Navigating the complexities of student loan repayment can feel overwhelming, particularly understanding the interest rates applied to your Mohela loans. This guide aims to demystify Mohela’s student loan interest rate structure, exploring the factors that influence these rates, their impact on repayment, and resources available to borrowers. We’ll delve into various interest rate types, comparing Mohela’s offerings to those of other federal loan servicers and providing practical strategies to manage your loan repayment effectively.

Understanding your Mohela student loan interest rate is crucial for effective financial planning. This involves comprehending how interest capitalization affects your total loan cost, the relationship between interest rates and loan repayment timelines, and the strategies available to minimize the financial burden. We will examine both fixed and variable interest rates, outlining the implications of each for your long-term repayment plan. By understanding these factors, you can make informed decisions about your repayment strategy and achieve financial stability.

Understanding the Mohela Student Loan Interest Rate

Mohela, the federal student loan servicer, manages a significant portion of the nation’s student loan debt. Understanding their interest rate structure is crucial for borrowers to effectively manage their repayment plans and minimize overall costs. This section will delve into the factors influencing Mohela’s rates, the types of rates offered, and a brief historical perspective. We will also compare Mohela’s rates to those of other federal student loan servicers.

Factors Influencing Mohela’s Student Loan Interest Rates

Several key factors determine the interest rate applied to a Mohela student loan. The most significant is the loan type. Federal student loans, such as subsidized and unsubsidized Stafford Loans and PLUS Loans, have interest rates set by Congress annually. These rates are typically fixed for the life of the loan. The borrower’s credit history generally does not impact these federal loan interest rates. Market conditions, while not directly impacting federal loan rates, can influence the rates offered for private student loans, though Mohela primarily services federal loans.

Types of Interest Rates Offered by Mohela

Mohela primarily services federal student loans, which predominantly feature fixed interest rates. This means the interest rate remains constant throughout the loan’s repayment period. While variable interest rates are sometimes associated with private student loans, these are not typically handled by Mohela. The fixed rate structure provides borrowers with predictability and stability in their monthly payments.

Historical Overview of Mohela’s Interest Rate Changes

Federal student loan interest rates are subject to annual adjustments by Congress. Therefore, Mohela’s rates have fluctuated over time, reflecting these legislative changes. Tracking these historical changes requires referencing official government sources and annual federal budget documents. For example, interest rates on federal student loans have generally trended upward in recent years, though there have been periods of relative stability or even slight decreases. Precise historical data should be obtained from the official Department of Education website or other reliable government sources.

Comparison of Mohela’s Rates to Other Federal Student Loan Servicers

It’s important to understand that interest rates for federal student loans are set by the government, not by the individual servicers. Therefore, Mohela, Navient, Aidvantage, and other federal student loan servicers will generally offer the same interest rates for the same type of federal student loan. Differences in servicing fees or customer service may exist, but the underlying interest rates are consistent across servicers for the same loan type.

| Servicer | Subsidized Stafford Loan Rate (Example) | Unsubsidized Stafford Loan Rate (Example) | PLUS Loan Rate (Example) |

|---|---|---|---|

| Mohela | 4.5% (Example) | 4.5% (Example) | 7.5% (Example) |

| Navient | 4.5% (Example) | 4.5% (Example) | 7.5% (Example) |

| Aidvantage | 4.5% (Example) | 4.5% (Example) | 7.5% (Example) |

*Note: These are example rates and may not reflect current rates. Always refer to official government sources for the most up-to-date information.*

Impact of Interest Rates on Loan Repayment

Understanding the interest rate on your Mohela student loans is crucial because it directly impacts the total cost of your loan and the length of time it takes to repay it. Higher interest rates mean you’ll pay significantly more over the life of the loan and may take longer to become debt-free. This section explores the various ways interest rates affect your repayment journey.

Interest capitalization, the addition of accrued interest to your principal loan balance, significantly increases the total amount you owe. This process compounds the interest, meaning you pay interest on interest, leading to a larger overall debt burden. For example, if you defer payments for a period, the accumulated interest during that time is added to your principal, resulting in a higher principal balance upon which future interest is calculated. This snowball effect can dramatically increase the final cost of your loan.

