Navigating the complexities of student loan repayment can feel overwhelming. MyGreatLakes.org serves as a central hub for millions of borrowers, offering a range of services to manage their student loan accounts. This guide provides a clear and concise overview of the website’s features, repayment options, and resources available to help you effectively manage your student loan debt and achieve financial well-being.

From understanding different repayment plans and exploring deferment and forbearance options to accessing account information and contacting customer support, we’ll delve into the key aspects of utilizing MyGreatLakes.org to your advantage. We’ll also address common questions and potential issues to ensure a smoother experience in managing your student loans.

Website Overview

mygreatlakes.org is a website dedicated to managing student loans serviced by the Great Lakes Higher Education Corporation. It provides a centralized platform for borrowers to access their loan information, make payments, and manage their accounts. The site aims to streamline the student loan repayment process and offer resources to help borrowers understand and navigate their financial obligations.

Primary Function of mygreatlakes.org

The primary function of mygreatlakes.org is to serve as a comprehensive online portal for managing federal student loans. This includes providing access to account information, enabling online payments, and offering tools and resources to help borrowers understand and manage their loans effectively. The site aims to simplify the often complex process of student loan repayment.

Types of Student Loan Services Offered

mygreatlakes.org offers a range of services related to federal student loan management. These include viewing account balances and payment history, making online payments, enrolling in autopay, updating contact information, consolidating loans (where applicable), and accessing educational resources on loan repayment strategies. Borrowers can also find information about deferment and forbearance options, as well as contact information for customer support.

Target Audience

The target audience for mygreatlakes.org is individuals who have federal student loans serviced by the Great Lakes Higher Education Corporation. This includes current students, recent graduates, and individuals who have already begun repaying their loans. The site caters to a diverse audience with varying levels of financial literacy and experience with student loan management.

Navigation Structure and User Experience

The website generally features a straightforward and intuitive navigation structure. Upon logging in, users typically find a dashboard displaying key account information, such as loan balances, payment due dates, and upcoming actions. Navigation menus and links allow users to access specific sections related to payment options, account management, and educational resources. While the specific layout may evolve, the goal is to provide a user-friendly experience that allows borrowers to quickly find the information and services they need.

Key Features and Functionalities

| Feature | Description | User Benefit | Example |

|---|---|---|---|

| Online Payment | Make payments directly through the website using various methods. | Convenience and flexibility in managing payments. | Paying your monthly loan installment using a debit card. |

| Account Summary | View a consolidated overview of all your loans serviced by Great Lakes. | Easy access to key account information and overall loan status. | Seeing a summary of all loan balances, interest rates, and payment schedules. |

| Payment History | Access a detailed record of all past payments made. | Track payment history and ensure accurate record-keeping. | Reviewing past payments to verify successful transactions and payment amounts. |

| Contact Information Update | Modify personal contact details such as address and phone number. | Ensure accurate communication from Great Lakes regarding loan updates and payments. | Updating your mailing address to reflect a recent move. |

Student Loan Repayment Options

Choosing the right repayment plan for your student loans is crucial for managing your debt effectively and avoiding financial hardship. Understanding the various options available and their implications is essential for making an informed decision. This section Artikels the different repayment plans offered, highlighting their advantages and disadvantages to help you navigate this important process.

Several repayment plans are designed to cater to different financial situations and repayment preferences. The best option for you will depend on your income, loan amount, and overall financial goals. Careful consideration of each plan’s features is vital before making a selection.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, resulting in less interest paid over the life of the loan. However, the monthly payments can be significantly higher than other repayment options.

Extended Repayment Plan

This plan offers longer repayment terms than the Standard Repayment Plan, typically ranging from 12 to 30 years, depending on the loan amount. The longer repayment period leads to lower monthly payments, making it more manageable for borrowers with limited income. However, the extended repayment period results in significantly higher total interest paid over the life of the loan.

