering the information presented here, and by conducting your own research, you can make a well-informed decision about your student loan financing, ensuring a smoother path towards your educational goals.

Question Bank

What is MEFA’s role in student loan financing?

MEFA is a non-profit organization that provides various student loan options to Massachusetts residents. They act as a lender, offering both private and sometimes state-sponsored programs.

Are there income requirements for MEFA student loans?

Income requirements vary depending on the specific MEFA loan program. Some programs may have income limits, while others may not. It’s best to check the eligibility criteria for each loan type on MEFA’s website.

What happens if I miss a payment on my MEFA student loan?

Missing payments can result in late fees, damage to your credit score, and ultimately, loan default. Contact MEFA immediately if you anticipate difficulties making a payment to explore possible solutions.

Can I refinance my MEFA student loan?

Yes, it is possible to refinance your MEFA student loan with another lender, potentially securing a lower interest rate or a different repayment plan. However, refinancing may have its own set of implications, so careful consideration is advised.