Interest Capitalization’s Effect on Total Loan Cost

Interest capitalization significantly increases the total cost of a student loan. Let’s consider a hypothetical scenario: a $20,000 loan with a 7% interest rate. If interest is capitalized annually for three years before repayment begins, the capitalized interest will be added to the principal, resulting in a substantially larger loan balance than the original $20,000. This larger principal balance will then accrue interest throughout the repayment period, leading to a higher total repayment amount. The longer the period of capitalization, the more significant the impact on the final cost. Ignoring capitalization in repayment planning can lead to a significant underestimation of the total loan cost.

Interest Rates and Loan Repayment Duration

Higher interest rates lengthen the repayment period, even if the monthly payment amount remains constant. This is because a larger portion of each payment goes toward interest when interest rates are high, leaving less to reduce the principal balance. Consequently, it takes longer to pay off the loan. For instance, a loan with a 10% interest rate will take considerably longer to repay than an identical loan with a 5% interest rate, even if the monthly payment amount is the same in both cases. Borrowers should carefully consider this relationship when choosing a repayment plan.

Strategies for Minimizing the Impact of High Interest Rates

Several strategies can help borrowers mitigate the effects of high interest rates. Making extra payments beyond the minimum payment amount accelerates loan repayment, reducing the total interest paid over the life of the loan. Refinancing to a lower interest rate loan, if available, can also significantly reduce the overall cost. Exploring income-driven repayment plans can lower monthly payments, making them more manageable, though it might extend the repayment timeline. Careful budgeting and financial planning are also essential to ensure consistent and timely payments.

Sample Repayment Plan: Illustrating Interest Rate Impact

Let’s compare two scenarios for a $10,000 loan with a 10-year repayment term:

| Interest Rate | Monthly Payment | Total Interest Paid | Total Repaid |

|---|---|---|---|

| 5% | $100 (approx.) | $1,800 (approx.) | $11,800 (approx.) |

| 10% | $120 (approx.) | $4,300 (approx.) | $14,300 (approx.) |

This table illustrates how a higher interest rate (10%) leads to a higher monthly payment and significantly more interest paid over the life of the loan compared to a lower interest rate (5%). The difference in total repaid is substantial, highlighting the importance of considering interest rates when managing student loan debt. Note that these are approximate figures and actual amounts may vary depending on the specific loan terms and calculation methods.

Factors Affecting Individual Interest Rates

Understanding the interest rate applied to your Mohela student loans is crucial for effective repayment planning. Several factors influence the specific rate you’ll receive, impacting your monthly payments and overall loan cost. These factors are determined at the time your loan is originated and generally remain fixed throughout the loan’s life, unless you consolidate your loans.

Mohela doesn’t set the interest rates themselves; they are determined by the original lender and the type of loan. The interest rate is a fixed percentage, meaning it won’t change over time unless you refinance or consolidate your loans. Key factors influencing your individual rate include the loan type, your credit history (for unsubsidized loans), and the prevailing interest rate environment at the time your loan was disbursed.

Subsidized vs. Unsubsidized Loan Interest Rates

Subsidized and unsubsidized federal student loans have different interest rate structures. Subsidized loans typically have lower interest rates because the government pays the interest while you’re in school (under certain eligibility criteria) and during certain grace periods. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed, regardless of your enrollment status. This means the final loan amount for unsubsidized loans will generally be higher than for a comparable subsidized loan due to accumulated interest. The exact interest rate difference between subsidized and unsubsidized loans varies depending on the loan’s origination year and prevailing market conditions. For example, a subsidized loan might have an interest rate of 4.5% while a comparable unsubsidized loan might carry a rate of 6.0% for the same loan period.

Impact of Loan Consolidation on Interest Rates

Consolidating your federal student loans through a program like the Direct Consolidation Loan Program can potentially affect your interest rate. The new consolidated loan will typically have a weighted average interest rate based on the rates of your individual loans. In some cases, this might result in a slightly lower interest rate, especially if you have a mix of loans with varying interest rates. However, it’s important to note that the weighted average might also result in a slightly higher interest rate than the lowest rate among your existing loans. It is essential to carefully weigh the potential benefits of simplification against the potential impact on the overall interest paid over the life of the loan before deciding to consolidate.

Common Misconceptions about Mohela Interest Rates

Several misconceptions surround Mohela student loan interest rates. Understanding these inaccuracies can help you make informed decisions about your loan repayment strategy.