Graduated Repayment Plan

Under the Graduated Repayment Plan, monthly payments start low and gradually increase over time. This option may be attractive to borrowers anticipating income growth, as the payments become more manageable as their income increases. However, the initial low payments can lull borrowers into a false sense of security, and the later payments can become quite substantial.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payments to your income and family size. These plans offer lower monthly payments than other repayment options, making them particularly beneficial for borrowers with lower incomes or significant financial obligations. However, they generally extend the repayment period, resulting in more interest paid over the loan’s lifetime.

Income-Driven Repayment Plans: Eligibility and Application

Eligibility for income-driven repayment plans typically requires having federal student loans and providing documentation of your income and family size. The specific eligibility criteria may vary slightly depending on the type of IDR plan chosen (e.g., Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Contingent Repayment (ICR)). Applying for an IDR plan usually involves completing an application through the student loan servicer’s website, providing necessary documentation, and undergoing a review process.

The application process generally involves completing a form online through your student loan servicer’s website. You will need to provide information about your income, family size, and other relevant financial details. Once your application is processed, your monthly payment will be recalculated based on your provided information.

Summary of Repayment Plan Options

The following list summarizes the key features of each repayment plan. Remember that specific details and eligibility criteria may vary, so it’s crucial to consult your loan servicer for the most up-to-date information.

- Standard Repayment Plan: Fixed monthly payments over 10 years; lowest total interest paid; highest monthly payments.

- Extended Repayment Plan: Fixed monthly payments over 12-30 years; lower monthly payments than standard; highest total interest paid.

- Graduated Repayment Plan: Payments start low and gradually increase; potentially manageable initially; payments can become substantial later.

- Income-Driven Repayment Plans (IBR, PAYE, REPAYE, ICR): Monthly payments based on income and family size; lowest monthly payments; longest repayment periods and highest total interest paid.

Managing Your Student Loan Account

Effectively managing your Great Lakes student loan account is crucial for staying on top of your repayments and ensuring a smooth repayment process. This section details how to access and utilize the various features available on the mygreatlakes.org website to manage your loans efficiently.

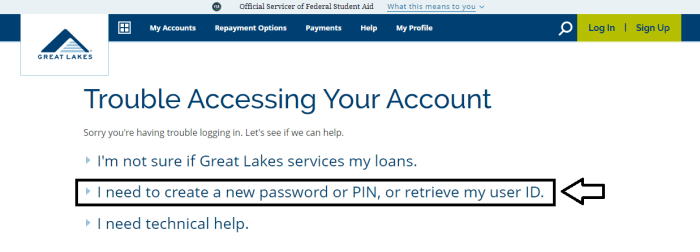

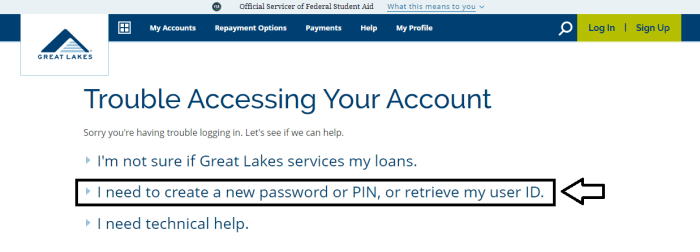

Logging into Your mygreatlakes.org Account

Accessing your account is straightforward. Navigate to mygreatlakes.org in your web browser. You’ll find the login area prominently displayed on the homepage. Enter your User ID and Password in the designated fields. If you’ve forgotten your User ID or Password, the website provides clear instructions and options for retrieval through a secure process involving email verification or security questions. Click “Log In” to access your account dashboard.

Updating Personal Information

Maintaining accurate personal information is essential for receiving important communications and ensuring the smooth processing of your payments. Once logged in, locate the “Profile” or “Personal Information” section—this is usually found in a user menu or settings area. You can then update your address, phone number, email address, and other relevant details as needed. The website will guide you through the necessary steps, often requiring verification to prevent unauthorized changes.

Making a Student Loan Payment

mygreatlakes.org offers multiple ways to make payments. Within your account dashboard, you’ll find a dedicated “Make a Payment” section. You can typically choose between making a payment online using a debit card, credit card, or electronic bank transfer. The website will provide clear instructions and security measures for each payment method. Remember to always note the payment confirmation number for your records.