- Misconception 1: Mohela sets the interest rates. Reality: Mohela is the loan servicer; the interest rate is determined by the original lender and the type of federal loan.

- Misconception 2: Interest rates always increase over time. Reality: Federal student loan interest rates are fixed unless you refinance or consolidate. They do not fluctuate with market conditions after the loan is disbursed.

- Misconception 3: Consolidation always lowers interest rates. Reality: Consolidation results in a weighted average interest rate; this may be lower, higher, or the same as your highest existing rate.

- Misconception 4: On-time payments reduce interest rates. Reality: On-time payments avoid late fees but do not directly lower the interest rate of the loan itself.

Resources and Information for Borrowers

Navigating the world of student loan interest rates can be confusing, but understanding where to find information and what resources are available is crucial for responsible loan management. This section provides a comprehensive guide to accessing your interest rate details, resolving discrepancies, and utilizing available support channels. Remember, proactive engagement with your loan servicer is key to successful repayment.

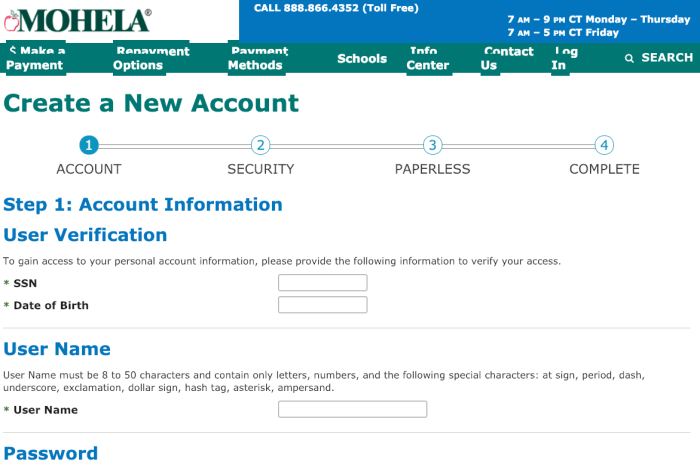

Finding your Mohela student loan interest rate is straightforward. Your interest rate is clearly displayed on your monthly statement, accessible through your online Mohela account. This statement details the interest accrued during the billing cycle, the principal balance, and other pertinent financial information. You can also find your interest rate information within your loan documents, such as your loan promissory note. Regularly reviewing these documents ensures you are aware of the current rate applied to your loan.

Locating Interest Rate Information

Borrowers can access their interest rate information through multiple channels. The primary method is via the Mohela online account portal. This secure platform provides a consolidated view of all your Mohela loans, including the applicable interest rate for each. Accessing this information requires logging in with your user credentials. Your monthly statements, delivered either electronically or via mail, also clearly show your current interest rate. Additionally, contacting Mohela customer service directly allows you to request this information.

Contact Information and Resources

Mohela offers various support channels to assist borrowers with questions regarding their interest rates. Their website provides a comprehensive FAQ section addressing common concerns. They also offer phone support, with dedicated lines for specific inquiries. Email support is another option, allowing borrowers to submit detailed questions and receive written responses. Finally, Mohela often hosts webinars and online forums where borrowers can interact with representatives and other borrowers to clarify any confusion. Their contact information can be readily found on their official website.

Appealing a Disputed Interest Rate Calculation

If you believe there is an error in your interest rate calculation, Mohela has a formal appeals process. This typically involves submitting a written request, detailing the discrepancy and providing supporting documentation, such as previous statements or loan agreements. Mohela will review your appeal and respond within a reasonable timeframe, outlining the resolution. It’s important to document all communication and retain copies of any supporting evidence. Failure to resolve the dispute through this process may require seeking external assistance, such as from a consumer protection agency or legal professional.

Frequently Asked Questions

Understanding your interest rate is vital for effective loan management. Here are some frequently asked questions and their answers:

- Q: How often does my interest rate change? A: Your interest rate is fixed for the life of your federal student loan, unless you consolidate your loans. Private loans may have variable rates.

- Q: Where can I find my interest rate? A: Your interest rate is listed on your monthly statement and within your online Mohela account.

- Q: What happens if I miss a payment? A: Missing payments can negatively impact your credit score and may lead to additional fees and accrued interest.