Tracking Payment History and Loan Balances

The website provides a comprehensive overview of your loan account information. Your account dashboard usually displays your current loan balance, payment due date, and a detailed history of past payments. This history often includes the payment date, amount paid, and the remaining balance after each payment. This feature allows you to easily monitor your progress towards loan repayment and identify any discrepancies.

Accessing and Downloading Account Statements

To download your account statements, log into your mygreatlakes.org account. Navigate to the “Statements” or “Documents” section within your account dashboard. This section usually allows you to view your statements online and download them in PDF format. You can select the desired date range for the statement you wish to download. Once selected, click the download button; the statement will download to your computer. You can then save the statement for your records or print a physical copy if needed.

Deferment and Forbearance Options

Navigating student loan repayment can be challenging, and sometimes life events necessitate a temporary pause in payments. Deferment and forbearance are two options that may provide this temporary relief, but they differ significantly in their impact on your loan. Understanding the distinctions between these options is crucial for making informed decisions about your repayment strategy.

Definitions of Deferment and Forbearance

Deferment and forbearance are both temporary pauses in your student loan payments, but they differ in their underlying reasons and consequences. Deferment is a postponement of payments granted based on specific qualifying circumstances, such as unemployment or enrollment in school. Importantly, interest may or may not accrue during a deferment period, depending on the loan type and the reason for the deferment. Forbearance, on the other hand, is a temporary suspension of payments granted when you experience financial hardship, making payments difficult. Interest typically accrues during a forbearance period, adding to your overall loan balance.

Comparison of Deferment and Forbearance Options

Several types of deferments and forbearances are available, depending on your lender and specific circumstances. For example, deferments are often available for those returning to school or experiencing unemployment. Forbearances are usually granted based on demonstrated financial hardship. The specific terms and conditions, including the length of the deferment or forbearance period and the impact on interest accrual, vary widely. It’s crucial to contact your loan servicer directly to understand the options available to you.

Eligibility Requirements for Deferment and Forbearance

Eligibility requirements for deferment and forbearance vary depending on the loan type and the specific program. Generally, deferments require documentation proving the qualifying event, such as an enrollment verification form for school deferment or proof of unemployment. Forbearances usually require documentation demonstrating financial hardship, such as proof of reduced income or significant medical expenses. Each lender has its own specific requirements, so checking with your servicer is essential.

Applying for Deferment or Forbearance

The application process typically involves contacting your loan servicer directly. You’ll need to provide documentation supporting your request, such as the aforementioned proof of enrollment or financial hardship. The servicer will review your application and notify you of their decision. The processing time can vary, so it’s advisable to apply well in advance of when you anticipate needing the deferment or forbearance.

Summary of Deferment and Forbearance Differences

| Deferment | Forbearance |

|---|---|

| Postponement of payments due to specific qualifying circumstances (e.g., unemployment, return to school). | Temporary suspension of payments due to financial hardship. |

| Interest may or may not accrue, depending on the loan type and reason for deferment. | Interest typically accrues, increasing the total loan amount. |

| Requires documentation proving the qualifying event. | Requires documentation demonstrating financial hardship. |

| Specific eligibility requirements vary by loan type and lender. | Specific eligibility requirements vary by lender and program. |

Contacting Great Lakes

Getting in touch with Great Lakes is straightforward, offering several convenient methods to address your student loan inquiries or concerns. Understanding the best way to contact them depends on the urgency of your situation and the nature of your question. Choosing the right method ensures a timely and efficient resolution to your needs.

Great Lakes provides multiple avenues for contacting them, each with its own advantages. Selecting the appropriate method depends on the urgency of your request and the type of information you need.

Contact Methods and Response Times

Below is a summary of the various ways to contact Great Lakes, along with estimated response times. Remember that response times can vary depending on factors such as call volume and the complexity of your inquiry.

- Phone: The phone is generally the quickest method for urgent matters. Expect a response time ranging from a few minutes (if you reach a representative immediately) to potentially longer wait times during peak hours. The specific phone number will be listed on your account statement or the Great Lakes website.

- Email: Email is suitable for non-urgent inquiries. While convenient, email response times can range from a few business days to a week or more, depending on the volume of emails received. The specific email address for inquiries will be available on the Great Lakes website.

- Mail: Mailing a letter is the least efficient method and should only be used for situations where other methods are unavailable or unsuitable. Allow ample time for postal delivery and processing, which could take several weeks to receive a response.

Situations Requiring Contact with Great Lakes

Several situations may necessitate contacting Great Lakes. Proactive communication can prevent potential issues and ensure a smooth loan management experience.

- Making a payment: While online payments are preferred, you may need to contact them for payment issues or inquiries about payment methods.

- Requesting Deferment or Forbearance: If you experience financial hardship and need to temporarily suspend or reduce your payments, you’ll need to contact Great Lakes to initiate this process.

- Inquiries about your loan balance or payment history: You can access this information online, but if you have questions or discrepancies, contacting Great Lakes is necessary.

- Updating your contact information: It’s crucial to keep your contact information up-to-date to ensure you receive important notifications.

- Reporting lost or stolen documents: If your loan documents are lost or stolen, immediately contact Great Lakes to report this and request replacements.

- Addressing billing errors or discrepancies: If you notice errors on your billing statement, contact Great Lakes to resolve the issue.

Contact Information

The specific contact information, including phone numbers and mailing addresses, should be readily available on the mygreatlakes.org website. Always refer to their official website for the most up-to-date contact details.

Understanding Loan Forgiveness Programs

Student loan forgiveness programs offer the possibility of eliminating a portion or all of your student loan debt under specific circumstances. These programs are designed to provide relief to borrowers who meet certain criteria, often related to their employment in public service or specific fields. However, it’s crucial to understand the eligibility requirements, limitations, and potential drawbacks before relying on loan forgiveness as a primary repayment strategy.

Types of Student Loan Forgiveness Programs

Several federal and state loan forgiveness programs exist, each with its own eligibility criteria and limitations. Understanding the differences between these programs is critical in determining which, if any, might apply to your situation. These programs aren’t always mutually exclusive; it’s possible to qualify for more than one.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. Qualifying employers include government organizations (federal, state, local, tribal) and not-for-profit organizations. The program’s complexities have led to significant changes in recent years aimed at improving clarity and accessibility. Borrowers should carefully review the updated guidelines to ensure they meet all requirements. A significant drawback is the strict adherence to the requirements, with any deviation potentially disqualifying a borrower.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans for qualified teachers who have completed five years of full-time teaching in a low-income school or educational service agency. Eligibility hinges on meeting specific teaching requirements and demonstrating financial need. While potentially beneficial, the program has a limited forgiveness amount, and the requirements for qualifying schools and service agencies can be stringent.

Income-Driven Repayment (IDR) Plans and Forgiveness

Several income-driven repayment plans (IDR) exist, such as Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR). These plans calculate monthly payments based on your income and family size. After a set number of years (typically 20 or 25), any remaining balance may be forgiven. However, the forgiven amount is considered taxable income. The length of time required to reach forgiveness under IDR plans is substantial, and the potential tax liability upon forgiveness is a significant consideration.

State Loan Forgiveness Programs

Many states offer their own loan forgiveness programs, often targeting specific professions or those working in underserved areas within the state. Eligibility requirements vary significantly by state and program. These programs can be valuable but often have limited funding and competitive application processes. It’s crucial to research your state’s specific programs to assess eligibility and understand the application process.

Limitations and Drawbacks of Loan Forgiveness Programs

Loan forgiveness programs, while offering potential relief, have limitations and drawbacks. These include complex eligibility requirements, long wait times before forgiveness, potential tax implications on forgiven amounts, and the possibility of program changes or discontinuation. It’s crucial to weigh the potential benefits against these limitations before relying on loan forgiveness as a primary repayment strategy. Furthermore, relying solely on forgiveness may delay or eliminate other repayment options with potentially lower long-term costs.