- Q: Can I refinance my student loans to a lower interest rate? A: You can refinance federal student loans into private loans, potentially securing a lower rate, but this relinquishes federal protections.

- Q: How is interest calculated on my student loans? A: Interest is typically calculated daily on your outstanding principal balance and added to your loan balance monthly. The exact calculation method may vary based on your loan type and terms.

Government Policies and their Influence

Government policies play a significant role in shaping the student loan interest rate landscape, directly impacting borrowers like those serviced by Mohela. These policies influence not only the rates themselves but also the overall accessibility and affordability of higher education. Understanding this governmental influence is crucial for navigating the complexities of student loan repayment.

The federal government sets the interest rates for federal student loans, including those managed by Mohela. These rates are not static; they are influenced by a variety of factors, including prevailing market conditions and specific legislative decisions. While Mohela doesn’t directly set these rates, their operations are entirely dependent on the policies established by the government.

Government Regulation of Student Loan Interest Rates

Federal student loan interest rates are often tied to Treasury securities indices, such as the 10-year Treasury note. This means that fluctuations in the broader financial market directly affect the interest rates charged to borrowers. Congress has the power to set these index rates, and the resulting rate is typically announced annually for each loan type (subsidized, unsubsidized, etc.). Regulations also dictate how these rates are applied to different loan programs and borrower categories. For example, specific income thresholds might qualify borrowers for lower interest rates through income-driven repayment plans.

Impact of Recent Legislative Changes on Mohela’s Interest Rates

Recent legislative changes, such as those included in the Consolidated Appropriations Act of 2023, have influenced interest rates for federal student loans. These acts may include provisions that temporarily adjust interest rates, modify index calculations, or introduce new income-based repayment options. For example, a temporary pause on interest accrual during the COVID-19 pandemic, while not directly altering the underlying interest rate, significantly impacted borrowers’ repayment schedules and the overall cost of their loans. Such legislative actions indirectly influence Mohela’s operations by altering the terms under which they service these loans.

Economic Conditions and Mohela’s Interest Rate Policies

Economic conditions, particularly inflation and interest rate trends set by the Federal Reserve, significantly impact student loan interest rates. Periods of high inflation generally lead to higher interest rates on federal loans, increasing the cost of borrowing for students. Conversely, periods of low inflation or economic downturn may lead to lower interest rates. Mohela’s interest rate policies are directly affected by these broader economic shifts as they are bound by the government’s set rates, which are, in turn, influenced by economic factors. For example, if the 10-year Treasury note yield increases due to inflation, the interest rate on federal student loans, and therefore those serviced by Mohela, will also increase.

Potential Effects of Future Policy Changes

Hypothetical scenarios can illustrate the potential impact of future policy changes. For instance, consider a scenario where Congress decides to permanently decouple student loan interest rates from Treasury indices and instead sets a fixed, lower rate for all federal loans. This would likely result in lower interest payments for borrowers, reducing their overall loan burden. Conversely, a scenario where Congress decides to increase the index used to calculate interest rates, perhaps switching to a shorter-term Treasury note with higher yields, would likely lead to increased interest payments for borrowers. Another possibility involves a significant overhaul of the student loan system, potentially including a shift towards a more needs-based system with varying interest rates based on income and future earnings. Such a change would drastically alter the landscape of student loan servicing for Mohela and other loan servicers.

Closing Notes

Successfully managing your Mohela student loan repayment hinges on a clear understanding of the interest rate dynamics involved. From the various factors influencing your individual rate to the resources available for support and guidance, we’ve explored the key elements impacting your repayment journey. By actively engaging with the information provided and utilizing the available resources, you can effectively navigate the complexities of student loan repayment and work towards a debt-free future. Remember, proactive engagement and informed decision-making are crucial for achieving your financial goals.

Detailed FAQs

What happens if I miss a Mohela student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default.

Can I refinance my Mohela student loan to a lower interest rate?

Yes, but refinancing with a private lender may lose federal benefits like income-driven repayment plans.

How often does Mohela update my interest rate information?

Your interest rate is generally fixed at the time of loan disbursement, though some loan types may have variable rates which are periodically adjusted.

Where can I find a detailed explanation of my Mohela loan terms?

Your loan documents and the Mohela website provide comprehensive details about your loan terms, including interest rates and repayment schedules.