Key Loan Forgiveness Programs

| Program Name | Eligibility | Forgiveness Amount | Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full-time employment with qualifying employer, 120 qualifying payments under an income-driven repayment plan. | Remaining loan balance | Specific employment, repayment plan, and payment history. |

| Teacher Loan Forgiveness | Full-time teaching in a low-income school or educational service agency for 5 years. | Up to $17,500 | Specific teaching requirements, low-income school designation. |

| Income-Driven Repayment (IDR) Plans | Specific income and family size thresholds. | Remaining balance after 20-25 years | Consistent enrollment in an IDR plan, timely payments. |

| State Loan Forgiveness Programs | Varies by state and program. | Varies by state and program. | Varies by state and program. |

Potential Issues and Troubleshooting

Navigating the mygreatlakes.org website and managing your student loan account can sometimes present challenges. This section addresses common problems and offers solutions to help you resolve them efficiently. Understanding potential issues and their solutions will empower you to manage your loans effectively.

Common Technical Issues

Experiencing technical difficulties on the mygreatlakes.org website can be frustrating. These issues often stem from browser compatibility, internet connectivity, or temporary website maintenance. If you encounter problems logging in, accessing specific pages, or completing transactions, first ensure your browser is up-to-date and compatible with the website’s requirements. Check your internet connection for stability. If problems persist, try clearing your browser’s cache and cookies. If the issue continues, consider contacting Great Lakes customer support for assistance. They may be able to provide more specific troubleshooting steps or inform you of any scheduled maintenance.

Account-Related Problems

Account-related issues are often related to login credentials, payment processing, or discrepancies in account information. For login difficulties, ensure you are using the correct username and password. If you’ve forgotten your password, use the password reset function on the website. Payment processing problems might involve declined payments due to insufficient funds or incorrect payment information. Verify your payment details and ensure sufficient funds are available. Account information discrepancies may require contacting Great Lakes to update your address, contact information, or other personal details. Providing accurate and updated information is crucial for smooth account management.

Resolving Payment Discrepancies or Account Errors

Payment discrepancies or account errors can arise from various factors. If you notice a discrepancy between your payment history and your account statement, carefully review both documents. Look for any missing payments, duplicate entries, or incorrect amounts. If you identify an error, gather supporting documentation such as payment confirmations or bank statements. Contact Great Lakes customer support to report the discrepancy and provide the necessary supporting evidence. They will investigate the issue and rectify any errors. For significant errors, keeping detailed records of all communication with Great Lakes is recommended.

Reporting Suspected Fraud or Identity Theft

Suspected fraud or identity theft should be reported immediately. If you believe someone has accessed your account without authorization or used your personal information fraudulently, contact Great Lakes immediately through their secure channels. Also, report the incident to the appropriate authorities, such as the Federal Trade Commission (FTC) or your local law enforcement. Take steps to secure your accounts by changing passwords and monitoring your credit reports. Protecting your personal information is paramount.

Navigating Common Website Error Messages

The mygreatlakes.org website may display various error messages. These messages typically indicate specific problems, such as invalid login credentials, server errors, or missing information. Each error message usually provides a brief description of the issue. If the message is unclear, review the website’s FAQ section or contact Great Lakes customer support for clarification. Common error messages often include “Invalid username or password,” “Server error,” or “Missing required information.” Understanding these messages helps you take appropriate action to resolve the problem.

Ultimate Conclusion

Successfully managing your student loans requires understanding the resources available and proactively engaging with your loan servicer. MyGreatLakes.org provides a valuable platform for borrowers to access crucial information, manage their accounts, and explore repayment options tailored to their individual circumstances. By utilizing the tools and resources Artikeld in this guide, you can navigate the student loan repayment process with greater confidence and achieve long-term financial stability.

Question Bank

What happens if I miss a student loan payment?

Missing a payment can result in late fees, damage to your credit score, and potentially lead to default. Contact Great Lakes immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

How can I consolidate my student loans?

MyGreatLakes.org doesn’t directly handle loan consolidation. You’ll need to explore federal loan consolidation programs through the Department of Education’s website.

What is the difference between a deferment and forbearance?

Deferment temporarily suspends payments due to specific qualifying circumstances, while forbearance allows for temporary reduced or suspended payments, but typically accrues interest.

How do I update my contact information?

Log in to your MyGreatLakes.org account and navigate to your profile settings. There you can update your address, phone number, and email address.